Discussion paper - Superannuation transfer planning: Proposed enhancements

10 November 2022

Executive summary

The superannuation industry continues to consolidate. APRA has observed, however, cases where RSE licensees have not planned or executed transfers in a prudent and timely manner, leading to poor outcomes for members.

In the context of the legislated performance test and APRA’s heatmaps, it is important that all RSE licensees consistently meet minimum standards for planning, pre-positioning and executing transfers of members.

Effective planning will also ensure that RSE licensees are able to respond promptly and appropriately in the event of a crisis, and that members are well supported in such a scenario.

APRA intends to introduce:

- requirements in Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) to ensure all RSE licensees are appropriately prepared to transfer, or receive, members, elevating what was previously guidance;

- new requirements relating to the transfer of MySuper product assets, in the event of cancellation of an authority to offer a MySuper product; and

- updated transfer planning guidance to replace existing Prudential Practice Guide SPG 227 Successor Fund Transfers and Wind-ups.

This discussion paper outlines these proposed requirements. It builds on a previous discussion paper, 'Strategic planning and member outcomes: proposed enhancements', released in August 2022 (the SPS 515 discussion paper).1

Submissions in response to this discussion paper are requested to be provided to APRA by 10 March 2023. Responses to this paper will inform proposed amendments to SPS 515 and updated transfer planning guidance, as well as requirements relating to the transfer of MySuper product assets (which are expected to come into effect from 1 July 2023). APRA intends to consult on revisions to SPS 515 and updated transfer planning in the first half of 2023.

Footnotes:

1 Discussion paper - Strategic planning and member outcomes: Proposed enhancements.

Glossary

BPR | Business performance review |

|---|---|

Draft CPS 190 | Draft Prudential Standard CPS 190 Financial Contingency Planning |

Draft CPS 900 | Draft Prudential Standard CPS 900 Resolution Planning |

RSE | Registrable superannuation entity |

RSE licensee | Registrable superannuation entity licensee |

SFT | Successor fund transfer |

SIS Act | Superannuation Industry (Supervision) Act 1993 |

SIS Regulations | Superannuation Industry (Supervision) Regulations 1994 |

SPS 114 | Prudential Standard SPS 114 Operational Risk Financial Requirement |

SPG 227 | Prudential Practice Guide SPG 227 Successor Fund Transfers and Wind-ups |

SPS 515 | Prudential Standard SPS 515 Strategic Planning and Member Outcomes |

SPG 515 | Prudential Practice Guide SPG 515 Strategic and Business Planning |

SPG 516 | Prudential Practice Guide SPG 516 Business Performance Review |

Transferring RSE licensee | A ‘transferring RSE licensee’ is the RSE licensee of the existing RSE from which the members’ benefits are to be transferred. |

Receiving RSE licensee | A ‘receiving RSE licensee’ is the RSE licensee of the successor fund (receiving RSE). |

Chapter 1 - Introduction

1.1 Background

Consolidation within the superannuation industry is expected to remain commonplace. Increasingly, RSE licensees are seeking opportunities to become more efficient and to strengthen capabilities to deliver quality outcomes for members.

Where there are concerns relating to sustainability, performance or cost (which are not able to be remediated through other actions), RSE licensees need to be prepared to transfer members to another RSE.2 This need has been amplified by:

- the legislated performance test – which focuses attention on RSE licensees meeting performance benchmarks and providing adequate returns for their members3;

- APRA’s heatmaps – which have increased the focus on performance, sustainability and longer-term outcomes for members, with reference to peer comparisons4; and

- the business performance review – which requires RSE licensees to assess the ongoing sustainability of the RSE licensee’s business operations (refer to Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515).

In 2017, APRA updated Prudential Practice Guide SPG 227 Successor Fund Transfers and Wind-ups (SPG 227) to provide guidance on RSE licensees undertaking successor fund transfers (SFTs), by both transferring and receiving members, and wind-ups. SPG 227 provides guidance to RSE licensees that choose to transfer members to a successor fund in the ordinary course of their business, to ensure such transfers are undertaken in a prudent manner. In conjunction with updates to SPS 515, APRA is planning to issue updated transfer planning guidance to replace SPG 227.5

1.2 The key phases of transfer planning

As outlined in APRA’s discussion paper, Strategic planning and member outcomes: proposed enhancements (August 2022), APRA is reviewing SPS 515 and the associated guidance. SPS 515 requires RSE licensees to conduct a business performance review to identify where outcomes for members need to be improved, which may involve members being transferred out of, or into, an RSE.

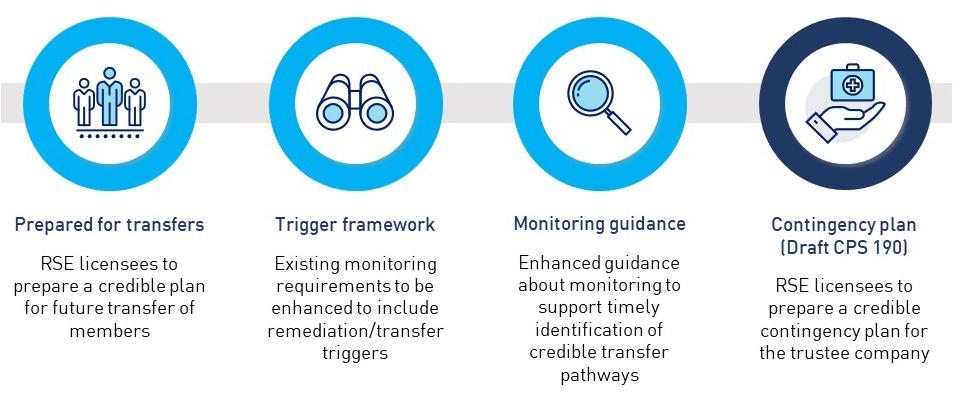

Guidance on transfers will be elevated to requirements in SPS 515 to ensure RSE licensees consistently meet minimum standards, including for appropriate planning and pre-positioning. This may include market scanning and monitoring, developing criteria and shortlisting potential merger partners, identifying triggers for action and potential barriers to a successful transfer. There are three distinct phases involved in a transfer of members, as outlined below.

Figure 1. The phases of a transfer of members

To set minimum standards for these phases for RSE licensees, with accompanying guidance, APRA intends to:

- elevate existing guidance on planning to requirements in SPS 515;

- set new requirements for the transfer of MySuper product assets when a MySuper product authorisation is cancelled; and

- update transfer planning guidance to replace existing SPG 227.

1.3 Connected reforms

APRA is pursuing related reforms, which are outlined below.

Connected reform | Objectives and focus | Timeline |

Strategic planning and member outcomes | Broader review of SPS 515, including enhanced requirements to drive prudent management of financial resources. | APRA released Discussion paper – Strategic planning and member outcomes: proposed enhancements for consultation in August 2022.6 |

Contingency and resolution planning | Proposes a requirement to develop a trustee-level contingency plan. Draft Prudential Standard CPS 190 Financial Contingency Planning (CPS 190), focusing on recovery and exit planning, is an important complement to the need for better planning for transfers of members. For RSE licensees, CPS 190 is focused on managing risks to the RSE licensee’s financial viability (or ‘insolvency’ of the trustee company). This is intended to supplement, but not replace, the actions that an RSE licensee would take to be prepared for a transfer of members to address underperformance. | APRA released draft CPS 190 and draft Prudential Standard CPS 900 Resolution Planning (CPS 900) for consultation in December 2021.7 Draft Prudential Practice Guide CPG 190 Financial Contingency Planning and draft Prudential Practice Guide CPG 900 Resolution Planning were released for consultation in September 2022. |

Financial resources for risk events in superannuation | Proposes requirements that seek to provide confidence that financial resources are readily available where significant recovery or transfer activity is required. | APRA plans to release a discussion paper in November 2022. |

RSE licensees may choose to meet the new requirements for transfer planning and financial contingency planning (required in draft CPS 190) with a single approach and plan. This will be made clear in the prudential requirements and guidance.

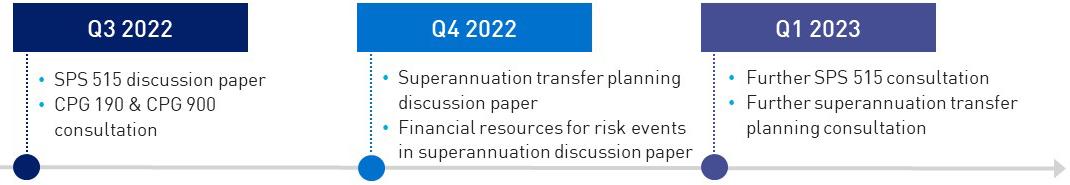

1.4 Next steps

Following the responses to this discussion paper, APRA intends to release draft prudential framework enhancements for further consultation in 2023, aligned with further consultation on proposed amendments to SPS 515.

Figure 2. Current and expected upcoming releases for key superannuation prudential reforms

Footnotes:

2 For the purposes of this paper, a reference to a ‘transfer of members’ is to be read as a transfer of beneficiaries and their associated benefits. It includes transfers involving an entire RSE(s), individual product or individual sub-funds to another RSE and covers situations where an RSE licensee transfers members out of their business operations and where an RSE licensee is a recipient of a transfer of members.

3 Refer to Part 6A of the SIS Act for requirements related to annual performance assessments.

4 Refer to APRA’s information papers on the MySuper and choice heatmaps: Superannuation heatmaps.

5 Refer to s. 52(2) of the Superannuation Industry (Supervision) Act 1993.

6 Strategic planning and member outcomes: Proposed enhancements (Discussion paper, August 2022)

7 Refer to Strengthening crisis preparedness. Draft CPS 190 proposes requirements for all APRA-regulated entities, including RSE licensees, to develop credible plans for managing financial stress that may threaten the entity’s viability, including plans for rebuilding financial resilience or effecting an orderly exit. Draft CPS 900, also released in December 2021, proposes, where required by APRA, that large and complex entities are to be pre-positioned for an orderly resolution by APRA, so that in the event of their failure, risks to members and financial system stability would be minimised. These standards together minimise the risk and impact of entity failure.

Chapter 2 - Planning

RSE licensees must be well-prepared, ahead of time, to take prompt actions, including a transfer of members, to promote the financial interests of beneficiaries.

2.1 Planning

2.1.1 Current framework

Developing and maintaining plans | |

SPS 515 |

|

SPG 515 |

|

SPG 516 |

|

SPG 227 |

|

2.1.2 Proposed enhancements

APRA intends to elevate current guidance relating to contingency planning from SPG 515 to new requirements for member transfer planning in SPS 515. The proposed enhancements to SPS 515 will also require RSE licensees to have in place triggers for remedial action to address BPR issues, including escalation steps in preparedness to undertake a complete or partial transfer of members. This will cover situations where an RSE licensee seeks to transfer members and where the RSE licensee is the recipient of a transfer of members.

The proposed enhancements aim to ensure that RSE licenses are better prepared to make changes to address BPR issues and achieve improved member outcomes.

Improvements to address issues arising in a BPR may be achieved through changes to product features, adjustments to investment strategies, member services or fee structures. RSE licensees are also expected to consider where changes to the business operations may be necessary to improve outcomes for members in response to emerging issues.

Transfer planning is a prudent step that supports an RSE licensee to make improvements to address issues in a timely and efficient manner. Where an RSE licensee decides that a transfer is necessary, planning reduces the risk to members of a protracted, costly, disruptive or unsuccessful transfer. Planning is also vital for RSE licensees that may be approached, or actively seek to be a receiving or successor fund. This may involve determining appetite for receiving transfers or transfer partners, and the preparatory steps to enable efficient transfers.

Figure 3. Robust planning mitigates the risk of poor member outcomes

APRA’s view is that all RSE licensees must be able to demonstrate that they undertake credible planning to deal with circumstances that may necessitate a transfer of members into, or out of, their business operations.

Refer to Attachment B for further detail about these potential requirements and guidance.

Chapter 3 - Pre-positioning and decision making

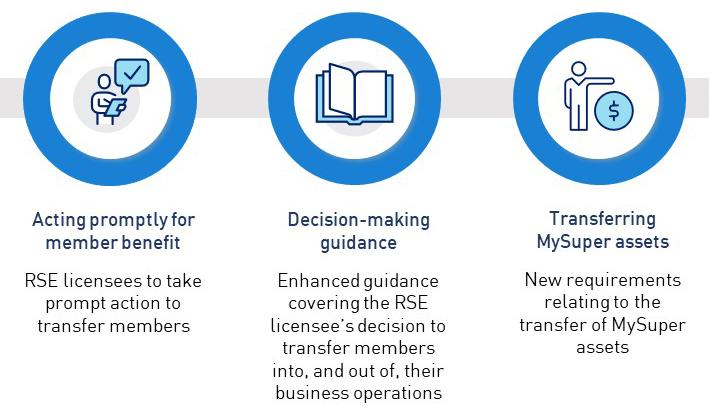

RSE licensees must act promptly to respond to triggers and undertake an objective and thorough analysis of transfer options, to determine the best outcomes for members.

3.1 Pre-positioning and decision making

3.1.1 Current framework

Pre-positioning to achieve a transfer | |

SPG 227 |

|

SPG 515 |

|

SPG 516 |

|

3.1.2 Proposed enhancements

To date, APRA has observed that RSE licensees can struggle to take prompt and proportionate action to respond to poor performance outcomes. Where an RSE licensee fails to identify and address barriers to transfers in a timely manner, members can be exposed to additional risks, including the potential for unnecessary costs and delays relating to transferring members.

RSE licensees need to be able to act promptly and take proportionate action to reduce the risk of poor outcomes for members, as set out below. APRA therefore intends to enhance existing guidance to replace SPG 227, as well as develop new requirements for a prompt transfer of MySuper members in the event of the cancellation of a MySuper authorisation.

Figure 4. Taking prompt and proportionate action reduces the risk of poor outcomes to members

Pre-positioning - proposed guidance

APRA has observed instances where proposed transfers have failed very late in the pre-positioning phase, often due to matters that should have been identified as unresolvable issues far earlier in the process. Such matters include, for example, issues relating to product or systems integration or mechanisms for the delivery of services to members.

Barriers to transfers also include legal matters, such as the application of the equivalent rights test and due diligence costs. There can also be challenges associated with the availability of a suitable transfer partner and the concentration of service providers, particularly fund administrators. Timeframes can be impeded by unnecessarily extensive, and costly, approaches to due diligence.

APRA’s enhanced guidance will outline expectations of prudent practice when preparing for a timely and efficient transfer of members. The guidance aims to minimise the risk of failed or inefficient transfers, which would expose members to undue cost, disruption and delays. The proposed content of the guidance is summarised in Attachment B.

Transfer of MySuper assets – new requirements

APRA intends to introduce new requirements that must be met in relation to the transfer of assets where a MySuper authorisation is cancelled (under section 29U of the SIS Act). This will enable APRA to require an RSE licensee to take specific preparatory steps in circumstances where a trigger relating to the MySuper product is reached. Such circumstances may include where an RSE licensee’s MySuper product first fails the legislated performance test or where APRA has reason to believe that one of the criteria in section 29U(2) of the SIS Act is met.8

APRA considers pre-positioning to be essential to ensure that risks and issues that might impede the successful transfer of members and assets in a MySuper product are identified and addressed prior to commencement of the 90-day period, in accordance with the RSE licensee’s election.9

The proposed requirements, which are outlined in Attachment A, will ensure that an RSE licensee is pre-positioned for the transfer of MySuper assets in a 90-day period, in the event that the authority to offer a MySuper product is cancelled. The requirements will be supported by the proposed guidance summarised in Attachment B.

Pending outcomes from this consultation, APRA intends that these provisions relating to the transfer of MySuper product assets would take effect from 1 July 2023.

Footnotes:

8 Refer to s. 52(9) of the SIS Act for the requirement for an RSE licensee to promote the financial interests of beneficiaries.

9 Refer to s. 29SAB of the SIS Act.

Chapter 4 - Execution

RSE licensees must execute transfers efficiently and with robust governance, risk and project management practices.

4.1 Execution

4.1.1 Current framework

Executing transfers | |

SPG 227 |

|

SPS 220 |

|

SPS 521 |

|

4.1.2 Proposed enhancements

The execution phase generally commences when transferring and receiving RSE licensees reach a joint agreement to transfer members. At this point, a joint implementation project is often established to manage integration, address execution issues and arrange for the transfer of assets. Actioning the project can be complex and must be well managed to achieve the desired outcomes for members in an orderly and cost-efficient manner.

During recent SFTs, APRA has observed instances where:

- transfers have taken excessive time to implement because of poor project management, unclear accountabilities for both the transferring and receiving RSE licensees, and inefficient (and occasionally conflicted) governance structures;

- RSE licensees have struggled to balance the need for compliance with complex legal obligations with a pragmatic approach pointed at the orderly completion of a transfer; and

- RSE licensees have been unable to secure the additional resources needed to maintain BAU operations whilst undertaking a transfer and to manage the associated transition risks.

Figure 5. A timely and well-executed transfer will lead to a less costly process which enhances outcomes to members.

APRA also intends to clarify that, following a decision to undertake a transfer, an RSE licensee’s business plan should be updated to include the plan for how this decision will be implemented. This would include how implementing the decision may affect other planned activities, in order to maintain business operations during implementation.10 The proposed content of the updated guidance is summarised in Attachment B.

Chapter 5 - Consultation

5.1 Request for submissions

APRA invites written submissions on the proposals set out in this discussion paper. Written submissions should be sent to superannuation.policy@apra.gov.au by 10 March 2023 and addressed to the General Manager, Policy, APRA.

Following review of feedback and submissions received, APRA plans to release draft transfer planning guidance for consultation. Pending outcomes from this consultation, APRA intends that new requirements relating to the transfer of MySuper assets would come into effect from 1 July 2023.

5.2 Consultation questions

APRA welcomes feedback on all aspects of the proposals in this discussion paper. The following questions are intended to identify specific areas for feedback that would assist APRA in finalising its proposals. They are intended to support, but not limit, responses.

Topic | Consultation questions |

Transfer preparedness | 1. APRA proposes that all RSE licensees must regularly consider, and plan for, future circumstances that may necessitate a transfer of members into, and out of, the RSE licensee’s business operations. Do you agree? If not, please provide views. 2. What are the minimum preparatory steps that an RSE licensee should take to be prepared for a transfer of members? 3. How would an RSE licensee look to balance being adequately prepared for a future transfer of members without incurring undue cost? |

Trigger frameworks | 4 What performance indicators do RSE licensees use to identify where a transfer of members is required? Of these, which indicators would be of most concern, for example, relating to performance, sustainability and service? |

RSE licensee decision making | 5. What guidelines would support an RSE licensee to ensure that appropriate due diligence is undertaken without resulting in undue cost and delays? 6. In what circumstances would an RSE licensee conclude that remediation of the RSE's business operations to improve member outcomes is not appropriate, necessitating a transfer of members? 7. Do you have any comments on the proposed requirements relating to the transfer of MySuper assets (refer to Attachment A)? |

Barriers to transfers | 8. What are the most significant barriers to a transfer of members, and how can the impact of these be reduced so that transfers are timely, orderly and less costly? |

Execution phase guidance | 9. What additional guidance for transferring and receiving RSE licensees would assist timely, well executed transfers? 10. Which parts of SPG 227 are particularly important to retain? 11. Has APRA sufficiently identified the critical components of the execution phase? If not, what is missing or inaccurate? |

Post transfer and winding up activities | 12. What challenges have transferring or receiving RSE licensees experienced, following an SFT (either partial or involving the whole RSE)? Please provide details, including in relation to the wind-up phase where a transferring RSE is to be wound up and any other issues or concerns associated with transfers that are not already addressed in these questions. 13. To what extent do RSE licensees currently undertake post-implementation reviews (or similar exercises) to support effective integration into the receiving RSE licensee’s business operations? |

5.3 Request for cost-benefit analysis information

APRA requests that all interested stakeholders use this consultation opportunity to provide information on the compliance impact of the proposed changes and any other substantive costs associated with the changes. Compliance costs are defined as direct costs to businesses of performing activities associated with complying with government regulation. Specifically, information is sought on any increases or decreases to compliance costs incurred by businesses as a result of APRA’s proposals.

Consistent with the Government’s approach, APRA will use the methodology behind the Commonwealth Regulatory Burden Measure to assess compliance costs. This tool is designed to capture the relevant costs in a structured way, including a separate assessment of upfront costs and ongoing costs. It is available at the Commonwealth Regulatory Burden Measure.

Respondents are requested to use this methodology to estimate costs to ensure the data supplied to APRA can be aggregated and used in an industry-wide assessment. When submitting their costs assessment to APRA, respondents are asked to include any assumptions made and, where relevant, any limitations inherent in their assessment.

Feedback should address the additional costs incurred as a result of complying with APRA’s requirements, not activities that entities would undertake regardless of regulatory requirements in their ordinary course of business.

5.4 Important disclosure requirements – publication of submissions

All information in submissions will be made available to the public on the APRA website unless a respondent expressly requests that all or part of the submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose. Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

Footnote:

10 APRA’s proposed enhancements to the SPS 515 framework to strengthen business planning practices include ensuring that an RSE licensee’s business plan is reviewed after certain trigger events.

Attachment A: Transferring MySuper product assets

As part of these reforms, APRA intends to set out requirements that must be met in relation to the transfer of assets where a MySuper authorisation is cancelled under section 29U of the SIS Act. The following sections are proposed requirements. The location of these requirements within the prudential framework is yet to be determined.

Role of the Board

1. The Board of an RSE licensee is ultimately responsible for ensuring that the RSE licensee, following the cancellation of an authority to offer a MySuper product, transfers any asset or assets that are attributed to the affected MySuper product into another MySuper product within the timeframe stipulated in s. 29SAB of the Superannuation Industry (Supervision) SIS Act 1993 (SIS Act).

2. The Board must ensure that there are clear roles and responsibilities at a senior executive level for the purpose of meeting the requirements in this Prudential Standard.

Planning for a transfer of MySuper assets

3. APRA may require an RSE licensee to be prepared, within a timeframe specified by APRA:

a) to transfer assets attributed to a MySuper product to another MySuper product within the timeframe stipulated in s. 29SAB of the SIS Act if the RSE licensee’s authority to offer a MySuper product is cancelled by APRA under s. 29U(1) of the SIS Act; and

b) to ensure the preparations cover other circumstances relevant to closure of the affected MySuper product and the transfer of assets to the receiving MySuper product.

4. The circumstances in which APRA may require an RSE licensee to be prepared to transfer MySuper assets include:

a) where the RSE licensee’s MySuper product fails the legislated annual performance assessment (refer to Part 6A of the SIS Act); and

b) where APRA has reason to believe that one of the criteria in s. 29U(2) of the SIS Act exists.

5. An RSE licensee must only nominate a receiving MySuper product to receive the MySuper assets where:

a) the RSE licensee of the receiving MySuper product has determined in writing, in its most recent annual determination, that the financial interests of the beneficiaries who hold the MySuper product are being promoted by the RSE licensee, having regard to the factors set out in ss. 52(9) to (11) of the SIS Act; and

b) APRA has determined that the receiving MySuper product has met the requirement in relation to the most recent legislated annual performance assessment (refer to s. 60C(2) of the SIS Act).

6. An RSE licensee must ensure that its approach for transferring MySuper assets has regard to and aligns with the RSE licensee’s risk appetite as set out in its risk management framework, the RSE licensee’s business plan and any other plans developed and maintained pursuant to Prudential Standard SPS 515 Strategic Planning and Member Outcomes, [draft Prudential Standard CPS 190 Financial Contingency Planning (CPS 190)] and [draft Prudential Standard CPS 900 Resolution Planning (CPS 900)].

7. An RSE licensee’s preparations for transferring MySuper assets must, at a minimum, include:

a) the governance arrangements for the transfer of assets, including the role of the Board;

b) a description of the roles and responsibilities of key stakeholders for each part of the transfer process;

c) the name of the MySuper product to which the RSE licensee considers that the assets should be transferred;

d) the name of the receiving RSE licensee, or RSE licensees, that have agreed in-principle to receive the assets of the MySuper product from the transferring RSE licensee; and

e) a communication strategy that will be deployed in the event that the authority to offer a MySuper product is cancelled.

8. APRA may require an RSE licensee to develop and implement additional actions if necessary to support the orderly transfer of assets to a receiving MySuper product.

Undertaking a transfer of MySuper assets

9. If an RSE licensee’s authority to offer a MySuper product is cancelled under s. 29U(1) of the SIS Act, the RSE licensee must:

a) take the prepared steps for transferring the MySuper assets;

b) if and as required by APRA, report to APRA on progress of the transfer of MySuper assets; and

c) transfer the assets of the MySuper product to the receiving MySuper product within the timeframe stipulated in s. 29SAB of the SIS Act.

10. An RSE licensee must comply with any requirements and any other matters required by APRA in relation to the transfer of any asset or assets of the MySuper product.

11. An RSE licensee must provide all reasonable assistance to the receiving RSE licensee to ensure that the transfer of any asset or assets to the receiving MySuper product is completed in accordance with relevant requirements.

12. An RSE licensee must notify APRA within 10 business days once the transfer of assets of the MySuper product has been completed.

Attachment B: Potential requirements and guidance

Phase | Potential requirements | Potential guidance |

Planning | Member transfer planning (SPS 515) (elevation of existing guidance) An RSE licensee must be able to demonstrate that it regularly considers, and where necessary plans for, future circumstances that may necessitate a transfer of all or some members.

| A prudent approach to planning would include:

|

Pre-positioning and decision making | Trigger framework (SPS 515) (elevation of existing guidance) An RSE licensee must have a trigger framework to identify and escalate the potential need for remedial action to address BPR issues. MySuper asset transfer plans (new requirements) Refer to Attachment A | An effective trigger framework ensures that the level of preparedness is commensurate with the need for readiness. As the need for a potential transfer becomes more pressing, an RSE licensee would take increasingly detailed preparatory steps, including to:

|

Execution | Business planning (SPS 515) An RSE licensee must, following a decision to undertake a transfer, ensure the business plan reflects how this decision will be implemented. This includes adjusting other plans as needed and maintaining business operations during implementation. | Prudent management of the critical components of the execution of a transfer plan would include:

|

Footnotes:

11 Note that r. 11.08 of the SIS Regulations requires a transferring RSE licensee to inform APRA of a decision to transfer members’ benefits from an RSE without the members consent as soon as practical after the transfer decision is made or before winding up is commenced.

Note on submissions

It is APRA's policy to publish all submissions on the APRA website unless the respondent specifically tells APRA in writing that all or part of the submission is to remain confidential. An automatically generated confidentiality statement in an email does not satisfy this purpose. If you would like only part of your submission to be confidential, you should provide this information marked as 'confidential' in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.