Information about taxonomies D2A and XBRL

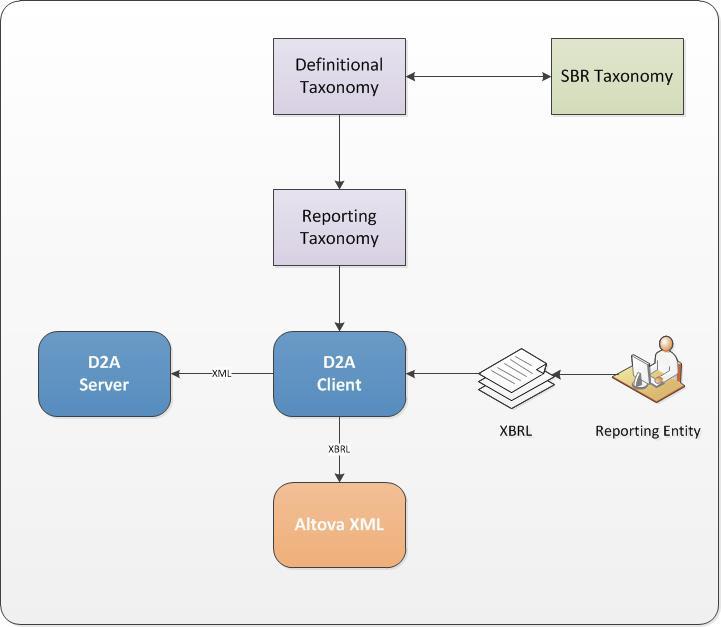

This is a general overview of SBR/XBRL and its support in D2A.

D2A, SBR and XBRL

D2A (Direct to APRA) is a client reporting tool to submit data in Returns and Forms.

SBR (Standard Business Reporting) own and manage the SBR Taxonomy. APRA provides content for the Definitional and Reporting Taxonomies during our form development projects, and are consulted on taxonomy changes with other member agencies.

XBRL (eXtensible Business Reporting Language) is a language for the electronic communication of business information.

XBRL (eXtensible Business Reporting Language)

XBRL provides Reporting Taxonomies which are the definitional elements that are reportable by businesses to government agencies.

APRA has one Reporting Taxonomy per D2A Form. The D2A functionality:

- Imports XBRL 2.1 instance documents produced from the SBR Reporting Taxonomy, or a collection of instance documents representing a D2A return.

- Generates sample XBRL 2.1 instance documents produced from form content.

The creation of an XBRL instance document against a Reporting Taxonomy is an alternative to manually entering the information into D2A. The content of an XBRL instance document can be imported into D2A, validated and submitted.

Document structure

The document structure includes the following high-level description elements:

- Namespace reference to load the Reporting Taxonomy to target

- Namespace reference to load the Definitional Taxomony files that are referenced.

- Unit elements to describe Monetary and Double data.

- Contexts for items using:

- Instant with Period Start Date

- Instant with Period End Date

- Duration with both Period Start and End Dates

- Report Header with the following information:

- Organisation Name

- Period Start Date

- Period End Date

- Return ID

- Return Version Number

- Return Name

- Form Code

- Form Version

- Form Name

- Reporting Consolidation Type

- Reporting Consolidation Sub Type

- Reporting Consolidation Name

- Unique Context Definitions

- Reported Facts mapped to Concepts (one element per item)

Instance document

APRA does not provide specific guidance on how to generate an XBRL instance document. To generate a valid XBRL instance document:

- Use the Report Header Tuple. A single instance type header must be provided in each XBRL instance document.

- Ensure that your XML and XBRL instance documents are valid and well formed. The Altova XML Spy editing tool determines if your XML file is valid.

Test instance

Test instance and data is not available. The test mode simulates submission of your return to identify any errors and the data is not sent to APRA.

Report headers

A report header contains the following elements:

- Organisation Name

- Period Start Date

- Period End Date

- Return ID

- Return Version Number

- Return Name

- Form Code

- Form Version

- Form Name

- Reporting Consolidation Type

- Reporting Consolidation Sub Type

- Reporting Consolidation Name

This information is available in the form list file created by D2A. The form list is created when the 'Request All New Blank Forms…' operation is performed and is found in the D2A installation directory: \lib\download\<entity ABN>\formList.xml. For more information refer to

D2A sample XBRL 2.1

The D2A sample XBRL 2.1 instance creator has the following features:

- The reporting period start date (startDate) is not available in D2A so a fixed value (1900-01-01) is used in the sample XBRL instances.

- Only D2A mappings associated with the reporting period end date will have the correct date value(s) in the XBRL context element. Please note: most mappings are associated with the reporting period end date.

- The sample instance generator will only produce XBRL for D2A attributes input values, i.e. any derived/calculated D2A attributes will not be generated in the sample instance.

- The value of the form precision is used to populate the XBRL item decimals attribute.

- The values in the D2A form header must match the values within the entities current form list.

External resources

Standard Business Reporting is a Federal Government initiative to reduce the financial reporting burden for business and software developers.

XBRL International is a consortium of worldwide companies and agencies that support and provide guidance for the use of XBRL.