Prudential Practice Guide - SPG 516 - Business Performance Review

About this guide

Prudential practice guides (PPGs) provide guidance on APRA’s view of sound practice in particular areas. PPGs frequently discuss legal requirements from legislation, regulations or APRA’s prudential standards, but do not themselves create enforceable requirements.

Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) sets out APRA’s requirements for a registrable superannuation entity (RSE) licensee (RSE licensee) to annually assess its performance in achieving its strategic objectives, incorporating monitoring of its business plan, the outcomes delivered to different cohorts of beneficiaries and the annual outcomes assessment under section 52 of the Superannuation Industry (Supervision) Act 1993 (SIS Act).

An RSE licensee that identifies, under the business performance review, opportunities to improve its performance is required to consider what changes should be made to its operations, as part of its business planning process. Accordingly, APRA expects Prudential Practice Guide SPG 516 Business Performance Review (SPG 516) would be read in conjunction with Prudential Practice Guide SPG 515 Strategic and Business Planning.

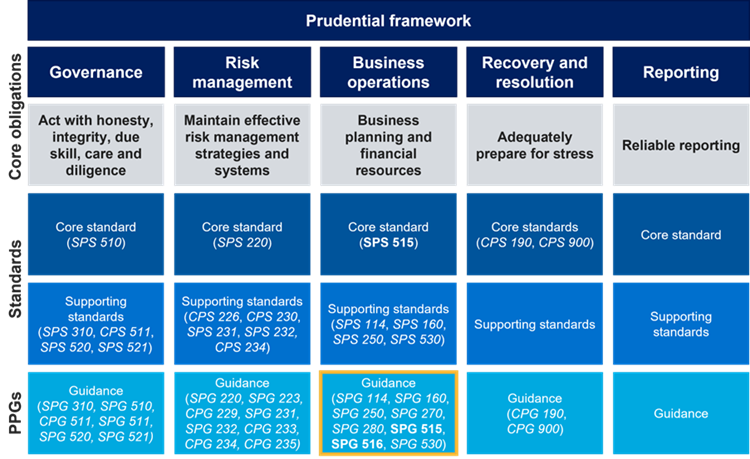

The graphic below summarises APRA’s prudential framework, showing the location of SPG 516 in the business operations pillar.

An accessible version of this figure is available here.

Subject to the requirements of RSE licensee law1, an RSE licensee has the flexibility to structure its business operations in the way most suited to achieving its strategic objectives. Not all practices outlined in this PPG will be relevant for every RSE licensee and some aspects may vary depending upon the size, business mix and complexity of the RSE licensee’s business operations.

For the purposes of this guide and consistent with the application of SPS 515, ‘RSE licensee’ has the same meaning given in section 10 of the SIS Act.

For the purposes of this guide and consistent with SPS 515, where an RSE licensee is required to ‘demonstrate’ a matter, that term requires the RSE licensee to prove or show the matter both in written form and in practice. This emphasises that APRA expects matters to not only be appropriately documented but importantly to be evidently put into practice.

Footnotes

1 Refer to section 10 of the SIS Act for the definition of ‘RSE licensee law’.

Glossary

APRA | Australian Prudential Regulation Authority |

|---|---|

Heatmaps | APRA’s superannuation heatmaps |

ORFR | Operational risk financial requirement |

PPG | Prudential practice guide |

RSE | Registrable superannuation entity as defined in section 10(1) of the Superannuation Industry (Supervision) Act 1993 |

RSE licensee | RSE licensee as defined in section 10(1) of the Superannuation Industry (Supervision) Act 1993 |

SIS Act | Superannuation Industry (Supervision) Act 1993 |

SIS Regulations | Superannuation Industry (Supervision) Regulations 1994 |

SPG 515 | Prudential Practice Guide SPG 515 Strategic and Transfer Planning |

SPG 516 | Prudential Practice Guide SPG 516 Business Performance Review |

SPS 160 | Prudential Standard SPS 160 Defined Benefit Matters |

SPS 515 | Prudential Standard SPS 515 Strategic Planning and Member Outcomes |

Chapter 1 - Business performance review

1. The business performance review is intended to provide the Board with a detailed understanding of the performance of its business operations in achieving its strategic objectives and is therefore critical to setting the future direction of the business, and is an important tool to identify areas for improvement.

2. Where an RSE licensee’s business performance review demonstrates a consistent pattern of underperformance in either absolute or relative terms, APRA expects an RSE licensee would demonstrate how, in light of this underperformance, it considers it is meeting, and will continue to meet, its obligations to act in the best interests of, and to promote, the financial interests of beneficiaries.

3. APRA expects an RSE licensee would put in place a robust and objective approach for undertaking the business performance review, using appropriate metrics and analysis. A ‘set and forget’, or wholly compliance-focused approach is not sufficient to support the consistent provision of quality outcomes for beneficiaries. This approach would also ordinarily ensure an appropriate focus on potentially systemic or widespread underperformance issues, rather than just idiosyncratic issues.

4. It is open to an RSE licensee to design its business performance review in a manner that reflects the structure of its business operations, including the range of products, investment options, sub-plans and retirement products offered to beneficiaries, and the RSE licensee’s understanding of its membership base. The design of the business performance review would be informed by an appropriate mix of data and sources.

5. A prudent RSE licensee would take reasonable steps to ensure the quality and accuracy of both internally and externally sourced data used in undertaking the business performance review.

6. APRA expects an RSE licensee would regularly consider how the design and process for undertaking the business performance review can be improved, to ensure it reflects changes in the RSE licensee’s business operations, and RSE membership, products and services.

7. APRA expects an RSE licensee would align or sequence the timing of the outcomes assessment and business performance review so they can be incorporated in the annual business planning process.

8. In certain circumstances, it may be appropriate for an RSE licensee to engage an external expert to access specialist expertise, associated data or to provide an independent view of the delivery of outcomes. An RSE licensee would demonstrate how an external expert or service provider has contributed to the business performance review and that their contribution has been reviewed or validated by the RSE licensee.

Scope of the business performance review

26. An RSE licensee’s business performance review must assess and demonstrate, at a minimum:

a) whether the strategic objectives are being met, including an explanation of what has driven this assessment;

9. The use of group policies may enable an RSE licensee to operate in a manner that is consistent with the group. When approving the use of group policies, a Board would demonstrate why it considers the policies to be appropriate to deliver outcomes to beneficiaries, including how conflicts between RSE licensee policies and group policies are to be managed, in accordance with the requirements of Prudential Standard SPS 521 Conflicts of Interest, as well as how the Board will be engaged in the process of reviewing these policies over time.

10. Factors that APRA expects an RSE licensee to cover in the business performance review include, but are not limited to:

a) the investment strategy for each investment option;

b) the insurance strategy and the insurance arrangements to address the strategy;

c) options, benefits and facilities provided to beneficiaries, including the availability of employer subsidised fees to certain member cohorts;

d) the fee structures adopted by the RSE licensee;

e) the scale of the RSE licensee’s business operations;

f) the objectives of the retirement income strategy; and

g) the costs incurred by the RSE licensee to operate and manage its business operations.

Cohort analysis

26. An RSE licensee’s business performance review must assess and demonstrate, at a minimum:

b) the outcomes achieved for beneficiaries, having regard to: (i) different cohorts of beneficiaries, including beneficiaries who are retired or approaching retirement (and sub-classes of those beneficiaries);

11. Appropriately segmenting beneficiaries into meaningful cohorts will assist an RSE licensee to have a deeper understanding of the needs of beneficiaries, which differ between the accumulation and retirement phases. Assessing the RSE licensee’s performance at a cohort level in the business performance review is intended to complement the annual outcomes assessment, which requires a point-in-time reflection on how the product has performed for the beneficiaries that hold the product. Establishing meaningful cohorts enhances the RSE licensee’s ability to appropriately benchmark its performance, to identify underlying trends and emerging issues and to take continuous steps to improve the outcomes delivered. Conversely, poor cohorting can result in provision of services that do not match the needs of beneficiaries or could lead to cross-subsidisation of services across membership cohorts.

12. An RSE licensee may determine cohorts of beneficiaries in a manner that best reflects its membership, provided each member is captured in at least one cohort. Meaningful cohorts would enable an RSE licensee to identify where poor outcomes may be experienced among groups of members. Individual beneficiaries may be included within multiple different cohorts across an RSE based on their particular attributes. Refer to Table 1 for illustrative examples to assist setting cohorts.

13. APRA expects a prudent RSE licensee would go beyond a product-based cohort analysis to ensure that the business performance review provides valuable insight into achievement of strategic objectives. For example, an RSE licensee may be able to use age pension eligibility to inform tailored assistance for beneficiaries in or approaching retirement.

14. APRA expects that an RSE licensee would segment beneficiaries into cohorts to support better understanding of beneficiaries’ retirement needs, with a view to achieving the objectives of its retirement income strategy. APRA expects such cohorts would be informed by appropriate information sources, including both internal data on its membership and external data sources. The target market, as described in the target market determination for products the RSE licensee offers, may assist with cohort construction. Given the continually changing nature of the membership in or approaching retirement, a prudent RSE licensee would regularly review its approach to cohorts and the data informing these cohorts to ensure they remain relevant.

Table 1. Additional considerations that may inform how an RSE licensee approaches cohort setting

Additional considerations to cohort setting – illustrative examples | |

Product features | Assessing how different product features affect the outcomes, including whether member benefits are being eroded by fees or whether there is potential cross-subsidisation in fees and costs across the membership base. |

MySuper product members | Using demographic data (e.g. age, gender), balance size or occupation-type. For MySuper lifecycle products, lifecycle stages, representing age-based cohorts, can be a useful starting point for undertaking comparisons and benchmarking. |

Choice products (other than platform products) | Applying a similar approach to the MySuper approach where the RSE licensee offers pre-mixed investment options. |

Platform products | Grouping a number of investment options to form a choice member cohort, for example, based on asset class, investment strategy, life stages, and/or how fees are set and charged. |

Defined benefit cohorts | Determining, consistent with the requirements in Prudential Standard SPS 160 Defined Benefit Matters, whether, on the basis of actuarial advice, future benefits of beneficiaries are expected to be fully funded by the time they become due and payable. |

Legacy/closed products | Demonstrating a reasonable basis for maintaining the legacy/closed products given that alternative products may be available within the RSE licensee, or offered by other RSE licensees, with potentially better outcomes for beneficiaries. |

Outcomes of the retirement income strategy

15. APRA expects an RSE licensee would, in its business performance review, demonstrate how its retirement income strategy has delivered appropriate outcomes for beneficiaries, including appropriate assistance to beneficiaries who are retired or approaching retirement, to achieve and balance the retirement objectives set out in section 52AA(2) of the SIS Act. This includes examining a variety of measures to assess the success of its retirement income strategy and how retirement outcomes can be improved.

16. APRA expects that an RSE licensee would develop metrics to measure the outcomes sought for beneficiaries in or approaching retirement, and track the success of these metrics, to inform the continual improvement of outcomes for these beneficiaries. This would involve a mix of specific, measurable, quantitative and qualitative metrics to measure how the outcomes delivered to members are considered. Such metrics may include, but are not limited to, changes to the rate of regular pension drawdown and member confidence in meeting their retirement goals.

17. APRA expects an RSE licensee to examine how it provides assistance to beneficiaries and whether this assistance is fit for purpose by tracking and testing the take-up rates and usefulness of assistance. Identifying which types of retirement products, information, tools and advice are likely to be most relevant to members is crucial to identify the channels more likely to be most effective in delivering good member outcomes.

Internal and external benchmarks

26. An RSE licensee’s business performance review must assess and demonstrate, at a minimum:

(b) the outcomes achieved for beneficiaries, having regard to: (ii) objective internal and external benchmarks; and

18. Objective benchmarks support an RSE licensee undertaking an unbiased assessment of performance in respect of different cohorts. APRA expects an RSE licensee to demonstrate how its approach to benchmarking results in objective and rigorous analysis of the outcomes achieved.

19. APRA expects that an RSE licensee would have regard, as appropriate, to the methodology used in determining the legislated annual performance assessment in Part 6A of the SIS Act (including the components of the 'performance measure'), and the methodology used for APRA's superannuation heatmaps (including relevant metrics) as objective benchmarks.

20. An RSE licensee may incorporate the product-based metrics and/or benchmarks required under the outcomes assessment into the business performance review where they are relevant to assessing the outcomes delivered to different cohorts invested in the relevant products. Factors that APRA expects an RSE licensee would consider when setting benchmarks include net returns, investment performance, fees and costs and insurance premiums and retirement incomes.

21. It is open to an RSE licensee to also consider internal benchmarks when conducting the business performance review. This may include comparing outcomes delivered by products or options that a member could access within the same RSE or across the RSE licensee’s business operations. For example:

a) comparison of performance and outcomes across multiple MySuper products within an RSE licensee’s business operations;

b) comparison of performance and outcomes for different member cohorts invested in similar choice products or options within an RSE licensee’s business operations; or

c) comparison of outcomes for beneficiaries under different fee arrangements, or the performance of similar investment options across the different advisor and dealer group channels.

Table 2. Factors to consider when setting benchmarks

Type of benchmark | Factors to consider |

Investment |

|

Fees and costs |

|

Insurance |

|

Retirement incomes |

|

Consideration of the outcomes assessment

26. An RSE licensee’s business performance review must assess and demonstrate, at a minimum:

(b) the outcomes achieved for beneficiaries, having regard to: (iii) the outcomes assessments under section 52(9) of the SIS Act, including having regard to the latest determination (if any) made by APRA under section 60C(2) of the SIS Act that related to the product.

22. A prudent RSE licensee would include, to the extent appropriate, the analysis underlying its assessment of the outcomes achieved for beneficiaries for each product in the business performance review.

23. APRA expects an RSE licensee would consider the degree to which the results of the comparison and analysis under sections 52(10), 52(10A) and 52(11) of the SIS Act, which in most circumstances will relate to the previous financial year, are relevant to the business performance review. Where outcomes assessment analysis has been superseded by more current data, APRA expects that an RSE licensee would highlight this in its business performance review.

Chapter 2 - Outcomes assessment

27. An RSE licensee must, at a minimum, document the methodology applied in undertaking the annual outcomes assessment under section 52(9) of the SIS Act, including:

a) how the RSE licensee has balanced the factors it must have regard to under sections 52(10) or (10A) and section 52(11) of the SIS Act and any benchmarks under the Superannuation Industry (Supervision) Regulations 1994 (the SIS Regulations) in making its overall determination(s) under section 52(9); and

b) how the RSE licensee has determined the products it will use for the purposes of comparing its MySuper or choice products. Where a product, or part of a product is assessed under the legislated annual performance assessment under Part 6A of the SIS Act, an RSE licensee’s methodology must demonstrate how it has taken into account the population of products against which it was assessed.

24. The annual outcomes assessment required under section 52(9) of the SIS Act is a key accountability and transparency obligation on all RSE licensees that offer MySuper and choice products. It enables an RSE licensee to publicly demonstrate its performance in promoting the financial interests of the beneficiaries that hold its MySuper and choice products. The assessment, and determination, is required to be completed at the individual product level, not at the RSE licensee or RSE level. For the avoidance of doubt, the outcomes assessment does not apply to defined benefit products.

25. Where an RSE licensee transfers members’ benefits from an RSE (the transferring RSE) to another RSE (the receiving RSE) by way of successor fund transfer before the next assessment is due, the transferring RSE licensee is not required to make and publish the determination in respect of the products that they no longer offer. Rather, the RSE licensee of the receiving RSE will be required to undertake the outcomes assessment for the existing product into which the members’ benefits are transferred. If the members’ benefits are transferred into a new stand-alone product in the receiving fund, an RSE licensee may consider whether it is in the members’ interests to continue the same outcomes assessment cycle established in the transferring RSE or adopt the cycle of the receiving RSE.

26. Central to a rigorous outcomes assessment is an RSE licensee being able to demonstrate that the methodology focuses on factors directly relevant to the financial interests of beneficiaries in undertaking the two steps of the assessment as outlined below.

Outcomes assessment methodology

27. APRA expects an RSE licensee’s outcomes assessment methodology would include:

a) the selection of the relevant 12-month period. It is open to an RSE licensee to determine whether the 12-month period is a calendar year, financial year, income year for the RSE licensee or any other 12-month period;

b) when the outcomes assessment is to be undertaken, including how it will incorporate APRA’s heatmaps and the results of the performance test;

c) data sources;

d) the framework or approach to undertaking the comparison and to assessing the relevant factors, including how changes in factors affect the overall product determination; and

e) the staff responsible for undertaking the assessment, including the use of external providers, if applicable.

28. The outcomes assessment requires an RSE licensee to reach a conclusion about the promotion of the financial interests of the beneficiaries that hold the product. As a consequence, APRA expects an RSE licensee would treat net returns delivered to beneficiaries as a primary consideration in reaching the overall determination for each product.

29. APRA expects an RSE licensee would regularly review its methodology, including where it might be enhanced to reflect better practices based on information published by other RSE licensees.

Timing and sequencing of the assessment

30. Access to publicly available data on product and fund performance is key to meeting the outcomes assessment requirements. This includes, where relevant, the published results of the performance test, APRA’s heatmaps and any other relevant publications issued by APRA.

31. APRA expects an RSE licensee would generally endeavour to undertake the annual outcomes assessments for each MySuper and choice product within two months of the publication of APRA’s most recent heatmaps, informed by other relevant publications issued by APRA.

32. APRA considers that the outcomes assessment determinations would occur immediately prior to completing the business performance review to enable the results of the assessments and underlying analysis, where appropriate, to be included in the review. This supports the business performance review informing the business planning process.

Assessing MySuper lifecycle products

33. APRA expects an RSE licensee’s approach to an outcomes assessment for a MySuper lifecycle product would, in addition to comparing the product as a whole, with other MySuper products, consider the benefits of:

a) comparing different lifecycle stages with relevant single strategy MySuper products (for example, with a similar asset allocation); and

b) appropriate lifecycle stages of other MySuper lifecycle products.

34. APRA expects that the determination and summary information published on an RSE licensee’s website would include information on all lifecycle stage comparisons.

Step 1: Determine comparison metrics

28. For the purposes of comparing a MySuper product with other MySuper products under section 52(9)(a)(i) of the SIS Act, an RSE licensee must calculate the comparison factors as follows:

a) for section 52(10)(a)-(b) of the SIS Act, use the methodologies set out in Reporting Standard SRS 705.0 Components of Net Return and Reporting Standard SRS 705.1 Investment Performance and Objectives; and

b) for section 52(10)(c) of the SIS Act, use the methodology set out in Reporting Standard SRS 700.0 Product Dashboard.

35. The first step of the outcomes assessment is to compare the relevant product against other products based on three metrics listed at section 52(10) or section 52(10A) of the SIS Act, as appropriate. Section 52(9)(a)(i) and (ii) of the SIS Act and SIS regulation 4.01A together require an RSE licensee to compare their MySuper product and relevant choice products based on the benchmark of whether the requirement in subsection 60D(1) was met in respect of the product being assessed.

36. This comparison results in an absolute metric and the relative placing of the product against the comparison products. For example, the comparison results in a MySuper product placing in respect of the performance test benchmark calculated with respect to fees and costs and net return. The RSE licensee may also use quartile comparison or graphical representations of the results.

37. For ‘fees and costs’ and ‘the level of investment risk’, the time period for comparison is limited to the one year period covered by the outcomes assessment.

Comparing MySuper products

38. When comparing MySuper product returns, APRA expects an RSE licensee present representative member investment performance for multiple time periods, for example, three, five, eight and 10 years (where the product has that history) against all other MySuper products with that history.

39. APRA expects an RSE licensee’s approach to combining performance history would be consistent with APRA’s methodology for combining the investment performance of products in the performance test.2

Comparing choice products (that are not retirement income products)

40. Section 52(9)(a)(i) and (ii) of the SIS Act and SIS regulation 4.01A together require an RSE licensee to compare their MySuper product and relevant choice product(s) based on the benchmark of whether the requirement in subsection 60D(1) was met in respect of the product being assessed.

41. The comparison of a choice product would ordinarily include a comparison based on whether the choice product’s investment options passed or failed the performance assessment (regardless of whether all investment options which comprise the choice product are subject to the performance assessment).

42. APRA expects an RSE licensee’s outcomes assessment for a choice product would be informed by benchmarking, including APRA’s heatmaps and other relevant publications, and comparison with appropriate peer groups.

Comparing retirement income products

43. Analysis and comparison of retirement income products supports an RSE licensee to assist beneficiaries who are in or approaching retirement to achieve and balance their retirement objectives. APRA expects an RSE licensee would consider how the features of retirement income products it offers compare to other similar products.

44. Where an RSE licensee offers an account-based pension product, APRA expects the RSE licensee would compare both outcomes, such as investment performance and fee levels, and product features. Gathering information on features of similar products supports a deeper understanding of how an RSE licensee’s products compare and can inform the continual improvement of the delivery of the RSE licensee’s retirement income strategy (noting that pension features will be constrained by the SIS Regulations).

45. For products with unique features, APRA expects the RSE licensee to regularly review the appropriateness of these features for its membership, analyse take-up rates and compare these to other comparable products.

Step 2: Assessment of specified factors

29. Pursuant to section 52(11)(e) of the SIS Act, in determining whether the financial interests of beneficiaries of the RSE who hold a MySuper product or choice product are being promoted, an RSE licensee must also assess the following matters:

a) whether, because of the scale of, and within, the RSE licensee’s business operations, those beneficiaries are disadvantaged;

b) whether the operating costs of the RSE licensee’s business operations are inappropriately affecting the financial interests of those beneficiaries; and

c) whether the basis for the setting of fees is appropriate for those beneficiaries.

46. The second step of the outcomes assessment is to assess how specified factors promote the financial interests of beneficiaries invested in the MySuper or choice product. A prudent RSE licensee would demonstrate a comprehensive understanding of its membership base when concluding how each of the specified factors promote the financial interests of beneficiaries.

47. SPS 515 includes three additional factors to those listed under section 52(11) of the SIS Act. It is important that this assessment be informed by the prudential requirements and guidance relevant to these factors, for example the relevant investment governance and insurance prudential standards. APRA also expects an RSE licensee would, to the extent relevant, ensure this assessment is informed by APRA’s most recent heatmap publication.

48. In addition to the requirements of section 52(9)(a)(i)-(ii) of the SIS Act and SIS regulation 4.01A, section 52(9)(a)(iv) of the SIS Act requires an RSE licensee to have regard to the latest performance test determination (if any) made by APRA for their product, i.e. the RSE licensee must consider the most recent pass or fail result when determining whether the financial interests of the beneficiaries holding the product are being promoted.

49. As noted in the Treasury Laws Amendment (Your Future, Your Super) Bill 2021 Revised Explanatory Memorandum, an RSE licensee of a product that fails the annual performance assessment will find it very difficult to show that the product is promoting the financial interests of beneficiaries in their annual outcomes assessment.3

Options, benefits and facilities

50. Beneficiaries are generally charged for a range of options, benefits and facilities related to the superannuation products they hold. Common services include those relating to investment, administration, education and communications and the cost of managing the business operations. Services provided to beneficiaries may include access to call centres, education, intra-fund advice (where made available), online account information and other services that may be provided by an RSE licensee or a third party on behalf of an RSE licensee.

51. APRA expects an RSE licensee would determine the extent of the impact of the cost of services on the financial interests of beneficiaries, as reflected in the fees and the ultimate returns to beneficiaries. For example, where costs or fees are measured as exceeding a set benchmark (e.g. of a median cost fund), the RSE licensee would demonstrate the value of additional services or features through evidence of additional member take up.

52. APRA expects that assistance provided by an RSE licensee to beneficiaries would be fit for purpose and informed by appropriate and regular data gathering and ongoing analysis of the characteristics of the membership and member cohorts. In relation to beneficiaries of an RSE who are retired or approaching retirement, APRA expects an RSE licensee would assess the needs of such beneficiaries on an ongoing basis and use this analysis to inform their approach in determining how to best assist those beneficiaries to achieve and balance the objectives outlined in section 52AA(2) of the SIS Act.

Investment strategy

53. Analysing how the investment strategy is contributing to the outcomes assessment would ordinarily consider whether the expected investment outcomes are being achieved and whether the investment outcomes remain appropriate for the membership.

54. Given that investment strategies are required to be set at fund level and investment option level (including each MySuper product), an RSE licensee may not have an investment strategy for a relevant choice product. In such cases, APRA expects an RSE licensee would consider all option investment strategies relevant to the product in forming a view of the appropriateness of these strategies.

55. In addition to the comparison metrics under sections 52(10) and 52(10A) of the SIS Act, APRA expects an RSE licensee would undertake sufficient analysis of net returns to understand the drivers of performance and the risk taken to generate the returns, and to identify any emerging trends, including persistent underperformance.

56. An RSE licensee may use metrics and benchmarks that assess returns relative to risk or to a relevant peer group to provide additional insights. However, APRA considers it would be inappropriate to select benchmarks or peer groups that are overly narrow or likely to bias the assessment in favour of the RSE licensee’s product.

57. A prudent RSE licensee would consider the glide path design in determining the appropriateness of the investment strategy for a MySuper lifecycle product, including the de-risking approach to asset allocation and the level of growth assets throughout the glide path. Further, an RSE licensee would assess how each lifecycle stage is contributing to the investment outcomes of the MySuper product and whether each stage is performing within expectations given its role in the glide path.

Insurance strategy and insurance fees

58. APRA expects an RSE licensee would assess the appropriateness of the RSE level insurance strategy and corresponding insurance costs, given their impact on the retirement income of its beneficiaries.

59. An RSE licensee would also consider how the impact of insurance arrangements varies by product. For example, insurance premiums may differ by superannuation product or insurance risk classification rather than be uniform across the RSE. Default arrangements for insurance products are likely to be a key consideration in assessing the appropriateness of the insurance strategy.

60. When assessing how insurance premiums are eroding retirement income, an RSE licensee would normally examine affordability measures, including benchmarking with comparable RSEs or other indicators, such as those established in relevant industry codes or guidance, with reference to the unique characteristics of beneficiaries that hold the MySuper or choice product.

Scale

61. Refer to Attachment A for illustrative considerations for an RSE licensee when assessing the impact of scale on beneficiaries.

Operating costs

62. For the purposes of the outcomes assessment, operating costs capture costs incurred by the RSE licensee to operate and manage its business operations and how these costs affect the financial interests of beneficiaries.

63. Operating costs include administration costs, actuarial services and IT expenses. While operating costs are not limited to the operating expenses item that an RSE licensee would report for an RSE or MySuper product under relevant reporting standards, an RSE licensee would normally consider reported data and the operating expense ratio.

64. APRA expects that, in forming a view on whether the operating costs are inappropriately affecting the financial interests of beneficiaries that hold a particular product, an RSE licensee would examine trends in its operating cost base, including in comparison to other RSE licensees where appropriate comparable data is available.

Fees

65. APRA expects an RSE licensee would, when assessing the appropriateness of the basis for setting fees, consider the attribution of costs to different products and product options, the structure of the fees charged (e.g. split between flat and variable fees), any fee caps, the timing of fee charges and any fee discounts or rebates, as well as the general and MySuper fee rules in the SIS Act.

66. When assessing the impact of fees on the beneficiaries invested in the relevant product, an RSE licensee would also consider the appropriateness of fees in different products across multiple account balances. Such analysis would determine the degree of cross-subsidisation within a product and across different products, and whether this is justifiable.

Publishing the outcomes assessment

67. An RSE licensee is required to publish the product determination, and a summary of the assessment and comparison on which it is based (product summary), on the relevant RSE website within 28 days. The product summary would accurately detail the analysis supporting the two steps of the outcomes assessment and how the RSE licensee has reached the determination.

68. APRA expects an RSE licensee would draft and format each product summary to allow a reader to understand the determination and product summary. The product summary would use plain language, be concise and accurately detail the determination and supporting assessment. An RSE licensee would also consider the visual presentation to ensure the product summary can be quickly and accurately interpreted. It is also open to the RSE licensee to use tables, diagrams and graphs in a manner that would promote understanding.

69. There will usually be two distinct and clearly identifiable sections of the product summary:

a) the results of each of the comparison matters under section 52(10) of the SIS Act for the MySuper product and section 52(10A) for the choice product; and

b) the RSE licensee’s analysis of each of the assessment factors under section 52(11) of the SIS Act.

70. An RSE licensee would ensure that the determinations and product summaries are easily accessible on the website of the relevant RSE, for example, being no more than two clicks from the homepage. The determination and product summary can be contained within one file (e.g. pdf file). Where the RSE licensee has multiple RSEs or white labelled products with separate websites and branding, the RSE licensee would ensure that the determinations and product summaries are located on the website for each relevant RSE or product.

71. In general, APRA expects the logical location for the determinations and summaries would be, for MySuper products, with the MySuper product dashboard and equivalent location of member disclosure information for choice products. The outcomes assessment determinations and summary are expected to be clearly labelled on the relevant page.

72. APRA considers that best practice would be to alert beneficiaries and other stakeholders via email alert or media release about the publication of the determinations and product summaries.

Footnotes

2 Refer to Information Paper - Combining MySuper product performance histories - APRA's approach.

3 Refer to paragraph 2.44, Treasury Laws Amendment (Your Future, Your Super) Bill 2021 Revised Explanatory Memorandum.

Attachment A: Illustrative considerations when assessing scale impacts

Considerations when assessing scale impacts |

Optimising cost and fee ratios by spreading fixed costs over a larger asset and membership base, through internal investment management and economies of scale in administration. |

Ability to offer customised and tailored member services and experience. |

Engagement in stewardship activities from a greater number of voting rights. |

Degree of bargaining power with service providers and access to any volume related discounts. |

Complexity from coordinating a common culture and purpose throughout the organisation. |

Impact of size on investment strategy, such as: a) access to investments in asset classes such as property and infrastructure that require scale; b) sourcing sufficient attractive assets to complete large portfolios; c) ability to tailor investment strategy and portfolio to the fund’s objectives; and d) difficulties in trading at scale, particularly with larger illiquid assets. |

Reliance on internal management which emphasises the importance of sound governance, culture, ability to attract and retain key staff and investment manager diversification. |

International expansion is difficult but potentially unavoidable at a very large size which may: a) magnify staffing challenges; b) heighten coordination problems throughout the organisation; and c) necessitate navigating multiple regulatory regimes. |

Adapting operating models to ensure they are evolving to succeed at scale. |

Opportunity to pool risk, which is important in the context of certain retirement and insurance products. |