The super system - what is on APRA's watch-list?

Helen Rowell, Executive Member - AFR Banking & Wealth Summit, Sydney

Good morning everyone, it is a pleasure to be here. This is a pivotal time for the financial services industry, and the superannuation industry in particular. The range of topics covered over the seminar’s two days provide a clear indication of the many important and strategic issues with which industry participants are currently grappling.

I have been asked to address what is on APRA’s watch-list for the superannuation industry. My aim this morning is to provide context from an APRA perspective on some of the key industry issues, and give an indication of APRA’s expectations in these areas.

I am going to focus on four key topics this morning:

- Industry response to strategic issues;

- Governance, risk management and risk culture;

- Investment governance and management; and

- MySuper and assessment of outcomes and efficiency.

Industry response to strategic issues

Let me start with the industry’s response to strategic issues.

Superannuation plays a critical role in helping Australia meet the economic and fiscal challenges of an ageing population. As you would all know, superannuation is now the second largest asset for many Australians. The Financial System Inquiry (FSI) noted that its growing importance underlines the need for a regulatory approach that puts individual members at the very centre of the system – benefiting both individual Australians and the economy as a whole.[1] The FSI also noted that an efficient superannuation system is critical to help Australia meet the economic and fiscal challenges of an ageing population. While its importance for retirees and, to a lesser extent, taxpayers is self evident, superannuation efficiency is also vital to sustaining long-term economic growth, given the system’s increasing importance in funding Australia’s prosperity.[2]

The current superannuation system has considerable strengths. Many commentators however, including the FSI, have identified areas where further enhancements may be needed to achieve better outcomes for members. So, there remain significant strategic challenges on the horizon as further changes are made to ensure the system meets its objectives. It is critical that industry participants, and trustees in particular, respond effectively to the changes ahead and remain focussed on achieving the long term objectives of the superannuation system.

The strategic issues and challenges facing the industry will be familiar to you all and include:

- the FSI recommendations relevant to superannuation;

- heightened trustee obligations in relation to MySuper products;

- possible changes to the tax treatment of superannuation;

- sustainability of insurance provided through superannuation funds; and

- investment governance and management issues.

The final shape of the changes in some of these areas may not be known for some months, or longer. It is nevertheless clear that there is no shortage of strategic issues to which the industry needs to respond in the coming months and years.

Change is both a challenge and opportunity – those that embrace it and prepare for it will fare better than those that do not. Readiness for change is one of the most important challenges for the industry, if it is to deliver on its obligations to fund members over the coming years.

We all suffer from change fatigue at times, but changes to the superannuation framework in one shape or form are almost inevitable as the environment in which the industry operates continues to change and evolve. This is not just a superannuation issue – every industry continually faces strategic challenges. Responding effectively to these is not always easy, and requires a strong, professional board willing to face up to the task. It requires boards to be proactive and forward-looking; to develop and implement clear and effective strategies; and ensure that they have the resources and capabilities that will be needed. For superannuation boards, this must be achieved whilst maintaining the necessary focus on meeting their obligation to act in members’ best interests.

Some trustees are clearly positioning themselves for the future and responding proactively to the challenges that they see ahead. But that is not universally the case across the industry. Some trustees may feel they need more clarity in some areas and will respond appropriately in due course – hopefully sooner rather than later. Others may decide that they are unlikely to have the resources and capabilities that will be needed to deliver value for their members into the future, and seek to merge or wind-up the funds under their oversight.

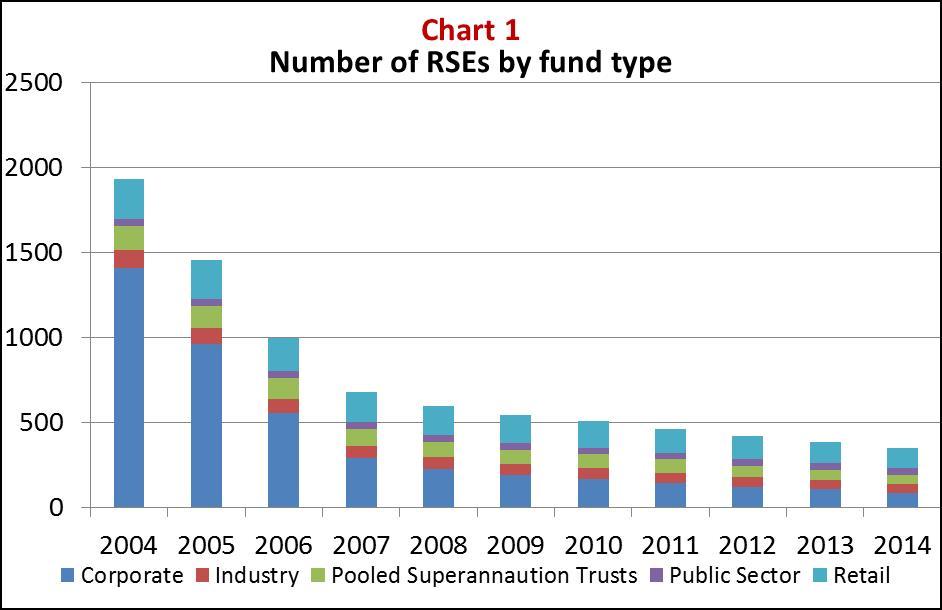

APRA therefore expects that there will be a continuation of the industry consolidation trend that Wayne touched on in his presentation earlier this morning. This is a trend that would be familiar to most industry observers. As Chart 1 shows, the number of funds reduced from over 1900 in June 2004 to around 350 in June 2014. It reduced further, to about 330, by December 2014. Consolidation has been particularly noticeable in the corporate fund segment, where the number of RSEs has declined from over 1400 to less than 100 in the last 10 years, but it has also been a feature of the other industry segments.

APRA’s focus in the coming months will remain on ensuring that all trustees are proactively considering their future strategy and putting in place concrete plans to address the issues ahead. In some cases, this may mean planning for (a hopefully graceful) exit from the industry. This is particularly relevant for those trustees offering MySuper products. We would encourage all trustees, however, to embrace change, challenge past approaches and practices when necessary, and always be prepared to ask whether or not you are really adding value for your members.

Governance, risk management and risk culture

Let me turn now to the topic of governance, risk management and risk culture.

Clearly the role of the board is important in responding to strategic issues. Many commentators have noted the importance of sound governance – led by a strong board - for the achievement of organisational performance. Some overseas research, for example, suggests that good governance adds one percentage point to pension fund returns.[3]

Sound governance has long been a priority for APRA across all of the industries which we regulate. It has been a particular focus throughout the implementation of the Stronger Super reforms over the last few years. The new prudential framework underpinning these reforms is aimed at enhancing governance and risk management practices across the superannuation industry.

APRA’s experience to date indicates that, while progress is being made, further improvements are needed in many areas. These include management of conflicts of interest and insurance management, which have been particular areas of focus in our recent thematic reviews. But there are a range of other areas across the new prudential standards where not all of the industry meets the heightened expectations that have been set for trustees.

Governance, risk management and risk culture are inherently linked. It is very difficult to have robust governance practices if the risk culture of the organisation is poor. In APRA’s view, the industry still has some way to go to really understand the difference between compliance and risk management. A robust compliance framework to ensure adherence with regulatory requirements is important, but just meeting minimum requirements is not enough. APRA is looking for trustees to develop a risk culture and approach that is truly focused on identifying and effectively managing risks, and which seeks to meet the spirit and intent, not just the letter, of the prudential requirements.

The role of the board and individual directors is critical here. Critical in providing strong oversight and robust challenge to management, in ensuring that risk management frameworks are appropriate and effectively implemented, and that a sound risk culture is expected and is being adopted across their operations.

The board also needs to set the future strategy for its operations, and take a lead role (working with senior management) in meeting challenges and addressing issues as they arise. At times this will mean making difficult decisions, such as deciding that the strategy that is in the best interests of fund members is to transfer them to another fund. APRA expects boards to be prepared to take those hard decisions, acting in the best interests of their members rather than self-interest.

For boards to be able to do this effectively, the right skills and capabilities are needed around the board table. APRA’s experience, over many years and across all industries, suggests that having at least some independent directors on boards best supports sound governance outcomes. As the FSI also noted, this is consistent with international best practice in corporate governance.[4] Independent directors improve decision making by bringing an objective perspective to issues the board considers. They also hold other directors accountable for their conduct, particularly in relation to conflicts of interest. In APRA’s view, the diversity of views and experience that independent directors bring supports more robust decision making by boards.

The appointment and selection processes for directors, and the implementation of regular and robust board and director performance assessments, are also critical to support sound governance practices. Irrespective of any changes that the Government may make to requirements for the composition of superannuation boards, APRA expects trustees to adopt robust director appointment and board renewal processes that seek to ensure that boards have the breadth of capability needed to meet their obligations to members into the future. And we would encourage all boards to actively consider the value that independent directors can add.

Investment governance and management

While the FSI has raised the need for broad political agreement for the objectives of the superannuation system, most industry stakeholders agree that it centres on providing adequate income for members in retirement. And one of the most critical areas for trustees in meeting this objective is the investment of fund assets – which is my third topic today.

To support trustees, APRA’s expectations are now much more clearly and explicitly articulated in the prudential standards and related guidance. APRA’s investment governance requirements seek to ensure that trustees have a clear view of their investment objectives, effectively implement an investment strategy to achieve those objectives, and rigorously monitor performance against the objectives and strategy that have been set. That may not sound particular new or insightful – but it is critically important, and not necessarily well achieved in practice!

Investment markets, instruments and structures continue to evolve and are increasingly complex. The economic uncertainty that was particularly heightened during the GFC continues. And the persistent low interest rate environment makes it increasingly difficult for trustees to achieve the risk/return objectives that they have set. The need to meet member’s expectations is leading many funds to offer an increasing number of investment options, particularly on wrap platforms. Some funds are increasing the level of investment undertaken in-house, and the use of lifecycle investment strategies is also increasing.

While many trustees have sound investment governance practices and have taken steps to enhance their practices to meet the expectations set out in the prudential standards, others have not. Some trustees appear to lack an understanding of their investment strategy and underlying investments, are over-reliant on service providers or have significant weaknesses in their investment governance and investment risk management frameworks.

APRA has noted in other forums that trustees seeking to manage investments in-house need to ensure that they have appropriate governance arrangements in place, and the necessary skills and resources required to effectively manage and monitor their investments. We have also set clear expectations regarding the due diligence and ongoing monitoring that we expect to be undertaken by trustees in respect of each product or option that is offered to members – particularly where product promoters are involved.

Finally, liquidity management and portfolio stress testing are areas where industry practice needs to further evolve. Stress testing is not just a compliance exercise; it is a useful risk management tool that assists in identifying key risk exposures and understanding potential losses. There is wide variation in liquidity management practices across the industry, and also some misunderstanding of APRA’s expectations in this area, which may be leading to unduly conservative liquidity management practices by some trustees. APRA will continue to provide feedback to trustees on better practice and areas for further improvement, and is undertaking a thematic review to delve further into industry liquidity management and stress testing practices.

Before I leave the topic of investments, I’d like to make a few comments on investment performance assessment and comparisons. In particular I’d like to emphasise the importance of taking a long term view; focusing on performance against objectives; and comparing apples with apples, rather than oranges or lemons.

Industry participants, and the media, have long been reporting industry investment performance each quarter, based on peer comparisons often over very short periods. We also see regular commentary about investment performance by industry segment, particularly focusing on comparisons between industry and retail funds based on average fund-level performance over various time periods. For a number of reasons, such comparisons are not meaningful in assessing whether investment objectives, and hence outcomes for members, are being achieved over the long term.

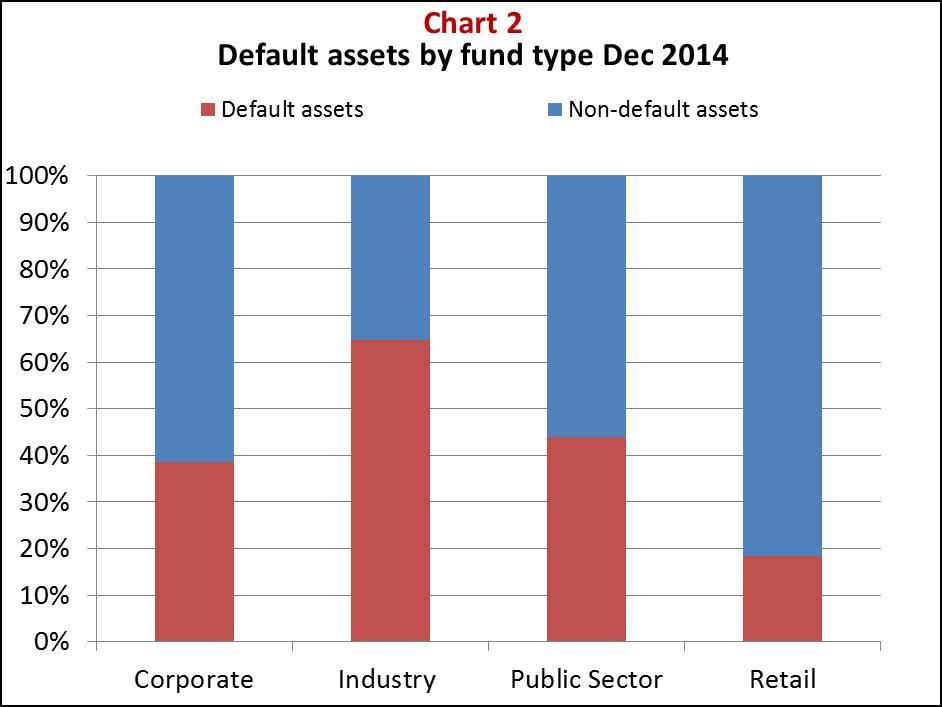

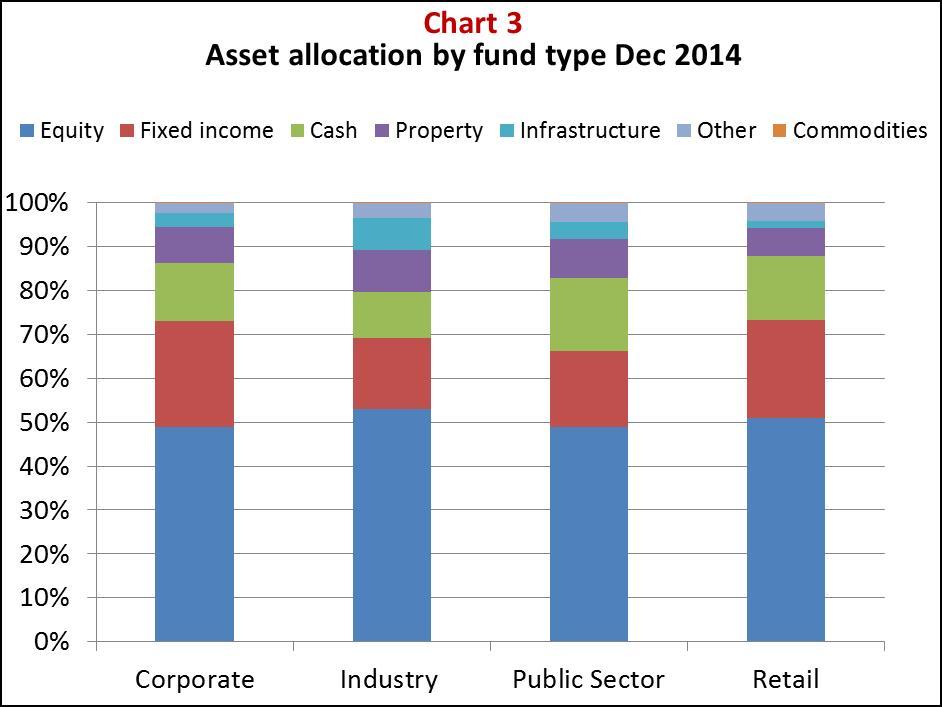

Firstly, members’ benefits are determined by the performance of the particular options in which they are invested, and this can vary significantly from overall performance at fund level. This is particularly the case for retail funds, where a much smaller proportion of fund assets are held in the default investment option, as shown on Chart 2. At fund level, particularly for the retail segment, overall investment outcomes will be very heavily dependent on the particular options which members choose, and the asset allocation of those options. Chart 3 shows that the asset allocation across all retail funds at December 2014, for example, is more heavily weighted towards more defensive cash and fixed interest asset classes (the red and green segments) rather than growth asset classes such as property and infrastructure (the purple and light blue segments) than is the case for industry funds. This difference in asset allocation, and hence the investment performance, for retail funds will be largely driven by the investment choices of individual fund members, given the relatively low proportion of assets in the default option(s) for these funds.

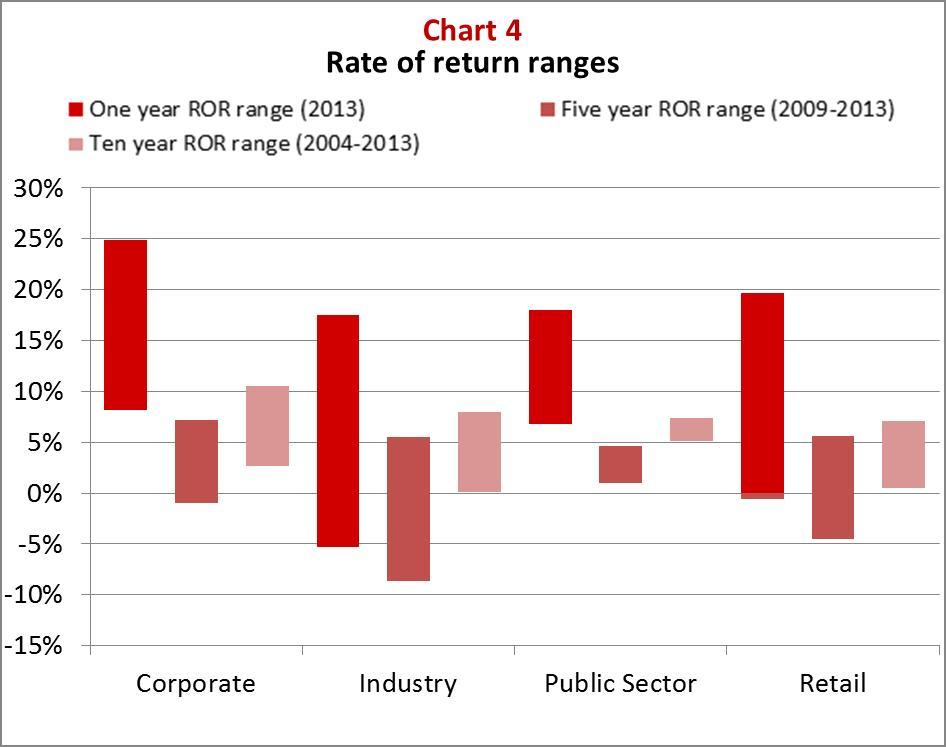

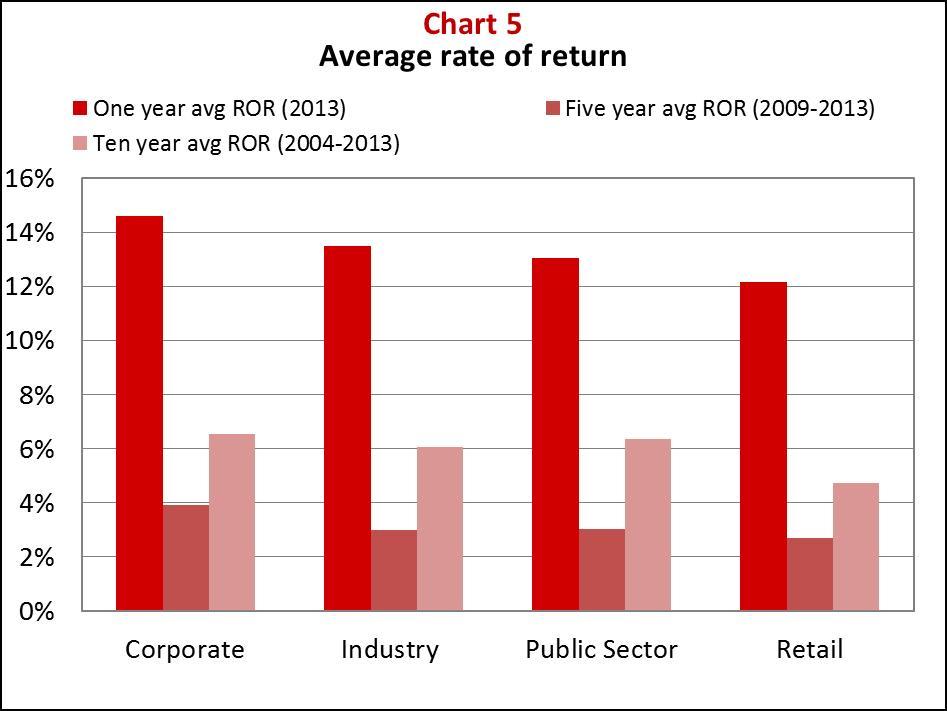

Similarly, average investment performance for any particular segment of the industry is not a meaningful basis for assessing whether investment objectives, and hence outcomes for members, are being achieved. As Chart 4 shows, investment performance varies widely over different time periods for all industry segments. Further, as I just noted, members invest in specific funds or options, not an aggregation of funds by segment. The outcomes for members will vary quite widely depending on whether their particular fund or investment option achieves net returns over the long term that are above or below the average for all funds, or for some segment of the industry. Short term investment performance also varies much more widely than performance over longer periods, as shown by Charts 4 and 5, and the latter provides a more stable and reliable basis for assessing performance against objectives. And as Chart 4 shows, there are performance laggards in all segments of the industry over the different time periods.

A key objective of APRA’s revised data collection, which has been progressively implemented since July 2013, is to facilitate like for like (or apples to apples) comparisons based on more granular information at investment option and MySuper product level. This is important for APRA, but is also of benefit for all industry stakeholders. Through our enhanced publications we will be seeking to focus on the assessment of performance relative to objectives over longer periods such as 5 and 10 years. In the case of the new investment option and MySuper product data, it will take a few more years before we get sufficient data to provide this longer term view. However it will be worth the effort that both APRA and the industry have put into this data collection if, as expected, it leads to enhanced understanding of the underlying differences between funds and key drivers of performance - hopefully raising the quality of the debate from current levels. Importantly, the new data collection will support more informed decision making and analysis by industry stakeholders in a range of areas, including trustees for whom the published information should provide a rich data source for benchmarking and analysis.

MySuper products and the assessment of outcomes and efficiency

Turning now to MySuper, initial analysis of the data submitted to date indicates that many of these products are starting to deliver the intended outcomes, but it is early days.

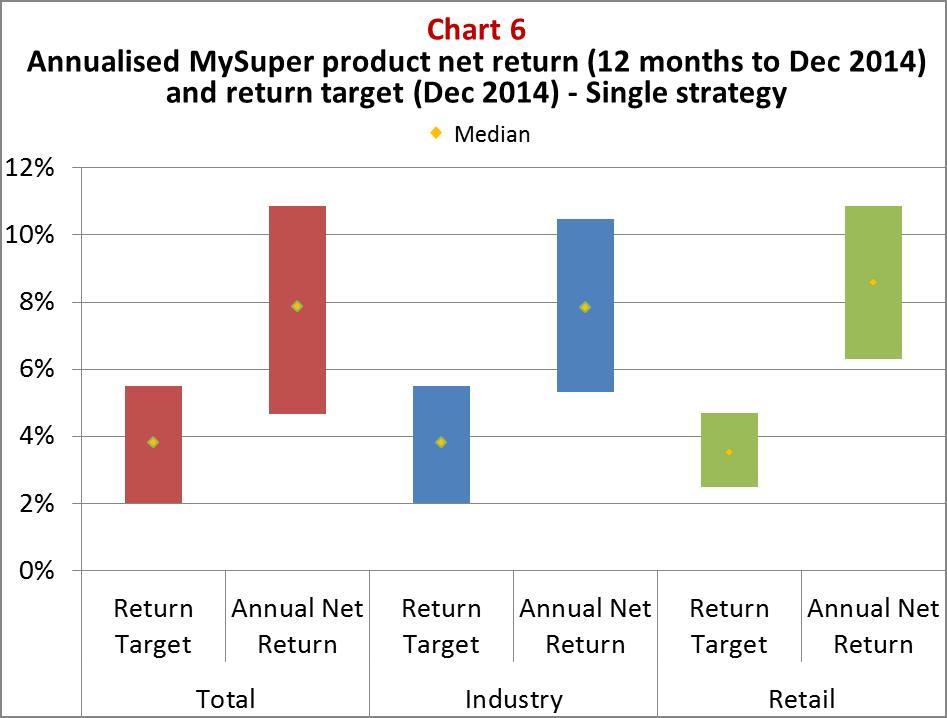

Chart 6 shows the median and range of investment performance relative to investment objectives for those MySuper products with a single investment strategy.[5] Although this is only one year’s performance, and so I should heed my own advice and not draw too many conclusions from it, the chart shows that nearly all products have exceeded their return target.

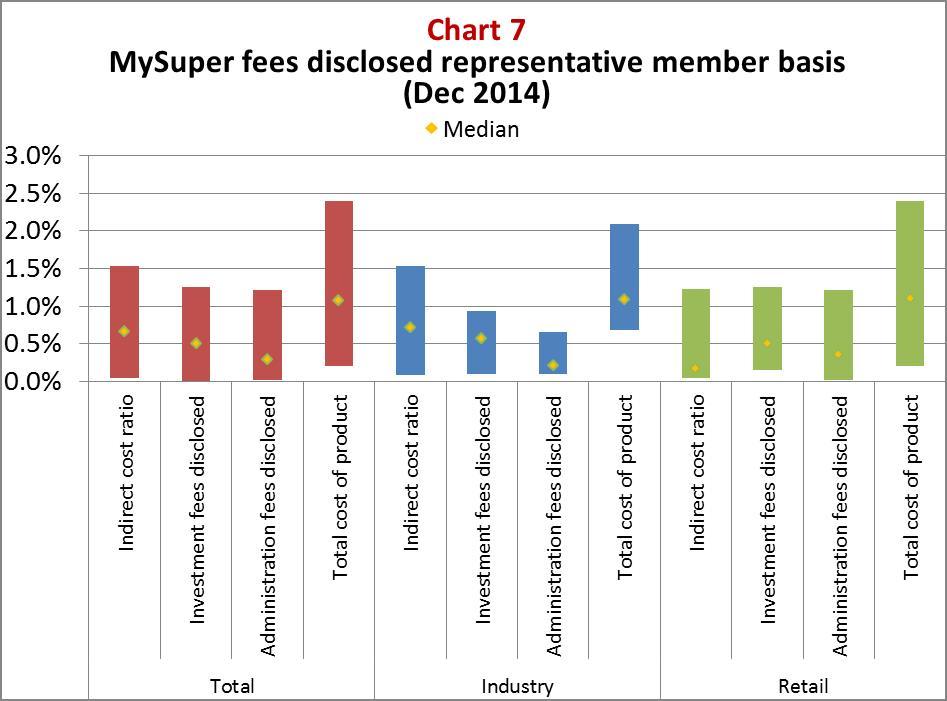

Chart 7 shows the range of fees disclosed.[6] While some very low fee levels are indicated, the range is quite wide. This suggests that there is indeed scope to reduce fee levels and hence enhance member outcomes, as the FSI and many industry stakeholders have indicated.[7]

Another area where there is likely to be scope to improve member outcomes is insurance. There is an obligation for trustees to ensure that insurance costs do not unduly erode members’ retirement benefits. This requires a careful balance to be struck between providing benefits that adequately meet members’ needs and ensuring that the cost of insured benefits is not unduly high. We would therefore encourage all trustees, working with their insurers, to review all aspects of their insurance arrangements to ensure they are meeting this obligation. They should consider the steps that can be taken to mitigate increases in insurance costs through, for example, design changes, enhanced claims management practices and improvements in data integrity.

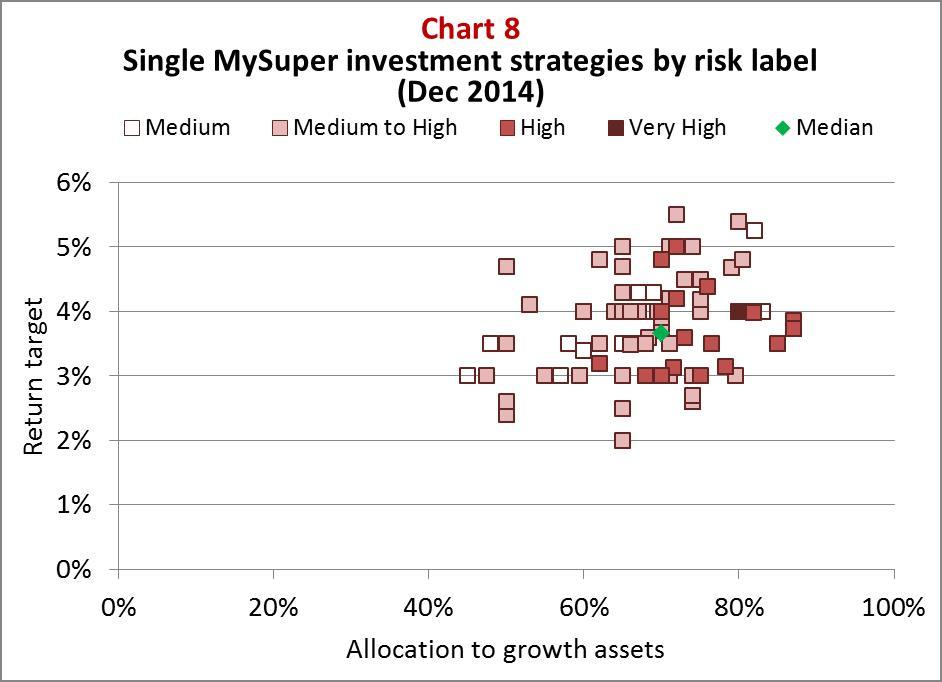

This next chart shows an interesting, if somewhat surprising, picture. For each MySuper product with a single investment strategy, it shows the allocation to growth assets and the return target (over CPI) that has been set. It also indicates the “risk label” based on the standard risk measure.[8] What is surprising is that we see medium, medium high and high risk products with similar levels of growth assets and return targets. The products are more clustered than we expected, rather than showing a stronger trend from lower to higher risk levels. We will be looking into this further as part of our supervision activities, seeking to understand why, for example, a medium risk product has a return target and level of growth assets that seems more consistent with a high risk product. Clearly it is important that there is consistency between return targets and the underlying investment strategy, and that the communication to members of the level of risk is accurate.

We are increasingly being asked about APRA’s expectations in relation to the annual “scale”, or as I prefer to call it “member outcomes”, test for MySuper products. It is too early to provide comments on the range of industry practice in this area, but this is clearly an area that we will be covering with trustees as part of our regular supervision.

It is important to note that this assessment is something that ALL trustees must undertake – it is not just required for smaller funds. APRA expects all trustees to be undertaking this assessment in a rigorous and comprehensive way. The assessment needs to consider a range of factors – it is not just about investment performance relative to peers, or fee levels. It should look at the net outcome for members across a range of dimensions, including net returns, performance relative to the benchmarks established by the trustee, fee levels, and the benefits and services provided. We expect trustees to have in place a robust framework, with clear criteria that address a wide range of aspects of the fund’s operations, in forming a view as to whether members in their fund are disadvantaged relative to members of other MySuper products. Further, consistent with my earlier comments, in looking at investment performance, long term returns relative to the investment objective that has been set should be the key measure, rather than short term peer comparisons.

Importantly, this is not just a question of size. We expect that some relatively small funds will be readily able to satisfy an assessment that looks at member outcomes in the context of a wide range of factors. And all trustees should be seriously asking themselves whether the strategy that is in the best interests of their members is actually to seek to transfer them to a fund that would be expected to provide better overall outcomes over the long term.

Let me conclude with a few brief observations on assessing the efficiency of the superannuation system, and in particular MySuper products, which was a focus of the FSI.

We would certainly agree that enhancing the efficiency of the superannuation system to improve long-term outcomes for members is an important objective. However, as we noted in APRA’s submission to the FSI, it is important to focus on the overall outcomes achieved, and not just fees and costs, when considering whether or not the system is effective and efficient, and assessing its performance. A range of performance measures or attributes need to be looked at, such as the net return achieved over the long term, the level of retirement income that is delivered, and the other benefits and services that are being provided. There are strong parallels here with what APRA expects trustees to do in undertaking the annual assessment required for each MySuper product.

There are significant complexities in the superannuation system and so there is likely to be some scope for efficiency to be enhanced through simplifications in many areas. At an individual fund level, for example, trustees could look to simplify their investment arrangements; review the insurance benefits provided; make changes to remove other design or service features that are not valued by members; or implement operational changes to enhance efficiency.

There are clearly trade-offs for trustees to consider here – between providing choice and flexibility for members on the one hand, and targeting simplicity and potentially reducing costs on the other. It also needs to be remembered that there may be limited scope to reduce costs while also maintaining the necessary investment in the systems and processes needed to prudently manage the funds under the trustee’s oversight. We would nevertheless encourage trustees to consider all of these issues, and the steps they can take to achieve an appropriate balance, as they develop their future strategy.

Concluding remarks

So, let me quickly sum up.

APRA expects trustee boards to be proactively tackling the many strategic challenges ahead and making the hard decisions that may be required if they are to truly meet their obligations to act in the best interests of members. They also need to drive sound governance and a strong risk culture across their operations, fostering a robust approach to risk management that meets the spirit and intent of the prudential standards. This requires adequate board skills and capabilities and robust appointment and board assessment and renewal processes, and would be supported by adding independent directors to boards.

There are many areas where industry practices could be strengthened, including investment governance and management which is of critical importance to members’ retirement outcomes. The next thematic review which APRA is undertaking is focused on this area, and in particular liquidity management and stress testing.

I would also encourage all industry stakeholders to adopt a more meaningful approach to the assessment of investment performance, moving away from focusing on average performance relative to peers at fund level or by industry segment. Performance at product or investment option level over the long-term relative to the objectives that have been set in the investment strategy is far more relevant to member outcomes.

And finally, MySuper is only in its early stages but there are promising signs that it will deliver its intended outcomes. That will require trustees to genuinely seek to meet the obligations imposed on them, and to undertake robust “scale” assessments that look beyond just fees and net returns. Trustees adopting this approach across all of their operations, not just for MySuper, should contribute significantly towards the enhanced superannuation system efficiency recommended by the FSI.

Thank you.

Footnotes

- Financial System Inquiry Final Report page 24.

- Ibid page 25.

- Ambachtsheer, K 2007, Pension Revolution: A Solution to the Pensions Crisis, John Wiley & Sons, Hoboken, page 130.

- Financial System Inquiry Final Report page 133.

- The chart shows the median and 25th to 75th percentile return target above CPI, and the annual net return for a representative member with a $50,000 account balance, for the 12 month period ending December 2014.

- The chart shows the median and 25th to 75th percentile for fees disclosed for a representative member with a $50,000 account balance.

- It should be noted that this is a new data collection, some of the data has not previously been collated and reported by the industry, and so APRA expects the quality and comprehensiveness of the data to continue to improve over time, particularly in relation to fees.

- The standard risk measure is based on the number of negative return years expected over a 20 year period.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.