Observations from SPS 530 Valuation Governance Framework Self-Assessment Survey

To: All RSE Licensees (RSEL)

APRA requires RSELs to have a robust asset valuation governance framework that addresses risks on a timely basis. Inappropriate asset valuations, especially during periods of heightened market volatility, may materially impact prices applied to member transactions, member equity and reported investment returns. APRA considers active and robust valuation processes, with strong oversight and governance, as critical elements within an RSEL’s investment governance framework.

Based on a survey of unlisted asset valuation governance practices that APRA conducted in late 2023, APRA expects RSELs to improve their practices in this area.

Background

The survey was designed to assess the quality of the implementation of enhancements made to APRA’s requirements and guidance relating to Investment Governance. 1

Responses were received from 45 RSELs.2 The participating RSELs accounted for close to 100 per cent of regulated entities’ exposures to unlisted assets.

APRA thanks those RSELs that participated in the survey and shares its key observations below.

Key observations

Better practices that were observed across the majority of RSELs included:

- checks and controls in place to ensure valuations fell within an expected reasonable range, with respect to external investment managers’ valuations and independent external valuers; and

- unlisted asset valuations were an area of focus in internal audit plans.

However, there is also room for improvement in some key areas including:

- use of revaluation triggers for ongoing and interim valuations. This issue was identified as having the most room for improvement in the survey. Some RSELs did not have predefined triggers or did not describe clear triggers for revaluations;

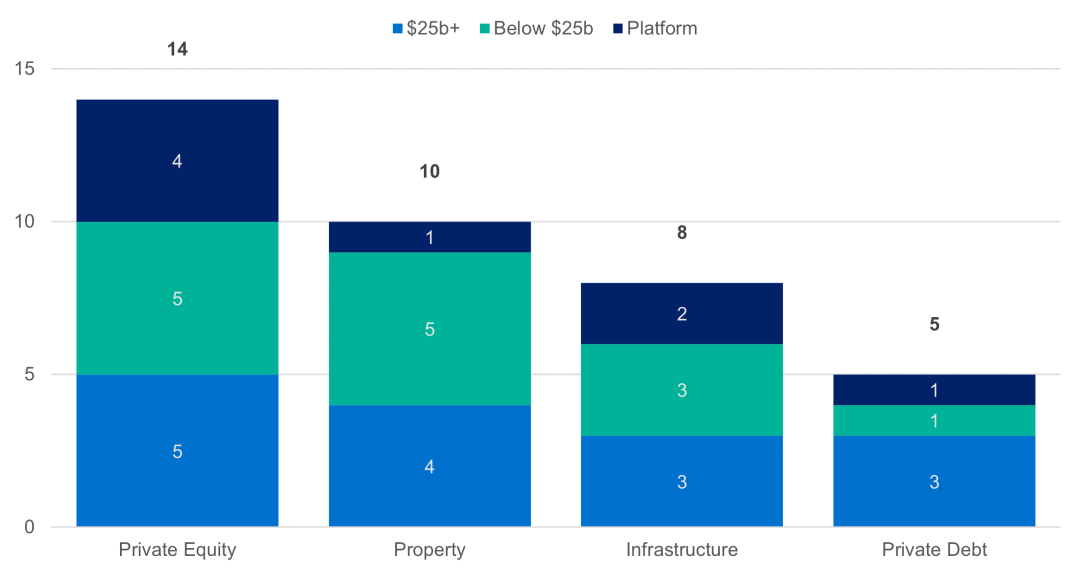

- frequency of valuations. Some unlisted assets were not valued at least quarterly as per SPS530 guidance (for example private equity, property and infrastructure); and

- extent of Board scrutiny of unlisted asset valuations. This was particularly prevalent with the platform trustees.

The areas for improvement by RSELs varied by size (> $25 billion vs < $25 billion funds under management) and whether the RSEL operated a platform-style business.3 Observations regarding these RSELs have been grouped according to these categories. The greatest areas for improvement were identified for the cohort comprising small/medium non-platform RSELs and platform RSELs. Additional observations on better practices and areas for improvement are set out in the attachment.

APRA encourages RSELs to consider the findings from this survey with a view to improving their own unlisted asset valuation practices.

Further engagement

APRA is engaging with RSELs that participated in the survey, prioritising activity using a risk-based approach.

Unlisted asset valuation governance practices are a heightened supervision priority for APRA. APRA will continue to directly engage with RSELs where weaknesses have been identified. In addition, further engagement on this topic will take place as thematic work relating to unlisted asset valuation governance practices continues. APRA expects that valuation governance processes are incorporated into the scope of the Investment Management Key Function within RSELs as part of addressing Financial Accountability Regime (“FAR”) requirements.

Please contact your responsible supervisor if you have any questions in relation to this letter.

Yours sincerely

Margaret Cole

Deputy Chair

Attachment

Better practices (across majority of RSELs):

- Use of checks and controls to assess the reasonableness of external investment manager valuations and valuations provided by independent external valuers.

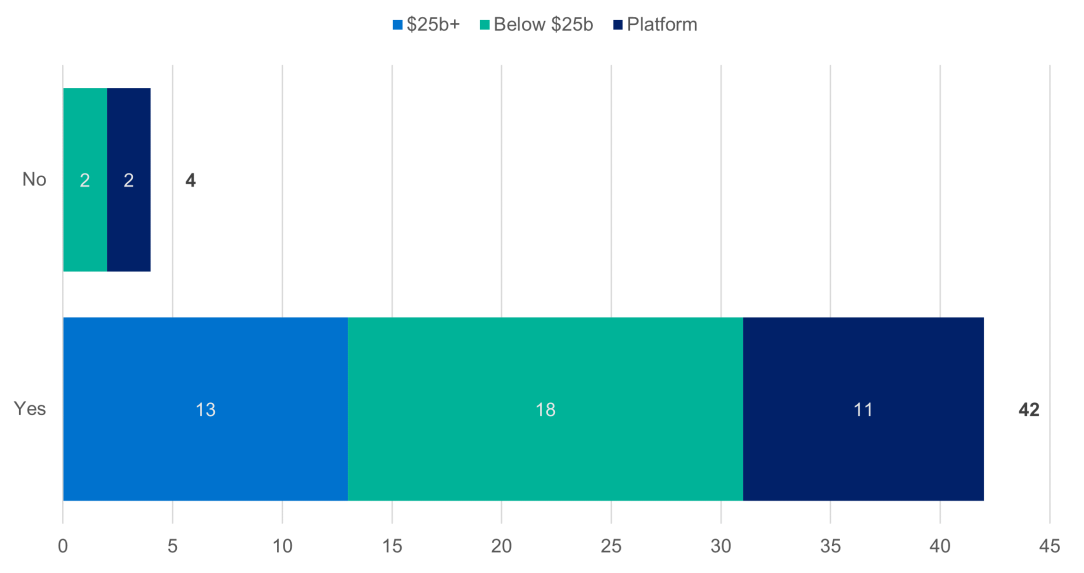

Does the Board have in place checks and controls to ensure that external manager valuations fall within a reasonable range?

Does the RSE licensee have in place checks and controls to assess the reasonableness of the valuation provided by the independent external valuers?

- Internal audit plans cover valuation risks as a focus area. However, larger funds appear under-represented.

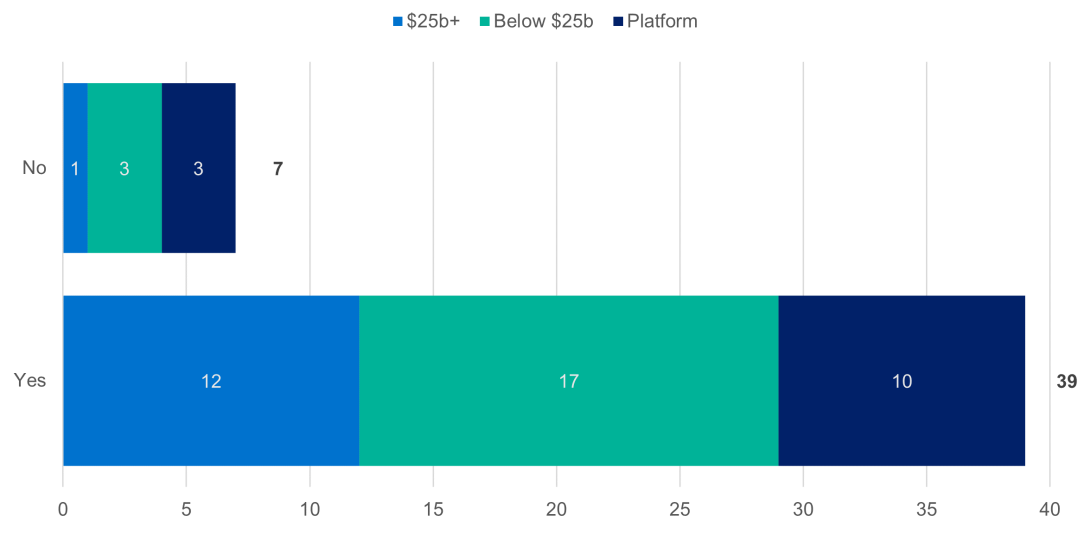

Does the RSE licensee’s annual or cyclical internal audit plan include valuation risks and aspects of the valuation governance framework as focus areas?

Areas for improvement:

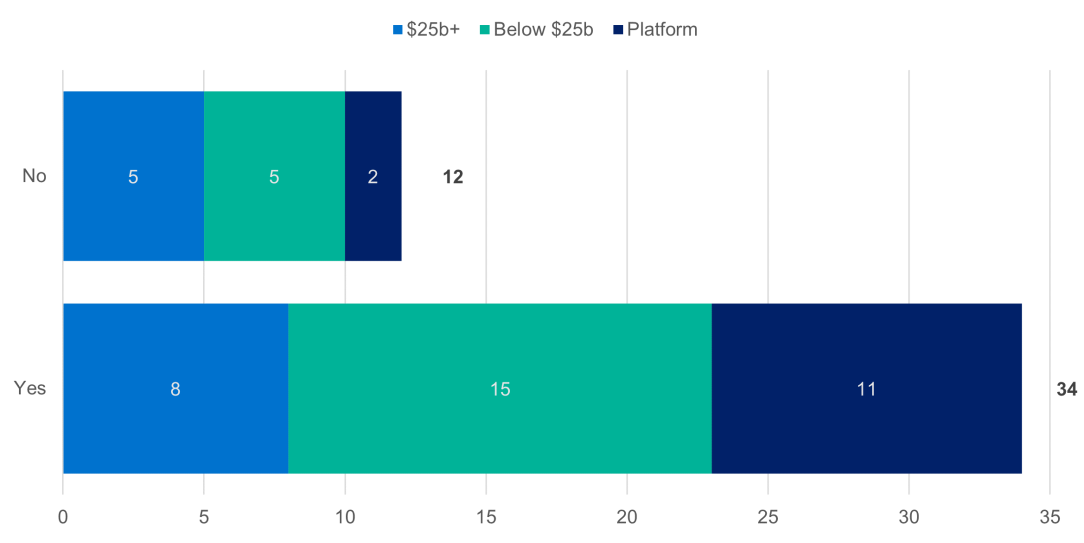

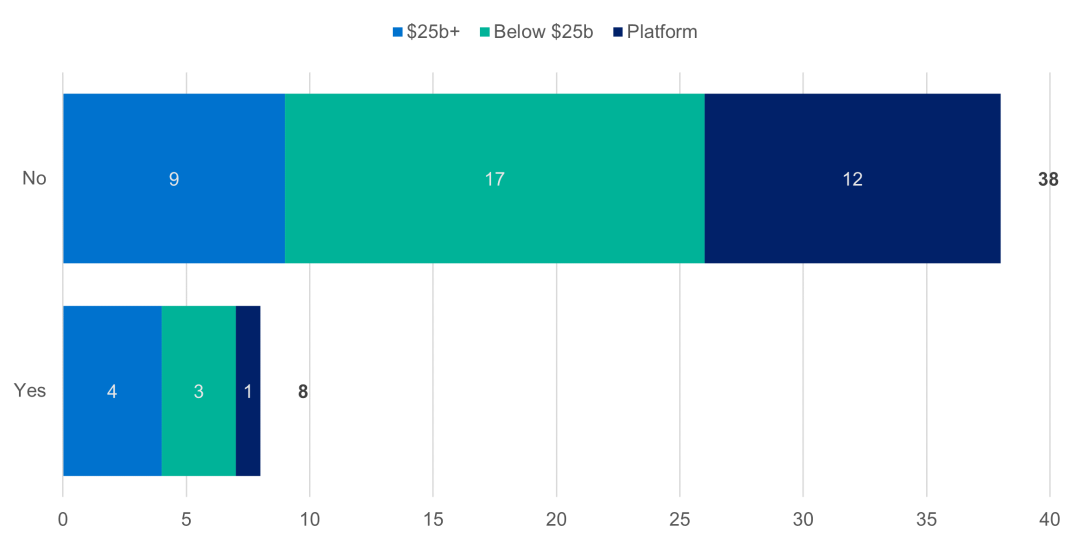

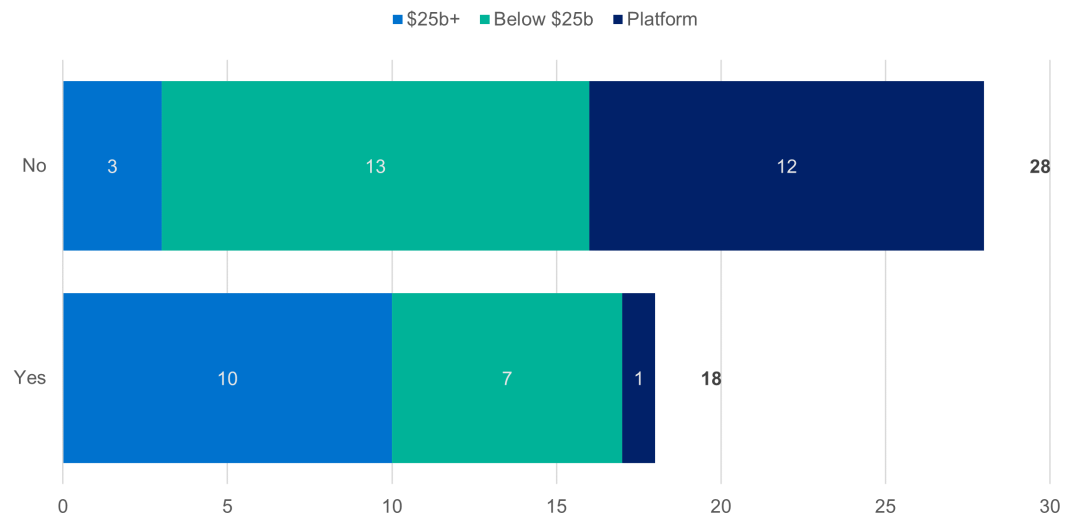

- Extent of Board scrutiny of valuation provided by management and external parties. Eleven of 13 platform responses indicated no challenge of valuations from either source.

Have there been instances of the Board (or relevant Board-delegated committee) challenging, rejecting, and/or overriding valuations provided by management since 1 July 2022?

Have there been instances of the Board (or relevant Board-delegated committee) challenging, rejecting, and/or overriding valuations provided by external parties since 1 July 2022?

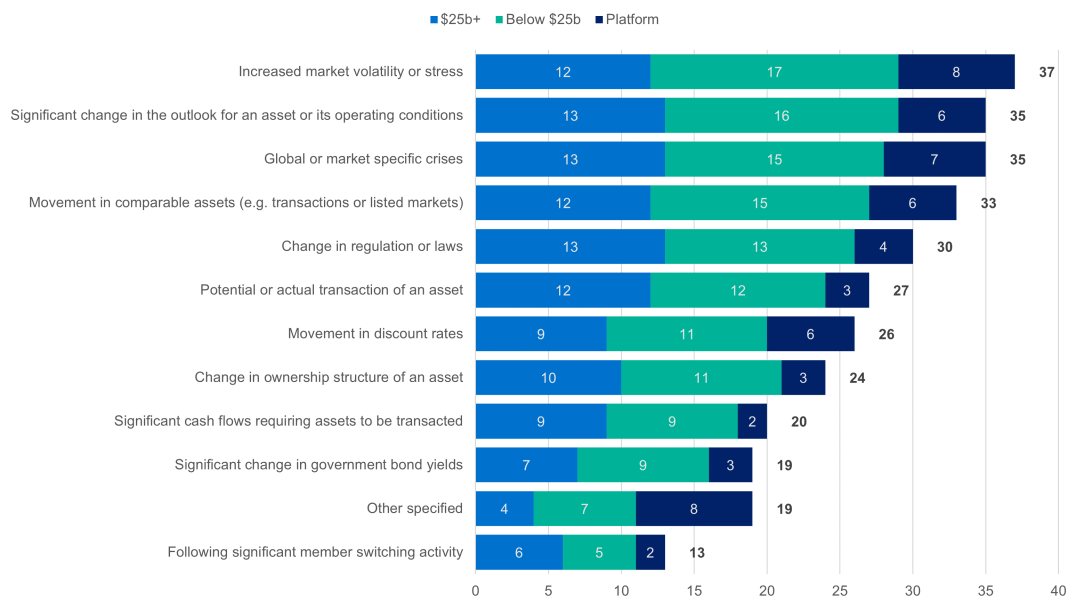

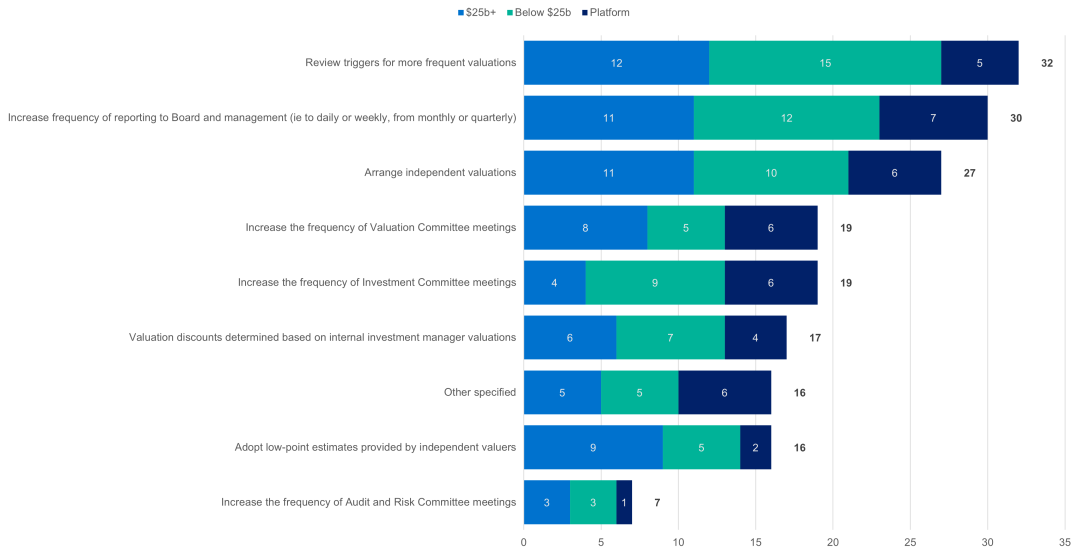

- Triggers for revaluations were rated lowest overall (see paragraph 40(g) of SPS 530). This varied across RSELs, but some do not have predefined triggers or are unable to set clear triggers for revaluations.

- The following graphs show the triggers used for more frequent revaluations and the considerations for out-of-cycle revaluations during heightened market volatility.

Which triggers would cause more frequent revaluations under the RSE licensee’s valuation governance framework?

What are the considerations within the RSE licensee’s valuation governance framework for out-of-cycle valuations during periods of heightened market volatility?

- Property and private equity valuations were most heavily scrutinised by Boards; recognising that of the main unlisted asset classes, private equity and property stood out as the most demanding to value at least quarterly.

Which unlisted asset classes have valuations that are not undertaken at least quarterly?

- Despite valuation risks being a focus in most internal audit plans, the regularity of audit coverage of valuation risks could be improved.

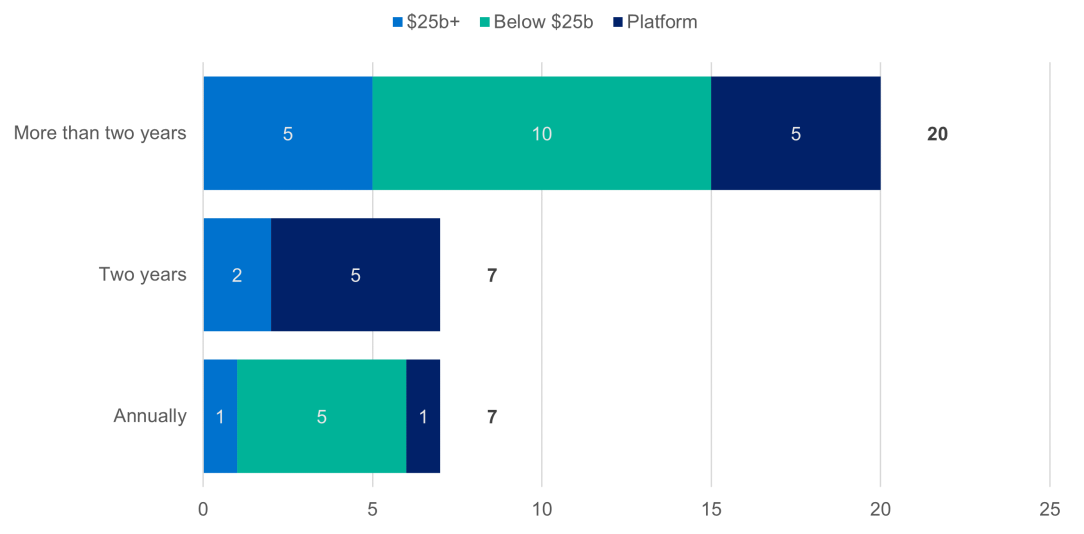

How often are valuation risks and aspects of the valuation governance framework covered by the RSE licensee’s annual or cyclical internal audit plan?

- Additionally, internal audit findings highlighted the need to improve reporting to the Board.

Footnotes

1Refer to Prudential Standard SPS 530 Investment Governance (SPS 530) and related guidance in Prudential Practice Guide SPG 530 Investment Governance.

2Total responses received was 46. One platform provided two responses to assist with delineating aspects of its business model.

3Platform RSELs are those that typically offer a large number (can be upwards of 1,000 options) of either internally or externally managed investment options to their, typically, retail clients or members who may have accessed products through a financial advisor. They are distinct from Industry or Corporate fund trustees that offer a smaller number of investment options.