APRA Explains: APRA’s role in the private health insurance premium round

The private health insurance (‘PHI’) premium round is the annual process of all private health insurers applying to the Federal Minister for Health to change the price of premiums they charge customers.

In order to change their premiums, private health insurers must get approval from the Federal Minister for Health, as required under section 66(10) of the Private Health Insurance Act 2007 (‘the Act’). Under the Act, the Minister must approve the proposed change unless it is contrary to the public interest.

But how does the PHI premium round involve APRA?

APRA’s role

APRA is the prudential regulator for private health insurance; responsible for making sure that insurers have the ability to pay all policyholder obligations. As such, the Department of Health requests APRA’s view on the implications of each private health insurer’s application to change premiums. Specifically, APRA’s role is to advise the Department of Health whether premium increase requests would result in an adverse prudential outcome.

Adverse prudential outcomes include:

- an insurer being unable to meet promises to policyholders,

- an insurer being unable to pay claims, and

- an insurer being unable to sustain its business over the long term.

APRA has a number of prudential standards and analytical tools to help identify whether these outcomes may occur.

APRA has no approval role in the PHI premium round. Rather, APRA – as an important stakeholder in the private health insurance industry – is an advisor to the Department of Health.

The process

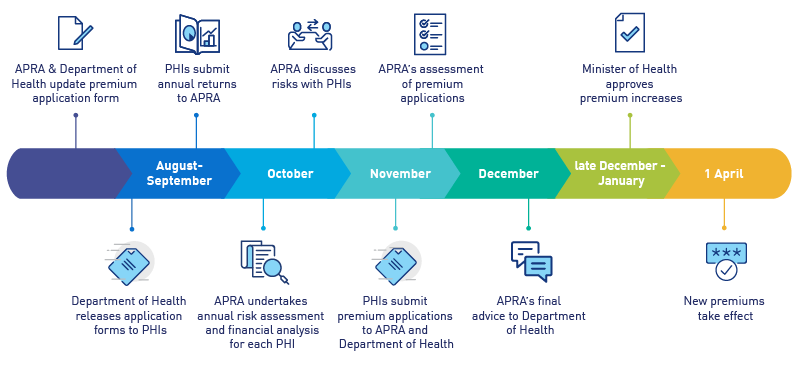

The PHI premium round usually occurs once a year, and involves all insurers applying for premium changes at the same time. Typically, insurers’ applications are made in November for changes on 1 April the following year. The Department of Health usually releases the application form in August or September. APRA collaborates with the Department of Health to design the application form, and to decide whether specific information should be gathered in relation to challenges facing the broader private health insurance industry.

APRA’s regular supervision of private health insurers focuses on ensuring that promises to policyholders can be met, so even before applications to change premiums are submitted to the Minister for Health, APRA is very familiar with the issues and challenges facing each insurer.

Internally, APRA’s focus is to ensure its understanding of these issues and challenges includes all information available from insurers, the industry and the broader financial sector environment. This preparation moves into full swing in early October, around six weeks before applications are submitted to the Minister for Health.

At this time, APRA carries out a full financial analysis. As part of this full financial analysis, the Appointed Actuary’s assessment of the insurer is reviewed in the annual ‘Financial Condition Report’ (the Appointed Actuary is the actuary required by law and selected by each APRA-regulated insurer to undertake certain functions), and the insurer submits its annual returns to APRA for review.

This is also the time when APRA meets with insurers to discuss how they are managing their risks (such as pricing, capital and strategy), current issues they may be facing, and their likely action in the premium round. This is to make sure the insurer is actively considering its key risks and taking action to avoid adverse prudential outcomes.

Once APRA receives the insurers’ applications, its focus is on understanding each insurer’s approach to managing its risks, and assessing the effectiveness of that approach. There are a number of aspects to this assessment including:

- the insurer’s ability to maintain capital levels,

- the insurer’s ability to cover the costs of claims,

- the level of uncertainty around issues including membership, claim costs, premium revenue, capital and adequacy of pricing, and

- risks to sustainability.

The information gathered by APRA in the steps outlined above informs APRA’s final advice to the Department of Health. APRA’s advice is then incorporated into the Department of Health’s advice to the Minister. After considering each insurer’s application, the Minister notifies APRA and the insurer as to whether the application to change premiums has been approved.

APRA's role in the PHI premium round

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.