APRA proposes measures to strengthen superannuation member outcomes

The Australian Prudential Regulation Authority (APRA) has today released a consultation package on measures aimed at assisting APRA-regulated superannuation licensees to be better positioned to deliver sound outcomes for their members.

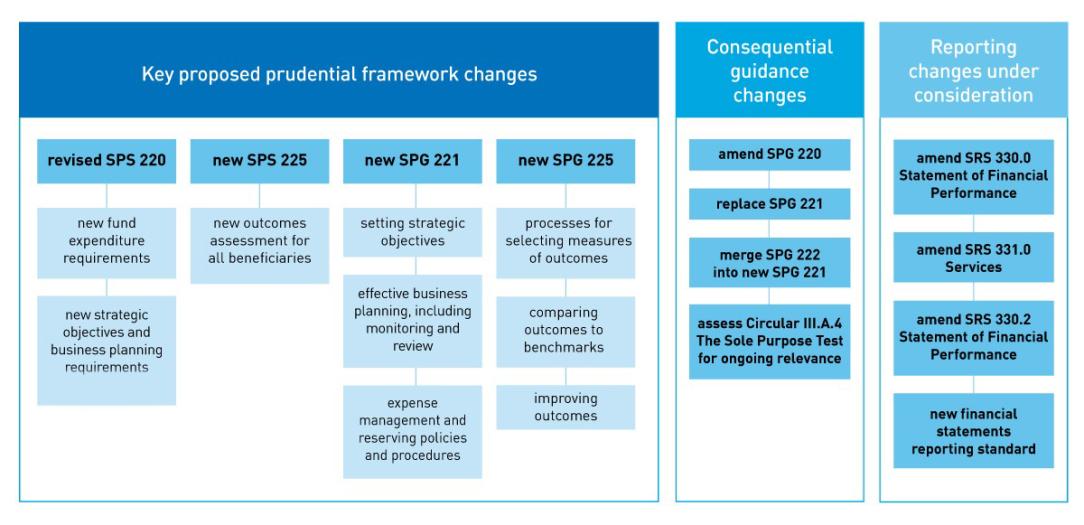

The package outlines proposed changes to the prudential framework designed to enhance strategic and business planning, oversight of fund expenditure and the assessment of outcomes for members of registrable superannuation entities (RSEs). This is the second stage of an extensive consultation process, which commenced in August with the release of a letter to industry outlining APRA’s intentions, followed by several roundtable discussions with key industry stakeholders.

Today’s consultation package proposes measures including:

- changes to the existing prudential standard SPS 220 Risk Management relating to strategic and business planning and fund expenditure policies and processes;

- a new prudential standard, SPS 225 Outcomes Assessment, requiring all RSE licensees to annually assess the outcomes provided to members using a broader range of measures;

- new prudential practice guides to assist RSE licensees with their strategic and business planning and the outcomes assessment; and

- amending SPS 250 to require RSE licensees to provide straight-forward processes for opting-out of all insurance products.

The proposed changes are intended to complement APRA’s supervisory focus on RSE licensees’ delivery of member outcomes, including increased engagement with those licensees identified as not consistently delivering quality outcomes.

Deputy Chairman Helen Rowell said APRA wanted to ensure all RSE licensees were prepared to manage emerging challenges, such as changing member demographics and a more competitive environment.

“Every super fund member deserves confidence their fund is delivering quality, value-for-money outcomes. APRA’s proposals, supported by our ongoing supervisory focus, will help RSE licensees lift their standards for the long-term benefit of their members.

“They also reflect APRA’s ongoing efforts to encourage all RSE licensees to go beyond the minimum legislative requirements by conducting a broader outcomes assessment as part of their strategic and business planning processes,” Mrs Rowell said.

APRA’s proposals are independent of, but aligned with, legislative proposals currently before the Parliament. In considering the final form of the standards being issued for consultation today, APRA will have regard to both feedback from consultation on its own proposals and the final form of any new legislation passed by the Parliament.

Submissions on APRA’s package are open until 29 March 2018. The new and revised prudential measures are expected to be released by mid-2018, with a proposed commencement date of 1 January 2019.

Overview of APRA’s proposed prudential framework changes

Copies of the publications are available on APRA’s website.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.