Prudential Practice Guide - SPG 515 – Strategic and Transfer Planning

About this guide

Prudential practice guides (PPGs) provide guidance on APRA’s view of sound practice in particular areas. PPGs frequently discuss legal requirements from legislation, regulations or APRA’s prudential standards, but do not themselves create enforceable requirements.

Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) sets out APRA’s requirements for a registrable superannuation entity (RSE) licensee (RSE licensee) in relation to prudent strategic and business planning, financial resource management, and monitoring and assessment of member outcomes. It also sets out requirements for an RSE licensee in the event it is notified by APRA that its authority to offer a MySuper product may be, or is, cancelled.

SPS 515 requires an RSE licensee to set and monitor progress against strategic objectives which underpin the outcomes sought for beneficiaries, and be adequately prepared to act in the event that these outcomes are not being delivered. Prudential Standard CPS 190 Recovery and Exit Planning (CPS 190) requires an RSE licensee to prepare for scenarios that may impact the viability of the RSE licensee.

In short, CPS 190 is concerned with the RSE licensee’s financial viability and SPS 515 is concerned with promptly addressing unsatisfactory outcomes for beneficiaries of RSEs. Given the material impact that the ongoing viability of an RSE licensee can have on its ability to properly perform its duties and exercise its powers as trustee of any RSE of which it is an RSE licensee, it is common for recovery and exit actions for an RSE licensee to also involve remediation or transfers of member benefits at the RSE level.

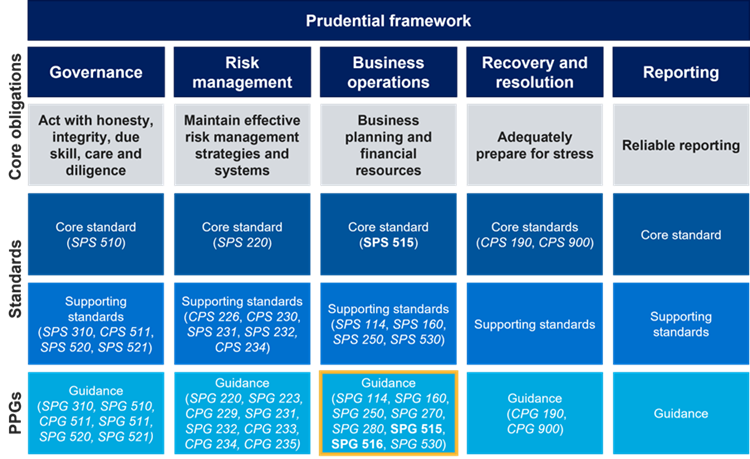

The graphic below summarises APRA’s prudential framework, showing the location of SPG 515 in the business operations pillar.

An accessible version of this figure can be found here.

This PPG is also to be read in conjunction with Prudential Practice Guide SPG 516 Business Performance Review (SPG 516) which provides guidance on APRA’s expectations with respect to the business performance review and matters related to the annual outcomes assessment required under section 52 of the Superannuation Industry (Supervision) Act 1993 (SIS Act).

Subject to the requirements of RSE licensee law1, an RSE licensee has the flexibility to structure its business operations in the way most suited to achieving its strategic objectives. Not all practices outlined in this PPG will be relevant for every RSE licensee and some aspects may vary depending upon the size, business mix and complexity of the RSE licensee’s business operations.

For the purposes of this guide and consistent with the application of SPS 515, ‘RSE licensee’ has the same meaning given in section 10 of the SIS Act.

For the purposes of this guide and consistent with SPS 515, where an RSE licensee is required to ‘demonstrate’ a matter, that term requires the RSE licensee to prove or show the matter both in written form and in practice. This emphasises that APRA expects matters to not only be appropriately documented but importantly to be evidently put into practice.

Footnotes

1 Refer to section 10 of the SIS Act for the definition of ‘RSE licensee law’.

Glossary

APRA | Australian Prudential Regulation Authority |

|---|---|

CPS 190 | Prudential Standard CPS 190 Recovery and Exit Planning |

CPS 230 | Prudential Standard CPS 230 Operational Risk Management |

CPS 900 | Prudential Standard CPS 900 Resolution Planning |

ORFR | Operational risk financial requirement |

PPG | Prudential practice guide |

RSE | Registrable superannuation entity as defined in section 10(1) of the Superannuation Industry (Supervision) Act 1993 |

RSE licensee | RSE licensee as defined in section 10(1) of the Superannuation Industry (Supervision) Act 1993 |

SFT | Successor fund transfer as referred to in regulation 6.29(1)(c) of the Superannuation Industry (Supervision) Regulations 1994; ‘successor fund’ as defined in regulation 1.03 of the Superannuation Industry (Supervision) Regulations 1994 |

SIS Act | Superannuation Industry (Supervision) Act 1993 |

SIS Regulations | Superannuation Industry (Supervision) Regulations 1994 |

SPG 515 | Prudential Practice Guide SPG 515 Strategic and Transfer Planning |

SPG 516 | Prudential Practice Guide SPG 516 Business Performance Review |

SPS 114 | Prudential Standard SPS 114 Operational Risk Financial Requirement |

SPS 250 | Prudential Standard SPS 250 Insurance in Superannuation |

SPS 515 | Prudential Standard SPS 515 Strategic Planning and Member Outcomes |

Chapter 1 - Strategic objectives

8. An RSE licensee must set specific strategic objectives for the sound and prudent management of its business operations that support achieving the outcomes the RSE licensee seeks for beneficiaries. The strategic objectives must be approved by the Board.

9. The strategic objectives must be informed by an RSE licensee’s consideration of:

a) the specific outcomes that the RSE licensee seeks to achieve for beneficiaries;

b) changes to the RSE licensee’s business operations that the RSE licensee considers, consistent with paragraph 14 of this Prudential Standard, are likely to improve outcomes for beneficiaries or the sound and prudent management of its business;

c) the RSE licensee’s risk appetite statement;

d) the strategies formulated pursuant to sections 52(2)(i), 52(6)(a), 52(7)(a), 52(8)(a) and 52(8A)(a) of the SIS Act;

e) the financial resources deemed necessary to cover the operational risk that relates to the RSE under section 52(8)(b) of the SIS Act;

f) the most recent business performance review; and

g) the sole purpose test.

1. SPS 515 makes clear that there must be a strong link between the outcomes the RSE licensee seeks to provide to members and the strategic objectives set by the Board.

2. Given the nature of the rolling multi-year business plan, APRA does not generally expect that the strategic objectives would be amended every year. However, where there are material changes to the RSE licensee’s operating environment, or significant performance issues arise that warrant a strategic response, SPS 515 requires an RSE licensee to consider whether its strategic objectives require amendment. Note that APRA expects that an RSE licensee would not amend a strategic objective solely in response to the failure, or likely failure, to meet the objective, without undertaking analysis to determine the factors that may have caused the failure.

3. APRA expects an RSE licensee’s strategic objectives would, in most instances, be defined in a way that makes them readily measurable. Where an objective does not lend itself to being meaningfully measured, a prudent RSE licensee would set clear qualitative criteria to determine if the objective has been achieved.

4. When setting strategic objectives, APRA expects an RSE licensee would consider its performance relative to previous business plans and its expectations for the future, including the strategic challenges that may arise from the operating environment.

5. APRA expects that an RSE licensee that is part of a conglomerate group would develop and approve strategic objectives independently of the group, to ensure that priority is given to the duties to and interests of beneficiaries.2

6. In the process of setting its strategic objectives, a prudent RSE licensee would ensure that the RSE’s governing rules, procedures and practices demonstrate that the RSE is maintained consistently with the ‘sole purpose test’.3 This includes demonstrating:

a) the purpose of the RSE with reference to what the RSE is organised for and how it achieves this purpose; and

b) how the RSE is maintained by undertaking the tasks that reasonably form part of the total operation of the RSE. Such tasks may include, but are not limited to, accepting contributions, recording benefit entitlements, investing fund assets, reporting, fund administration, benefit payments and providing insured benefits.

Articulating member outcomes

7. The specific outcomes an RSE licensee seeks for beneficiaries are the anchor for decision making, assessment of performance and identifying areas for improvement. APRA expects an RSE licensee’s articulated member outcomes incorporate both financial and non-financial outcomes and are informed by historical and forward-looking analysis. In the limited circumstances where an outcome does not lend itself to being meaningfully measured, APRA expects an RSE licensee would demonstrate how it determines whether the outcome is being delivered.

8. APRA expects that the types of outcomes sought would reflect, but are not limited to, the types of outcomes listed in Figure 1.

Figure 1. Illustrative examples of types of outcomes

9. APRA expects an RSE licensee would also identify whether specific member cohort outcomes are appropriate. For members approaching or in retirement, APRA expects an RSE licensee would determine outcomes that reflect an evidence-based assessment of member needs.

10. Understanding members’ retirement income needs involves considering the financial position and future spending needs of members to form a broad understanding of an RSE licensee’s membership profile. A prudent RSE licensee would fully explore both internal and external data to seek to better understand the financial profile of their membership in different sub-classes beyond superannuation balance.

Footnotes

2 Refer to section 52(2)(d)(i) of the SIS Act.

3 Refer to section 62 of the SIS Act.

Chapter 2 - Business planning

10. An RSE licensee must create and maintain a written rolling plan, of at least three years’ duration, that covers the entirety of an RSE licensee’s business operations (business plan). The business plan must be approved by the Board and set out the RSE licensee’s approach for implementing and delivering on its strategic objectives.

11. An RSE licensee’s business plan must specify:

a) the key initiatives it will undertake to achieve the RSE licensee’s strategic objectives, including for each initiative, the expected cost, how it will be funded and the expected results;

14. The business plan must be updated annually having regard to the results of the most recent business performance review and ongoing monitoring. The annual updates to the business plan must incorporate changes to the RSE licensee’s business operations that the RSE licensee considers are likely to improve outcomes for beneficiaries or the sound and prudent management of its business, including, but not limited to, changes arising from recovery and exit planning activities required under Prudential Standard CPS 190 Recovery and Exit Planning or changes arising from remedial actions or transfer planning required under this Prudential Standard.

11. An RSE licensee’s business plan reflects how it will organise and manage its business operations and pursue its strategic objectives, and the resulting member outcomes, over the term of the plan. It is open to an RSE licensee to develop a business plan in a manner that best suits the structure of its business operations.

12. Effective governance, risk management and compliance systems, and having the resources to support these functions, are critical to the sound and prudent management of an RSE licensee. These systems are inherently linked to an RSE licensee’s business and strategic decisions regarding its operational risk profile and operational resilience and the development and maintenance of its recovery and exit plan in response to stress that may threaten its viability. APRA expects that an RSE licensee would, where necessary, include in its business plan initiatives relating to the systems, processes, supporting infrastructure and resources necessary to support the core components of sound and prudent management.

13. Initiatives detailed in the business plan will vary in size, complexity, duration and associated budget or expenditure, and will often be generated by the results of the business performance review. APRA expects that the detail provided in the business plan will reflect the complexity, size and budget of each initiative.

14. APRA expects that prior to deciding to pursue an initiative, an RSE licensee would demonstrate that:

a) there is a sound rationale for pursuing the initiative, informed by the intended impact on the outcomes sought for beneficiaries, supported by a robust analysis of costs and benefits;

b) the risk appetite statement has informed the RSE licensee’s view of risks associated with new business initiatives and planned business activities;

c) metrics and processes to enable the monitoring and assessment of the outcomes of the initiative have been developed to determine the success or otherwise of the initiative; and

d) there is a plan to cease the initiative where the expected results are not being achieved.

15. APRA expects a prudent RSE licensee would integrate their retirement income strategy and their business planning by incorporating the key retirement income strategy initiatives into the business plan, showing a clear pathway to implementation.

Review of the retirement income strategy

16. The annual review of the appropriateness of the retirement income strategy supports an RSE licensee ensuring that its activities, as reflected in the business plan, assist beneficiaries in achieving and balancing the objectives under section 52AA(2) of the SIS Act.

17. APRA expects that the scope of this annual review would be informed by the size, business mix and complexity of the RSE licensee’s business operations, the extent of any change to those operations and any changes to the external environment in which the RSE licensee operates.

18. Factors that APRA expects would inform the annual review of the appropriateness of the retirement income strategy include:

a) whether the retirement income strategy is fit for purpose, including incorporating any changes to the RSE or the RSE licensee’s business operations or membership profile during the period, as reflected in the relevant data informing the strategy;

b) whether there have been changes to relevant risks during the period under review, including longevity risk, investment risk and inflation risk;

c) whether the retirement income strategy is resulting in the achievement of the identified outcomes sought for members;

d) the availability of relevant data and other sources of information; and

e) review of provisions for any relevant service providers relating to retirement assistance and offerings to members.

19. A prudent RSE licensee would also consider the benefits of obtaining an independent review of its retirement income strategy at least every three years by an operationally independent and appropriately experienced person.

Business plan financials

13. An RSE licensee must be able to demonstrate how the business plan reflects the RSE licensee’s view of its current, and expected, level of financial resources, informed by:

a) financial projections that demonstrate the ongoing financial soundness of the RSE licensee’s business operations, including under different potential scenarios, for at least the term of the business plan; and

b) key assumptions used in the required financial projections and how these assumptions take into account the material risks identified under the risk management framework.

20. It is open to an RSE licensee to decide whether to include the detail of its current and expected level of financial resources, financial projections, and underlying assumptions in the business plan.

21. A prudent RSE licensee would, when determining whether it has access to adequate resources, be able to demonstrate that it has considered human, technical and financial resources to effectively achieve its strategic objectives and desired outcomes by executing the underlying business plan.4 As part of its business planning processes, an RSE licensee would typically prepare budgets, and associated forecasts of income, for the coming period(s).

22. APRA expects that an RSE licensee’s financial projections would consider all relevant factors including, but not limited to, those included in Table 1.

Table 1. Considerations for financial projections

Financial projection considerations |

Current and forecast financial position and performance, cash flow forecasts to meet the RSE licensee’s liquidity, liabilities and operational requirements, and an assessment of scale. This includes where a product is closed to new members and is unlikely to reopen. |

Membership projections, including the active member ratio and membership demographics (including those members approaching or in retirement). |

Operating costs and fees charged to members. |

Changes in strategy, business plans, operating environment, current and potential sources of competition and other factors that might affect the operations or risk profile of the RSE licensee and its underlying RSE(s), with a prudent RSE licensee considering both favourable and unfavourable future scenarios. |

The financial interdependency of the RSE(s) with other entities, such as promoters, or where the RSE licensee is part of a broader group of related entities. |

Access to shareholder capital and ongoing employer sponsor financial support where relevant. |

The sustainability of and potential for innovation in the products and services available within the RSE(s). |

23. Once the business plan is approved by the Board, an RSE licensee would ensure that detailed plans for relevant initiatives are developed and incorporated into the operational plans of the RSE licensee. A prudent RSE licensee would clearly articulate and regularly review the resources allocated to the ongoing implementation of the business plan.

Financial projections for products that failed the legislated performance test5

24. Where an RSE licensee has a product that has failed the legislated performance test, APRA expects an RSE licensee would review, and update as required, its financial projections and underlining assumptions. This includes, at a minimum, reflecting the effect of the failure on:

a) membership flows (i.e. new entrants and exits) for the product and the RSE;

b) investment, administration and operating expenses for the RSE;

c) reserve levels and description of the purpose of each reserve;

d) the level of concessional and non-concessional contributions;

e) projected annual fees and any change in fees for members in other products across the RSE; and

f) measures of liquidity, including where a liquidity provider arrangement is used, such as cash flow ratios and illiquid assets as a percentage of net assets.

footnotes

4 Refer to requirements in Prudential Standard SPS 220 Risk Management to have adequate resources.

5 For the purposes of this PPG, the legislated annual performance assessment under section 60C of the SIS Act is referred to as the ‘performance test’.

Chapter 3 - Financial resource management

Setting fees

16. An RSE licensee must set each fee prudently and transparently. This includes demonstrating why the RSE licensee is satisfied, with respect to a fee charged to beneficiaries or a fee charged by the RSE licensee out of an RSE, that:

a) the charging of the fee, including determining the amount of the fee, complies with its legal duties and obligations; and

b) the fee is appropriate and proportionate, having regard to the arm’s length value of the features and services that the fee relates to, comparable fees charged in relation to comparable RSEs and financial resources currently available to the RSE licensee.

17. An RSE licensee must ensure that the use of any new fee power, or the use of an existing power for the first time, is approved by the Board.

25. APRA expects that an RSE licensee would adopt a rigorous process that clearly measures the impact of fees on the financial interests of beneficiaries, and on the ongoing viability of its operations. This process would also ensure compliance with the MySuper fees rules (where relevant), the general fees rules where relevant (including approaches to setting fees on a cost recovery basis) and be informed by the tax consequences of the fee design and capital management.6

26. In relation to fees and costs associated with a successor fund transfer (SFT), APRA expects that fees charged to beneficiaries would be on a cost recovery basis only.

Management of reserves

18. An RSE licensee’s strategy for the prudential management of reserves must demonstrate the need for, and purpose of, each reserve in the RSE licensee’s business operations. An RSE licensee’s reserving strategy must include:

a) how each reserve is managed in the context of its purpose; and

b) an appropriate target amount or range for each reserve, including how and over what period the reserve is to be established and replenished in an equitable manner, with reference to different cohorts of beneficiaries, and intergenerational issues.

19. An RSE licensee’s regular review of each reserve must ensure:

a) the reserve remains appropriate to the RSE’s circumstances; and

b) there are adequate controls and procedures to ensure the reserve is used for the intended purpose.

27. Appropriate and prudent management of reserves benefits all beneficiaries of an RSE, even if the circumstances that would warrant use of the reserve do not eventuate during the membership of a particular cohort of members.

28. Sound reserve management also includes an RSE licensee having a process to manage any excess, in the event that a reserve is in excess to requirements of the relevant policy for the management of the reserve, or where it is no longer required. This may include, for example, a cap on the size of the reserve. APRA expects an RSE licensee would monitor the balance of each reserve, the movements in and out of the reserve and the purpose of the movements.

29. Whilst reserves are monies that have not been allocated to members, not all unallocated monies constitute reserves. Unallocated monies that are not reserves include accounting constructs, such as suspense accounts, used to record contributions and rollovers pending their allocation to the accounts of specific members. APRA’s view is that provisions for accrued administration expenses, taxation liabilities or other present costs would not be classified as reserves for reporting purposes.

30. Where an RSE licensee has an insurance premium adjustment mechanism in place, such that an insurer returns a portion of the premium when the claims experience is better than expected than at the time the premium was set, it would be prudent to manage this mechanism through a specific insurance reserve. An RSE licensee’s insurance reserve policy would ordinarily ensure appropriate, equitable and timely use of the insurance reserve for this purpose and that the reserve would be used only to meet future insurance premium costs.

Management of other financial resources

31. When deciding to pay an amount to a parent company, APRA expects an RSE licensee would make that decision consistent with a Board-approved policy that specifies:

a) how the payment demonstrably supports the ongoing sustainability of the RSE licensee’s business operations and is consistent with its ability to properly perform its legal duties and obligations;

b) whether any fee charged to members to fund the payment is validly charged and is charged on an equitable basis; and

c) the circumstances where the Board will not approve a payment.

32. Where an RSE licensee builds a financial contingency amount by way of charging a fee, APRA expects the amount generated would not be excessive, and expects that the level of this amount would be transparent, evidence-based and aligned with the stated purpose of the reserve. Further, APRA expects that an RSE licensee would have diligently explored and exhausted all other avenues for raising or using financial resources prior to building this amount. Full details of alternative avenues pursued for building or using financial resources would also be clearly evidenced and actively considered by the Board.

Footnotes

6 Refer to Part 11A of the SIS Act and Division 5 of the SIS Act (in respect of MySuper products).

Chapter 4 - Expenditure management

33. As noted in the Treasury Laws Amendment (Your Future, Your Super) Bill 2021 Revised Explanatory Memorandum, the duty to act in the best financial interests of beneficiaries and the associated reverse onus of proof are intended to increase the accountability of an RSE licensee in relation to the execution of their fiduciary duties across the many actions RSE licensees take in operating a superannuation entity.7

34. An RSE licensee remains responsible for monitoring, managing and reviewing all expenditure, even where a related party or service provider has been engaged to carry out functions within the RSE licensee’s business operations. This may involve setting and amending appropriate contract terms and parameters, as well as effectively using service-level agreements.

Expenditure policies and processes

35. Rigorous decision-making in relation to fund expenditure positions an RSE licensee to meet the duty to act in the best financial interests of beneficiaries and is likely to lead to more considered use of fund monies and better quality outcomes for members. As such, APRA expects an RSE licensee would maintain robust governance and oversight of fund expenditure. This may take the form of an expenditure management framework with a defined risk assessment process for expenditure decisions and oversight.

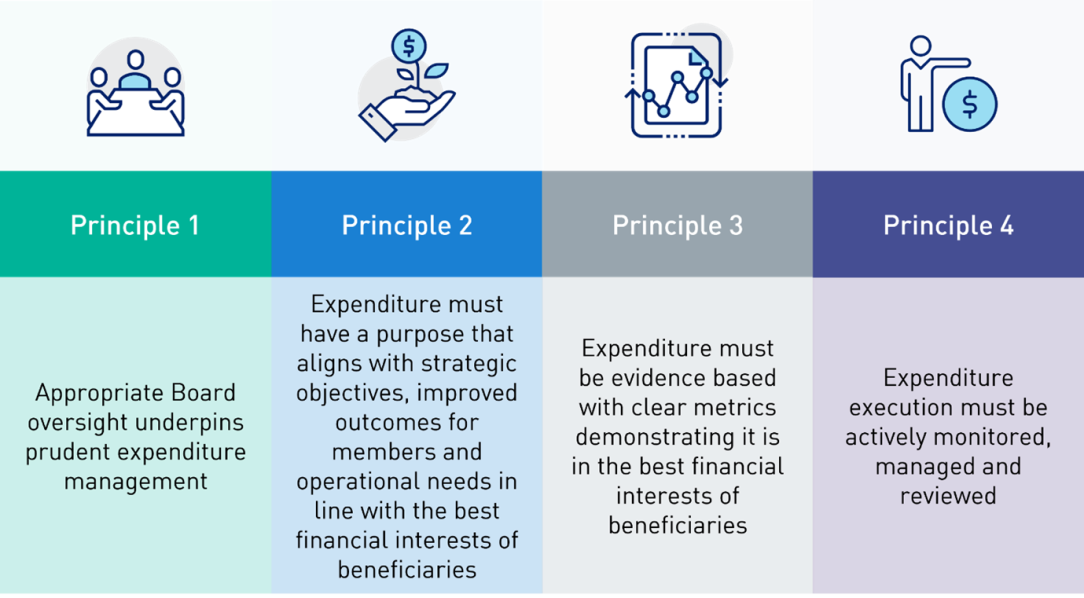

36. A comprehensive approach to expenditure management includes rigorous policies and processes for the approval and monitoring of spending. Key principles for a prudent approach for expenditure are illustrated below in Figure 2.

Figure 2. Key principles of expenditure policies and processes

37. APRA expects an RSE licensee’s expenditure management procedures, as relevant, would:

a) set out criteria to assist its employees to understand where expenditure may be inconsistent with the RSE licensee’s legal duties and obligations or the sound and prudent management of the business operations. For example, a policy that covers travel expenses would detail criteria to ensure travel spending is in the best financial interests of beneficiaries and is consistent with the pursuit of the RSE licensee’s strategic objectives; and

b) detail the controls and delegations for all types of spending. These controls and delegations may differ based on the size and nature of the expenditure, with well-defined approval thresholds and criteria, and clear requirements for reporting to the Board. For example, spending on training initiatives for RSE licensee employees above a certain amount would need to be approved by a senior manager of the RSE licensee based on set criteria.

Making expenditure decisions

22. When making an expenditure decision relating to its business operations, an RSE licensee must demonstrate, at a minimum:

a) the purpose of the expenditure, including how the expenditure will contribute to the RSE licensee meeting its strategic objectives and outcomes sought for beneficiaries together with consideration of any previous assessment by the RSE licensee of whether the expenditure or type of expenditure has achieved its intended purpose;

b) where the expenditure results in a non-financial benefit to beneficiaries, or a benefit not directed towards promoting the financial interests of beneficiaries, why, in such circumstances, the expenditure remains consistent with all legal duties and obligations of the RSE licensee;

c) how the expenditure will be funded; and

38. APRA expects an RSE licensee would, before making an expenditure decision, assess the nature and extent of the estimated financial benefit to beneficiaries from the proposed action. This may take the form of a robust business case with clearly stated objectives and specific and measurable expected outcomes.

39. Where an RSE licensee is able to demonstrate that it has met the requirements under CPS 230 for entering into or renewing an agreement with a service provider, including a rigorous approach to assessing the operations of that provider, it is likely the RSE licensee would be able to also demonstrate that it meets the expenditure requirements of SPS 515.

40. A prudent RSE licensee would maintain records of expenditure decisions in order to demonstrate, with appropriate evidence, compliance with the duty to act in the best financial interests of beneficiaries. APRA expects that the level of detail in an RSE licensee’s records would be commensurate with the nature, quantum, complexity, regularity and duration of the expenditure. Further, a prudent RSE licensee would ensure such records detail any dissenting views raised in the process of making the decision (including where individual directors did not support the decision).

41. In circumstances where the intended benefits to beneficiaries are not being delivered, APRA’s view is it would be difficult for an RSE licensee to demonstrate that further expenditure on the same activity (such as a renewal) would be consistent with the duty to act in the best financial interests of beneficiaries, or otherwise meet the requirements of SPS 515.

Monitoring and assessing expenditure

22. When making expenditure decisions relating to its business operations, an RSE licensee must demonstrate, at a minimum:

d) how the expenditure will be monitored, including the metrics used to determine delivery of expected outcomes, the circumstances that would trigger a review of the decision and timely action.

42. Evaluation of actual benefits against intended benefits, including whether the decision was value for money, is integral to an RSE licensee being able to demonstrate that a decision to continue to incur the expenditure is consistent with the duty to act in the best financial interests of beneficiaries.

43. In order to determine whether expenditure is consistent with the duty to act in the best financial interests of beneficiaries, an evidence base with measurable metrics is critically important. APRA expects an RSE licensee would periodically monitor the outcomes of expenditure decisions relative to the intended objectives to ensure desired targets are being met and any expenditure review triggers are identified in a timely manner.

44. APRA expects the metrics an RSE licensee puts in place to determine performance would be quantifiable or otherwise measurable. These metrics can take the form of an overarching set of metrics applying to an entire project or initiative or be specific to each payment or project milestone.8

45. When reviewing an expenditure decision, APRA expects an RSE licensee would consider whether the intended benefit had the expected outcome over the expected timeframe. For example, if the expected outcome was increased membership by an amount sufficient to secure a meaningful reduction in fees to members, the evaluation would be expected to not only cover whether membership increased, but also whether fees were reduced or member services enhanced at no additional cost to members.

46. APRA expects an RSE licensee would identify key decision points to continue, amend or cease expenditure based on ongoing monitoring, assessment of outcomes and triggers.

Footnotes

7 Refer to Treasury Laws Amendment (Your Future, Your Super) Bill 2021 Revised Explanatory Memorandum.

8 Refer to Attachment A for an illustrative list of indicators relevant to marketing expenditure.

Chapter 5 - Monitoring

47. Effective monitoring of progress against the business plan enables an RSE licensee to identify when its actions or initiatives are not achieving their expected outcomes, or when the assumptions on which strategic objectives are based are no longer appropriate. Additionally, the monitoring of the performance against the business plan is a key input into the business performance review.

48. APRA expects an RSE licensee’s monitoring process would have specified triggers that require reporting to the Board when they have been breached, and to identify appropriate action(s) to address the underlying issues. APRA expects the triggers would operate to reflect an escalation in the impact of issues, so that an RSE licensee intensifies its response as a situation deteriorates.

49. The use of appropriate metrics is a core feature of tracking performance against the business plan.9 When deciding these metrics, a prudent RSE licensee would consider:

a) whether the metrics can be meaningfully measured and monitored;

b) the balance between qualitative and quantitative data underpinning the metrics; and

c) the balance between leading and lagging metrics.

50. In addition to identifying actions to remediate issues, APRA expects an RSE licensee would consider a transfer of beneficiaries and planning for the recovery or exit of the RSE licensee, where appropriate. It is important that trigger levels or tolerances would not be expected to be set at levels that make it unlikely they would ever be breached. APRA expects an RSE licensee would include failure of the legislated performance test as a trigger for action.

Setting and monitoring transfer triggers

51. It is important that an RSE licensee’s transfer planning triggers are directed at identifying, with sufficient advance notice, where a transfer of beneficiaries would likely improve outcomes for members (or prevent further poor outcomes for members). These triggers would also reflect a range of reasonable scenarios and opportunities that may necessitate the need for a transfer, are clearly aligned with the RSE licensee’s strategic objectives and are regularly reviewed.

52. When determining triggers for transfer planning, APRA expects an RSE licensee would conduct a risk analysis of the likelihood of triggers being activated and an analysis of indicative time horizons within which the RSE licensee would need to act. In conducting this risk analysis, APRA expects an RSE licensee would include consideration of how it would respond to an unexpected or stress scenario affecting the RSE licensee itself.

53. When setting transfer planning triggers, APRA expects an RSE licensee would demonstrate how the RSE’s governing rules provide it with the power to transfer members’ benefits to a successor fund. Generally, this power is conferred on an RSE licensee by an RSE’s trust deed.

Footnotes

9 Refer to Attachment A for a non-exhaustive list of relevant metrics that can inform key performance indicators and triggers.

Chapter 6 - Remedial actions and transfer planning

30. An RSE licensee must be able to demonstrate how it is taking timely remedial action where expected outcomes it seeks for beneficiaries are not being achieved, including where relevant triggers have been met as set out in paragraph 24.

31. An RSE licensee must take appropriate and timely steps to prepare for circumstances that may necessitate a transfer of beneficiaries out of, or into, its RSE(s), including where relevant triggers have been met as set out in paragraph 24.

32. Where an RSE licensee has received a determination from APRA that one or more of its products has not met the requirements of the legislated annual performance assessment under section 60D(1) of the SIS Act, the RSE licensee must document its plan for responding to this determination in a timely manner. This plan may include, but is not limited to:

a) remedial actions to improve the performance of such products; and

b) commencing preparations for a transfer of beneficiaries.

An RSE licensee must notify APRA if it has activated a plan made for the purposes of this paragraph.

54. Where an RSE licensee forms a view that the outcomes it seeks for beneficiaries are not being achieved, it is important than an RSE licensee acts promptly to determine whether it should continue to operate the RSE in its current form. This may result in a decision to take actions to improve performance of a product or a decision to undertake a transfer of beneficiaries.10 To ensure that such decisions are made in a timely manner, APRA expects an RSE licensee would form a view, at a minimum, about the following matters:

a) the options available to the RSE licensee, with accompanying preparatory measures, and relevant supporting analysis that sets out the circumstances where these options will best support the RSE licensee meeting its legal duties and obligations;

b) how choosing an action will be informed by the ability to reduce costs, improve returns and provide a better range of products and services to achieve member outcomes;

c) how each action is likely to be funded; and

d) a communication strategy to mitigate risks from adverse stakeholder reactions, including the acceleration of membership outflows.

55. APRA expects an RSE licensee would demonstrate how it will put in place governance arrangements for making decisions about potential remedial actions or transfers. This includes roles and responsibilities of key stakeholders for each part of the governance process, particularly the role of the Board.

Additional expected actions where a product fails the legislated performance test

56. Where an RSE licensee has a product that has failed the legislated performance test, it is important that the RSE licensee assesses the impact of failing the performance test on its beneficiaries, and the RSE licensee’s business operations more broadly. APRA therefore expects an RSE licensee would:

a) identify whether the RSE licensee considers it likely that the product will fail next year’s legislated performance test, or alternatively the year in which the RSE licensee expects to pass the test;

b) demonstrate how the failure affects the RSE licensee’s strategic direction for its business operations as a whole; and

c) for closed products, demonstrate a reasonable basis for maintaining the closed products given that alternative products may be available within the RSE licensee, or offered by other RSE licensees, with potentially better outcomes for beneficiaries.

57. APRA expects an RSE licensee would monitor member outflows from a product that has failed the legislated performance test. This would typically include tracking the following data items for both the product and the RSE as a whole:

a) number of member accounts;

b) number and value of closed member accounts; and

c) number of closed member account rollovers.

11. An RSE licensee’s business plan must specify:

b) where an RSE licensee has decided to undertake a transfer of beneficiaries or other recovery or exit activities, how this decision will be implemented. This includes, where necessary, adjusting key strategic initiatives and maintaining business operations during implementation.

58. After a decision is made to undertake a transfer, it is important that both the transferring and receiving RSE licensees execute the transfer proactively and efficiently with robust governance, risk and conflicts management practices that support the timely completion of project milestones. An RSE licensee would also typically form a view about existing strategic initiatives which may no longer be appropriate. For example, it may no longer be appropriate to embark on a marketing campaign or product development initiative if the RSE is to be merged into an RSE with an agreed go-forward brand and product offering.

59. As a transfer can take time to implement, APRA expects an RSE licensee would demonstrate how it will ensure critical services will be maintained within tolerance levels throughout the transition period. To ensure appropriate resources are identified, secured and allocated for all business plan initiatives during the transition phase, APRA expects an RSE licensee would update its business plan to reflect the transfer and necessary BAU activities.

MySuper assets transfer plans

36. Where APRA notifies an RSE licensee that its authority to offer a MySuper product may be cancelled by APRA, the RSE licensee must document, within a time specified by APRA, a plan that demonstrates preparedness to transfer any MySuper product assets to another MySuper product (MySuper assets transfer plan).

37. An RSE licensee must nominate a MySuper product to receive the MySuper product assets (the receiving MySuper product) that meets the following requirements:

a) the RSE licensee of the receiving MySuper product has determined in writing, in its most recent annual determination, that the financial interests of the beneficiaries who hold the MySuper product are being promoted by the RSE licensee; and

b) APRA has determined that the receiving MySuper product has met the requirement in relation to the most recent legislative annual performance assessment and is not closed to new members.

38. An RSE licensee must ensure that its MySuper assets transfer plan has regard to:

a) the RSE licensee’s risk appetite as set out in its risk management framework;

b) the RSE licensee’s business plan; and

c) any other plans developed and maintained pursuant to this Prudential Standard, CPS 190 and Prudential Standard CPS 900 Resolution Planning.

39. An RSE licensee’s MySuper assets transfer plan must, at a minimum, include:

a) the governance arrangements for the transfer of MySuper product assets, including the role of the Board;

b) a description of the roles and responsibilities of stakeholders with a key role in the transfer process;

c) the name of the MySuper product to which the RSE licensee considers that the assets should be transferred;

d) the name of the receiving RSE licensee that has agreed in-principle to receive the MySuper product assets from the transferring RSE licensee; and

e) a communication strategy that will be deployed in the event that the authority to offer a MySuper product is cancelled.

60. SPS 515 sets out requirements for the purpose of the election made by an RSE licensee in accordance with section 29SAB of the SIS Act to take the action required under the prudential standards in relation to any MySuper product assets including any corresponding member benefits attributed to the MySuper product if the authority to offer the MySuper product is cancelled, and to do so within 90 days of receiving notice of the cancellation. Note that a transfer of member benefits of this nature is made under regulation 6.29(1)(d) of the SIS Regulations and is not an SFT within the definition of successor fund in the SIS Regulations.

61. Where APRA requires an RSE licensee to document a MySuper assets transfer plan, it is open to the RSE licensee to amend an existing plan to meet this requirement.

62. APRA expects an RSE licensee’s MySuper assets transfer plan would document all necessary steps to demonstrate preparedness to complete the transfer of MySuper product assets within 90 days of cancellation of a MySuper authority. A prudent RSE licensee would examine different scenarios and interdependencies that may impact on the timing for successful completion of the necessary steps.

63. A notification by APRA that it may cancel an RSE licensee’s MySuper authorisation relates only to the assets of the MySuper product. Where an RSE licensee receiving such a notification holds assets outside the MySuper product, for example assets of a choice product, APRA expects the RSE licensee would consider whether it is appropriate to undertake an SFT of the non-MySuper product assets at the same time.

64. Notwithstanding the above, APRA may take into account matters documented in a MySuper assets transfer plan when determining its decision to give a notice to cancel a MySuper authority. This may include matters related to timing issues, such as delays in redemption of certain assets, and reliance on third parties, for example, as a result of unit pricing delays in the custodian’s administrative system.

Footnotes

10 Refer to SPG 516 for guidance relating to identifying actions to improve performance under the business performance review.

Chapter 7 - Undertaking an SFT

65. Deciding to undertake an SFT involves a significant shift in focus for an RSE licensee. It is therefore important that the preparation for an SFT commences as early as necessary to reduce the risk of poor outcomes for beneficiaries.11

66. APRA expects an RSE licensee would be able to demonstrate that a decision to undertake an SFT is the result of a rigorous and formally documented process, and is consistent with the duty to act in the best financial interests of beneficiaries. This decision would be demonstrably informed by an assessment of:

a) all reasonable methods for undertaking the SFT, and their impact on the outcomes for members;

b) the impact on investment strategy, return target and recent investment performance and members’ entitlement to other benefits, such as fee subsidisation by an employer when selecting or narrowing the range of suitable receiving RSEs; and

c) the ongoing sustainability of the RSE licensee’s business operations, including the RSE licensee’s ability to continue to deliver outcomes to members and potentially further improve the member offering.

67. Where an RSE licensee is seeking to undertake a partial SFT, APRA expects the RSE licensee would demonstrate how it balanced the rights and benefits of all beneficiaries, including those being transferred and those remaining in the transferring RSE.

68. APRA expects an RSE licensee would weigh the consideration of benefits provided to individual members, or small groups of members, with the overall benefits and outcomes to members as a whole.

69. APRA’s view is that the features of the proposed receiving RSE do not necessarily have to be the same for all beneficiaries. APRA considers that a thorough evaluation of the features of a proposed receiving RSE would assist a transferring RSE licensee to demonstrate its decision to transfer is consistent with the duty to act in the best financial interests of beneficiaries.

Equivalent rights assessment

70. The key requirement of an SFT is the agreement between the transferring RSE licensee and the receiving RSE licensee that the successor fund will confer on the members equivalent rights to those rights the members had in the transferring RSE in respect of their benefits. This is referred to in this guidance as the ‘equivalent rights’ assessment.

71. APRA expects that an RSE licensee would be able to demonstrate how they identify the rights of members in respect of their benefits when undertaking the ‘equivalent rights’ assessment. APRA considers that a ‘right’ is a legally enforceable right. Legally enforceable rights may arise under an RSE’s governing rules, the general law and legislation. These rights may be able to be altered by action taken by an RSE licensee, for example, by amendment of the governing rules where permitted, or they may be unalterable.

72. APRA’s view is that rights can be distinguished from features of an RSE. Features which are determined, and can be changed, at the discretion of an RSE licensee provide no ongoing entitlement to a member, and are therefore not rights. Ultimately, what are features and what are rights will be determinable by an RSE’s governing rules. Generally, features may include the amount of fees that will be charged to a member, product features and particular investment options. What is a right in one RSE may be considered a feature in another RSE. A prudent RSE licensee, therefore, would be able to demonstrate how it determined rights and features, having regard to the governing rules of the relevant RSE.

73. In making an ‘equivalent rights’ assessment, APRA expects both the transferring and receiving RSE licensees would each conduct a thorough assessment and comparison of the members’ rights in respect of the members’ benefits in both the transferring and receiving RSEs, with reference to the governing rules of both RSEs and all relevant legislative requirements.

74. Features in a member’s existing RSE and in a proposed successor fund can differ without affecting the equivalency of the member’s rights in respect of the member’s benefits.

75. Accordingly, APRA expects both the transferring RSE licensee and receiving RSE licensee would undertake the assessment of equivalent rights on a ‘bundle of rights’ basis. In determining which rights are to be bundled and considered together, APRA expects an RSE licensee would give appropriate weighting to significant rights and the materiality of any changes to individual rights.

76. While the SIS Regulations require that equivalent rights be assessed on the basis of the member, APRA considers that it would be open to an RSE licensee to consider equivalent rights based on groups of members with common rights. Groups of members that may suggest separate consideration include, but are not limited to, default members, choice members, defined benefit members, retained members and members with pension benefits. In grouping members for the purpose of considering whether their rights are equivalent, an RSE licensee must at all times comply with the trustee covenants, including the duty to act fairly in dealing with different classes of beneficiaries and beneficiaries within a class.12

MySuper to MySuper SFTs

77. APRA considers that an SFT of members’ benefits from a transferring RSE’s MySuper product to a receiving RSE’s MySuper product would generally satisfy the equivalence test.

78. All MySuper products must, to be considered to be a MySuper product, comply with the provisions of Part 2C of the SIS Act. This results in all MySuper products having the same core characteristics. For the equivalence test to be met, APRA’s view is that it is not necessary for a MySuper product in a proposed receiving RSE to have the same features as the MySuper product in the transferring RSE.

79. APRA considers that the equivalence test will generally be met, and an SFT will usually be able to occur, in the following types of scenarios:

a) a transfer from a transferring RSE’s MySuper product with a single diversified investment strategy to a receiving RSE’s MySuper product with a single diversified investment strategy or a lifecycle investment option, and vice versa; and

b) a transfer between MySuper products with different features, for example, different asset allocation, different investment strategy, different applicable fees or different insurance offerings.

Preparing to undertake an SFT

80. A prudent RSE licensee would review relevant governance arrangements to ensure that they support robust oversight with necessary flexibility to respond to the demands of a transfer. APRA expects the transferring and receiving RSE licensees would each demonstrate how relevant conflicts of interest, including those unique to the proposed transfer, are evaluated and managed during all phases of the transfer.

81. APRA expects an RSE licensee would seek expert advice to support the identification of issues early in the process of undertaking a transfer and inform the formal decision to undertake and execute the transfer. Such advice may include legal, actuarial, tax, data, investment, audit or assurance advice.

82. APRA expects a transferring RSE licensee would undertake appropriate due diligence and risk assessment when assessing potential receiving RSEs. APRA expects that an RSE licensee would demonstrate how it arrived at a suitable short-list of receiving RSEs, informed by criteria based on the outcomes it seeks for its members.

83. APRA expects an RSE licensee would consider, at a minimum, the following matters when assessing a potential receiving RSE:

a) long term sustainability of the receiving RSE and RSE licensee;

b) performance across investments, fees and costs;

c) fees, both direct and indirect, covering investment, insurance and administration;

d) product design including insurance offerings and any restrictions or exclusions that are likely to impact on the membership;

e) the retirement income strategy of the receiving RSE licensee;

f) systems compatibility; and

g) member engagement.

84. Similarly, APRA expects a receiving RSE licensee would have a documented due diligence and risk assessment process for assessing the impact of receiving the transferred members into the receiving RSE.

Identifying barriers to SFTs

85. To support an orderly and timely SFT of members’ benefits, it is critical that an RSE licensee identifies and documents, at an early stage, any barriers or issues that may impede or delay a transfer. Such barriers may include legislative barriers, legal constraints, taxation issues, investments issues and issues relating to the identification and confirmation of suitable transfer funds. APRA expects an RSE licensee would be able to demonstrate, when deciding to undertake an SFT, a sound understanding of any existing barriers to transfer and the steps the RSE licensee will take to address or manage these barriers.

86. Additional barriers or issues that could impede an orderly SFT of beneficiaries’ benefits, and which require early engagement by an RSE licensee, include, but are not limited to:

a)whether the governing rules of the transferring RSE or the receiving RSE require amendment to enable an SFT;

b) where the RSE or RSE licensee is established under State or other Commonwealth Government legislation;

c) termination provisions in service provider arrangements13;

d) potential disruptions to critical business activities that may arise during an SFT;

e) matters relating to insurance (at the beneficiary and director levels), including issues relating to pending claims or difficulties in obtaining the same terms and conditions;

f) taxation issues including capital gains/loss relief and GST issues;

g) meeting disclosure obligations relevant to the SFT; and

h) outstanding legal matters and any issues that may need to be resolved with other regulators.

Engaging early with APRA and other regulatory bodies

87. To support the identification and resolution of barriers and issues, APRA expects an RSE licensee would inform APRA of any potential transfer of members and identify the need for any approvals from APRA or other regulators as early as practicable.

88. Regulatory approvals that may be required include, but are not limited to, MySuper authorisations, applications for relief, such as portability relief in relation to administration outage periods during the transfer and other forms of relief, licence variations or approval to hold a controlling stake in an RSE licensee.

89. Relief may be required as an RSE licensee may be considered to be unable to contract with itself, i.e. the RSE licensee cannot legally agree with itself that the receiving RSE will confer on the members equivalent rights to the rights the members had under the original RSE. A modification to regulation 1.03(1) of the SIS Regulations, as it applies to regulation 6.29 of the SIS Regulations, may be required to facilitate the RSE licensee’s ‘equivalent rights’ requirement in respect of the SFT.

90. Where an exemption or a modification declaration is in force for a transferring RSE and is considered to be still appropriate, APRA recommends that the receiving RSE licensee approach APRA in advance to discuss options for the application of the exemption or modification declaration to the receiving RSE.

Footnotes

11 For the purposes of this PPG, ‘an RSE licensee’ refers to both a transferring RSE licensee and a receiving RSE licensee.

12 Refer to section 52(2) of the SIS Act.

13 Refer to Prudential Standard CPS 230 Operational Risk Management.

Chapter 8 - Executing an SFT

Governance and conflicts considerations

91. It is important that an RSE licensee executes an SFT on a timely basis, with appropriate oversight and management of associated risks. This includes ensuring that the Board and any project governing committees receive regular reporting on the project progress against objectives, deliverables, risks, issues and key decision points.

92. A prudent RSE licensee would put in place documented decision-making protocols, and an escalation process, to ensure key decisions are timely, suitably informed, taken at the appropriate levels of responsibility, well documented and demonstrably in the best financial interests of beneficiaries. Where an RSE licensee decides to defer any key dates in the transfer, APRA expects these decisions would be documented with sound reasons for the delay.

93. Where an RSE licensee establishes a project to manage the implementation of the SFT in a structured and efficient manner, it is important that the project plan outlines clear timeframes for achievement of the various stages of the SFT activity to support progress monitoring and enable early responses to emerging issues. The project plan and supporting documentation would also provide clarity on key deliverables, milestones, roles, responsibilities and accountabilities.

94. The management of conflicts of interest during the SFT process is important to ensure that decisions are evidently made with primacy to the interests of beneficiaries. Registers of interests and duties will need to be reviewed given the SFT may change views on the relevance of disclosures. Existing conflicts management protocols will also need to be assessed to establish whether refinements or supplemental processes, training and guidance is necessary during the SFT so that an RSE licensee is able to demonstrate that any conflicts that arise during the SFT are suitably managed.

Communicating with members

95. The development of a communications strategy must identify and follow legal requirements on communications matters, including disclosure, significant event notice and exit statement requirements for the holders of financial products within the Corporations Act 2001 which are administered by ASIC.14

96. APRA expects that an RSE licensee would develop and implement a communications plan to ensure members and stakeholders are kept informed about matters that impact them in relation to the SFT, including, for example:

a) a decision to conduct an SFT;

b) details of any material changes to the benefit structure and future superannuation arrangements;

c) the continuity of, or changes to, existing insurance cover and how any claims in progress are to be managed; and

d) details of how disputes or concerns can be raised with the transferring RSE licensee, and any other matters relevant to the members.

97. APRA expects a transferring RSE licensee would clearly document the timing and methods for providing information to beneficiaries and other stakeholders including, but not limited to:

a) significant event notices, exit statements and other relevant disclosure documents;

b) communication that demonstrates that members’ benefits have been successfully transferred; and

c) contact details for the receiving RSE licensee and individual membership details in the receiving RSE.

Risk management

98. Transfers typically involve substantive changes to systems, people and processes. An RSE licensee’s risk profile will change as new risks arise and existing issues may be identified. Effective management of risks during an SFT supports the orderly and timely transfer of members’ benefits and assists an RSE licensee in meeting its legal obligations.

99. APRA expects an RSE licensee to demonstrate how it manages all material risks from the SFT. This includes consideration of any macro-economic events or other issues may potentially adversely affect investment markets or members’ benefits at the time of transfer.

100. The risk of disruption is heightened, particularly if the SFT is not managed well. An SFT cancelled late in the process can also expose members to costs that might have been avoided. APRA expects key risks and issues that could become potential ‘showstoppers’ to the transfer are identified and addressed as a priority.

Data management

101. APRA expects a transferring RSE licensee would ensure that the data being transferred and received is of sound quality, and that the risk of data breach, corruption and leakage is robustly managed. This includes processes for capturing and transmitting member data and assets and transferring records of insurance data to the receiving RSE, particularly where there is a change of insurer.15

102. At a minimum, APRA expects a transferring RSE licensee would perform a data cleansing exercise before the assets and liabilities are transferred to a receiving RSE. It may be prudent to engage appropriate specialists to assist in assessing the quality and accuracy of the data. An RSE licensee may refer to guidance issued by the Australian Tax Office (ATO) on the transfer of data for SFTs, including SuperStream requirements. The guidance is outlined in the ATO’s ‘Successor and intra fund transfer reporting guidance’.16

103. After the completion of an SFT, APRA expects a transferring RSE licensee and a receiving RSE licensee would each conduct a reconciliation of the member benefits, assets and liabilities transferred as part of the SFT.

Calculating benefits

104. APRA expects a transferring RSE licensee would be able to demonstrate how it has fully assessed and allocated each member’s entitlements. This may involve obtaining specialist advice on the calculation and verification of benefits and ensuring that final balances are signed off by the RSE auditor (and RSE actuary where the benefits of defined benefit members are being transferred).

105. Where relevant, APRA expects a transferring RSE licensee would have processes in place to ensure that the final crediting rate/unit price is fair and equitable. APRA also expects a transferring RSE licensee would have processes in place to confirm the valuation placed on the assets at the time of transfer and to ensure that the transfer of all assets is fully documented.

106. An RSE licensee would also agree and document arrangements for how insurance claims incurred, but not finalised, will be managed.

Financial resources held to meet regulatory requirements

107. An RSE licensee may be required, prior to a decision to undertake a transfer, to maintain financial resources within the RSE, the RSE licensee, or a combination of both to meet a legislative or regulatory requirement. This may include financial resources held to meet the operational risk financial requirement (ORFR) and ensuring any reserves in the RSEs will be treated in a manner that is consistent with the respective policies of the transferring RSE and the receiving RSE.17

108. In such circumstances, APRA expects the transferring and receiving RSE licensees would resolve how financial requirements for the receiving RSE licensee will be met once the transfer is complete. This includes, but is not limited to, financial resources held to meet the requirements under section 52(8) of the SIS Act.

109. In determining how to proceed, APRA expects the transferring and receiving RSE licensees would reach agreement on an equitable approach that, on balance, is demonstrably consistent with the duty of each RSE licensee to act in the best financial interests of beneficiaries. How each RSE licensee has funded these financial resources is likely to be relevant to the agreement. In the case of a partial SFT, APRA expects a transferring RSE licensee would also consider the effect on any members remaining in the transferring RSE.

110. It is APRA’s view that differences in the ORFR financial resources, the ORFR target amount or the ORFR strategy would not generally, of themselves, prevent an SFT occurring, as the ORFR is only one of a number of factors relevant in an SFT.

Wind-up of an RSE

111. After the completion of a transfer of all beneficiaries’ benefits out of an RSE or out of a MySuper product, an RSE licensee must ensure that registrations are cancelled and, where relevant, the RSE is wound up. This includes:

a) where an RSE is closed to new entrants and all members’ benefits are transferred out, the transferring RSE licensee making arrangements for the RSE to be wound-up and for its registration as an RSE to be cancelled by APRA18; and

b) where all the members’ benefits are transferred out of a MySuper product, the transferring RSE licensee contacting APRA to determine whether the authority to offer the MySuper product must also be cancelled.19

112. Before a wind-up is finalised, APRA expects a transferring RSE licensee and a receiving RSE licensee would formally agree on how minor residual assets or liabilities, for example, taxes, legal fees, outstanding APRA levies or unexpected receipts are to be managed after the transfer has been completed. Such agreements would ordinarily be documented in the arrangement between the transferring RSE licensee and the receiving RSE licensee.

113. A prudent transferring RSE licensee would ensure it has the necessary arrangements in place to ensure it can meet its ongoing reporting, financial statement and audit obligations until such time as all wind-up reporting has been completed.

114. Reporting Standard SRS 602.0 Wind-up (SRS 602.0) sets out the requirements for lodgement of a wind-up return with APRA within three months of the wind-up date. APRA expects a transferring RSE licensee would have a process in place to confirm that lodgement of a wind-up return and cancellation of registration has occurred.

115. Where there are no other RSEs under trusteeship, APRA expects that a transferring RSE licensee would immediately apply to APRA to have its RSE licence cancelled after completion of the transfer.20

Footnotes

14 Refer to section 1017B of the Corporations Act 2001 and Notifying members about superannuation transfers without consent | ASIC.

15 Refer to Prudential Standard SPS 250 Insurance in Superannuation and Prudential Practice Guide SPG 250 Insurance in Superannuation for requirements and guidance in relation to the maintenance of sufficiently detailed insurance records.

16 Refer to the ATO’s Successor and intra fund transfer reporting guidance available at: Successor and intra fund transfer reporting guidance | Australian Taxation Office (ato.gov.au).

17 Refer to Prudential Standard SPS 114 Operational Risk Financial Requirement.

18 Refer to section 29N of the SIS Act. A reference to ‘winding up’ in this PPG can also be read as a reference to cancelling the registration of an RSE.

19 Refer to section 29U of the SIS Act and paragraphs 33 to 43 of SPS 515 for requirements relevant to the cancellation of a MySuper authority.

20 Refer to section 29G(2)(a) of the SIS Act.

Attachment A: Illustrative indicators relevant to an RSE licensee’s business operations

Financial performance indicators | |

| |

| |

| |

| |

| |

| |

Membership indicators | |

| |

| |

| |

| |

| |

| |

| |

| |

Service provider indicators | |

| |

| |

Marketing indicators |

|

|

|

|

|

|

|

|

|