APRA and ASIC: a new era in cooperation

APRA and the Australian Securities and Investments Commission (ASIC) are often referred to as the “twin peaks” of Australia’s system of financial regulation. Appropriately for twins, both agencies share the same birthday; they were established on 1 July 1998 following the Wallis Inquiry into the financial system.

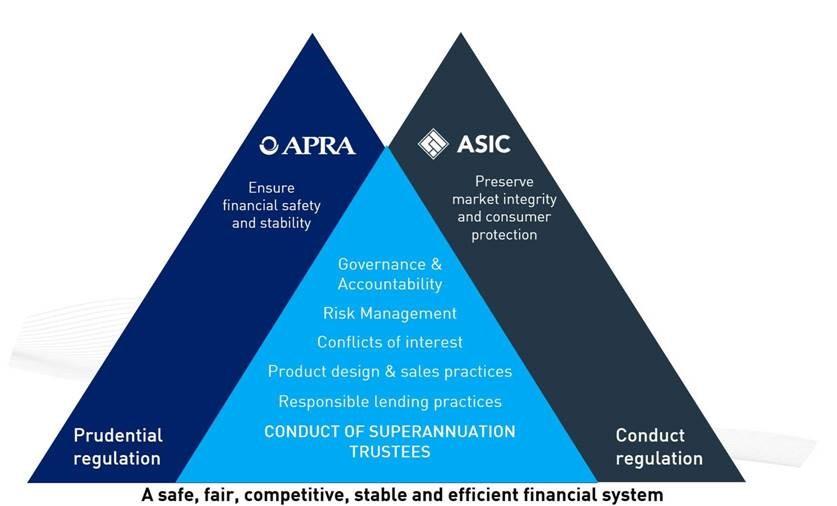

Like any siblings, APRA and ASIC have a long history of cooperation and collaboration, but also have distinct and independent personalities. APRA is the financial safety regulator, with a focus on the financial soundness and stability of authorised deposit-taking institutions (banks, credit unions and building societies, insurers and superannuation funds). As the conduct regulator, ASIC focuses on preserving market integrity, conduct and investor protection.

In pursuing their respective mandates, there are many areas of common interest. In particular, both agencies share an interest in achieving a safe, fair, competitive and efficient financial system. It is therefore important that APRA and ASIC maintain close engagement and proactively exchange information with each other. While this has always been the case, the relationship has grown even tighter over the past two years to better address the types of misconduct, poor performance and weak accountability that were raised during the financial services Royal Commission.

Milestones since the Royal Commission

The Royal Commission concluded that coordination and cooperation between the two agencies, particularly in areas of joint responsibility, needed to be stronger and more formalised. One year on from these findings, a commitment to closer collaboration and information sharing between APRA and ASIC has been underpinned by an updated Memorandum of Understanding (MoU) and new engagement arrangements.

Royal Commission recommendation 6.10 – Co-operation memorandum

ASIC and APRA should prepare and maintain a joint memorandum setting out how they intend to comply with their statutory obligation to co-operate.

The memorandum should be reviewed biennially and each of ASIC and APRA should report each year on the operation of and steps taken under it in its annual report.

The updated MoU, which implements Royal Commission Recommendation 6.10, sets out a framework for engagement and reflects the agencies’ intention to maintain a proactive, open and collaborative relationship. To further support the objectives of this MoU, a new engagement structure has seen both agencies regularly meeting to discuss and share information on important and emerging issues, and to allow for the coordination of joint activities.

The structure is led by APRA Members and ASIC Commissioners, who form the APRA-ASIC Committee (AAC), and is supported by five standing committees. The AAC sets the strategic direction for APRA-ASIC cooperation, while the standing committees are charged with the coordination of APRA-ASIC engagement relating to:

- credit, banking and payment providers;

- insurance;

- superannuation;

- enforcement activities; and

- internal capabilities, which focuses on internal matters of common interest, such as communication and risk management.

These structured arrangements help establish relationships between relevant areas of APRA and ASIC. These relationships support stronger informal, day-to-day engagement on areas of joint responsibility. This is particularly important for ensuring that the actions of each agency are coordinated and not duplicative or contradictory.

Increased engagement leading to stronger outcomes

Milestones aside, there has been a significant increase in inter-agency engagement, including strategic discussions on key risks, greater information sharing, and coordination on supervisory activities and enforcement matters. APRA and ASIC have effectively engaged with each other to deliver stronger outcomes for the community in the past 12 months. Both agencies expect that the above milestones will support greater collaborative engagement where there are opportunities to maximise outcomes for both prudential and conduct regulation.

Trustee responsibilities for superannuation fees

On 10 April 2019, APRA and ASIC issued a joint letter to all registrable superannuation entity (RSE) licensees to reinforce the importance of trustees undertaking appropriate oversight of fees and other charges being deducted from members’ accounts. Through this letter, APRA and ASIC together set the expectation that all trustees review the robustness of their existing governance and assurance arrangements for fees charged to members’ superannuation accounts, and address any identified areas for improvement in a timely manner.

Since then, APRA, in consultation with ASIC, has been reviewing trustee responses to the joint letter and engaging with trustees where deficiencies have been identified. APRA and ASIC intend to issue additional guidance to industry on fees for no service, which are instances where there is a failure to deliver ongoing advice services to financial advice clients who were charged fees for those services.

Life insurance claims and disputes

In March 2019, APRA’s Life insurance claims and disputes statistics publication, a dataset from 20 life insurers including claims and disputes information across all cover types and distribution channels, was concurrently released with ASIC’s MoneySmart Life insurance claims comparison tool. The tool, which is updated using APRA’s dataset, helps consumers to make informed decisions about their life insurance cover by comparing life insurers’ performance in handling claims and disputes.

The joint project was a culmination of more than two years of work aimed at enhancing industry transparency and accountability. The project was able to effectively leverage the expertise of each agency to generate stronger outcomes for the community.

Governance, culture, remuneration and accountability (GCRA)

The Royal Commission and the prudential inquiry into the Commonwealth Bank of Australia highlighted that the resilience of a regulated entity can be seriously damaged by poor governance, remuneration structures and accountability mechanisms. These issues are of primary interest to APRA and ASIC.

APRA and ASIC have committed to strengthening collaboration on GCRA issues in order to maximise alignment of each regulator’s activities and minimise duplication for regulated entities. Recent examples of cooperation in this area have focused on governance and remuneration. On governance, insights from ASIC’s report into Director and officer oversight of non-financial risk are being considered by APRA as part of its ongoing work in relation to governance. Similarly on remuneration, APRA is liaising with ASIC to ensure the proposed new remuneration prudential standard aligns with findings from APRA’s ongoing work into board oversight and discretion in variable executive remuneration.

Both agencies are seeking further opportunities for collaboration on GCRA related projects, including partnering on planned thematic reviews where there is overlap between the mandates and work plans of agencies, and conducting risk-based follow-ups on issues identified from the risk-governance self-assessment process1.

Next on the agenda

APRA and ASIC are currently working with Government and Treasury on legislation to implement Royal Commission Recommendation 6.9, which will create a statutory obligation on each agency to cooperate, share information and notify each other of suspected breaches of laws administered by the other. This legislation will further formalise the agencies’ commitment to closer collaboration and information sharing.

By working more closely and cooperatively, APRA and ASIC can enhance protections for bank depositors, insurance policyholders and superannuation members by ensuring prudential risks as well as misconduct or poor performance are better detected, and that those responsible are appropriately held accountable.

Footnotes

1For further information on APRA’s work with GCRA issues, see our ‘APRA’s evolving approach to supervising risk culture’ article, March 2020 and Information paper - Transforming governance, culture, remuneration and accountability: APRA’s approach, November2019.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.