Enhancing Australia’s superannuation system: A vision for a sustainable future

Helen Rowell, Deputy Chairman - 2017 ASFA Conference, Sydney

Good morning everyone. It’s a pleasure to be here, and I welcome the opportunity to talk to you again at what is one of the major events on the superannuation industry’s calendar.

Twelve months ago I spoke about “measuring up”, setting out APRA’s expectations for how trustees should be assessing their funds’ performance to ensure they are delivering quality, value-for-money outcomes for members and positioned to remain fit-for-purpose into the future. I noted then that trustees couldn’t take current policy settings for granted.

They say a week is a long time in politics, and a whole year is an eternity. And so it is not surprising that the policy settings for superannuation have evolved, with the Federal Government introducing legislation to enhance superannuation governance, accountability and member outcomes. The intense focus on the superannuation industry also continues, with the Productivity Commission’s review of superannuation competition and efficiency well into its final stages and likely to lead to recommendations for further change for the industry.

APRA is also taking steps to make sure that the prudential framework supports trustees delivering quality outcomes for superannuation fund members, complementing the Government’s proposed reforms. We will shortly release a consultation package outlining proposed revisions to the prudential framework, including changes to promote greater transparency, especially around expenditure, and implement member outcomes assessments for all funds.

Given the various reviews and changes that are afoot, there is a measure of uncertainty, and perhaps anxiety, in the industry about the extent of the proposed changes and what impact they may have. So today I want to outline some of the key features of APRA’s proposals, and what they may mean for trustees and their business operations – to spell out clearly the reasons behind APRA’s desire to bolster prudential practice in strategic and business planning and assessing member outcomes. In doing so, my objective is to help trustees start making the adjustments needed to remain successful and sustainable for years to come.

It is important to note that the proposed revisions to APRA’s prudential framework complement, but are largely separate from, the Government’s proposed reforms. And so while we have yet to go through our usual consultation process, we expect that they will go ahead. APRA has already incorporated some of the industry’s initial feedback into the more detailed proposals that we expect to release shortly, and we welcome ongoing conversation with the industry about the measures as we work to finalise them by mid-2018. We see these changes to the superannuation prudential framework as essential in light of the challenges the sector faces, to ensure that standards of practice across the industry are lifted and the best interests of all super beneficiaries are adequately protected.

The future shape of the super industry

If we look ahead five years, what might the superannuation sector look like and what will be required for trustees and funds to be sustainable and successful in this brave new world?

If growth trends persist broadly in line with the past five years, by 2022 the superannuation sector will be managing roughly $4 trillion on behalf of Australians, give or take a few billion.

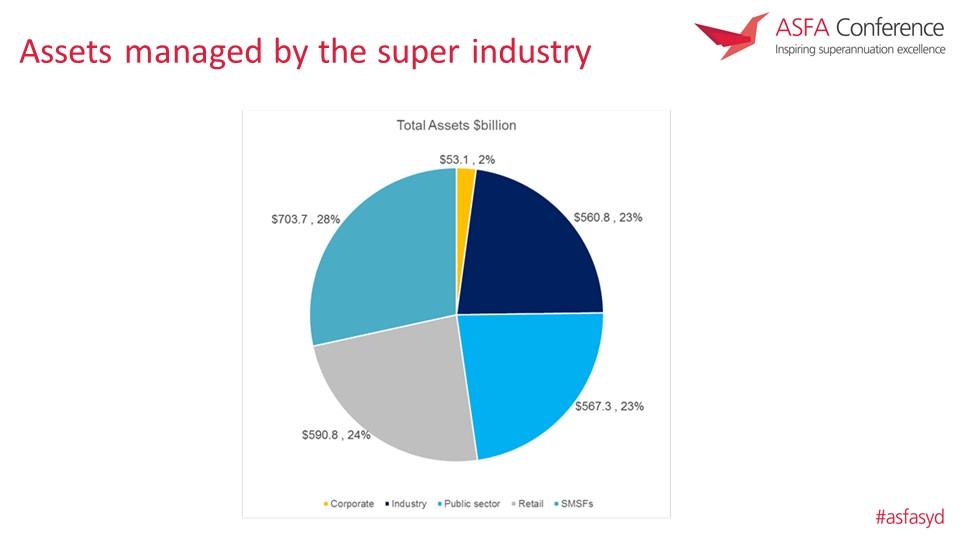

As of September 2017, the breakdown of the current $2.5 trillion of assets managed by the industry was:

- 2.1 per cent in corporate funds;

- 22.2 per cent in industry funds;

- 17.0 per cent in public sector funds;

- 23.4 per cent in retail funds; and

- 27.7 per cent in self-managed super funds.

Many industry stakeholders are concerned about what impact changes to legislation or prudential standards will have on the make-up of the industry, and the different industry segments. APRA’s interest, however, is in making sure all of the APRA-regulated funds that make up the super industry are delivering sound outcomes and have a strong and sustainable future – irrespective of whether they are a retail, industry, corporate or public sector fund. As long as a fund is well-managed and delivering quality, value-for-money outcomes for its members, which industry segment it may belong to is irrelevant to us.

Consequently, the changes proposed in our upcoming consultation package are designed to put pressure on poor performers – irrespective of industry segment – to lift their game or, if the needed improvement is not possible within a reasonable timeframe, to gracefully exit the industry.

Strengthening member outcomes

Flowing from this, APRA expects to see further industry consolidation in the years ahead, leading to both fewer APRA-regulated funds and investment options to choose from over time. If we look at the composition of the industry five years ago, there were 51 industry funds, 179 retail funds, 40 public sector funds and 64 corporate funds. By comparison, in 2017 there are 40 industry funds, 126 retail funds, 37 public sector funds and 25 corporate funds – a loss of 106 funds overall. This has come about for various reasons, including unsustainable funds closing and transferring their members elsewhere, or funds voluntarily choosing to merge, pool their assets and resources, and hopefully gain the benefits of increased scale.

As indicated in the letter we issued to the industry of 31 August 2017 on the assessment of quality member outcomes, some trustees and funds appear insufficiently prepared to manage current and future industry challenges. These include a more competitive environment; changing fund demographics as more members move into retirement; and low investment returns.

That is why our proposed prudential framework enhancements are so important. The strengthened prudential requirements will require trustees to bolster their strategic and business planning practices, decision-making and oversight for fund expenditure, and approach to defining, assessing and delivering quality outcomes for members.

The consultation package will provide more details on the proposed enhancements to the prudential requirements for strategic and business planning and fund expenditure. They are designed to reflect the better practices we have observed across the industry, and so should supplement, rather than disrupt, the practices of trustees who already run their business operations well.

The strategic and business planning proposals should prompt trustees to ask the most important questions first – what are their strategic objectives, and how are they going to deliver sound outcomes for members? Trustees must then translate those objectives into action through their business plan, and be clear about how those actions will be funded using fund assets or other sources of income. The proposed changes to the prudential framework are intended to support trustees as they set objectives to secure their ongoing strength and sustainability: retaining members and supporting them in retirement, maintaining employer relationships, and considering strategic opportunities to optimise efficiency.

Further, as industry transparency improves, the quality of the outcomes delivered for members should increasingly dictate who Australians entrust to manage their retirement savings. Weaknesses in the current reporting and disclosure framework for super make it difficult for regulators, industry and members of the public to meaningfully compare outcomes across funds, and the many products and investment options they offer. Enhancements to the reporting regime, which we will explore through our consultation package, seek to provide more detailed and comparable superannuation data for APRA to analyse and publish. This is expected to enable industry stakeholders to better assess the outcomes being delivered, and ultimately drive improvements in these outcomes and promote increased competition. Trustees that have confidence in the outcomes they are providing for their members should welcome such enhanced transparency, as funds that are high performing, with strong returns, appropriate fees and quality service should benefit from it.

Trustees that are identified, or which ideally self-identify, as being unable to consistently deliver sound and sustainable member outcomes will be encouraged to make potentially fundamental changes to the way they operate their business – if necessary by merging with, or transferring their members to, another fund. The proposed directions power before the Parliament would allow APRA to enforce this in cases where trustees failed to see the writing on the wall. If granted, this is a power I would prefer APRA only had to use very rarely, if at all. APRA’s preference is always for trustees to determine their own destinies.

Of course, examples abound of trustees with robust governance and business planning processes, resulting in superior outcomes for their members. It’s my hope that by applying APRA’s proposed outcomes assessment to all funds, those high performing trustees will act as a beacon for the rest of the industry to aspire to. Moreover, for the majority of trustees that already have sound business planning, risk management and decision-making processes in place, the revisions to the prudential framework shouldn’t require fundamental changes to how they operate.

Sustainability and fund size

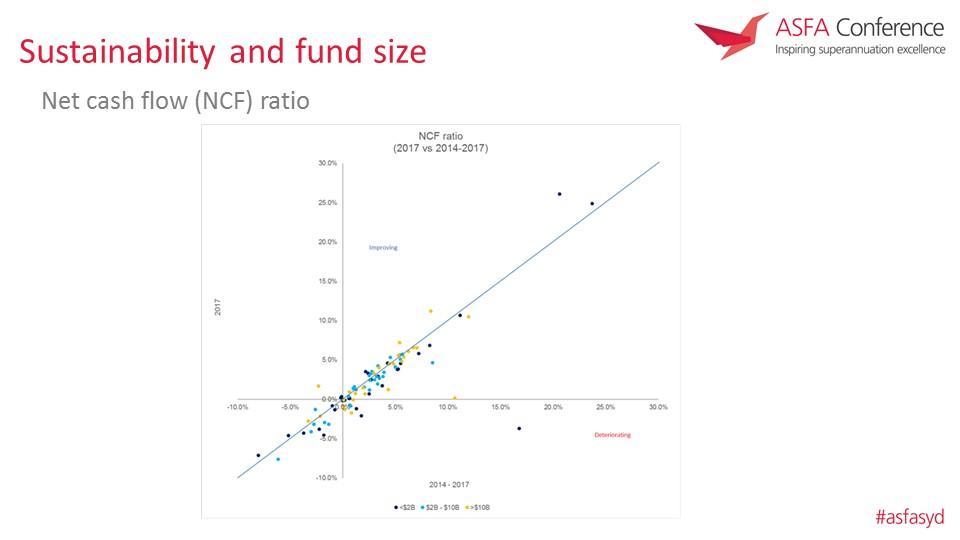

Let me illustrate how APRA is thinking about sustainability and member outcomes, using two examples of relevant metrics that show the position of RSEs relative to the industry and their own recent history.

Chart 1: plots the net cash flow (NCF) ratio for 2017 against the period 2014-17; those RSEs that fall below the line are deteriorating in terms of NCF i.e. they are contracting.

This slide shows how the net cash flow ratio for 2017 compares against the net cash flow ratio for the three year period from 2014 to 2017. Those entities that are positioned below the line have experienced a deterioration of their net cash flow ratio. The different coloured dots on the chart indicate fund size – the dark blue dots are funds with less than $2bn in total assets; the light blue dots are funds with between $2 and $10bn in total assets; and the yellow dots are funds with more than $10bn in total assets.

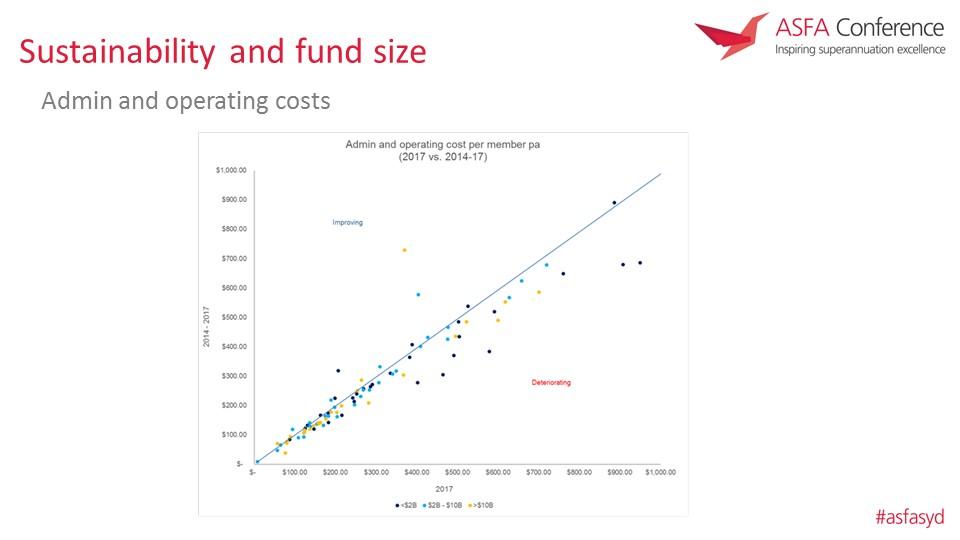

Chart 2: plots administration and operating costs per member for 2017 against the period 2014-17, those RSEs that fall below the line have seen an increase in costs per member and (unless there has been an explainable one-off increase in costs) it is likely that cost per member is trending upwards.

Similarly, this slide shows how administration and operating expenses per member for 2017 compare against the amount for the period from 2014 to 2017. Those entities that are positioned below the line have experienced a deterioration i.e. an increase in their admin and operating expenses.

I don’t want you to get bogged down in the details of either slide as they are just two examples of a number of different measures of member outcomes. They do highlight, however, the need for trustees to look at the available data to understand how their metrics are trending and use this to inform their strategic and business planning. APRA has seen business plans that continue to forecast 5 per cent growth in membership year-on-year when actual experience suggests a very different trend. Armed with appropriate trend analyses, we expect to see from trustees more realistic forecasts of the future state of their funds and how members will be impacted, and strategies and business plans appropriately anchored in what is realistically likely to be achieved.

I have said in previous forums that bigger is not always better – but analysis of our future-focused metrics suggests some correlation between scale, future viability and member outcomes is evident. It is therefore critical that trustees take a frank look at what they want to achieve and the resources required to deliver those objectives. Where resources are limited, trustees must make tough calls about which initiatives are most likely to deliver quality outcomes for members. Our data across a range of metrics show the different challenges faced by smaller funds compared with larger funds, from generally lower returns, to higher operating costs and a general trend towards greater contraction of membership. There are exceptions to this rule, but APRA cannot ignore the trends evident in our data.

Less (choice) is more

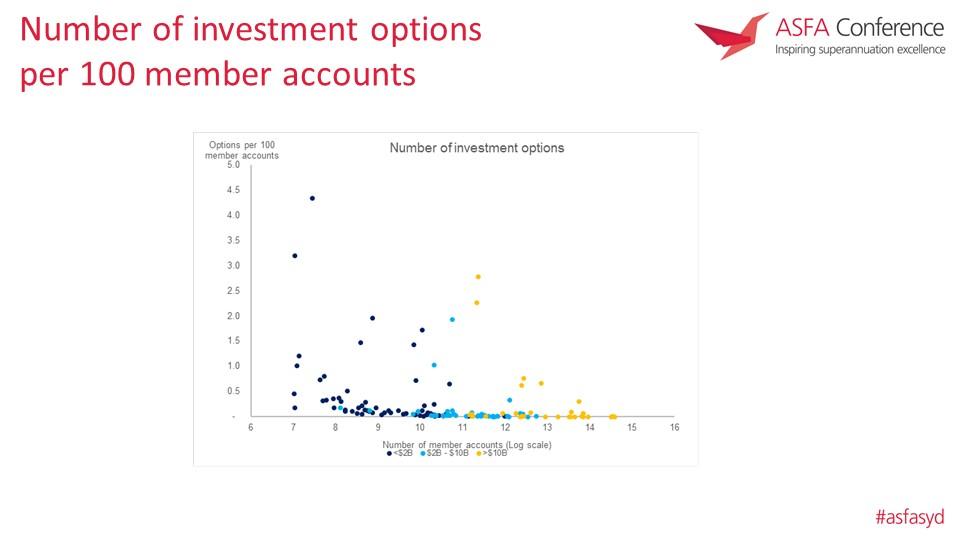

Another area that warrants consideration as part of any member outcomes assessment is the number and nature of the different investment options that are offered to fund members. Australians in 2017 have the option of choosing between 209 super funds; and within those funds there are an astonishing forty one thousand [41,000] investment options. That’s an average of 196 investment options per fund.

This graph plots the number of investment options per 100 members for different size super funds, colour coded by size of fund as for the previous slides. (A few outliers have been excluded.[1]) You can see from the number of dark blue dots on the left-hand-side of the graph that it’s generally smaller funds that offer more options per 100 member accounts. When looking at this data, the obvious question it raises is whether those smaller RSEs offering a large number of options for their membership have the capacity and resources to properly manage this degree of investment complexity.

From the member’s perspective, the question is: at what point does the level of choice become more a headache than a help? It seems legitimate to ask why the industry offers members an average of nearly 200 investment options when many funds have a significant proportion of members in their default MySuper products and hence relatively few members in each of the many choice investment options on offer. And that is particularly the case when many of the options don’t appear to be markedly different in their asset allocation or risk/return characteristics.

I have previously expressed the view that there are too many investment options within super. Research published in 2015 out of the University of Pennsylvania[2] concluded that over a 20-year investment horizon, funds that provide an excessive number of investment choices reduce member value by nearly $10,000; a not unsubstantial financial hit, given the average fund balance for the industry is $55,777,[3] and certainly not in the best interests of those fund members.

Under APRA’s proposed member outcomes assessment, and as part of sound strategic and business planning, we would expect trustees to seriously consider the optimal number of investment options they should be providing to efficiently deliver quality outcomes for members. Might the time and fees dedicated to administering so many options, many of which appear to be very similar, be better directed elsewhere? In particular, might members be better off with a smaller number of options delivering appropriate risk/return outcomes and a reduction in both fees and fund administration costs? I suspect, in many instances, the answer to both questions is yes.

Boards for the future

Finally, let me make a few observations on super fund boards.

When 2022 rolls around, it seems likely that superannuation boards will be more diverse than they are today, which is positive for member outcomes. The broader the pool from which trustees choose directors, the more likely they will be able to find the capabilities, experience and diversity of views needed to enhance decision-making, and position themselves to meet the challenges of being larger and more complex, and the needs of their members.

There continues to be public commentary expressing varying views about why the best performing super funds over recent times have achieved the outcomes they have. APRA remains of the view that the quality of outcomes delivered to members results from a combination of factors and decisions, and is not just a reflection of investment strategy or ownership structure. Our preliminary analysis of outcomes across the industry using a wide range of metrics suggests, however, that there may be some correlation between enhanced member outcomes and board composition. The trustees with outcomes at the better end of the industry, on average, appear to be those that have appointed independent or non-affiliated directors. This was consistent for funds with and without equal representation, across measures of investment performance, fees and costs, and sustainability metrics such as net cash flows.

Board diversity, of course, goes beyond the question of the affiliation of directors on the board. Only last month, it was suggested by one industry stakeholder that boards should have directors aged over 80 to ensure the views of retirees were better represented. APRA does not consider that mandating an age based restriction is the way forward, but we would certainly agree that trustees need to consider whether the diversity on their board appropriately reflects the diversity of their membership.

Speaking at the AIST Governance Ideas Exchange last month, I observed that the gender balance on the boards of not-for-profit funds had improved – albeit only marginally – over the past two years: the proportion of female directors increased from 26 per cent in 2014 to 30 per cent in 2016. In the for-profit sector, this was 30 per cent in 2014 and 36 per cent in 2016.

It is also interesting to note that average tenure is (slowly) shortening; in the not-for profit sector, the change is less pronounced, from 6.2 years in 2014 to 6 years in 2016, when compared with the for-profit sector: 4.6 years in 2014 to 4.1 years in 2016. And we still observe (too many) examples of unduly long tenure.

Importantly, though, the trends from APRA’s perspective are moving in the right direction. Increasingly, trustees recognise the importance not only of having the right mix of skills, but also bringing in the varied perspectives that come from a range of life experiences. Our large superannuation funds, as active shareholders, are increasingly pushing corporate Australia to tackle the diversity question head on, arguing that diverse groups generally provide better outcomes than non-diverse groups. In this light, it’s hard to imagine that the industry itself will not continue to improve the diversity on its own boards.

During recent Senate hearings on the government’s superannuation legislation, several stakeholders, sceptical of the need to mandate independent directors, argued “cognitive independence”[4] was more important; the ability of board members to think independently of each other. I agree with the principle of cognitive independence but, as one witness noted, this is extremely difficult to legislate for. I’d strongly suggest, however, that a board comprising a balance of genders, ages, ethnicities, skills and experience is more likely to achieve cognitive independence.

Same but (hopefully) different

So in five years’ time, APRA expects the superannuation industry to be quite different in some ways from now. But no matter what changes lie ahead, the broad principles that underpin sound superannuation governance will remain constant. Superannuation trustees must remain ultimately focused on delivering optimum outcomes for their members. And that is what our prudential framework proposals seek to achieve. By providing greater clarity on our expectations regarding strategic and business planning and assessing member outcomes with a view to continuous improvement, trustees will be better able to continue to meet the needs of their membership into the future.

In some cases, that may require trustees to conclude they lack the scale or skills to do so, and exit the industry – after all, the interests of members need to come before directors’ interests when there is a conflict.

APRA supervisors will continue to seek evidence of robust governance and risk management arrangements. These practices have always been important, but in an ever-more competitive and challenging environment, they will become more so. Crucially, trustees with industry-leading governance practices in place will be best placed to adapt to whatever legislative or regulatory changes may emerge, because they are most likely doing much of what’s required.

At a time when banks, life insurers and health insurers face significant reputational challenges, public confidence in superannuation funds, across all industry sectors, remains fairly solid. No-one will benefit from erosion of this trust – especially as the demographic challenges that are emerging make superannuation ever more important in ensuring Australians can enjoy a comfortable and dignified retirement.

It is your members whose interests APRA ultimately seeks to protect through its outcomes assessment and the other prudential changes which we are proposing. Consequently, the super industry will look different in 2018 and beyond: stronger, more sustainable, more resilient and consistently delivering better outcomes for those it’s designed to serve. That’s a vision of the future I hope we can all get behind.

Footnotes

- Outliers with more than 5 options per 100 member accounts have been removed to enable comparison of the majority of funds.

- 'Simplifying Choices in Defined Contribution Retirement Plan Design’. D. Keim and O. Mitchell, 2015.

- Taken from APRA’s 30 June 2016 Annual Superannuation Bulletin.

- Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation Measures No. 1) Bill 2017 and Superannuation Laws Amendment (Strengthening Trustee Arrangements) Bill 2017 p 33.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9.8 trillion in assets for Australian depositors, policyholders and superannuation fund members.