Stress testing insurers during COVID-19: results and key learnings

COVID-19 has shown how quickly the key risks insurers face – not only traditional insurance risks, but also emerging, new and non-financial risks – can change. As a result, APRA conducted a series of stress testing activities on life and general insurers during 2020. These activities demonstrated that insurers are well-positioned to withstand a very severe economic downturn, while still meeting their commitments to policyholders.

APRA’s 2020 stress testing activities on insurers have also provided insights into how insurers use stress testing to inform their capital and risk management frameworks, as well as wider business decision-making. The findings of the stress tests reinforce the importance of continued development in stress testing capabilities by insurers, including conducting regular stress tests under a wide range of sufficiently severe scenarios to challenge capital levels as a key part of their decision-making.

Details of the 2020 stress tests

Stress testing is used by APRA and its regulated entities to provide forward-looking assessments of entities’ resilience to severe but plausible downturns, and complements APRA’s risk-based supervision approach by enhancing capital management practices.

In 2020, APRA conducted several stress tests with the 21 largest life insurers (LIs), including 14 direct insurers and seven reinsurers, covering 90 percent of the sector by gross written premium (GWP), and four active lenders mortgage insurers (LMIs) (covering most of the sector by GWP).

These stress tests used scenarios based on significantly worse macroeconomic outcomes than the RBA’s August 2020 Downside Scenario, and were designed to assess insurers’ resilience to further deteriorations in macroeconomic conditions, and the actions they would take in response, both individually and collectively.

During 2020, APRA also completed its assessment of internal stress testing capabilities of the 18 largest general insurers (GIs) to identify how they could enhance their capital management practices and improve their resilience to adversity. This assessment included 15 direct insurers and three reinsurers (covering 80 per cent of the sector by GWP), focusing on areas of governance, scenario design and usage of stress testing in capital management.

Stress scenarios and assessing capabilities

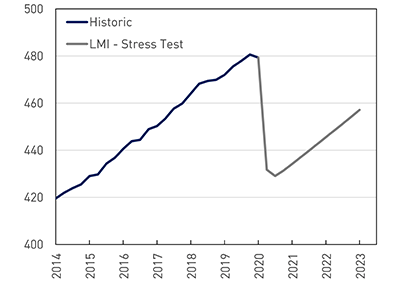

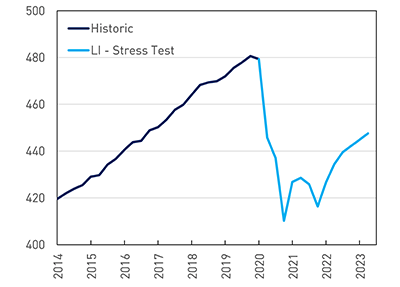

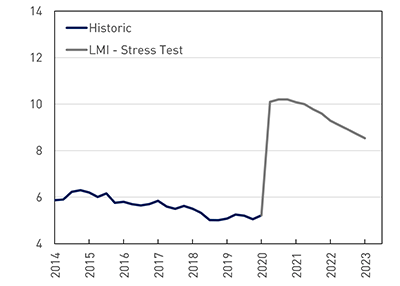

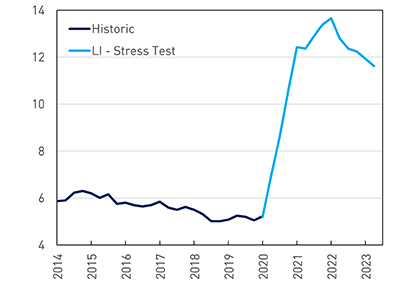

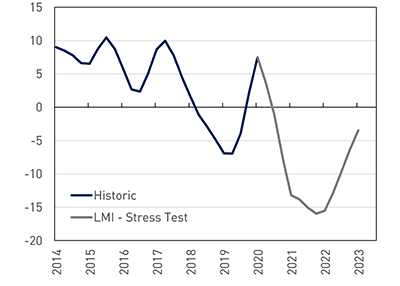

APRA’s stress tests of LMIs and LIs featured two separate severe downturn scenarios designed by APRA, both including continued COVID-19 outbreaks within Australia leading to recurring Stage Three and Four restrictions, ongoing international border closures, and sharp contractions in economic activity over a three-year period.

The stress test of LMIs featured gross domestic product (GDP) contracting 10 per cent, unemployment levels rising to 10 per cent, and house prices falling 30 per cent, driving higher levels of claims. LIs faced a more severe scenario, with GDP contracting 15 per cent and unemployment rising to over 13 per cent, and significant claims deterioration. Both scenarios also featured sharply falling asset prices, prolonged low bond yields and rising credit spreads, hitting both sides of insurers’ balance sheets.

The differing severity between the stress tests reflects the different times during 2020 that these exercises were conducted, reflecting a continually evolving view of severe downside risks throughout a period of rapidly changing economic outlooks.

LMI stress test - Real GDPQuarterly GDP, $ billion

| LI stress test - Real GDPQuarterly GDP, $ billion

|

LMI stress test - Unemployment rate (%)

| LI stress test - Unemployment rate (%)

|

LMI stress test - House Price growthAnnual, %

|

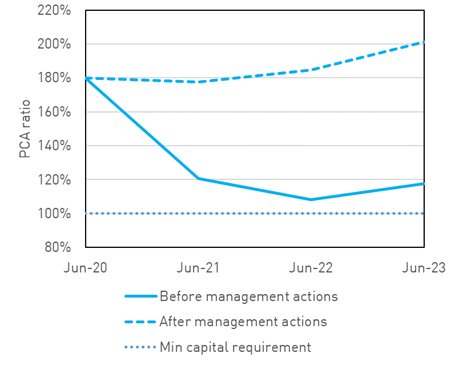

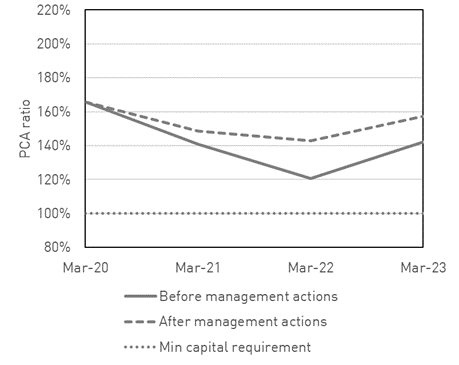

LIs and LMIs projected the impacts of their respective stress scenarios on their capital levels, both before and after mitigating management actions in response to the stress – such as capital raisings and repricing – on capital levels. Insurers also provided information that APRA used to inform assessments of their stress testing capabilities, including how effectively stress test outcomes are internally challenged, the board’s and senior management’s engagement in stress testing, and how stress tests are used in capital management decisions.

APRA requested similar information from general insurers, which formed the basis of APRA’s assessment of their stress testing capabilities.

Key results and learnings

The results of APRA’s stress tests of LMIs and LIs indicate they are well-positioned to withstand a very severe economic downturn. Specifically, the results indicate that despite significant losses of capital under a severe economic downturn, both the LMI and LI industries as a whole remained above their minimum capital requirements, while still meeting their commitments to policyholders. However, the outcomes of the stress test were highly variable across both industries, with some individual insurers falling below their minimum capital requirements.

The key reasons for insurers’ falling capital levels during the stress were:

- Large investment losses emerging in insurers with exposures to lower-rated investments, as credit spreads over Australian Government Securities rose sharply; and

- Significant deteriorations in disability income insurance claims and credit quality of underlying mortgages insured as economic conditions worsened, leading to significantly higher claims costs.

Importantly, however, these results are before any benefits that insurers would derive from management actions to respond to the stress. After deploying management actions to mitigate the stress, capital levels return towards pre-stress levels.

LI Aggregate Capital Coverage Ratios (%)

| LMI Aggregate Capital Coverage Ratios (%)

|

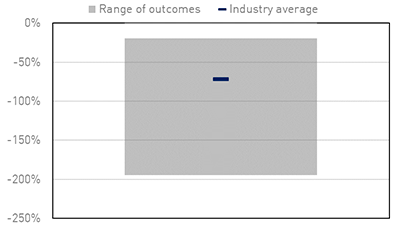

Variability of industry impacts

The capital impacts of each of the stress scenarios varied considerably between individual LMIs and LIs, reflecting differences in business models, portfolio composition and levels of reinsurance coverage.

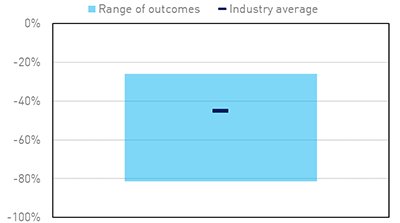

Note: Open to low point refers to starting value to the lowest point seen over the projected time horizon, the 5th-95th percentile range is presented. | LI - Range of capital coverage ratio falls, before management actionsOpen to low point, percentage points |

Note: Open to low point refers to starting value to the lowest point seen over the projected time horizon | LMI - Range of capital coverage ratio falls, before management actionsOpen to low point, percentage point |

The resilience of some LMIs and LIs was challenged under the severe downturn scenarios, with some insurers falling below their minimum capital requirements before using management actions to respond to the stress. This highlights the importance of insurers regularly using stress testing under a wide range of scenarios – including sufficiently severe downturns – to test the boundaries of their capital levels, especially as key risks evolve.

Throughout APRA’s assessment of GIs’ stress testing capabilities, several insurers were observed to develop and use internal stress test scenarios that were severe enough for them to respond to the stress via management actions, but were not sufficiently severe to test the limits of their capital adequacy.

Management actions used by insurers

Management actions used in response to the stress were crucial for rebuilding insurers’ capital levels, particularly insurers that breached minimum capital requirements under the severe downturn scenarios.

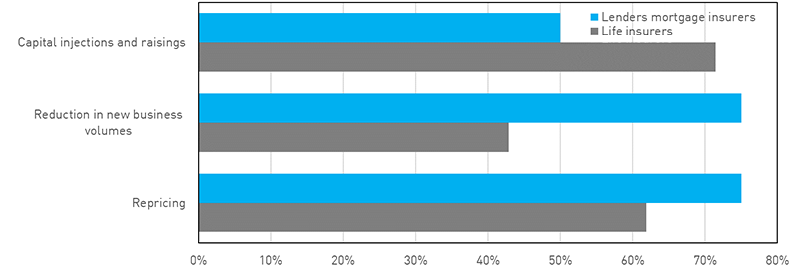

Common management actions used by insurers

Percentage of participating insurers by count (%)

Capital injections provided by parent owners, capital raisings, repricing and reductions in new business were used by most insurers to mitigate the impacts of the stress. While individual actions appeared credible in isolation, few insurers considered the feasibility and second-order impacts of these actions in the context of a broader industry-wide stress, particularly when other market participants are likely to be using similar actions to rebuild capital levels.

Better practice insurers considered the impacts of an industry-wide stress on the capacity of both the broader market and parent owners to provide capital support, especially when capital sources are likely to be scarce and in high demand. Better practice insurers also incorporated thorough assessments of flow-on effects of repricing and reductions in new business volumes. This included considerations of increases in selective lapses, changes in reinsurers’ appetite to absorb increased levels of risk, and impacts on the cost and availability of insurance.

Insurers’ recovery plans

The impact of the stress scenarios on an insurer’s capital levels highlights the importance of credible recovery options, both to withstand a stress that threatens their viability, and to rebuild their resilience afterwards. The stress tests provided insights into the robustness of insurers’ recovery plans. (Recovery plans include a list of recovery options designed by financial institutions to allow them to survive a financial shock and restore themselves to a sound financial condition without the need for public sector support.)

In relation to recovery plans, APRA observed the following:

- Across several LIs, recovery plans are not yet mature, with further improvements needed to effectively embed recovery plans into insurers’ broader risk management frameworks.

- Recovery plans of several LMIs had not undergone a process of regular review, challenge and updating to ensure their ongoing robustness and credibility as their key risks evolve.

- For several GIs, the effective testing of key recovery options on the emergence of stress was limited by a lack of severe enough stress scenarios.

Given the challenges faced by insurers over 2020, including the emergence of natural disasters, adverse claims experience in LIs and a low earnings environment, these insights reinforce the importance of taking a dynamic and rigorous approach to recovery planning. Such an approach, as highlighted in APRA’s most recent thematic review of insurers’ recovery plans, effectively integrates recovery plans into an insurer’s broader risk management framework. APRA is encouraging insurers to consider how recovery plans can be improved in light of APRA’s stress test findings to increase their credibility.

Use of stress testing

APRA expects stress testing to form an integral part of insurers’ approach to capital, crisis and risk management.

Most insurers were able to clearly show how stress testing outcomes informed the calibration of their capital settings. Better practice insurers used stress testing to challenge their capital plans, inform wider business decisions such as pricing, and to test the robustness of their reinsurance programs and recovery plans.

However, despite previous stress tests of insurers showing that using insights from stress testing was a core area for improvement across the industry, some insurers were only able to show limited progress in using stress testing as a key part of their risk management frameworks, capital management practices, recovery plans and risk appetite statements.

Where to from here?

COVID-19 has been an important reminder of how quickly and unexpectedly periods of adversity and combinations of different risks can emerge. APRA’s recent stress testing activities provide valuable assurance of insurers’ resilience, and their ability to meet their commitments to policyholders during tough times.

The stress tests have also reinforced APRA’s view that there remains room to improve stress testing capabilities across the insurance industry, with regular stress testing of a range of sufficiently severe but plausible downturns forming a key part of insurers’ capital management decisions. APRA expects insurers to continually self-assess their own internal stress testing frameworks in light of these findings in order to improve their capabilities.

APRA will continue its program of targeted stress testing activities on regulated institutions, subject to macroeconomic and emerging risks. Building on lessons learned from recent industry stress tests, APRA intends to consult in the future on new guidance for entities on stress testing. In doing so, APRA aims to enhance the insurance industry’s stress-testing capabilities, as well as APRA’s own ability to promote the stability of Australia’s financial system.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.