A more effective capital framework for a crisis: Update

To: All authorised deposit-taking institutions and insurers

The effective operation of regulatory frameworks in a crisis reinforces public confidence in the safety of deposits, minimises the impact of bank failures, and avoids the need for taxpayer funded support. The potential risks were demonstrated most recently by the international banking turmoil that occurred in 2023. APRA’s role as the prudential regulator is to ensure that its own regulatory framework is effective, and deposits are protected, if similar events were to occur in Australia.

In 2023, APRA initiated a review into the operation of Additional Tier 1 (AT1) Capital instruments in Australia in light of their recent shortcomings overseas and the unique characteristics of the Australian AT1 market. Following an extensive consultation process and careful consideration of potential options to improve these regulatory capital instruments, APRA released a second discussion paper on 10 September 2024 that proposed a more effective capital framework for a crisis.1

Overview of policy changes

The key proposal in the September 2024 discussion paper was the replacement of AT1 in the bank prudential framework with more reliable and effective forms of capital, to ensure that capital instruments operate effectively in stress and the capital strength of the banking system is maintained. These are significant policy reforms, and the consultation and implementation phases are an important part of this policy process.

In its discussion paper, APRA requested submissions on framework design, expected impacts, and other implementation considerations relevant to the proposal. After considering these submissions, APRA has decided to proceed with its proposal to replace AT1 in the bank prudential framework, while not amending the insurance capital framework.

APRA’s decision to replace AT1 is based on the challenges with AT1 meeting its regulatory objectives of stabilising a bank so that it can continue to operate as a going concern during a period of stress and supporting resolution with the capital strength that is needed to prevent a disorderly failure. Submissions to APRA’s discussion paper broadly supported APRA’s view that AT1 has not been shown to act effectively in a going concern scenario and does not offer advantages to Tier 2 in resolution. APRA acknowledges there are costs associated with the proposal but considers the benefits of a more proportionate, simpler, and effective framework to outweigh these.

APRA’s decision to replace AT1 in its bank prudential framework has broad implications for how banks manage their capital and for AT1 investors. The purpose of this letter is to confirm APRA’s approach, minimise uncertainty, and to support an orderly transition. Further details on the decision, including transition arrangements and other issues for consideration, are provided in Attachment A to this letter.

Consultation process

In response to the discussion paper, APRA received 23 submissions and undertook around 20 engagements with a range of external stakeholders, including banks, industry associations, rating agencies, brokers, investors, and peer regulators internationally and domestically.

Stakeholders were generally supportive of APRA’s proposal to simplify the capital framework by primarily replacing AT1 with Tier 2. Stakeholders also welcomed the proportionate approach for smaller banks, recognising that the proposal balances simplicity with that of safety and strength.

However, some submissions highlighted the benefits of AT1 and recommended that APRA retain hybrid capital in the bank prudential framework. Submissions noted the benefits associated with the strength and depth of demand for AT1 capital instruments, and that AT1 provides an investment opportunity and a source of franked distributions for investors. APRA acknowledges these concerns but remains of the view that AT1 does not do effectively what it is intended to do: absorb losses while the bank is a going concern and support resolution.

No material concerns were raised with APRA’s cost analysis set out in the discussion paper.

In addition to providing feedback on APRA’s proposal, stakeholders also requested further information on transition arrangements and provided suggestions on consequential amendments to the prudential framework. A summary of issues raised in submissions specifically in response to the removal of AT1 has been provided in Attachment B.

Next steps

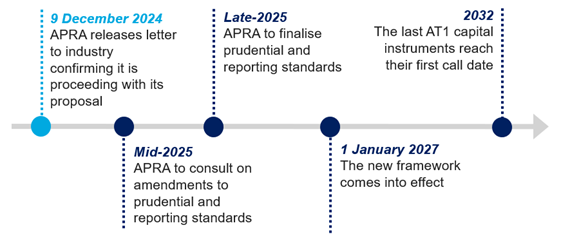

To provide a clear roadmap for consultation and industry engagement, APRA has set out an indicative timeline below. Over the course of 2025, APRA intends to:

- consult on specific consequential amendments to relevant prudential and reporting standards to implement the removal of AT1 from the framework. This will include consequential amendments for requirements that relate to Tier 1 Capital requirements;

- continue engaging with banks as capital management plans are updated to reflect the new requirements, ensuring that internationally active banks remain compliant with the Basel Committee on Banking Supervision’s (BCBS) framework during and after the transition phase; and

- finalise updated prudential and reporting standards to provide 12 months for implementation over 2026, ahead of the effective date of 1 January 2027.

APRA notes the constructive engagement with stakeholders to date and looks forward to continuing these discussions as the reforms are finalised. If there are any questions on the content of this letter, please direct these to PolicyDevelopment@apra.gov.au and, if relevant, copy in the entity’s supervision team.

Yours sincerely,

John Lonsdale

APRA Chair

Attachment A – Additional information

APRA is proceeding with its proposal to remove AT1 from the bank prudential framework, replacing it with more reliable and effective forms of regulatory capital.

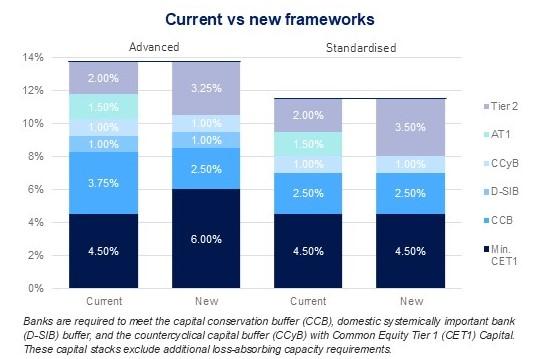

The following graphic summarises the current and new capital frameworks for Advanced and Standardised banks, with the new framework commencing from 1 January 2027.

APRA intends to consult on amendments to the bank prudential framework in 2025 to effect the removal of AT1. This consultation will also include consequential amendments required due to the removal of AT1.

Transition arrangements

As set out in the September 2024 discussion paper, APRA is aiming for an orderly transition over eight years to provide sufficient time for banks to transition onto the new framework. This approach allows for a staged replacement of AT1 primarily with Tier 2 and minimises impacts for existing investors.

Submissions to the discussion paper sought further information on transition. This included whether AT1 could be issued ahead of the 1 January 2027 effective date, given that replacing AT1 with Tier 2 before 1 January 2027 may create challenges for some banks in meeting existing prudential requirements.

APRA expects banks with surplus AT1 up to 1 January 2027 to not issue AT1. APRA will consider requests to issue AT1 in cases where there are challenges in meeting existing prudential requirements, such as the minimum Tier 1 Capital requirement.

Banks that are seeking to replace existing AT1 must provide APRA an indicative plan by 31 March 2025. APRA expects these plans to consider the appropriate level of internal capital buffer needed. AT1 issuances must not have call dates beyond 1 January 2032 or increase the bank’s existing dollar amount of AT1.

In line with the proposal in the discussion paper, APRA’s intention is that from 1 January 2027 existing AT1 would be eligible to be included as Tier 2 until their first scheduled call date. This transitional treatment would not alter the legal terms, including subordination, of the existing instruments. All existing instruments would reach their first call date by 2032 at the latest.

Issues for further consideration

In addition to consulting in 2025 on changes to remove AT1 from the bank prudential framework, APRA also intends to consider, and consult where necessary, on the following related issues:

- Consequential amendments – APRA will further consider the impact of the removal of AT1 on other prudential requirements and determine whether any amendments should be proposed. This includes, for example, leverage ratio requirements, large exposure limits, and related entity limits.

- ‘Subordinated’ Tier 2 – Some respondents sought clarity on whether banks could issue different tranches of Tier 2 to retain a layer of subordination in resolution below existing Tier 2 investors. APRA intends to retain simplicity in the framework and to not create new forms of capital, such as Tier 2 with going concern features (for example, loss absorption triggers prior to the point of non-viability). However, APRA will further consider the implications of tiering Tier 2.

- Simplification of Tier 2 – APRA will consider amendments to the eligibility criteria of Tier 2 to require conversion first (with write-off as the backstop if conversion fails) and further restrictions on mandatory or investor conversion after the first call date. This approach simplifies regulatory capital instruments and increases certainty for investors.

- AT1 issuance via non-operating holding companies(NOHCs)– APRA will further consider the implications of the removal of AT1 on NOHCs that issue AT1 and will engage impacted entities.

Attachment B – Summary of issues raised in submissions

The below table summarises the key issues raised in submissions and APRA’s initial response. While submissions also raised questions relating to other issues, such as consequential amendments and transition arrangements, the below table focuses on the issues raised against the removal of AT1. A full response to submissions will be included as part of the consultation scheduled for 2025.

| Issue | Comments received | APRA response |

|---|---|---|

| Design of the framework |

|

|

| Flexibility |

|

|

| International comparability |

|

|

| Bank leverage |

|

|

| Investment options |

|

|

| Franking credits |

|

|