Information report - Implementation of the retirement income covenant: Findings from the joint APRA and ASIC thematic review

About this report

This information report sets out the findings of a recent thematic review of the implementation of the retirement income covenant (‘the covenant’) by a sample of Registrable Superannuation Entity (RSE) licensees. The review was undertaken jointly by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC).

The thematic review considered how RSE licensees:

- identify and understand members’ needs in retirement;

- assist members with information, financial advice and product offerings; and

- execute and oversee their retirement income strategy, and assess whether the intended outcomes are being achieved.

APRA and ASIC undertook this thematic review in the first year since the introduction of the covenant to share early learnings and experience across the industry, call out areas where industry needs to accelerate its implementation efforts and encourage innovation by RSE licensees.

Executive summary

The fundamental purpose of the superannuation system is to provide income to the Australian community in retirement. However, evidence shows that the majority of the Australian community do not make the most of their superannuation assets in retirement. As highlighted by the Retirement Income Review, many people die with the bulk of the wealth they had at retirement intact.1

To address this issue, the Superannuation Industry (Supervision) Act 1993 (SIS Act) was amended in 2022 to include a retirement income covenant. The covenant requires RSE licensees to have a strategy to assist members in or approaching retirement.2

The covenant is principles-based, providing RSE licensees with the flexibility to decide how best to assist their members to meet their retirement income needs – which may include helping members to access products and solutions outside their RSE.

Aligned with the ultimate purpose of the covenant, the strategies put in place by RSE licensees are expected to improve how the Australian community use their superannuation in retirement.

Our review

During the 2022–23 financial year, APRA and ASIC jointly reviewed how RSE licensees were implementing their new obligations under the covenant. We examined the progress of 15 RSE licensees, which are trustees for 16 RSEs with varying characteristics. Collectively, these RSEs cover about half of the accounts and benefits of members aged 45 and above in APRA-regulated superannuation funds.3

Our findings

We observed that RSE licensees were focusing most of their efforts on expanding the assistance and support available to members in or approaching retirement (see summary of findings on page 6). However, we found variability in the quality of approach taken – overall, there was a lack of progress and insufficient urgency from RSE licensees in embracing the retirement income covenant to improve members’ retirement outcomes.

Next steps

In this report we have outlined our findings and included examples of better practices. We have also highlighted priority actions for RSE licensees (see page 6). We expect all RSE licensees to consider the findings and examples of better practices outlined in this report. They should address, with urgency, the gaps in their approach.

We will continue to engage with RSE licensees and other stakeholders to understand how industry and other relevant providers are improving practices to better assist members with the retirement phase of superannuation. Where appropriate, APRA’s prudential framework will be enhanced to reflect key findings of this review. APRA will consult on proposed enhancements later in 2023.

We note that the Government has recently released its response to the Quality of Advice Review.4 This information report does not address the implications of future advice laws on the assistance that RSE licensees may provide as part of their retirement income strategies. This is a matter that RSE licensees will need to consider as legislative changes are made. Under the existing laws, there are still a number of actions that RSE licensees can take now to better assist members in or approaching retirement, some of which involve the provision of advice.

An accessible version of this infographic is available here.

Footnotes

1 Treasury, Retirement Income Review – Final report, 20 November 2020, p. 432.

2 For the purposes of this report, ‘the covenant’ refers to the retirement income covenant in s52AA of the SIS Act.

3 Data of APRA-regulated RSEs with more than six members from SRF 611.0 Member Accounts as at December 2022.

4 Treasury, Government response to the Quality of Advice Review, report, 13 June 2023.

Introduction

Retirement income decisions can be complex for superannuation members. Once a member reaches retirement, moving their superannuation balance to the retirement phase requires an active choice, sometimes involving difficult trade-offs.5 Members generally need to consider their future intentions related to work and leisure, their broader financial situation, health considerations and their risk preferences.

There is evidence that a high proportion of the superannuation benefits of many members in the Australian community remain unspent over the retirement phase.6 Such low consumption of superannuation may lead to a lower living standard in retirement than could otherwise have been achieved. This suggests the Australian community needs assistance to use their superannuation benefits for retirement income.

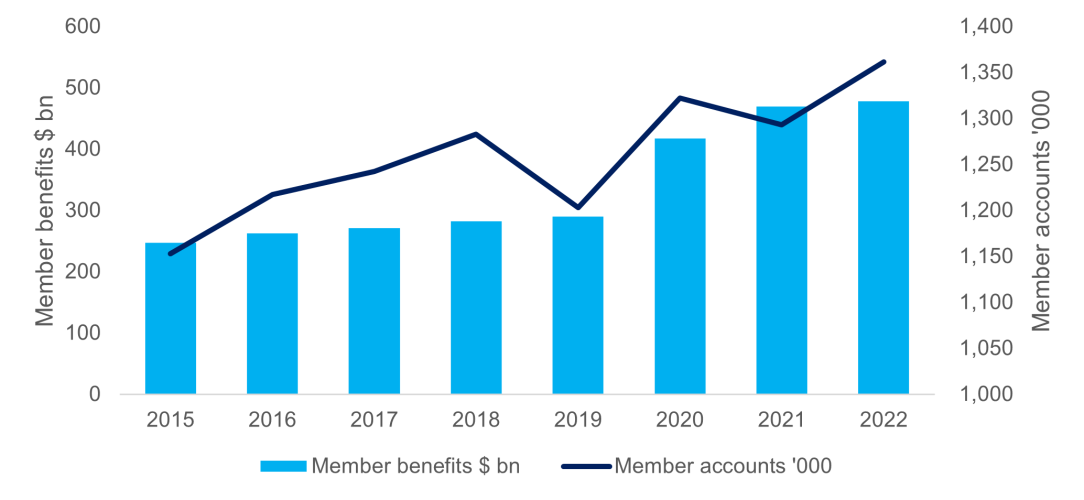

Furthermore, the growth in member accounts and member benefits in the retirement phase of superannuation emphasises the need and urgency for RSE licensees to address this challenge. Figure 1 illustrates that the number of member accounts in the retirement phase increased over 7 years to more than 1.3 million, with an average growth rate of 2.4% p.a.7 Over the same period, member benefits within the retirement phase increased from $247 billion to $478 billion, growing at a rate of almost 10% p.a. on average.8

Figure 1: Member benefits and accounts in the retirement phase

Growth in member accounts and benefits in the retirement phase has been driven by an ageing population, the increase of the compulsory superannuation guarantee rate over time and the compounding of investment returns leading to higher balances. If these trends continue, member benefits in the retirement phase would be expected to double by 2030, and member accounts would have increased by more than 20% from the levels observed in 2022.

The retirement income covenant

The retirement income covenant places a positive obligation on RSE licensees to assist members in or approaching retirement to improve member outcomes in retirement. The covenant is an important step in broadening industry focus beyond the accumulation phase to the decumulation, or retirement phase of superannuation.

Under the covenant, RSE licensees are required to implement a strategy to assist members to achieve and balance the three objectives of:

- maximising expected retirement income;

- managing expected risks to the sustainability and stability of retirement income; and

- having flexible access to expected funds during retirement.

The covenant gives RSE licensees the flexibility to decide how best to assist their members to meet their retirement income needs – which may include helping members to access products and solutions outside of their RSE. Ultimately, the covenant requires RSE licensees to carefully consider the financial needs of their members in retirement and to take action to support their members to meet these needs.

Reviewing implementation of the covenant

During the 2022–23 financial year, APRA and ASIC undertook a joint thematic review of RSE licensees’ implementation of the covenant, against the expectations outlined in the joint letter that we issued in March 2022.9

We undertook this review to gather information on the initial implementation of the covenant, so that we could then share early learnings from across the industry, call out areas where industry needs to accelerate implementation efforts and encourage innovation by RSE licensees.

Our review builds on a range of activities undertaken by ASIC and APRA to support the implementation of the covenant.10 These include recent updates to ASIC’s relief from certain financial advice requirements for providers of superannuation calculators and retirement estimates if they provide these forecasting tools in line with conditions set by ASIC.

We conducted the review by examining each RSE licensee’s retirement income strategy, and by meeting with RSE licensees to discuss their approach and decisions as well as their progress in implementing their strategies.

The 15 RSE licensees we reviewed included trustees of industry, retail, corporate and public sector funds. As at December 2022, four of the 16 RSEs had total member benefits of less than $10 billion, five were between $10 billion and $50 billion, and the remaining seven above $50 billion. The average balance of members aged 45 and above for the 16 RSEs, ranged from approximately $30,000 to $350,000.11

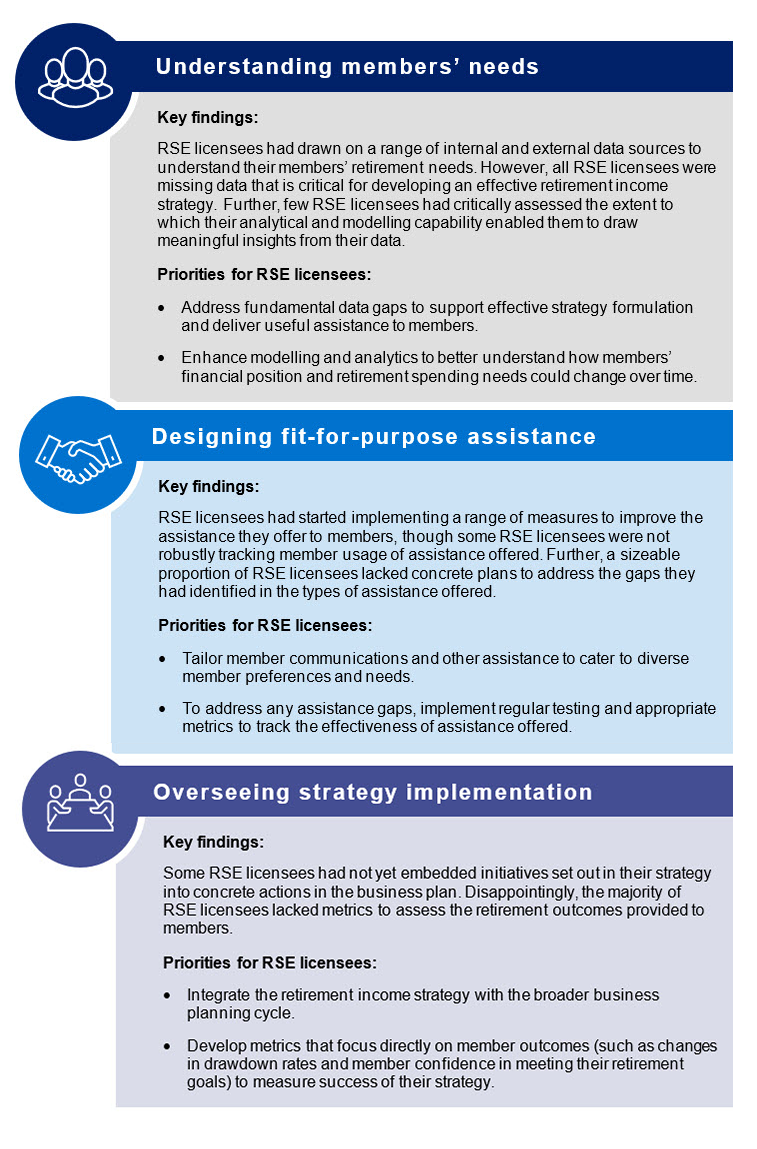

Throughout the review, it became evident that effective implementation of the covenant centres on satisfying three core elements:

- understanding members’ needs;

- designing fit-for-purpose assistance; and

- overseeing strategy implementation.

Our findings set out in the remainder of this report are framed around these three elements.

Footnotes

5 Generally, ‘retirement phase’ refers to the period between the start of retirement or when an individual moves their account into the tax-free phase, and end of life.

6 Treasury, Retirement Income Review – Final report, 20 November 2020, p. 432.

7 Data is based on the member accounts and benefits identified as being in the ‘tax-free phase’ in APRA’s data collection, which represents where the members’ benefits are no longer liable for income tax on earnings due to the members’ benefits being identified as in the ‘retirement phase’ (ITAA, Division 294, Division 307).

8 APRA Annual fund-level superannuation statistics back series June 2004 to June 2022 (Table 11).

9 APRA and ASIC, Implementation of the retirement income covenant, joint letter to RSE licensees, 7 March 2022.

10 Activities include APRA and ASIC joint letter (see footnote 9); J Eccleston, ASIC Senior Executive Leader – Superannuation, 'Are you prepared for the Retirement Income Covenant?', ASFA Superfunds, 21 April 2022; and Joint APRA-ASIC, Implementation of retirement income covenant – FAQs, APRA webpage, released on 1 June 2022.

11 Data from APRA’s SRF 611.0 as at December 2022, includes insurance only and defined benefit members.

Findings: Understanding members’ needs

Understanding members’ retirement income needs is critical to having a retirement income strategy that is appropriate for members. This involves considering the financial position and future spending needs of members to the extent necessary to form a broad understanding of an RSE licensee’s membership profile. We looked at what data was being gathered and how RSE licensees were using it to understand members’ needs.

We note that there is a distinction between gathering information from various data sources, including fund membership, to understand the needs of groups of members and inform the RSE licensee’s strategy, and gathering member-specific information to provide recommendations concerning financial product solutions tailored to the particular member. In this section, when we discuss gathering information about members, we are referring to gathering data to understand the needs of groups of members at the aggregate level.

Key points

- Most RSE licensees drew on a range of data sources to understand members’ financial position and retirement income needs, including member account data, member surveys and external sources.

- Many RSE licensees recognised they had gaps in critical member data, both around members’ financial position and income needs in retirement. However, only a few RSE licensees had developed robust plans to address these data gaps to enhance their retirement income strategy.

- Although some RSE licensees had advanced analytical capabilities, most were not modelling how members’ retirement income needs may evolve over time.

- Some RSE licensees explored membership sub-classes to group members’ needs, but these were largely limited to factors such as age and superannuation balance. In some instances, RSE licensees were unable to demonstrate how their choice of sub-classes informed their strategy development.

Understanding members’ financial position

To provide meaningful assistance to members in or approaching retirement, RSE licensees need to have sufficient understanding of members’ financial position at retirement as this will have an impact on their Age Pension eligibility and spending in retirement. This does not mean that RSE licensees need to accurately know the financial position of each member; rather, RSE licensees need to know enough about their membership profile to formulate and review an effective strategy.

Rudimentary and point-in-time analysis that does not consider material assets outside of superannuation or how members’ superannuation balances may change over time is unlikely to provide sufficient insights into members’ financial position to develop a member-centric strategy.

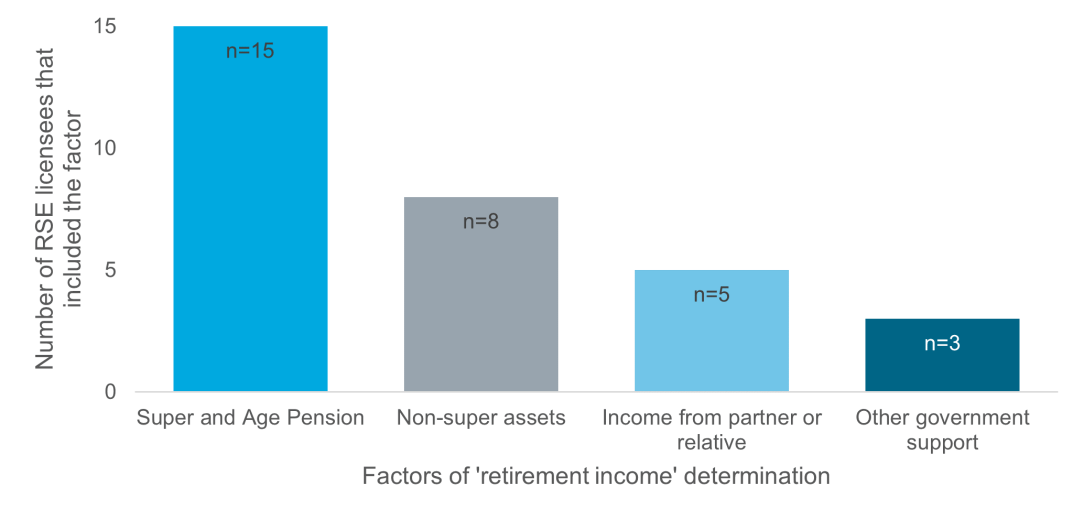

We found all RSE licensees captured superannuation savings and the Age Pension when determining the meaning of ‘retirement income’, as shown in Figure 2 on page 10. However, only 8 out of 15 RSE licensees considered members’ financial position beyond these factors.

Figure 2: Factors captured by RSE licensees when determining ‘retirement income’

All RSE licensees analysed internal data when formulating their retirement income strategies, although the depth of analysis varied. A small number of RSE licensees analysed only basic factors such as member accounts by age or balance bands at a point in time, and in some instances using very outdated data. The majority of RSE licensees also employed external data sources, with data from the Australian Bureau of Statistics (ABS) being the most common.

Better practices included RSE licensees:

- fully exploring the depth and breadth of their own data, ensuring data was sufficiently current, and supplementing this with external (population level) data, such as that listed in Table 1; and

- seeking to better understand the financial profile of their membership in different sub-classes beyond superannuation balance, including key information such as home ownership, partner/marriage status, and material assets and income outside of the RSE or the superannuation system.

Table 1: Examples of external data sources used by RSE licensees

Data source | Data (non-exhaustive list) |

|---|---|

Australian Bureau of Statistics (ABS) | Life expectancy, retirement trends, retirement intentions and spending behaviour |

Reports by the Australian Treasury | Insights and analysis included in the Retirement Income Review final report, or the 2021 Intergenerational Report |

Consumer research | Member behaviour and engagement with retirement planning |

APRA data | Analysis of market share and membership characteristics based on APRA’s annual fund-level statistics |

Academic literature | Journal articles on topics such as mortality and utility functions |

Household, Income and Labour Dynamics in Australia (HILDA) Survey | Demographics and information on household expenditure in retirement, assets and income |

Australian Government Actuary | Life expectancy |

Considering members’ income needs in retirement over time

Retirees’ income needs typically vary by standard of living pre-retirement, life stage and lifestyle preferences in retirement. To assist members in establishing and achieving their income goals in retirement, RSE licensees require sufficient understanding of the spending needs of their membership profile and how these needs might change over time.

We found most RSE licensees had not conducted an in-depth analysis of their members’ income needs in retirement. Referencing a fixed income target based on external data and research was the most common practice. Only a small number of RSE licensees analysed drawdown patterns of their retired members, or considered how their members’ retirement income needs may correlate to their pre-retirement income.

When considering members’ income needs, the majority of RSE licensees relied on external data, such as those from the ABS and the HILDA Survey. Seven RSE licensees also referenced broad industry-developed measures of retirement standards in their strategies, most with an emphasis on the lump sum amount, rather than regular income level in retirement.

External data can provide useful population-wide insights such as life expectancy, retirement trends, retirement intentions and spending behaviour. When using such data, RSE licensees must consider the application of the data to their membership. For example, whether using a fixed retirement or income target for all members is appropriate given the range of members’ current income levels and lifestyle preferences in the accumulation phase.

Better practices included RSE licensees integrating external data and research with internal data on retirees’ behaviour. Some explored the relationship between members’ lifestyle preferences to their income level pre-retirement, using the concept of replacing pre-retirement income. Several RSE licensees conducted member surveys across a representative sample to understand their retirement lifestyle preferences and potential spending needs.

When conducting member surveys, it is important that RSE licensees apply sound sampling techniques to ensure the findings are representative of their membership.

Case study: Understanding members’ needs

When determining members’ financial position, one RSE licensee linked internal member information (age, account balance, estimated account balance at retirement, gender, estimated salary) with external data to better estimate Age Pension eligibility (full, part, none).

By separately surveying representative samples of members on their retirement needs and segmenting this by Age Pension eligibility, the RSE licensee was able to combine insights on financial status with needs expressed by members in each eligibility group. This provided a greater understanding of the needs of each group, informing the assistance to provide members.

Modelling retirement needs

To account for potential changes in members’ spending needs over the period of retirement, some RSE licensees had begun to develop more advanced modelling techniques to estimate how member balance and spending needs could develop through retirement and the range of potential outcomes members could experience. However, most RSE licensees were yet to focus on enhancing their modelling capability in this area.

Better practices included a small number of RSE licensees modelling member behaviours and pension drawdown amount using historical transactional and account data they hold. Some RSE licensees have also reflected on the size and evolution of household debt or medical expenditure that members may be required to service. These considerations helped them to better understand trends in drawdown decisions and how these are associated with various member characteristics, as well as how member behaviours may change over time.

Addressing data gaps

The majority of RSE licensees identified specific data items that they would like to collect to deepen their understanding of members’ needs. The most common data gaps identified by RSE licensees are summarised in Table 2.

Table 2: Examples of data gaps identified by the RSE licensees

Data type | Examples of data gaps |

|---|---|

Financial position |

|

Income needs |

|

Other |

|

We found that, despite 12 out of 15 RSE licensees explicitly acknowledging that they had data gaps, only four had concrete plans to address these gaps.

Some RSE licensees expressed reluctance to collect additional data from members directly due to a concern that this could place them at risk of inadvertently providing personal financial advice. As stated in the Explanatory Memorandum, collecting information on members, in and of itself, would not result in the provision of financial product advice.12 Rather, financial product advice involves a recommendation or statement of opinion (or a report of either of those things) that is intended to influence a person in making a decision about a financial product or could reasonably be regarded as being intended to have such an influence.13 RSE licensees seeking to avoid providing personal financial advice to their members should therefore focus on the way they communicate about financial products, particularly as the test for personal financial advice can be satisfied even in the absence of knowing a person’s objectives, financial circumstances and needs.

Other RSE licensees appeared to have reservations about collecting additional data because of the associated cost or difficulty, mainly due to lack of member engagement, privacy and data security concerns, or uncertainty around how they would use the data. We recognise the difficulty for RSE licensees in addressing their data gaps; however, RSE licensees need to think beyond this as to what is possible to form a sufficient understanding of their membership upon which to base their strategy.

One RSE licensee took the view that understanding needs of their membership was not necessary as they stated that many of their members were likely to be receiving advice from a financial adviser. This issue and how it interacts with assistance offered is discussed in the next section.

Better practices included RSE licensees undertaking robust data gap analysis based on what is needed to further develop their strategy, identifying cost-effective ways to obtain the data required by using both internal and external resources, and having a clear plan and accountable person(s) in place to address data gaps identified.

Segmenting membership

Segmenting membership into sub-classes based on members’ financial position and income needs can help RSE licensees to consider how best to assist members and measure outcomes for these sub-classes.

We found that the majority of RSE licensees had established sub-classes. The number of sub-classes varied widely between licensees, from 2 to more than 20, with 3 sub-classes being the most common.

Age and superannuation balance were the most common factors used to determine the sub-classes, with only a minority of RSE licensees considering additional factors such as Age Pension eligibility. RSE licensees need to be aware that segmentation done based on very narrow member information and consideration could potentially lead to developing inappropriate strategy and inadequate assistance to members.

A few RSE licensees adopted a cohort of one approach, whereby each member is supported to develop their own personalised whole-of-life retirement plan consisting of tailored retirement income goals and product selection. With this approach, RSE licensees need to ensure they have the capacity to assist all their members in or approaching retirement.

Some RSE licensees that had established sub-classes did not tailor their strategy to these sub-classes, which undermines the purpose of segmentation.

Better practices included RSE licensees giving careful and comprehensive consideration in member segmentation, and closely linking their sub-classes of members to designing assistance and product offerings for each sub-class. In addition, a minority of RSE licensees considered member engagement preferences when developing their sub-class approach and tailoring the channel and type of assistance to meet these preferences.

More examples of how thoughtful segmentation assisted RSE licensees to formulate strategies and initiatives to assist members are discussed in the next section.

Footnotes

12 Refer to paragraph 17.67, Explanatory Memorandum of the Corporate Collective Investment Vehicle Framework and Other Measures Bill 2021 (Explanatory Memorandum).

13 Refer to paragraphs 17.60 – 17.68, Explanatory Memorandum.

Findings: Designing fit-for-purpose assistance

We assessed how RSE licensees were using their analysis of member needs and behavioural preferences to deliver fit-for-purpose assistance. We also assessed the range of assistance offered, including product offerings, to improve member outcomes in retirement.

Key points

As part of their retirement income strategies, RSE licensees were developing a range of measures to assist members in or approaching retirement, including:

- updated website content to provide information on a range of retirement topics;

- tailored member communications to provide information that is likely to be most relevant to members’ individual preferences and needs, for example, members with limited understanding of superannuation;

- ‘self-serve’ options such as digital tools and calculators;

- assistance to access financial advice; and

- new products and product features that help members draw a sustainable income and manage risks.

While most RSE licensees had reviewed their existing suite of member assistance such as information, financial advice tools and products, we identified several gaps in practices. Some RSE licensees:

- did not have concrete plans for how they would implement the new initiatives they had identified;

- did not appear to be robustly tracking member usage of assistance offered; or

- did not have a good understanding of the extent to which members were receiving assistance about retirement income from external sources such as financial advisers.

Catering to diverse member needs

As discussed in the previous section, members in or approaching retirement will have different retirement aspirations and income needs.

Members will also have varying levels of engagement and understanding about superannuation and retirement, and different preferences for making decisions, such as the extent to which they prefer to research options themselves before making a decision.

RSE licensees are well placed to help members navigate the various options for how they can use their superannuation in retirement. They are in control of the ‘choice architecture’, the decision-making environment, and the services, products and processes relevant to retirement income. They also create and resource the marketing, communications, application processes and complaints handling with which members interact.

By analysing data on members’ choices and their retirement income needs, RSE licensees can identify which types of retirement products, information, tools and advice are likely to be most relevant to different types of members. This can also help RSE licensees to identify which channels are likely to be most effective in delivering good member outcomes, which in turn can help RSE licensees to further enhance their choice architecture.

We found that some RSE licensees were using their analysis of sub-classes of their membership to identify gaps in the types of assistance offered. They were also using this analysis to help prioritise new forms of assistance that can most effectively meet the needs of a significant number of members. For example, some RSE licensees analysed sub-classes defined on the basis of retirement income needs to identify how best to assist members wanting more income (for example, by offering tools that assist with member decisions on how to draw down their savings).

Some RSE licensees were providing tailored information and communications to members approaching or in retirement, based on factors such as age and superannuation balance. Some were also using a range of communication channels to inform members about the available assistance. These approaches may be appropriate for some members to ensure they receive the relevant information at the right time, without being overloaded.

Better practices included RSE licensees using member surveys to understand members’ preferences for decision making and levels of engagement in retirement planning (i.e. not just financial characteristics). We also observed some RSE licensees giving careful consideration to how to reduce the risk that the assistance they provide will be unsuitable for some members – for example by identifying ways to cater to members who do not fit neatly into one of the sub-classes, or who have personal or household circumstances that mean that their needs are significantly different from other members in the same sub-class.

RSE licensees need to give specific consideration to how they may assist members who are already in the retirement phase, for example by helping members experiencing cognitive decline or who may be more vulnerable to scams. Retired members are likely to have different assistance needs and communication preferences from members in the accumulation phase who are planning for, or transitioning to, retirement.

Identifying ways to assist members

All RSE licensees in our review had a range of measures already in place to assist members to make decisions about how to use their superannuation in retirement. Most were also exploring ways they could improve and expand the types of assistance they offer.

Information, general advice and tools

Factual information, general advice and interactive tools can be beneficial to members who actively seek information or wish to input their own information or assumptions to explore future outcomes.

We found that, as part of their strategies:

- many RSE licensees were planning to update website content and direct member communications to better educate members on a range of retirement topics, including voluntary contributions, account-based pensions, income streams, lump sum withdrawals, investment options, and transition to retirement options. This included plans to add new types of content (such as videos, podcasts and webinars) as an alternative to written materials

- some RSE licensees had enhanced the general advice and support they provide to members, for example through phone-based contact centres, online chat services and workplace seminars

- many RSE licensees provided their members with superannuation calculators or retirement estimates that can help some members to explore how much income they may have in retirement, how changes to their level of contributions can affect their retirement income, how long their superannuation might last in retirement, or the impact of drawing down their balance at different rates. Some RSE licensees also provided budgeting and expenditure tools to help members estimate their spending needs see - Table 3

- some RSE licensees referred members to retirement-related content on ASIC’s Moneysmart website, including tools such as the Moneysmart superannuation calculator and retirement planner. For some RSE licensees, this could be a more efficient way to assist members than developing their own tools and website content from scratch.

Case studies: Digital retirement planning

Two RSE licensees were exploring digital planning services, which had been designed having regard to the characteristics of their membership. One was developing a product solution as part of its digital planning service that prompts members to consider their retirement goals and set action plans that can be regularly reviewed. This product solution will further provide information to members to explore various retirement topics, including the impact of choosing alternative investment options and making additional contributions.

The other RSE licensee was exploring how to enhance its existing digital planning tools for members of a certain age with lower balances. The RSE licensee had ascertained that such members are less likely to seek advice and so is providing tools as part of intra-fund advice, making direct intervention for members approaching retirement to consider how much they need for retirement and how long their current balance will last.

Another RSE licensee was exploring whether to offer a new digital advice tool to members but was concerned about how to achieve consistency between advice produced by the digital tool and advice on similar issues given by human advisers. It was also considering how to manage the risks of the advice not being suitable at the time of implementation as a result of members delaying implementation and having a change of personal circumstances.

We also observed that some RSE licensees were reviewing their website content and how it is presented. Regular reviews of this content can help RSE licensees to ensure the information is current and relevant for members and in a logical location on the website, such as housing all retirement information together.

However, caution is required in some areas. We observed that some RSE licensees were offering (or planning to offer) assistance with aged care planning, applying for the Age Pension, or accessing home equity release. In some cases, this involved RSE licensees arranging for an external provider to deliver this assistance.

Where assistance is funded using the assets of the RSE, RSE licensees must be satisfied that any assistance they provide or arrange for members is consistent with the sole purpose test and is in the best financial interests of members.

Further, ASIC observed some examples of superannuation calculators that used outdated or inappropriate assumptions. RSE licensees need to ensure they have appropriate assumptions and sufficient disclosures when providing forecasts (including, but not limited to, RSE licensees providing forecasts under ASIC’s relief). ASIC has written directly to RSE licensees with problematic assumptions, to raise concerns and seek changes.

Table 3: Assistance offered through calculators and tools (by type and percentage of RSE licensees providing the assistance)

Type of assistance | Percentage |

|---|---|

Budgeting tool or expenditure calculator | 80% |

Superannuation forecasts (calculators and retirement estimates) | 67% |

Personal advice

Depending on a member’s circumstances, they may want or need financial advice about retirement that takes into account their personal circumstances. This advice may be either limited or comprehensive in nature.

We found that all RSE licensees provided access to personal advice either directly or by assisting members to access personal advice from an external adviser, as shown in Table 4.

Table 4: Assistance offered on personal advice (by type and percentage of RSE licensees providing the assistance)

Type of assistance | Percentage |

|---|---|

Access to comprehensive personal advice (referral to a related-party or external financial adviser) | 100% |

Intra-fund personal advice | 86% |

We observed a range of approaches:

- Some RSE licensees were expanding their offering of intra-fund advice to cover a wider range of topics relevant to retirement income (whether as a free service to members or requiring members to pay a nominal fee) or planning to make intra-fund advice more readily accessible to members through their call centres.

- Some RSE licensees helped their members access limited or comprehensive personal advice, with the option to pay some or all of the cost from their superannuation.

- Other RSE licensees did not provide personal advice and focused on helping members to find an external adviser (e.g. a find an adviser tool).

Some RSE licensees were also exploring ways to provide members with access to digital personal advice, which may be limited to specific topics such as investment options and contribution strategies. Some RSE licensees indicated that these digital personal advice channels could generate statements of advice for members so they can implement the advice or consider their options before seeking additional advice from an adviser.

Product solutions

All of the RSE licensees in our review offered an account-based pension.

We found that some RSE licensees were considering refining their existing products by introducing default features into their account-based pensions. Some had developed, and others were exploring, default investment options (e.g. balanced option or lifecycle options) to help members manage risks, including investment risk, inflation risk and sequencing risk. Other RSE licensees already had, or were considering, account-based pensions with ‘default’ drawdown rates that were above the regulated minimum drawdown rules (with the flexibility for members to change their drawdown rate at any time). These RSE licensees were doing this to help members confidently draw a higher income in retirement, and cited evidence that many members tend to underspend because they draw down at the regulated minimum rate.

Some RSE licensees were exploring solutions that allow members to easily select a product (or combination of products) with particular features that are designed to help them improve their retirement income or better manage risks. While members generally need to make an active choice to use these solutions, they are designed in a way that requires minimal decision making or ongoing engagement from the member.

Case studies: Innovative default solutions

One RSE licensee was considering developing different ‘default solutions’ for different sub-classes of members. These solutions would involve a combination of products and features, such as default investment strategies and drawdown rates in an account-based pension and, in some cases, a longevity product.

The RSE licensee had segmented its membership into sub-classes based on estimated financial needs and superannuation balance. It used modelling to project future financial situation and income needs of each sub-class, which it then used as the basis for developing a fit-for-purpose default solution for each sub-class. The licensee was also planning to undertake consumer testing and seek feedback from financial advisers on the default solutions prior to implementation.

Another RSE licensee introduced a default drawdown rate feature in its account-based pension. The RSE licensee told us that approximately one third of members who took up this feature had remained on the default drawdown setting, while the remaining two thirds of members had since chosen to select their own drawdown rate, suggesting they had actively engaged with their retirement income needs.

However, caution is required when communicating with members about products. RSE licensees need to ensure they comply with their personal advice obligations when making a product recommendation (whether explicit or implied). They should take particular care in situations when members are likely to consider that the RSE licensee has considered their personal circumstances. This might be avoided by providing only factual information to members in these communications about products, which is less likely to imply a recommendation. RSE licensees must also refrain from offering products or inviting a consumer to apply for a product in the course of unsolicited real-time interactions, such as outbound call campaigns.14 An alternative would be to use non-real-time channels, such as email or letters, to communicate information about specific products.

Longevity products

Some members may benefit from retirement income products that provide an income for the remainder of their life, regardless of how long they live – that is, protection against ‘longevity risk’.

We found that seven RSE licensees were providing access to products with longevity protection, such as lifetime annuities or other retirement income streams with guarantees relating to the level and/or duration of payment. This included products offered directly by the RSE licensee where the longevity component is built into the product and provided by a life insurer, as well as externally issued products that members access through an adviser. However, five of these RSE licensees told us that take-up of these products by members had been generally low to date, with some of these RSE licensees considering whether to continue offering these products in their current form.

Six RSE licensees were considering developing or offering a new longevity product. Some of these RSE licensees acknowledged the need to test the demand for a new product with their members early in the process. A few other RSE licensees were seeking opportunities to partner with an external provider, such as a life insurer, to make one of the life insurer’s products available to their members. This may be more appropriate for RSE licensees that do not have the capability to build products in house due to cost-benefit considerations and potential capital requirements, or are unlikely to achieve sufficient uptake from their membership for a standalone product to be sustainable.

Some RSE licensees had chosen not to pursue longevity protection products at this time. Some noted that they did not see a current need for them since an account-based pension would be a suitable product for many of their members, and the members who are eligible would also receive longevity protection in the form of the Age Pension. Other licensees were mindful of the development costs involved and the risk of developing a product that does not have sufficient take-up by members.

Better practices in relation to longevity products included:

- undertaking member research (including analysis of financial circumstances and income needs, and consumer testing) to gauge the likely demand for a new product, and suitability before commencing product design as well as testing the design of the product with members and advisers during development;

- defining a clear target market for new products early in the product development process and identifying what steps will be needed to ensure that the product is distributed to consumers in the target market (as is required by the design and distribution obligations); and

- considering what protections are required to prevent members entering a product that might be unsuitable or unsustainable to address the additional risks that arise if a product is difficult for a member to exit. This includes product features such as a cooling-off period, as well as the ‘choice architecture’ and communications that would be used to help members understand and make decisions about the product, while being mindful of personal advice obligations.

Some RSE licensees also indicated that they plan to engage with Government agencies through the cross-agency process for innovative retirement income stream products (which comprises APRA, ASIC, the Australian Taxation Office, the Department of Social Services, and Services Australia).15 This forum allows RSE licensees and other product providers to test concepts and seek guidance in the early stages of product development or concept exploration, and can help product providers to efficiently navigate the complex regulatory and taxation issues that may arise for innovative retirement income products.

Addressing gaps in the types of assistance offered

To contribute to improved member outcomes in retirement, RSE licensees need to consider the extent to which their members are taking up their assistance, as well as the extent to which members are receiving assistance from external sources.

Implementing new initiatives

We found that, in developing their strategies, most RSE licensees had reviewed their existing suite of member assistance including information, financial advice, tools and products to identify any relevant gaps in their offerings.

Some RSE licensees were building on existing practices or programs of work. For example, one RSE licensee was making enhancements to its member services to deliver on the measures outlined in their strategy.

Better practices included RSE licensees providing details in their strategy and business plan about the scope of their changes, the timeline for implementation and the relevant approvals required.

Member uptake of the assistance offered by RSE licensees

We found that some RSE licensees indicated they had plans to track the usage of calculators and other tools by extracting data on how members used and engaged with them. However, other RSE licensees did not appear to be tracking member uptake or usage of their existing assistance. Some indicated that they could not determine how many consumers were accessing their tools and information, whether these consumers were members of the fund, and what actions consumers were taking as a result of using the tools and information. This could make it difficult for RSE licensees to identify whether the assistance they offer is meeting members’ needs, or whether enhancements or a redesign is needed.

RSE licensees should consider developing robust monitoring and evaluation processes to assess the uptake and usefulness of the assistance they provide, such as tracking uptake, actions and queries in relation to assistance provided.

Better practices included RSE licensees using focus groups or surveys to test whether members understood new initiatives and assess whether the initiatives would meet their current or future needs.

RSE licensees also need to develop methods to track whether the assistance they offer is contributing to improved member outcomes.

Member use of external assistance

RSE licensees may have members who receive assistance from external sources about retirement, such as financial advisers.

We found that many RSE licensees were grappling with what their role is in delivering assistance to members when most of their membership was advised, especially as advisers held more data about members’ needs. In some cases, RSE licensees decided not to provide any specific assistance to this group (beyond generally accessible materials on the RSE’s website). Some of these RSE licensees considered members were best assisted if encouraged to obtain personal advice. In other cases, RSE licensees were considering ways to proactively inform members of the types of assistance they make available to all members.

However, many RSE licensees did not have a robust way of identifying which members were receiving financial advice relating to retirement planning or using their superannuation for their retirement income. Most generally relied on data about which members joined through an adviser, or which have an active adviser fee arrangement in place on their superannuation account, to identify advised members. This approach may not be accurate if a member is no longer receiving advice or is not receiving advice about retirement.

RSE licensees can be more confident in meeting their obligations under the covenant when they understand what assistance members receive from advisers and other third parties. The RSE licensee may gain some insights into this in the course of maintaining oversight over the appropriateness of advice fee deductions from members’ superannuation accounts (having regard to RSE licensees’ legal obligations, including restrictions on advice fee deductions from superannuation accounts and the covenants in s52 and s62 of the SIS Act).16

Better practices included RSE licensees having mechanisms in place to identify assistance gaps. This could be achieved by interviewing a sample of advisers to understand how they use the RSE licensee’s products, including demand for new products, or collecting feedback from some advisers to gain insights on their business and better understand the outcome of the advice provided to members in aggregate. Some RSE licensees also provided training to advisers in relation to the available products and various retirement topics.

Informing members about the RSE licensees’ retirement income strategy

The covenant requires a summary of the strategy to be made publicly available on the RSE’s website. This is intended to provide information to the public and assist members to make informed choices about the RSE in light of their circumstances.

We found that the summaries were consistent with the underlying strategy, but RSE licensees’ approaches varied. In most cases the determinations required by the covenant were detailed in the summary. Some RSE licensees indicated they did not want to put too much detail in their public strategy; however, in general, RSE licensees with a short website summary also had a short and high-level underlying strategy.

Better practices included RSE licensees highlighting the important elements of the underlying strategy in their summary, while ensuring that the summary remained readable and catered for different audiences. For example, some RSE licensees used tables and infographics to present information in an easy-to-understand format that also met all accessibility requirements for screen-reader users.

Footnotes

14 For more information on giving personal financial advice, see ASIC Regulatory Guide 36 Licensing: Financial product advice and dealing (RG 36). For more information on how RSE licensees can comply with the hawking prohibition, see ASIC Regulatory Guide 38 The hawking prohibition (RG 38).

15 See Cross-agency process for retirement income stream products on the APRA website.

16 APRA, APRA and ASIC release letter to trustees on oversight of advice fees charged to members’ accounts, media release, 30 June 2021.

Findings: Overseeing strategy implementation

Having a strong framework in place to drive a strategy’s implementation is critical to its success. We looked at the management and governance structure adopted by RSE licensees, how they were integrating their retirement income strategy into their broader business planning process, and how they intend to track the performance of their strategy.

Key points

- Many RSE licensees had appointed a senior executive to oversee the implementation of the retirement income strategy.

- Some RSE licensees had not yet embedded the initiatives arising from their strategy into concrete actions in their business plan.

- Success measures identified by RSE licensees had minimal consideration of measures to assess member outcomes, such as the impact of the strategy on members’ retirement income and decision making.

Establishing management and governance structure

Successful formulation and implementation of the retirement income strategy necessitate attention and priority.

We found that most RSE licensees had taken steps to increase the focus on the retirement phase, in many cases appointing a senior executive to oversee the formulation. A few did not. A small number of RSE licensees created specific executive level roles to focus on the business operations of the retirement phase.

Nine RSE licensees had formed working groups to conduct research and data analysis to inform the strategy, overseen by an executive sponsor. In most cases, the working group contained subject matter experts from many areas of business operations, such as Product, Member Engagement and Experience, Technology, Data, and more, reflecting the complexity of the retirement phase.

Four RSE licensees had also engaged external consultants to assist with formulating or reviewing their retirement income strategy. An external review may provide value by giving an independent lens; however, the RSE licensee remains accountable for the strategy and the outcomes delivered.

Having a senior executive with appropriate experience, expertise and capacity to oversee implementation of the strategy can help ensure the strategy receives proper attention, including suitable allocation of staff, time and budget to support the implementation of the strategy and the delivery of initiatives. Regular reporting to the board also ensures close monitoring of the strategy’s performance and provides an opportunity for deficiencies to be identified in a timely manner.

Integrating the strategy into the business planning process

We expect RSE licensees to integrate their retirement income strategy into their overall strategic and business planning process required under Prudential Standard SPS 515 Business Planning and Member Outcomes (SPS 515).

We found that many RSE licensees had not integrated their retirement income strategy and initiatives into their overall strategic and business plans. This could be due to timing, given the first iteration of the retirement income strategy was required by 1 July 2022, when business plans for the 2022–23 financial year may have already been finalised. However, we expect by now such integration to be completed by all RSE licensees.

Better practices included RSE licensees having a business plan that incorporated the key initiatives identified in the retirement income strategy and showed a clear pathway to implementation.

Measuring success

Success measures are a necessary component for effective oversight. The ability to measure and monitor member outcomes is paramount for assessing the appropriateness of the retirement income strategy and its continuous improvement.17 This requires a mix of specific, measurable, quantitative and qualitative metrics that consider the retirement income needs of the RSE licensee’s membership, or different sub-classes where appropriate.

We found that a small number of RSE licensees had identified metrics to measure meeting retirement income needs – typically in terms of meeting a retirement adequacy target. As discussed in an earlier section, RSE licensees adopting a fixed retirement adequacy target need to consider whether such a target is appropriate for their membership. Only one RSE licensee had a metric that assessed the suitability of the level of retirement income over the period of retirement.

A majority of RSE licensees had specific success measures in at least one of the following areas:

- Tracking usage of assistance offered – such as product uptake and utilisation of available assistance, including financial advice, calculators, and information and guidance. The use of assistance offered could be an indicator of member engagement. However, we found RSE licensees’ tracking process generally needed further development, and usage data alone is unlikely to be sufficient to measure the helpfulness of the assistance offered.

- Measuring member sentiment – typically in the form of member satisfaction or retention metrics. While member satisfaction metrics can provide an indication of satisfaction levels, these metrics can be subjective and unreliable on their own as it would be difficult for an RSE licensee to isolate the impact of their retirement income strategy from other external factors.

Some RSE licensees were using measures to monitor changes in their market share or member retention to assess the success of their retirement income strategy. While such measures provide useful insights, they do not assess whether members are being assisted to achieve and balance the covenant objectives.

Only a small number of RSE licensees planned to measure investment performance and fees of the pension products offered, despite being a requirement of the legislated member outcomes assessment.18 RSE licensees are already familiar with using such metrics to measure the performance of products in accumulation, and so extending these measures to products in the retirement phase should be straightforward.

Better practices included RSE licensees considering appropriate metrics to measure each covenant objective and the trade-offs between the objectives, evolving their modelling capability to better illustrate the range of likely outcomes for members. A few RSE licensees with advanced practices considered a broad range of metrics, both quantitative and qualitative, to objectively measure the outcomes delivered to members against internal benchmarks and peers in the market where relevant and available. A list of observed metrics is provided in Table 5.

Table 5: Examples of success metrics that focused on member outcomes

Category | Examples of success metrics |

|---|---|

Product |

|

Retirement income outcomes |

|

Usage and quality of assistance offered |

|

Other |

|

Fewer than half of RSE licensees mentioned limitations in their ability to design member outcome measures, with some noting data gaps as a reason. While the development and tracking of some success metrics may require additional data collection, it is likely that RSE licensees already have access to key data to start measuring product performance, pension drawdown rates and quality of assistance. The general paucity of metrics in these areas suggests a need for RSE licensees to better use existing data to develop specific and measurable metrics.

Case study: Designing quantitative measures of members’ retirement outcomes

One RSE licensee documented multiple metrics that specifically measured each covenant objective in the strategy – for example, metrics that encompassed investment returns and fees with specific and measurable KPIs which demonstrated a commitment to strong member outcomes. The licensee also provided a clear rationale for each metric and how it is relevant to the objectives.

This RSE licensee was also actively tracking the proportion of members reaching retirement that are moving into the available retirement income products, and the percentage of members in retirement that are drawing down more than the legislated minimum rate.

All RSE licensees we reviewed needed to significantly improve how they measure success. We strongly encourage RSE licensees to develop a roadmap setting out how they will develop their success measures over time and improve their use of data analytics and modelling to assess member outcomes.

Footnotes

17 SPS 515 requires RSE licensees to annually assess whether they are achieving the outcomes it seeks for beneficiaries.

18 Member outcomes assessments are required under s52(9) of the SIS Act.

Appendix: Thematic review focus areas

The thematic review considered three core elements of effective implementation, against the expectations set out in the joint letter in March 2022.

Table 6: Retirement income covenant thematic review core elements and objectives

Core elements | Review objectives |

|---|---|

Understanding members’ needs |

|

Designing | Assistance

Product governance

Website summaries

|

Overseeing strategy implementation | Strategy implementation and oversight

Success measures

|

Glossary

Corporations Act | Corporations Act 2001, including regulations made for the purposes of that Act |

|---|---|

covenant | The retirement income covenant under s52(8A) and 52(8B) |

retirement phase | Generally, ‘retirement phase’ refers to the period between the start of retirement or when an individual moves their account into the tax-free phase, and end of life |

s52 (for example) | A section of the SIS Act (in this example numbered 52) |

SIS Act | Superannuation Industry (Supervision) Act 1993 |

SPS 515 | Prudential Standard 515 Strategic Planning and Member Outcomes |

strategy | Retirement income strategy required under s52AA |

tax-free phase | Represents where the members’ benefits are no longer liable for income tax on earnings due to the members’ benefits being identified as in the ‘retirement phase’ (ITAA, Division 294, Division 307) |

we | The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) |

Disclaimer