Discussion paper - Strategic and transfer planning: enhancing member outcomes

Executive summary

Australia’s superannuation industry plays a critical role in supporting the financial wellbeing of Australians. The industry continues to grow at pace; with assets totalling $3.5 trillion, representing over 150% of GDP, Australia’s superannuation system has an ever-increasing impact on the broader financial system and economy.

APRA’s role in regulating superannuation is to maintain prudential soundness and safety, ensure prudent management of an RSE licensee’s business operations, and support the obligations of the Superannuation Industry (Supervision) Act 1993. To do this effectively, APRA supervises enforceable prudential standards, and updates these over time so that they adapt as the industry evolves.

Role of SPS 515

Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) is a core standard for superannuation. It is designed to ensure RSE licensees have robust business operations and are held to account to ensure their strategies and decisions deliver outcomes that are in the best financial interests of members, consistent with community expectations.

Since SPS 515 came into effect in 2020, the operating environment has changed markedly. Not only have there been changes to the legislative settings for superannuation, but industry consolidation has continued, implementation challenges in strategic planning have emerged, and key enhancements have been made to other areas of APRA’s prudential framework.1

Enhancing SPS 515

Responding to these changes in the operating environment, and requests for greater clarity, the proposed enhancements position SPS 515 as the core standard in the superannuation prudential framework, ensuring member outcomes are front of mind when RSE licensees are setting strategies and making key decisions. Together, the proposed enhancements to SPS 515 are designed to strengthen business planning and operations, improve the transfer process and, ultimately, ensure that every dollar saved for retirement is appropriately managed.

The proposed enhancements to SPS 515 include revisions, in particular, to:

- ensure expenditure requirements better align with the best financial interests duty and, in relation to the retirement phase, to support the retirement income covenant;

- reflect supervisory observations on areas where the industry needs to lift the bar, with a particular focus on management of financial resources; and

- improve the management of risks to members being transferred across funds, in the context of heightened transfer activity.2

Further, following careful consideration, APRA plans to retire the 2001 Superannuation Circular III.A.4 Sole Purpose Test and is not currently minded to issue new guidance on the sole purpose test. It is APRA’s expectation that RSE licensees have evolved, with experience, and are now well placed to make robust decisions consistent with their legislative duties, capable of standing up to scrutiny.

Consultation process

In August 2022, APRA released for consultation Discussion Paper – Strategic planning and member outcomes: Proposed enhancements (the August 2022 paper). In November 2022, APRA released for consultation Discussion Paper – Superannuation transfer planning: Proposed enhancements (the November 2022 paper).

Submissions were generally supportive of the proposed enhancements, and the specific feedback has been used to inform the draft SPS 515 framework. This discussion paper sets out APRA’s responses to industry feedback, together with proposed:

- draft Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515);

- draft Prudential Practice Guide SPG 515 Strategic and Transfer Planning (SPG 515); and

- draft Prudential Practice Guide SPG 516 Business Performance Review (SPG 516).

Submissions to this discussion paper are requested to be provided no later than 21 December 2023. APRA expects to finalise the SPS 515 framework by mid-2024, ahead of its expected commencement on 1 January 2025.

Glossary

APRA | Australian Prudential Regulation Authority |

|---|---|

BFID | Best financial interests duty |

ASIC | Australian Securities and Investment Commission |

ATO | Australian Taxation Office |

BPR | Business performance review |

CPS 190 | Prudential Standard CPS 190 Recovery and Exit Planning |

CPS 230 | Prudential Standard CPS 230 Operational Risk Management |

CPS 900 | Prudential Standard CPS 900 Resolution Planning |

PPG | Prudential practice guide |

RSE | Registrable superannuation entity |

RSE licensee | RSE licensee as defined in s10(1) of the Superannuation Industry (Supervision) Act 1993 |

SFT | Successor fund transfer; ‘successor fund’ as defined in r1.03 of the Superannuation Industry (Supervision) Regulations 1994 |

SIS Act | Superannuation Industry (Supervision) Act 1993 |

SPG 227 | Prudential Practice Guide SPG 227 Successor Fund Transfer and Wind-ups |

SPG 515 | Prudential Practice Guide SPG 515 Strategic and Transfer Planning |

SPG 516 | Prudential Practice Guide SPG 516 Business Performance Review |

SPS 114 | Prudential Standard SPS 114 Operational Risk Financial Requirement |

SPS 515 | Prudential Standard SPS 515 Strategic Planning and Member Outcomes |

Footnotes

1 Changes to legislative settings include the introduction of the best financial interests duty, the annual performance test and the retirement income covenant. Key enhancements to APRA’s prudential framework include the introduction of recovery and resolution planning requirements.

2 Draft SPS 515 proposes to require all RSE licensees regularly consider, and where necessary, plan for a transfer of beneficiaries. These requirements are aimed at improving transfer processes and limiting the risk that a transfer of members negatively impacts benefits to members.

Chapter 1 - Introduction

1.1 Background

Robust business planning and financial management by RSE licensees are fundamental to the safety and soundness of superannuation businesses, the financial system and providing better outcomes for members.

This discussion paper outlines proposed enhancements to the superannuation prudential framework to strengthen strategic and business planning and transfer planning. It also responds to feedback provided in response to APRA’s 2022 discussion papers and findings from relevant thematic reviews.3

APRA received 15 submissions in response to the August 2022 paper and 11 submissions in response to the November 2022 paper. Submissions were generally supportive of the proposed enhancements and raised a number of areas of specific feedback and request for clarification. These requests included:

- refinement to the role of cohorts;

- providing greater flexibility in business planning and performance review; and

- RSE licensees being required to be broadly prepared for a transfer of beneficiaries, rather than a focus on a documented and detailed plan for a transfer (when there was no immediate likelihood of that transfer being required).

This discussion paper summarises feedback from the August 2022 and November 2022 papers where relevant to the draft requirements and guidance and sets out APRA’s responses to the feedback.

1.2 Modernising the prudential architecture

One of APRA’s core strategic initiatives is to modernise the prudential architecture to make it clearer, simpler and more adaptable.4

Prudential framework structure

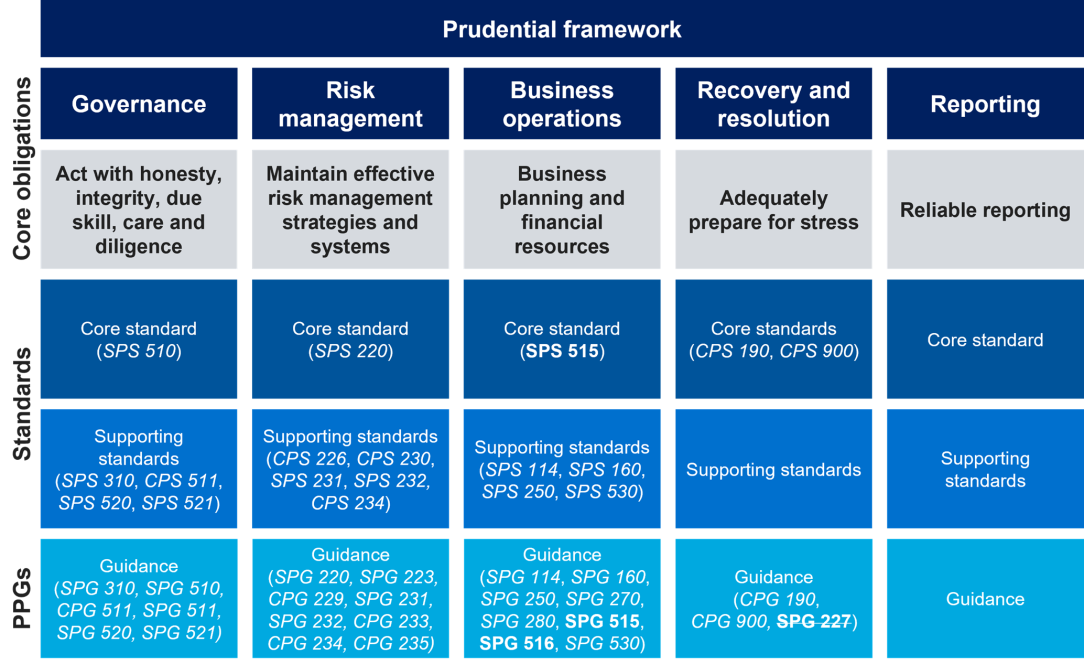

The prudential framework consists of prudential standards, reporting standards and prudential guidance. The superannuation prudential framework covers five key areas: governance, risk management, business operations, recovery and resolution, and reporting.

APRA’s guidance in prudential practice guides (PPGs) is principles-based and focused on RSE licensees achieving sound prudential outcomes, leaving it open for RSE licensees to demonstrate how best to achieve a given outcome without prescribing how this should be done. In superannuation, it is important that the PPGs do not inadvertently limit the operation of the Superannuation Industry (Supervision) Act 1993 (SIS Act) or other primary legislation.

To improve understanding and navigation of the prudential framework, APRA has categorised standards and PPGs into five pillars (representing the five key areas of the framework), defining core standards and supporting standards and guidance for each pillar. Core standards set foundational requirements in each pillar, with supporting standards being narrower in focus and setting requirements for particular risks. All standards have equal legal force whether they are categorised as being a core standard or a supporting standard.

This new structure, shown in Figure 1, enables the audience to quickly find relevant requirements and guidance and understand how the standards fit together.

Figure 1. Superannuation prudential framework

An accessible version of this image can be found here.

Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) is the core standard in the Business operations pillar of the superannuation prudential framework. Proposed enhancements to simplify and streamline the guidance are contained in draft Prudential Practice Guide SPG 515 Strategic and Transfer Planning (SPG 515) and draft Prudential Practice Guide SPG 516 Business Performance Review (SPG 516).

The proposed enhancements are also connected to recovery and resolution requirements. APRA plans to retire Prudential Practice Guide SPG 227 Successor Fund Transfers and Wind-ups (SPG 227) and incorporate guidance about undertaking an SFT in broader transfer planning guidance in SPG 515.

Approach to guidance

Under APRA’s approach to modernising the prudential architecture, specific guidance is directly linked to specific prudential requirements in integrated PPGs. This better enables understanding of which guidance supports which requirements, avoiding where possible the need for supplemental guidance, such as FAQs and information papers. Industry has been supportive of this approach in recent consultations.

In updating guidance supporting SPS 515, APRA is therefore seeking to:

- ensure that all matters relevant to setting and implementing strategies and delivering quality outcomes to members are clearly located in a single prudential standard and connected guidance; and

- remove superseded and outdated guidance, to support a clearer view on APRA’s current expectations. This includes retiring SPG 227 (with guidance on the prudent transfer of beneficiaries to other products and RSEs to be included in SPG 515) and Superannuation Circular III.A.4 Sole Purpose Test (the sole purpose test circular).

1.3 Review of the sole purpose test circular

As part of its review of SPS 515 and associated guidance, APRA has considered its 2001 sole purpose test circular.

Superannuation industry stakeholders requested the circular be reviewed, with a view to updating it, to provide greater certainty about those activities that are, or are not, consistent with the sole purpose test.

Originally designed to provide general guidance for a larger number of less sophisticated RSE licensees, focusing primarily on simple explanations of the law, the circular has no legal status or effect. Since 2001, there has been considerable industry consolidation and RSE licensees are operating more mature businesses. RSE licensees have evolved and are well placed to make robust decisions consistent with legislative duties, capable of standing up to scrutiny.

APRA’s role as the prudential regulator of superannuation is focused on an RSE licensee’s obligation to manage the funds in the best financial interests of members solely for their retirement and meet the reasonable expectations of its members. APRA does not consider that it is the regulator’s role to issue guidance that indicates, even in a non-enforceable way, whether a hypothetical action is or is not consistent with a legislative duty. Doing so runs the risk of being interpreted as limiting the operation of the primary legislation, which is not APRA’s intention.

Furthermore, whether a particular activity undertaken by an RSE licensee is consistent with the sole purpose test turns on the facts of each matter and is a matter for the RSE licensee.

APRA therefore proposes to retire the circular and is not minded to issue new guidance on the sole purpose test.

1.4 Connected reforms

The core objective of SPS 515 is for an RSE licensee to manage its business operations in a sound and prudent manner, to achieve the outcomes it seeks for its beneficiaries.

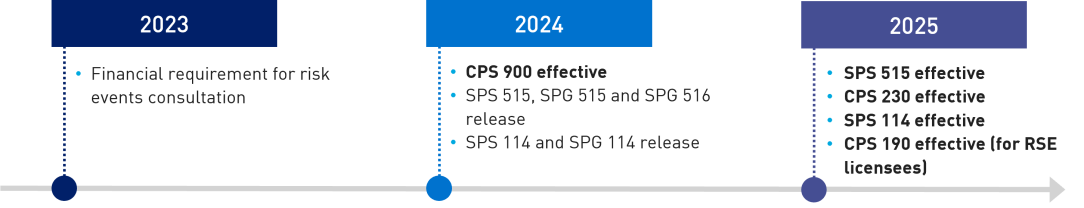

APRA has finalised, and in some cases continues to consult on, connected policy reforms that will also support this objective. These connected reforms are:

- to strengthen crisis preparedness to ensure that, in times of stress, an RSE licensee can rebuild its financial resilience or exit regulated activity before it becomes non-viable through Prudential Standard CPS 190 Recovery and Exit Planning (CPS 190). In the event that an RSE licensee becomes non-viable, APRA would resolve the RSE licensee through Prudential Standard CPS 900 Resolution Planning (CPS 900) (both CPS 190 and CPS 900 sit in the Recovery and resolution pillar)5;

- to strengthen operational risk management, including business continuity and service provider management for all APRA-regulated entities through Prudential Standard CPS 230 Operational Risk Management (which sits in the Risk management pillar)6; and

- to maintain financial resources to manage the impact of operational risk events through enhancements to Prudential Standard SPS 114 Operational Risk Financial Requirement (which sits in the Business operations pillar).7

Figure 2. Expected upcoming releases and implementation

Relationship between SPS 515 and CPS 190

In December 2022, APRA finalised CPS 190, setting out requirements for APRA-regulated entities (including RSE licensees) to have recovery and exit plans for responding to severe financial stress.8

As outlined in the November 2022 discussion paper, APRA’s transfer planning reforms are targeted at transfers of beneficiaries, whereas CPS 190 applies at the RSE licensee level.

Submissions expressed the need for clear guidance on the interaction between the requirements for transfer planning and the obligations under CPS 190. Some respondents queried whether the requirements for both sets of obligations could be addressed with a single approach and plan. Some submissions also requested guidance on expectations around different mechanisms of transfer.

Draft SPS 515 makes clear that an RSE licensee must take appropriate steps to prepare for future circumstances that may necessitate a transfer of members out of, or into, its RSE(s). It also proposes to require that where an RSE licensee has a product that fails the legislated annual performance assessment, the RSE licensee document its plan for responding to the failure.

CPS 190 requires an RSE licensee to prepare for scenarios that may impact the viability of the RSE licensee. Given the material impact that the ongoing viability of the RSE licensee can have on its ability to sustainably operate RSEs under its trusteeship, it is common for recovery and exit actions for an RSE licensee to also involve remediation or transfers of member benefits at the RSE level.

The supporting guidance (SPG 515) explains that it is open to an RSE licensee to develop, and maintain, a single approach that meets the requirements of both SPS 515 and CPS 190. For example, an RSE licensee may decide that it is clearer and more efficient to have one document setting out planned actions that may be interlinked; for example the actions to address an RSE licensee stress event may also include or necessitate the transfer of its RSE(s).

1.5 Next steps

Subject to the responses to this discussion paper, APRA intends to finalise SPS 515 and the associated guidance by mid-2024. At this stage, it is intended that SPS 515 be implemented with effect from 1 January 2025.

Footnotes

3 Strategic planning and member outcomes: Proposed enhancements (Discussion Paper, August 2022) and Superannuation transfer planning: Proposed enhancements (Discussion Paper, November 2022).

4 Modernising the prudential architecture (Information Paper, September 2022).

5 Strengthening crisis preparedness (Consultation Page, updated May 2023).

6 Operational risk management (Consultation Page, updated July 2023).

7 Strengthening Financial Resilience in Superannuation (Consultation Page, updated November 2022).

8 These plans set out actions that could be taken to restore the financial resilience of the RSE licensee, or for the RSE licensee to exit the industry in an orderly manner to protect members. CPS 900 was finalised in May 2023, confirming new requirements for RSE licensees to support APRA in the development and maintenance of bespoke resolution plans - when needed to ensure an orderly resolution.

Chapter 2 - Strategic planning and member outcomes

In the August 2022 discussion paper, APRA sought industry feedback on the high-level direction of potential enhancements to the SPS 515 framework. Areas covered in the August 2022 paper included improvements in defining outcomes for members, financial resource management, expenditure, fee setting and performance assessment.

Key feedback from submissions to the consultation included:

- The SPS 515 framework has improved strategic and business planning discipline and promoted a focus on member outcomes across industry.

- Guidance was sought to clarify APRA’s expectations on strategic objectives, member outcomes and the appropriate metrics to use for performance assessments.

- Cohorts play an important role in understanding member needs, but data and cost concerns may reduce the benefits of requiring more granular cohorts.

- There are challenges in the business planning cycle, where earlier releases of statistical publications would greatly benefit sequencing of plans and the relevance of data in assessments.

Where relevant specific feedback was received, it is discussed in further detail below. APRA’s view is that these proposed enhancements clarify the intent of the SPS 515 framework and its interaction with the overarching legislative requirements.

2.1 Strategic objectives and member outcomes

Clearly measured outcomes enable RSE licensees to understand how outcomes are achieved and how they might be improved for members. Through APRA’s supervision and the Prudential Standard SPS 515 Strategic Planning and Member Outcomes benchmarking review, APRA has observed that strategic objectives are not always clearly linked to specific member outcomes.9

APRA therefore proposes to update SPS 515 to clarify that the outcomes an RSE licensee seeks to achieve for beneficiaries must be specific. APRA also proposes to update SPG 515 to clarify guidance on measuring outcomes.

As indicated in the recent Implementation of the retirement income covenant: Findings from the APRA and ASIC thematic review, APRA proposes to embed review findings into the SPS 515 framework to ensure an appropriate focus is placed on the needs of retired members and members approaching retirement. The updates include amendments to SPS 515 to require an RSE licensee to consider the retirement income strategy when developing strategic objectives.10

2.2 Business planning and financial projections

RSE licensees need to create and maintain a business plan which provides a roadmap for delivering its strategic objectives and achieving the outcomes sought for members. APRA is seeking to move away from a ‘documentation-focus’ towards a focus on member outcomes in business operations.

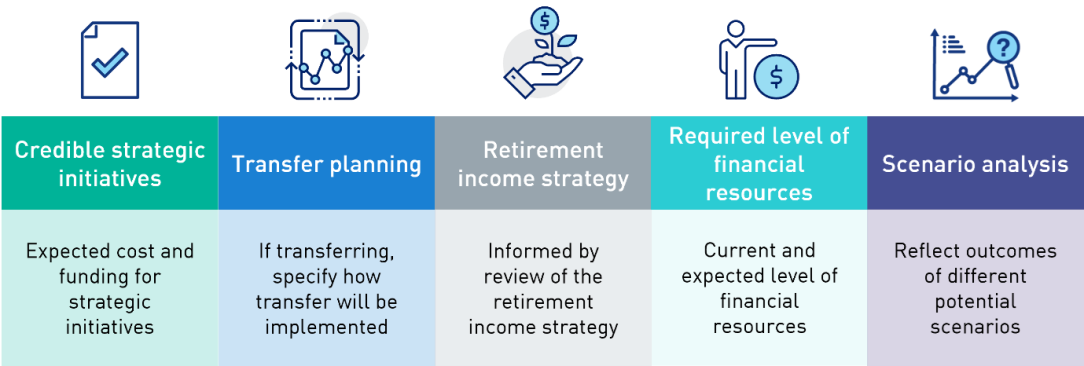

As such, while draft SPS 515 requires an RSE licensee’s business plan to include information about strategic initiatives and the implementation of remedial actions or planned transfers, it is open to an RSE licensee to maintain a simple and streamlined business plan that best meets its needs.

Further, while business plans have evolved to include more detail about planned initiatives, and the outcomes the RSE licensee expects them to deliver, further refinements are needed. To ensure a focus on delivery and implementation, APRA proposes to require RSE licensees to include in the business plan the expected cost for key initiatives, as well as how they will be funded.

To ensure members approaching and in retirement are reflected in the broader strategic direction of an RSE licensee’s business operations, APRA also proposes to require that the business plan be informed by an annual review of the RSE licensee’s retirement income strategy.

The proposed enhancements to SPS 515 are also intended to support better financial management: draft SPS 515 requires the business plan to be informed by an RSE licensee’s view of its expected level of financial resources and expects financial projections to be tested under a range of different scenarios. This is to ensure RSE licensees can form a view about their ability to continue to deliver quality outcomes to beneficiaries under different potential future circumstances. Having a view of the expected level of financial resources and projecting different scenarios is crucial to ensuring the holistic management of financial resources.

Figure 3. Proposed enhancements to business planning

In response to feedback questioning the value of requiring the Board to assess the methodology for financial projections, APRA no longer proposes to require the Board to undertake this assessment. However, APRA expects a Board’s review and approval of the business plan would be informed by a sound understanding of the methodology used to develop the associated financial projections.

2.3 Financial resource management

Feedback from APRA’s November 2021 Discussion Paper – Strengthening financial resilience in superannuation and August 2022 paper indicated that many RSE licensees are still working towards a mature, holistic approach to managing financial resources. Submissions generally supported requirements for a more robust approach to financial resource management.

Consistent with this feedback, draft SPS 515 seeks to ensure that RSE licensees maintain a prudent approach to financial management, with requirements relating to fee setting, managing reserves and fund expenditure.

2.3.1 Fee setting principles

As fees charged to members directly impact the benefits members ultimately receive, RSE licensees must be able to account for how they set and apply fees to members. While supporting the aim of APRA’s fee setting principles, submissions generally highlighted the importance of not disturbing existing robust approaches to fee setting when incorporating any new requirements in SPS 515, and emphasised being clear on the types of fees to which requirements would apply.

APRA proposes to amend SPS 515 and the associated guidance to require RSE licensees to demonstrate a prudent approach to setting their fees and costs, integrating the fee setting principles from the August 2022 paper into the prudential framework.

2.3.2 Reserving practices and management of other financial resources

Reserves are ultimately funded by members. As such, RSE licensees need to be able to explain clearly why such reserves exist and how they will be used. APRA has published guidance relating to the prudent management of reserves. Consistent with a holistic approach to financial management, APRA proposes to elevate this guidance to new principles-based requirements in draft SPS 515. Specifically, APRA proposes to require that an RSE licensee’s strategy for reserve management demonstrates the need for each reserve, includes how each reserve is managed in the context of its purpose, and how the RSE licensee establishes an appropriate target amount and replenishment strategy.

APRA also proposes to require that an RSE licensee puts in place controls to ensure prudent management of financial resources held at the trustee company level, including by way of a capital management plan.

2.3.3 Expenditure

How an RSE licensee spends directly affects the benefits received by members. RSE licensees are trusted by members to ensure that every dollar saved for retirement is protected and delivers quality retirement outcomes. Vigilant expenditure management practices ensure RSE licensees are minimising wastage and maximising value, thereby improving outcomes for members.

SPS 515 currently requires an RSE licensee to ensure expenditure decisions are for the purpose of the sound and prudent management of its business operations and, in the case of significant expenditure, that they have a rigorous approach to decision making which can be evidenced.

The expenditure provisions in draft SPS 515 have been enhanced to respond to APRA’s supervisory observations and to reflect the introduction of the duty to act in the best financial interests of beneficiaries.

When making expenditure decisions relating to its business operations, an RSE licensee must be able to justify the purpose of the expenditure and take into account any previous assessment by the RSE licensee of whether the expenditure has achieved its intended purpose.

APRA recognises industry requests for guidance on expenditure management to support RSE licensees ensuring a commensurate approach that minimises compliance costs. It is APRA’s expectation that documentary support to evidence decision-making will be commensurate with the nature and size of the expenditure. Draft SPG 515 includes additional guidance on expenditure management in response to this feedback, noting that this guidance supports the revised requirements set out in draft SPS 515.

2.4 Monitoring performance and triggers

To drive a timely response where expected outcomes are not being achieved, SPS 515 currently requires that an RSE licensee must monitor its progress against strategic objectives and the business plan.

To ensure RSE licensees are well placed to undertake transfer or remedial actions, APRA proposes to require an RSE licensee to include, in their monitoring frameworks, triggers that identify the need to commence taking actions to improve outcomes for beneficiaries or to commence preparations for a transfer of members. It is open to an RSE licensee to meet similar requirements for monitoring of triggers under CPS 190 and the obligations of draft SPS 515 by maintaining a single set of triggers covering both the RSE licensee and the RSE.

2.5 Business performance review

Clear assessments of performance are critical to delivering quality outcomes for members. There was a general view in submissions, shared by APRA, that the business performance review (BPR) process has focused on the production of a standalone artefact, rather than a robust assessment of performance. Some submissions also suggested that more flexibility in the BPR is more likely to result in more constructive assessment.

Consistent with an outcomes-focused approach, APRA proposes to streamline the business performance review requirements in draft SPS 515. An RSE licensee must, in their business performance review, assess and demonstrate whether the strategic objectives are being met and the outcomes have been achieved for beneficiaries having regard to various factors. Draft SPS 515, however, removes the requirement to separately articulate a conclusion.

2.6 Annual outcomes assessment

Submissions to the August 2022 paper requested greater alignment and integration between the annual outcomes assessment, the annual performance test, and other metrics by which to assess performance.

APRA acknowledges this feedback and proposes to revise the annual outcomes performance test requirements and guidance to clarify the interaction between, and consideration of, metrics to assess performance. Draft SPS 515 and draft SPG 516 also make clear how the results of the legislated annual performance assessment should inform how an RSE licensee completes its annual outcomes assessment.

Footnotes

9 Findings from APRA’s superannuation thematic reviews (Information Paper, October 2021).

10 Implementation of the retirement income covenant: Findings from the joint APRA and ASIC thematic review (Information Report, July 2023).

Chapter 3 - Remedial actions and transfer planning

The November 2022 paper proposed a series of measures to enhance planning by RSE licensees in the event they need to transfer members out of, or into, their RSE. The November 2022 paper also included proposed wording for requirements that would apply in the event APRA cancels a MySuper product authority.

Submissions expressed strong support for the proposals, but raised a number of matters that required clarification. Draft SPS 515 and draft SPG 515 reflect APRA’s approach to responding to this feedback.

The proposed reforms would require RSE licensees to be prepared to act promptly so members are not disadvantaged if expected outcomes are not achieved. The proposed changes would ensure RSE licensees have a clear picture of when they need to act and what steps they need to take to minimise negative impacts on members.11

3.1 Remedial actions

One of the core tenets of SPS 515 is that an RSE licensee takes timely and meaningful action where it identifies opportunities to improve outcomes for beneficiaries. APRA’s supervisory focus on continuous improvement, particularly driven by APRA’s heatmaps and the legislated annual performance assessment, has resulted in RSE licensees taking more timely action.

To maintain this focus, APRA proposes to require an RSE licensee to be able to demonstrate how it is taking timely action where expected outcomes are not being achieved or relevant triggers have been met.

3.2 Planning for transfers

Prompt action relies on an RSE licensee having a clearly expressed position on when to act and what it needs to do to prepare. APRA proposed to elevate existing guidance on contingency planning to new requirements in SPS 515. This would require all RSE licensees to demonstrate that they regularly consider and, where necessary, plan for future circumstances that may necessitate a transfer of some or all of their members out of, or into, their RSE(s). APRA also proposed to require RSE licensees to have in place a trigger framework for remedial action, including escalation steps in preparedness to undertake a complete or partial transfer of members.

Overall, submissions supported a general requirement for transfer preparedness, where this requirement was proportional or scaled to an RSE licensee’s circumstances, to ensure the benefits of advance planning for a transfer are not outweighed by the costs of doing so. Respondents agreed a trigger framework is important, but emphasised that more detailed planning should only be required if triggers are breached. Only in this circumstance should RSE licensees be required to develop formal plans for a transfer.

Following this feedback, draft SPS 515 proposes to require all RSE licensees to demonstrate that they regularly consider, and where necessary, plan for a transfer of beneficiaries, as a critical component of their business planning cycle. Rather than being required to have a formal plan in place at all times, draft SPS 515 makes clear that an RSE licensee will only be required to consider or be prepared for a transfer, and not make a formal plan until a trigger is reached. The advantage of being prepared for a transfer is that an RSE licensee would have considered, and resolved in advance, many issues that may otherwise cause unnecessary delays and adversely impact the success of a transfer after the decision to undertake a transfer has been made.

3.3 Understanding the phases of a transfer

The November 2022 paper set out three distinct phases of planning for a transfer of beneficiaries: planning, pre-positioning and decision-making, and execution. A range of factors identifying likely proposed guidance for the distinct phases was provided in Attachment B to that paper.

Some respondents suggested that expectations for the planning phase should not place as much focus on external preparations and instead should focus on internal preparations which would benefit all RSEs, not just those in the inevitable position of transferring. Other submissions sought greater clarity on the distinction between the phases.

Some preparation by RSE licensees during the ordinary course of business is necessary to support an RSE licensee being able to act quickly when expected outcomes are not met. APRA remains of the view that these phases are a useful way to understand the processes for undertaking a transfer, but recognises that there is value in requiring RSE licensees to take appropriate steps to plan for a future transfer of beneficiaries, rather than requiring a formal plan at this early stage.

Draft SPG 515 makes clear that an RSE licensee would use the trigger framework to determine when to take more formal steps to plan for a transfer. APRA considers that understanding the phases of a transfer and the relevant triggers is important so that RSE licensees are able to assess the necessary preparations for a transfer including when these preparations should be undertaken.

3.4 Transfers of MySuper product assets

Being well prepared for a transfer of MySuper product assets is essential to ensure that risks and issues that might impede the successful transfer of members and assets in a MySuper product are identified and addressed, and to facilitate the orderly transfer of MySuper product assets within 90-days of being given a notice of cancellation of the RSE licensee’s authorisation to offer a MySuper product.

In the November 2022 paper, APRA proposed new prudential requirements that would allow APRA to require an RSE licensee to take specific preparatory steps in circumstances where a trigger relating to the MySuper product is reached.

Submissions queried the scenario where an RSE may have assets additional to those in the MySuper product, so that some assets may not be transferred as part of this arrangement and may be considered “stranded” assets. Another issue noted was the inability to access capital gains tax benefits on partial transfers, and overall concerns were raised regarding the ability of an RSE licensee to meet its best financial interest obligations in the context of these issues. Some expressed concern with the intended commencement date of 1 July 2023.

In many circumstances, it is likely that an RSE licensee will take steps to transfer MySuper product assets as part of an RSE-licensee led transfer of members. The provisions relating to the transfer of MySuper product assets in draft SPS 515 therefore has a very limited, though necessary, role as it is only triggered where APRA notifies the RSE licensee that its authorisation to offer a MySuper product under its trusteeship may be cancelled.

3.5 Barriers to transfers

If barriers to a transfer are not identified early, the RSE licensee risks wasting assets and resources on preparing for a transfer that ultimately cannot be carried out as planned. As the need for a potential transfer becomes more pressing, it is important that an RSE licensee is able to demonstrate a sound understanding of any existing barriers to transfers, including legislative, operational and practical barriers, and how the barriers will be addressed or managed.

Respondents submitted a number of examples of transfer barrier issues. These issues included: equivalent rights (and a preference for “Safe Harbour Rules”); the need to apply to APRA for portability relief; provisions related to the legislated performance assessment; legislative restrictions related to MySuper products; the lack of automatic transfer of nominations and elections; secret commissions laws; compliance with design and distribution obligations and anti-hawking requirements; and tax matters such as capital gains tax relief, stamp duty and transfer duty.

The proposed enhancements in draft SPG 515 aim to ensure that RSE licensees are better prepared to understand and address barriers well before the steps to complete an SFT commence. APRA notes, however, that the specific barriers raised in submissions largely relate to matters beyond APRA’s mandate. APRA will engage with other Government authorities (including the Australian Treasury, ASIC or ATO) to explore these matters further.

APRA considers it important that all RSE licensees understand any critical barriers to a transfer and be prepared to address these barriers very early in the transfer planning stage. Barriers to transfers must be well understood prior to an RSE licensee entering into negotiations with transfer partners.

Footnotes

11 The proposals to sharpen RSE licensees’ focus on remedial action and planning for a transfer of members complement and support requirements in CPS 190. The proposed requirements aim to lift recovery planning and resolution readiness across the industry, a focus of the Financial Regulator Assessment Authority review report recommendations.

Chapter 4 - Consultation

4.1 Requests for submissions

APRA invites written submissions on draft SPS 515 and associated guidance. Submissions should be sent to superannuation.policy@apra.gov.au by 21 December 2023 addressed to the General Manager, Policy, APRA.

Following the review of feedback received through submissions, APRA aims to finalise the SPS 515 framework in the first half of 2024, ahead of commencement on 1 January 2025.

4.2 Request for cost-benefit analysis information

APRA requests that all interested stakeholders use this consultation opportunity to provide information on the compliance impact of the proposed changes and any other substantive costs associated with the changes. Compliance costs are defined as direct costs to businesses of performing activities associated with complying with government regulation. Specifically, information is sought on any increases or decreases to compliance costs incurred by businesses as a result of APRA’s proposals.

Consistent with the Government’s approach, APRA will use the Commonwealth Regulatory Burden Measure framework to assess compliance costs. Guidance in relation to the framework is available at https://oia.pmc.gov.au/.

Respondents are requested to use this framework to estimate costs to ensure the data supplied to APRA can be aggregated and used in an industry-wide assessment. When submitting their costs assessment to APRA, respondents are asked to include any assumptions made and, where relevant, any limitations inherent in their assessment.

Feedback should address the additional costs incurred as a result of complying with APRA’s requirements, not activities that entities would undertake regardless of regulatory requirements in their ordinary course of business.

4.3 Important disclosure notice – publication of submissions

All information in submissions will be made available to the public on the APRA website unless a respondent expressly requests that all or part of the submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose. Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.