Views from APRA

Ian Laughlin, Deputy Chairman - Insurance Council of Australia Regulatory Update Seminar, Sydney

When I was asked to speak at today’s meeting, my first reaction was to wonder what I would say that would be new and not bore everyone silly. You certainly won’t want to hear me talk about LAGIC again – probably ever, in your whole remaining lifetime!

We’ve had many policy changes over the last few years, as we have renovated the regulatory framework. But we have largely completed that work – if you like, the renovation is almost complete, with just finishing touches required.

Indeed, right now we have no plans for significant regulatory change.

But there are many areas where improvement can and should be made without any formal changes by APRA at all. That is, we want to put the renovated framework to its best use, as comfortably and effectively as possible.

So we won’t be sitting on our hands - there is always a better way, and you should expect that we will tackle our job accordingly.

The first message I’d like to leave you with, therefore, is that you, the industry, should not become complacent.

To pre-empt the question, this does not necessarily mean more regulation! Indeed, as you will see, we are seeking ways to reduce the compliance burden.

So, as I thought about it, I realised there is quite a lot that I might say which might be at least partly new, and hopefully a little interesting to you.

I’ll follow this general path:

International context

Let’s start with the international perspective.

Forgive the acronyms – I will explain as I go.

As I am sure you are well aware, APRA is an active member of the International Association of Insurance Supervisors (IAIS). I am on the Executive Committee, my colleague Keith Chapman is on the Technical and Financial Stability Committees, and we have various other people engaged in IAIS work. The IAIS sets Insurance Core Principles (ICPs) which provide guidance for its members. There is usually work under way refining these ICPs and this has continued over the last year. That work is not likely to lead to significant changes in Australia.

The ICPs cover both individual insurers and insurance groups. However, for the last few years, the IAIS has been working on Comframe – a common framework for the supervision of internationally active insurance groups (IAIGs).

There has been further extensive work and consultation on Comframe over the last year, and this has resulted in some simplification and better alignment with the ICPs. Field testing has now started, and supervisory colleges are already putting Comframe thinking to good use.

There was a particularly significant development during the year which overtook some of the Comframe work.

Before I elaborate, a little background will help. In July 2013, the IAIS completed the development of methodology to assess the global systemic importance of insurers. This resulted in a ranking of insurers. The Financial Stability Board (FSB) then decided that nine insurers on this list should be declared to be global systemically important insurers (G-SIIs). Further work was requested on reinsurers before a decision was made on them, and this work is now underway.

That led to the measures that should be taken for each G-SII to address its systemic importance. One of these is what is called higher loss absorbency or HLA – basically extra capital. But that presented a problem: given there is no global capital standard, to what would HLA actually be added?

The idea of an international insurance capital standard has been discussed for years, and it was intended that Comframe tackle capital in an as yet undetermined way. However, an international capital standard has never really gained traction. There is a variety of reasons for this, including a belief that it was not needed, a lack of alignment of thinking on how minimum capital should be determined, and no accepted global accounting standard for insurance.

However, the G-SII HLA issue changed the nature of the conversation and helped break down some of the barriers. In short, the IAIS has responded to FSB calls and committed to the development and promulgation of not one but two international capital standards:

The first, the BCR, is intended to be the foundation for HLA for G-SIIs. The BCR is intended to be a relatively simple calculation, and is planned to be finalised by the end of this year. The associated HLA would then be finalised by end 2015.

The ICS is intended to be more of a fully-fledged capital standard for IAIGs, though its precise form (framework, standard formula etc) is still being debated. It will take a number of years to develop, and is intended to be operational in 2019.

We (APRA) are actively involved in this work.

How will these two standards impact Australia and when?

It’s a bit early to tell, but let me offer some thoughts.

First the BCR is primarily intended to be a tool for G-SIIs. Australia does not have any of these. However, there is a possibility that the BCR will be applied more broadly in future (e.g. to IAIGs), and so eventually it could have implications here in Australia.

The ICS is intended to apply to IAIGs. We do have some of those. So the ICS is likely to be relevant for us. This does not mean though that it necessarily will have any great impact. The reason for this is that the ICS may well be initially set at a level below LAGIC – it remains to be seen.

Solvency II

Many of you will have heard of Solvency II. Solvency II is often assumed to be an international standard. It isn’t – it is a European standard. However, perhaps because it is quite sophisticated (indeed complex), and it has attracted a lot of attention during its long gestation, it does have an influence beyond European borders. For example, some jurisdictions are seeking to replicate much of its functionality in their own requirements.

Indeed, in developing LAGIC, we had regard to Solvency II thinking. But then the Europeans tell us they had regard to our requirements in developing Solvency II.

The main development during the year was the commitment to finally implement it from 1 January 2016, and that commitment is changing the nature of the discussion. By then it will have been in development for around 15 years!

The Americans have a very different approach, and they are working on their own solvency modernisation initiative.

Domestic context

Now let’s turn to matters more domestic.

Recap

Let’s start with a brief review of the main changes APRA has introduced over the last few years (for GI):

- 2008: Level 2 insurance group supervision, including power to supervise group holding companies and capital requirements for the insurance group. There were refinements in Oct 2011.

- April 2010: requirements for remuneration arrangements that supported prudential risk management.

- July 2010: changes to align prudential reporting more closely with statutory reporting for general insurers

- July 2010: changes to Maximum Event Retention (MER) for Lenders Mortgage Insurers (LMIs)

- July 2012: consolidated (multi-industry) prudential standards on governance, fit and proper, outsourcing and business continuity.

- January 2013: the introduction of new capital standards under LAGIC.

- 2013: consultation on data confidentiality (ongoing)

- Sept 2013: guidance on data risk management

- January 2014: reinsurance counterparty data collection; presently consulting on guidance and reinsurer identifiers

- From January 2015: consolidated (multi-industry) risk management standards (largely consistent with existing GI standards). So there has been a lot of change, some major and some minor. We recognise the challenges this has given to industry and we acknowledge the constructive approach you have taken in addressing them. Again, I stress the renovation is largely complete.

From last year

This is a from my ICA talk last year. It shows the matters that were on our radar at the time.

We have made progress on most of these issues, as I will explain in more detail shortly.

The legislation required to strengthen APRA’s powers - mainly to help us better deal with a failed institution – is not within our control and has not progressed greatly, and so time will tell how that plays out.

New government

We have a new government with a clear aim to reduce regulatory burden and red tape.

In support of this policy position, APRA has commenced a process to identify ways to reduce the cost of meeting APRA’s regulatory requirements - in a manner that maintains sound prudential outcomes. (For clarity, this is about administrative costs, and not capital costs etc.). The July 2010 changes mentioned above to align prudential and statutory reporting is an example of this sort of thing. We will be seeking opportunities through an internal exercise, and also asking industry for its views.

As a matter of course, when we introduce significant changes to the regulatory regime, we ask for information on compliance costs. Unfortunately, we very rarely are given any feedback at all. So please do take the opportunity to give us input when we ask for it in coming months.

In the meantime, the Financial System Inquiry is underway. This eventually will have an impact on APRA and its regulation of the financial services industries. To be continued.

Stock-take - APRA

So has all of this made a big difference? Has it helped APRA achieve its Mission?

It’s notoriously hard to assess the value we provide.

If none of the depositors or policyholders or members of our institutions have suffered any losses, does this mean we have done our job well and provided value? Not necessarily – that might be just good luck, or a function of a strong economy. What if we do a very good job of resolving a financial institution that gets into trouble? Is that providing good value too? And what if there had been no losses by depositors or policyholders or super members, but our supervision had impeded competition or efficiency in some way?

So, all very difficult. I won’t attempt to provide any answers here.

We do survey our various stakeholders every couple of years using an independent firm, and publish the results. The 2013 survey report is on our web-site. I don’t have time to go through those results now, but they are generally quite positive.

I do want to touch on another, less obvious value that APRA provides. As you know, we have a principles-based approach to much of our regulation and supervision. As our prudential standards, guidance and supervision evolve, in effect they capture what we see as good practice. We develop our thinking on this good practice based on our own experience and expertise, and on what we see within the many and varied institutions we supervise.

While this good practice is intended to support our aims and the prudential responsibilities of boards and management, rather than the business objectives of our institutions, much of it is actually good business practice too. For example, having an effective, well-governed and well-managed risk management framework makes just as much sense for shareholders as it does for depositors or policyholders or super members.

A stand-out example of this is the introduction of the ICAAP to insurers as part of LAGIC. Because it was new and we had set high expectations of management and boards, by and large it was taken very seriously. Many boards had lengthy workshops, often with support from consultants or advisers, to help develop thinking and the formal documentation.

In meetings with boards and management, we have on a number of occasions been told how valuable the board found this to be. Not only did it help them in meeting the formal obligations, but it also helped give much greater insight into the business’s risks and capital needs. In some cases it seemed to help align thinking of management and board also.

In summary, we’d like to think that the changes we have introduced have helped lift not just the prudential soundness of insurers, but also general governance and management standards across the industry.

Stock-take – industry

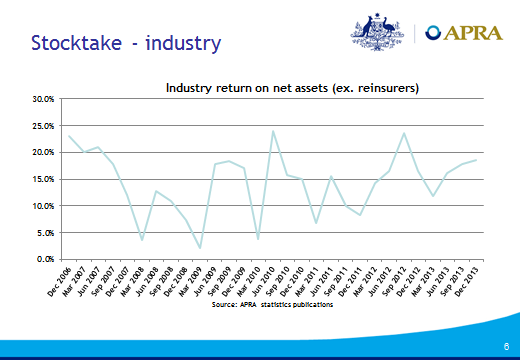

The industry’s financial performance in recent times has been generally quite sound. Insurance margins have been reasonable high, as has return on capital. This shows a steady upward trend.

Retail business in particular has been quite profitable, on the back of significant price rises following the natural catastrophes in 2010/11, particularly in home portfolios, and relatively benign claims experience since that time.

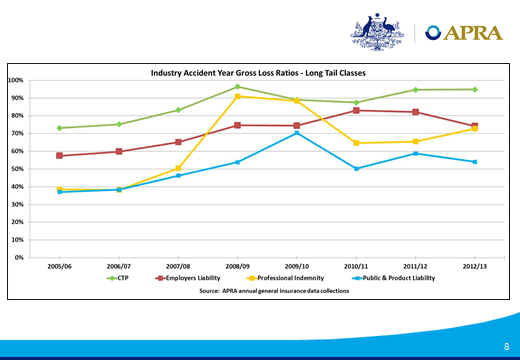

This is an interesting graph showing undiscounted loss ratios of long-tail business. A couple of point to note: First the ratios appear to have stabilised in recent years, and second the ratios differ quite a lot by class of business. For various reasons, care needs to be taken in translating this into profitability, but long tail classes generally appear profitable at an industry level. Reserve releases have helped, and more on this later.

Feedback from a number of insurers indicates that pricing in the commercial lines market remains soft because of excess capacity available in the market. This feedback is supported by recent industry surveys and commentary by brokers.

APRA is monitoring this position closely through a stocktake of the premium and pricing data available to APRA. This will highlight changes in market share by insurer which could be attributable to aggressive pricing strategies. Later this year, supervisors will engage with their insurers to discuss pricing strategies and the rigour of their technical pricing framework.

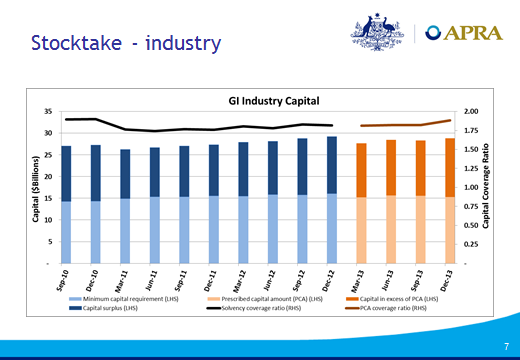

At the same time, overall capital levels remain healthy.

Generally, governance standards are adequate, with larger insurers tending to be stronger. Likewise, board quality is generally satisfactory, again with larger insurers being better than smaller insurers. Boards generally have reasonably diverse compositions, but some could benefit from directors with more insurance (and reinsurance) expertise.

There is clear evidence that boards continue to increase their engagement in matters such as risk management, and in general they are providing more rigorous oversight of management. In some cases, we would like to see more challenge of management from the board – for example in strategy development.

Management is generally competent and capable, and is becoming more proficient in risk management.

The industry continues to develop its risk management capabilities, but there is certainly ongoing need for improvement. More on that below.

The industry continues its journey to become more sophisticated in its analysis, pricing, reserving and monitoring. The quality of Financial Condition Reports (FCRs) continues to improve, and FCRs seem to be well accepted as a powerful tool for management and board.

APRA attention

So, to what is our attention now directed? Let me walk through this list.

Bedding down LAGIC

LAGIC commenced 1 January last year. We are quite pleased with the way industry has managed the adoption of LAGIC. There was a great deal of work involved of course, but actual implementation has been relatively pain-free. By and large the industry has met our expectations and requirements.

Our attention is now turned to the practical aspects of LAGIC. We do need to ensure there are no misunderstandings or errors in the application of the standards. We will do this over time as part of our ongoing supervision and review processes. Feedback will be provided to each insurer and where necessary we will communicate to the industry.

ICAAP

ICAAP is a particular subset and a critical component of LAGIC. Again, by and large the industry has done reasonably well in its implementation of ICAAP. There is still considerable improvement needed in many Summary Statements, but that is as we expected.

There is also widespread need for improvement in the use of stress testing, and we will give this particular attention in our supervision.

As required, we have given direct feedback to insurers on Summary Statements, and we will continue to do this. Also, as you might recall we wrote to all insurers in December setting out the results of our analysis of Summary Statements at an industry level, and providing broad guidance based on this. This included a series of questions for insurers to consider. We urge you to closely review that letter and its suggestions.

The first ICAAP reports are about to come to us in significant numbers. Later this year, we will conduct an industry wide review of the Reports, as we did for the Summary Statements. We will then write to all insurers with observations and suggestions.

Risk management, governance and culture

As you know, we place considerable importance on an insurer’s quality of risk management. GPS 220 was introduced some years ago and practices have generally improved over the time since.

More recently, because of its fundamental importance to robust and effective risk management, we have given a great deal of attention to risk appetite. This was supported by a letter giving guidance and posing questions for the board and management to consider. We continue to see improvement in risk appetite statements and in board engagement in their operation, but improvements are still needed on both for many insurers. I hope we will be able to give further guidance on risk appetite in due course.

More recently of course, the cross industry standard CPS 220 was developed and will apply from 1 Jan 2015. It is broadly consistent with GPS 220, but there are some additional requirements – in particular, the need for a separate board risk committee and a designated chief risk officer.

In my talk last year, I mentioned that we intended to increase the attention we were giving to governance and risk culture. I referred you to a speech John Laker had given a week earlier.

Subsequently, I gave a speech to an Actuaries Institute conference which built on John’s speech, and focused more on risk culture.

If you have not done so, I would urge you to read both of these speeches, as they provide useful insight into governance and risk culture and APRA’s views and expectations in this area.

Last November, through its work on Increasing the Intensity and Effectiveness of Supervision, the FSB issued a paper for consultation: Guidance on Supervisory Interaction with Financial Institutions on Risk Culture. APRA was involved in the development of this paper, and you might want to read it if you have an interest in this area.

The paper reflects the importance that the international regulatory community is placing on these issues.

Governance and risk culture will receive appropriate attention from us in coming years.

Catastrophe risk management

The significant natural peril events in Australia and New Zealand during 2010/2011 highlighted the importance of strong governance and risk management by insurers when deciding their catastrophe risk appetite and catastrophe reinsurance arrangements.

As a result, during 2012/13 APRA undertook a review of catastrophe modelling governance and risk management policies and practices applied by a sample of property insurers. We found that insurers could improve their catastrophe risk governance and management in a number of ways.

We set out our findings in a letter to CEOs and chairmen in December last year. This highlighted our concerns in a number of areas and posed questions for insurers to consider.

One matter in which we have a keen interest is the sometimes blind reliance on catastrophe models. This can lead to inadequate levels of reinsurance being purchased, and expose property insurers (& reinsurers) to significant claims costs in the event of a natural catastrophe. It can also lead to inappropriate decisions on capital targets.

These models are clearly only a representation of the real world. They will contain explicit assumptions, limitations and unknown shortcomings, which means there is considerable uncertainty in their output. APRA expects the board and senior management to have a sound understanding of the insurer’s approach to the use of models to manage catastrophe risks. It is essential that insurers undertake appropriate due diligence in relation to the use of catastrophe models.

The letter also urged insurers’ boards and senior management to satisfy themselves that the policies and practices they follow for catastrophe risk management are sound and lead to appropriately prudent outcomes. For example, each insurer should ensure that it clearly sets and articulates its appetite for catastrophe risk and should satisfy itself that the residual catastrophe risk is truly within its appetite.

We are quite intent on seeing improvements in this area and our supervision will reflect this.

It is encouraging to see the consortium of insurers and brokers setting up the OASIS Loss Modelling Framework in London – an “independent, global, open framework for use by any party with an interest in creating a catastrophe model”. This looks to be a valuable addition to industry capabilities, and we are keen to see how it evolves. It is good to see that Australian flood risks are already within scope.

It is also good to see progress being made on flood mapping in Australia.

Alternative risk transfer

It is clear that alternative risk transfer (ART) has had a surge in interest in recent times and is gaining greater market acceptance around the world. While the use of these products in Australia by APRA-authorised insurers (and reinsurers) has been modest to date, activity and interest has increased significantly.

During 2013 we met with a number of players in this market – brokers and investment banks as well as the Bermuda Monetary Authority.

These meetings have been helpful in that we were able to better understand market developments and at the same time the brokers and bankers had the opportunity to understand APRA’s thinking.

As you know, ART comes in a variety of forms – cat bonds, side cars, special purpose reinsurance, insurance-linked securities, industry loss warranties and so on. And then there are issues of collateralisation, and a variety of triggers – indemnity, parametric, modelled loss, industry loss etc.

APRA has no philosophically negative view of these developments. Indeed we welcome them, as they provide more depth to the market.

We are primarily concerned with their effectiveness in providing the cover needed - in particular, for regulatory capital purposes. So basis risk – the risk that the cash flow from the security does not match the cash outflow from the insurer – is of particular concern.

An important part of recent development has been the increase in indemnity arrangements, where this risk is eliminated.

Another concern is the possible impact of new supplies of capital from institutional investors into the reinsurance market. This increase in capacity could lead to underwriting risk and insurer/ reinsurer pricing not properly reflecting risk.

There are other risks (legal, counterparty and operational risks) which need to be understood by boards and senior management.

We are also concerned that there is no inappropriate recognition of ART in the Prudential Capital Requirement (PCR).

In summary, we are monitoring developments closely, increasing our own understanding, and expect more interaction with industry in this field.

Reinsurance counterparty data

Following the introduction of the reinsurance counterparty data collection from this year, we will analyse the information collected, and assess the implications for the industry and individual insurers.

FSAP actions

In 2012, the IMF conducted a Financial Sector Assessment Program (FSAP) review for Australia. This included an assessment of our compliance with the IAIS ICPs. Generally, the assessment was quite positive, but there were a some areas where we were criticised – for example:

- Our disclosure regime under Pillar 3 of LAGIC is not as strong as it could be. We are currently consulting with industry on making non-confidential more of the industry data we collect. I would hope we will resolve that this year. In due course, we will turn our attention to other disclosure matters (which will be less relevant for listed companies because of their ASX disclosure obligations);

- Our requirements for risk management and control functions could be improved. This has largely been addressed with the issue of CPS 220, the new risk management standard, and revised CPS 510 on governance.

D-SIIs

The FSB, after first dealing with global systemic importance in the banking industry, turned its attention to domestic systemic importance. In December, APRA finalised its requirements for domestic systemically important banks in Australia.

The FSB and the IAIS are still working on global systemic importance for Insurers (as mentioned earlier). In due course, they will turn their attention to domestic systemic importance, and APRA will then consider the implications for Australia. You may think this will never happen, given I first mentioned D-SIIs about three years ago, but we will get to it in due course.

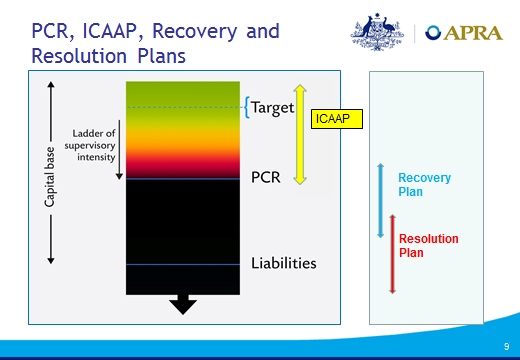

Closely associated with D-SIIs is the idea of recovery and resolution plans. Again, you may have heard me mention this before. It’s not urgent, but it too is moving up the priority list.

In any event, we see merit in some of the thinking behind recovery and resolution planning, independently of formal D-SII requirements. To remind you, this is how recovery and resolution plans complement our capital requirements in concept:

Level 3

Level 3 is about the supervision of conglomerate groups – those with elements such as banking, insurance, superannuation, and funds management, and perhaps non-financial services businesses.

In late 2012 and extensively throughout 2013, we consulted on our proposals for capital and other requirements for Level 3 groups. This only affects eight groups.

This work is largely finalised.

Reserve releases

General insurers (and reinsurers) - particularly those with significant long tail business - face the risk of inadequate reserving, exposing them to potential losses as claims experience emerges.

Reserve releases have been a strong feature of general insurers’ results in recent years particularly following the tort reform of the CTP and liability classes.

So there is the possibility that insurers will become reliant – in the heads of management and in their published results – on reserve releases. Certainly, we see both public and internal commentary by insurers that support that contention. The market then comes to expect releases, and management is disinclined to disappoint, and so we have the makings of a problem.

Even though some lines of business have been particularly profitable in recent times, the very low current interest rates impact profitability and this may add to the temptation to bolster profits with reserve releases.

So are reserve releases sustainable at recent levels?

In addressing this question, it is useful to consider the various sources of reserve releases. Here are some examples:

- When reserves are set up they include an allowance for low frequency but high cost claims in the IBNR. Most years such claims do not occur therefore the provision for them can subsequently be released. Of course, on the odd occasion that the low frequency claim does arise then the insurer must raise reserves as the IBNR amount will likely be insufficient.

- Reserves generally make an allowance for superimposed inflation. Most years, superimposed inflation does not occur and the reserve can be released. Of course, in those years where superimposed inflation does occur it often takes off quite quickly and reserves may prove insufficient.

- When there are scheme changes, court decisions etc it can be difficult to assess the likely outcome. It can be easier and more prudent to hold on to reserves until the effect of the change becomes clear, than it is to release reserves to profit and then strengthen again if the improvements turn out to be not as good as initially believed.

- The most recent accident period is the least certain. There is often a range of outcomes that might be considered a central estimate. It can often be more comfortable to set reserves towards the high end of that range for the most recent year knowing that it is easier to subsequently release reserves as likely outcomes become clearer, than it will be to strengthen them. This is a case of over-reserving, but is not usually explicitly quantified.

The first two factors will generate releases in many years and may lead to an expectation about the level of releases. However they are not necessarily a sign of conservative reserving.

The third and fourth factors are over-reserving, although the caution surrounding environmental changes in point 3 is understandable.

So what does all of this mean for APRA as supervisor?

We would like insurers to conduct a thorough analysis and explanation of any release of reserves, distinguishing between sources of movement so that they can be clearly justified. This should include an assessment of sustainability.

The board - are we asking too much?

We sometimes are told that we expect too much from boards or that we are giving boards responsibilities that more rightly sit with management.

And there are numerous references in prudential standards and guidance to the board, many of which place specific responsibilities on directors or the board or a board committee.

For some time we have been working – when resources allow - on a review of the requirements we impose on boards. There are two initiatives:

We are developing an ‘information pamphlet’ for new and existing board members to give a concise and plain-English view of what APRA expects of board members in their oversight of prudential matters. We are also performing a stock-take of APRA’s existing requirements for boards to assess consistency across industries and whether any requirements are unreasonable or unduly onerous. In short, are boards being asked by APRA to do too much, too often?

That takes us to the end of our list.

To my earlier comments, in a number of cases, this work will support good business practice.

Conclusion

To summarise:

- The renovations are largely complete - we have no significant regulatory changes in the pipeline;

- There is much international activity, but this will not have a great impact on Australia in the next few years;

- The industry is generally healthy;

- APRA will continue to seek to lift industry standards where it can;

- There is a substantial number of areas of attention for APRA over the coming year; and

- Stay on your toes.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.