Seeking strength in adversity: Lessons from APRA's 2014 stress test on Australia's largest banks

Wayne Byres, Chairman - AB+F Randstad Leaders Lecture Series 2014, Sydney

Good afternoon.

Let me start by posing a question: are Australian banks adequately capitalised?

That’s a pretty important question, and one that the Financial System Inquiry is rightly focussed on. When compared against the Basel III capital requirements, they certainly seem to be. At end June 2014, the Common Equity Tier 1 ratio of the Australian banking system was 9.1 per cent, well above the APRA minimum requirement of 4.5 per cent currently in place, or 7.0 per cent when the capital conservation buffer comes into force in 2016. And in APRA’s view, after adjusting for differences in national application of the Basel standards, the largest Australian banks appear to be in the upper half of their global peers in terms of their capital strength. [1] But the question remains: is that adequate?

There is no easy answer to that question. To answer it, you need to first answer another question: adequate for what?

Adequate to generate confidence is one simple answer. We require banks to have capital because they make their money by taking risks using other people’s money. That is not intended to sound improper; the financial intermediation provided by banks is critical to the efficient functioning of the economy. However, as very highly leveraged institutions at the centre of the financial system, investing in risky assets and offering depositors a capital guaranteed investment, we need confidence that banks can withstand periods of reasonable stress without jeopardising the interests of the broader community (except perhaps for their own shareholders). But what degree of confidence do we want?

Risk-based capital ratios are the traditional measure used to assess capital adequacy. Risk weights can be thought of as an indicator of likely loss on each asset on (and off) a bank’s balance sheet. [2] So they tell us something about the maximum loss a bank can incur. But they don’t tell us anything about how likely, or under what scenario, those losses might eventuate.

Over the past decade, and particularly in the post-crisis period, regulators and banks have supplemented traditional measures of capital adequacy with stress testing. Stress testing helps provide a forward-looking view of resilience in a way in which static comparisons or benchmarks cannot. It provides an alternative lens through which the adequacy of capital can be assessed. In simple terms, it tries to answer the question: does a bank have enough capital to survive an adverse scenario – can we be confident it has strength in adversity?

Stress testing practices in Australia

In focussing on stress testing, APRA doesn’t try to predict the probability of a period of stress, let alone the precise scenario by which it will arrive. We simply start with the premise that there are financial and business cycles, and sometimes there will be periods where financial institutions – individually or collectively, and of their own making or otherwise – will experience adversity and be placed under severe stress. We are simply asking: what if? In Australia, following a very long period of benign conditions, this has even greater resonance because there is less experience of living through financial stress than elsewhere. Let me be clear: that lack of experience is a good thing, but we shouldn’t be blind to the risks that nevertheless exist.

But it is difficult to get right! For that reason, APRA has in recent years increased the attention it gives to ensuring that banks improve their governance, modelling and (ultimately) complex judgements to make stress testing more meaningful. APRA’s approach differs somewhat from international practice, with the onus on the industry first and foremost to improve their capabilities.

My predecessor outlined some principles for stress testing best practice two years ago, at this same forum. [3] These were structured around five key areas:

- the use of stress testing to drive decision-making within the institution, as an integral part of risk management and the setting of capital buffers;

- strong governance, with results routinely reported to board risk committees and senior management, and challenged by them;

- the development of “severe but plausible” scenarios;

- the importance of robust data and IT systems to support the stress testing process; and

- credible modelling, combining quantitative approaches and expert judgement to effectively translate economic scenarios into financial impacts.

Against these principles, APRA supervisors have been reviewing banks’ current practice and, where necessary, identifying areas for further development.

At quite a number of banks, there has been considerable investment in their stress testing programs in recent years. Where this is working effectively, there is a clear role for stress testing in planning capital, considering risk limits and highlighting vulnerabilities. Rather than an ex post validation of capital sufficiency, it is a central part of setting the forward capital strategy within the bank’s internal capital adequacy assessment processes (ICAAPs).

Consistent with this has been a general strengthening of governance frameworks, with greater senior management oversight and informed discussion on both the design of stress tests and the assessment of the results. At larger banks, there are dedicated resources to coordinate stress testing exercises, and to develop and improve the modelling infrastructure that is so essential to delivering them.

However, there are three areas where there is still scope for improvement: scenario development, modelling and data. Developing a well-targeted and sufficiently adverse scenario is fundamental to any stress testing exercise. For some banks, however, there is not a great deal of innovation in the design of scenarios, which are not always customised to the institution’s particular risk profile and most importantly not always pushing to the boundary of adversity. [4] To help overcome this, from 2015 APRA intends to provide banks with a common scenario to be used in their ICAAP processes, in addition to the more tailored scenarios that they will continue to develop themselves. This is intended to ensure an appropriate degree of severity is considered as part of banks’ capital planning processes, and enables APRA to compare and aggregate results to gain an industry perspective on an annual basis – albeit with some caveats that I will talk more about in a moment.

Modelling also remains a challenge. There is a wide range of stress test modelling approaches across banks, with varying degrees of sophistication. In reviewing these, APRA looks to test that models are reasonably calibrated, sufficiently granular, and appropriately validated.

The most credible models have been built with intuitive risk drivers, including macro-economic factors and inherent risk characteristics of the particular asset class being modelled. These models are sensitive to different economic scenarios: they estimate a reasonable level of loss, and on a profile consistent with the shape of the scenario. At some banks, there is more to do to comfortably reach this point. Some models still rely too heavily on a single economic driver or judgement alone, lacking a convincing link to the scenario or taking a high-level approach that misses the differences in risk across different types of asset. [5]

And for all models, they are only as good as the data that feeds them. This applies both to the internal risk data, such as accurate records of LVRs, and external economic data. The paucity of loss data in Australian experience is a particular challenge for estimating losses, especially on residential mortgages – again, this is a good dilemma to have, but still a problem for the modellers!

Industry stress tests

Since 2012, APRA increased its own investment in stress testing. This has included expanding our central coordination team with additional resources, developing a consistent framework for testing across different regulated industries, as well as providing specialist training for frontline supervisors. [6]

A core part of our stress testing strategy, in addition to more detailed reviews of banks’ own stress testing practices, are periodic industry stress tests run by APRA. These are needed, in our view, to ensure scenarios are consistent and suitably severe, modelling approaches can be benchmarked and improved, and results can be aggregated to provide a system-wide perspective. Our strategy involves rotating our focus across industry sectors: this year we have focussed on banks, with the life insurance sector to be tested in 2015.

APRA is, of course, not alone in conducting industry stress tests. The European and US authorities have also conducted banking stress tests this year. In those cases, there has been extensive disclosure of the outcomes for individual banks. In Europe, the disclosures have reflected a need to put an end to the lingering doubts that have hung over the quality of European bank balance sheets since the financial crisis – where necessary by insisting on capital raisings. In the US, the regulators effectively determine banks’ dividend payouts and capital management strategies each year based on the stress test results. In both cases, transparency is therefore an essential element in explaining supervisory intervention.

APRA has traditionally not followed this approach. While we have disclosed the aggregate results, the purpose of our testing has been different to those of our colleagues on either side of the North Atlantic. We are wary about stress testing results becoming the primary assessment of capital adequacy, given the results can be quite scenario-specific. Rather, we see stress testing as helpfully informing our supervisory assessment of capital, but not determining it.

2014 - a focus on housing risks

Unsurprisingly, our stress test this year has targeted at risks in the housing market. [7] The low risk nature of Australian housing portfolios has traditionally provided ballast for Australian banks – a steady income stream and low loss rates from housing loan books have helped keep the banks on a reasonably even keel, even when they are navigating otherwise stormy seas. But that does not mean that will always be the case. Leaving aside the current discussion of the state of the housing market, I want to highlight some key trends that demonstrate why housing risks and the capital strength of Australian banks are inextricably and increasingly intertwined.

I have endeavoured to summarise this in six charts (and seven lines) below. The key trends are pretty important drivers of where we are today.

Over the past ten years, the assets of Australian ADIs have grown from $1.5 trillion to $3.7 trillion (Chart 1). Over the same period, the paid-up capital and retained earnings have grown from $84 billion to $203 billion (Chart 2). Both have increased by almost identical amounts – close enough to 140 per cent each. This similarity in growth rates over the decade hides some divergent trends in individual years, but today the ratio of shareholders’ funds to the balance sheet assets of the Australian banking system – a simple measure of resilience – is virtually unchanged from a decade ago (Chart 3). Much of the recent build up in capital has simply reversed a decline in core equity in the pre-crisis period – as a result, on the whole we’re not that far from where we started from.

So how have regulatory capital ratios risen? Largely through changes in the composition of the asset side of the balance sheet. While the ratio of loans to assets has barely budged (Chart 4), the proportion of lending attributable to housing has increased from roughly 55 per cent to around 65 per cent today (Chart 5). Because housing loans are regarded as lower risk, the ratio of risk- weighted assets to total (unweighted) assets has fallen quite noticeably – from 65 per cent to around 45 per cent. [8] The impact of this trend is that, even though balance sheets have grown roughly in line with shareholders’ funds, risk-weighted assets have grown more slowly and regulatory capital ratios are correspondingly higher (Chart 6).

Put simply, much of the strengthening of capital ratios relative to a decade ago is less the product of substantial growth in capital and more the product of the increasing proportion of housing loans within loan portfolios. In short, banks have de-risked rather than deleveraged.

This is the risk-based framework in action: housing has tended to be a relatively low risk asset for Australian banks, and banks with safer balance sheets are allowed to operate with lower levels of capital per dollar of assets. However, given housing loans have become such a high concentration on the system’s balance sheet and require, particularly for the most sophisticated banks, very limited levels of capital, assessing potential losses within the housing book are critical to judging the adequacy of the capital of Australian banks. It therefore makes sense that APRA keeps the health of housing portfolios, and the appropriateness of the capital required to support them, under considerable scrutiny.

Stress test scenarios and results

The 2014 stress test involved 13 large, locally-incorporated banks – together, these banks account for around 90 per cent of total industry assets. Participating banks were provided with two stress scenarios, which were developed in collaboration with the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ).

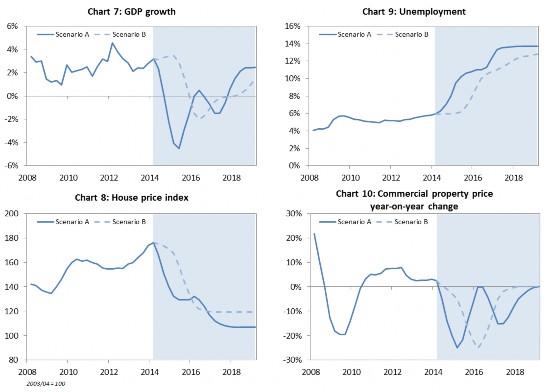

Central to both scenarios was a severe downturn in the housing market. Scenario A was a housing market double-dip, prompted by a sharp slowdown in China. In this scenario, Australian GDP growth declines to -4 per cent and then struggles to return to positive territory for a couple of years, unemployment increases to over 13 per cent and house prices fall by almost 40 per cent. Scenario B was a higher interest rate scenario. In the face of strong growth and emerging inflation, the RBA lifts the cash rate significantly. However, global growth subsequently weakens and a sharp drop in commodity prices leads to increased uncertainty and volatility in financial markets. In Australia, higher unemployment and higher borrowing costs drive a significant fall in house prices.

Let me stress (with no pun intended) that these are not APRA’s official forecasts! Nor would we even say they are the most likely scenarios to emerge. But they are very deliberately designed, specifically targeting key vulnerabilities currently front of mind for prudential supervisors.

The results of the stress test were generated in two phases. In the first phase, results are based on bank’s own modelling, within the confines of the common scenarios and certain instructions. The second phase replaces the banks’ individual estimates of loss impacts with APRA’s own estimates, developed using a combination of models, internal research and external benchmarks. The phased approach is a necessary part of understanding the respective drivers of the results, given the variability in banks’ modelling in phase 1.

Let me share with you our key findings from each phase.

Phase 1

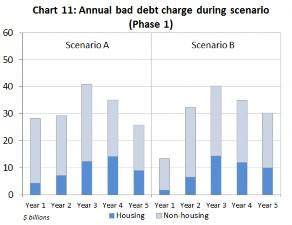

In the first phase, banks projected a significant impact on profitability and marked declines in capital ratios in both scenarios, consistent with the deterioration in economic conditions. The stress impact on capital was driven by three principal forces: an increase in banks’ funding costs which reduced net interest income, growth in risk weighted assets as credit quality deteriorated, and of course, a substantial increase in credit losses as borrowers defaulted.

In aggregate, the level of credit losses projected by banks was comparable with the early 1990s recession in Australia, but unlike that experience, there were material losses on residential mortgages. This reflects the housing market epicentre of the scenarios, and also the increasing concentration of bank loan books on that single asset class. In each scenario, losses on residential mortgages totalled around $45 billion over a 5 year period, and accounted for a little under one-third of total credit losses. By international standards, this would be broadly in line with the 3 per cent loss rate for mortgages experienced in the UK in the early 1990s, but lower than in Ireland (5 per cent) and the United States (7 per cent) in recent years. In other words, banks’ modelling predicts housing losses would certainly be material, but not of the scale seen overseas.

Stress testing on this core portfolio is an imprecise art, given the lack of domestic stress data to model losses on. Beneath the aggregate results, there was a wide range of loss estimates produced by banks’ internal models. This variation applies both to the projections for the number of loans that would default, and the losses that would emerge if they did. Our view was that there seemed to be a greater range than differences in underlying risk are likely to imply. [9]

Another key area where there were counter-intuitive results was from the modelling of the impact of higher interest rates on borrowers’ ability to meet mortgage repayments. Banks typically projected little differentiation in borrower default rates between the two scenarios, despite the very different paths of interest rates and implied borrowing costs. This raises the question whether banks could be underestimating the potential losses that could stem from sharply rising interest rates in the scenario. In the current low interest rate environment, this is a key area in which banks need to further develop their analytical capabilities.

Phase 2

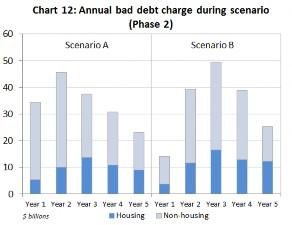

The results in the second phase of the stress test, based on APRA estimates of stress loss, produced a similar message on overall capital loss – although the distribution across banks differed from Phase 1 as more consistent loss estimates were applied. Aggregate losses over the five years totalled around $170 billion under each scenario. Housing losses under Scenario A were $49 billion; they were $57 billion under Scenario B. [10]

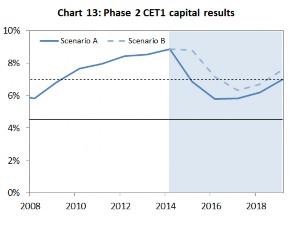

These aggregate losses produced a material decline in the capital ratio of the banking system. The key outcomes were:

- Starting the scenario at 8.9 per cent, the aggregate Common Equity Tier 1 (CET1) ratio of the participant banks fell under Scenario A to a trough of 5.8 per cent in the second year of the crisis (that is, there was a decline of 3.1 percentage points), before slowly recovering after the peak of the losses had passed.

- From the same starting point, under Scenario B the trough was 6.3 per cent, and experienced in the third year.

- The ratios for Tier 1 and Total Capital followed a similar pattern as CET1 under both scenarios.

- At an individual bank level there was a degree of variation in the peak-to- trough fall in capital ratios, but importantly all remained above the minimum CET1 capital requirement of 4.5 per cent.

This broad set of results should not really be a surprise. It reflects the strengthening in capital ratios at an industry level over the past five years. But nor should it lead to complacency. Almost all banks projected that they would fall well into the capital conservation buffer range and would therefore be severely constrained on paying dividends and/or bonuses in both scenarios. For some banks, the conversion of Additional Tier 1 instruments would have been triggered as losses mounted. More generally, and even though CET1 requirements were not breached, it is unlikely that Australia would have the fully-functioning banking system it would like in such an environment. Banks with substantially reduced capital ratios would be severely constrained in their ability to raise funding (both in availability and pricing), and hence in their ability to advance credit. In short, we would have survived the stress, but the aftermath might not be entirely comfortable.

Recovery planning

The aggregate results I have just referred to assume limited management action to avert or mitigate the worst aspects of the scenario. This is, of course, unrealistic: management would not just sit on their hands and watch the scenario unfold. As part of Phase 2, APRA also asked participating banks to provide results that included mitigating actions they envisaged taking in response to the stress. The scale of capital losses in the scenarios highlights the importance of these actions, to rebuild and maintain investor and depositor confidence if stressed conditions were to emerge.

This was an area of the stress test that was not completed, in our view, with entirely convincing answers. In many cases, there was clear evidence of optimism in banks’ estimates of the beneficial impact of some mitigating actions, including for example on cost-cutting or the implications of repricing loans. [11] The feedback loops from these steps, such as a drop in income commensurate with a reduction in costs, or increase in bad debts as loans become more expensive for borrowers, were rarely appropriately considered.

Despite the commonality of actions assumed by banks, there was variation in the speed and level of capital rebuild targeted. Some banks projected quick and material rebuilds in their capital positions, after only a small “dip” into the capital conservation range. Other banks assumed that they would remain within the range for a long period of time. It is far from clear that a bank could reasonably operate in such an impaired state for such a length of time and still maintain market confidence.

Disappointingly, there was a only a very light linkage between the mitigating actions proposed by banks in the stress test and their recovery plans (or “living wills”), with loose references rather than comprehensive use. Recovery plans should have provided banks with ready-made responses with which to answer this aspect of the stress test. APRA will be engaging with banks following the stress test to review and improve this area of crisis preparedness.

Most importantly, the exercise also raised questions around the combined impact of banks’ responses. For example, proposed equity raisings, a cornerstone action in most plans, appeared reasonable in isolation - but may start to test the brink of market capacity when viewed in combination and context. The tightening of underwriting standards, another common feature, could have the potential to lead to a simultaneous contraction in lending and reduction in collateral values, complicating and delaying the economic recovery as we have seen in recent years in other jurisdictions. In other words, banks may well survive the stress, but that is not to say the system could sail through it with ease.

Concluding comments

To sum up, the Australian banking industry appears reasonably resilient to the immediate impacts of a severe downturn impacting the housing market. That is good news. But a note of caution is also needed - this comes with a potentially significant capital cost and with question marks over the ease of the recovery. The latter aspect is just as important as the former: if the system doesn’t have sufficient resilience to quickly bounce back from shocks, it risks compounding the shocks being experienced. Our conclusion is, therefore, that there is scope to further improve the resilience of the system.

There are three mutually-reinforcing ways in which to work towards that goal:

- Firstly, making sure we have a solid starting point through strong capital management and a focus on prudent capital buffers, allowing a margin that can be utilised in stress as the Basel framework intends, but without sailing too close to the wind by trimming these buffers to the lowest possible level of sufficiency.

- Secondly, by limiting the potential exposure to stress, with appropriate lending standards and risk settings to ensure that the risk that is taken on is well understood and appropriately managed.

- And finally, by ensuring recovery plans are credible, with a realistic and continuously reviewed menu of actions that can be practically implemented even in stressed operating conditions, bearing in mind that others may well be seeking to undertake the same actions at the same time.

APRA has been focusing on all of these areas in recent years, and dialling up the intensity of its supervision on each. If we draw one conclusion from the stress test this year, it’s that there remains more to do to be able to confidently deliver strength in adversity.

Footnotes

- International comparisons are fraught with difficulty as data is not always available to properly compare ‘apples with apples’. And there are a multitude of ratios – eg, CET1, Total capital and leverage. However, APRA’s assessment, which incorporates the Basel Committee’s monitoring data and our own estimates of the necessary adjustments to risk-weighted assets, is that the largest Australian banks are broadly in the middle of third quartile (ie above the median) of their peers when it comes to the all-important CET1 ratio. These banks would, however, rank lower on other measures.

- Strictly speaking, it is a bank’s risk weights multiplied by its CET1 capital ratio that provides the loss rates that would exhaust the bank’s shareholders’ funds.

- J.F. Laker, The Australian Banking System Under Stress – Again?, AB+F Randstad Leaders Lecture 2012, Brisbane, 8 November 2012.

- Most commonly, in a system-wide stress it is rare for a bank to assume that their management has been the most aggressive in risk-taking – though ultimately one bank will turn out to be so. More specifically, although banks regularly stress for house price falls, these are sometimes mild in comparison with international experience, or on a gradual trajectory that smooths the stress over time.

- For example, in the Phase 1 stress test results described below, one bank estimated an identical underlying loss rate (ie before mortgage insurance) across all mortgage lending LVR buckets. In other words, its stress test was built on the assumption that, in a scenario where house prices fell substantially, it would lose the same amount on a defaulted loan with a 60% LVR as it would on one with a 95% LVR.

- That said, our small team is a very, very long way from the 6,000 supervisors estimated to have been involved in the recent European stress test!

- Previous stress tests have involved scenarios involving a slowdown in China with flow-on impacts on the Australian economy, and a disorderly resolution of the fiscal problems in Europe.

- The introduction of Basel II, which provided for lower housing risk weights for both IRB and standardised banks, also played a notable (albeit largely one-off) role in this downward trend.

- For example, the average annual loss on housing loans that defaulted in the Scenario A varied from 6 per cent at one bank to over 21 per cent at another, despite a common house price fall. Another example was net interest income, where estimates ranged from being 35 per cent lower to 3 per cent higher than the current year.

- As an aside, the stress test results can also give us a perspective on the relative levels of capital required by different regulatory approaches. This was not the purpose of the test, but it is topical given the FSI’s focus on the issue. The loss rates on residential mortgages in the scenarios did demonstrate that banks using the IRB approach tended to generate, on average, lower loss rates than banks using the Standardised approach. However, regulatory capital for housing held by Standardised banks was (just) sufficient to cover the losses incurred during the stress period; that was not the case for IRB banks (although strict comparison between these specific stress scenarios and regulatory capital requirements needs a degree of caution, given differences in time periods and modelling methodology between the stress test and the capital framework).

- For example, some banks assumed as much as a 10 percentage point fall in their cost-to-income ratios as a result of cost-cutting, a measure of unprecedented efficiency even in good times.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.