Quarterly authorised deposit-taking institution performance statistics - highlights

Key messages

- Stagnant income growth caused a slight decline in profitability across the banking sector. Margins remained tight as competitive pressures remain. Net interest income fell slightly while funding costs increased. Market expectations of a decrease in the cash rate could pose further challenges for margins and profitability.

- ADIs completed the final repayments of the Term Funding Facility smoothly. Liquidity levels remained well above regulatory minimums.

- Overall asset quality remained sound, despite a continued gradual increase in non-performing loans. Losses from these non-performing loans remained minimal, as rising house prices enabled borrowers who faced repayment difficulties to sell their properties and discharge the loan at breakeven or better.

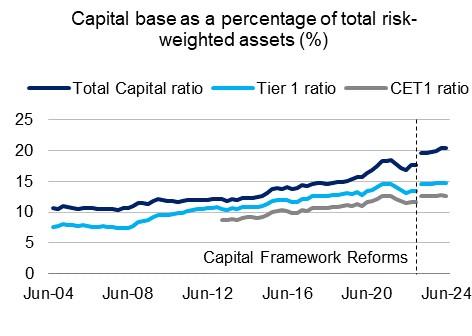

- ADIs are well-capitalised despite a slight decline in capital ratios over the quarter. Capital levels remain near all-time highs, well above the unquestionably strong benchmarks. Capital levels have been bolstered by the domestic systemically important banks (D-SIBs) increasing tier two capital to meet APRA’s loss-absorbing capacity requirements.

Financial performance

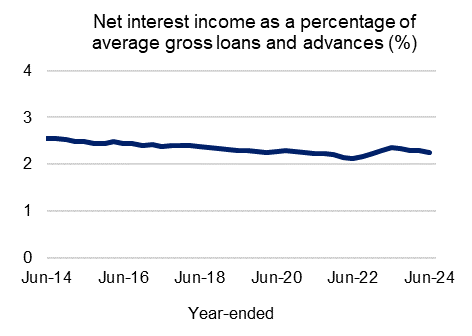

Competition continued to weigh on net interest income, as margins slightly declined.

- ADIs continued to offer competitive pricing which placed pressure on their margins. As a percentage of gross loans and advances, net interest income declined marginally to 2.25 per cent. This remained above the historical low in June 2022 of 2.1 per cent, though any easing in the cash rate may cause additional downward pressure.

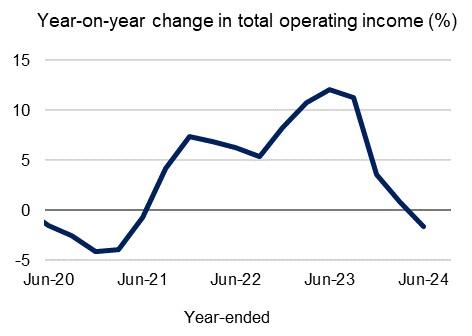

- The decline in margins flowed through to income. Total operating income declined over the year to June 2024 by 1.6 per cent.

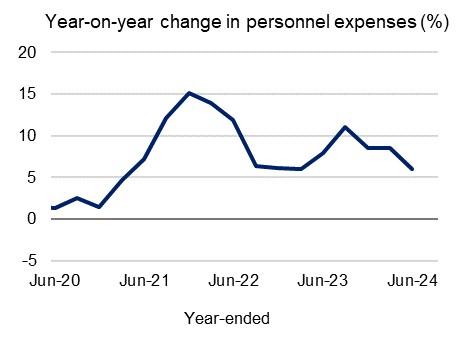

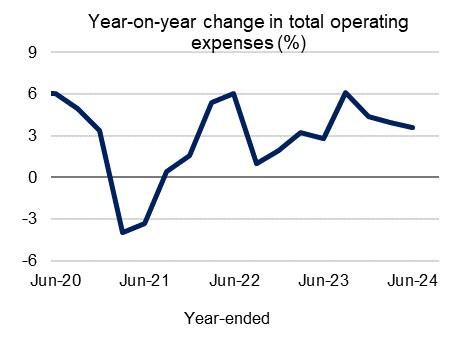

Operating expenses continued to grow, driven in part by elevated wage growth.

- Personnel expenses remained elevated, increasing 5.9 per cent over the year. Wage growth for the banking sector is higher than other financial services, with the broader “Financial and Insurance Services” category reporting a 3.6 per cent WPI growth.

- Some ADIs announced redundancies over 2023 and 2024 which may have contributed to the easing seen in June.

- Other expenses remained broadly stable, and growth in total operating expenses eased slightly to 3.6 per cent in June 2024.

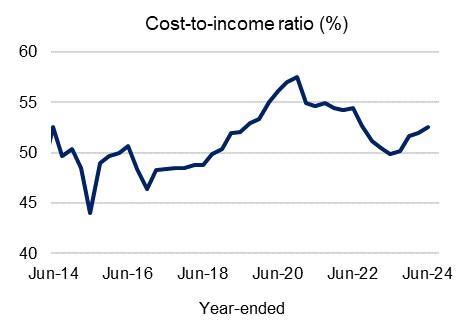

Declining income and growth in expenses led to a deterioration in the ratio of cost-to-income…

- The industry’s cost-to-income ratio increased to 52.5 per cent over the year to June 2024. This marks the fourth consecutive quarter of increases, though remained below their pandemic peak. With the possibility of margin compression over the medium-term weighing on income growth, ADIs may face increased pressure to reduce growth in expenses.

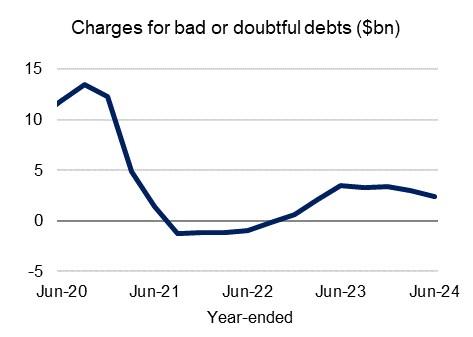

…but credit losses remained very low, supported by rising asset prices.

- The charge for bad and doubtful debts for the year ending June 2024 fell by $1.1 billion compared to the previous year. A key driver of this result was the security profile of loan portfolios. Rising asset prices, particularly in the housing market, help mitigate potential credit losses from loan defaults.

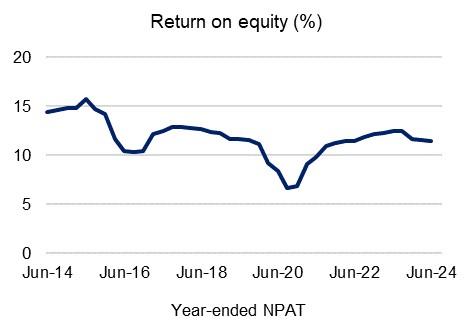

Net profit declined, with low credit losses not offsetting stagnant income and rising costs.

- Net profit after tax (NPAT) was $39.0 billion for the year to June 2024, which is a marginal decline of $456 million compared to the year ended March 2024. Return on equity (ROE) declined by 60 basis points to 10.5 per cent over the quarter, though remained broadly in line with levels seen over the past decade.

Liquidity

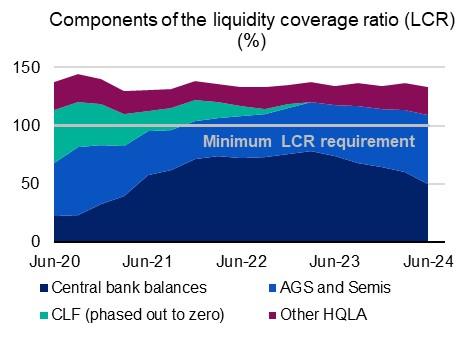

The final repayments of the Term Funding Facility were well-managed by ADIs.

- ADIs successfully completed the final repayments of the Term Funding Facility (TFF) in the June 2024 quarter. This contributed to a large decline in central bank balances, which led to a 2.1 per cent decline over the quarter in high-quality liquid assets (HQLA). These central bank balances were largely replaced with Australian Government securities (AGS) and Semi-Government securities (Semis).

- Net cash outflows increased marginally by $5.7 billion over the quarter. Along with the decline in HQLA, this resulted in the liquidity coverage ratio (LCR) declining by 3.6 percentage points to 133.0 per cent. This remained well above the regulatory minimum of 100 per cent.

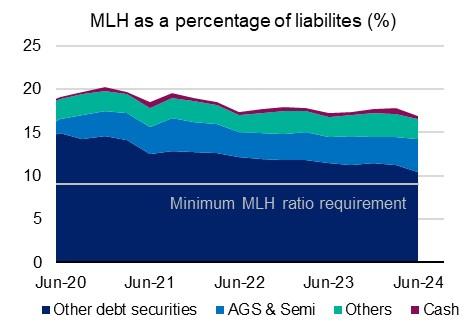

Smaller ADIs’ liquidity positions were also stable and above regulatory minimums.

- The minimum liquidity holding (MLH) ratio, which is applicable to smaller, less complex ADIs, declined from 17.8 per cent to 16.9 per cent over the quarter. This is well above the regulatory minimum of 9 per cent.

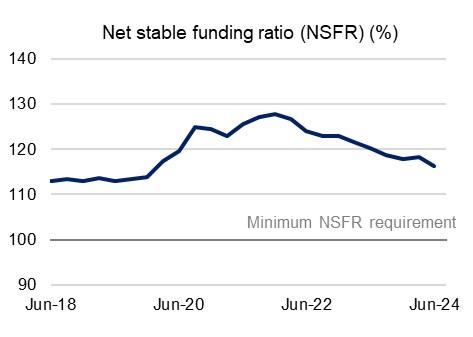

The industry’s funding base continued to normalise and return to pre-pandemic levels.

- The industry’s aggregate net stable funding ratio (NSFR) declined by 2 percentage points to 116.2 per cent, remaining well above the minimum NSFR requirement of 100 per cent. The NSFR has been returning to the long-term average as pandemic measures continue to wind down.

Asset quality

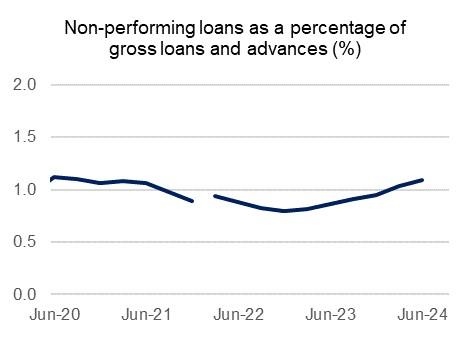

Overall asset quality remained sound despite an increase in non-performing loans.

- Despite persistent inflation and elevated interest rates, non-performing loans (NPLs) remained low. As a share of total loans, NPLs increased 5 basis points to 1.1 per cent over the June quarter. This was a slower increase than the 9 basis point increase reported over the prior quarter.

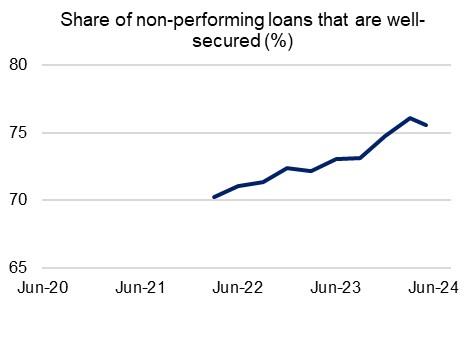

High levels of collateral are supporting bank balance sheets.

- Bank lending remains very well secured, supported by rising asset prices. The share of NPLs that are well-secured fell slightly from 76.1 per cent to 75.5 per cent in June 2024. A well-secured loan is a loan where the value of its collateral is sufficient to cover the outstanding loan amount. This high level of security limits losses for ADIs.

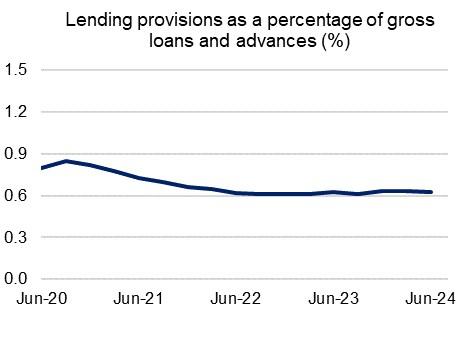

- The industry is resilient and well-positioned to manage any future credit losses. Provisioning coverage remained stable at 0.62 per cent.

Capital

Capital ratios fell very slightly in June, impacted by seasonality as some large banks declared dividends over the quarter.

- The Common Equity Tier 1 (CET1) and Tier 1 ratios were 12.7 per cent and 14.7 per cent, respectively. ADIs remain very well capitalised with some of the highest capital ratios in the world.

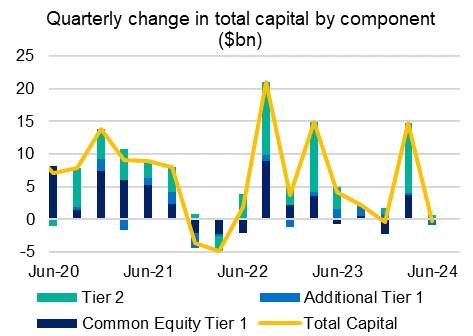

Components of total capital were broadly unchanged over the quarter.

- A slight decrease in Total Capital was partially offset by the issuance of $1.2 billion of Tier 2 capital instruments by domestic systemically important banks (D-SIBs). These ADIs have largely already met the loss absorbing capacity (LAC) requirements, which come into effect from 1 January 2026.

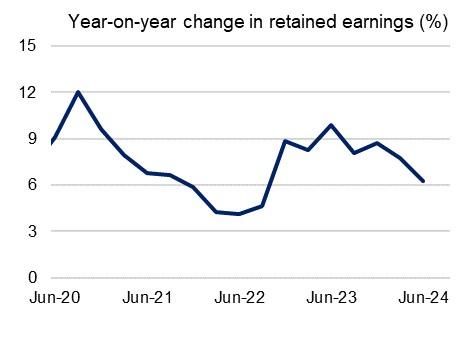

- Growth in retained earnings remained within historic averages, growing at 6.3 per cent over the year. Some banks have increased their dividend payout ratio, with more earnings being returned to shareholders.

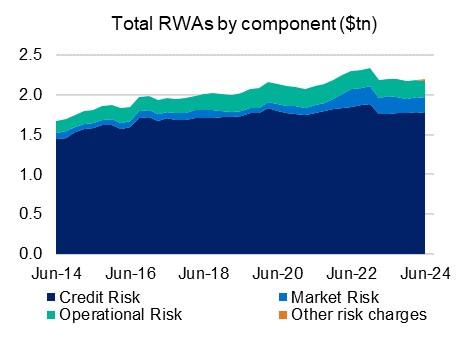

Risk-weighted assets were broadly stable.

- Total risk-weighted assets (RWAs) increased marginally over the quarter by 0.3 per cent, driven by operational risk and other risk charges.

Population changes

The number of ADIs on a consolidated group basis operating in Australia declined from 138 to 135 over the quarter:

- Credit Suisse AG had its licence revoked, ceasing to be an APRA regulated ADI as at 3 June 2024, in line with action taken by the parent entity overseas.

- Macquarie Credit Union Limited had its licence revoked, ceasing to be an APRA regulated ADI as at 13 May 2024, following the merger with Regional Australia Bank.

- Lithuanian Co-operative Credit Society ‘Talka’ Limited had its licence revoked, ceasing to be an APRA regulated ADI as at 27 May 2024, following the merger with Bank Australia.

Additionally, during the quarter:

- Challenger Bank Limited changed its name to Heartland Bank Australia Limited and was reclassified from an ‘other ADI’ to a foreign subsidiary bank, effective 13 June 2024.