Finalising loss-absorbing capacity requirements for domestic systemically important banks

Alongside the release of the draft Prudential Standard CPS 900 Resolution Planning (CPS 900), APRA is finalising loss-absorbing capacity requirements for domestic systemically important banks (D-SIBs). This requirement will be set as an increase to minimum Total Capital requirements of 4.5 percentage points of risk-weighted assets (RWA) on a Basel III basis. It will come into effect from 1 January 2026.

Loss-absorbing capacity requirements

In 2018-19, APRA consulted on a framework for loss-absorbing capacity, to support resolution planning for authorised deposit-taking institutions (ADIs).1 This framework sought to ensure that, in the event that a large or complex ADI failed, it could be resolved with minimal impact to the critical functions it provides to the economy and the community (such as deposit-taking and payments). Loss-absorbing capacity also reduces the risk of taxpayer funds being used for resolution purposes. For the D-SIBs (currently, the four major banks), APRA proposed to increase minimum Total Capital requirements.2 For other ADIs, financial resources for resolution will be assessed as part of planning under CPS 900 where relevant, although APRA anticipates that most will not be required to maintain additional loss-absorbing capacity for resolution purposes.

Interim requirement

APRA’s approach to loss-absorbing capacity for the D-SIBs has involved two stages: an interim and final requirement. This staged approach provided APRA with an opportunity to monitor the impact of increased issuance of Tier 2 capital instruments on market capacity, before determining final requirements.

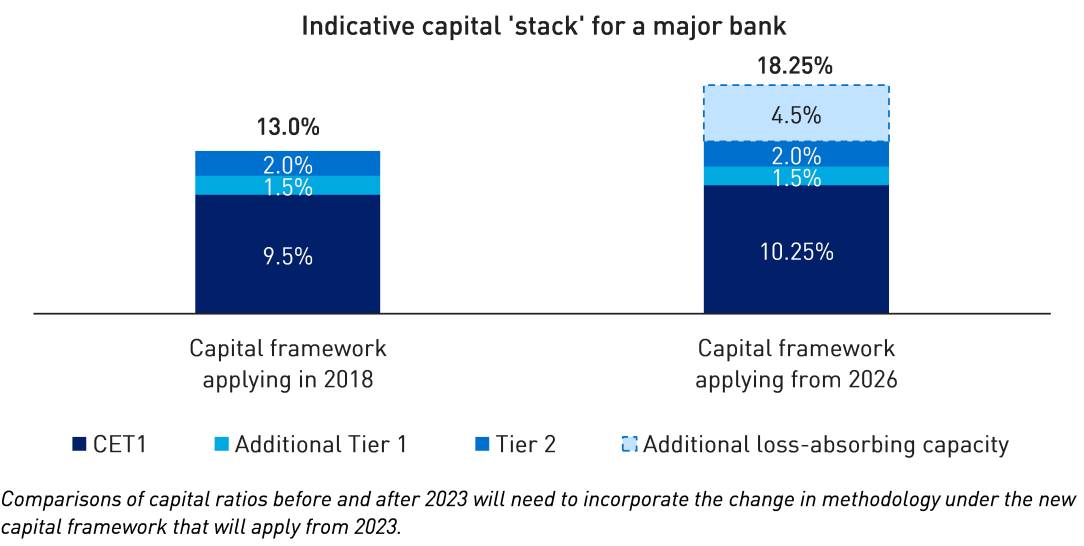

The interim setting was an increase in the minimum Total Capital requirement for the D-SIBs of three percentage points of RWA, to be met by January 2024. D-SIBs have already met this level, and have issued more than $50 billion of Tier 2 capital in recent years.3

Final requirement

The final requirement will be set at the lower end of the range previously announced by APRA, in dollar terms. Given changes to RWA from the ADI capital reforms, the lower end of the range in dollar terms broadly equates to a requirement of 4.5 percentage points of RWA under the new capital framework, in place from 2023.4 This requirement will apply from 1 January 2026 for all D-SIBs at Level 1 and Level 2.5

The chart below sets out the minimum Total Capital requirement that will apply to a D-SIB from 2026. In total, the minimum Total Capital requirement, including regulatory buffers, will be 18.25 per cent, inclusive of the additional loss-absorbing capacity and other changes from the broader ADI capital reforms.

The calibration of additional loss-absorbing capacity for the major banks has been a judgement, based on:

- Historical losses experienced by large banks internationally, including during the global financial crisis;

- Loss-absorbing capacity requirements set by peer jurisdictions internationally;

- Benchmarking of loss-absorbing capacity levels of large banks internationally;

- Observed Tier 2 issuance and the implications for market capacity and funding costs; and

- Consideration of other capital instruments issued by subsidiaries within the group, including in New Zealand.

APRA does not expect this increase to have a material impact on market capacity for Tier 2 capital instruments. D-SIBs have already met the bulk of the required increase, given their progress in meeting the interim requirement. APRA anticipates that D-SIBs may issue around a further $20 billion of Tier 2 capital, in aggregate, to meet their final requirement.

CPS 900 Resolution Planning

Alongside this letter, APRA has released for consultation new Prudential Standard CPS 900 Resolution Planning (CPS 900).6 The proposed CPS 900 is designed to embed APRA’s approach to loss-absorbing capacity within the prudential framework for resolution planning. The proposed CPS 900 will only apply to significant financial institutions or entities that provide critical functions to the economy. Under the proposed CPS 900, APRA may impose obligations on these entities to support resolution planning, including requirements to maintain additional loss-absorbing capacity. Such obligations would be determined by APRA as part of its resolution planning for individual entities.

Yours sincerely,

John Lonsdale

Deputy Chair

Footnotes

1 Increasing the loss-absorbing capacity of ADIs to support orderly resolution (Discussion Paper, November 2018) and Response to Submissions – Loss-absorbing capacity (Response to Submissions, July 2019).

2 The proposed range was 4-5 percentage points of RWA, to be adjusted for changes in the capital framework based on the Basel III reforms. Unlike other jurisdictions, APRA did not propose to design new instruments for resolution and instead proposed that loss-absorbing capacity would be implemented through adjustments to minimum Total Capital requirements.

3 Spreads on major bank Tier 2 capital instruments have remained broadly in line with 2019 levels and consistent with large global peers.

4 The changes to the capital framework are expected to reduce total RWA for the major banks in aggregate. In 2018, APRA stated that an adjustment to the proposed calibration would be needed to incorporate the changes to the capital framework to achieve the same absolute amount of additional loss-absorbing capacity. Broadly, to keep the dollar amount of non-CET1 capital constant under the new framework requires additional Total Capital of 4.5 percentage points, consistent with a calibration at the lower end of the range.

5 The interim requirement of three percentage points is included within this (it is not a separate requirement).

6 See consultation, Strengthening crisis preparedness.