Platform TDP product performance

Trustee directed products (TDPs) are diversified investment offerings where the trustee or a connected entity of the trustee has control over the management of investments and/or sets the strategic asset allocations of the product offering. Platform TDPs are investment offering structures that allow members to create bespoke portfolios by investing in a wide range of options.

APRA’s platform TDP product performance lookup tool enables users to interact with and compare investment returns, fees and performance test metrics across products.

Metric definitions

- RSE licensee

- RSE name

- Superannuation product name

- Investment menu name

- Investment option name

- Pathway identifier

Unique identifier for each pathway.

- Member assets ($'000)

At the pathway level, as at 30 June 2025.

- Member accounts (rounded to nearest tenth)

At the pathway level, as at 30 June 2025.

- Open/Closed to new members

- Strategic growth asset allocation

The allocation to growth assets as at 30 June 2025, based on strategic asset allocation data provided to APRA and a consistent definition of growth and defensive assets used for this analysis only.

- Strategic growth asset allocation category

The allocation to growth assets as at 30 June 2025, sorted into six categories.

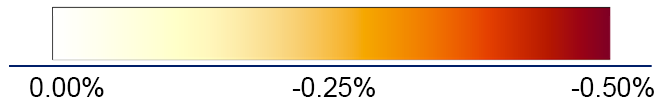

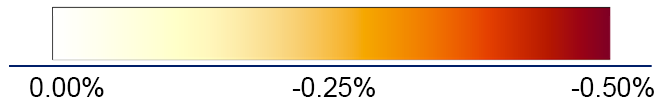

- Performance Test measure

Legislated performance measure as at 30 June 2025. The performance measure includes an assessment of investment performance and administration fees.

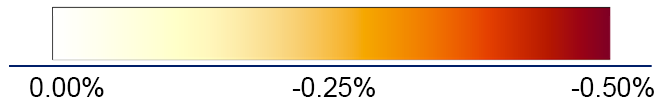

- Pass / Fail indicator

The result of the annual Performance Test. If a product’s Performance Test measure is -0.50% or lower, the product fails the test. A product that fails in consecutive years is labelled 'Fail - consecutive time'.

- Lookback period (years)

The number of financial years of a product's performance history used to calculate the Performance Test measure.

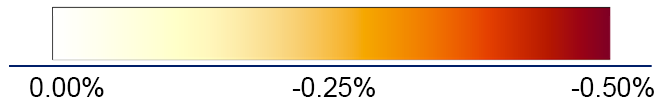

- Actual return minus benchmark return

The investment return of the product relative to a benchmark portfolio based of the products reported strategic asset allocation.

- Representative administration fees and expenses (RAFE)

Administration fees, costs and taxes charged to a representative member with a $50,000 account balance over the year to 30 June 2025.

- Relevant benchmark representative administration fees and expenses (BRAFE)

The median of all representative administration fees and expenses for platform TDPs.

- yfys_performance_test_indicator_filter

- yfys_performance_test_indicator_filter_consecutive_fail

- 10 year Gross Investment Return Net of Fees (GIRNF) p.a.

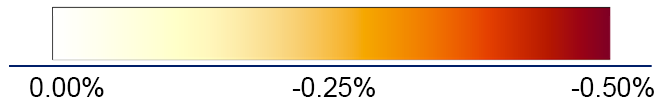

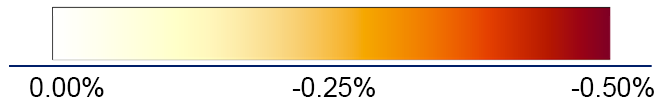

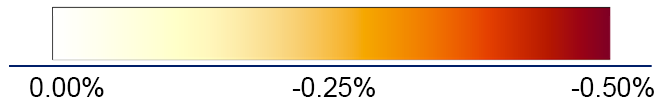

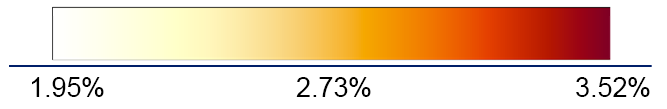

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the GIRNF / growth asset allocation trend line and in line with the colour scale below:

- 10 year GIRNF relative to SAA Benchmark Portfolio p.a.

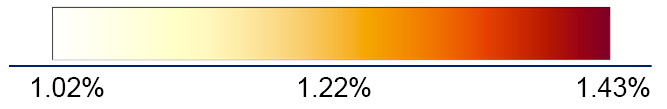

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 10 year GIRNF relative to Simple Reference Portfolio p.a.

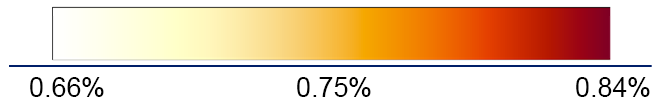

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

- 7 year Gross Investment Return Net of Fees (GIRNF) p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the GIRNF / growth asset allocation trend line and in line with the colour scale below:

- 7 year GIRNF relative to SAA Benchmark Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 7 year GIRNF relative to Simple Reference Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

- 5 year Gross Investment Return Net of Fees (GIRNF) p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the GIRNF / growth asset allocation trend line and in line with the colour scale below:

- 5 year GIRNF relative to SAA Benchmark Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 5 year GIRNF relative to Simple Reference Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

- 3 year Gross Investment Return Net of Fees (GIRNF) p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the GIRNF / growth asset allocation trend line and in line with the colour scale below:

- 3 year GIRNF relative to SAA Benchmark Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 3 year GIRNF relative to Simple Reference Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

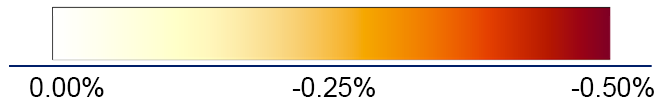

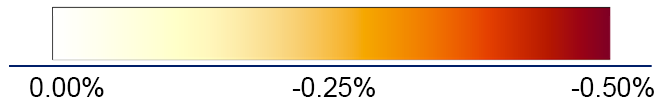

- Administration fees and costs charged ($10,000 account balance)

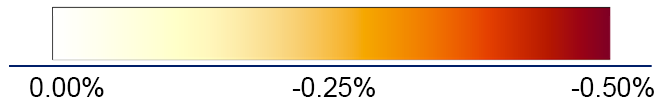

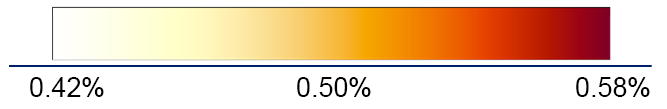

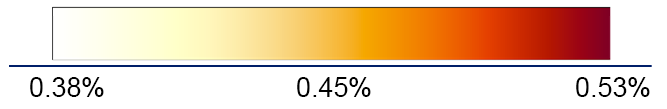

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($25,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($50,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($100,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($250,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Total fees and costs charged ($10,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($25,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($50,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($100,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($250,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

* If a product has a performance history of less than seven years, the product has met the requirements of the performance test, unless APRA issues a determination under regulation 9AB.10(4) to calculate a performance test measure for the product.

^ Under s. 60F of the SIS Act, this TDP is closed to new members.

APRA Choice Product Performance Tool Disclaimer and Terms of Use

The Australian Prudential Regulation Authority (APRA) is an Australian Government statutory authority that supervises institutions across banking, insurance and superannuation and promotes financial system stability in Australia. As part of APRA’s role, APRA makes publications including on statistics for the financial sector.

- The Choice Product Performance Tool (“the Product Performance Tool”) utilises asset allocation, investment return and fee data provided to APRA by regulated RSE licensees. Superannuation RSE licensees are responsible for ensuring they report accurate data to APRA. APRA has taken reasonable steps to ensure the accuracy of metrics in the Product Performance Tool publication, and will endeavour to liaise with an entity directly if it identifies potential concerns regarding data quality. APRA believes that the Choice Product Performance Tool is a useful tool supporting transparency in superannuation and provides valuable insights for Australian superannuation members and the industry.

- The listing of a Choice investment option in the Product Performance Tool, regardless of the set of ‘heat’ colours attributed to that Choice investment option, in no way implies any form of APRA endorsement or advice. It should not be taken as such. You will need to exercise your own skill and care with respect to your use of the Product Performance Tool. The Product Performance Tool is not a substitute for independent professional advice and you should always obtain any appropriate professional advice relevant to your particular circumstances.

- APRA will take reasonable actions to ensure the Product Performance Tool is not compromised with bugs, trojan horses, spyware or adware. APRA accepts no liability or responsibility for any interference with or damage to your computer, software or data occurring as a result of access to, or use of, the Product Performance Tool.

- By accessing the Product Performance Tool you agree to the APRA’s terms and conditions of use.

© Australian Prudential Regulation Authority 2025.

Platform TDP significant underperformers

Significantly poor investment performance (10-year)

| RSE licensee | RSE name | Investment option name |

|---|---|---|

| Avanteos Investments Limited | Avanteos Superannuation Trust | CFS Fixed Interest AUD |

| Bendigo Superannuation Pty Ltd | The Bendigo Superannuation Plan | Bendigo Balanced Wholesale Fund |

| Bendigo Superannuation Pty Ltd | The Bendigo Superannuation Plan | Bendigo Conservative Wholesale Fund |

| Bendigo Superannuation Pty Ltd | The Bendigo Superannuation Plan | Bendigo High Growth Index Fund |

| I.O.O.F. Investment Management Limited | IOOF Portfolio Service Superannuation Fund | MLC Wholesale Diversified Debt Fund |

| I.O.O.F. Investment Management Limited | IOOF Portfolio Service Superannuation Fund | MLC Wholesale Horizon 2 Income Portfolio |

| I.O.O.F. Investment Management Limited | IOOF Portfolio Service Superannuation Fund | MLC Wholesale Horizon 5 Growth Portfolio |

| I.O.O.F. Investment Management Limited | IOOF Portfolio Service Superannuation Fund | MLC WS Horizon 4 Balanced Portfolio |

| I.O.O.F. Investment Management Limited | IOOF Portfolio Service Superannuation Fund | OnePath Wholesale Diversified Fixed Inte |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | AMP Capital Income Generator (was Select Income Generator) |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | ipac Life Choices Active 100 |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | ipac Life Choices Active 50 |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | ipac Life Choices Active 70 |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | ipac Life Choices Active 85 |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | ipac Life Choices Income Generator |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | ipac Select Income Generator |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Guardian Balanced Fund |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Guardian Growth Fund |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Guardian Moderately Defensive Fund |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Professional Balanced |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Professional Conservative |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Professional Growth |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Professional High Growth |

| N. M. Superannuation Proprietary Limited | Wealth Personal Superannuation and Pension Fund | North Professional Moderately Conservative |

| Oasis Fund Management Limited | Oasis Superannuation Master Trust | OnePath Wholesale Diversified Fixed Interest Trust |

Significantly higher administration fees

| RSE licensee | RSE name | Product name | Investment menu name |

|---|---|---|---|

| Macquarie Investment Management Ltd | Macquarie Superannuation Plan | Macquarie Super Consolidator | Super Investment Menu - Manager/Consolidator |

| Macquarie Investment Management Ltd | Macquarie Superannuation Plan | Macquarie Super Consolidator II | Super Investment Menu - Manager/Consolidator |

Key documents

- Insights paper - APRA has published an Insights Paper to illustrate the key insights from the data in the Comprehensive Product Performance Package, in particular identifying improvements to outcomes delivered to members and highlighting areas of poor performance.

- Methodology paper - APRA has also provided an information paper on the methodology used to produce the Comprehensive Product Performance Package.

Related links

- CPPP FAQs - includes both general information and answers to a number of technical questions.

- Heatmap archived documents and information - the central location for all documents related to previous iterations of the heatmap.