APRA hosts life insurance roundtable on longevity solutions – July 2024

The Australian Prudential Regulation Authority (APRA) held its annual life insurance CEO roundtable on 17 July 2024 with a focus on longevity solutions. Hosted by APRA Member Suzanne Smith together with Executive Director Sean Carmody and General Manager Nancy Ma, the roundtable was attended by 21 life insurance CEOs and other executives (participants), as well as representatives from Treasury, ASIC and the Council of Australian Life Insurers.

The roundtable represented a valuable opportunity for APRA to have an in-depth discussion with industry stakeholders about the challenges and potential solutions for life insurers in delivering longevity solutions for suitable retirees. This discussion was facilitated by the key insights (refer to Appendix 1) APRA garnered from its bilateral engagements with selected industry stakeholders in the Australian longevity market and from observations on some overseas jurisdictions.

Key topics discussed

Demand

Participants discussed the market for longevity solutions. There was general consensus that an increase in the demand for longevity solutions is necessary for insurers to be incentivised to develop a business case to invest in, and accurately and sustainably price risks. Participants believed that the limited demand by the Australian community is driven by several factors, such as:

- limited awareness of longevity products;

- misconception about longevity products; and

- a ‘nest egg’ mindset which results in a preference to preserve an account balance. Participants noted that this is not the case for defined benefit members who tend to have an income stream mindset.

APRA noted that although there is no ‘silver bullet’ to addressing the demand challenge, life insurers are an important stakeholder in the retirement ecosystem and can play a key role in leaning into the challenge. APRA also noted that based on its overseas study, countries that have a high level of take-up of longevity products are those with a strong level of compulsion or incentive provided by the government.

Participants commented that there is a genuine need for longevity solutions for certain cohorts of retirees, but those needs are often not recognised by the retirees. APRA was encouraged to hear that some insurers are proactively engaging with trustees on their retirement income strategies and taking steps to improve awareness and understanding of longevity solutions, including developing educational materials for superannuation members. Such collaborative effort will make a positive difference to improving member engagement and financial literacy, an area identified as a key challenge by trustees in the pulse check on retirement income covenant implementation (Pulse Check).1 Participants also noted that, if the demand challenge is addressed, there would be sufficient capital and support from life insurers’ parents to back the offering of those longevity solutions.

Meeting retirees’ demand with the appropriate product design and distribution is important. ASIC noted that the result of the Pulse Check highlighted the importance of member research and having a clear target market early in the product development process. It is also important to determine how to distribute products to the target market and the protections that are required to prevent retirees entering products that might be unsuitable for them and difficult to exit.

‘Default’ option in retirement

Participants highlighted the success of the accumulation phase of superannuation and the potential benefit for members from compulsory default solutions. The topic of a default option was discussed in Treasury’s superannuation in retirement consultation earlier this year.2 Treasury noted that several stakeholders raised that the needs of members in the retirement phase are more varied than those in accumulation, making it more challenging to design appropriate default products. Treasury asked for participants view on this.

Despite the absence of compulsion for members moving to the retirement phase to take up a default option, participants agree that there is value for certain cohorts of members to be nudged into a ‘soft default option’ that includes a longevity protection component. Such an option would provide members with a starting point for making informed choices that would enable them to spend their savings confidently in retirement. Participants generally agreed that the focus for industry stakeholders should, therefore, be on the design of a ‘soft default option’ rather than whether such an option should be offered. However, any mechanism in promoting a retirement option needs to be carefully designed with robust safeguards and supported by an appropriate engagement and advice model. ASIC emphasised the any retirement solution needs to be tailored to members’ personal circumstances, including how member needs evolve over time.

Innovation

Participants observed that part of the challenge is insurers’ hesitation to innovate and introduce new products in the absence of adequate support mechanisms if the products do not achieve scale to be sustainable. Participants noted the current legislative settings limit the ability of insurers to rationalise legacy products and that this stifles innovation. Establishing a legacy rationalisation mechanism would allow insurers to innovate safely and manage products which no longer meet member needs. Whilst APRA sees potential merit for such a mechanism, APRA encourages life insurers to take a considered approach to product development, based on meeting retiree needs and supported by a robust business case.

Participants also noted that there are elements of APRA’s capital framework that are more constraining relative to other capital regimes but recognised that the demand challenge is the key in unlocking the longevity market. APRA acknowledged that capital settings have an impact on the supply of longevity products, but there are prudential considerations for APRA in balancing the financial resilience of life companies with commercially viable innovation.

Next steps

Australians are transitioning into retirement in ever growing numbers and with increasingly higher account balances. The need for innovative retirement offerings that help to address longevity risk for relevant cohorts presents a real opportunity for the life insurance industry. APRA encourages insurers to continue to work closely with superannuation trustees to help members better understand longevity risk and the role of longevity solutions in mitigating that risk.

APRA remains committed to continue engaging with the life insurance industry to explore ways to potentially reduce barriers for insurers to provide and innovate longevity solutions that improve retirement outcomes for the Australian community.

Appendix 1

Domestic Market

Demand

Stakeholders identified weak demand for longevity solutions as the key challenge impeding insurers from providing and/or further innovating longevity solutions and noted several factors that contribute to limited demand. Stakeholders also highlighted that the complexity of the retirement ecosystem provides limited incentive for retirees and makes it challenging for insurers to design longevity products that are well-integrated within the system. Those factors combined with distribution challenges (e.g. falling advisor numbers, high cost of financial advice and barriers to scale up advice) has, based on APRA’s bilateral engagements, hindered take-up of longevity solutions for retirees that have a genuine need.

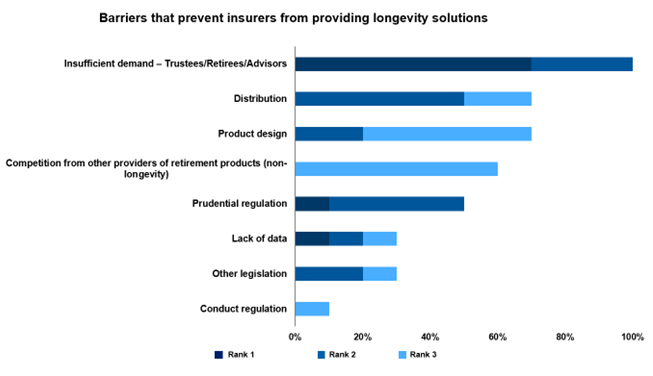

The table below shows the top three factors that the 10 local insurers surveyed view as the top challenge.

Supply

Life insurers have highlighted elements of the capital framework that are more restrictive than capital regimes in overseas jurisdictions. Recalibrating those elements will likely make returns more attractive to customers and attract new providers of longevity solutions to participate in the market. However, almost all insurers and industry bodies agreed that recalibrating the capital framework will only make a marginal difference. The consensus was that the demand challenge needs to be addressed to unlock the longevity market.

Additionally, insurers pointed out that some elements of the longevity solutions related legislations may be discouraging and restricting product innovation. Suitable changes could help insurers to design products desired by customers without adding additional complexity. Life insurers also cited concerns that longevity products could become legacy products if there is low take-up or if the product fails to meet or evolve with the needs of retirees and the external environment. Having a mechanism that enables rationalisation of legacy products can encourage an increase in supply of longevity solutions, as well as innovation.

International Market

APRA conducted a desktop research of longevity markets of four countries including, Netherlands, Denmark, United Kingdom and the United States of America.

APRA observed that overseas jurisdictions with a thriving longevity market, such as Netherlands, either have a strong level of compulsion or strong incentives provided by the Government.

APRA also observed complementary factors that can contribute to an increase in demand for longevity solutions, but these factors alone don’t make a material difference to the level of demand relative to the compulsion and incentives factors. The complementary factors include:

- wide availability and easy access to financial education and/or financial advice;

- availability of quality data to enable product providers to design and distribute appropriate products to retirees;

- high level of trust in the system; and

- financially literacy initiatives.