Industry update - Pulse check on retirement income covenant implementation

About this paper

This industry update summarises the responses to a voluntary survey issued by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) in November 2023.

The survey gathered information on the self-assessments undertaken by registrable superannuation entity (RSE) licensees on their progress and planned improvements since the release of the information report, Implementation of the retirement income covenant: Findings from the joint APRA and ASIC thematic review (‘the thematic review report’), in July 2023.1

The survey asked RSE licensees to elaborate on improvements made and planned across the three core areas for the effective implementation of the covenant, namely:

- understanding members’ needs;

- designing fit-for-purpose assistance; and

- overseeing strategy implementation.

In addition, RSE licensees were asked to identify challenges in delivering successful retirement outcomes to members.

All RSE licensees invited to the survey responded with a total of 48 responses received.

Executive summary

As of December 2023, $426 billion in superannuation benefits are held in retirement products, an increase of $34 billion in the past two years.2 The continued growth of members and benefits in the retirement phase emphasises the pivotal role RSE licensees have in assisting their members to meet their retirement income needs. This role has been enshrined in the retirement income covenant (‘the covenant’) introduced on 1 July 2022.

APRA and ASIC have been working together to support implementation of the covenant, and in July 2023 jointly released an information report setting out the findings of a joint thematic review of the implementation of the covenant. The review found considerable variability in the implementation approach taken by RSE licensees, and a lack of urgency in embracing the intent of the covenant. The report also set an expectation that RSE licensees assess themselves against the findings and examples of better practices outlined in the thematic review report, and address gaps in their approach. A survey was later issued to RSE licensees to gather information on these self-assessments.

Overall, survey responses indicated that progress has been made by RSE licensees in some areas since the thematic review. RSE licensees with a greater number of member accounts and assets in retirement or approaching retirement generally have made more progress than the rest of the industry. However, the survey identified that many RSE licensees are still not adequately tracking the success or otherwise of their retirement income strategy (‘the strategy’).

We expect all RSE licensees to assess gaps and identify opportunities to accelerate progress in closing these gaps, including leveraging examples of progress outlined in this industry update.

Key findings from the survey

Based on survey responses, the following commentary highlights areas that RSE licensees indicated they are focusing on, areas where responses suggested incremental progress since the thematic review, and challenges identified in implementing the covenant.

Some survey responses lacked sufficient detail on the specific actions to be undertaken by RSE licensees to improve their implementation approach. APRA’s supervision teams will engage with these RSE licensees to address specific concerns, and more broadly as part of ongoing supervisory activity to drive continuous improvement.

Areas of focus

Survey responses indicated that RSE licensees are actively engaged in areas of improvement identified in the thematic review report.

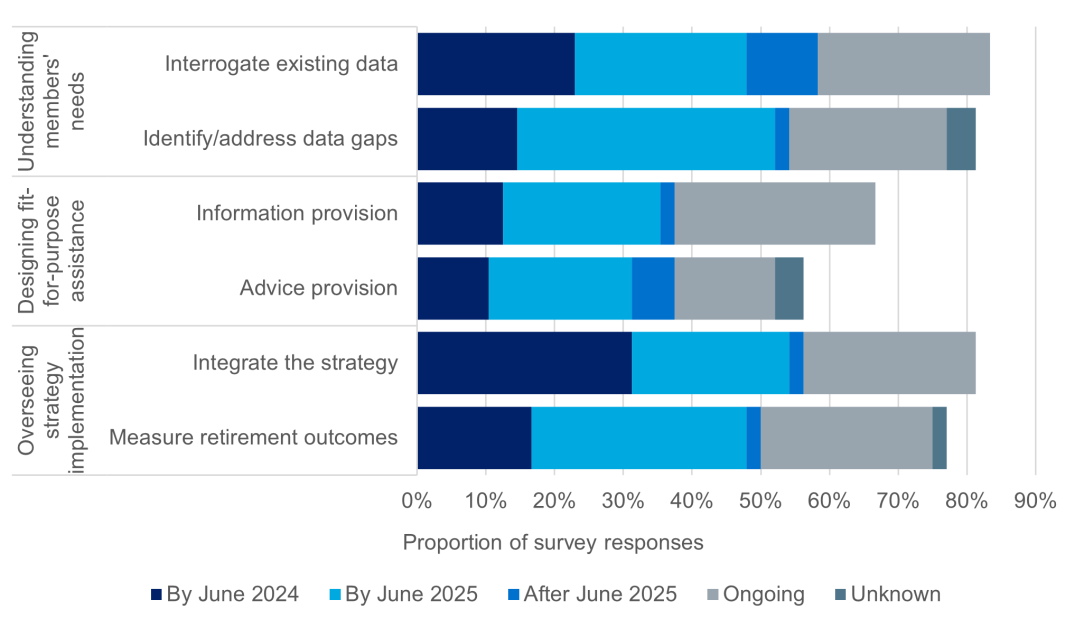

48 survey responses highlighted the following common areas of improvement (see Figure 1):

- increased effort is being placed on understanding members’ needs, with many RSE licensees (over 80%) indicated prioritising interrogating existing data and identifying and addressing data gaps;

- member guidance and advice continue to be an area of focus, with more than half of RSE licensees focusing on updating or expanding existing offerings on website content and member communication, or advice offerings; and

- governance and oversight are being updated to explicitly address the retirement phase, with some progress made towards integrating the retirement income strategy with the broader business planning process and designing and implementing measures to assess the impact of the strategy on members’ retirement outcomes and decision-making.

Figure 1: Areas of improvements identified by RSE licensees and expected timeframe of completion

It is encouraging that RSE licensees are taking steps to better understand the retirement needs of their members and have invested efforts towards promoting the availability and access to retirement-focused information for members, to assist them in planning for their retirement journey. These actions are expected to provide a strong foundation for the continued development of the retirement income strategy.

However, approximately only 1 out of 5 planned improvements identified is expected to be completed by June 2024, indicating that a period of continued development, beyond ongoing measurement of success, lies ahead.

A continuous improvement process is an essential element in the ongoing review of the retirement income strategy to ensure it remains effective in promoting members’ retirement outcomes.

The thematic review report highlighted the areas that require RSE licensees’ urgent attention and shared examples of better practice to facilitate ongoing improvements.

Better practices cited by some RSE licensees since the thematic review included:

- developing centralised databases to bring together existing data stored in different systems, such as transactional, engagement and sentiment data, to enable a holistic understanding of member behaviour and more comprehensive data analysis;

- providing retirement-specific information to members through targeted cohort communications, email nudge programs and pre-retirement guidebooks and checklists;

- forming a member panel to conduct regular member testing and research and gather feedback; and

- establishing retirement-focused leadership roles and teams.

Areas lacking progress

There is only incremental progress in measuring and tracking the success of retirement income strategies.

Approximately three quarters of RSE licensees selected ‘measuring retirement outcomes’ as one of their priorities. However, the limited mention of specific metrics in survey responses suggests that only incremental improvements have been made since the thematic review.

The thematic review report included examples of success metrics that focused on member outcomes by category, such as product, retirement income outcomes, and usage and quality of assistance. Based on the survey responses, the adoption of metrics aligned to the examples provided in the thematic review report is very low.

- Only two-thirds of survey responses confirmed the adoption of success metrics focusing on members’ retirement outcomes in more than one category.

- 1 out of 8 mentioned the adoption of metrics across all three categories.

- 9 responses did not mention any metrics outlined in the thematic review report at all, although 3 have provided additional measures.

Moreover, only 8 RSE licensees indicated that tracking the effectiveness of retirement-focused assistance offered to members was a priority. Additionally, only 4 RSE licensees indicated that they are prioritising the enhancement of their understanding of members receiving assistance from external sources.

Table 1 gives examples of success metrics observed in the thematic review, supplemented by additional metrics extracted from the self-assessment survey responses.

Table 1: Examples of success metrics that focused on members’ retirement outcomes

| Category | Examples observed in the thematic review | Additional examples observed in the self-assessment survey |

|---|---|---|

| Product |

|

|

| Retirement income outcomes |

|

|

| Usage and quality of assistance offered |

|

|

| Other |

|

|

Ongoing measurement and monitoring of success of retirement-focused outcomes for members is paramount to ensuring the continued appropriateness and effectiveness of the retirement income strategy, and to identify areas of uplift as members’ needs and priorities evolve.

As outlined in the thematic review report, this requires a mix of specific, measurable, quantitative and qualitative metrics that consider the retirement income needs of the RSE licensee’s membership, or different sub-classes where appropriate.

Better practices cited by some RSE licensees since the thematic review included:

- establishing retirement dashboards or reports to provide insights on members in or approaching retirement, or to track the outcome of activities and initiatives against targets; and

- developing (or planning to adopt) retirement-focused metrics before June 2025, to assess the impact and measure the success of initiatives within the retirement income strategy, such as those specified in Table 1.

Challenges to covenant implementation

RSE licensees have acknowledged a number of challenges in implementing the covenant but are committed to supporting their members through the retirement phase.

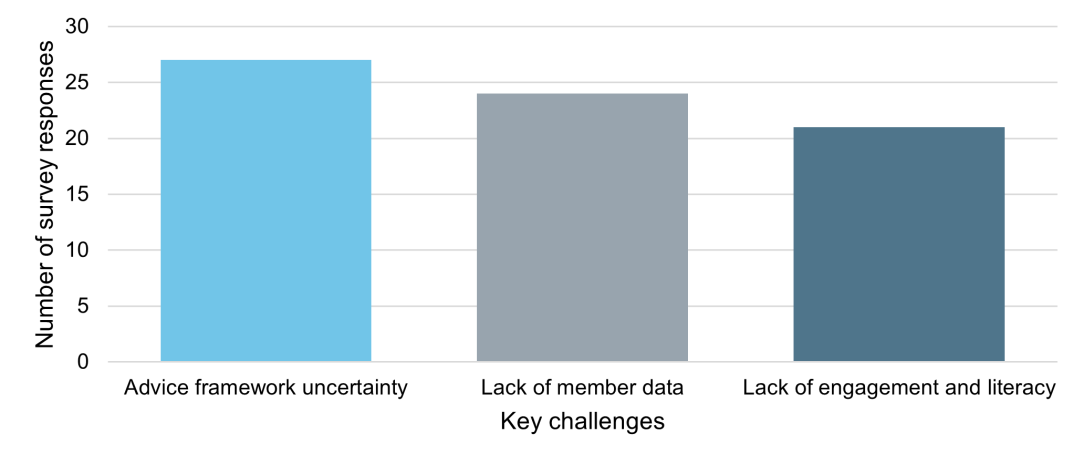

Assisting members to achieve quality outcomes in retirement is a complex task. To better understand the obstacles experienced by the superannuation industry, the survey asked RSE licensees to identify up to three challenges they face in implementing the covenant.

The key challenges identified were:

- the ability to meet members’ retirement advice needs, given the uncertainty around the financial advice framework, such as potential law reform (27 responses);

- the depth and availability of existing data pertaining to members, and privacy, security and cost concerns surrounding the need to collect more member data in order to better understand and support members’ needs (24 responses); and

- a general lack of member engagement and financial literacy relating to their superannuation and retirement phases (21 responses).

Figure 2: Key challenges identified by RSE licensees

Notwithstanding the challenges, RSE licensees indicated through the survey responses that they are pushing ahead with improvements, reflecting the broad range of initiatives RSE licensees can pursue to assist their members under current laws.

Some examples of improvements cited include:

- undertaking research on members’ advice requirements and expanding the availability and access to advice;

- completing a data gap analysis and taking steps to address data in a timely and cost-effective manner, such as deeper exploration into external data sources, estimating marital status and salary based on existing data, or leveraging existing member touch points including onboarding and surveys to collect more data from members; and

- developing members’ journeys with tailored communications to promote constructive engagement to and through retirement.

Looking ahead

Six million members of the Australian community were at or above superannuation preservation age in June 2023, and a further three million members will become eligible to draw from their super in the next 10 years—a 50% increase over the next decade.3

Given the large number of superannuants moving into the retirement phase in future years, and the growth of account balances transitioning into retirement, continued focus on the retirement phase is critical. RSE licensees have a pivotal role to play in assisting their members to improve their retirement outcomes.

APRA and ASIC expect RSE licensees to continue to take a member-centric approach in monitoring and reviewing their members’ retirement outcomes as part of Prudential Standard 515 Strategic Planning and Member Outcomes (SPS 515) and the product design and distribution obligations. We encourage RSE licensees to consider how their existing retirement income strategy will support improving those outcomes in retirement.

APRA and ASIC will continue working together to monitor and drive industry progress in improving the retirement outcomes and customer experience of members of the Australian community.

Glossary

| covenant | The retirement income covenant under s52(8A) and 52(8B) |

|---|---|

| retirement phase | Generally, ‘retirement phase’ refers to the period between the start of retirement or when an individual begins to draw down on their super as an income stream (or lump sum), and the end of their life |

| s52 (for example) | A section of the SIS Act (in this example numbered 52) |

| SIS Act | Superannuation Industry (Supervision) Act 1993 |

| SPS 515 | Prudential Standard 515 Strategic Planning and Member Outcomes |

| strategy | Retirement income strategy required under s52AA |

| we | The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) |

Footnotes

1Information report—Implementation of the retirement income covenant: Findings from the joint APRA and ASIC thematic review, 19 July 2023.

2Quarterly Superannuation Industry publication, which refers to APRA-regulated entities with more than six members.

3 National, state and territory population, September 2023 | Australian Bureau of Statistics (Population by age and sex – national, Table 8).