Deferred lifetime annuities

Ian Laughlin, Deputy Chairman - ASFA Unpacks: Deferred lifetime annuities and more, Sydney

Good morning.

It’s good to be here talking about what may well become quite an important aspect of the super system.

If you are even a casual follower of technology, you would be aware that Apple recently released a new iPhone – the 5S. One of its features is a fingerprint security system to be used instead of a password. Sounds great, but it has raised a concern: would a mugger be tempted to sever a finger so that he could access the contents of the phone?!

That reminded me of a story I read many years ago about an annuity issued by an English life company operating in the Far East. One annuitant was living a particularly long life, to the point that it aroused suspicion. So the life company sent someone to check. The life company required a fingerprint each year as proof the annuitant was still alive before it made that year’s payment. You guessed it – the family had severed the finger and preserved it in fluid, and once a year it was dried off and used to make the print!

So the world of lifetime annuities is full of new and interesting challenges.

Today I want to explore some of those challenges from the perspective of both the annuitant and the life company.

The Market - Australia and UK

The market for life time annuities in Australia has never been strong, but there is a reasonable book of business in force.

This contrasts with the UK, for example, where the annuity business of life insurers is huge and the market quite sophisticated. A major reason for this is due to the UK law, which in the past has required retirees to take a major portion of super (pension fund) as a lifetime pension or annuity. The rules have changed in more recent times to reduce this compulsion, so sales have declined, but it is still a major business.[1]

It is worth drawing on UK experience to illustrate some points today. Just as background here are some UK figures:

- There are more than 6 million annuity policies in force

- In 2012, 400,000 new annuities were taken out.

As you might expect, the UK market is highly developed with a multitude of product types available. At times the market has made major errors in the management of this business, and large losses have been made as a result – to the point of putting significant pressure on solvency in some cases.

Immediate Lifetime Annuities

I might start with a quick review of the broad types of immediate (as opposed to deferred) lifetime annuities. It’s instructive to look at immediate lifetime annuity designs as they are likely to form the basis of deferred lifetime designs.

First it’s important to note that it is technically possible to price all sorts of strange immediate lifetime annuity designs. The issue is more what customers might find attractive.

Here are some examples -

- the most basic arrangement – a single life, with a fixed amount paid each year until death;

- as in 1, but with a guaranteed minimum payment term (of say 10 years);

- as in 1, but with a death benefit on early death;

- as in 1, but with a guaranteed withdrawal option over say the first 10 years;

- as in any of the above, but payable until the later death of two lives (or maybe the first of the two deaths), with or without a decrease in payments following the first death;

- any of the above, with payments indexed.

You get the idea – there is not much theoretical constraint on annuity design. The issue is attractiveness to the market.

DLAs

Let’s now turn to deferred lifetime annuities (DLA). As the name implies, with a DLA, the commencement of annuity payments is deferred in some way.

In theory, any of the immediate lifetime designs above could be adopted for the payment part of a DLA.

However, with a DLA, there is another design element that needs to be considered – and that is what happens in the deferral period. There are two broad classes of DLA: in the event of the death of the annuitant (or surrender of the policy) during the deferral period, either a benefit payment is made or no benefit payment is made.

A little history is relevant here. In 1983, the concept of a superannuation rollover was introduced. This allowed a departing employee (nearly all super funds were corporate funds) to retain his or her benefit within the super system.

There were two vehicles for doing this – an approved deposit fund and a deferred annuity. The latter was issued by life companies only. With this type of deferred annuity the benefit payable during the deferral period was the account balance. At retirement age, there was a right to buy an immediate lifetime annuity. In some cases this was at a price determined at the commencement of the deferral period, and in others it was the price at the date of retirement. In the latter case, there was no real risk borne by the life company if and until the annuity was actually purchased on retirement. In the vast majority of cases, this never happened. So the deferred annuity was really just a superannuation investment vehicle for rollover money.

Now all of the recent interest has been about the first type of DLA – where there is no benefit payable on death (or withdrawal) during the deferred period.

I think we all understand the reason for this. In a defined contribution market, super fund members take both investment risk and longevity risk during their retirement period, and this poses real challenges to a retiree in translating a lump sum to a reasonable income for the remainder of his or her life.

There are various ways of tackling this problem. Let’s explore some of them briefly.

We might do that through the eyes of George, a 65 year-old, recently retired and a widower. George has $1 million dollars in super, and wants to use it as effectively as he can to provide income for the rest of his life.

He has many options of course, but let’s consider a few of them:

- He can be completely unstructured in his approach, with the knowledge that he can fall back on the age pension, and/or downsize his house. So he withdraws enough to live comfortably and dips into his pension plan from time to time for holidays and new cars and so on.

- He can still just rely on his allocated pension, but tackle his drawdowns in a structured way. So, for example, he could decide each year how many years he think he might live and work out how much he can spend each year over that time.

- Another approach would be to assume he is going to live to age 80, and spend accordingly, and if he lives past 80 rely on the age pension only.

- Yet another would be to work on the assumption he will live to age 80, but set aside a sum to cater for his needs after age 80.

Let’s explore the last of these.

How on earth does George decide how much he should set aside to provide for his needs after age 80? He might live to age 81 or 92 or 99. So he is ok for the first 15 years, but after that he might have a real problem. If he wanted to be sure he had enough, he would have to set aside a sizeable sum, even though the chances of needing it are low.

The life company

What, though, if there were many other people in the same boat as George? Some of them will die before age 80, some will live to 81, some to 82, 83, 84, and so on. This is where a life insurance company comes into play. A life company does not need to set aside enough for the worst case for all of the lives – in simple terms it just needs to ensure it has enough for the average outcome.

In other words, the life company is able to diversify longevity risk by pooling the experience of many lives (something George could not do).

However, it is not that simple!

There are three significant risks for the life company which are particular to annuities, as shown on the slide:

- longevity risk;

- investment and reinvestment risk;

- underwriting risk.

Longevity Risk

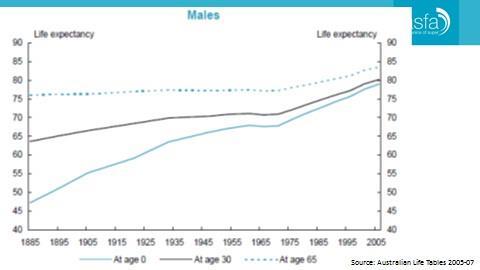

The insurer is exposed to longevity risk in two broad ways. First, the mortality experience may differ from what is assumed. This might be because of random fluctuations (the bigger the pool, the less of a problem this will be), or because assumptions were simply incorrect. This could be, for example, because the positive selection effect (healthy lives being more likely to take an annuity) was underestimated. However, this is little different to the risks that a life company takes on with its normal life business – it’s just the inverse situation. The second broad longevity risk comes about because the average life span has increased consistently for a long time. It’s instructive to look at some history on this. This graph shows how Australian life expectancy has changed over the years.

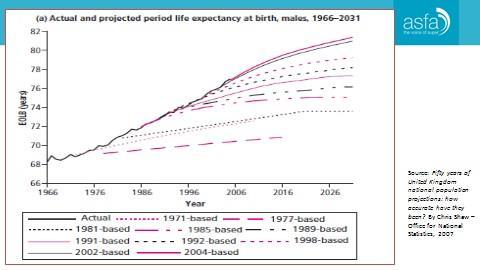

To illustrate, life expectancy at birth has increased from about 47 for a male in 1885 to about 79 in 2006. (These figures make no allowance for expected longevity improvements at the time.) Clearly, in pricing an annuity a life company must make allowance for improvements in longevity, or they will pay more than allowed for in the pricing. There is a risk that this will be underestimated. The trouble is that the more conservative the life company is in allowing for improvements, the less attractive the annuity pricing becomes. It is worth noting that in the UK market, the industry has regularly under-estimated longevity improvements and this has cost it dearly. This graph illustrates this phenomenon:

Source: Fifty years of United Kingdom national population projections: how accurate have they been? By Chris Shaw – Office for National Statistics, 2007.

And then there is the possibility of a real discontinuity that could be caused by a medical breakthrough. Imagine the impact of the proverbial cure for cancer on life expectancy! This longevity risk is magnified with deferred lifetime annuities (compared to immediate lifetime annuities). To illustrate let’s look at some life expectancy figures (using Australian Life Tables 2005-07). All of these figures are based on a male aged 65.

| Life expectancy | No mortality improvements | With mortality improvements (25 year trend) | Increase | With mortality improvements (3% per annum flat) | Increase |

|---|---|---|---|---|---|

| at 55 | 19.9 | 22 | 10% | 24.7 | 24% |

| number of years age 80+ | 6.5 | 8.5 | 28% | 11 | 70% |

| number of years age 85+ | 3.3 | 4.8 | 44% | 7.4 | 122% |

| number of years age 90+ | 1.3 | 2.2 | 71% | 4.6 | 250% |

You can see that if mortality improves in accordance with the 25 year trend, then the life expectancy for a 65 year old increases by 10%. And if mortality improves by flat 3% pa improvements, longevity increases by 24%. But note what happens to the expected number of years of life after age 80 – which is what is relevant for a DLA. The increases are 28% and 70% for the same improvements! This effect is even more pronounced for expectancy after age 85 and age 90. That is, there is a strong gearing effect. The insurer will always make some allowance in the pricing for improvements in longevity. However, the financial risk to the insurer of unanticipated improvements in longevity is proportionately much greater for a DLA compared with an immediate annuity.

Investment and Reinvestment Risk

The second significant issue for an insurer offering deferred lifetime annuities is investment and reinvestment risk. What does this mean? Let’s consider investment risk first. If the insurer wants to offer a reasonably high/contemporary guaranteed interest rate, it will normally back the liability with quite secure fixed interest investments, to minimise the risk that it will pay more interest to the policyholder than it earns on its investments. Most business where this is an issue in Australia is relatively short term in nature. This means that assets of duration similar to that of the liabilities are readily available. However, deferred lifetime annuities, by definition, are particularly long term in nature. And this means that it may not be possible to invest in assets of a suitable duration (there are no long term government bonds available in Australia for example). The insurer is then faced with reinvestment risk. That is, during the course of the policy’s life, the original backing assets will need to be replaced by the insurer, and of course the new investments will be subject to interest rates prevailing at that time. Those rates might be quite low. Note that the long term nature of the annuities does provide the opportunity to invest in illiquid assets, which may produce a higher return for a given level of investment risk.

Underwriting risk

The last potential significant issue is underwriting risk. At first blush you might be surprised at this, given the less healthy the life the more likely they are to die early. But that is the point. Less healthy lives should be given better annuity rates than healthy lives. In the UK, these are called enhanced annuities, and they make up a large proportion of the market:

- 20% of sales in recent times were enhanced annuities;

- apparently 50% of new annuitants could be eligible for an enhanced annuity.

It may be that initially there will be no need for enhanced annuities in Australia, especially DLAs, as they are only likely to be attractive to very healthy people. However, if DLAs were to become popular, competitive pressures would soon result in the introduction of enhanced annuities. This would require a new set of skills for the industry and risks of getting it wrong will be high.

Implications

So what are the implications to the insurer of these risks inherent in deferred lifetime annuities?

Well, the technical management of this business, the prices charged and the capital held must reflect the risks. That is, the risks must be explicitly allowed for in the pricing of the annuity and/or in the capital backing the policy. APRA will expect this to be done very well and very diligently. And through its prudential standards and its supervision will ensure this is so.

This does mean that pricing may appear high to the market, and this may affect the attractiveness of the product and the development of the market.

It would be unfortunate if the market perceived the pricing to be unreasonably high, when in fact the life companies are simply managing their business prudently.

Possible Alternative Approaches

So is there anything a life company can do to counter the risks I have described, and so make the proposition more attractive to the market?

There are a various possible ways to tackle the impact on pricing of investment risk.

The first is that the insurer takes more investment risk itself, with a view to generating a higher return on its investments, and passing some of this on to the annuitants in the pricing. However, there are no free lunches here, and the insurer would have to hold and service more capital because of the greater risk. So this won’t necessarily be a fruitful avenue.

The second is that the annuitant keeps more of the investment risk themselves, while maintaining protection against longevity risk. This would allow the annuitant to enjoy the (potentially) higher returns, commensurate with the risk. How might that be done? The UK market for immediate annuities gives some answers:

- The first approach is a participating annuity. You might be familiar with the old style whole of life and endowment assurance policies. These policies increased sums insured by the addition of annual bonuses and often increased final payouts with non-guaranteed terminal bonuses. These bonuses reflect in part the underlying investment returns, giving some exposure to investment risk whilst still providing guaranteed returns. These bonus concepts can be applied to annuities – with the two types of bonus increasing the annuity payments. There are other participating arrangements also available in the UK.

On paper this has some appeal. Participating funds typically invest in a mix of asset types (including equities). So such a participating annuity has guaranteed minimum payments, with the potential for increased payments if underlying investment performance is strong. This makes even more sense in the case of a DLA, where a particularly long term perspective is taken. - The second is a unit–linked annuity. In these cases, the annuity payment is linked to the returns from the chosen asset mix. There are various way so of doing this, and they do tend to be complicated. One version in the UK is called the flexible lifetime annuity. And the so-called variable annuity (VA) is a special example of a unit-linked annuity. VAs usually offer various guarantees e.g. minimum withdrawal benefit for life, or minimum account balances at certain points. These guarantees attract explicit fees.

Let’s turn now to possible ways to tackle the impact on pricing of longevity risk.

The insurer could use reinsurance or invest in longevity bonds. Whilst either of these techniques can reduce the longevity risk to the insurer, they would come at a cost and won’t necessarily result in a better return for the annuitant.

It also would be possible to share the longevity experience with the annuitants in some way, so the risk to the insurer is lowered, along with its capital needs. This might result in better initial pricing for the annuitants, but it also could mean that eventual annuity payments are lower if longevity proves better than expected.

Conclusion

In conclusion, it is not simply a matter of making the necessary changes to the law, and the market for very conventional DLAs will blossom. Even if DLAs turn out to be quite attractive to the market, there is a myriad of issues for the life insurers to work through. And APRA will expect the necessary analysis, pricing and capital management to be done to a high standard.

Let me finish with another story. In the 1970s, I worked in New Zealand. The life company I worked for sold the occasional deferred annuity. Every year (for at least the few years I was there), a spry old fellow would come into the office and buy a DLA, with a deferral period of 5 years. He was very fit and healthy and openly expressed the view that the life company did not know what it was doing in taking him on. And of course, if he did survive long enough, the returns would have been very good indeed. This is a good example of the anti-selection process at work. If he had been in poor health, there is no way he would have done this.

Footnote

- Editorial note: Since the date of this speech, the UK has changed its law significantly, removing any compulsion to take benefits in the form of an annuity.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.