Data strategy: APRA’s evolving data capability

Data has been described as the oil of the 21st century, and analytics as the combustion engine. A discussion paper published by the Bank of England in 2020 highlighted that technological developments have placed data at the heart of the modern economy, and noted the regulator’s dependence on good and timely information in order fulfil its objectives of monetary and financial stability. This trend is widespread, with financial sector regulators around the world greatly expanding the depth and breadth of data they collect.

In Australia, APRA relies heavily on timely, accurate and comprehensive data to fulfil its mandate of supervising Australia’s banking, insurance and superannuation sectors. The data APRA collects from Australia’s financial sector is also relied on by peer regulators, Government, Treasury and the Australian Bureau of Statistics.

As the centrality of data to decision-making grows, APRA has begun transforming how it collects data from the over-2,000 entities it regulates. The key objectives of APRA’s changes to its data collection are to expand APRA’s capabilities in assessing how APRA-regulated entities are performing, while at the same time making the collection process more efficient to reduce the regulatory burden on data providers.

Technology enabled

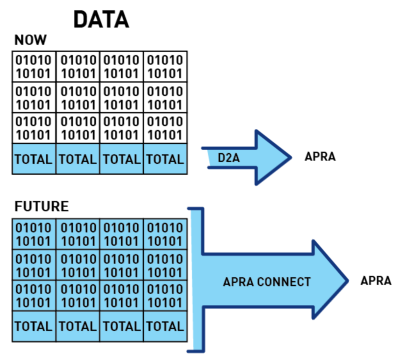

Advancements in technology are key to the cost-effective collection and analysis of vast amounts of data. A key enabler of APRA’s evolving data capability is the APRA Connect project, which is scheduled to go live at the end of September 2021.

APRA Connect will dramatically increase the volume of data APRA can collect. While APRA’s existing D2A (Direct to APRA) platform has served APRA and reporting entities well for many years, the technology is now 20 years old. Given the significant developments in technology and data availability since the early 2000s, D2A is limited in its ability to adapt to new data needs. APRA Connect will ultimately replace D2A as APRA’s data collection tool with a view to overcoming these obstacles.

Currently, many of APRA’s data requests are relatively narrow and targeted, with each request designed to provide information for a specific purpose. These requests can require reporting entities to undertake extra work to compile the specific data, rather than simply sending APRA existing data in the format that is held by each entity. This brings the added challenge for APRA that different entities may have different processes to compile the requested data, increasing the potential for inconsistency between data sets and reducing the ability to make accurate comparisons.

Another consequence of this approach is that entities may receive similar data requests, each designed to meet a slightly different regulatory requirement. Further, other regulators may make data requests that – although not identical – are effectively drawn from the same or similar source data. The result is a duplication of effort that increases compliance costs.

A new approach

APRA’s data strategy involves a shift to collecting source data, in order to minimise the burden on entities. This will allow APRA to conduct more of its analysis in-house, rather than having to make a new data request each time particular information is required.

APRA’s intent is to design the data collections so that, as much possible, they reflect the data sets that entities require to conduct their day-to-day business. Achieving this goal requires APRA to take a different approach to its industry consultation process.

In particular, APRA consultation on proposed data collections will focus more on APRA’s objectives (rather than starting with specific data requirements) so entities can share their views on how best to meet these objectives. This will, in turn, require active engagement from entities to explain how they manage their data internally, so this information can inform the composition of APRA’s data requests.

An ongoing consultation process is planned to minimise friction points and design collections which, where possible, mirror industry practice so the volume of data collected can be increased as efficiently as possible.

Implementing this change of approach and increase in capability will require investment from both APRA and its regulated entities. APRA will implement the strategy incrementally, with new and revised data collections being undertaken using this new approach, utilising the capabilities of APRA Connect. When fully rolled out, the expected result is a framework that delivers APRA the data it needs to achieve its objectives while at the same time minimising entities’ effort and compliance costs.

A substantial increase in data volumes being submitted to APRA brings with it the question of accountability for the accuracy of that data. APRA provides guidance regarding this issue through Prudential Practice Guide CPG 235 Managing Data Risk, and continues to engage with industry to find workable solutions as issues arise. This may involve certain data requiring full attestations as to accuracy and reliability, while other data is provided simply on a best endeavours basis.

Security and sharing

Maintaining the security of entity data will continue to be of the highest priority for APRA. Sharing of data with peer regulators and the Treasury will continue to be constrained by section 56 of the APRA Act 1998, ensuring that sensitive information is protected. However, in keeping with APRA’s focus on greater transparency, APRA will continue to consult on data that can be made non-confidential, and entities can expect an increase in the amount of analysis that is made public as a result.

The expansion and enhancement of APRA’s data collection and analysis capabilities is a key strategic objective. It will further enable data-driven decision making, providing an essential tool for effective regulation of the financial sector. This transformation process will require APRA and its regulated entities to collaborate to manage the change process, so the efficiency and transparency benefits can be fully realised.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.