APRA releases inaugural Your Future, Your Super Performance Test Results

The Australian Prudential Regulation Authority (APRA) has today released the results from the inaugural MySuper Product Performance Test introduced as part of the Government’s Your Future, Your Super reforms.

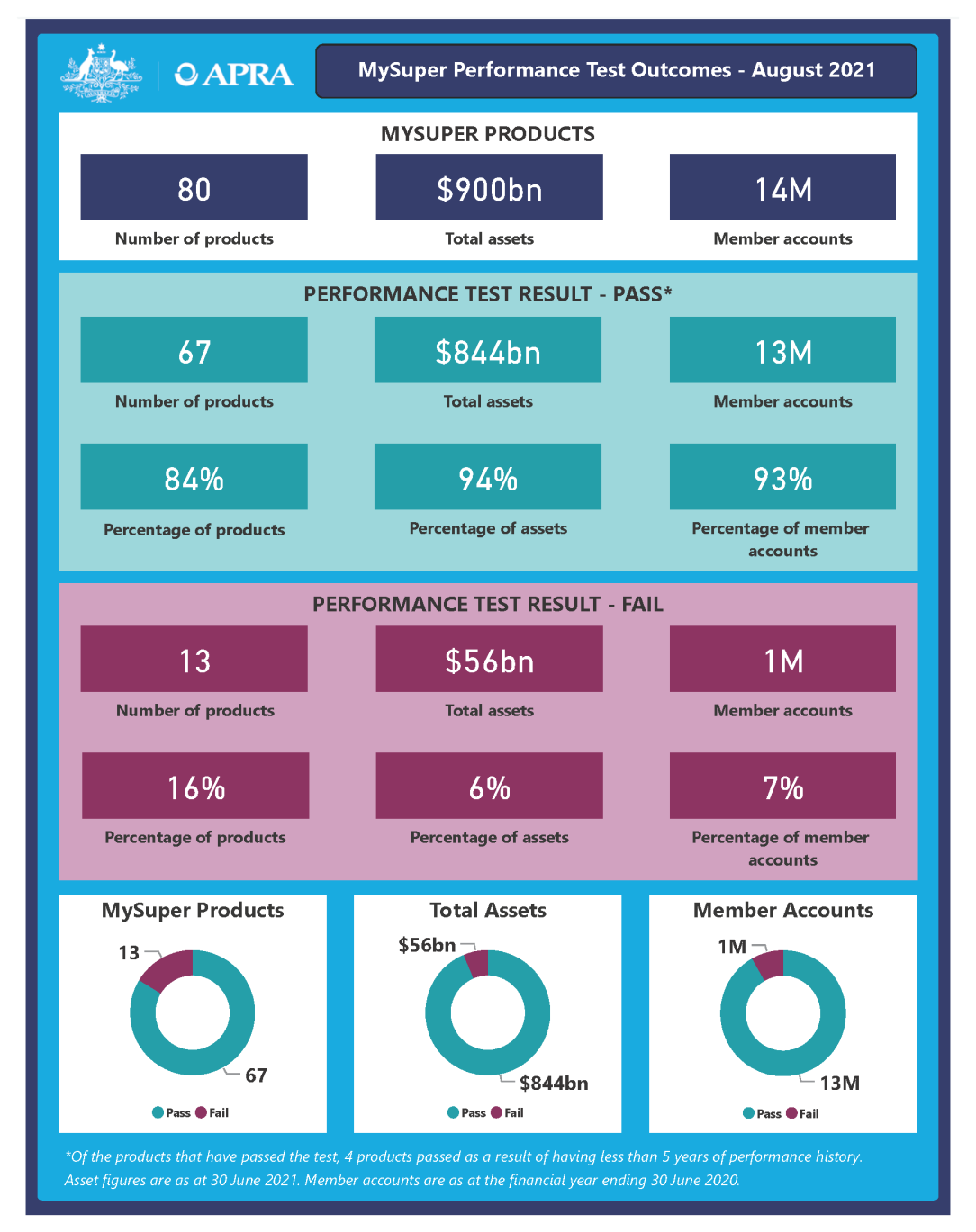

There are 80 MySuper products. APRA has assessed 76 MySuper products with at least 5 years of performance history against the objective benchmark. A total of 13 products failed to meet the objective benchmark.

“It is welcome news that more than 84 per cent of products passed the performance test, however APRA remains concerned about those members in products that failed,” APRA Executive Board Member Margaret Cole said.

“Trustees of the 13 products that failed the test now face an important choice: they can urgently make the improvements needed to ensure they pass next year’s test or start planning to transfer their members to a fund that can deliver better outcomes for them.

“APRA has intensified its supervision of trustees with products that failed the test and has requested they provide a report identifying the causes of their underperformance and how they plan to address them. Trustees have to monitor their products closely and report important information to APRA – including relating to the movement of members and outflow of funds.”

Trustees of failed products are required to write to members by 27 September 2021 advising them of their Performance Test outcome and providing the details of the ATO’s YourSuper comparison tool: YourSuper comparison tool.

As well as scrutinising the plans of the 13 funds that failed the test, APRA is engaging with trustees at risk of failing the performance test next year to ensure they take the steps necessary to improve performance, and to understand their contingency plans. These contingency plans must include pre-positioning to be able to give effect to an orderly transfer of members to another fund, if required.

From next year, trustee directed products will also be subjected to the performance test.

Results

Failing products

RSE | MySuper product |

AMG Super | AMG MySuper |

ASGARD Independence Plan Division Two | ASGARD Employee MySuper |

Australian Catholic Superannuation and Retirement Fund | LifetimeOne |

AvSuper Fund | AvSuper Growth (MySuper) |

BOC Gases Superannuation Fund | BOC MySuper |

Christian Super | My Ethical Super |

Colonial First State FirstChoice Superannuation Trust | FirstChoice Employer Super |

Commonwealth Bank Group Super | Accumulate Plus Balanced |

Energy Industries Superannuation Scheme-Pool A | Balanced (MySuper) |

Labour Union Co-Operative Retirement Fund | MySuper Balanced |

Maritime Super | MYSUPER INVESTMENT OPTION |

Retirement Wrap | BT Super MySuper |

The Victorian Independent Schools Superannuation Fund | VISSF Balanced Option (MySuper Product) |

The Your Future, Your Super Performance Test page is available on the APRA website at: Your Future, Your Super Performance Test.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.