Regulation: Responding to market change or driving it?

Wayne Byres, Chairman - Actuaries Institute Banking on Change Seminar, Sydney

Good morning, and thank you for the invitation to be part of this event. It is good to see the Actuaries Institute taking a greater interest in banking-related matters: there is no shortage of important issues where the analytical disciplines of the actuarial profession can make a significant contribution.

This morning's theme is 'Regulation – Responding to Market Change or Driving it?' That is a 'chicken or the egg' type of question. Financial sector regulation is designed to create incentives, so that the interests of society are appropriately balanced with the private incentives of individual financial institutions and their managers. If regulation doesn't have an impact, if it doesn't shape behaviours, if it doesn't drive change, then there is no point to all the effort we put into it.

But regulators are not omniscient. Financial systems, markets, institutions and products evolve – including in response to changes in regulation. Regulators cannot foresee, with any degree of precision, how this will play out. And often, no matter how well-considered regulation may be, there will be unexpected outcomes due to factors that were not anticipated when regulations were designed. So regulation needs to be adjusted and updated periodically in response to market developments.

Today I want to talk about some of the changes stemming from the post-crisis regulatory reforms in banking. They represent both a response to, and an attempt to drive, changes in banking and financial markets.

We all know the basic narrative of the global financial crisis. For a range of reasons, neither risk management in banks, nor regulation by the official sector, had kept up with innovation and risk-taking in the financial system. Banks were under-capitalised, liquidity was under-priced, and risk was under-estimated. So in one sense the reforms – centred on the Basel III framework – can be seen as an attempt to respond to undesirable market developments.

However, the reforms are comprehensive and far-reaching: more than just closing a few gaps, they reflect a desire to drive fundamental changes in the shape and operation of the banking system. At the heart of the reforms is the intent to make banks, and the financial system, more resilient: that is, to improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source, and thereby reduce the risk of spillovers from the financial sector to the real economy. That has led to substantial reforms in capital, liquidity, risk management, and disclosure, as well as additional reforms designed to, amongst other things, address systemic importance, provide macro-prudential tools, and strengthen the operation of derivative markets.

While these measures have international origins, their rationale is very similar to that underlying the recommendations of the recent Financial System Inquiry (FSI) – in particular, the FSI’s first recommendation that authorised deposit-taking institutions’ (ADIs) capital ratios should be ‘unquestionably strong’. Strong and resilient ADIs can be important shock absorbers in difficult times. On the other hand, if the strength of ADIs is called into question, it will tend to exacerbate whatever difficulties or stresses might already be occurring.

The FSI established the ‘unquestionably strong’ concept in terms of capital ratios. I think it important, however, to point out that to be truly ‘unquestionably strong’ requires an ADI to have more than just a strong capital ratio – and there may be trade-offs in how ‘unquestionably strong’ is achieved. To be sure, it’s next-to-impossible to be regarded as ‘unquestionably strong’ if an ADI’s capital base is weak. So capital must remain at the core of any definition. But other financial measures – such as liquidity, earnings, and asset quality – are important too. And even then, an ADI with strong financial metrics, but weaknesses in risk management, governance, and culture will surely see its financial strength eroded: it’s only a matter of time. When we look to define an ‘unquestionably strong’ ADI, these other characteristics must therefore also be taken into account.

So let’s run the ruler over the Australian banking sector, and see how it shapes up against the broad reform agenda, and its goal to produce stronger banks.

Capital

Greater capital strength was the cornerstone of the post-crisis reform agenda, and at the heart of the Basel III changes and the FSI recommendations.

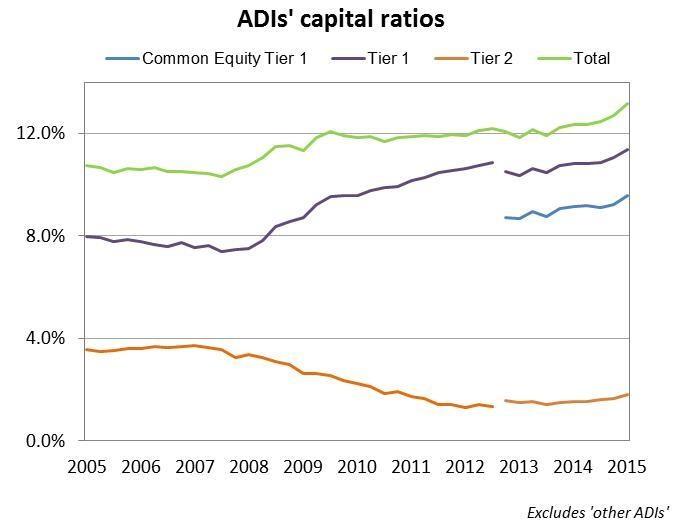

In a speech I gave yesterday, I made some observations on how we see the capital strength of the Australian banking sector.[1] In short, the sector is well-capitalised, and risk-based capital ratios are as high as they have ever been. And these higher ratios have been achieved with tighter definitions of what counts as capital. Compared internationally, Australian CET1 capital ratios are comfortably in the top half of the spectrum, but will likely need to be higher if they are to retain their relative positioning over time. International developments may well also necessitate higher capital levels, but given the situation we are in today, this challenge should be manageable provided ADIs continue to sensibly accumulate capital.

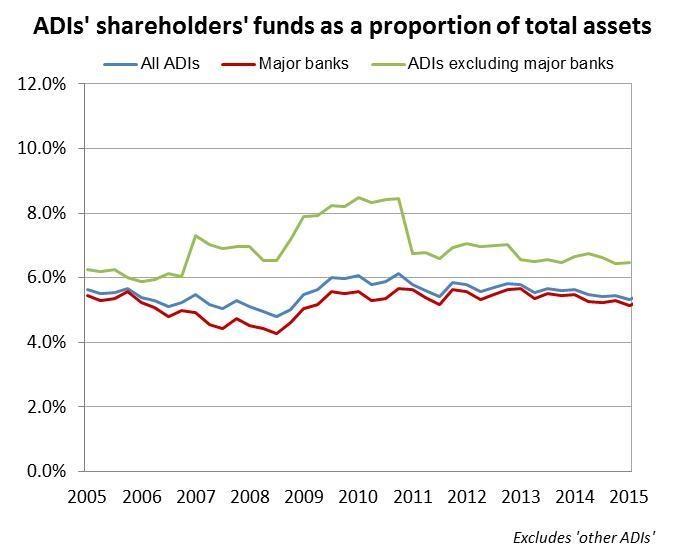

But Basel III also noted the importance of looking at leverage as well as capital adequacy. And on that score, the story is less positive. Leverage ratios have not been materially strengthened thus far, and the largest Australian banks compare less well on this measure compared to peers. Certainly, Australian ADIs have leverage ratios well above the 3 per cent minimum currently envisaged (although this calibration has not yet been confirmed by the Basel Committee)[2], and leverage ratios are intended to act only as a backstop. But we shouldn’t lose sight of them altogether.

Liquidity and Funding

The introduction of global liquidity and funding standards in Basel III - the 30-day Liquidity Coverage Ratio (LCR), and the longer-term Net Stable Funding Ratio (NSFR) – potentially have a greater impact on the Australian banking sector, given its excess of loans over deposits and reliance on foreign-sourced funding, than changes to capital requirements.

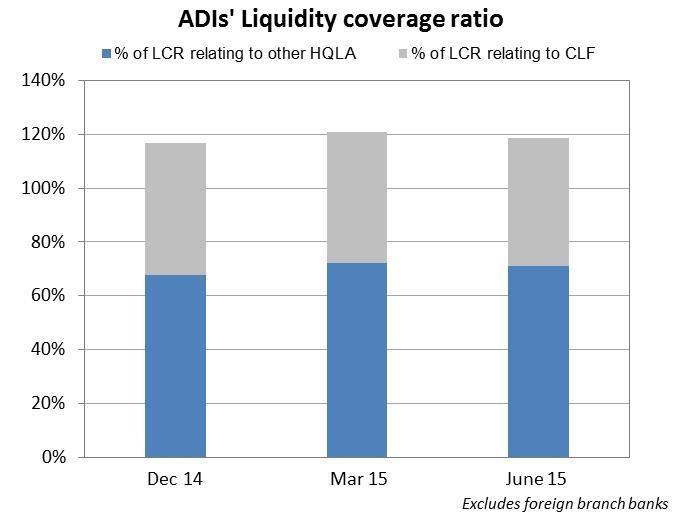

The LCR was introduced in Australia at the beginning of this year, for a group of larger banks.[3] The LCR has improved bank liquidity in four key ways. First, it shifted the measure of liquidity from a one week test to a one month test, requiring banks to hold more liquidity as a result. Second, it eliminated the past practice of banks holding as liquid assets the debts of each other: in other words, the quality of liquid assets is now more independent of the health of the banking sector. Third, the Australian version of the LCR provided for banks to be able to meet their requirement for high quality liquid assets (HQLA) by establishing, and paying for, a Committed Liquidity Facility with the RBA. And fourth, liquidity risk management and governance has been materially strengthened. All of these steps mean that banks are maintaining a stronger liquidity position than was previously the case.

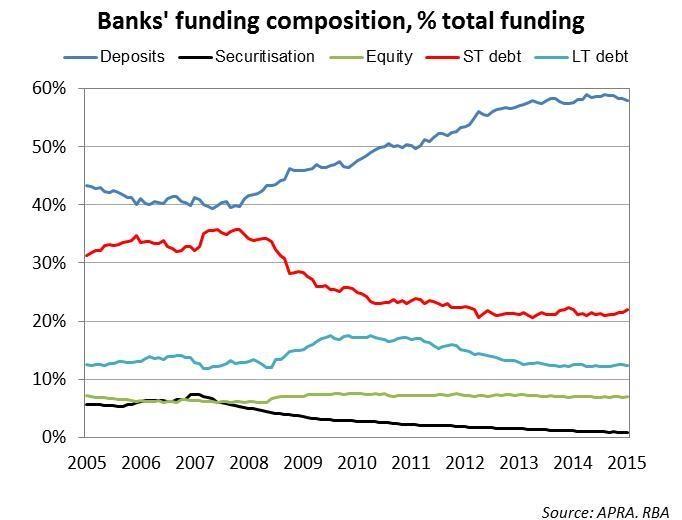

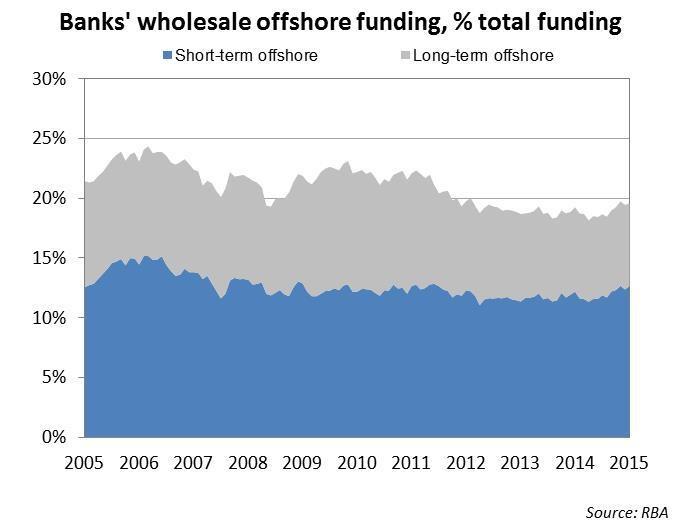

More broadly, the overall funding profile of the Australian banking system has improved in the post-crisis environment. ADIs have sourced a much greater proportion of their funding from deposits, and reduced their reliance on short-term wholesale debt. It’s difficult to know how much of this is regulatory-induced change, and how much is bank liquidity risk management practices being recalibrated to take account of the experiences of late 2008, but these compositional changes should strengthen liquidity and funding profiles overall.

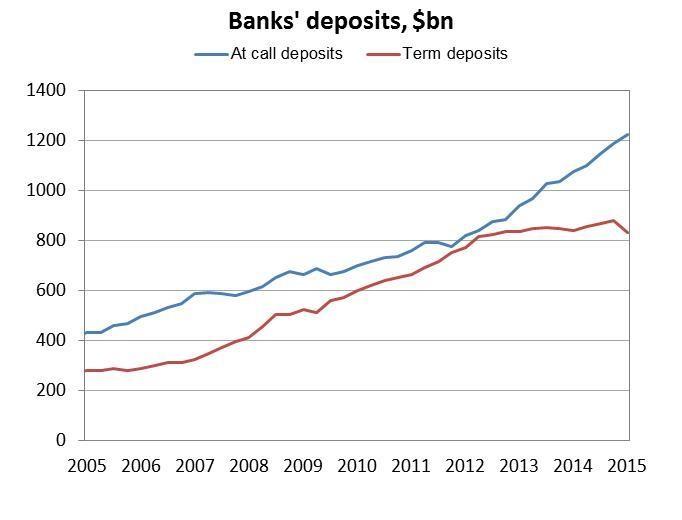

Within these broadly positive trends, however, there are a couple of aspects that bear further scrutiny. First, while banks have actively pursued deposit growth, not all deposits have similar liquidity characteristics. In recent years, deposit growth has primarily come in the form of at-call, rather than term deposits. The apparent ceasefire in the ‘war for deposits’ means liquidity profiles have been strengthened less than it might first appear.

Second, while the industry has reduced its reliance on short-term funding, wholesale funding and offshore funding, it has not materially reduced its reliance on the form of funding that is most likely and able to run in a crisis: short-term wholesale funding from offshore. That might seem paradoxical, but as a percentage of total funding, short-term wholesale offshore funding is virtually unchanged from a decade ago.

The NSFR, which provides a longer-term funding mismatch measure to complement the short-term LCR, is not scheduled for introduction until 2018. APRA will consult further on its implementation in Australia in the coming months, so I will not say too much about it today. The only observation that I want to make is that given their funding structures, the largest Australian banks do not easily meet the new standard and, as things stand today, international comparisons are not favourable to them. Some further lengthening of Australian bank maturity profiles is therefore likely to be needed over time to truly strengthen their funding resilience. This is an important issue to address, because a key rationale for the FSI’s ‘unquestionably strong’ recommendation was recognition this has been a key vulnerability in the past.

Asset Quality

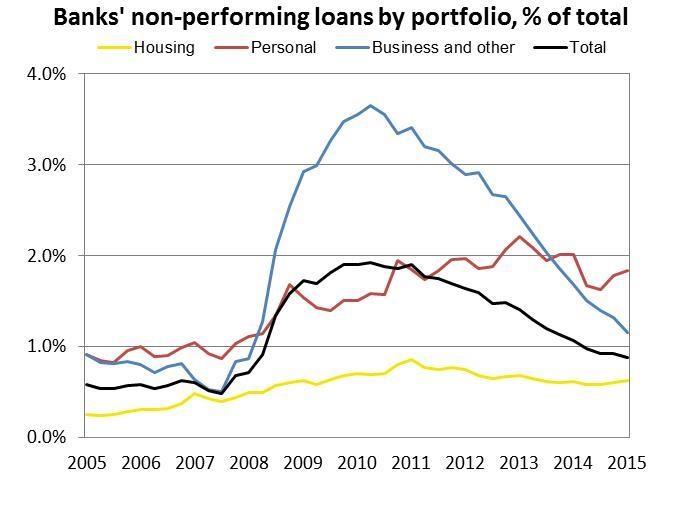

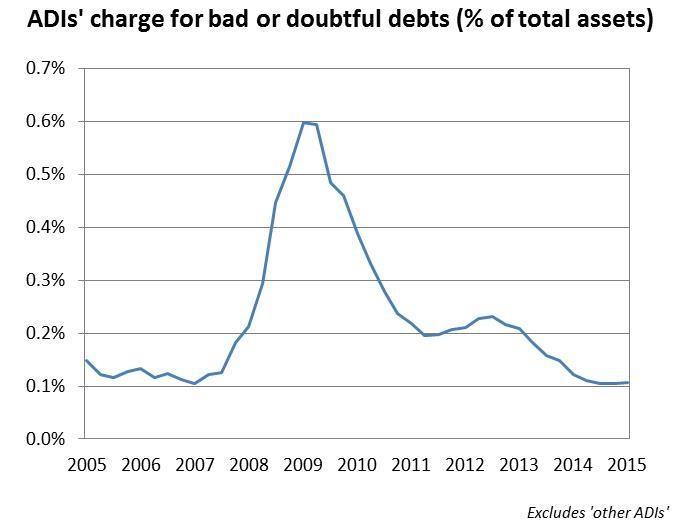

A positive story for the Australian banking sector over the past couple of decades has been its relatively strong asset quality. There was a notable increase in non-performing loans in the aftermath of the global financial crisis, but problem loans have since fallen back to closer to pre-crisis levels. The only exception has been personal lending but, because this makes up less than 5 per cent of domestic loan portfolios, it does not have a material impact in aggregate.

To give this chart a little more context, aggregate non-performing loans are now less than 1 per cent of gross lending, having peaked close to 2 per cent in 2010. But 2010 was a blip when compared to the aftermath of the recession in the early 1990’s. Then, the ratio peaked at almost 8 per cent. Today’s levels are fairly low, when examined historically or internationally.

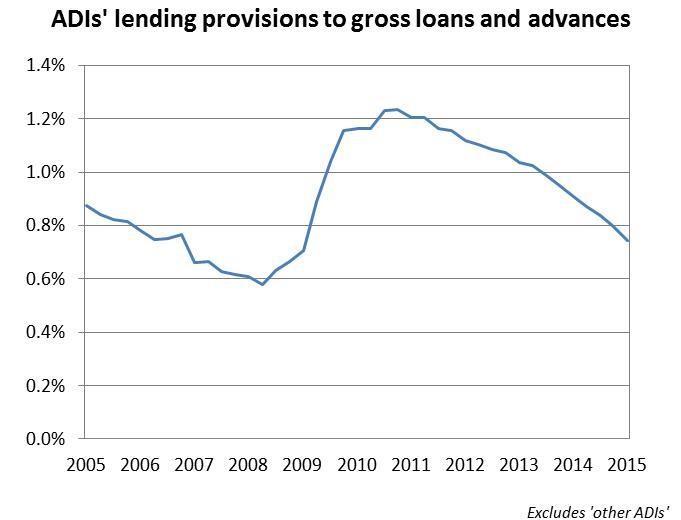

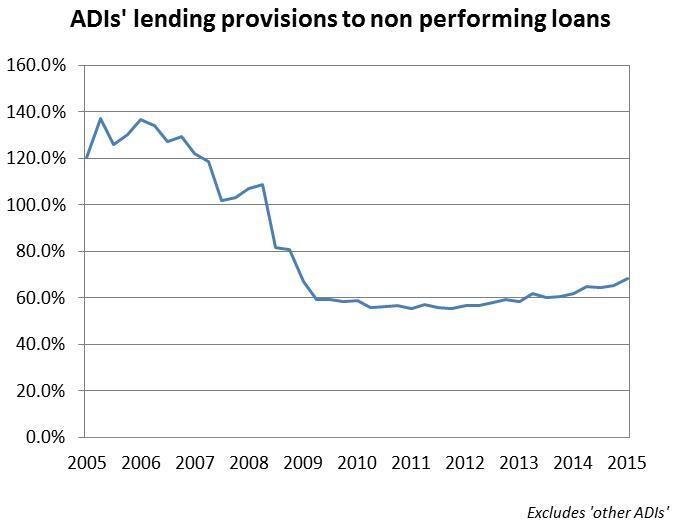

One area that has been of significant regulatory interest, even if it attracts less public attention than capital and liquidity, has been provisioning for problem loans. It is fair to say that regulators and accountants have not always seen eye-to-eye on this issue. The introduction of the ‘incurred loss model’ for provisioning under IAS39 has always made prudential regulators a little uneasy4. Incurred loss provisioning has tended to lag adversity, and hence be pro-cyclical, something regulators generally try to discourage.

Banking regulators have therefore welcomed impending moves to an ‘expected loss model’, with a view to encouraging a more proactive and forward-looking approach to provisioning.[5] This change is still to be fully implemented but should, in APRA’s view, lead to a strengthening of provisioning levels.[6] This is one area of regulatory change where the impact has yet to be felt, but encouraging more prudent and forward-looking provisioning practices over the next few years will help build more resilience and strength in bank balance sheets.

Earnings

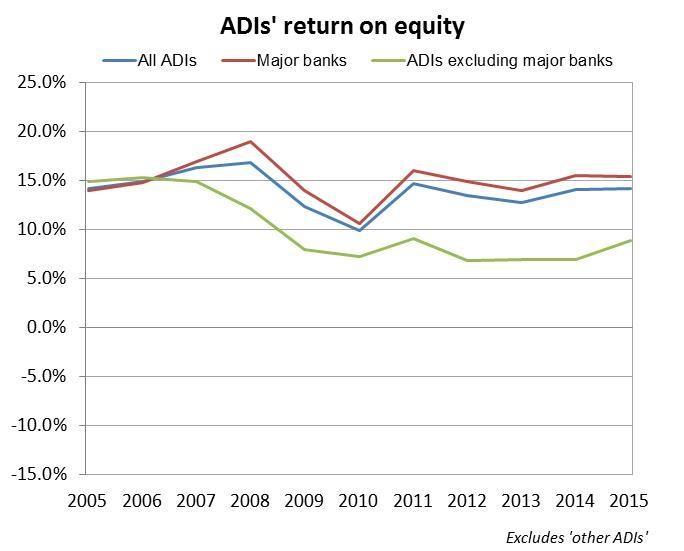

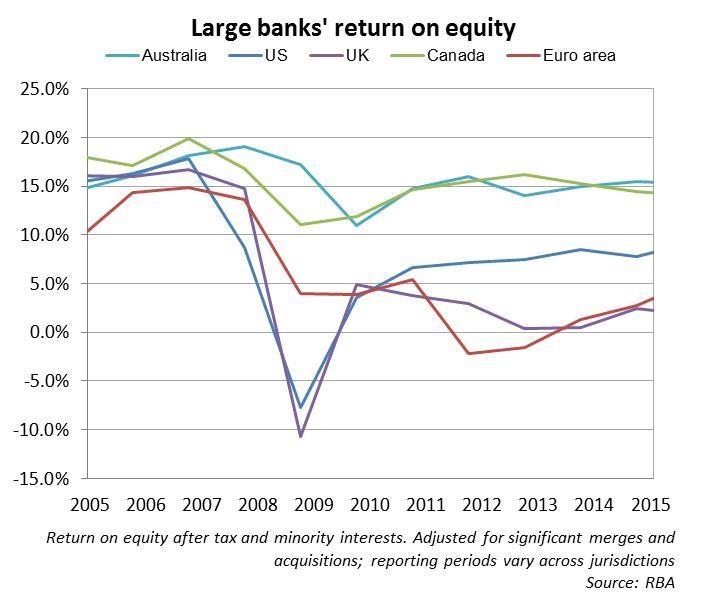

The regulatory reforms did not, of themselves, set out to determine the appropriate returns to shareholders from the business of banking. There was, however, an expectation that returns may well decline, certainly from the high teens and even 20+ per cent returns on equity achieved by many banks before the financial crisis. By making banks more resilient and, in particular, less leveraged, it was envisaged that returns to shareholders – both expected and required – would fall somewhat.

Experience thus far in Australia has been that the overall industry return on equity (RoE) has been little changed, hovering around the 15 per cent mark. But this has masked the divergent returns achieved by the major banks and other ADIs. The major banks have restored their returns to around pre-crisis levels (like their peers in Canada), while the remainder of the industry is earning an RoE closer to 10 per cent.[7] While low relative to the major banks, this group of ADIs is still earning a return that is commensurate with large US banks, and above that of large UK and European banks. Therefore, one of the more interesting questions that I think remains open to debate is where the ‘right’ RoE for a more resilient banking system is likely to settle.

Governance and culture

Up to this point, I’ve focussed on the financial strength of the banking sector. But we know that, like any business, financial strength will not ensure on-going resilience; indeed, if not well governed and managed, whatever financial strength exists will inevitably be eroded. So in looking for ‘unquestionably strong’ (in FSI terms) and resilient (in Basel Committee terms) ADIs, we need to not just be mindful of their financial strength today, but the likelihood they will maintain their strength over time.

APRA’s supervisory approach has traditionally placed a strong emphasis on the governance and risk management of financial institutions. Since the financial crisis, remuneration arrangements and risk culture have also received more prominence. We see these areas as providing strong indicators of how confident we should be about an ADI’s current financial health being maintained into the future. Recent papers by the Financial Stability Board and the Basel Committee on the topics of governance, risk management, risk culture and remuneration have reinforced the importance of these assessments.[8]

Within APRA, we’ve recently established a small team – designed to act as a centre of expertise – to help drive our supervisory efforts in relation to governance, culture and remuneration. We see the three issues as highly interrelated. Our assessment is that, broadly speaking, governance standards in Australia have probably already addressed most of the issues covered in the new international guidance, but that on culture and remuneration we have more to do before we can be confident that these are genuinely supportive of long-term financial strength rather than, as we have seen in the past, possible threats to it.

Preparing for the worst

In the highly leveraged world of banking, financial strength provides comfort and confidence to customers and counterparties that financial promises and commitments will be met. But there can be no guarantees. ‘Living wills’ has therefore been a new addition to the regulatory lexicon in recent years. A key lesson from the crisis has been the need to prepare for the worst – both in terms of ADIs having credible recovery plans that they can implement to restore their financial wellbeing after incurring losses, and the official sector having resolution plans if those recovery plans prove insufficient.

The ability to handle a period of severe adversity is a key consideration in demonstrating an ADI is ‘unquestionably strong’. If ADIs are unable to demonstrate that they can successfully navigate difficult environments, then their resilience needs to be bolstered further. They can, of course, be aided in this regard by the official sector ensuring its powers and tools for managing crises are in order – and this was also an important recommendation of the FSI. But official sector action is intended to be the last resort; a higher degree of self-sufficiency is needed. As I have discussed elsewhere, findings from our most recent stress test of the ADI sector suggests there is more to do in this regard.[9]

Concluding remarks

Measuring the resilience of the Australian banking sector, and judging whether it can be regarded as ‘unquestionably strong’, is inevitably a matter of judgement. It certainly requires, as I said in my introductory remarks, more than just a strong capital ratio (although that is still a good place to start). Beyond capital, we need to look at a number of dimensions.

Having provided a quick overview this morning, it’s reasonable to conclude the financial health and resilience of the banking sector has improved overall. How much of that improvement is in response to regulation, rather than more prudent management or market pressure, is not possible to disentangle. Regardless, the banking sector has been able to adjust and respond to the changes in the regulatory framework, and the broader financial environment, in an orderly fashion.

That said, there are still some challenges and risks to grapple with, a few more regulatory changes in the pipeline, and the environment will inevitably evolve further. Being able to respond and adapt to these events without too much difficulty will be important for demonstrating that the Australian community, and international investors, can continue to have confidence in the strength and resilience of the Australian banking industry. The ability to successfully deal with changing, and at times adverse, circumstance is, after all, the very essence of the resilience that we are looking for.

Footnotes

- See Byres, W. (September 2015), ‘In Search Of …. Unquestionably Strong’, Speech to the Risk Management Association, Sydney. Available at www.apra.gov.au.

- The leverage ratio used for regulatory purposes is not the same as the simple ratio of shareholders’ funds to assets shown in the chart (the regulatory ratio would be marginally lower than shown in the chart, primarily due to the addition to the denominator of certain off-balance sheet exposures).

- Smaller banks, as well as building societies and credit unions, continue to use a stock-based liquidity measure. This measure has been in place for these institutions for many years, and has proven effective for measuring and managing liquidity for small, domestic retail ADIs.

- I would think actuaries, if they compared it against good practices in provisioning for future potential insurance losses, might be uneasy too.

- The only disappointment is that the IASB and the FASB have not been able to find common ground on the best way to apply the expected loss model.

- The Basel Committee is currently working on guidance for supervisors and banks to help ensure the objectives of the new standard are achieved in practice.

- This may not be an entirely fair comparison, since the ‘non-major ADIs’ grouping includes mutual and not-for-profit organisations that are not driven to maximise returns to shareholders.

- For example, from the FSB, see ‘Principles for Sound Compensation Practices – Implementation Standards’ (September 2009), ‘Thematic Review on Risk Governance – Peer Review Report’ (February 2013), and ‘Guidance on Supervisory Interaction with Financial Institutions on Risk Culture – A Framework for Assessing Risk Culture’ (April 2014). From the Basel Committee, see ‘Compensation Principles and Standards Assessment Methodology’ (January 2010) and ‘Corporate Governance Principles for Banks’ (July 2015).

- See Byres, W. (November 2014), ‘Seeking strength in adversity: Results from APRA 2014 stress test on Australia’s largest banks’, Speech to AB+F Randstad Leaders Lecture Series, Sydney. Available at www.apra.gov.au.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.