Temporary loan repayment deferrals due to COVID-19, August 2021

As announced on 19 July 2021, APRA provided a further round of temporary regulatory treatment for loans impacted by COVID-19. For eligible borrowers, ADIs do not need to treat a repayment deferral as a loan restructuring or the period of deferral as a period of arrears.

To provide greater transparency APRA is resuming publishing of aggregate and entity-level loan repayment deferrals data, in a similar manner as in 2020/21. In this ‘second round’, however, the threshold for reporting has been lifted to those ADIs with $50 million and 50 facilities in loans subject to repayment deferral, compared to $20 million and 20 facilities in the ‘first round’.

A number of ADIs have chosen to take advantage of this capital treatment and allow borrowers to defer their loan repayments for a period of time. Other ADIs have chosen to support their customers through various other means, including offering repayment deferrals without taking advantage of the concessional capital treatment. While these ADIs may not appear in the published statistics as they do not meet the threshold for reporting, this does not suggest they are not providing appropriate support for their customers.

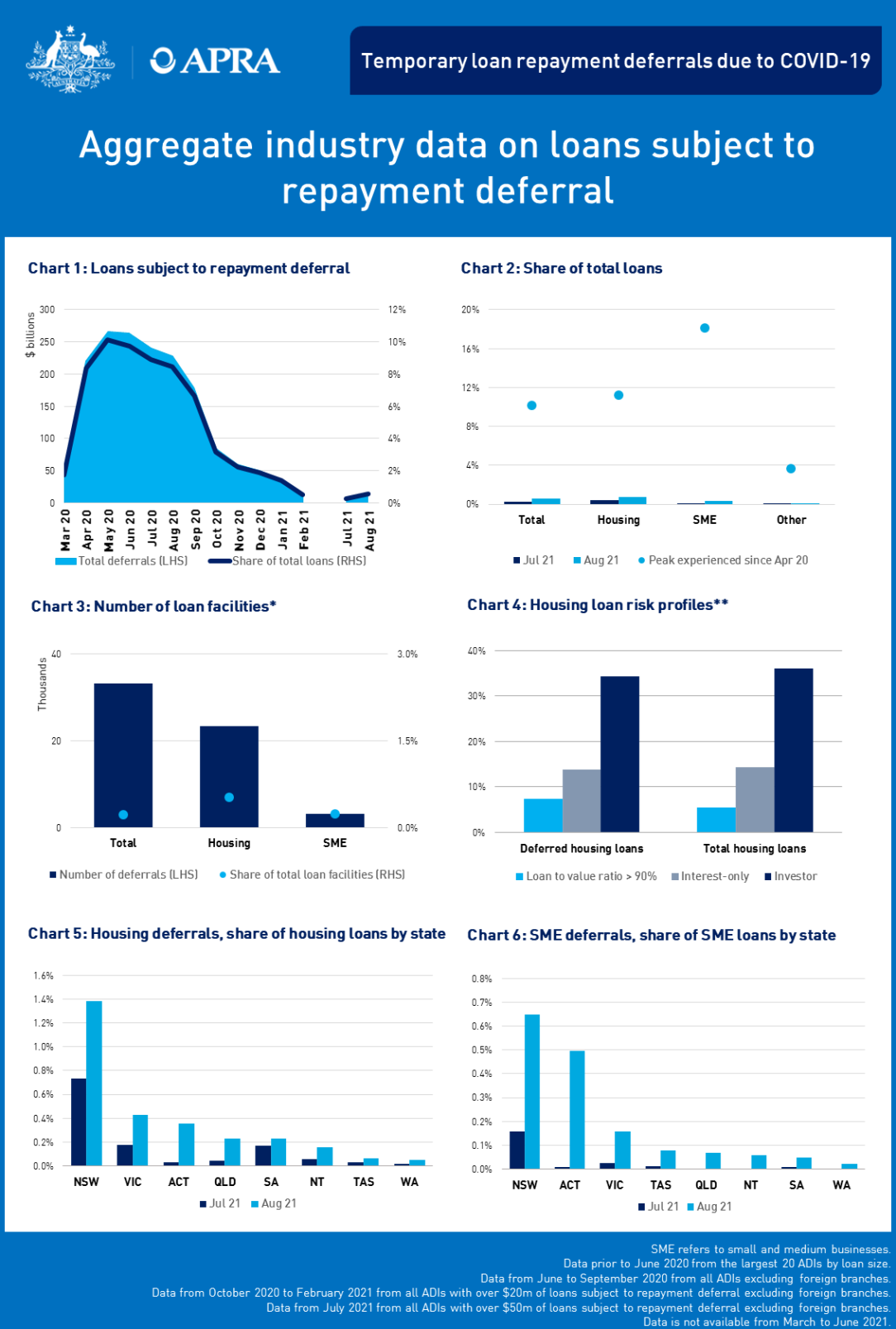

* the number of facilities does not necessarily indicate the number of borrowers as individual facilities with more than one repayment type may be reported more than once.

** to give an indicator of potential elevated risk in loans subject to deferral this chart compares loans subject to deferral to total loans across three key cohorts – loan to value ratio of greater than 90 per cent, investor loans and interest only loans.

An accessible version of this dashboard is available here.

Additional commentary

| Deferred loans | Total loans1 | Deferred loans, share of total loans |

Total | $11.9 billion | $2.2 trillion | 0.5% |

Housing | $10.8 billion | $1.5 trillion | 0.7% |

SME | $765 million | $252.7 billion | 0.3% |

As at 31 August, according to data submitted by ADIs with over $50 million in loans subject to repayment deferral, a total of $11.9 billion worth of loans are on temporary repayment deferrals, which is around 0.5 per cent of total loans outstanding for these ADIs, up from $5.6 billion (0.3 per cent of total loans outstanding) in July. This is a significantly lower amount than at the height of the crisis in mid-2020 where repayment deferrals peaked at around 10 per cent of total lending.

Housing loans make up the majority of total loans on repayment deferral and have a higher incidence of deferral, with 0.7 per cent of these loans subject to deferral, compared to 0.3 per cent of SME loans.

New South Wales has the highest proportion of loans subject to deferral, at 1.4 per cent compared with the rest of the country at 0.3 per cent, though this difference tightened in August.

Explanatory notes

This data is sourced from the domestic loan portfolios2 of APRA-regulated authorised deposit-taking institutions (ADIs), excluding foreign branches. The spreadsheet below contains data for all ADIs with total loans subject to temporary repayment deferral of greater than $50 million and more than 50 deferred facilities in any given reporting period. In addition, for privacy reasons, fields are masked where there is a non-zero value below $10 million or there are less than 20 facilities. For an entity where either the "new or extended in the month" field or the "expired or exited in the month" field falls below this threshold, both of these fields are masked.

Changes in total loans subject temporary repayment deferral occur due to several factors. These factors include (but are not limited to) new deferrals, exits from deferral, addition of interest charges on existing deferrals and customers paying down their loans subject to deferral. Also note that, when a borrower’s loan repayment deferral is extended it is reported in this data as both "expired or exited in the month" (as the initial deferral has expired) and "new or extended in the month" (as it has been extended).

All data has been submitted to APRA on a best endeavours basis under relatively tight timeframes. As a result, data may be revised in future reports.

Footnotes:

1 Of ADIs that meet the reporting threshold for loan repayment deferrals.

2 Domestic loan portfolio refers to loans provided within Australia on the balance sheet of the licenced ADI.

Next issue

The September 2021 issue will be released on 29 October 2021. As temporary loan repayment deferrals programs are coming to an end, APRA will consider the continuation of its statistical publication after the September 2021 edition.

For more information

Email dataanalytics@apra.gov.au or mail to

Manager, External Data Reporting

Australian Prudential Regulation Authority

GPO Box 9836, Sydney NSW 2001Looking for discontinued publications?

Search historical snapshots of APRA's website on the Australian Government web archive.