How super trustees can improve management of outsourcing arrangements

Superannuation trustees have long outsourced services, such as administration and investment management functions, to external providers. Expectations of trustees have increased due to APRA’s continued focus on improving the operational resilience of trustees and thereby outcomes for superannuation members. This increase in expectations coupled with concerns around trustees' management of related party arrangements that emerged from the financial services Royal Commission led APRA to conduct a thematic review focused on outsourcing arrangements in the superannuation industry.

APRA's review found that trustees' efforts since the Royal Commission have resulted in stronger board oversight and monitoring of outsourcing arrangements and service providers. However, there is more to be done and APRA's review has identified some key areas for improvement. These insights have helped to inform the broader work APRA is undertaking in relation to strengthening operational risk management.

Given the widespread use of outsourcing arrangements by trustees, APRA expects its findings to drive industry-wide improvements in trustee oversight and management of these arrangements so that better outcomes are delivered to members.

Outsourcing's impact on outcomes for members

Many outsourced services – for example, arrangements to process contributions, rollovers and transfers – are essential to the smooth functioning of a superannuation fund. In some cases, outsourcing gives trustees access to specialist expertise and capability, often at a lower cost and with less risk than if they carried out these operations themselves. However, it can also increase or introduce additional and different risks. A trustee's decision to outsource parts of its operations and, if so, to which service provider, has the potential to significantly impact outcomes for members. As such, it is vital that trustees adequately oversee services outsourced to external providers. Specific obligations on trustees in the management of outsourcing arrangements are set out in APRA’s Prudential Standard SPS 231 Outsourcing(SPS 231), noting APRA has also recently released draft Prudential Standard CPS 230 Operational Risk Management (CPS 230) for consultation, which proposes to enhance and incorporate these obligations in a single cross industry prudential standard.

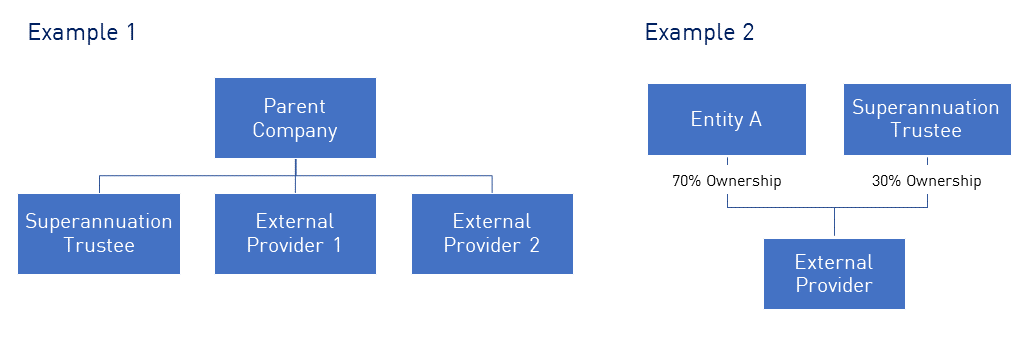

In some circumstances trustees may decide to outsource certain parts of their operations to entities connected to the trustee. This could be because a trustee and an external provider are part of a group of companies with shared ownership (sometimes known as a conglomerate group), or because a trustee owns an interest in the external provider, or due to other ownership or structural reasons, as outlined in Diagram 1. This situation is often referred to as related-party outsourcing. Regardless of whether a trustee outsources activities to service providers (both related and unrelated) or not, the trustee is ultimately accountable for the quality and cost of that work. In a related-party outsourcing arrangement a trustee needs to be especially aware of, and carefully manage, actual and potential conflicts of interest.

Diagram 1: Related party arrangements

Note:

- All entities are related parties.

- Services provided by the external providers to the superannuation trustee are considered related-party arrangements.

The thematic review

APRA’s review, conducted between February 2019 and October 2021, involved an in-depth review of the management of outsourcing arrangements across a sample of 10 retail superannuation trustees. This group was selected because related-party outsourcing arrangements have typically been more common for retail trustees, which tend to operate as part of larger conglomerate groups. The review covered four key services – administration, financial advice, investment management and insurance – across the sampled trustees, with outsourcing contracts worth approximately $1.2 billion per year.

APRA partnered with Grant Thornton, an external consultant, to conduct the thematic review. The observations identified in this article reflect APRA’s views, having considered Grant Thornton’s input.

APRA's key observations focus on three areas:

- Trustees' assessment of service providers' value-for-money;

- Trustees' measurement and monitoring of service providers' performance; and

- Trustees' oversight of service providers.

1. Assessment of value for money

|

SPS 231 requires that trustees undertake a tender or other selection process when choosing or renewing arrangements with service providers. Generally, most trustees undertake a tender process when selecting a service provider – obtaining quotes and specifications from providers in the market to test costs and services on behalf of their members. Where trustees use related-party service providers, APRA observed that instead of undertaking a tender, trustees often benchmark costs and services against an expert’s view of the market, using either an external consultant or an internal team. This is because, in some cases, obtaining quotes was impractical.

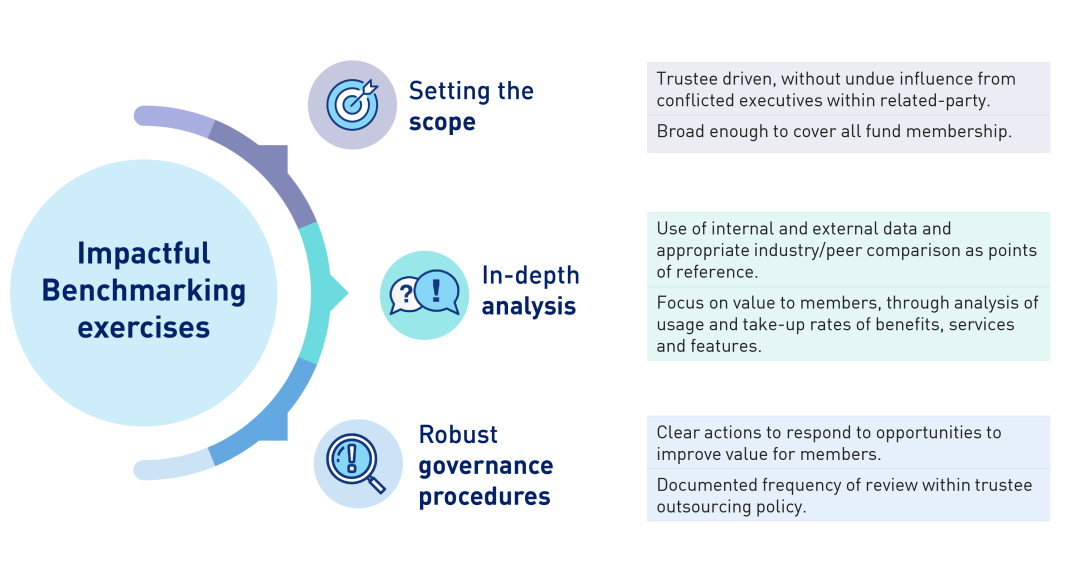

Done well, both tenders and benchmarking exercises can generate real benefits for members by helping trustees to assess and, where possible, improve the value members get from outsourcing arrangements. This may be by either enhancing services provided to members, reducing costs and in turn fees charged to members, or both. However, APRA found that some trustees had scoped their benchmarking activities too narrowly, and consequently missed the opportunity to understand, challenge and improve the value to members obtained from certain outsourcing arrangements. APRA also observed that some trustee benchmarking exercises didn’t generate any specific recommendations relating to opportunities to improve value for members.

A common pitfall APRA observed was for benchmarking exercises to focus on justifying existing costs and service standards, rather than seeking to challenge the status quo. Weaker benchmarking exercises focused mainly on costs of an arrangement, without sufficient consideration of the quality of services provided.

APRA observed benchmarking exercises that drove trustees to take specific action to improve member outcomes had a number of common characteristics as per Diagram 2 below.

Diagram 2: Characteristics of impactful benchmarking exercises

Better practice example

A trustee suspended payments to a related-party service provider until services were provided in line with agreed standards. The trustee also benchmarked the services provided by the related-party service provider, supporting the trustee’s successful negotiations for a reduction in fees paid for the service in future, improving outcomes to members.

Poor practice example

A trustee benchmarked the value of administration services provided by a related-party service provider, which didn’t identify any opportunities to improve outcomes for members. APRA observed that the scope of this exercise was narrow and focused on assessing whether existing costs could be justified, rather than challenging the costs and quality of services provided by the related-party service provider to form a more robust view of value for members.

2. Performance measurement and monitoring |

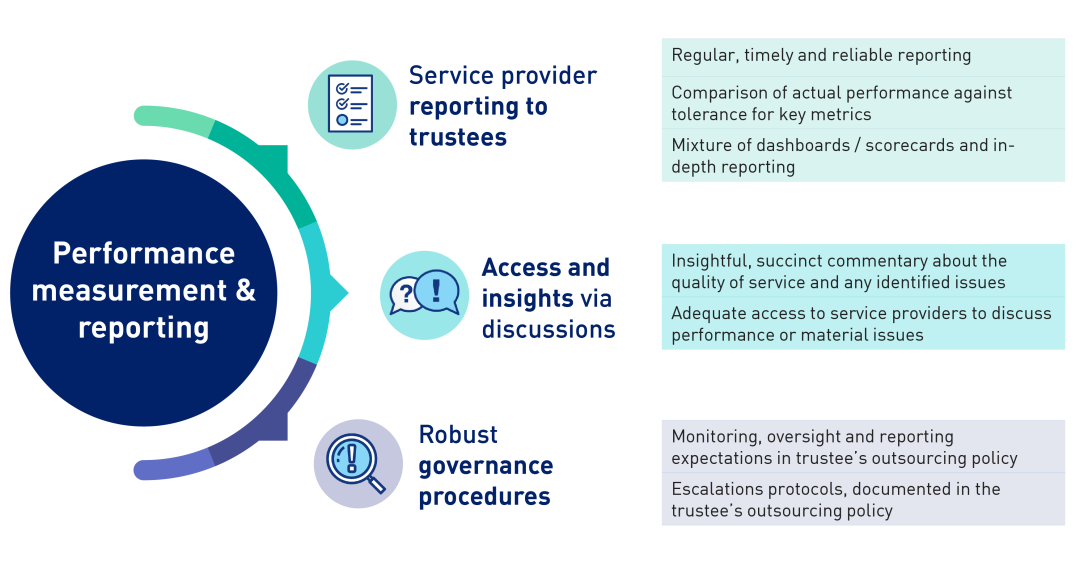

A trustee’s outsourcing arrangements can be complex and extend across several service providers and sub-providers. To monitor and support the measurement of outcomes for members effectively, in line with Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515), better practice requires trustees clearly to define and measure service standards that balance value, quality and efficiency. This can then be supported by regular reporting, including an appropriate mix of data and analysis, from service providers to the trustee.

While the quality of service reporting varied across trustees APRA has observed material improvements in this area over recent years. As part of the review, APRA identified that effective service provider reporting to trustees had a number of common characteristics as per Diagram 3 below.

Diagram 3: Characteristics of effective service provider reporting

Better practice example

A trustee used system-based tools, including data analytics, to monitor the compliance status of financial advisors of a related party that provides advice to fund members. This included monitoring where advice fees were deducted from member accounts, and fees as a percentage of account balance, to ensure there had been no inappropriate erosion of account balances.

Poorer practice example

A trustee's service provider performance reporting process demonstrated a lack of rigour. Quarterly performance reporting to the board was provided two months after the end of the quarter, the reporting did not cover actual performance against tolerance on key metrics and relied heavily on data with very little supporting analysis or explanatory commentary provided.

3. Oversight of service providers |

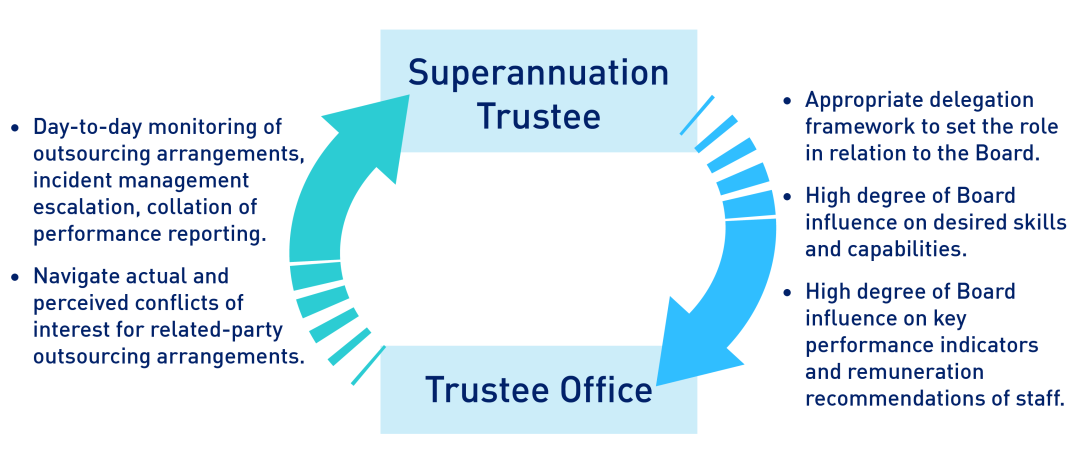

Where there are related-party outsourcing arrangements, the oversight of service providers necessarily includes navigation of actual and perceived conflicts of interest. While there is no legislative or prudential requirement for a trustee to operate a trustee office, a majority of the trustees sampled had established a trustee office or equivalent. One of the functions of a trustee office is to assist the trustees to oversee and manage outsourcing arrangements for the benefit of members. This includes day-to-day monitoring of outsourcing arrangements, incident management and escalation, collation of performance reporting and, to a varying degree, challenging and influencing service providers for the benefit of members.

APRA observed a range of sizes and structures of trustee office functions, and different approaches by trustees to establishing functional independence for the trustee office from the broader conglomerate group within which they operate. The most value is gained when the office can effectively challenge and influence the trustee’s service providers. This relies on the office having an appropriate mandate and the necessary skills and capability.

Of the trustee office functions in the sample, APRA observed that effective trustee office functions had several common characteristics as outlined below.

Diagram 4: Characteristics of effective trustee office functions

Better practice example

A trustee directly employed all staff in its trustee office, minimising the potential for conflicts of interest.

Poorer practice example

A trustee without an independent oversight function noted a greater burden on the board and board committees to provide effective oversight of service provider performance, leading to a need for more meetings between the board and the service providers on matters perceived as operational.

Looking ahead

APRA has engaged directly with each of the trustees included in the thematic review and has directed supervisory attention to ensuring trustee-specific observations are addressed. All sampled trustees have made good progress.

Beyond entity-specific observations, the insights from the thematic review should assist all trustees as they evaluate and improve their outsourcing management practices, especially given the higher governance and decision-making expectations of trustees established by the Your Future, Your Super reforms and SPS 515.

The findings from this thematic review will also inform the evolution of the prudential standards and guidance. More specifically, APRA has recently released CPS 230 for consultation. The findings from the review have informed draft CPS 230 and will also be used to develop the associated guidance.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.