Is IDII back on track?

At first glance, the recent run of reported profits in the individual disability income insurance (IDII) market looks promising for an industry that has been plagued by sustainability issues. Is this the light at the end of the tunnel for IDII?

IDII plays an important role in protecting the financial wellbeing of Australians. Life insurance companies have sold this product for decades, providing policyholders with an income when they cannot work for prolonged periods due to injury or illness. However, in recent years, the product’s future has become much less certain.

Intense competition, higher claims and lower insurance affordability resulted in a prolonged period of losses that significantly challenged the sustainability of the IDII product, calling into question its continued availability to meet the needs of the community.

In the five years to 2019, for example, the collective losses from IDII totalled $3.4 billion. This included significant increases in reserves for future payments for claims materially exceeding original expectations. Exacerbating the situation, life insurers were reluctant to risk competitive disadvantage by being the first mover to redesign their products to make them more sustainable since this would involve either reductions in benefits provided or increases in price – or both.

To address these concerns, APRA intervened in 2019 by implementing a series of measures, including additional capital requirements, that encouraged life insurers to address flaws in IDII product design and pricing, and to strengthen capabilities in risk governance and data quality. The aim of APRA’s intervention was to secure the affordability and availability of IDII into the future, including greater stability of premiums over the long term. This requires product terms and conditions that meet the needs of policyholders at a price that is affordable, while also allowing insurers to earn an adequate return on their capital. Without these conditions being met, the product can never be sustainable.

An improving outlook?

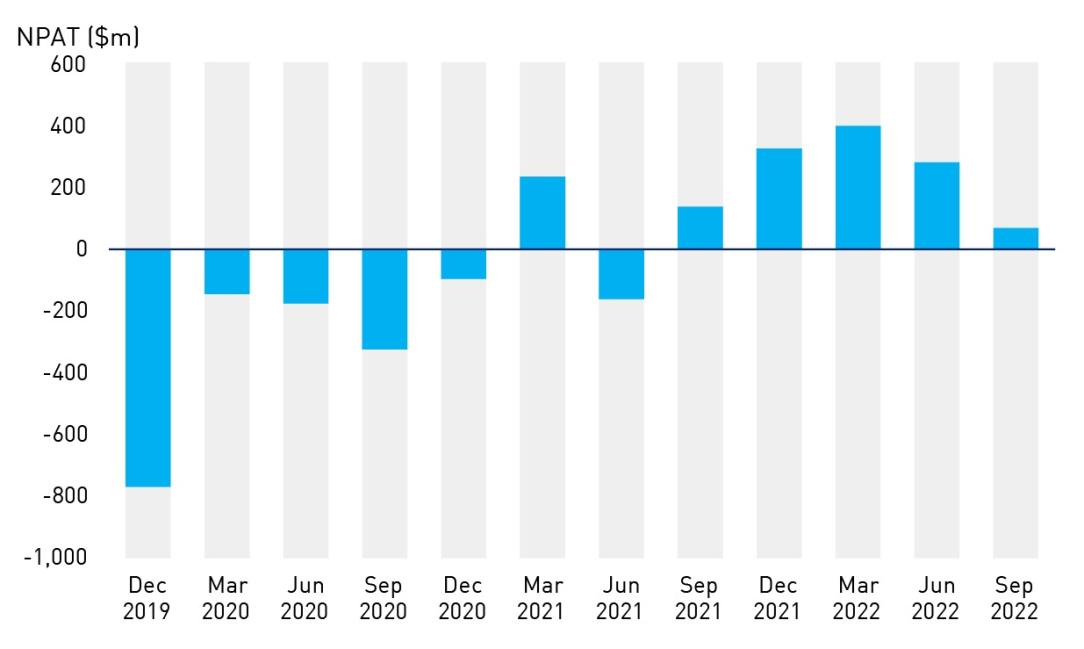

Chart 1: IDII has been making consecutive profits in recent quarters

Against this backdrop, IDII’s run of favourable reported results has been a welcome development. The industry reported net profits after tax (NPAT) for five consecutive quarters from mid-2021 to September 2022.

Does this mean IDII is finally over the worst of its challenges? Or, at least, that the previously gloomy outlook has improved? To understand what these results mean for the future sustainability of IDII, it is worth taking a closer look at what’s been driving reported profits of late.

As background, insurers hold reserves for current and expected claims and expenses. When these reserves exceed future premiums, it means the insurer expects to make future losses. Insurers are required to recognise these losses immediately and hold additional capital to ensure they can meet the expected claims. The losses accumulated in relation to IDII to 2020 were therefore, in many cases, a reflection of the fact that insurers expected to make losses on that business in the future.

Analysis of the industry’s results show three key drivers contributed to the recent profit turnaround: bond yields, repricing and releases of COVID-19 reserves.

Bond yields

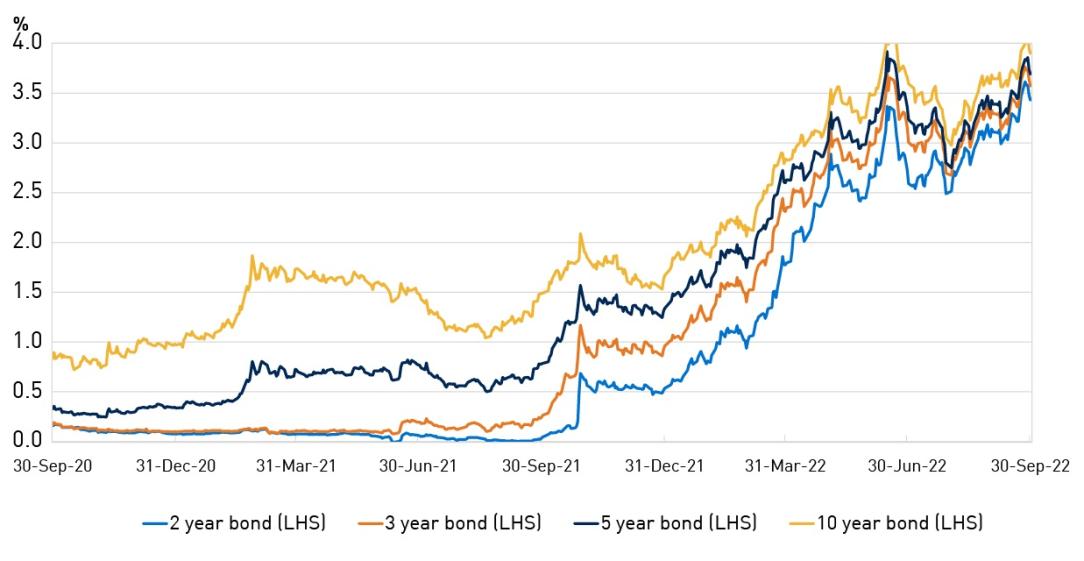

Chart 2: Australian Daily Government Bond Yields

Insurers typically rely on the stable and predictable returns from government bonds to help manage financial risk and meet their obligations arising from insurance claims.

As government bond yields increase, the future liabilities of insurers are discounted at a higher rate leading to a reduction in their value. This downward revaluation of liabilities makes a positive contribution to an insurer’s profit.

Increasing bond yields will also affect bonds held by insurers as they are also discounted at a higher rate, leading to a reduction in their value. As a result, life insurers experience unrealised losses on the bonds that they hold, which negatively impacts profitability.

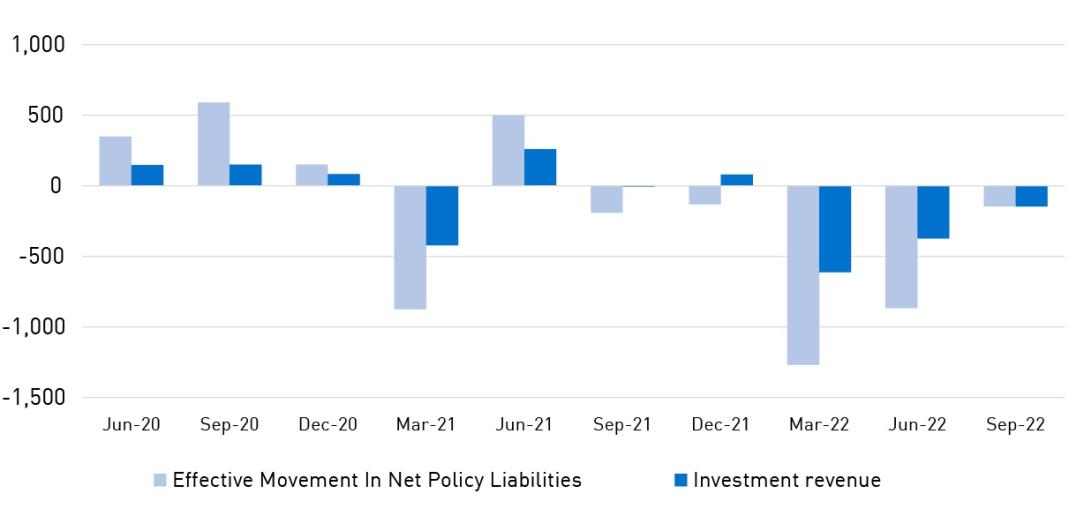

Many insurers aim to match the investments with the expected claims. However, changing credit spreads or differences in duration of liabilities and bonds can result in the two not being perfectly matched, so the profits that have emerged from the reduction in liabilities will not always be totally offset by the investment losses on the assets. This has been a main driver behind the improvement in IDII in recent quarters. However, there are also other components positively impacting liabilities and therefore profits, such as COVID-19 reserve releases and repricing. The overall impact can be seen in Chart 3 for the March and June quarters.

Chart 3: Recent improvement in IDII NPAT has been driven by movement in reserves with some offset from investment losses

Insurers should be prepared for a reversal of this trend, with the potential for the 10-year bond yield to return to a lower level over the next few years. For example, the liability valuation benefits experienced from interest rate movements began to reduce in the September quarter as the rate increased at a slower speed, as shown in Chart 3.

Repricing

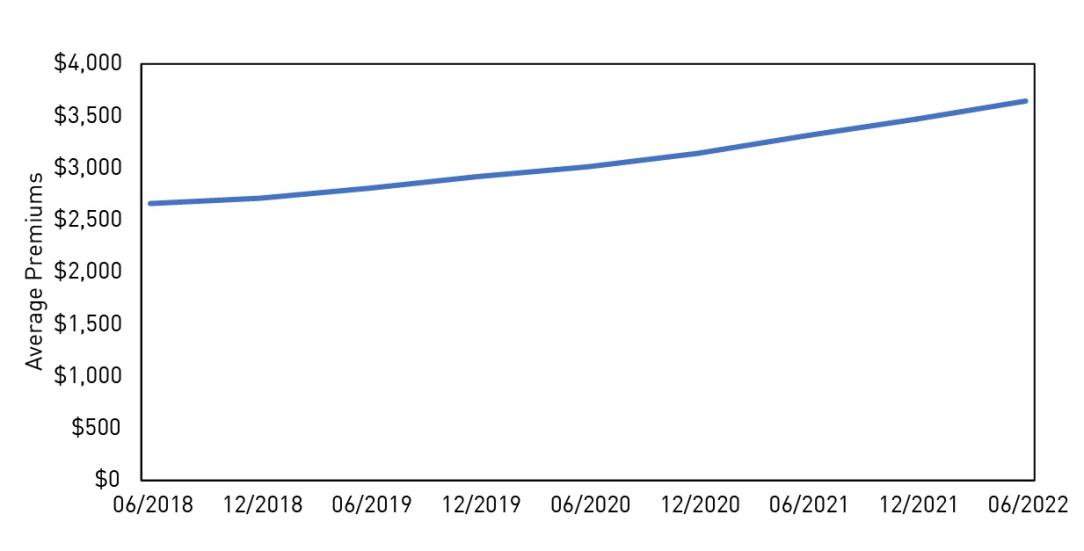

Chart 4: Repricing activities are expected to continue

Premiums are key for an insurer’s profitability, so repricing is another factor that contributed to the improved financial results. A life company that is holding reserves for expected future losses can make releases from those reserves when it reprices.

Chart 4 illustrates the continued increase in average premiums due to various repricing activities across the industry. This contributed to the reduction in cumulative losses and expected improved future profitability for most insurers.

Repricing is expected to continue as many insurers still expect future losses from their current IDII portfolio to rise. While repricing of existing policies is necessary for insurers to meet the increasing level of claims, it has produced poor outcomes for consumers. APRA expects insurers to balance the need for premium increases with providing affordable and fit for purpose cover for policyholders. Looking forward, the new IDII products launched following APRA’s IDII intervention should have much more stable premiums over the long term than the pre-intervention products.

COVID-19 reserves

During the early stages of the pandemic, insurers set aside increased reserves to meet potential liabilities arising from an anticipated spike in claim costs related to COVID-19.

To date, the industry has experienced a lower level of COVID-related claims owing to strict lockdowns, government support measures and high vaccination rates as well as lower impact than forecast on the younger, insured population. Most insurers have released parts of their COVID-19 reserves as a result, which further incrementally boosted reported profits during the year.

Residual risks from mental health, long-COVID conditions and the economic downturn remain. Mental health outcomes have been adversely impacted by the pandemic and it is unclear how long they will last. Long-COVID conditions, such as joint pain, fatigue and memory difficulties, could result in a further increase in IDII claims. APRA encourages insurers to carefully consider the unknown impacts of COVID-19 to ensure policyholders are protected and supported in this journey.

Looking ahead

The sustainability challenges with IDII have been well documented, and the premium increases that have been necessary given escalating claims costs have been very challenging for policyholders. APRA’s IDII measures are intended to help bring the product back from the brink and ensure that these problems don’t recur in the future.

Providing income support for Australians when injury or illness prevents them from being able to work directly benefits policyholders and their families, but also the community more broadly. Genuine sustainability means that the product is widely available and that the terms and conditions meet the needs of the customer at an affordable price. This sustainability will only be achieved if insurers earn a sufficient return on their capital to allow them to continue to offer the product.

The return to profitability for IDII is therefore a positive sign for sustainability of the product. However, since the net gains from improved bond yields and the COVID-19 reserve releases that have contributed to recent profits are cyclical events, that could reduce or reverse. While further premium increases can be imposed to respond to a future deterioration in profitability, this reduces affordability and leads to poor consumer outcomes. This will be further exacerbated by the lower household income and spending in a high inflation environment.

Overall, the industry continues to forecast future losses (albeit less than previously), showing that there is still some way to go before anyone should conclude that IDII has returned to a sustainable state. As such, it is important that the industry remains disciplined with its product design and pricing to strike the right balance between sustainability and profitability.

There may well be a light at the end of the IDII tunnel, but there is still a way to travel before we reach the end.1

Footnote

1 The data from this article was drawn from current APRA forms. As part of APRA-ASIC Insurance Data Transformation project, the two agencies have started engagements with life companies to improve the quality, quantity and timeliness of data available to all stakeholders in the future – including IDII data.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.