Governance of Unlisted Asset Valuation and Liquidity Risk Management in Superannuation - December 2024

1.Executive summary

The Australian superannuation sector is an increasingly important part of the financial system. Total assets of APRA-regulated superannuation entities were approximately $2.7 trillion as at 30 June 2024, with around $500 billion invested in unlisted assets such as property, infrastructure, credit and equity. As holdings in unlisted assets are expected to increase, the need to address risks related to valuation governance and liquidity management is a critical issue for the industry and a priority area for APRA.1

Superannuation fund members rely on trustees to invest their retirement savings prudently, safeguarding and growing their funds through robust risk management practices. To support equitable and sound member outcomes, RSE licensees need to have timely and reliable information on asset values when making investment decisions, calculating unit prices and returns on investment assets. Additionally, RSE licensees must implement effective processes to manage liquidity risk.

In January 2023, APRA updated Prudential Standard SPS 530 Investment Governance (SPS 530), which enhanced requirements for valuations and liquidity management. To evaluate RSE licensees' implementation of the new requirements, APRA began a thematic review in December 2023. It assessed detailed responses and data from 23 RSE licensees, covering approximately 80% of total assets managed by APRA-regulated superannuation entities. This paper summarises the progress of RSE licensees in implementing APRA’s enhanced valuation governance and liquidity risk requirements, and highlights areas where further improvement is needed.

While the approach to asset valuation governance has generally improved since APRA’s 2021 unlisted asset review2, a significant proportion of RSE licensees still displayed material gaps in key areas. The findings of the thematic review indicate that 12 of the 23 in-scope RSE licensees require material improvement in either or both their valuation governance or liquidity risk frameworks. APRA regards these findings as concerning and indicative of the need for a continued drive to lift practices across the industry.

As set out in SPS 530, effective board and management oversight of valuation processes and procedures, as well as adequate separation of duties, are crucial to managing valuation risks and the delivery of good member outcomes (Figure 1). RSE licensees must also be able to effectively plan for and respond to liquidity risk, manage cash flow requirements, optimise investment strategies, and avoid being a source of broader industry or systemic stress (Figure 2).

In relation to unlisted asset valuation governance, the thematic review highlighted particular weaknesses in the areas of:

- Board oversight and conflicts of interest management;

- Revaluation frequency;

- Revaluation triggers;

- Valuation control; and

- Fair value reporting.

In relation to liquidity risk management, the thematic review highlighted particular weaknesses in the areas of:

- Trigger frameworks for potential liquidity stress;

- Management of potential liquidity risks relating to unlisted assets; and

- Liquidity action plans.

Next Steps

Given the significance of the findings in the thematic review, APRA will be directly engaging with those RSE licensees identified as having deficiencies and will expect them to formulate appropriate and timely remediation plans. Where necessary, APRA will take further action within its regulatory remit to enforce the provisions of SPS 530 and related regulatory requirements.

APRA expects all RSE licensees to review the findings in this paper, assess themselves against SPS 530 and SPG 530, and enhance their valuation governance and liquidity risk frameworks where needed. The findings set out in this paper provide direction on better practices for RSE licensees, including relating to the valuation of externally managed assets and managing conflicts of interest.

Figure 1. SPS 530 principles - unlisted asset valuation governance

Figure 2. SPS 530 principles - liquidity risk management

2. Scope and approach

2.1 Prudential standards and guidance

RSE licensees and their accountable persons are subject to a number of regulatory requirements relevant to investment management and investment governance.

Investment governance standard and guidance

APRA updated SPS 530 Investment Governance and related guidance (SPG 530) in 2023. SPS 530 includes requirements for the governance of RSE licensees’ overall approach to investing member assets, in addition to requirements specifically relating to asset valuation governance and the management of liquidity risk. Both SPS 530 and SPG 530 emphasise the need for adequate separation of duties and reporting lines.

The following sections of SPS 530 (and relevant aspects of SPG 530) were the particular focus of the thematic review:

- Valuation governance: SPS 530, paragraphs 39-41; and

- Liquidity risk management: SPS 530, paragraphs 30-38 (including stress testing).

While the review focused on the above aspects of SPS 530, the entirety of both SPS 530 and SPG 530 apply to all RSE licensees.

Use of external managers

Under CPS 231 Outsourcing requirements, RSE licensees must be able to demonstrate how they have considered the changes to the risk profile of business activities (including oversight of valuation and associated liquidity risks) that arise from outsourcing investment management activity to an external manager.3

Risk management frameworks

RSE licensees and their accountable persons are subject to other requirements in APRA prudential standards related to large exposures to unlisted assets. RSE licensees are expected to ensure that valuation governance practices relating to unlisted assets are a focus of risk management declarations4 and annual and triennial reviews of risk management and investment governance frameworks5.

Financial Accountability Regime

Requirements in the Financial Accountability Regime (FAR Act) will apply to RSE licensees from 15 March 2025. Oversight of external investment managers and related risk management frameworks are included in the responsibilities of accountable persons for investment management functions. This is particularly relevant to the investment management of unlisted assets, where activities are often outsourced to external parties.

2.2 Review approach

For this review, APRA selected 23 RSE licensees with meaningful exposure to unlisted assets to participate. Total investment assets managed by the participating RSE licensees were $2,018 billion as at 30 June 2024, or around 80% of total assets managed by APRA-regulated superannuation entities.

The participating RSE licensees ranged in asset size and operated a range of business models. Platform-based RSE licensees (defined as typically offering a high number of externally managed investment options to members) were included, as were RSE licensees employing a narrower range of investment managers, in some cases internal to the entity.

The review examined alignment to APRA’s requirements and guidance relating to governance of unlisted asset valuation practices and associated liquidity risk. This entailed a review of the RSE licensees’ qualitative responses to APRA’s questionnaire, and quantitative data relating to valuations and liquidity. APRA did not assess RSE licensees’ valuation methods, nor the resulting asset valuations. In developing its findings from this review, APRA has also considered the findings arising from the recent RSE licensee self-assessment survey for SPS 530.6

APRA assessed each in-scope RSE licensee’s approach to unlisted assets in aggregate, rather than undertaking specific analysis of individual asset classes. Asset classes covered by the review were Unlisted Property, Unlisted Infrastructure, Unlisted Equity and Fixed Income Private Debt.

The overall alignment of each RSE licensee’s practices to the relevant parts of SPS 530 was assessed using the following ratings:

- Favourable: RSE licensee has demonstrated better practice alignment with SPS530. APRA will monitor risks via business-as-usual supervisory activity.

- Acceptable: RSE licensee has demonstrated broad alignment with SPS530 but needs to uplift some practices. APRA will either require or recommend improvements, prioritising areas of risk.

- Requires improvement: RSE licensee has not demonstrated alignment to SPS530 and needs to make material improvements to its practices to address identified weaknesses. APRA will require timely remediation plans and, where necessary, take further action within its regulatory remit to enforce SPS530 and related requirements.

3. Unlisted asset valuation governance

3.1 Unlisted asset valuation governance ratings

The overall ratings for unlisted asset valuation governance for the 23 RSE licensees included in the thematic review are summarised below (Table 1).

Table 1. Summary of valuation governance risk ratings

Valuation Governance Rating | Favourable | Acceptable | Requires Improvement | Total |

|---|---|---|---|---|

| Number of RSE licensees | 3 | 12 | 8 | 23 |

| Funds under management7 | 31% | 48% | 21% | $2,018b |

| Member Accounts | 5.7m | 8.6m | 4.4m | 18.7m |

Of the 23 RSE licensees included in the review:

- Three RSEs were rated green (favourable) for their valuation governance frameworks: these were large funds that represented 31% of in-scope FUM and 5.7 million member accounts.

- Eight RSEs were rated red (requires improvement) for their valuation governance frameworks. This included two platforms, four mid-sized funds and two large funds, and represented 21% of in-scope FUM and 4.4 million member accounts.

- Twelve RSEs were rated amber (acceptable) for their valuation governance frameworks. This included two platforms, two mid-sized funds and eight large funds representing in total 48% of in-scope FUM and 8.6 million member accounts.

The most common issues across those rated red or amber related to the management of conflicts of interest arising from investment staff being involved in the valuation process and lack of demonstrated challenge to valuations (see section 3.2 for further details).

Overall, whether an RSE licensee holds assets directly (either internally managed or via an externally managed mandate) or indirectly (typically via holdings in externally managed unitised pooled vehicles) had a significant bearing on the practices observed in the review. In general, valuation governance for externally managed assets was shown to be less robust than for internally managed assets.

Further commentary on findings for key issues is provided below.

3.2 Board oversight and conflicts of interest

While RSE licensees have responded to the enhancements to SPS 530 by adopting elements of better governance and related features, APRA observed cases of material weaknesses in board oversight of valuations and in the management of potential conflicts of interest.

Observations

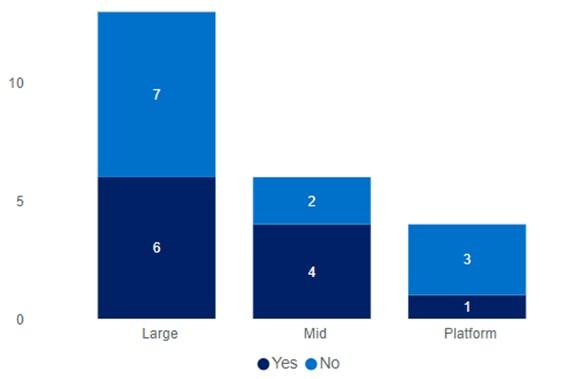

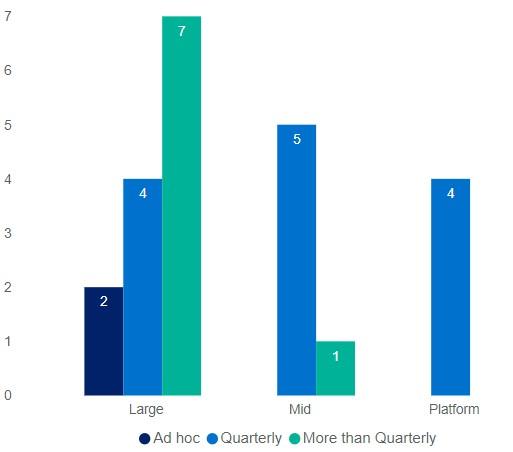

While all in-scope RSE licensees used a governance committee or group for valuation oversight, only 11 had a dedicated valuation committee (Figure 3). Other RSE licensees used alternative groups (such as investment or audit committees) to oversee valuations, raising concerns that this may not be within the relevant governance body’s capability or capacity. Consistent with our findings in the 2021 thematic review, RSE licensees with dedicated valuation committees in place were shown to have more effective frameworks for managing potential conflicts of interest in the valuation process.

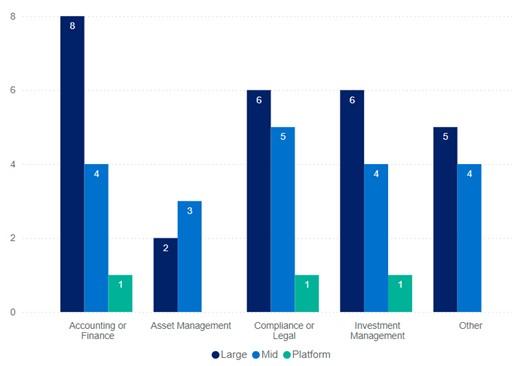

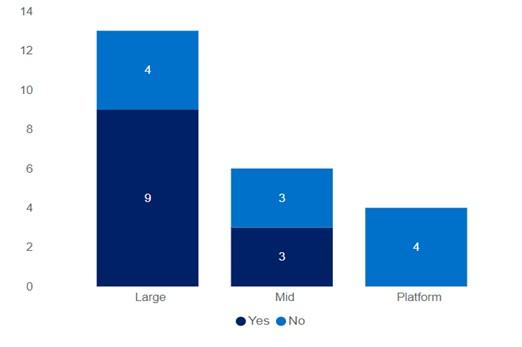

Overall, APRA observed the need for greater inclusion of independent committee members with specialist knowledge concerning individual unlisted asset classes. In some cases, members of committees overseeing valuations included individuals whose remuneration may be dependent on the outcome of the valuation process, in particular from asset management or investment management functions, something which could create a conflict of interest (real or perceived) (Figure 4). Similarly, APRA observed inconsistent practices in the separation of operational staff from staff conducting valuation processes.

For externally managed assets, there was often high reliance placed on the investment manager’s valuation policies and processes (especially for platform RSE licensees). APRA observed the need for greater challenge or assurance activity from RSE licensees in relation to valuations that are provided by investment managers.

Figure 3. Implementation of a dedicated valuation committee (number of RSE licensees)

Figure 4. Management functions included in valuation-related committees (number of RSE licensees)

Better practice application of SPS 530

Meeting SPS 530 requirements would be demonstrated through the effective management of conflicts of interest and ensuring adequate skills and knowledge are incorporated in the valuation governance process. This may involve the creation of a separate Board-appointed governance committee dealing with all aspects of the valuation process to support a robust valuations framework. The members of this committee should be independent of investment decision makers, and include members with appropriate unlisted sub-sector specific market knowledge of the key unlisted sectors in which the entity invests. The governance process should also apply clear criteria for accepting or rejecting valuations from external investment managers.

3.3 Revaluation frequency

While the RSE licensees included in the thematic review generally adopted a quarterly valuation cycle, opportunities for improvement were identified. A key example of better practice observed in larger RSE licensees was carrying out more frequent independent valuations of asset classes with a higher valuation risk.

Observations

While generally adopting a quarterly valuation cycle, some RSE licensees did not require their valuation committees (or other governance group) to meet on a quarterly basis (Figure 5). APRA also observed instances where an insufficient proportion of assets were included in regular valuation processes, with the result that some assets may not be revalued for multiple quarters at a time.

Figure 5. Meeting frequency of valuation-related committees (number of licensees)

Better practice application of SPS 530

APRA expects that an RSE licensee would undertake valuations on at least a quarterly basis. Where an RSE licensee chooses to undertake valuations less frequently, APRA expects the RSE licensee to clearly demonstrate how it has determined that the valuation frequency is appropriate, including evidence that member outcomes are not likely to be impacted.

3.4 Revaluation triggers

While most RSE licensees adopted some form of qualitative and quantitative revaluation triggers, APRA observed a need for more proactive consideration of out-of-cycle valuations. APRA also observed cases where triggers appear to have been met without leading to a revaluation or appropriate challenge to the existing valuation.

Observations

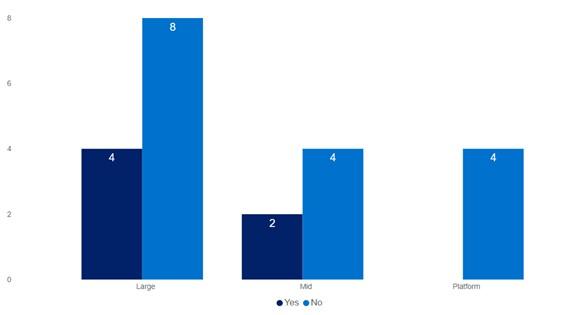

While APRA observed the wide use of generic quantitative revaluation triggers by RSE licensees such as movements in broad equity market indices (Figure 6), the review highlighted the opportunity for greater use of quantitative triggers relevant to specific unlisted asset classes. For example, with respect to unlisted property, movement in the MSCI Unlisted Property index would be more closely aligned with the characteristics of the assets being monitored (albeit with some timing lags).

In general, APRA observed that the qualitative revaluation triggers used by RSE licensees were more focused on retrospective issues, such as the departure of a major tenant, rather than contemporary issues that could also impact valuations (e.g., media discussion on office vacancies from the impact of remote working).

Overall, APRA observed a general lack of proactivity by RSE licensees in considering out-of-cycle valuations, and in commissioning independent valuations for externally managed investments (Figure 7). This highlights the risk that RSE licensees may be overly reliant on their external managers for asset valuations, giving rise to potential conflicts of interest and placing member outcomes at risk of inaccurate asset valuations.

Figure 6. Implementation of quantitative triggers for out-of-cycle valuations (number of RSE licensees)

Figure 7. Independent valuation sourced for externally managed investment within last 12 months (number of licensees)

Better practice application of SPS 530

RSE licensees can best demonstrate that they are meeting the requirements of SPS 530 through the use of both quantitative and qualitative revaluation triggers. Quantitative triggers for out of cycle valuations and independent valuations of externally managed assets should be relevant to the specific unlisted sub-sector and as prescriptive as possible (i.e.: %-movement over a certain trading day window in an appropriate market index or relevant valuation model input metric). Qualitative triggers should be retrospective, current and prospective.

Based on the trigger framework, APRA would expect that the valuation committee or equivalent would meet and consider out of cycle valuations with clear criteria as to when to obtain an independent external valuation or an independent valuation of externally managed assets. This should facilitate regular independent external valuations of directly held assets and ensure clear, robust criteria for the appointment of external investment managers.

3.5 Valuation control and audit

The review highlighted that most RSE licensees who use external managers are reliant on those external managers to provide unlisted asset valuations. APRA observed only limited instances of ongoing monitoring of external manager valuations following the initial due diligence prior to appointment. APRA notes that in some cases the auditors of RSE licensees have raised this lack of monitoring as a matter requiring remediation.

Observations

APRA observed instances of control weaknesses in relation to ongoing monitoring of externally held unlisted assets, including over-reliance by some RSE licensees on due diligence performed prior to initial engagement of the external manager and the policies of the external manager.

APRA observed instances where the auditors of some RSE licensees had raised control weaknesses relating to the oversight of valuation practices of external managers (e.g., Level 3 assets misclassified as Level 2, control weaknesses at the investment manager and problems with Net Asset Value (NAV) back-testing). RSE licensees should ensure that significant issues identified by the external auditor in relation to valuation controls are addressed in a timely manner.

Better practice application of SPS 530

APRA expects that, following initial due diligence, there should be ongoing monitoring of external managers to demonstrate the basis for reliance on valuations. There should be active implementation of the findings of periodic internal and external audit reviews of valuation control practices.

3.6 Fair value reporting

As part of the review, APRA observed some inconsistent approaches to fair value reporting of unlisted assets in RSE licensee responses and disclosures. This could lead to risk identification and assessment deficiencies that could impact member outcomes when members and other parties rely on RSE licensee reported information.

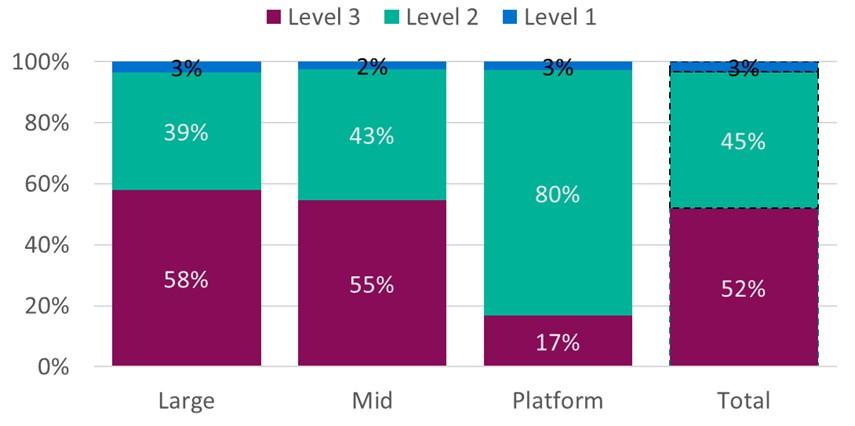

From an accounting perspective, inputs to the valuation methods used to determine fair value comprise three levels of the fair value hierarchy, with Level 3 being the most uncertain and often the most applicable to unlisted assets.8 Following the 2007-09 financial crisis, the International Accounting Standards Board strengthened the fair value measurement and disclosure requirements in financial statements which apply to RSE licensees. ASIC acquired the power to oversee superannuation financial reporting and audit from 1 July 2023, increasing the focus on the accuracy of financial reporting.

Notwithstanding the differences in asset allocations across RSE licensees, the findings of the review suggest that the inconsistent application of the fair value accounting requirements and the APRA “look-through principle”9, could be a significant factor in the high proportion of unlisted assets classified outside Level 3 (Figure 8).

Figure 8. Fair value level proportion of unlisted assets by cohort

The in-scope platform RSE licensees were observed as having the highest proportion of their unlisted assets (83%) classified outside Level 3. Given that most, if not all, unlisted assets would require significant unobservable inputs in their valuations, these would generally be expected to be classified as Level 3 within the fair value hierarchy.

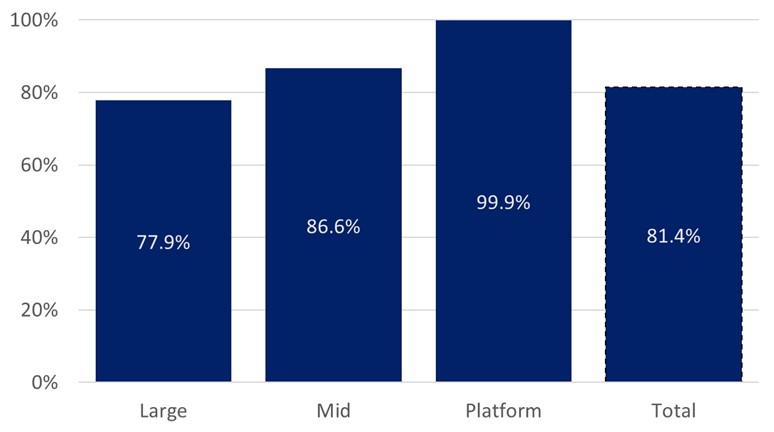

It is important to note that a large proportion of unlisted assets held by RSE licensees are managed externally, with platform RSE licensees having almost 100 per cent of their unlisted assets externally managed (Figure 9). Some RSE licensees noted in their submissions to APRA that there are limitations in their ability to look through to the underlying asset being valued.

Figure 9. Externally managed proportion of unlisted assets by cohort

4. Liquidity risk management

4.1 Liquidity risk management ratings

The overall ratings on liquidity risk management across the 23 RSE licensees included in the thematic review are summarised below (Table 2).

Table 2. Summary of liquidity risk management ratings

| Liquidity Risk Management Rating | Favourable | Acceptable | Requires Improvement | Total |

|---|---|---|---|---|

| Number of entities | 7 | 8 | 8 | 23 |

| Funds under management10 | 58% | 15% | 27% | $2,018b |

| Member Accounts | 9.9m | 3.4m | 5.4m | 18.7m |

Of the 23 RSE licensees included in the review:

- Seven of the 23 RSE licensees were rated green (favourable) for their liquidity risk management. These comprised mainly large RSE licensees and represented 58% of in-scope FUM and 9.9 million member accounts.

- Eight of the 23 RSE licensees were rated red (requires improvement) for their liquidity risk management. These comprised mainly medium sized RSE licensees or those operating a platform business model, and represented 27% of in-scope FUM and 5.4 million member accounts.

- Eight of the 23 RSE licensees were rated amber (acceptable) for their liquidity risk management. These comprised mainly small to medium-sized RSE licensees, and represented 15% of in-scope FUM and 3.4 million member accounts.

Further commentary of findings on key issues is provided below.

4.2 Potential liquidity stress - triggers

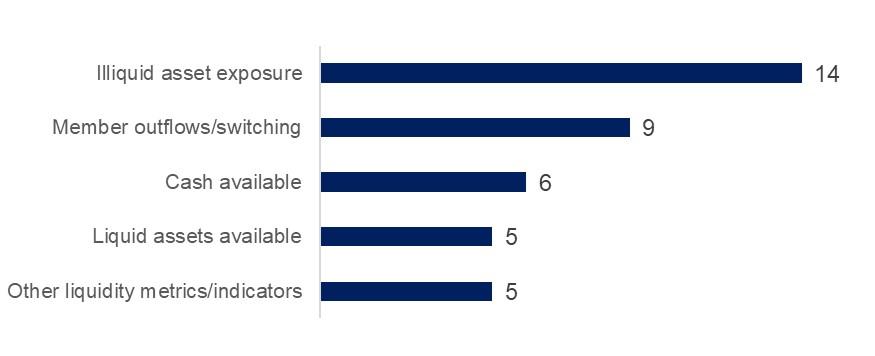

While APRA observed that the majority of in-scope RSE licensees undertake frequent liquidity risk monitoring and several are deploying or developing multiple triggers for the early identification of liquidity risk, there is need for a continued improvement of practices across the cohort. The range of liquidity triggers currently considered by RSE licensees needs to be widened to cover broader risks (Figure 10).

Observations

APRA observed the wide use of a single liquidity trigger (% of illiquid asset exposure in investment portfolio) to identify emerging liquidity risk across RSE licensees. While this is an intuitive and important trigger to monitor, reliance on a single trigger may be overly-simplistic and could lead an RSE licensee not perceiving broader risks, such as trends in member outflows or switching (Figure 10). In some cases, APRA also observed liquidity triggers described in such broad or overly qualitative terms that they may be difficult to use in practice.

For a small number of in-scope RSE licensees, APRA observed differences between their documented quantitative triggers and the triggers employed in the operation of their portfolio. Further, some RSE licensees do not appear to have sufficient early warning indicators to prompt pre-emptive liquidity mitigation actions to reduce vulnerability to liquidity risk.

Figure 10. Top five liquidity event triggers/indicators (number of RSE licensees)

Better practice application of SPS 530

RSE licensees should consider deploying a range of liquidity triggers, with sufficient levels of detail, to help identify emerging liquidity risk and facilitate the RSE licensee to take pre-emptive action in the event of an emerging liquidity stress event. The risk assessment framework should also seek to enable detection of early warning signs of potential liquidity stress so that proactive measures can be taken.

A better practice set of liquidity risk triggers would consist of both forward-looking and retrospective indicators including:

- Member outflows,

- Minimum cash level,

- Liquid assets available, and

- Relevant indicators of market stress and portfolio characteristics (for example, equity market falls, changes in bond yields, credit spreads, foreign currency exchange rates, projected illiquid assets or cash holdings and liquidity ratios).

4.3 Specific liquidity risks relating to unlisted assets

As part of the thematic review, APRA requested that RSE licensees consider liquidity risks posed by exposures to unlisted assets and outline their processes in place to manage such risks. The majority of RSE licensees were cognisant of these risks, however, the liquidity action plans of RSE licensees generally lacked sufficient consideration of the specific liquidity risks posed by unlisted asset exposures.

Observations

While some RSE licensees identified key liquidity requirements related to risks from unlisted asset exposures, such as maintaining asset allocation and ensuring member equity, appropriate risk mitigation plans were not yet in place.

In some cases, APRA observed inadequate consideration of how to ensure that the investment strategy, risk profile, diversification and liquidity profile of investment options remain appropriate following liquidity events. For example, there were some cases of reliance on outdated indicators such as quarterly or annual routine checks, or adherence to illiquid asset limits.

APRA also observed the need for greater consideration of the potential contagion risks to or from affected underlying markets or other institutions. Risk analyses were generally performed on the basis that the RSE licensee would be the only institution impacted by a liquidity stress event, without considering the dynamic ramifications for transaction costs, operational demands and liquidity sources from the actions of peers or from other segments of the financial system.

Better practice application of SPS 530

APRA expects RSE licensees to have clear frameworks for managing liquidity risks related to unlisted assets in order to enhance resilience to liquidity stress scenarios caused by illiquid asset exposures and to take into account contagion risks. These frameworks should ensure that key decision makers have access to the necessary information regarding asset allocation impacts and valuations to allow them to take effective actions in a liquidity stress event.

4.4 Liquidity action plans (LAPs)

While all in-scope RSE licensees were found to have broad frameworks in place to guide them through potential liquidity events, there is a need to enhance LAPs so they provide the level of specific detail needed to enable decisions makers to take effective actions in liquidity stress.

Observations

Each RSE licensee provided an outline of the key elements of their approach to managing a liquidity stress under the LAP. APRA observes that most of the LAPs assessed in the review were general frameworks designed to provide guidance through potential liquidity events, rather than detailing the specific steps needed to effectively address potential liquidity stress associated with unlisted asset exposures.

APRA also observed a need to improve understanding of the liquidity management capabilities of external providers, particularly investment managers that would be likely to face similar urgent demands from multiple investors in response to an external liquidity event. This challenge is particularly relevant to platform models that have limited control and understanding of their product providers.

Better practice application of SPS 530

RSE licensees are expected to have an effective LAP which ensures its key decision makers have the required information to be able to act effectively during potential liquidity events. This should include a clear outline of the actions to be taken under a liquidity event, escalation and communication protocols, asset liquidation and liquidity risk mitigation plans, and clear roles and accountabilities. The LAPs should also demonstrate a clear understanding of the liquidity management capabilities of the RSE licensee’s external investment managers. LAPs should meet these objectives across a range of potential liquidity events.

Footnotes

1 See “Superannuation Initiatives” in the APRA Corporate Plan 2024-25.

2Findings from APRA’s superannuation thematic reviews, 26 October 2021

3Refer CPS 231 Outsourcing. From 1 July 2025 onwards, CPS 230 Operational Risk Management takes effect. This standard has specific requirements for material service providers for RSE licensees such as investment management and funds management.

4 Refer SPS 220 Risk Management

5 Refer SPS 220 Risk Management and SPS 530 Investment Governance (which requires a comprehensive review of the investment governance framework on a triennial basis).

6Observations from SPS 530 Valuation Governance Framework Self-Assessment Survey,19 June 2024

7 The percentages are based on the total funds under management (FUM) of the 23 in-scope RSE licensees as at 30 June 2024 ($2,018bn).

8 The measurement uncertainty associated with the valuation of assets increases through the fair value hierarchy (from Level 1 to Level 3). The valuation inputs for classification within Level 1 of the hierarchy involve quoted prices (unadjusted) in active markets. Classification within Level 2 of the hierarchy involves inputs other than quoted prices within Level 1 that are observable, either directly or indirectly. Classification within Level 3 of the hierarchy involves valuation inputs based on unobservable inputs.

9 APRA’s reporting principle that aims to look through investment structures to the underlying asset being valued.

10 The percentages are based on total funds under management (FUM) of the 23 RSE licensees as at 30 June 2024 ($2,018bn).

Disclaimer and Copyright

While APRA endeavours to ensure the quality of this publication, it does not accept any responsibility for the accuracy, completeness or currency of the material included in this publication and will not be liable for any loss or damage arising out of any use of, or reliance on, this publication.

© Australian Prudential Regulation Authority (APRA) 2024

This work is licensed under the Creative Commons Attribution 4.0 Licence (CCBY 4.0). This licence allows you to copy, redistribute and adapt this work, provided you attribute the work and do not suggest that APRA endorses you or your work. To view a full copy of the terms of this licence, visit: https://creativecommons.org/licenses/by/4.0/