Life insurance in superannuation: Improving outcomes for members

Life and disability insurance are important benefits offered by superannuation funds to Australians. Under the Superannuation Industry (Supervision) Act 1993 (SIS Act), all members in MySuper (default) products must have death and permanent incapacity benefits provided through their superannuation fund (subject to certain limited exceptions). Consequently, almost 70 per cent of Australians who have life insurance hold it through their superannuation fund and in 2020, over $5 billion was paid in insurance claims to superannuation members.

In monitoring industry trends and practices across the insurance and superannuation sectors, APRA has seen a re-emergence of some concerning developments in relation to premium volatility, the availability and provision of data, and tender practices. APRA’s view is that these developments, if left unaddressed, are likely to result in poor outcomes for those Australians with life insurance held through their superannuation fund, and could ultimately adversely impact the availability and sustainability of life insurance through superannuation in the future.

Insurance experience

Following a period of intense competition among life insurers contesting for superannuation business, where material premium reductions and benefit increases were offered, many life insurers experienced significant financial losses between 2012 and 2014.

As a result, between 2014 and 2016, many superannuation funds and their members experienced large increases in their premiums for life insurance. More restrictive cover terms were also introduced as the life insurance industry sought to restore the sustainability of their business. In addition, a number of superannuation trustees had difficulty obtaining quotes for cover for their members, as insurers and reinsurers declined to participate in many tenders because of their recent poor experience.

The significant volatility in premiums (as a result of premium reductions followed relatively quickly by large increases) was a poor outcome for superannuation members. In particular, it makes it difficult for members (and trustees) to ascertain the value being provided by their insurance arrangements.

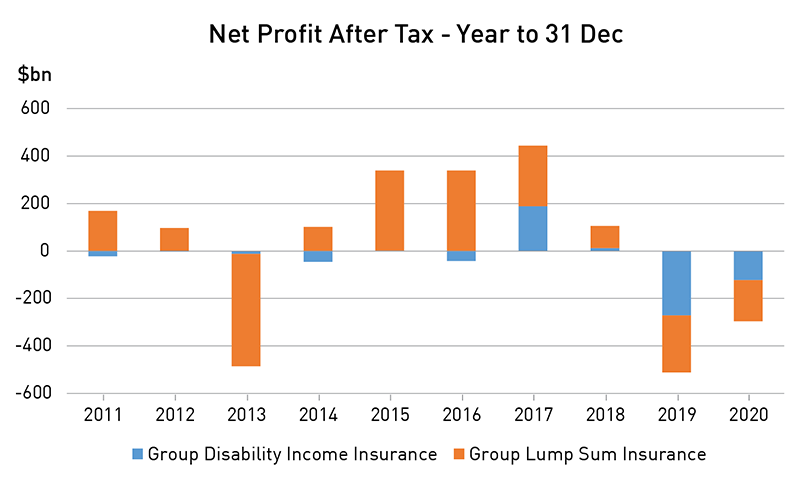

The trends and practices which APRA has recently observed appear similar to the cycle seen in 2012-2016, and have similarly been accompanied by a deterioration in group life insurance claims experience (for example, through increasing mental health claims) and a significant impact on life insurer profitability (as illustrated below).

APRA is concerned that, should these cyclical trends remain unaddressed, superannuation fund members are again likely to be adversely impacted through further substantial increases in insurance premiums and/or a reduction in the value and quality of life insurance in superannuation.

Indeed, the ongoing viability and availability of life insurance through superannuation may be jeopardised, adversely impacting access to life insurance cover for a large part of the Australian community.

External forces and evolving market conditions have also affected the provision of life insurance in superannuation, including the impacts of COVID-19 and changes introduced by the Protecting Your Super and Putting Members Interests First legislative reforms.

APRA wants the life insurance and superannuation industries to take appropriate and timely steps to address these trends and impacts, with a focus on measures to deliver high quality and sustainable insurance outcomes for Australians.

Premium volatility

Unsurprisingly, with the deterioration in life insurance claims experience within superannuation, and consequent substantial losses for insurers, recent APRA data illustrates that insurance premiums per insured member have been escalating during 2020.

APRA has also observed that material premium increases by insurers have contributed to superannuation trustees tendering insurance arrangements more frequently. APRA is concerned that, in some cases, the pricing on which tenders are being won by insurers, while initially attractive to trustees, may prove to be unsustainable, and therefore likely to lead to significant increases in premiums at the end of premium guarantee or contractual periods.

Ultimately, members are not best served by such unpredictability and volatility in insurance premiums, with members inevitably paying more in future for insurance as a result of unsustainable prices being offered to win tenders in a prior period.

This volatility makes it more difficult for members to assess insurance costs and the value of the insurance. As a result, it is increasingly difficult for superannuation members to make decisions about the true cost and benefits of their insurance benefits.

Many participants play an important role in the provision of life insurance to superannuation fund members and their dependants, including life insurers, reinsurers, superannuation trustees, administrators, tender managers and advisers. Accordingly, all these stakeholders have a role to play to ensure that the design and pricing of insurance arrangements have a greater emphasis on the sustainability of premiums and the value for money for consumers, and in reducing volatility in premiums for superannuation members.

Availability and provision of data

Understanding the risk within an insured portfolio is critical to being able to correctly price insurance cover. Life insurers, however, are continuing to face challenges in accessing high quality and timely superannuation fund and membership data relevant to designing and pricing their insurance offer. This is due to the varying quality and type of data captured by superannuation trustees on members, as well as varying approaches to providing such data to insurers.

The lack of sufficiently granular, quality data impacts the ability of superannuation trustees and life insurers to design and price appropriate insurance arrangements, often contributing to losses for insurers when experience doesn’t align with expectations based on the data provided.

For the ultimate long-term benefit of their members, superannuation trustees should maintain, and make available to insurers, high quality and sufficiently granular data to support a thorough understanding of fund membership and sound insurance benefit design, consistent with Prudential Standard SPS 250 Insurance in Superannuation (SPS 250). ASIC’s Report 675 Default insurance in superannuation: Member value for money also contains key observations about the data superannuation trustees have, that can give insights into improving the quality of membership and insurance records.

Tender practices

Superannuation trustees must act in the best interests of members at all times, and must ensure that the superannuation fund is providing sound outcomes for members. This includes annually assessing the insurance they provide and insurance outcomes for members. The annual outcomes assessment must include consideration of a range of factors including:

- The appropriateness of the fund’s insurance strategy, and

- The impact of fees and costs associated with the insurance provided, including whether those costs inappropriately erode the retirement income of members.

An important part of ensuring sound insurance outcomes is the tender process for providing insurance in superannuation funds. Superannuation trustees often contract third-party tender managers to conduct tenders, with life insurers submitting their proposals, which are then assessed by the superannuation trustees. This process allows superannuation trustees to evaluate benefit features and member services in a competitive environment.

But it is important that tender managers conduct the process in a way that helps optimise member outcomes in both the immediate and the longer term.

APRA has recently observed some examples of undesirable tender practices that are contributing to many of the unwelcome developments outlined in this article. These include:

- abbreviated timeframes for the tender process, or to respond to revisions in insurance design or other parameters as part of that process, being imposed,

- life insurers being unduly restricted by superannuation trustees seeking to have a major role in determining the reinsurers that must be used, and

- the data provided being inadequate, out of date and/or not made available to all tender participants.

Tender practices should support sustainable insurance benefit design and pricing. Tenders should be conducted in such a way that insurers are given adequate time to consult on scheme designs and appropriately price the risks and benefits. New data that becomes available during the tender process should be provided to all participants, with sufficient time for the impact of any changes to be assessed.

Looking ahead

APRA’s focus is on ensuring superannuation trustees and life insurers take steps that will support the provision of high quality and sustainable insurance outcomes for both current and future superannuation members, and reduce the unpredictability and volatility in insurance outcomes that makes an assessment of the value of insurance very difficult.

In doing so, APRA expects that superannuation trustees and life insurers will take steps to ensure that insurance offerings and benefits are sustainably designed and priced, provide good value for members, and adequately reflect the underlying risk and expected experience.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.