Non-platform EDP product performance

Externally directed products (EDPs) are diversified investment offerings where the trustee or connected entity of the trustee has no control over the management of investments and does not set the strategic allocation of the product offering. Non-platform EDPs are standalone offerings.

APRA’s non-platform EDP product performance lookup tool enables users to interact with and compare investment returns, fees and performance test metrics across products.

Metric definitions

- RSE licensee

- RSE name

- Superannuation product name

- Investment menu name

- Investment option name

- Pathway identifier

Unique identifier for each pathway.

- Member assets ($'000)

At the pathway level, as at 30 June 2025.

- Member accounts (rounded to nearest tenth)

At the pathway level, as at 30 June 2025.

- Open/Closed to new members

- Strategic growth asset allocation

The allocation to growth assets as at 30 June 2025, based on strategic asset allocation data provided to APRA and a consistent definition of growth and defensive assets used for this analysis only.

- Strategic growth asset allocation category

The allocation to growth assets as at 30 June 2025, sorted into six categories.

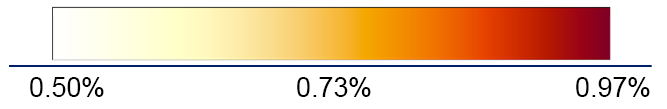

- 10 year Net Investment Return (NIR) p.a.

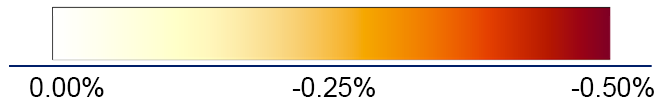

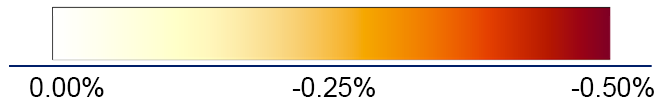

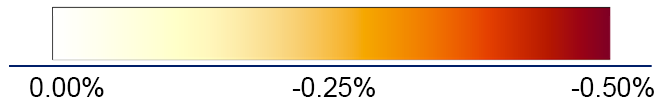

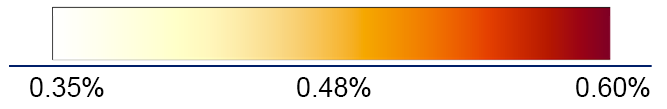

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the NIR / growth asset allocation trend line and in line with the colour scale below:

- 10 year NIR relative to SAA Benchmark Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 10 year NIR relative to Simple Reference Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

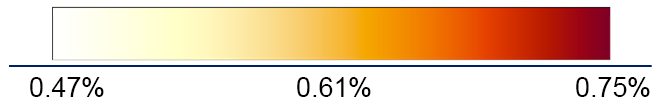

- 7 year Net Investment Return (NIR) p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the NIR / growth asset allocation trend line and in line with the colour scale below:

- 7 year NIR relative to SAA Benchmark Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 7 year NIR relative to Simple Reference Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

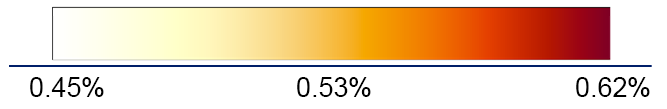

- 5 year Net Investment Return (NIR) p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the NIR / growth asset allocation trend line and in line with the colour scale below:

- 5 year NIR relative to SAA Benchmark Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 5 year NIR relative to Simple Reference Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

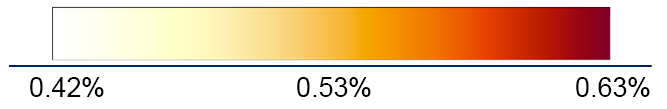

- 3 year Net Investment Return (NIR) p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the appropriate reference point in the NIR / growth asset allocation trend line and in line with the colour scale below:

- 3 year NIR relative to SAA Benchmark Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the SAA benchmark portfolio and in line with the colour scale below:

- 3 year NIR relative to Simple Reference Portfolio p.a.

As at 30 June 2025. Colours are applied based on the level of relative performance to the Simple Reference Portfolio and in line with the colour scale below:

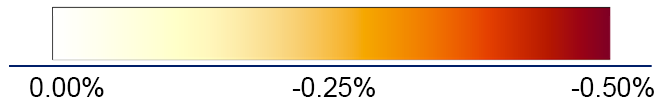

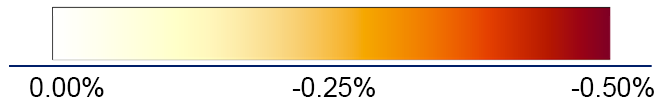

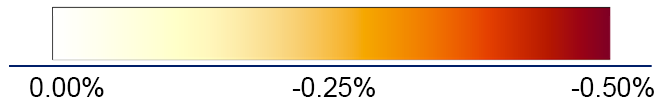

- Administration fees and costs charged ($10,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($25,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($50,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($100,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Administration fees and costs charged ($250,000 account balance)

Over the year to 30 June 2025. Colours are applied based on the administration fees and costs charged for the representative account balance in line with the colour scale below:

- Total fees and costs charged ($10,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($25,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($50,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($100,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

- Total fees and costs charged ($250,000 account balance)

Over the year to 30 June 2025. Based on administration, advice, investment and transaction fees and costs charged net of tax reported to APRA.

~ These investment options do not have investment return data shown due to incomplete reporting.

APRA Choice Product Performance Tool Disclaimer and Terms of Use

The Australian Prudential Regulation Authority (APRA) is an Australian Government statutory authority that supervises institutions across banking, insurance and superannuation and promotes financial system stability in Australia. As part of APRA’s role, APRA makes publications including on statistics for the financial sector.

- The Choice Product Performance Tool (“the Product Performance Tool”) utilises asset allocation, investment return and fee data provided to APRA by regulated RSE licensees. Superannuation RSE licensees are responsible for ensuring they report accurate data to APRA. APRA has taken reasonable steps to ensure the accuracy of metrics in the Product Performance Tool publication, and will endeavour to liaise with an entity directly if it identifies potential concerns regarding data quality. APRA believes that the Choice Product Performance Tool is a useful tool supporting transparency in superannuation and provides valuable insights for Australian superannuation members and the industry. Data collection for superannuation choice products is still relatively new and will continue to improve as reporting requirements are embedded across the industry.

- The listing of a Choice investment option in the Product Performance Tool, regardless of the set of ‘heat’ colours attributed to that Choice investment option, in no way implies any form of APRA endorsement or advice. It should not be taken as such. You will need to exercise your own skill and care with respect to your use of the Product Performance Tool. The Product Performance Tool is not a substitute for independent professional advice and you should always obtain any appropriate professional advice relevant to your particular circumstances.

- APRA will take reasonable actions to ensure the Product Performance Tool is not compromised with bugs, trojan horses, spyware or adware. APRA accepts no liability or responsibility for any interference with or damage to your computer, software or data occurring as a result of access to, or use of, the Product Performance Tool.

- By accessing the Product Performance Tool you agree to the APRA’s terms and conditions of use.

© Australian Prudential Regulation Authority 2025.

Non-platform EDP significant underperformers

Significantly poor investment performance (10-year)

| RSE licensee | RSE name | Investment option name |

|---|---|---|

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | Pendal Sustainable Balanced |

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | Perpetual Balanced Growth |

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | Perpetual Conservative Growth |

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | Perpetual Diversified Growth |

| Avanteos Investments Limited | Colonial First State FirstChoice Superannuation Trust | Schroder Real Return |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Accelerator Personal Superannuation Plan - Capital Guaranteed |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Accelerator Personal Superannuation Plan - Fully Guaranteed |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Flexipol Superannuation - Capital Guaranteed |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Goldline Personal Superannuation Plan - Capital Guaranteed |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Goldline Personal Superannuation Plan - Property |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Personal Superannuation Bond - Capital Guaranteed |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Personal Superannuation Bond - Guaranteed - OLD |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Personal Retirement Plan - Conservative |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Personal Retirement Plan - Matched |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Top Up Retirement Plan - Conservative |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Provider Top Up Retirement Plan - Matched |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Bond - Conservative |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Bond - Listed Property |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Bond - Managed |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Bond - Matched |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Bond - Property Biased |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Bond -Diversified Conservative |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | Retirement Security Plan - Guaranteed |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | RLA Personal Super Plan - Conservative |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | RLA Personal Super Plan - Listed Property |

| Equity Trustees Superannuation Limited | National Mutual Retirement Fund | RLA Personal Super Plan - Shielded |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Non-participating) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Capital Guaranteed (Par) |

| Equity Trustees Superannuation Limited | Super Retirement Fund | Conservative 4 |

| Legal Super Pty Ltd | legalsuper | Balanced Socially Responsible Accumulation |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | MoneyForLife Index Balanced |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | OnePath Capital Stable |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Pendal Monthly Income Plus |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Perpetual Balanced Growth |

| OnePath Custodians Pty Limited | Retirement Portfolio Service | Perpetual Conservative Growth |

Significantly higher administration fees

| RSE licensee | RSE name | Product name |

|---|---|---|

| N/A | N/A | N/A |

Key documents

- Insights paper - APRA has published an Insights Paper to illustrate the key insights from the data in the Comprehensive Product Performance Package, in particular identifying improvements to outcomes delivered to members and highlighting areas of poor performance.

- Methodology paper - APRA has also provided an information paper on the methodology used to produce the Comprehensive Product Performance Package.

Related links

- CPPP FAQs - includes both general information and answers to a number of technical questions.

- Heatmap archived documents and information - the central location for all documents related to previous iterations of the heatmap.