The superannuation Early Release Scheme: Insights from APRA’s Pandemic Data Collection

While COVID-19 continues to have a significant impact on our financial sector, most superannuation funds have managed these impacts well so far. However, the effect of the pandemic on Australians’ retirement savings has varied, and not only due to the virus’ impact on investment performance: millions of members withdrew money from their super under the Government’s Early Release Scheme (ERS), while many others switched investment options.

To better understand the impact of COVID-19 on superannuation funds and their members in this highly uncertain environment, APRA – in collaboration with ASIC – launched the COVID-19 Pandemic Data Collection (PDC) in June. Data was collected from APRA-regulated funds with more than four members on a quarterly basis, covering both tranches of the ERS. Data on a number of topics was also collected monthly, to ensure APRA had the most recent information available for analysis during this volatile period.

The PDC includes data on a range of topics including ERS applications, payments and demographics, member switching, fraud risk, service provider disruptions, and insurance and investment option characteristics. Overall, the data has shown that operational resilience is high, cash holdings remain relatively high and members with lower account balances had the highest take-up rate of ERS withdrawals.

The PDC has helped guide APRA’s risk-based supervision during the pandemic, and enabled a continued focus on ensuring trustees sustainably deliver sound outcomes for their members.

Trustees’ response to the ERS

The headline numbers related to the ERS are well-known, through the weekly publication of data from APRA’s early release data collection initiative: at the time of publishing this article, there have been 4.6 million payments to superannuation fund members, with total payments of $18 billion in the first tranche (April – June) and $17 billion in the second tranche (July - 15 November).

The PDC goes beneath the surface to paint a more detailed picture of how the ERS is impacting funds and member outcomes.

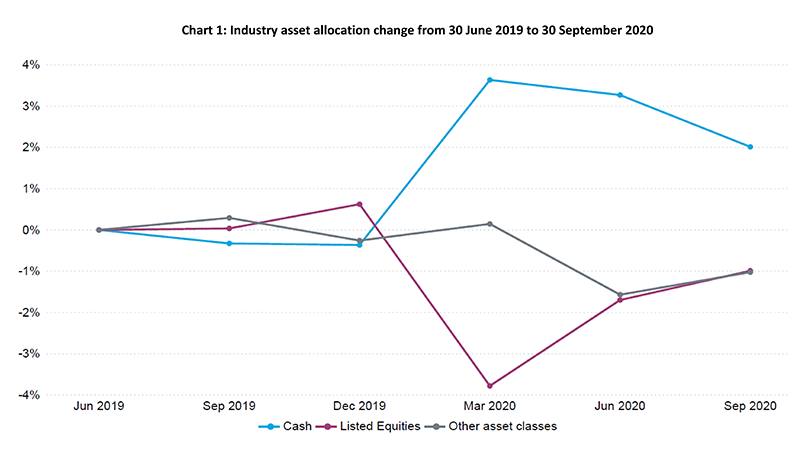

The data shows that during the first two weeks of the ERS – in late April and early May 2020 – over $6 billion of Australians’ retirement savings were withdrawn by superannuation fund members. While this placed significant liquidity pressure on a small number of funds, the movement of some investments to cash by the industry in the March quarter largely mitigated any potential liquidity concerns for superannuation funds. (During the March quarter, the actions of trustees and individual members saw an increase of more than $50 billion in cash held through members’ retirement savings, representing an overall increase to cash across the industry of 4.0 per cent of total investments).

By the end of June, the weekly impact of the first tranche of the ERS had declined, with a significant decrease in the number of members withdrawing their retirement savings compared to the first few weeks. The net switching flows of members into cash and defensive options also reversed, with investments being directed out of cash and defensive options towards growth options. During the June quarter, $7.5 billion net came out of cash/conservative options, and $7.9 billion net flowed into diversified and equity options (excluding platform products where switching functionality is not available without the use of an intermediary cash account). This trend continued but at a slower rate in the September quarter, with $1.4 billion net switched out of cash/conservative options and $1.2 billion net switched into diversified and equity options.

The timing of members’ switches potentially had significant impacts on their retirement balances, due to the volatility and large swings observed in financial markets between late February and June 2020. This volatility was particularly seen in listed equity markets. For example, the ASX200 experienced a 37 per cent drop in late February and March, followed by a 35 per cent rebound from late March to early June. Some members may have timed the market well and preserved their retirement balances. But many more are likely to have switched at the wrong time after markets fell, and switched back after markets were already in recovery.

Despite some easing of the pressure to hold cash or cash-like assets in the June quarter, trustees continued to hold higher levels of cash at the end of the quarter than in previous periods, with cash assets accounting for 13.2 per cent of industry investments as at June 2020, compared to 9.5 per cent in December 2019. This ensured adequate levels of cash were available to meet the second tranche of the ERS and to respond to continued volatility in the COVID-19 environment. In the first two weeks of July 2020 (the second tranche of the ERS), Australians withdrew a further $7 billion of retirement savings. Cash holdings have subsequently reduced, falling to 11.9 per cent of industry investments as at September 2020.

The movement in cash investments over these quarters can be observed in Chart 1 below, which also highlights the volatility in the listed equity markets over this period.

Operational resilience

Fraud risk

The risk of fraudulent activities within superannuation funds was significantly heightened during the early months of the pandemic for a range of reasons, including the high volume of transactions under the ERS and the changed workplace environment (where people were working from home for extended periods). This put significant pressure on trustees’ operational risk practices, but overall, these practices held up well.

In implementing the ERS, it was important to ensure that superannuation withdrawals were being paid to the correct members. Controlling the risk of fraud was made more challenging by the large volume of ERS applications at the start of each tranche: the first tranche starting in April saw 1.8 million applications made during the first 35 days, while the second tranche starting in July saw 1.6 million applications during its first 35 days.

Trustees strengthened their practices (75 per cent of funds modified their fraud oversight and management reporting processes in April) to address these challenges and minimise the impact of fraudulent activities during the pandemic. This included increased reporting and monitoring on both new risks and heightened existing risks. Fraudulent activities did rise during the very early period of ERS applications. However, as at the end of October, reported fraud events were able to be contained to 1,703 (0.04%) of the 4.5 million ERS payments to members.

In addition, a number of instances of potential fraud were detected before payments were made, further containing actual fraud impacts. This highlights the robustness of the processes that trustees have in place to ensure that fraudulent activities have minimal effect on the delivery of member outcomes during this period.

Service provider disruptions

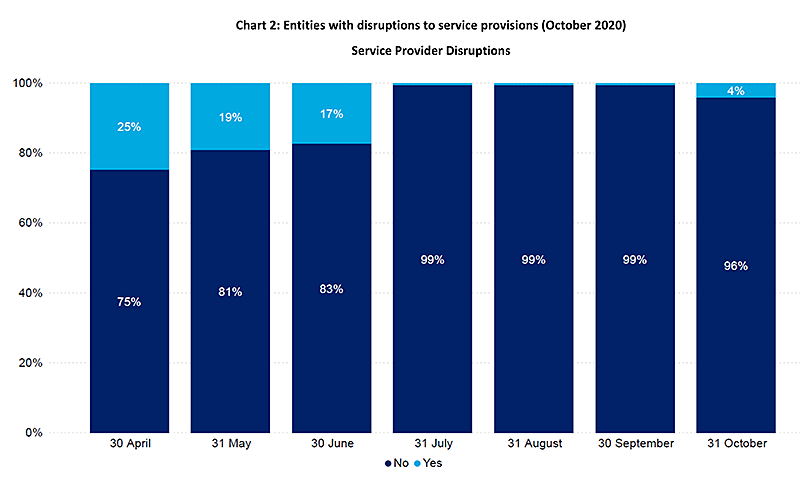

In the early stages of COVID-19, one quarter of superannuation entities experienced service provider disruptions as lockdowns were introduced and most of the workforce began working from home. Since the end of the June quarter, there have been only a small number of funds experiencing service disruptions as shown in Chart 2 below. These disruptions have been short-lived and had minimal impact on members.

Member profiles

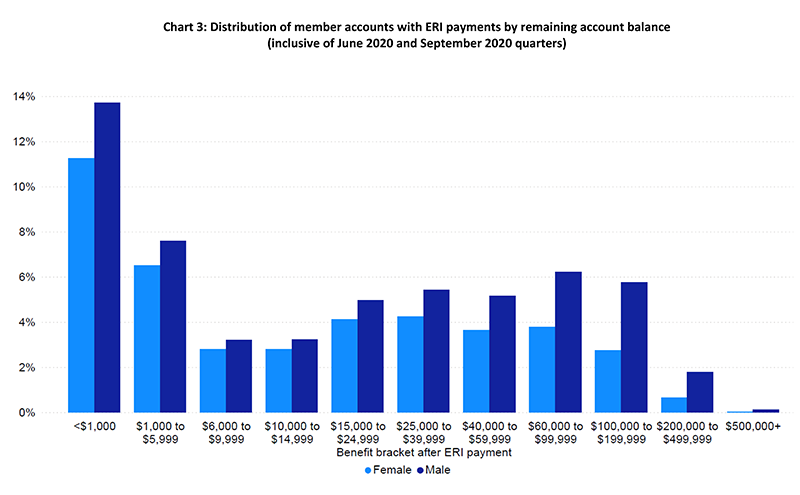

The PDC captured member demographic information on 4.3 million ERS payments over the June and September quarters. During the two tranches of ERS payments, the range of member balances after the ERS payment for those accessing the ERS was relatively wide, ranging from remaining balances of less than $1,000 to greater than $500,000. Accounts with remaining balances of less than $1,000 accounted for 1.08 million payments (or 25 per cent) of payments made to members. These accounts are likely to largely represent newly established accounts or supplementary accounts (i.e. not the primary account to which ongoing contributions are being made). Data from APRA’s weekly ERS data collection also indicates that approximately 163,000 accounts were fully depleted by ERS payments and closed in the June and September quarters. As expected, remaining balances of less than $1,000 accounted for fewer accounts from which an ERS payment was made in tranche two, dropping from 27 per cent in tranche one to 22 per cent.

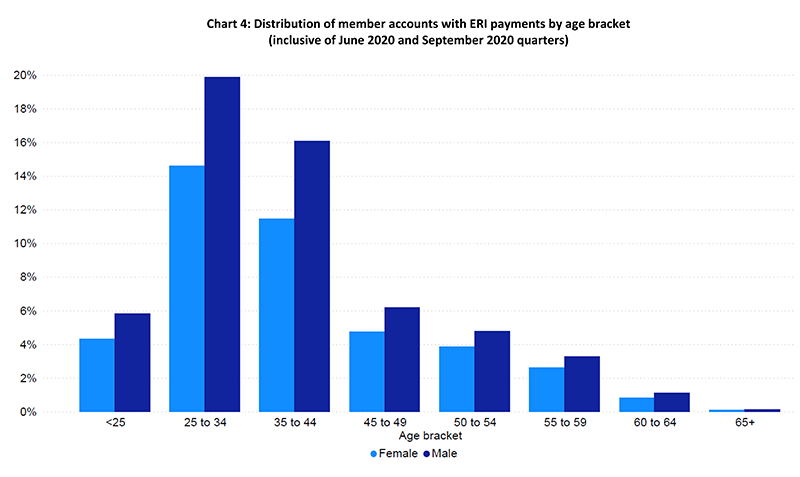

Males have had a higher total take-up across all age and account balance brackets, with the total male to female take-up ratio 57:43 for ERS payments made to members in the June 2020 and September 2020 quarters. When looking at members across fund types, male take-up rates were higher in both industry and retail funds while female take-up rates were higher in public sector and corporate funds.

Members aged 25-44 had the highest take-up rates of ERS payments, indicating the pandemic had a greater impact on the income of these members and/or these members had less access to other income during this period.

This demographic collection has given APRA key insights into how the ERS may have affected member outcomes being delivered by funds both now and into the future. This includes key member outcome issues – such as potential loss of insurance for members following an ERS payment (due to account closures or insufficient funds to pay premiums), and potential fee increases that may be required in future in light of reductions in fee income, for example as a result of the increase in closed and low balance accounts.

Where to now?

COVID-19 has placed pressure on superannuation funds and impacted their members over the past 10 months, and the pandemic will continue to present ongoing challenges. However, the ability of superannuation funds to facilitate payments under the ERS has helped members in financial hardship, and the operational resilience shown by the industry provides confidence that funds will continue to be able to navigate the uncertain environment ahead.

By giving APRA a better understanding of how the pandemic has affected superannuation funds and their members, the PDC has enhanced APRA’s supervision of superannuation trustees. As the volatility in financial markets and other pressures have reduced in recent months, APRA stopped collecting information on many of the topics covered by the PDC on 30 September 2020. However, APRA will continue to collect data on ERS applications and payments, fraud risk and service provider disruptions until January 2021. This will give APRA a complete dataset on the ERS, and allow APRA to analyse any effects of COVID-19 on funds’ operations that may yet emerge.

The PDC has been, and will continue to be, a key source of information for APRA to use when considering the approach to strategic planning and delivery of sound member outcomes by trustees, taking into account the requirements of Superannuation Prudential Standard (SPS) 515: Strategic and Business Planning.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.