Member Outcomes and Design and Distribution Obligations

The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) are issuing this letter to RSE licensees in relation to the Member Outcomes (MO) obligations1 and the Product design and distribution obligations (DDOs), to assist RSE licensees to better understand the way in which the MO obligations and the DDOs interact.

This letter follows APRA guidance on the MO obligations in SPS 515 Strategic Planning and Member Outcomes, SPG 515 Strategic and Business Planning and SPG 516 Business Performance Review and ASIC guidance on the DDOs in RG 274 Product design and distribution obligations.

The MO obligations and the DDOs are transformative regulatory changes that will have a significant impact on every RSE licensee’s operations and product offerings. APRA and ASIC are committed to working together to assist RSE licensees understand and comply with the obligations.

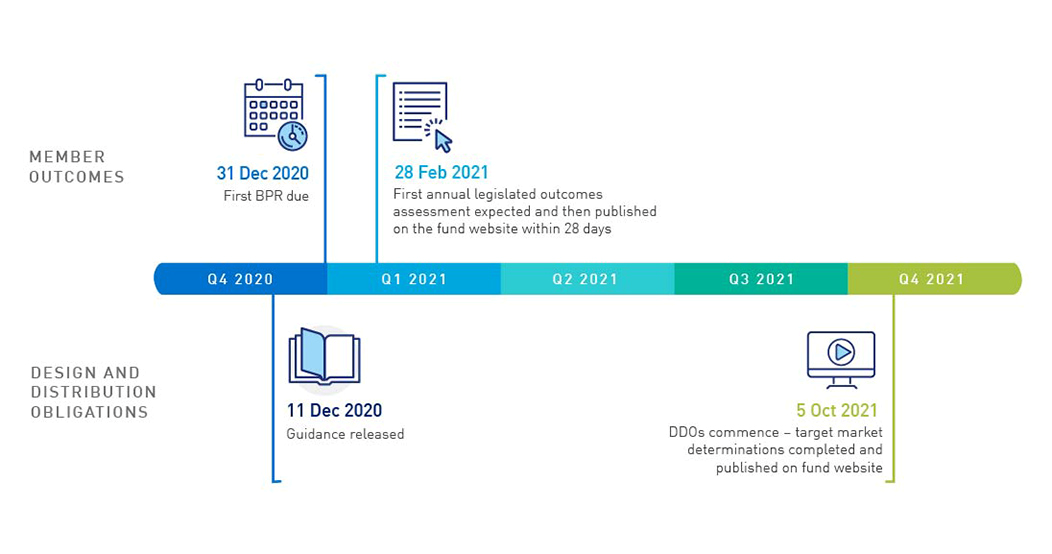

For the MO obligations, administered by APRA and commenced on 1 January 2020, the first Business Performance Reviews (BPR) are due by 31 December 2020 and the first Outcomes Assessments are expected to be completed early 2021. APRA expects RSE licensees to be well progressed in completing their first BPR.

For the DDOs, administered by ASIC, the commencement date for the reforms is 5 October 2021 but significant preparation is needed by RSE licensees ahead of this date.

Given the commencement date of each regime and the opportunities to capitalise on potential synergies, APRA and ASIC encourage RSE licensees to consider both regimes in tandem when they look to build systems and processes. This is necessary and appropriate to ensure that both sets of obligations are implemented in an efficient way and all obligations are complied with in the best interests of members.

Interaction between the MO obligations and the DDOs

The MO obligations and the DDOs are, in many ways, complementary. In considering the requirements and implementation of both regimes, RSE licensees should look for opportunities to derive efficiencies (e.g. processes, system design, etc.) and learnings (e.g. data, etc.).

The MO obligations focus on RSE licensees’ broader business operations, enhancing strategic planning and ensuring licensees are continually reviewing their products and operations, to deliver quality outcomes for members holding MySuper products or choice products.

The DDOs, which apply to RSE licensees in respect of their choice product offerings, require choice products to be designed for an identified target market of consumers, and require RSE licensees to take reasonable steps in distribution that will, or are reasonably likely to, result in distribution to that target market. RSE licensees must review the target market determination (TMD) periodically to ensure that it remains appropriate.

The requirements of the MO obligations and the DDOs respectively seek to ensure the good governance of superannuation funds as a whole and the entire choice product lifecycle, from initial design and distribution through to monitoring, assessing and refining products.

At a high level, both regimes require RSE licensees to:

- identify the needs of members;

- determine whether their decisions about choice products and broader business operations are delivering quality outcomes for members; and

- make decisions that are evidence-based and to monitor and review their product offerings and operations on an ongoing basis.

Complementary regimes

There are three key areas in which the MO obligations and the DDOs interact closely.

1. Planning, reviews and adjustments

MO obligations:

- APRA requires RSE licensees to set strategic objectives for member outcomes, reflected in a three-year rolling Business Plan updated annually.

- RSE licensees are required to analyse business performance against strategic objectives, conduct cohort analysis and undertake product-level Outcomes Assessments on an annual basis.

DDOs:

- RSE licensees must make a TMD for any choice products they offer from 5 October 2021.

- RSE licensees must review TMDs periodically, when review triggers occur, or where other events or circumstances reasonably suggest the TMD is no longer appropriate.

Both the MO obligations and the DDOs require RSE licensees to make business decisions based on the outcomes they are seeking to achieve for their members who hold the product. The desired outcomes can inform both the cohort analysis under the BPR and the target market under the DDOs. Further, reference to the target market may assist with cohort construction, noting that under the MO obligations, RSE licensees are required to go beyond product-based cohort construction. Similarly, learnings derived from the cohort analysis undertaken as part of the BPR could be used by licensees to test the appropriateness of the target market.

When preparing TMDs, RSE licensees may be able to use information contained in their Business Plan.

Adjustments to the Business Plan following the BPR may prompt reconsideration and amendments to the licensee’s TMDs to, for example, reflect changes to product, target market or distribution arrangements. RSE licensees may also find the analysis undertaken as part of complying with the DDOs has valuable insights to inform future reviews of their business performance.

2. Data

- APRA expects RSE licensees to use internal and external data to meet their MO obligations.

DDOs:

- Product governance arrangements should include collecting and analysing relevant and reliable consumer, product performance, value and transaction data.

The quality of the BPR and the Outcomes Assessments will hinge on an RSE licensee’s ability to access granular and accurate data, as well as how the licensee uses that data to improve its performance over time. For example, distribution and complaints data collected as part of the monitoring process for the DDOs may assist to inform annual Outcomes Assessments.

Similarly, in meeting the requirements of the DDOs, ASIC expects RSE licensees to collect and analyse relevant and reliable consumer, product performance, value and transaction data. This data may be sourced both internally and externally and need not be developed for the purposes of the DDOs specifically. RSE licensees should consider what external data may be required when specifying in the TMD the kinds of information needed from distributors to identify if a review trigger or other event or circumstance that would reasonably suggest the TMD is no longer appropriate has occurred.

Alongside the need for greater collection and synthesis of internal data, RSE licensees will be aided by APRA’s Superannuation Data Transformation program – a multi-year program to enhance the breadth, depth and quality of APRA’s superannuation data collection.

3. Insurance in superannuation

- RSE licensees must carefully consider the appropriateness of their insurance strategy, including product design and the impact of insurance premiums on members’ retirement balances, in both the cohort analysis under the BPR and product-level Outcomes Assessments.

DDOs:

- Insurance, where offered as a component of the product, is a key attribute of the product that should be considered in developing a TMD.

RSE licensees need to ensure that their insurance strategy is appropriate for their membership, that the cost of cover does not inappropriately erode members’ retirement savings, and that the other obligations in APRA’s SPS 250 Insurance in Superannuation are met.2

There may be information or data collected by an insurance provider on behalf of an RSE licensee that is relevant to both the MO obligations and the DDOs. RSE licensees may be able to use the same data to ensure that the cover offered to members achieves the outcome sought under the licensee’s strategic objectives and Business Plan, and that the cover meets the requirements of the DDOs.

RSE licensees will need to ensure that insurance arrangements are considered when identifying the target market for a choice product offering. This remains the case where the RSE licensee has the same insurance arrangements across their MySuper and choice product offerings.

Next steps

APRA and ASIC will continue to engage with the industry over the coming months on the interaction between the two regimes. A timeline to assist RSE licensees’ understanding of the interactions of both regimes is attached in Appendix A.

Signed

| Helen Rowell Deputy Chair Australian Prudential Regulation Authority www.apra.gov.au | Danielle Press Commissioner Australian Securities and Investments Commission www.asic.gov.au |

Footnotes:

1 MO obligations include the Outcomes Assessment required under section 52(9) of the Superannuation Industry (Supervision) Act 1993 (SIS Act) and SPS 515 Strategic Planning and Member Outcomes.

2 SIS Act 52(7) and (11)

Appendix A – Timeline