Recovery and exit planning

APRA has finalised the requirements of Prudential Standard CPS 190 Recovery and Exit Planning (CPS 190). Draft CPS 190 had been subject to industry consultation since December 2021, under the title ‘Financial Contingency Planning’.

CPS 190 is an important new prudential standard aimed at reinforcing the resilience of the financial system. It will ensure that APRA-regulated entities are better prepared to manage periods of severe financial stress. It complements recent prudential reforms aimed at strengthening financial resilience, by ensuring that entities are well-prepared to rebuild that resilience if needed.

Under CPS 190, entities will be required to develop and maintain credible plans for managing stress; this includes actions that could be taken to stabilise and restore financial resilience and actions that effect an orderly and solvent exit from regulated activity. These requirements will apply across all APRA-regulated industries; they are consistent with international better practice.

In introducing CPS 190, APRA has sought to balance several important complementary objectives. These include:

- Proportionality: Under CPS 190, smaller and less complex entities will be subject to less onerous requirements, compared to larger and more complex entities. This has reduced potential adverse impacts for expenses and competition.

- Flexibility: CPS 190 is principles-based and outcomes-focused, providing entities flexibility to develop plans that are credible for them. A tick-box approach to requirements would not support effective planning for crisis scenarios.

- Accessibility: APRA has sought to improve the useability and clarity of policy material related to CPS 190. This includes presenting guidance in an integrated manner, to assist entities in understanding the reforms in totality.

Issues raised in consultation

Submissions to the consultation were generally supportive of APRA’s objectives.1 APRA is therefore finalising CPS 190 without material revision to the draft proposals.

APRA’s response to specific issues raised during the consultation is set out in Annex A. The main changes to the prudential standard include a retitling of CPS 190 to ‘Recovery and Exit Planning’ to avoid confusion and better align with international terminology, and a restructuring of requirements to reduce repetition and improve accessibility. APRA has also provided further clarity on certain requirements to explain their application across industries.

Next steps

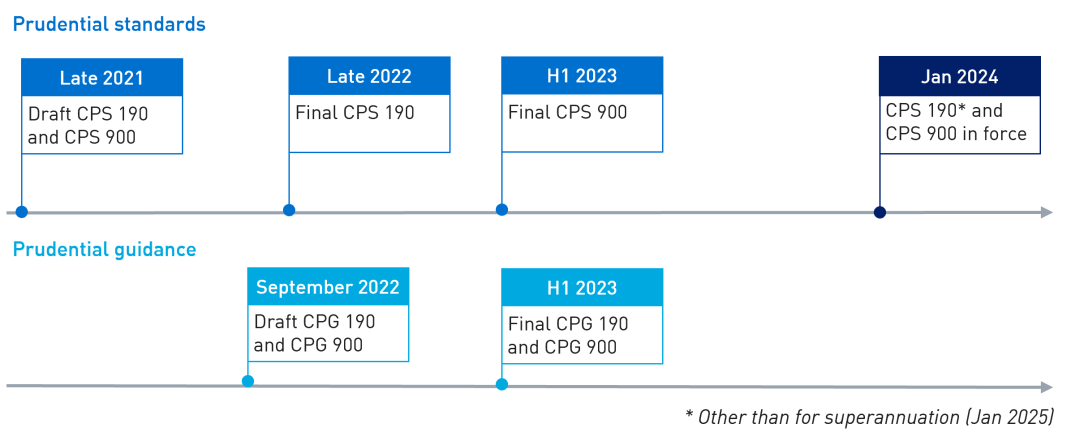

CPS 190 will come into effect from 1 January 2024 for banks and insurers, and from 1 January 2025 for RSE licensees. The longer timeframe for RSE licensees supports these entities in responding to other related reforms for the sector, including the recently released consultations on draft requirements for superannuation transfer planning and financial resources for risk events in superannuation. These complementary reforms further reinforce the objectives of CPS 190, by supporting prudent transfers of members and access to financial resources in a range of risk events.2

Throughout 2023, APRA’s focus will be on engaging with entities on their approach to implementation and finalising complementary reforms. These reforms include:

- Resolution Planning: APRA is planning to finalise Prudential Standard CPS 900 Resolution Planning (CPS 900) in the first half of 2023. CPS 900 reinforces the objectives of CPS 190 by seeking to ensure that, in the unlikely event of failure, barriers to achieving an orderly resolution have been removed. Entities can continue to provide feedback on CPS 900 until 6 December 2022.

- Accompanying guidance: the consultation on the draft prudential practice guides to accompany CPS 190 and CPS 900 will close on 6 December 2022. APRA plans to finalise this guidance in the first half of 2023.

Timeline of next steps

Yours sincerely,

John Lonsdale

Chair

ANNEX A: ISSUES RAISED IN CONSULTATION

Title of the standard

Draft CPS 190 had previously been titled ‘Financial Contingency Planning’, consistent with its focus on entities planning for financial stress. However, several stakeholders suggested that this term had the potential to create confusion with other areas of the prudential framework. This includes, for example, contingency plans expected under Prudential Standard SPS 515 Strategic Planning and Member Outcomes.3

To better differentiate from other plans expected under APRA’s prudential standards, APRA has revised the title of CPS 190 to ‘Recovery and Exit Planning’. This revision has also clarified the basis for the standard, which is to be able to respond to major stress events that threaten an entity’s viability whether the trigger is financial or non-financial.4 The revised terminology is more in line with international practice.

Accessibility

Respondents supported APRA’s objectives to apply simpler requirements to non-significant financial institutions (non-SFIs). However, several stakeholders suggested that the presentation of the standard made it difficult to understand the difference in requirements between SFIs and non-SFIs; this would present challenges for entities transitioning between regimes.5

In finalising CPS 190, APRA has maintained a set of simpler requirements for non-SFIs and restructured the presentation of CPS 190. The final CPS 190 more clearly indicates which requirements apply to all entities, and which requirements are additional to SFIs only. This has involved some minor edits to the way certain requirements have been expressed.

Guidance

Throughout consultation, many respondents requested further guidance to assist in the implementation of CPS 190. APRA has addressed the majority of this feedback via a draft prudential practice guide (PPG) to accompany the new standard, which was released for consultation in September 2022. Entities can provide feedback on APRA’s draft PPG in the period to 6 December 2022.6

APRA’s draft PPG is intended to assist entities in meeting the requirements of CPS 190. It provides further explanation of the outcomes that APRA expects and includes guidance for key sections of the proposed standard. It is principles-based, rather than prescriptive, to cater to a diverse range of regulated entities, and sets out examples of better practice. It has been informed by APRA’s supervisory findings, international benchmarking and lessons learned through recent episodes of stress.

Application

The application of the prudential standard to different industries was a key area of feedback. It was suggested through consultation that APRA could consider developing industry-specific requirements, rather than the proposed approach of applying the standard on a cross-industry basis. Some respondents suggested that cross-industry requirements may not adequately capture the differences in risks faced by APRA-regulated entities.

In APRA’s view, it is important that all entities are held to a common set of principle-based requirements for recovery and exit planning. In releasing draft guidance to accompany CPS 190, APRA has sought to demonstrate how the requirements of CPS 190 would apply to different industries. This includes providing examples of better practices that are relevant to banks, insurers and RSE licensees.

In finalising CPS 190, APRA has also clarified requirements for foreign bank branches. These entities would not be required to meet the requirements of CPS 190, unless they are individually instructed to by APRA. Importantly, foreign bank branches will continue to be subject to recovery planning requirements in their home jurisdictions. APRA may subject a foreign bank branch to CPS 190 where, for example, the entity has a material presence in Australia or there is a potential threat to its viability.

Some respondents also requested clarity regarding whether entities would be permitted, under CPS 190, to develop a consolidated recovery and exit plan, where there are multiple regulated entities within a group. Under the standard, each regulated entity must be able to demonstrate how they individually meet the relevant requirements of CPS 190. Entities would be expected to form their own view on whether this is best achieved through a consolidated group plan or separate individual plans.

Credibility of plans

Some entities sought clarity on APRA’s expectations where certain recovery or exit actions may not be credible for them. This has been a particular focus for APRA’s guidance, which is currently out to consultation in a draft form and includes advice to assist entities in making such assessments.

APRA’s draft guidance to CPS 190 provides entities with a framework for assessing credibility. In broad terms, the type of actions that would be considered credible will differ according to the industry an entity operates in, its ownership structure, its business model and its risk profile.7

Integration

Some submissions sought clarity on how CPS 190 would interact with other parts of the prudential framework, including the Internal Capital Adequacy Assessment Process (ICAAP) that is required for banks and insurers. There was a particular focus on understanding how granular the modelling of CPS 190 scenario analysis should be. Some entities sought clarity on how recovery planning should be used in the setting of capital targets.

As set out in APRA’s draft guidance to CPS 190, it is important that there are strong linkages between the ICAAP, stress tests, and recovery and exit plans. In particular, prudent entities would use their assessment of recovery capacity to inform the setting of capital targets. Where recovery capacity is insufficient for restoring financial resilience following stress, a prudent entity would reflect this in higher capital targets.

The focus of scenario analysis is to assess the effectiveness of recovery and exit actions in scenarios that may threaten an entity’s viability. Prudent entities would leverage existing stress tests for these purposes, where appropriate. It is important, for demonstrating credibility, that the recovery and exit plan is continually tested under a range of different scenarios.

Supervision

Some respondents requested further clarity on the way APRA intends to supervise entities under CPS 190, particularly non-SFIs. The prudential standard sets out the minimum legally-enforceable requirements that entities must adhere to, with non-SFIs subject to a smaller set of minimum requirements. Non-SFIs that meet better practices, above minimum requirements, would have this reflected in a lower risk rating under APRA’s Supervision Risk and Intensity (SRI) model. Recoverability is a key determinant of an entity’s risk rating for financial resilience.8

Footnotes

1 APRA released draft CPS 190 for consultation in December 2021. See Draft Prudential Standard CPS 190 Financial Contingency Planning. APRA received 23 submissions to the consultation, and has published non-confidential submissions on APRA’s website.

2 See Transfer planning in superannuation: proposed enhancements and APRA releases discussion paper on financial resources for risk events in superannuation.

3 See paragraphs 22-23 of Prudential Practice Guide SPG 515 Strategic and Business Planning.

4APRA is also consulting on new cross-industry reforms aimed at improving business continuity planning to ensure that APRA-regulated entities are prepared to respond to severe business disruptions, and maintain critical operations. See Discussion paper - Strengthening operational risk management.

5 The draft CPS 190 separated the standard into two sections: Part A listed the requirements relevant to SFIs; and Part B listed the requirements relevant to non-SFIs.

6 See Strengthening crisis preparedness.

7 Some entities may have limited credible actions for restoring their financial resilience, such as certain RSE licensees; APRA would expect these entities to focus more on exit actions. In contrast, systemically important entities may have few credible options for exiting regulated activity in an orderly and solvent manner.

8 See APRA Information Paper Supervision Risk and Intensity (SRI) Model.