Discussion paper - Strategic planning and member outcomes: Proposed enhancements

Executive summary

RSE licensees are trusted by members to put their interests first, to be focused on ensuring that every dollar saved for retirement is both protected and delivers quality retirement outcomes for each member.

RSE licensees are therefore accountable for ensuring that their business operations, their strategy and their decisions are sharply focused on delivering a set of clearly defined and measurable outcomes. Critically, these outcomes for members must recognise, as far as possible, the different needs of existing and future members.

Since the introduction of APRA’s superannuation prudential framework in 2013, the quality of RSE licensee practices has improved considerably. The introduction of Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) and associated guidance in 2020 was a further step forward by addressing the need for enhanced business planning practices in an increasingly complex superannuation environment.

Since that time, APRA has observed the industry moving towards greater efficiency, delivering better outcomes for many members. There is, however, more to do.

Recognising that SPS 515 is relatively new and RSE licensee practices continue to mature, APRA is now seeking to move beyond the ‘documentation-focus’ of the implementation period – where supervisory engagement focused on the business plan, the member outcomes assessment and the business performance review, to one where member outcomes considerations are embedded and integrated across an RSE licensee’s business operations.

Recent benchmarking of RSE licensee implementation of SPS 515 has made clear that there remain opportunities for improvement and enhancement. This discussion paper reflects APRA’s view on how SPS 515 and associated guidance must evolve and seeks input from the superannuation industry in pursuit of the common goal of delivering better outcomes to all members.

In undertaking this review of SPS 515, APRA’s approach is informed by plans to modernise the prudential architecture to deliver a simplified and more cohesive framework that provides RSE licensees clarity on their obligations and flexibility to meet them. APRA’s objective is that the superannuation prudential framework, anchored by revised SPS 515, will be more integrated, have a greater focus on outcomes and be easier to understand and navigate. This discussion paper also describes how connected reforms will be pursued consistent with this objective of a simple and forward-looking framework.

Submissions to this discussion paper are requested to be provided no later than 11 November 2022. Information provided in response to this paper will inform revisions to SPS 515 and associated guidance, with consultation on the draft standard and guidance expected to commence in 2023.

Glossary

BFID | Best financial interests duty |

|---|---|

BPR | Business performance review |

Draft CPS 190 | Draft Prudential Standard CPS 190 Financial Contingency Planning |

Draft CPS 230 | Draft Prudential Standard CPS 230 Operational Risk |

Draft CPS 900 | Draft Prudential Standard CPS 900 Resolution Planning |

ORFR | Operational risk financial requirement |

RSE | Registrable superannuation entity |

RSE licensee | Registrable superannuation entity licensee |

SIS Act | Superannuation Industry (Supervision) Act 1993 |

SPS 114 | Prudential Standard SPS 114 Operational Risk Financial Requirement |

SPS 515 | Prudential Standard SPS 515 Strategic Planning and Member Outcomes |

SPG 515 | Prudential Practice Guide SPG 515 Strategic and Business Planning |

SPG 516 | Prudential Practice Guide SPG 516 Business Performance Review |

YFYS | Treasury Laws Amendment (Your Future, Your Super) Act 2001 |

Chapter 1 - Introduction

1.1 Background

Australia’s superannuation industry plays a critical role in the delivery of retirement incomes for Australians and, through its investment of superannuation assets, in the economy more broadly. It is crucial that the sector is made up of resilient and prudently managed entities with a strong focus on delivering quality outcomes for their members, particularly in an evolving environment.

APRA is therefore focused on actively driving an RSE licensee culture of continuous improvement, accountability and transparency in the delivery of quality outcomes to superannuation members to and through retirement.

In January 2020, consistent with the need to put member outcomes at the centre of the superannuation prudential framework, APRA issued new prudential requirements and guidance (referred to as the ‘SPS 515 framework’ throughout this paper):

- Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515);

- Prudential Practice Guide SPG 515 Strategic and Business Planning (SPG 515); and

- Prudential Practice Guide SPG 516 Business Performance Review (SPG 516).

The SPS 515 framework responded to the need for RSE licensees to improve their business planning processes by requiring RSE licensees to focus decision-making on the delivery of quality outcomes for members.

The SPS 515 framework represented a step change for many RSE licensees, requiring that they determine, assess and articulate the outcomes they are seeking to achieve for different cohorts of beneficiaries.

APRA’s interactions with RSE licensees have indicated that, while considerable progress has been made as RSE licensees complete the second business planning cycle since the commencement of SPS 515, there are still areas where practices need to improve.1 Equally, APRA’s ongoing supervision has identified areas where the SPS 515 framework can be enhanced to support more effective prudential regulation of the superannuation industry.

The operating environment for RSE licensees has also changed markedly since the SPS 515 framework was introduced. Legislative reforms have focused on the financial nature of an RSE licensee’s duty to act in the best financial interests of beneficiaries.2 There is now also the annual legislated performance test and new requirements relating to the delivery of retirement outcomes.3 On the latter, APRA has previously advised that amendments to the SPS 515 framework will be explored to connect the retirement income covenant and existing prudential requirements relating to member outcomes.4

APRA’s heatmaps and Superannuation Data Transformation project are also driving greater transparency and scrutiny on product performance. The pace of change in the industry continues with recent business mergers and transfers of members, with more either in progress or being contemplated. These factors have led to a greater focus on the financial resilience of the superannuation industry, given this is critical to ensuring stability. RSE licensees, therefore, must be financially resilient to ensure the continued delivery of quality outcomes and to operate in the best financial interests of beneficiaries.

1.2 The role of SPS 515

It is in the context of ongoing evolution, including in APRA’s prudential framework, that APRA is reviewing the role and content of the SPS 515 framework.

The SPS 515 framework requires RSE licensees to have a holistic approach to bringing together important decision inputs and other policies and frameworks that are critical to the delivery of outcomes to members (including, but not limited to, the investment governance framework, the insurance management framework and the risk management framework).5 It also requires RSE licensees, via the obligation to conduct a business performance review (BPR), to identify where outcomes for members need to be improved and how such improvements will be made – including where improvements may involve transferring members or otherwise deploying the RSE licensee’s contingency plan.6

APRA’s supervision of RSE licensees draws on the business plan and the BPR as key tools to understand how an RSE licensee views its current performance, how it will act to improve outcomes based on this assessment and, in certain cases, whether the RSE licensee’s assessment of its strategic future and longer-term viability is reasonable.

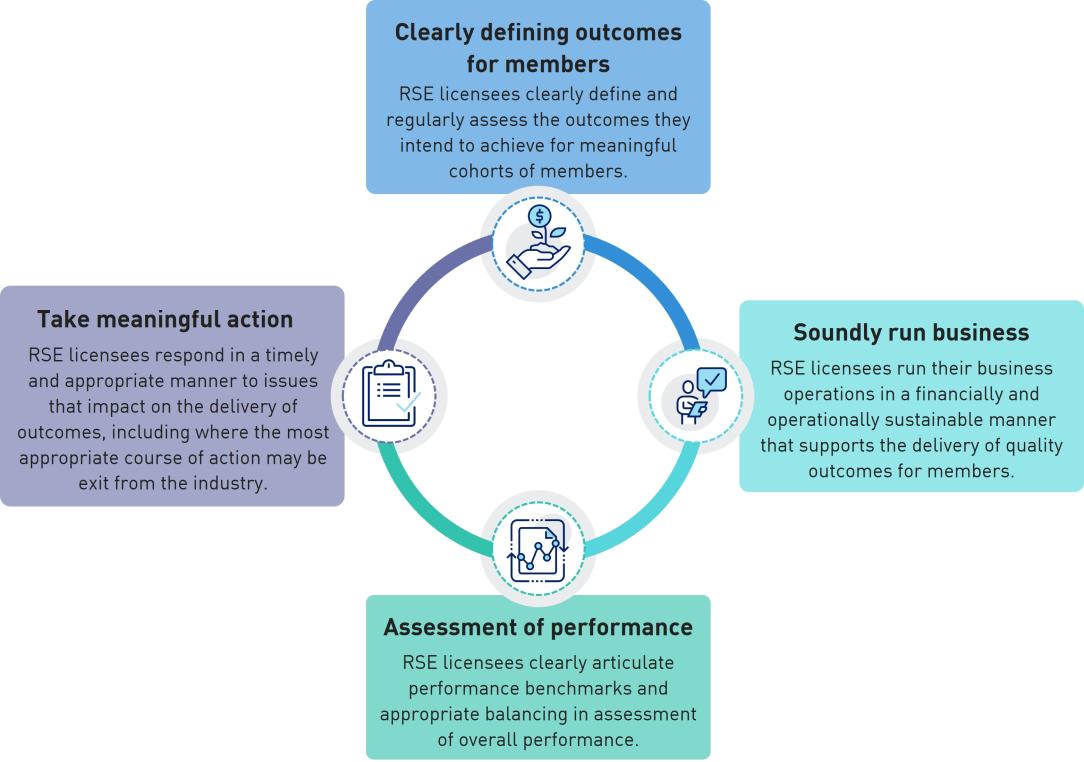

APRA’s review of the SPS 515 framework is therefore focused on four key actions that drive RSE licensee decision-making and delivery of outcomes for members:

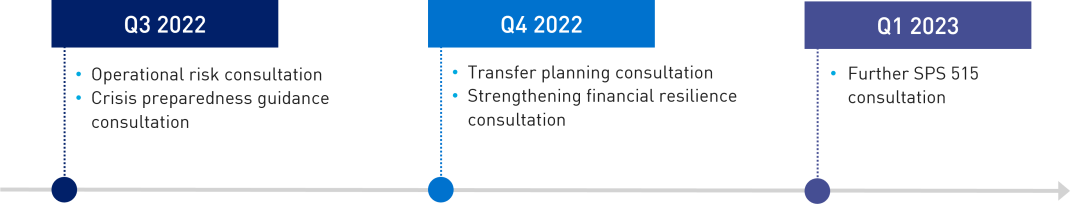

1.3 Connected APRA reforms

APRA is pursuing important reforms applying to all APRA-regulated industries.

On crisis preparedness, APRA has released draft Prudential Standard CPS 190 Financial Contingency Planning (CPS 190) for consultation, which introduces requirements for entities to develop credible plans for managing stress that may threaten their viability. This includes plans for rebuilding financial resilience or effecting an orderly exit. In addition, draft Prudential Standard CPS 900 Resolution Planning (CPS 900) will require large and complex entities to be pre-positioned, so that in the event of their failure, risks to beneficiaries and to financial system stability would be minimised. Together these standards minimise the risk and impact of entity failure.

APRA is also releasing draft Prudential Standard CPS 230 Operational Risk (CPS 230), which will strengthen the prudential framework through new and updated requirements covering operational risk, business continuity and service provider management for all APRA-regulated entities. A key objective of this standard is for APRA-regulated entities to effectively manage operational risks to strengthen both operational and financial resilience.

Figure 1: Expected upcoming releases for key superannuation prudential reforms7

1.4 Next steps

Following the responses to this discussion paper, APRA intends that draft enhancements to the SPS 515 framework would be released for further consultation in the first quarter of 2023. This second round of consultation will communicate the proposed commencement date for changes to the SPS 515 framework.

Footnotes

1Refer to Findings from APRA’s superannuation thematic reviews | APRA for the outcomes of both APRA’s benchmarking review of SPS 515 implementation and the fund expenditure thematic review.

2Refer to ss. 52(2)(c) and 220A of the Superannuation Industry (Supervision) Act 1993 (the SIS Act). The intent of the best financial interests duty and the associated reverse onus of proof is to increase the accountability of superannuation trustees in relation to the execution of their fiduciary duties across the many actions RSE licensees take in operating a superannuation entity (refer to Treasury Laws Amendment (Your Future, Your Super) Bill 2021 Revised Explanatory Memorandum). APRA is cognisant of the planned review of the Your Future, Your Super (YFYS) measures. Further consultation of potential prudential framework enhancements will be informed by relevant outcomes from the YFYS review.

3Refer to Part 6A of the SIS Act (for requirements related to annual performance assessments) and ss. 52(8A) and 52AA of the SIS Act (for requirements relating to the retirement income strategy).

4Refer to the Joint APRA and ASIC letter Implementation of the Retirement Income Covenant, dated 7 March 2022.

5Refer to Prudential Standard SPS 530 Investment Governance, Prudential Standard SPS 250 Insurance in Superannuation and Prudential Standard SPS 220 Risk Management respectively.

6As discussed in Chapter 5, APRA is currently reviewing the transfer planning framework for superannuation, as well as pursuing contingency planning requirements across all APRA-regulated industries.

7Consultation on draft Prudential Practice Guide CPG 190 Contingency Planning (CPG 190) and the release of final Prudential Standard CPS 190 Contingency and Recovery Planning (CPS 190) will be confirmed in the second half of 2022.

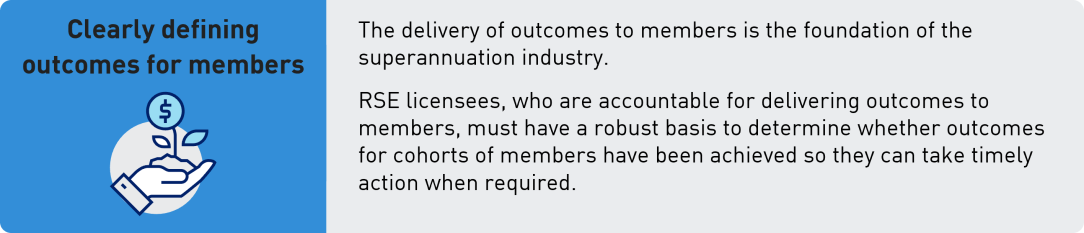

Chapter 2 - Clearly defining outcomes for members

2.1 Defining outcomes for members

2.1.1 Current framework

Defining outcomes for members | |

SPS 515 |

|

SPG 515 |

|

SPG 516 |

|

2.1.2 Proposed enhancements

APRA’s experience is that the outcomes sought by RSE licensees are not always clearly defined in an objectively measurable way. Further, some RSE licensees demonstrate limited consideration as to how outcomes differ across cohorts, and cohorts tend to be constructed using simplistic characteristics.

APRA expects RSE licensees to demonstrate a deep understanding of their membership base and to go beyond such simplistic cohorts that only reflect age, product and investment option. This avoids a limited assessment of whether outcomes for members are being delivered, or whether strategic initiatives are supporting improved outcomes for members.

Strengthened requirements will ensure RSE licensees are accountable for the delivery of outcomes to members in a more granular and measurable way, reducing the risk of pockets of poor performance or outcomes being masked.

APRA intends to refine the SPS 515 framework to:

- require that the Board approve outcomes only where they are defined in a quantifiable and objective manner, and which clearly apply either to all beneficiaries or a specified cohort or cohorts;

- ensure an RSE licensee demonstrates why the cohorts are reasonable in the context of the relevant RSEs. These enhancements continue APRA’s principles-based approach to setting cohorts, rather than seeking to specify cohorts that must be adopted; and

- ensure that the cohorts identified by an RSE licensee have regard to the requirements relating to the class (or sub-classes) of beneficiaries who are retired or who are approaching retirement (for the purposes of the retirement income strategy formulated for an RSE by the RSE licensee).8

A cohort-based view of outcomes is supported by the range of performance metrics and the depth of data that has become available to RSE licensees since 2020, particularly the legislated performance test and APRA’s heatmaps. The role of such performance benchmarks in the overall monitoring of outcomes for members will also be clarified in the SPS 515 framework.

Questions: Defining outcomes for members | |

| SPS 515 implementation | 1. Which, if any, provisions in the SPS 515 framework have worked well in improving business planning? Which, if any, provisions have caused unintended consequences? Please provide details. |

Defining member outcomes | 2. Has APRA correctly identified the areas for enhancement? What additional areas could benefit from enhanced requirements or guidance to support effective strategic planning and delivery of outcomes to members? |

Cohorts | 3. What additional guidance could be provided to help inform the development of cohorts? |

Pre- and post- retirement cohorts | 4. What challenges, if any, has industry faced in developing cohorts of members for the purposes of the retirement income strategy? |

Footnotes

8Refer to ss. 52AA(3) and (4) of the SIS Act.

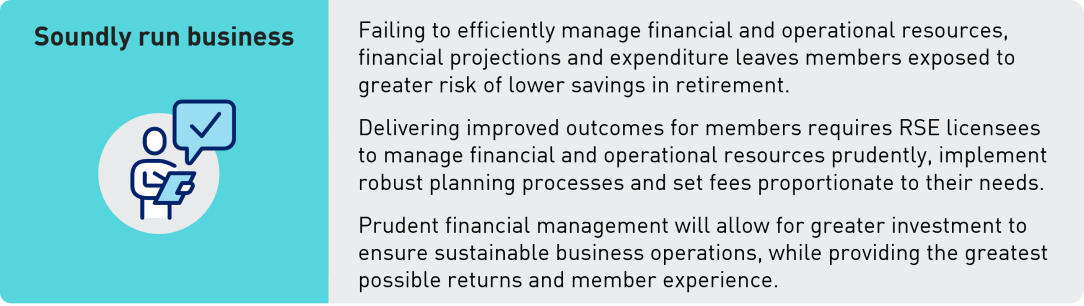

Chapter 3 - Soundly run business

3.1 Managing financial resources

3.1.1 Current framework

Managing financial resources | |

SPS 515 |

|

SPG 515 |

|

SPS 114 |

|

SPG 114 |

|

3.1.2 Proposed enhancements

In late 2021, APRA issued a discussion paper, Strengthening financial resilience in superannuation (the November 2021 discussion paper) as a first step toward ensuring that the superannuation prudential framework drives holistic and prudent management of financial resources.

In response, APRA received 19 submissions and met with a diverse range of RSE licensees and related stakeholders on the issues raised in that discussion paper.

Feedback consistently indicated that many RSE licensees are still working towards a mature approach to managing financial resources, indicating that members would benefit from an industry that takes a more sophisticated, rigorous approach to financial resource management.

Submissions made clear that there are potential inefficiencies arising from the impact of having insufficient financial resources, as well as holding more than required, resulting in negative impacts on member balances. Financial resilience, therefore, is optimised where sufficient financial resources are held to respond to the needs of the business, without creating inefficiencies that may result in poor member outcomes.

APRA is, therefore, considering amendments to the prudential framework to:

- enhance existing requirements and guidance that inform the management of financial resources on a business-as-usual basis; and

- create greater flexibility in responding to operational risk events that cause negative outcomes for members. These will be consulted on later in 2022 as part of APRA’s review of Prudential Standard SPS 114 Operational Risk Financial Requirement (SPS 114) and associated guidance. It is likely that proposals will include increasing the scope of permitted use, including to meet any additional costs of addressing operational risk events.

On the management of financial resources in the ordinary course of business, APRA proposes to include in SPS 515 more specific obligations aimed at ensuring holistic financial management practices by RSE licensees. Proposed requirements are likely to include obligations on RSE licensees to:

- adopt and clearly articulate financial management related performance measures, action plans, objectives, strategic goals and targeted outcomes for members;

- monitor the adequacy of financial resources across the RSE licensee’s business operations relative to targets and triggers, to ensure the RSE licensee can respond to challenges by making the required investments in the business; and

- ensure stress testing and scenario analysis are used to determine the robustness of the financial management strategy and forecasts.

The proposed requirements seek to heighten Board oversight of financial arrangements with a view to greater stability, efficiency and to improve outcomes for members across the superannuation industry. These obligations will ensure RSE licensees improve, and are held to a higher standard of, financial management which better reflects their risk profile and the size and scale of their business.

| |

| Management of financial resources on a business-as-usual basis | 5. To what degree would taking the above approach to financial management, including adoption of performance measures, monitoring and stress testing, differ from current practices? How might such obligations be implemented without undue regulatory burden? |

6. What, if any, unintended consequences may arise from these proposed requirements? Please provide details. | |

Financial resources to manage and respond to operational risk | 7. Given the scope of the current requirements in SPS 114, much of the financial resources to manage and respond to operational risk have, necessarily, been met through existing reserves. How do RSE licensees presently use their financial resources to minimise the impact of operational risk events on members? |

3.2 Financial projections

3.2.1 Current framework

Financial projections | |

SPS 515 |

|

SPG 515 |

|

SPG 516 |

|

3.2.2 Proposed enhancements

The SPS 515 framework drives RSE licensees to demonstrate financial resilience to ensure outcomes are delivered in a sustainable manner, including having financial capacity to implement strategic initiatives to improve outcomes for members.

Findings from APRA’s thematic review highlighted that the quality and depth of financial projections varied significantly across the industry. More importantly, the financial information in many business plans did not clearly demonstrate ongoing financial soundness and did not effectively integrate the expected financial impacts of strategic initiatives.

APRA is concerned that assumptions underpinning RSE licensee analysis are often unsubstantiated or inconsistent with historical trends, and are not routinely subject to robust stress-testing.

APRA therefore intends to enhance the SPS 515 framework to ensure that the Board only approves financial projections that form part of the business plan where it is satisfied that these financial projections:

- provide sufficient detail to understand the expected impacts of member contribution and rollover/payment flows and planned strategic initiatives;

- are the result of reasonable and robust assumptions when compared with historical trends and analysis of expected future impacts;

- have been prepared using a range of stress-testing scenarios and the results presented enable an understanding of potential downside scenarios; and

- are consistent with a Board-approved financial projections methodology.

Questions: Financial projections | |

| Board oversight of projections | 8. How does the Board currently satisfy itself that a robust financial projections methodology underpins the business plan? How does the Board intend to develop its use of financial projections (and assumptions underpinning them) presented in the business plan? |

3.3 Fee setting principles

3.3.1 Current framework

Fee setting principles | |

SPS 515 |

|

SPG 515 |

|

SPG 516 |

|

3.3.2 Proposed enhancements

In the November 2021 discussion paper, APRA outlined fee setting principles. APRA intends to elevate these principles – with some amendment – into the SPS 515 framework (refer to Attachment A).

To continue to meet the needs and expectations of members, RSE licensees must manage their expenditure to enable the required investment to support provision of their products and member services. As such, APRA does not consider that a ‘race to the bottom’ in operating costs is appropriate if improved outcomes for members are to be sustained over the long term. RSE licensees must be rigorous in reviewing their strategic and business plans and pay particular attention to their operational efficiency and expenditure management. In doing so, an RSE licensee will need to consider the sustainability of its operating model, including setting appropriate fee structures to cover reasonable operating expenses, while also appropriately managing the tension with promoting the financial interests of members to deliver better outcomes over the longer term.

Prior to deciding to charge or alter any fee, it is expected that an RSE licensee would investigate, understand and take into account the tax consequences of the fee design and capital management as well as all other legal obligations.

APRA intends to amend the SPS 515 framework to require RSE licensees demonstrate how they have set their fees and costs in a manner that is consistent with the fee principles.

Questions: Fee setting principles | |

| Fee setting principles | 9. What additional fee setting principles should be reflected in the SPS 515 framework? |

3.4 Expenditure management

3.4.1 Current framework

Expenditure management | |

SPS 515 |

|

SPG 515 |

|

3.4.2 Proposed enhancements

Expenditure management is a core component of business planning and directly impacts the outcomes delivered for members. In October 2021, APRA published findings from its expenditure thematic review, which identified areas where APRA expected industry practices to be strengthened.

To limit the impost on respondents, APRA intends to consider the insights received through the planned YFYS review, along with the findings from the expenditure thematic review, to inform potential enhancements to the prudential framework to be consulted on in 2023.

Footnotes

9Refer to s.52(2)(i) of the SIS Act and s.115 of the SIS Act (for requirements relating to reserves).

Chapter 4 - Assessment of performance

4.1 Assessing performance

4.1.1 Current framework

Requirements to assess performance | |

SPS 515 |

|

SPG 516 |

|

4.1.2 Proposed enhancements

APRA’s recent thematic review identified that RSE licensees failed to identify and assess factors affecting business performance and outcomes delivered to members and to include this analysis in the BPR. Identification and quantification of the drivers of performance is an essential component in developing a robust action plan to improve outcomes.

APRA expected RSE licensees would, post the introduction of the SPS 515 framework, implement the BPR in a way that made sense for their existing business planning cycle. Some RSE licensees have questioned how member outcomes assessments and BPRs can be completed in a manner that allows the subsequent business plan to be informed by the RSE licensee’s reflections on performance. APRA also recognises that some RSE licensees struggled to interpret the requirements.

To drive an appropriately embedded approach to assessing performance, APRA intends to enhance the SPS 515 framework to:

- ensure that the Board can clearly demonstrate, in its approval of the BPR, a deeper understanding and quantification of the factors driving performance and how planned actions will respond to the factors identified;

- clarify that, whilst RSE licensees may determine the timing of their business planning cycle, the BPR and member outcomes assessment must be undertaken prior to the Board’s approval of the next business plan, allowing for sufficient time for planning to be informed by the most recent performance assessments;

- require an RSE licensee to have a robust trigger framework for identifying where a formal review of outcomes is required;

- clarify, through guidance, the circumstances that would trigger revisions to the business plan, for example, an expected failure of the legislated performance test; and

- ensure RSE licensees integrate their BPR with other actions required under the prudential framework, for example, attribution analysis as part of the investment governance framework.

The enhancements to APRA’s data collection under the Superannuation Data Transformation project will increase the depth and breadth of data collected and reported back to industry. APRA intends to clarify the expectation that RSE licensees will leverage this additional and more granular data to support enhancements in their assessment of outcomes.

| Questions: Assessing performance | |

| The performance assessment cycle | 10. What challenges have RSE licensees experienced in aligning the timing of the member outcomes assessments and annual BPRs and business planning cycles? How might these challenges be avoided in future? |

Benchmarks | 11. How have RSE licensees incorporated the result of APRA’s heatmaps and the legislated performance test into their BPRs? 12. What additional benchmarks do RSE licensees consider when assessing performance? In determining an overall assessment of outcomes, how are the various benchmarks weighted? |

Data | 13. What additional areas of data would be useful in developing comparable assessments of performance? 14. What data (including benchmarks) do RSE licensees plan to use to develop retirement cohorts and assess performance of post retirement income strategies? |

Chapter 5 - Take meaningful action

5.1 Taking action to improve member outcomes

5.1.1 Current framework

Taking action to improve outcomes for members | |

SPS 515 |

|

SPG 515 |

|

SPG 516 |

|

SPG 227 |

|

5.1.2 Proposed enhancements

APRA intends to make connected enhancements to the superannuation prudential framework, focused on supporting efficient and prudent transfers of members to other products and RSEs, and the effective exit of RSE licensees from the industry. These, and the relationship with existing requirements and guidance, are outlined below.

An RSE licensee’s BPR is expected to make clear where an RSE licensee needs to take action to improve outcomes for members. Such remediation action may be to change product features, adjust investment strategies or change fee structures. APRA also expects RSE licensees to consider where changes to the business operations are necessary to improve outcomes for members. This may include transferring members out of an RSE, which can, in some cases, result in the RSE licensee exiting the industry.

In other words, SPS 515 provides the framework for an RSE licensee making a decision to transfer and/or exit.

In November 2021, APRA released draft CPS 190 for consultation. Draft CPS 190 proposes that all APRA-regulated entities have plans for responding to stress that may threaten their viability. These plans would set out actions that an entity could take to restore financial resilience or exit the industry in an orderly manner; to protect depositors, insurance policyholders and superannuation fund members.

Consultation on the draft standard closed in April 2022. APRA is currently reviewing submissions and plans to communicate next steps in the second half of 2022.

APRA will also soon consult on Prudential Practice Guide CPG 190 Contingency Planning, which will provide further detail on APRA’s expectations for RSE licensees in developing appropriate contingency plans.

Where an RSE licensee decides to undertake a successor fund transfer, APRA expects the RSE licensee to meet the expectations in Prudential Practice Guide SPG 227 Successor Fund Transfers and Wind-ups. APRA intends to update SPG 227 so that it aligns with the SPS 515 framework and the new contingency planning obligations in CPS 190 – and make any necessary consequential amendments to the SPS 515 framework and CPS 190.

As part of these reforms, APRA intends to also issue a new prudential standard with requirements that must be met in relation to the transfer of assets where a MySuper authorisation is cancelled under s. 29U of the SIS Act. This will include provisions to require an RSE licensee to transfer the assets of a cancelled MySuper product into another MySuper product.

These amendments will ensure cohesion across the prudential framework consistent with RSE licensees undertaking transfers and exits that are appropriate for their members and can be completed in a timely manner. These transfer planning reforms will be released for consultation later in 2022.

Chapter 6 - Consultation

6.1 Request for submissions

APRA invites written submissions on the questions set out in this discussion paper.

Written submissions should be sent to superannuation.policy@apra.gov.au by 11 November 2022 and addressed to:

General Manager

Policy Development

Policy and Advice Division

Australian Prudential Regulation Authority

6.2 Important disclosure requirements – publication of submissions

All information in submissions will be made available to the public on the APRA website unless a respondent expressly requests that all or part of the submission is to remain in confidence.

Automatically generated confidentiality statements in emails do not suffice for this purpose.

Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA).

APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

6.3 Consultation questions

Submissions are welcome on all aspects of the proposals in this discussion paper. In addition, specific areas where the feedback on the proposed direction would be of assistance to APRA in finalising its proposals are summarised in the table below. Note that these questions are also included in the substantive chapters of this discussion paper.

Topic Consultation questions | |

SPS 515 implementation | 1. Which, if any, provisions in the SPS 515 framework have worked well in improving business planning? Which, if any, provisions have caused unintended consequences? Please provide details. |

Defining member outcomes | 2. Has APRA correctly identified the areas for enhancement? What additional areas could benefit from enhanced requirements or guidance to support effective strategic planning and delivery of outcomes to members? |

Cohorts | 3. What additional guidance could be provided to help inform the development of cohorts? |

Pre- and post- retirement cohorts | 4. What challenges, if any, has industry faced in developing cohorts of members for the purposes of the retirement income strategy? |

Management of financial resources on a business-as-usual basis | 5. To what degree would taking the above approach to financial management, including adoption of performance measures, monitoring and stress testing, differ from current practices? How might such obligations be implemented without undue regulatory burden? 6. What, if any, unintended consequences may arise from these proposed requirements? Please provide details. |

Financial resources to manage and respond to operational risk | 7. Given the scope of the current requirements in SPS 114, much of the financial resources to manage and respond to operational risk have, necessarily, been met through existing reserves. How do RSE licensees presently use their financial resources to minimise the impact of operational risk events on members? |

Board oversight of projections | 8. How does the Board currently satisfy itself that a robust financial projections methodology underpins the business plan? How does the Board intend to develop its use of financial projections (and assumptions underpinning them) presented in the business plan? |

Fee setting principles | 9. What additional fee setting principles should be reflected in the SPS 515 framework? |

The performance assessment cycle | 10. What challenges have RSE licensees experienced in aligning the timing of the member outcomes assessments and annual BPRs and business planning cycles? How might these challenges be avoided in future? |

Benchmarks | 11. How have RSE licensees incorporated the result of APRA’s heatmaps and the legislated performance test into their BPRs? 12. What additional benchmarks do RSE licensees consider when assessing performance? In determining an overall assessment of outcomes, how are the various benchmarks weighted? |

Data | 13. What additional areas of data would be useful in developing comparable assessments of performance? 14. What data (including benchmarks) do RSE licensees plan to use to develop retirement cohorts and assess performance of post retirement income strategies? |

Attachment A: Fee setting principles

Fee design and setting must support member outcomes and meet obligations to act in the best financial interests of beneficiaries and comply with the sole purpose test.

APRA expects the following principles to inform the RSE licensee’s decisions and for consideration of these principles to be supported by appropriate documentary evidence.

Key principles:

Setting a fee: An RSE licensee would ensure that the level of a fee was appropriate and proportionate, and regularly reviewed. In the event that an RSE licensee is building a financial contingency reserve by way of charging a fee, APRA expects the reserve generated would not be excessive, and expects that the purpose of the fee and level of this reserve would be transparent, evidence-based and aligned with the stated purpose of the reserve.

Evidence of purpose: When seeking a new trustee fee power, or using an existing power for the first time, an RSE licensee will document how the power is to be used, and that proposed use of the fee power is to be approved by the Board. When implementing a new fee to members, or revising an existing fee to members, an RSE licensee will document the need for the fee and why a fee is appropriate giving regard to current reserve levels.

Prudent management: An RSE licensee will raise and manage fee revenue prudently and transparently, including in respect of its subsequent disbursement and its management as trustee capital. For a financial contingency reserve at the trustee company level, an RSE licensee would have safeguards in place to ensure prudent management of the capital generated for that purpose. This would, at a minimum, include a capital management plan which would restrict the permitted use of this capital.

Other avenues: Prior to charging a trustee fee (or using RSE licensee capital generated from such a fee for contingency events), APRA expects that an RSE licensee would have diligently explored and exhausted all other avenues for raising or using financial resources. Full details of alternative avenues pursued for building or using financial resources should be clearly evidenced and actively challenged by the Board.

These principles are general in nature, and specific fees must be considered on their individual facts. Importantly, an RSE licensee must be satisfied that the charging of a fee complies with their legal duties and obligations.

Note on submissions

It is APRA's policy to publish all submissions on the APRA website unless the respondent specifically tells APRA in writing that all or part of the submission is to remain confidential. An automatically generated confidentiality statement in an email does not satisfy this purpose. If you would like only part of your submission to be confidential, you should provide this information marked as 'confidential' in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.