A more effective capital framework for a crisis

Executive summary

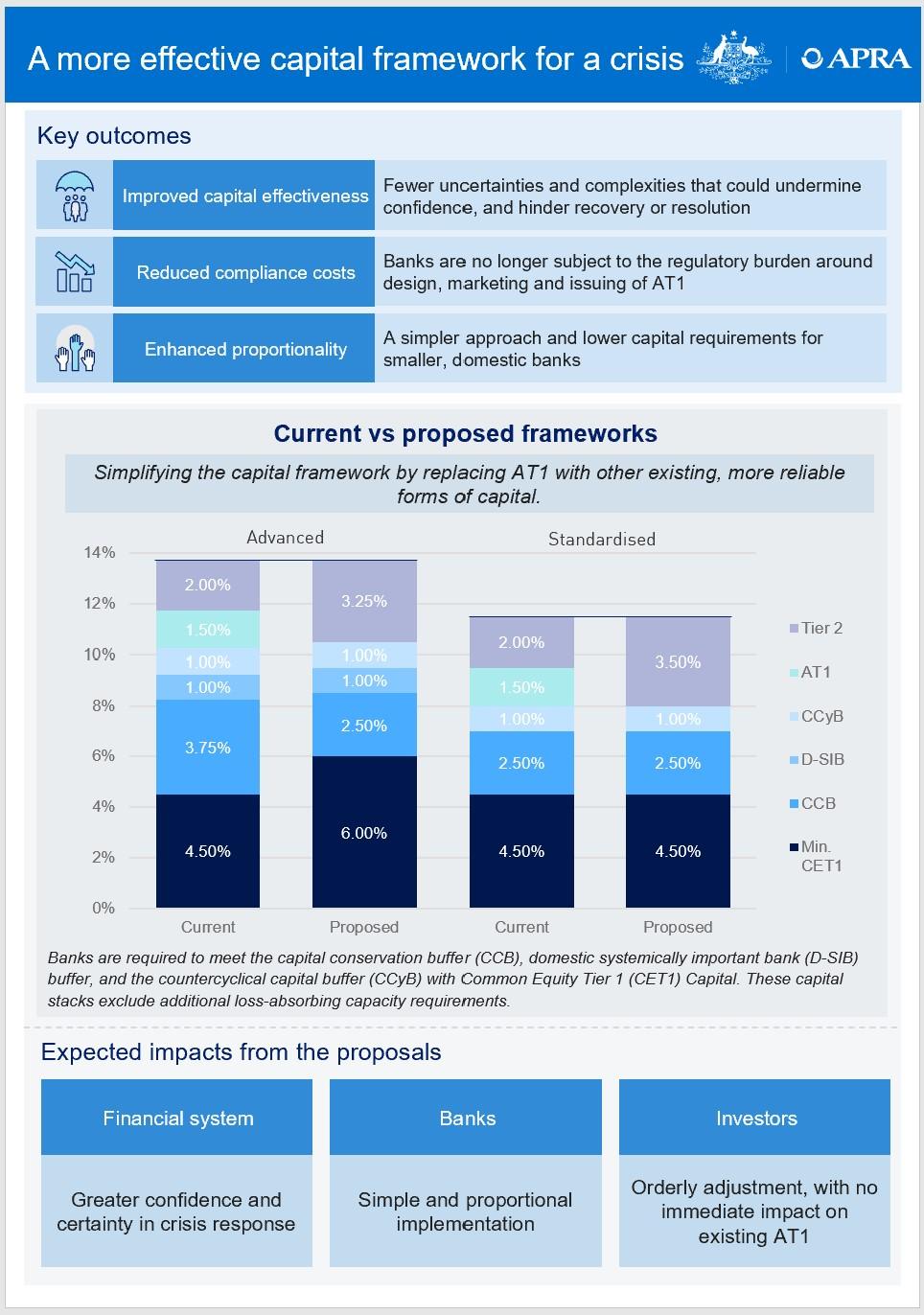

This Discussion Paper outlines potential amendments to APRA’s prudential framework to ensure that the capital strength of the Australian banking system operates more effectively in stress, proposing to replace Additional Tier 1 (AT1) capital with more reliable and effective forms of capital.

Policy background

Over the past decade, APRA and the Australian Government have implemented measures to strengthen the crisis preparedness of the Australian financial system. This includes legislative changes to enhance APRA’s crisis management powers, developing a policy framework for resolution planning, and requiring certain banks to increase their loss-absorbing capacity.

More recently, APRA has been seeking to enhance the effectiveness of capital in a crisis. In 2023, APRA issued a Discussion Paper to gain feedback on the effectiveness of AT1 capital. The intent of AT1 is to stabilise a bank so that it can continue to operate as a going concern during a period of stress, and support resolution with the capital that is needed to prevent a disorderly failure.

The Discussion Paper noted that there are currently certain design features and market characteristics that create significant challenges for the effective use of AT1 in Australia: international experience has shown that it does not absorb losses to stabilise a bank early in stress, and it would be challenging to use to support resolution without complexity, contagion, and litigation risk. Australia is an outlier internationally with a material proportion of AT1 held by domestic retail investors.

Following the release of the Discussion Paper, APRA undertook around 40 engagements with a range of external parties and received 26 formal submissions. While responses varied, there was constructive discussion on the challenges with AT1 and on the potential policy options. APRA also discussed the feedback and policy options with other agencies on the Council of Financial Regulators (CFR).

Policy pathways

Through the course of the first half of 2024, APRA reviewed the feedback and issues raised and assessed the options for policy reform. APRA considered three broad policy paths:

- Maintain status quo, with no immediate changes, while continuing to monitor international developments. This path, however, does not address the current challenges that could limit the effectiveness of the capital framework during crises.

- Redesign AT1 in Australia to make instruments more effective as a going concern tool, with enhancements including higher trigger levels, a new discretionary trigger, and restrictions on the investor base. Feedback from industry was clear, however, that this would be complex and costly to implement effectively, particularly if it required increased offshore issuance.1

- Simplify the framework by replacing AT1 with other existing, more reliable forms of capital (Tier 2 and Common Equity Tier 1 (CET1)). This would, however, be a significant structural change and would require careful consideration and transition.

In APRA’s view, AT1 has not been shown to act effectively in a going concern scenario and does not offer advantages to Tier 2 in resolution; in fact, it has the potential to create additional complexities through the investor base. While APRA has explored options to improve AT1 to address these concerns, these are likely to be more complex and costly to implement than the simpler third path. APRA is therefore seeking feedback on the third path.

For insurers, APRA is not proposing any changes to capital instruments at this time. APRA’s concerns for AT1 are less acute for insurers, and simplifying the capital framework involves different trade-offs, given the different nature of how stress may impact the insurance industry. APRA will monitor developments in the AT1 market for insurers and may review the approach to insurance capital instruments in due course.

A more effective capital framework

The aim of APRA’s proposed changes is to ensure that regulatory capital more effectively does what it is intended to do: absorb losses while the bank is a going concern and support resolution. This Discussion Paper sets out the design of a simpler capital framework in line with this aim, evaluates its benefits and trade-offs, and discusses the steps needed for transition.

The proposed approach is summarised in the graphic on the following page. At a high level:

- Large, internationally active banks would be able to replace 1.5 per cent AT1 with 1.25 per cent Tier 2 and 0.25 per cent CET1 capital.2

- Smaller banks would be able to fully replace AT1 with Tier 2, with a removal of Tier 1 requirements and no proposed changes to Total Capital requirements.

Key benefits from implementing this approach include:

- Improving capital effectiveness in crises, with fewer uncertainties and complexities in its operation that could undermine confidence, and hinder recovery or resolution.

- Reducing compliance costs for banks, by simplifying the framework and replacing an instrument in AT1 that is subject to additional burden relating to design, marketing and issuing.

- Further enhancing proportionality, with a simpler approach and lower capital requirements for smaller, domestic banks relative to larger banks.

For depositors, the proposal reinforces confidence in the safety of their deposits, with a simpler and more certain approach to resolving banks in the unlikely event of failure. For existing investors, APRA does not envision an immediate impact with AT1 capital instruments continuing to be eligible as regulatory capital until their first call dates.

Next steps

This Discussion Paper outlines a conceptual policy framework. APRA seeks to confirm whether these proposals appropriately address the challenges in using AT1 in a balanced and proportionate way. APRA will consider and assess any adjustments to the proposed approach that may be required, before drafting specific changes to requirements and finalising future implementation plans. To ensure this decision considers feedback from industry and other key stakeholders, APRA requests submissions on the framework design, expected impacts, and other implementation considerations relevant to the proposed approach.

Written submissions should be provided to APRA by 8 November 2024. APRA intends to hold roundtable discussions with industry associations on this Discussion Paper and is open to meeting with key stakeholders thereon. Following subsequent discussions with the CFR, APRA plans to provide an update on the consultation process in late 2024 and formally consult on specific changes to prudential standards in 2025.

An accessible version of the infographic is available here.

Chapter 1 – Overview

This chapter recaps APRA’s reforms to enhance crisis preparedness, the challenges with AT1 in Australia, and discusses the path forward to address these challenges. APRA’s response to submissions to the 2023 Discussion Paper is provided in Appendix A.

Strengthening crisis preparedness in Australia

APRA is responsible for protecting the interests of beneficiaries (depositors, policy holders and superannuation fund members) and promoting financial system stability in Australia. In line with this mandate, APRA sets prudential requirements to improve the financial safety of regulated entities, and, in the unlikely event of entity failure, protect beneficiaries and limit risks to the broader financial system. The disorderly failure of banks, as previous crises have shown, can cause significant disruptions to the broader financial system. It is critical that regulators have a comprehensive set of tools to limit the negative consequences that can arise from bank failure.

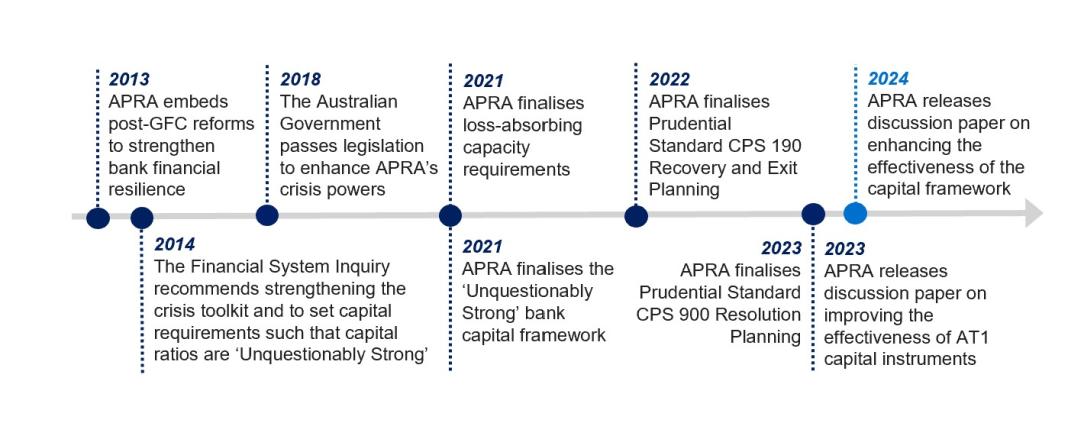

APRA and the Australian Government have taken steps over the past decade to be better prepared to respond to a crisis in Australia. These include:

- enhancing crisis management powers available to APRA to manage a bank failure;3

- developing a prudential standard for resolution planning, to ensure large and complex entities are pre-positioned in a way that will protect beneficiaries and the financial system, should they fail;4 and

- increasing loss-absorbing capacity for certain banks, to facilitate orderly resolution and minimise the potential need for taxpayer support.5

These reforms to reduce the impact of failure are in addition to APRA reducing the likelihood of a crisis; by requiring banks to hold additional levels of capital, which strengthens their financial resilience.6

While these reforms have improved the toolkit available to limit the adverse effects of bank failure and help reduce the execution risks in resolution, last year’s international banking turmoil demonstrated the importance of regulatory capital performing as designed and when needed. In 2023, APRA released a Discussion Paper on the operation of AT1 capital instruments in Australia that sought feedback on options to improve their effectiveness in stress and resolution.

Figure 1. Crisis policy reforms

Role of AT1

APRA’s current framework defines three forms of regulatory capital. AT1 is a form of regulatory capital that sits between CET1 capital and Tier 2 capital. AT1 was implemented in Australia in 2013 as part of reforms to the international banking regulatory framework in response to the Global Financial Crisis. The objective of these reforms was to improve the quality and quantity of capital to increase banks’ financial resilience in periods of stress and to support orderly resolution.

Implementation of the reforms differed internationally, leading to a variety of AT1 capital instruments available in the global market today. AT1 issued by Australian banks are generally permanent, hybrid forms of capital with discretionary coupons.

Table 1. Forms of regulatory capital

| Form of capital | Description | Minimum requirement | |

|---|---|---|---|

Tier 1 (going concern) | CET1 | The most subordinated form of capital. CET1 absorbs losses in both stress and in resolution, is permanent, and pays holders discretionary dividends. | Banks must hold CET1 of at least 4.5 per cent of RWA. |

| AT1 | Only senior to CET1, AT1 absorbs losses in stress and in resolution. While permanent, AT1 may be callable. Holders are paid discretionary distributions. | Banks must hold Tier 1 of at least 6 per cent of RWA. | |

Tier 2 (gone concern) | Tier 2 is senior to CET1 and AT1 and only absorbs losses in resolution. Tier 2 is not permanent and has a maturity date of five years or more. Coupon payments are mandatory. | Banks must hold Total Capital (comprising Tier 1 and Tier 2) of at least 8 per cent of RWA. | |

AT1 has two fundamental roles in APRA’s prudential framework:

- stabilising a bank so that it can continue to operate as a going concern during a period of stress; and

- supporting resolution with the capital that is needed to prevent a disorderly failure.

While AT1 has been designed specifically to perform these roles, the strength and resilience of Australia’s banks means AT1 has never been tested domestically. In 2023, APRA raised concerns over whether AT1 would function as intended in Australia when needed, after reviewing how AT1 has performed internationally, its design features, and the unique characteristics of Australia’s AT1 market.

Challenges facing AT1

While AT1 has never been used in Australia to stabilise a bank, international experience has shown that AT1 has not been effective in absorbing losses in stress and can complicate resolution. APRA’s 2023 Discussion Paper highlighted certain design features and market practices that would create significant challenges to, or potentially compromise, the effectiveness of AT1 in Australia.

Reflecting on the lessons learnt from the international banking turmoil of 2023, the Basel Committee on Banking Supervision noted that ‘there may be merit in further assessing the complexity, transparency and understanding of AT1.7

Challenges in using AT1 to absorb losses in stress

Rather than acting to stabilise a bank as a going concern in stress, international experience has shown that AT1 absorbs losses only at a very late stage of a bank failure. This was evidenced in the case of Credit Suisse in 2023, with the Swiss National Bank noting that ‘the AT1 features designed for early loss absorption in a going concern were not effective’.8 In this instance, AT1 only absorbed losses when the point of non-viability was imminent and failed to stabilise the entity earlier in stress. If AT1 was used in Australia APRA considers it would not fulfil its role in stabilising the bank before non-viability was reached.

While AT1 has been designed to absorb losses prior to resolution, this has been challenging in practice:

- Discretionary distributions – distributions on AT1 are discretionary, meaning that banks under financial stress can cancel distributions to conserve capital. In theory, this would allow a bank to continue lending during tighter economic conditions. However, in practice, the market signalling effects from cancelling distributions are considered more detrimental than the minor benefit of additional financial support. This was observed internationally where Credit Suisse did not cancel distributions despite reporting losses over several consecutive quarters.

- Loss absorption trigger – APRA requires banks to include a loss absorption trigger in their AT1 capital instruments that requires banks to either convert them to shares or write them down when their CET1 ratios fall below 5.125 per cent. However, international experience has shown that banks have failed with CET1 ratios much higher than 5.125 per cent, making it unlikely the loss absorption trigger would be used in practice. With Australian major banks running CET1 ratios of higher than 11 per cent, they would have to deplete more than half of their CET1 capital base before reaching the trigger. While the loss absorption trigger could be increased, this could undermine recovery plan actions and the useability of capital buffers.

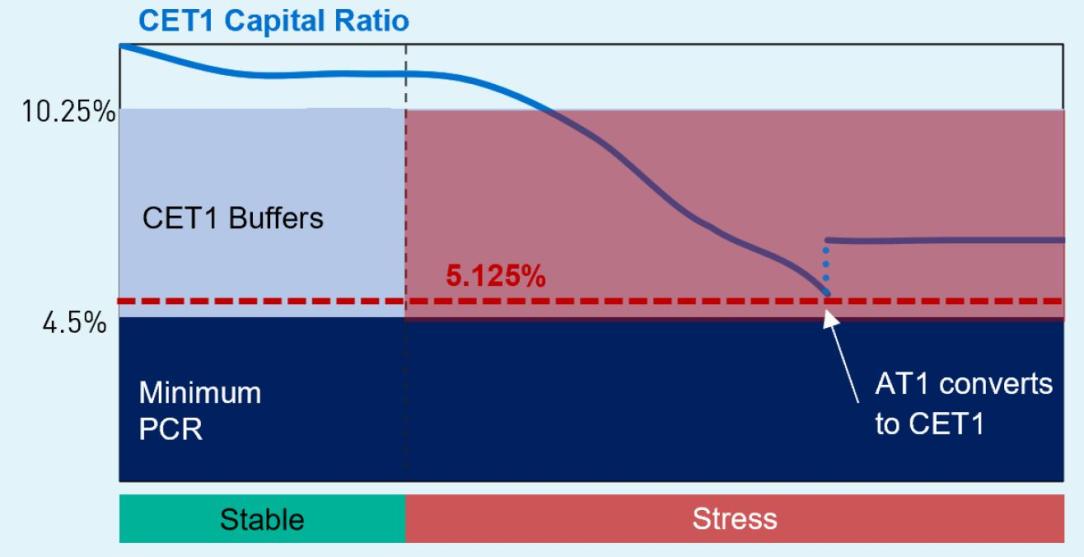

Box 1: Conceptual operation of the loss absorption trigger

The illustration below is a simplified example of how AT1 could conceptually support a bank during stress. AT1 is designed to convert to equity when a bank’s CET1 ratio falls to a trigger point, with this additional equity used to shore up confidence and absorb losses.

However, given the design of the loss absorption trigger, and the reliance on reported CET1 figures that are backward-looking and delayed, a bank would likely become non-viable before this trigger is reached. Even if a bank did reach the loss absorption trigger while remaining viable, increasing the CET1 level by 1.5 per cent by converting or writing off AT1 capital is unlikely to lead to recovery by itself in most scenarios.

Figure 2. AT1 converting to CET1 at the loss absorption trigger

Therefore, it is unlikely that the loss absorption trigger would provide timely and meaningful support to a bank during stress. This is because of two main factors:

- 5.125 per cent is too low – International experiences have shown that banks likely need to be resolved before their CET1 ratio has fallen to 5.125 per cent; and

- Other factors can drive failure – The additional CET1 capital generated by converting AT1 may not offset a broader loss of confidence in the entity from other factors, such as liquidity and operational concerns.

Challenges in using AT1 to support resolution

The impact of bank failure can go beyond disrupting creditors and depositors, to having significant implications on broader financial stability. Bank failure can occur quickly and can often be complex. Having frameworks and tools in place that can be rapidly and effectively deployed is essential to limiting adverse outcomes. There are also benefits in taking actions to reduce complexity in resolution before stresses emerge.

Removing AT1 can help reduce complexity of bank resolution and increase certainty of the treatment of bank stakeholders during stress and in resolution. Replacing AT1 with other forms of regulatory capital would mean there is no longer a form of capital that may or may not absorb losses while the bank remains a going concern. This change would provide greater certainty of how investors would be treated when a bank is under stress or in resolution, reducing the potential for unexpected outcomes and resulting contagion effects.

The below table summarises the key prudential challenges AT1 faces with supporting resolution.

Table 2. Prudential challenges in using AT1 to support resolution

| Challenge | Key considerations |

|---|---|

| Challenges in absorbing losses |

|

| Contagion risk |

|

| Complicating decision-making |

|

Australia is an outlier internationally with a material proportion of AT1 held by domestic retail investors.12 This could make it more challenging to use AT1 to facilitate the recapitalisation of a bank in resolution, as APRA is concerned that imposing losses on these investors would bring complexity, contagion risk, and undermine confidence in the system in a crisis.

Addressing these challenges

Stakeholders generally agreed with the challenges outlined in APRA’s 2023 Discussion Paper. However, views on the best policy options to address these challenges were mixed. Many stakeholders were supportive of limited changes to AT1 instruments, suggesting APRA should only increase the loss absorption trigger to no more than 7 per cent and amend the eligibility of AT1 to remove advised retail from primary offerings to ensure a prudent investor base at issuance. However, it is unlikely that these changes alone would improve the loss absorbency of AT1 in stress or simplify the resolution process.

There were concerns with APRA proposing more material changes to the design of AT1 instruments. Increasing the trigger level beyond 7 per cent could undermine recovery plan actions and the useability of capital buffers. A higher trigger, if exercised, may operate as a negative signal to the market at the very time when regulators are aiming to restore confidence. Restrictions on retail investment through minimum denominations, as implemented in other jurisdictions, could limit domestic investment, and require banks to issue AT1 offshore at a higher cost, particularly given Australian tax settings.13

Based on this feedback, APRA is concerned that material improvements to AT1 would be complex and costly for industry to implement. Moreover, without raising the trigger significantly or basing it on more subjective forward-looking measures, it would be difficult for AT1 to stabilise a bank in stress and restore confidence. This means that AT1 as currently designed is likely to fulfill a role in Australia more akin to gone concern capital. Changes to the eligibility of AT1 based on restrictions on the investor base are also likely to be complex to implement effectively in practice, and in some scenarios could materially increase the cost of issuance for banks.

After assessing stakeholder feedback and exploring policy options to improve AT1, APRA is not confident that regulatory requirements can be adjusted to address the challenges facing AT1 – to ensure AT1 absorbs losses in a going concern and operates as intended in resolution. APRA is therefore seeking feedback on another option to address issues with AT1 – simplifying the capital framework by replacing AT1 with other forms of existing regulatory capital.

Chapter 2 of this Discussion Paper details proposed changes to the capital framework for Australian banks. Given AT1 is not meeting its regulatory purpose by only operating as gone concern capital, APRA considers it reasonable to replace AT1 largely with Tier 2 capital, a simpler and cheaper form of gone concern capital. Chapter 3 of this Discussion Paper explores the benefits and trade-offs of the proposal, including analysis on the ability for banks to issue more Tier 2 and the cost implications. APRA expects the cost of this proposal would be significantly lower than that arising from implementing more material changes to the design of AT1 instruments.

Chapter 2 – A more effective capital framework

The feedback to APRA’s 2023 Discussion Paper highlighted the difficulty in enhancing the design of AT1 while limiting costs and complexity. APRA is therefore exploring a simpler approach to address the challenges with AT1 in Australia.

This chapter outlines proposed amendments to the capital framework in Australia, for consultation with industry. It sets out the proposed capital requirements, and discusses other considerations such as transition arrangements and consequential amendments.

Design of the framework

The framework design balances three key principles, which are outlined in the below table.

Table 3. Key design principles

| Design principles | How the principles have informed the proposed framework |

|---|---|

| Maintain capital neutrality |

|

| International equivalence |

|

| Capital instruments operate as intended |

|

Advanced banks

There are currently six banks in Australia that have received APRA approval to use the Internal Ratings-based Approach to credit risk capital requirements (Advanced banks).15 Guided by the design principles outlined above, the proposed approach would:

- replace the existing 1.5 per cent AT1 with 0.25 per cent CET1 and 1.25 per cent Tier 2;

- increase the minimum CET1 requirement from 4.5 per cent to 6.0 per cent, but offset this increase by removing the Advanced portion of the capital conservation buffer of 1.25 per cent. The reason for this change is to maintain a minimum Tier 1 capital ratio of 6.0 per cent and a minimum 2.5 per cent CCB in line with the Basel minimum standards; and

- retain the total capital requirement plus CET1 buffer level of 13.75 per cent by increasing the minimum Total Capital ratio to 9.25 per cent as a result of the additional Tier 2.

Standardised banks

The design for banks using the Standardised Approach to credit risk capital requirements (Standardised banks) would mirror the Advanced changes, with further simplification:

- fully replace AT1 with Tier 2 capital; and

- remove the minimum Tier 1 Capital ratio.

Table 4. Minimum prudential capital requirements under the proposed approach

Minimum capital requirements | Advanced | Standardised | ||

|---|---|---|---|---|

Current | Proposed | Current | Proposed | |

| CET1 Capital requirement | 4.5% | 6.0% | 4.5% | 4.5% |

| Tier 1 Capital requirement | 6.0% | - | 6.0% | - |

| Total Capital requirement | 8.0% | 9.25% | 8.0% | 8.0% |

| Total Capital requirement + CET1 buffers16 | 13.75% | 13.75% | 11.5% | 11.5% |

Insurers

APRA’s AT1 reforms have largely focused on bank capital requirements given the prudential challenges with using AT1 are more acute for banks compared to insurers. This is a result of the differences between how financial crises unfold for banks and insurers, and the different implications for recovery and resolution planning. For example, banks are more susceptible to sudden crises and contagion risk compared to insurers.

Some features of AT1 may remain useful for insurers in resolution. This is because of the different approaches to resolving banks and insurers; while banks often need to be resolved relatively quickly, insurers are generally subject to lengthy run-off periods where an insurer is no longer operating but still has outstanding policies. During run-off, the permanent nature of AT1 may be beneficial for policyholders. This is because the insurer can cancel distributions and not exercise AT1 call options, and instead redirect capital to paying out insurance claims.

While APRA has considered retaining the alignment between the bank and insurance capital frameworks, there are inherent differences in the costs and benefits of AT1 and Tier 2 between the two industries. APRA is therefore not proposing any immediate changes to AT1 policy settings for insurers. APRA will monitor the extent of any impact to insurers from the changes to the bank prudential framework and may review the approach to capital for insurers in due course, following the finalisation of AT1 policy settings for banks.

Other considerations

In addition to amending bank capital adequacy requirements, APRA must also consider other impacts on the prudential framework and the broader market. To ensure the smooth implementation of the proposed approach, APRA would employ adequate transition periods and implement consequential amendments.

Transitional arrangements

APRA’s intention is for an orderly transition path with changes implemented over time. This would allow an orderly replacement of AT1 with Tier 2 by banks and ensure there were no immediate changes for existing AT1 investors. More information on next steps is provided in Chapter 4.

To achieve this orderly outcome, APRA would likely apply the following high-level transitional arrangements:

- Changes to the minimum capital requirements and buffers would come into effect from 1 January 2027. This would include the increase to CET1 levels required of Advanced banks.

- From this date, existing AT1 instruments would be eligible to be included as Tier 2, until their first scheduled call date. All existing instruments would reach their first call date by 2032 at the latest.

- To maintain an orderly transition, APRA would not expect to approve regulatory calls of these instruments at an earlier date than the first call.

- APRA would also not expect to see banks increase AT1 from current levels or extend call dates beyond 2032 in advance of APRA confirming changes to prudential requirements.

APRA would welcome feedback on these arrangements and whether other options should also be considered.

Consequential amendments

Alongside the above changes to the capital framework which would be implemented in Prudential Standard APS 110 Capital Adequacy, Tier 1 Capital is referenced in other parts of the prudential framework. Requirements such as the leverage ratio, large exposures limits and related entities limits, for example, are set in relation to a bank’s Tier 1 capital position. APRA would consider amending such requirements in line with the principles of maintaining (rather than strengthening or relaxing) current settings and retaining international equivalence.

The required consequential amendments to AT1 and Tier 1 capital references in other areas of the prudential standards are summarised in the table below.

Table 5. Summary of consequential amendments

| Framework | Consequential amendments |

|---|---|

| Amending Tier 1 measures in the framework | The following three measures would need to replace a base of Tier 1 with CET1 capital. APRA would also consider amending the calibration of these requirements.

|

| Removing other references to AT1 |

|

| Tier 2 |

|

| Reporting framework |

|

Chapter 3 – Expected impacts

This chapter details the key benefits and trade-offs of the proposed changes to bank capital requirements. The more detailed cost analysis includes consideration of the ability for banks to raise additional Tier 2 Capital and compares costs to other options to enhance AT1.

Benefits of the proposed approach

While the proposed approach would task banks with raising additional CET1 and Tier 2 to replace existing AT1 in the short term, the simplification would provide broad benefits over time. The key benefits are summarised in the below table.

Table 6. Benefits of the proposed approach

| Benefits | Key considerations |

|---|---|

| Improving capital effectiveness in crisis |

|

| Reducing compliance costs |

|

| Further enhancing proportionality |

|

Trade-offs of the proposed approach

APRA recognises there are also several key trade-offs to be considered in implementing the proposed approach, as set out below. There are no reform options that do not involve trade-offs, so APRA recognises the importance of working through issues and considerations.

Table 7. Trade-offs of the proposed approach

| Trade-offs | Challenge | Key considerations |

|---|---|---|

| Reduced flexibility | Replacing AT1 reduces the flexibility to respond to crises.

| APRA considers that the benefits of reform outweighs the reduced flexibility.

|

| Less internationally comparable | Removal of AT1 reduces international comparability of the capital framework for Australian banks. This may impact the market perception of investors regarding Australian banks.

| There would be no change to international comparability on CET1, which is a key focus of investors and is unchanged (or slightly increased for Advanced banks). There would, however, be some impact on Tier 2 international investors from the removal of AT1, which may in turn impact pricing (see below).18F19 |

| Increased funding costs for Advanced banks | While banks would benefit from predominantly replacing AT1 with a cheaper instrument in Tier 2, this is likely to be partially offset by an increase in Tier 2 costs. Advanced banks will also need to fund an increase in CET1, which is more expensive than AT1.

| APRA expects the long-term funding cost impact is likely to lead to a relatively low cost increase for Advanced banks and a neutral to potential cost saving for Standardised banks. This analysis is detailed further below. APRA considers that these impacts are reasonable in the context of the broader benefits of the reform. |

| Investors will need to seek alternative products | While there is no impact to current investments, investors will lose access to new AT1 going forward, given it is unlikely that banks would issue AT1-like instruments in the absence of Tier 1 capital recognition in the framework. In this case, investors would need to seek alternative investment products.

| While AT1 has been an attractive investment to some investors, the core purpose of the instrument is to support prudential regulatory outcomes. On balance, APRA considers the proposed changes, removing the recognition of AT1 in the capital framework, are needed to improve the effectiveness of bank capital in a crisis. This may result in a material change in asset allocation for some individual investors. However, at an aggregate level, AT1 is only a small proportion of overall assets held by households, reflecting the size of the AT1 market in the broader securities market. |

Funding cost impact

APRA expects that the implementation of the proposed framework over the long term is likely to lead to a relatively low cost increase for Advanced banks and a neutral to potential cost saving for Standardised banks. While replacing AT1 with Tier 2 should deliver funding cost benefits to issuers, given that Tier 2 is cheaper to issue, the broader cost of Tier 2 would likely increase without AT1 in the capital structure. This is because banks will need to issue more Tier 2 with some potentially in longer dated format, Tier 2 will have less subordination in the new capital stack, and there may be rating downgrades.

Advanced banks are likely to experience relatively larger impacts over time compared to Standardised banks, given the small additional increase to CET1 requirements and the larger existing stock of Tier 2 to be repriced (particularly for banks meeting additional loss-absorbing capacity requirements). The expected cost impacts of the proposed framework across three potential scenarios are summarised in the table below. The base case is considered the most likely outcome.

Table 8. Expected funding cost impacts across industry ($ million)

| Cohort | Lower case | Base case | Higher case |

|---|---|---|---|

| Advanced banks | 20 | 70 | 260 |

| Standardised banks | -15 | -10 | 0 |

The proposed approach is unlikely to materially impact the pricing of loans. The cost impact for Advanced banks is expected to equate to a 0.1 basis point increase to the cost per interest-bearing asset, with a 0.3 basis point decrease for Standardised banks.

While implementing the proposed framework could lead to increased costs for some parts of industry, APRA considers that the benefits of the proposed framework as discussed in this Chapter outweigh these costs. APRA welcomes feedback on the potential cost impact of the proposed approach. More detail on the feedback process is provided in Chapter 4.

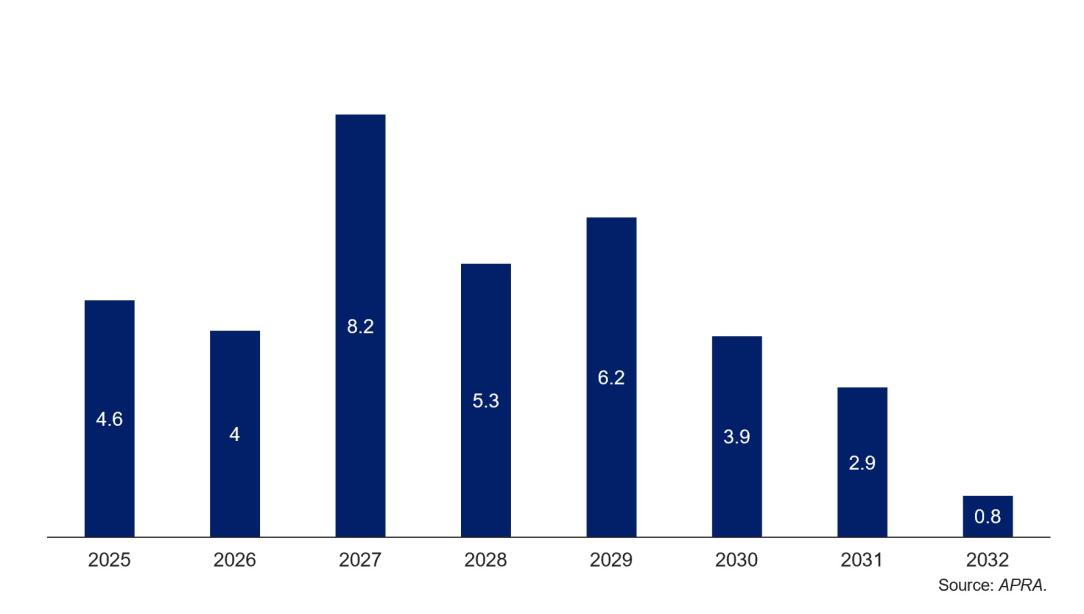

Tier 2 market capacity

In considering the funding cost impact, APRA has considered whether there is enough market capacity to support an increased volume of Tier 2 capital. APRA’s initial analysis shows there is likely to be sufficient capacity. The below chart depicts the expected volume of Tier 2 funding needed to replace AT1 over the next several years. These volumes seem manageable in the context of banks currently having around $125 billion of Tier 2 outstanding.

Figure 3. Tier 2 additional funding task ($ billions)

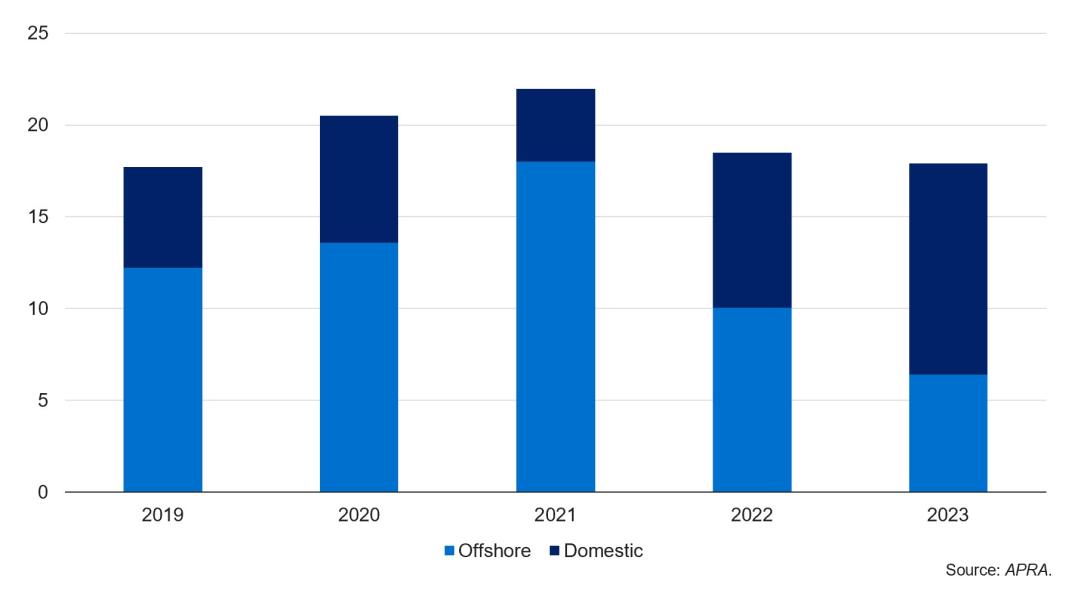

Banks could source the Tier 2 funding domestically, including from previous AT1 investors, or offshore. APRA expects the material demand from offshore investors for Australian Tier 2 capital instruments will remain, albeit at higher pricing given the changes to bank capital structures and the potential for increased issuance in longer dated format. The below chart compares Tier 2 issuance in recent years, in both the offshore and domestic markets, showing that there likely remains offshore capacity.

Figure 4. Recent Tier 2 issuance by Australian banks ($ billions)

Chapter 4 – Providing feedback to APRA

Next steps

Depending on the outcome of this Discussion Paper, APRA intends to formally consult on amendments to APRA’s prudential framework in 2025. If APRA decides to implement the proposed approach, it will ensure appropriate transition arrangements are in place to minimise disruption on market participants. Further detail on the expected timeline is provided in the below table.

Table 9. Timeline for reform

| Timeline for reform | |

|---|---|

| Discussion Paper | September-November 2024 |

| APRA provides an update on the consultation process | Late 2024 |

| Consultation on specific changes to prudential standards | H1 2025 |

| Effective date for new requirements and start of transition | Expected January 2027 |

APRA welcomes feedback on these arrangements and whether other options should also be considered.

Request for submissions and cost-benefit analysis information

APRA invites written submissions on the proposals set out in this Discussion Paper. Written submissions should be sent to policydevelopment@apra.gov.au by 8 November 2024 and addressed to:

- General Manager

- Policy

- Policy and Advice Division

- Australian Prudential Regulation Authority

To assist interested stakeholders in providing feedback on the proposals outlined in this Discussion Paper, APRA offers the following questions to guide, but not limit, responses:

Table 10. Discussion questions

| Questions |

|---|

|

|

|

Important disclosure notice – publication of submissions

All information in submissions will be made available to the public on the APRA website, unless a respondent expressly requests that all or part of their submission is to remain in confidence. Automatically generated confidentiality statements in emails do not suffice for this purpose. Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submissions about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

Request for cost-benefit analysis information

APRA asks that all stakeholders use this consultation opportunity to provide information on the compliance impact of the proposals, and any other substantive costs including business costs. Compliance costs are defined as direct costs to businesses of performing activities associated with complying with government regulation. Specifically, information is sought on any changes to compliance costs incurred by businesses as a result of APRA’s proposals.

Consistent with the Government’s approach, APRA will use the methodology behind the Regulatory Burden Measurement Framework to assess compliance costs. It is available at https://oia.pmc.gov.au/resources/guidance-assessing-impacts/regulatory-burden-measurement-framework.

APRA requests that respondents use this methodology to estimate costs to ensure the data supplied to APRA can be aggregated and used in an industry-wide assessment. When submitting cost assessments to APRA, respondents should include any assumptions made and, where relevant, any limitations inherent in their assessment. Feedback should address the additional costs incurred as a result of complying with APRA’s requirements, not activities that institutions would undertake due to foreign regulatory requirements or in their ordinary course of business.

Appendix A – Response to submissions

APRA’s 2023 Discussion Paper sought feedback on three broad policy options to improve the effectiveness of AT1 capital instruments to stabilise a bank during stress and to support resolution. This appendix summarises stakeholder feedback on these three policy options, which are summarised in the table below.

Table 11. Policy options in APRA’s 2023 Discussion Paper

| Policy Options | |

|---|---|

| Improving key design features to ensure AT1 more effectively absorbs losses and can be used earlier to stabilise a bank in stress. |

| Reducing reliance on AT1 by changing the level or mix of regulatory capital requirements. |

| Changes to diversify the AT1 investor base away from domestic retail investors. |

Feedback summary

In response to APRA’s 2023 Discussion Paper, APRA received 26 formal submissions and undertook around 40 engagements with a range of external parties, including banks, insurers, industry associations, investment banks, rating agencies, law firms, investors, brokers, academics, and peer regulators internationally and domestically.

While responses varied between respondents, and there was debate on the options raised by APRA, there was broad acknowledgement of the challenges discussed. The table below summarises stakeholder feedback and APRA’s responses.

Table 12. Summary of stakeholder feedback

| Options | Comments received | APRA’s response |

|---|---|---|

Design of AT1

|

|

|

Role of AT1

|

|

|

Participation in AT1

|

|

|

Footnotes

1Internal APRA estimates are that for meaningful policy changes, such as a significantly high trigger and minimum denominations to restrict the investor base, there could be material costs for industry to implement. Limited changes to the design of AT1 are unlikely to sufficiently improve the effectiveness of the instrument in stabilising a bank as a going concern.

2These measures are as a percentage of risk-weighted assets (RWA). Tier 2 is an existing, cheaper form of capital, which is designed to be used to support resolution actions when a bank has reached the point of non-viability.

3Financial Sector Legislation Amendment (Crisis Resolution Powers and Other Measures) Act 2018.

4Prudential Standard CPS 900 Resolution Planning.

5APRA, ‘Finalising loss-absorbing capacity requirements for domestic systemically important banks’ (Letter, 2 December 2021), Finalising loss-absorbing capacity requirements for domestic systemically important banks.

6APRA, An Unquestionably Strong Framework for Bank Capital (Information Paper, November 2021) https://www.apra.gov.au/sites/default/files/2021-11/Information%20paper%20-%20An%20Unquestionably%20Strong%20Framework%20for%20Bank%20Capital.pdf.

7Basel Committee on Banking Supervision, Report on the 2023 banking turmoil (October 2023) https://www.bis.org/bcbs/publ/d555.pdf.

8Swiss National Bank, Financial Stability Report 2023 (June 2023), https://www.snb.ch/en/publications/financial-stability-report/2023/stabrep_2023.

9Bank for International Settlements, Financial Stability Institute Crisis Management Series No.4: The 2008-14 banking crisis in Spain (July 2023) https://www.bis.org/fsi/fsicms4.pdf.

10The Basel Committee on Banking Supervision’s report on the 2023 banking turmoil noted that ‘the recent turmoil suggests that even relatively sophisticated investors were still uncertain about how, at which point in time, and in which order their holdings would participate in losses in certain jurisdictions. This, in turn, may indicate either that investors are not prepared to accept the loss-absorbing hierarchy of such instruments, or that the rules on AT1 instruments may be too complex and/or opaque so as to be appropriately reflected in AT1 market prices’. Basel Committee on Banking Supervision, Report on the 2023 banking turmoil (October 2023), https://www.bis.org/bcbs/publ/d555.pdf.

11For example, in March 2023, Silicon Valley Bank in the United States failed after announcing material losses on recent sales of Treasuries and mortgage bonds. Market reactions contributed to a deposit run, leading to government authorities seizing control of the bank two days later.

12Feedback to APRA’s 2023 Discussion Paper suggested retail investors could make up around 20-30 per cent of outstanding AT1 listed on the Australian Securities Exchange. Peer international jurisdictions, such as the UK, Canada, and the European Union, have restricted retail participation in hybrid capital markets.

13A particular concern raised was that minimum denominations could impact the liquidity of trading in AT1 instruments and not meet minimum ASX listing requirements, leading to the need for over-the-counter and offshore issuance that would be materially higher cost.

14Tier 1 Capital is the sum of a bank’s CET1 and AT1 capital, as defined in Prudential Standard APS 111 Capital Adequacy: Measurement of Capital.

15These include Australia and New Zealand Banking Group Limited, Commonwealth Bank of Australia, ING Bank (Australia) Limited, Macquarie Bank Limited, National Australia Bank Limited, and Westpac Banking Corporation.

16The ‘Total Capital Requirement plus CET1 buffers’ for Advanced banks in this table includes the 1 per cent CET1 buffer for banks that APRA has designated as domestic systemically important and excludes additional loss-absorbing capacity requirements.

17In APRA’s view, the lower tranche of the capital buffers below 6.0 per cent would be challenging to use in stress in a going concern, as it would follow a very material fall in capital (for a major bank, this could be from around 11 per cent to half this level). This is only likely to be the case in a very severe crisis scenario. It is also worth noting that alternative options to the simpler framework, such as improving AT1 by raising the trigger level to 7 per cent or higher, would also impact buffer useability.

18APS 110 restricts banks from making capital distributions when their CET1 Capital ratio is within certain capital buffer ranges.