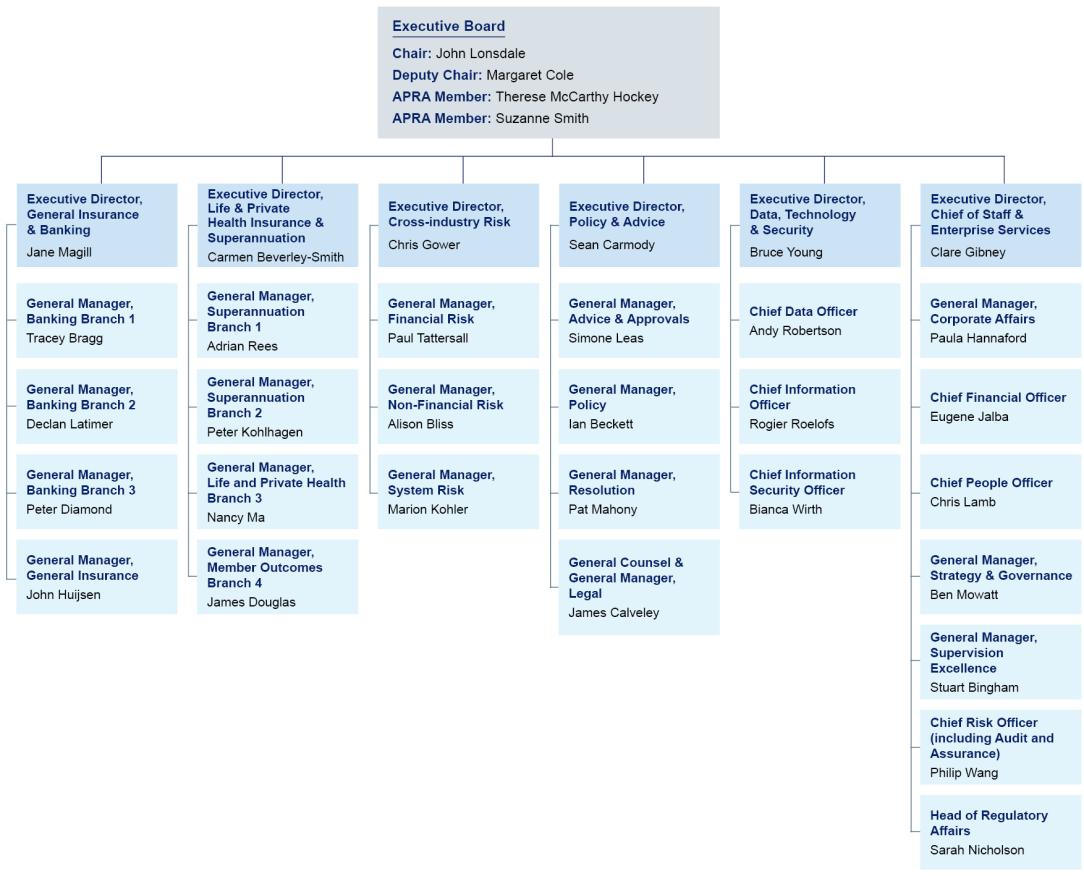

APRA's organisation structure

The organisation structure below is correct as of 1 October 2025

APRA’s Executive Leadership Team

The APRA Executive Board consists of four members:

- John Lonsdale, Chair

- Margaret Cole, Deputy Chair

- Therese McCarthy Hockey, APRA Member

- Suzanne Smith, APRA Member

Six Executive Directors report to the Board:

- Jane Magill, Executive Director: General Insurance and Banking

- Carmen Beverley-Smith, Executive Director: Life Insurance, Private Health Insurance and Superannuation

- Chris Gower, Executive Director: Cross-industry Risk

- Sean Carmody, Executive Director: Policy and Advice

- Bruce Young, Executive Director: Data, Technology and Security

- Clare Gibney, Executive Director: Chief of Staff and Enterprise Services

Divisions of APRA

APRA has an industry-based supervision model, with separate frontline supervision teams responsible for general insurance, life insurance, private health insurance, superannuation and banking. Frontline supervision conducts financial and risk analysis with data-driven insights collected as part of APRA’s statistical collections, and regular contact with regulated financial services institutions including onsite reviews.

In terms of how APRA is organised internally:

- general insurance and banking are grouped together in one division

- life insurance, private health insurance and superannuation are grouped together in another division.

These areas of frontline supervision are complemented by those in the Cross-industry Risk division. Cross-industry Risk brings together risk and system specialists who assist frontline in supervising entities and identifying risks and trends across industries and the financial system as a whole. Risks classes considered in this area include financial risk, operational and cyber security risk, climate risk and governance, as well as thematic and system-wide work including stress-testing, macroprudential policy and geopolitical risk.

The Policy and Advice division ensures that APRA's frontline supervisors have the best possible tools to support them in their risk analysis and supervisory interventions. This division consists of Legal Services, Policy, Advice and Approvals, Resolution and Licensing.

The Data, Technology and Security division is responsible for APRA’s core data capabilities including data management, data collection, design, business and enterprise data reporting and data governance. The team also manages APRA’s day-to-day technology operations.

The Chief of Staff and Enterprise Services division is responsible for key stakeholder management and integrated communications to internal and external audiences, as well as providing corporate shared services functions that assist other areas of APRA to achieve its strategic objectives. The division consists of Corporate Affairs, Regulatory Affairs, Strategy, Governance, People and Culture, Finance, and Project and Portfolio Management functions.

The Internal Audit team advises on managing risk across all of APRA, with an independent reporting line to the Audit Committee and direct access to the APRA Members and Executive Board.

The Risk team considers and coordinates risk management across APRA, with an independent reporting line to the Audit and Risk Committee and APRA Deputy Chair.

APRA’s senior leadership including General Managers

The following provides a list of those within APRA’s senior leadership team, who report into the Executive Board and Executive Director group.

Three independent internal teams lead by the Chief Internal Auditor, Chief Risk Officer and Executive Lead - Supervision Practice report directly to the Board.

- Chief Internal Auditor, Philip Wang (interim)

- Chief Risk Officer, Philip Wang

Other General Manager-level office bearers and their reporting lines are listed below.

Executive Director – General Insurance and Banking, Jane Magill:

- General Manager – Banking Branch 1, Tracey Bragg

- General Manager – Banking Branch 2, Declan Latimer

- General Manager – Banking Branch 3, Peter Diamond

- General Manager – General Insurance, John Huijsen

Executive Director – Life Insurance, Private Health Insurance and Superannuation, Carmen Beverley-Smith:

- General Manager, Superannuation – Branch 1, Adrian Rees

- General Manager, Superannuation – Branch 2, Peter Kohlhagen

- General Manager, Life and Private Health – Branch 3, Nancy Ma

- General Manager – Member Outcomes, James Douglas

Executive Director – Cross-industry Risk, Chris Gower:

- General Manager – Financial Risk, Paul Tattersall

- General Manager – Non-Financial Resilience, Alison Bliss

- General Manager – System Risk, Marion Kohler

Executive Director – Policy & Advice, Sean Carmody:

- General Manager – Advice and Approvals, Simone Leas

- General Manager – Policy, Ian Beckett

- General Manager – Resolution, Pat Mahony

- General Counsel and General Manager – Legal, James Calveley

Executive Director – Data, Technology and Security, Bruce Young:

- Chief Data Officer, Andy Robertson

- Chief Information Officer, Rogier Roelofs

- Chief Information Security Officer, Bianca Wirth

Chief of Staff and Enterprise Services, Clare Gibney:

- General Manager – Corporate Affairs, Paula Hannaford

- Chief Financial Officer, Eugene Jalba

- Chief People Officer, Chris Lamb

- General Manager – Strategy & Governance, Ben Mowatt

- General Manager – Supervision Excellence, Stuart Bingham

- Chief Risk Officer - Philip Wang