Response to submissions - Targeted changes to ADI liquidity and capital standards

Executive summary

Background

In November 2023, APRA commenced consultation on targeted changes to strengthen liquidity and capital requirements for authorised deposit-taking institutions (ADIs). This followed bank crisis events in the US and Europe last year. Those events reinforced the value of a strong Australian banking system in which depositors can be confident as to the safety of their deposits even during periods of international market turbulence. Those events also provided important “lessons learned” for banks and prudential regulators, including highlighting the potential pace of deposit withdrawals that can occur through digital channels.

APRA’s consultation proposals were directed to strengthening ADIs’ liquidity positions in three ways: ensuring that ADIs on the Minimum Liquidity Holdings (MLH) regime value liquid assets at their market value, ensuring ADIs have robust processes for requesting exceptional liquidity assistance (ELA), and strengthening the composition of liquid assets.

This Response Paper sets out APRA’s response to submissions, and is accompanied by final changes to the relevant standard and guidance, Prudential Standard APS 210 Liquidity (APS 210) and Prudential Practice Guide APG 210 Liquidity (APG 210).1

Consultation process

APRA’s consultation on the targeted changes was conducted formally between November 2023 and February 2024. This allowed a 3-month window for submissions, which is consistent with our approach for all major policy consultations. However, given the potential impact of the proposals, APRA enhanced our usual policy process with additional workshops and discussions with industry stakeholders.

APRA received 35 submissions from entities, individuals and industry bodies during consultation. Industry provided a range of feedback, though the headline concern was the profitability impact of APRA’s proposal to fully remove bank debt securities as liquid assets for MLH ADIs.2 Some industry participants suggested that APRA should consider the proposal regarding bank debt securities as part of APRA’s planned broader review of liquidity risk.

Key policy changes

Following the consideration of industry feedback to APRA’s consultation letter, APRA will:

- proceed with the proposed policy changes on market valuations for liquid assets;

- proceed with the proposed improved processes for ELA; and

- defer policy changes to APS 210 regarding the composition of liquid assets to APRA’s planned broader review of liquidity risk, to allow a more holistic review of the MLH regime, but undertake supervisory actions with ADIs with material concentrations of bank debt securities as liquid assets.

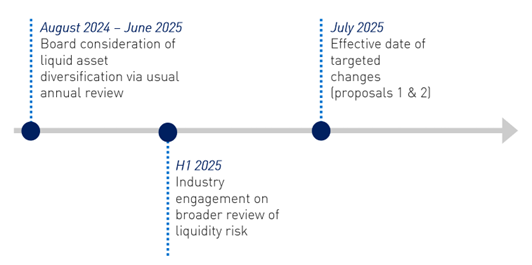

To support the smooth implementation of the first two changes, APRA has deferred commencement by six months to 1 July 2025, as suggested by some industry participants. APRA has also provided several technical clarifications, as detailed in this Response Paper.

APRA’s prudential concern with bank debt securities and existing requirements and guidance relating to diversification of liquid assets

APRA remains concerned with ADIs relying on bank debt securities as liquid assets, given that this may not be a dependable or effective form of liquidity in a crisis. These concerns are particularly acute for ADIs with a material concentration of bank debt securities.

A diversified liquid asset portfolio is an important risk mitigant for ADIs, providing confidence that sufficient funds will be available to repay depositors, even during periods of financial market stress. International and domestic evidence shows bank debt securities can be less liquid in such stress scenarios. For this reason, APRA’s closest international peer regulators disallow or otherwise limit reliance on bank debt securities for smaller banks.

A long-established objective of APS 210 is for ADIs to maintain a portfolio of liquid assets sufficient in size and quality to enable it to withstand a severe liquidity stress. This includes:

- maintaining a liquidity management strategy appropriate for an ADI’s liquidity needs under normal conditions as well as periods of liquidity stress (APS 210, paragraph 30); and

- ensuring the liquid asset portfolio is appropriately diversified, including to provide confidence that assets can be readily liquefied in time of stress with limited erosion of value (APG 210, paragraphs 149 to 151).

In APRA’s assessment, material concentrations of bank debt securities are not consistent with this existing prudential objective and guidance. APRA estimates that bank debt securities currently comprise almost 60% on average of MLH ADIs’ liquidity portfolios. There is also significant variation across the cohort of MLH ADIs – with some holding no bank debt securities in their liquidity portfolio and others holding materially above the average level.

APRA expects that MLH ADIs will note APRA’s prudential concerns and existing requirements and guidance, and take steps to improve the diversification of their liquidity portfolios. APRA expects that this is reflected in ADIs’ usual annual review of liquid assets under APS 210. APRA requests these annual reviews be provided to APRA when approved by the board and by no later than 1 July 2025.

APRA envisages that MLH ADI boards will determine a suitable glidepath tailored for their ADI and take into account their ADI’s individual circumstances. Where an MLH ADI continues to have a material concentration of bank debt securities for liquidity purposes, they can expect heightened supervisory engagement and attention from APRA consistent with APRA’s existing supervisory framework.

Next steps

The timeline below sets out the key next steps in the process. Following finalisation of these targeted changes, APRA will proceed to the planned broader review of liquidity risk, including expected industry engagement in H1 2025. Feedback provided to APRA as part of the targeted review will, where applicable, be captured and carried forward to the broader review.

Market value for liquid assets

Using the market value of liquid assets for MLH ADIs

As part of the targeted changes, APRA proposed MLH ADIs would be required to adjust the value of their liquid assets regularly for movements in market prices. Unrealised losses on liquid assets were a key source of stress for some US banks last year, resulting in less liquidity being available at a time when it was needed most. APRA’s proposal would ensure that ADIs’ liquidity portfolios are based on market valuations and able to be realised at those valuations when needed.

While some submissions noted that this would increase complexity for MLH ADIs, overall submissions were supportive of the proposal. Submissions noted the benefits of regular revaluation of liquid assets as part of a robust risk management framework. Submissions sought clarification on several issues including the scope of application, the valuation method and frequency, as well as the treatment of hedges. APRA’s clarification on these matters is detailed below.

Scope of application

Comments received

Entities raised questions around what liquid assets should be measured at market value, including whether management buffers are included.

APRA’s response

The market value requirement applies to all financial instruments that qualify for prudential liquidity requirements (in APS 210). Securities that do not count towards prudential liquidity requirements are excluded.

Valuation methodology

Comments received

A number of submissions raised questions regarding valuation practices. In particular, they queried the method for measuring certain financial instruments at market value.

APRA’s response

In addition to the guidance in APG 210, APRA expects MLH ADIs to be guided by Attachment A to APS 111 and the Australian Accounting Standards.3

Valuation frequency

Comments received

Submissions raised queries on the expected frequency of revaluations. Concerns were raised as to the increased administrative cost of revaluing liquid assets regularly, with submissions generally suggesting monthly or quarterly intervals as appropriate.

APRA’s response

APRA notes that ADIs must maintain sufficient liquidity at all times. However, APRA acknowledges it is important to strike an appropriate balance between regulatory impact and the timeliness and accuracy of revaluations, particularly for smaller ADIs.

APRA considers that a proportionate and balanced approach for MLH ADIs would be where the ADI, at a minimum, conducts revaluations quarterly to meet prudential reporting requirements. However, APRA expects MLH ADIs to be capable of more frequent revaluations, and to set triggers for when ad-hoc valuations would occur. For example, more frequent revaluations could be triggered if there was an event that caused valuations to change significantly intra-quarter (for example, material shifts in yield curves or significantly increased market volatility).

To determine the market value of liquid assets on a timely basis, MLH ADIs may select what is an appropriate valuation technique. However, APRA expects MLH ADIs to mark-to-market liquid assets at a financial instrument level at least quarterly for accuracy.

APRA has clarified this expectation in APG 210.

Treatment of hedges for liquidity

Comments received

Submissions raised questions about the treatment for when a derivative has been used to hedge the interest rate risk on a liquid asset, as to whether the derivative assets (in the money) or liabilities (out of the money) should be included in the MLH ratio calculation.

APRA’s response

MLH ADIs can hedge their stock of liquid assets. MLH ADIs need to take into account in the market value of their liquid assets all cash flows that would arise if hedges are closed out early in the event of the asset being sold.

Deducting unrealised losses from capital

APRA proposed that unrealised losses for liquid assets should be deducted from Common Equity Tier 1 (CET1) Capital at Level 1 and Level 2, for both ADIs on the MLH and LCR regimes. This would allow unrealised losses to flow through to capital positions in a timely manner, and ensure capital and liquidity ratios provide an accurate representation of financial resources available to absorb stress. An asymmetric treatment was proposed where gains in value would not be recognised for capital purposes.

Submissions generally did not support this proposal, citing several concerns. APRA notes that an intended outcome of this proposal is for entities to have a heightened awareness of the risk present in their portfolios. This will be achieved through strengthened risk management practices and increased transparency on what may eventuate to liquidity portfolios in periods of stress. The comments received and APRA’s response is summarised below.

Capital volatility and asymmetric treatment

Comments received

Submissions raised concerns about this proposal's potential to increase the volatility of capital ratios. Submissions also queried the asymmetric treatment for deducting unrealised losses from capital, but not recognising unrealised gains.

APRA’s response

It is important that holdings of liquid assets are reflected at a prudent value and feed into calculations for both liquidity and capital. In the absence of frequent risk oversight and fair valuing of securities, an adjustment is necessary to reflect any embedded losses that would be realised in the event liquidity is needed. APRA acknowledges this could increase the volatility of capital ratios to some extent, but ultimately APRA considers this is the right approach because it provides a more accurate reflection of ADIs’ financial strength.

Where an ADI already measures its liquid assets at fair value for financial accounting purposes, it recognises both fair value gains and losses in capital. APRA emphasises that this accounting treatment is available for adoption by any ADI. The asymmetric approach, where unrealised gains are not recognised in capital, applies only for those ADIs that choose to use an accounting approach where liquid assets are valued at amortised cost.

Treatment of hedges for capital

Comments received

Where a derivative has been used to hedge the price risk on a liquid asset that is not fair valued, some submissions requested clarity as to whether the derivative asset (in-the-money) can be allowed to offset any unrealised fair value loss otherwise deductible from capital.

APRA’s response

Fair value hedges can be used to reduce the risk of unrealised losses on fixed-rate securities flowing through to capital. Consistent with current practice, fair value changes in securities and derivatives both impact profit and loss, meaning no adjustment will be required for securities subject to fair value hedges. In circumstances where only a specific risk component of a security (e.g. interest rate risk) is designated to be part of a hedge accounting relationship, only unrealised cumulative fair value losses associated with the unhedged component will be deducted from capital.

APRA is considering the appropriate capital treatment in circumstances where cash flow hedges are used for liquid assets. APRA is aware entities could create economic interest rate risk on floating-rate securities using cash flow hedges, with any unrealised loss on the swap not being recognised until the security is liquidated. APRA plans to consider the materiality of this issue and possible reform options as part of the broader review of liquidity risk. In the meantime, should an ADI be using cash flow hedge accounting on liquid assets, APRA expects the ADI to be able to demonstrate that the capital outcome is prudent and in line with the intent of this proposal.

Level of calculation for capital

Comments received

Some submissions queried whether unrealised losses could be deducted at a portfolio level, so unrealised gains at a financial instrument level could offset unrealised losses. Submissions noted that a portfolio view is sensible, given decisions are typically based on the overall portfolio.

APRA’s response

APRA confirms that an ADI may deduct unrealised fair value losses at a portfolio level so that unrealised fair value gains on liquid assets can offset unrealised fair value losses at a financial instrument level. APS 111 has been amended to reflect this clarification.

Risk weighting of liquid assets where unrealised losses are deducted

Comments received

Some submissions asked if an ADI should risk-weight liquid assets measured at amortised cost net of any unrealised losses deducted from capital.

APRA’s response

In relation to an entity’s liquid assets which are accounted for at amortised cost, as clarified through a consequential amendment to APS 112, an ADI may adjust its exposures for any deduction from its CET1 capital made to reflect unrealised fair value losses at a portfolio level.

While APRA has provided scope for ADIs to make such adjustment, APRA acknowledges this could be burdensome for smaller entities to incorporate into their regulatory reporting systems. Accordingly, APRA has also allowed the option for ADIs to elect not to make such adjustment, in which case the ADI would for simplicity be accepting some (typically a very small level) of double counting.

Interaction with APS 117 capital charge

Comments received

Submissions queried if there would be double counting of capital where an ADI is subject to the full requirements under Prudential Standard APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book (APS 117) and is also required to hold capital for fair value losses on liquid assets if they account for these liquids at amortised cost.

APRA’s response

APRA confirms that if an adjustment to capital has been made in APS 111, to reflect the fair value of an asset, then that adjustment would be reflected in calculations under APS 117, avoiding any duplication.

Exceptional liquidity assistance

APRA proposed that ADIs must be operationally ready to provide certain key information regarding their financial position when requesting exceptional liquidity assistance (ELA) from the Reserve Bank of Australia (RBA). It is important that ADIs are prepositioned and ready to request emergency liquidity if needed in a crisis, and that systems are in place in advance.

Submissions indicated widespread support for this proposal. Submissions sought clarification on the basis for completing the ELA data request template, the applicability of the proposed ELA requirements to foreign bank branches and the interaction of the proposed ELA requirements and template with the RBA’s process for requesting ELA. APRA’s clarification on these matters is outlined below.

Best endeavours basis for data

Comments received

In relation to the ELA data request template, some submissions commented that the cost to develop the capability to provide shareholders’ equity and capital ratios as at the day prior to the day of the ELA request and at the end of the prior month would be significant. Submissions requested clarification that the data can be provided on a ‘best endeavours’ basis, such as using the last reported values and adjusting them on a high-level basis for known movements and material changes.

APRA’s response

APRA expects ADIs to be capable of providing the data outlined in the ELA data request template and take all reasonable steps to ensure its accuracy. However, given the short timeframe to provide the specified information in a liquidity stress, APRA acknowledges that the data may be provided using approximation, as clarified in APG 210.

Foreign ADI branches

Comments received

One submission sought clarification on if and how the proposed ELA requirements apply to branches of foreign ADIs, given the ELA data request template includes items that are not relevant to foreign ADI branches (capital ratios and shareholders’ equity).

APRA’s response

APRA confirms that the proposed ELA requirements apply to branches of foreign ADIs. APRA has amended the ELA data request template to clarify that branches of foreign ADIs must complete the template on a domestic books consolidation basis and that capital ratios are not required.

Interaction with RBA’s process for ELA

Comments received

Some submissions requested clarification on how the proposed ELA requirements and the ELA data request template interact with the RBA’s process for requesting ELA.

APRA’s response

The proposed ELA requirements are consistent with the RBA’s process for requesting ELA. Specifically, the ELA data request template will need to be completed to support the RBA’s positive net worth attestation requirement. An ADI will be required to have the operational capability to complete the template in line with paragraph 70 of APS 210 (July 2025).

Improving MLH liquid asset composition

APRA proposed that bank bills, certificates of deposits and debt securities issued by other ADIs (‘bank debt securities’) would no longer be recognised as eligible liquid assets for ADIs on the MLH regime.

APRA noted, however, that this proposal would reduce earnings at some ADIs without offsetting actions. APRA therefore sought feedback on policy options that would assist ADIs in managing adjustments to their liquidity portfolios.

In the consultation, some stakeholders conveyed strong concerns regarding the impact of removing bank debt securities, with suggestions that consideration of the proposal be deferred to APRA’s broader review of liquidity risk. A summary of the key issues raised through consultation and APRA’s response are set out below.

Comments received

Profitability

Submissions shared strong concerns on the significant impact of removing bank debt securities on profitability. Submissions highlighted both investment and funding cost impacts, particularly for MLH ADIs holding high proportions of bank debt securities. Some submissions noted that ADIs would potentially consider recouping lost profits by either reducing investment or increasing fees charged to customers.

Impact on funding

In addition to profit impacts, submissions raised concerns that the proposed changes would reduce investor demand for MLH ADI bank debt securities, resulting in a narrower and more expensive funding base for MLH ADIs. Submissions suggested that the proposal would result in increased reliance and competition for other funding sources (e.g. retail deposits) or moving into alternative funding sources with higher costs and complexities (e.g. residential mortgage-backed securities).

Some submissions also commented that MLH ADIs issue negotiable certificates of deposit as a tool for operational liquidity management, and their removal as an eligible liquid asset would reduce demand, resulting in increased liquidity risks or higher costs to manage operational liquidity (e.g. holding greater cash balances).

Interest rate risk

Some submissions raised concerns on interest rate risk being introduced into MLH ADIs’ liquidity portfolios. Submissions noted that MLH ADIs are likely to replace bank debt securities with government and semi-government bonds. These forms of liquid assets are often characterised by long maturity dates with fixed rates, as opposed to bank debt securities which are generally available with short maturity dates and floating rates. Submissions noted that establishing the capability to manage increased interest rate risk would be challenging and involve additional costs. Some also noted it may impact MLH ADIs’ ability to hedge fixed rate loans offered to customers.

Competition, efficiency and proportionality considerations

Some submissions considered that APRA was not striking an appropriate balance, or was otherwise not giving due weight, to considerations of competition, efficiency and/or proportionality. For example, some submissions contended:

- the removal of bank debt securities does not present a proportionate response to the perceived contagion risk that manifests in a rare, more severe and systemic scenario;

- APRA was giving undue weight to the experience of international bank failures such as Silicon Valley Bank, which was less likely in the Australian context given ‘unquestionably strong’ capital requirements; and

- the removal of bank debt securities would reduce the ability of MLH ADIs to compete sustainably, reinforcing the competitive advantage available to larger ADIs.

Mitigating options and transition timeframes

In the consultation letter, APRA sought feedback on policy options that would assist ADIs in managing adjustments to their liquidity portfolios. Some submissions welcomed engagement with APRA on mitigating policy options. Feedback on possible policy options included:

- extending the transition timeline, particularly for those ADIs with the highest proportions of liquid assets in bank debt securities;

- expanding the list of eligible MLH liquid assets to facilitate diversification, for example by allowing covered bonds or residential mortgage-backed securities;

- allowing for the inclusion of certain types or quality of bank debt securities, or a set proportion of higher quality bank debt securities, for example by allowing credit rating grades 1 and 2; and

- implementing a cap or haircut on bank debt securities.

Some submissions also suggested deferring consideration of the proposal to APRA’s broader review of liquidity risk to allow further industry engagement and more holistic liquidity risk reform to be implemented.

APRA’s response

APRA’s assessment is that bank debt securities are not a reliable liquid asset and cannot be depended on if needed in a significant banking stress. APRA’s assessment is reinforced by international standards and practices. The Basel III liquidity standards do not recognise bank debt securities. APRA’s closest peer regulators also generally do not recognise (or at least strictly limit) these assets as liquids for smaller banks.

There are also contagion risks associated with MLH ADIs’ crossholdings of bank debt securities. The international banking turmoil last year showed the unprecedented speed at which contagion can spread and how the failure of a smaller bank can have an outsized impact on overall system stability. While there are important differences between overseas and Australian banking systems, that does not mean Australia is immune from similar types of contagion risks, which crossholdings of bank debt securities amplify.

Within this context APRA has, as set out in the Executive Summary, deferred any policy changes to APS 210 regarding bank debt securities to the broader review of liquidity risk. This will allow the opportunity for APRA, in consultation with industry, to consider the MLH regime more holistically. Alongside assessing the ultimate role of bank debt securities, this holistic review will consider whether broader tools could promote MLH ADI liquidity resilience in a more cost-effective way, the appropriate calibration and design of MLH minimum requirements, and other initiatives, such as potential changes to the list of eligible liquid assets. Feedback provided to APRA as part of the targeted review will, where applicable, be captured and carried forward to the broader review of liquidity risk.

Footnotes

1There are also changes to Prudential Standard APS 111 Capital Adequacy: Measurement of Capital (APS 111), Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk (APS 112) and the ELA data request template.