Is self-regulation dead?

8 August 2019

Wayne Byres, Chairman – Crossroads: The 2019 Banking and Finance Oath Conference, Sydney

Good morning. I am very pleased to be part of this event, and to lend my support to the Banking & Finance Oath and to Finsia, both of whom are playing important and timely roles highlighting the importance of trust and professionalism for a successful financial sector.

In my remarks this morning, I’ve been asked to answer the question: is self-regulation dead? To cut to the chase, my answer is that I certainly hope not. If self-regulation is failing, we need to revive it, not write it off. Good self-regulation – in the broadest sense of the term, capturing self-discipline and restraint – is essential to providing the community with a well-regulated, efficient and value-adding financial services sector. It is not optional.

The fact the question is being asked indicates self-regulation, while perhaps not dead, is certainly not in peak physical condition. The Royal Commission has solidified the community’s perception that financial institutions do not value their customers, but instead take advantage of them. That is no doubt unfair to the majority of those who work in the industry who want to compete with honour, pursue their ends with ethical restraint, and speak out against wrongdoing, in line with the Oath’s precepts. Yet we still too often see in the financial sector a failure to self-regulate in a manner that appropriately balances the interests of all stakeholders.

Regulators must – as we do – accept some responsibility for these failures, and seek – as we are – to do better. Stronger and more active enforcement of the law as advocated by the Royal Commission is part of the solution and, supported by stronger powers, both APRA and ASIC are getting on with that. Nevertheless, our regulatory framework is rightly and firmly founded on the premise that boards and executives are ultimately responsible for the activities and performance of their companies. While after-the-event punishment will act as a general deterrent against illegal behavior, more than just compliance with the law is needed to restore the financial sector’s reputation. Individuals, companies and industries must better regulate their own behaviour: to do not only what is legal, but also have regard to what is right.

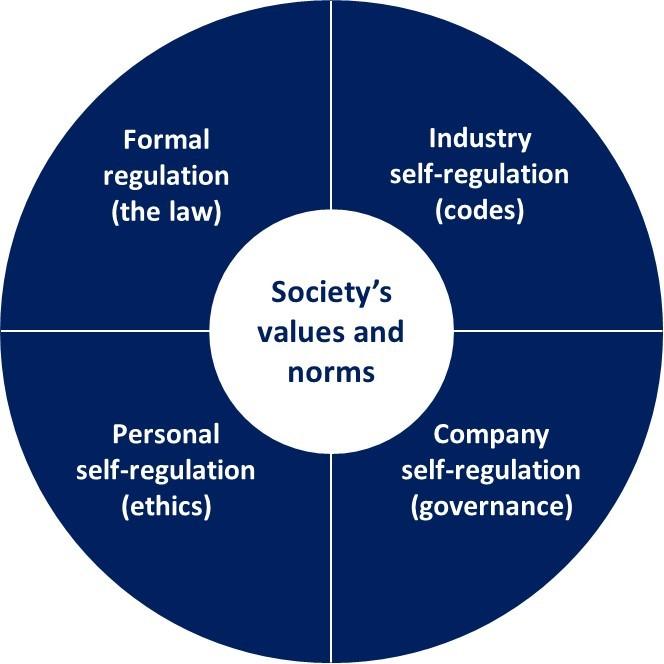

The optimal model of financial regulation – lowest cost, best outcomes – therefore requires self-regulation to play its part. Underpinned by society’s value and norms, there will always need to be a layer of formal regulation established by Government in the public interest, but it can be both much reduced, and at the same time made much more effective, when it is reinforced by three layers of robust self regulation: at the industry level, at the company level, and at the level of the individual.

Filling the void

Recently, I was out at the Sydney Olympic Park at Homebush. Its establishment was, and remains, a great addition to the city. Walking around there today, however, it’s easy to forget that it was once one of the most polluted and toxic areas of Sydney.

To create the wonderful space that saw Sydney at its best in the year 2000 required one of Australia’s largest ever environmental remediation programs. Over many decades prior, an estimated nine million cubic metres of waste, including chemicals, heavy metals and asbestos, had been dumped around the once pristine Homebush Bay, slowly but steadily poisoning the water and contaminating the soil[1]. Back in the 1950s and 60s when much of this pollution took place, there were few laws that restricted factories and businesses from these kinds of harmful waste disposal practices. And nor was there any incentive for self-regulation; at the time, it was seen as an acceptable way of dealing with waste. As a result, it delivered a classic example of the tragedy of the commons. The perception of fairness in the financial system has, in many ways, suffered from similar long-term neglect.

At the heart of these sorts of conundrums is the need to balance self-interest with collective interest, and temper short-term views with a longer-term perspective. Sometimes markets can provide that balance naturally, but sometimes not. Governments intervene with laws or regulations on businesses due to an inability or unwillingness of market participants to self-regulate in a manner that aligns with the broader public interest. As BFO Chair John Laker pointed out recently, even Adam Smith acknowledged that his ‘invisible hand’ should not operate unrestrained – without a foundation of trust and ethics, free markets could not flourish.

All four levels of regulation have failed to some degree in the financial sector. You can argue the extent to which failings in formal regulation and self-regulation are to blame, but one thing is certain: the consequence of weak self-regulation has been an increase in formal regulation. The Government’s Banking Executive Accountability Regime (BEAR), APRA’s more prescriptive remuneration prudential standard, and ASIC’s product intervention power are recent examples. Undoubtedly, this additional regulation comes at a cost, and industry complaints about regulatory burden are increasingly being heard again. Thus far, however, not much has been offered as an alternative means of generating better outcomes.

Yet even this increase in formal regulation does not disregard the criticality of strengthened self-regulation as part of the solution. By giving industry codes of practice real teeth, and forcing firms to embed frameworks that adequately address accountability and misconduct, governments and regulators are seeking to empower the financial services sector to more effectively police itself – and creating the opportunity for more genuine self-regulation to play a role in helping win back lost trust.

The question is whether the industry is ready to embrace that challenge.

A case in point (at the risk of pre-empting Karen Chester’s remarks) is consumer credit insurance (CCI). ASIC’s recent review found that CCI is poor value for money – a finding that should have surprised no-one, especially the insurers. ASIC first issued a report in 2011 that made 10 recommendations to improve the design and sale of CCI. ASIC raised further concerns in 2017. In spite of repeated declarations from CCI providers and industry associations that they would address the problems, ASIC’s latest report suggests self regulation has not worked; policyholders in 2019 are receiving only 19 cents back in claims for every dollar of premiums, compared with 18 cents in 2011 when ASIC blew the whistle. No one would regard that one cent difference as progress!

APRA has also needed to intervene more forcefully in areas where self-regulation has not delivered for either the financial industry or the community more broadly. Two weeks ago, for example, we began consulting on a stronger prudential standard for remuneration in APRA-regulated firms. Our intervention with a much more prescriptive framework follows a growing body of evidence that poorly designed incentives and an absence of accountability have been promoting conduct and decision-making that is often contrary to the long-term interests of firms and their stakeholders. A better solution – which I urged some time ago – would have been for industry participants to take up the challenge and not wait for regulatory intervention. Unfortunately, despite the efforts of some, stronger regulation seems unavoidable.

Taking ownership

Thankfully, all is not lost. The 2014 Financial System Inquiry noted that self-regulation tends to work best in setting governance, customer service and technical standards that supplement (note: not replace) the law. There are promising signs that industry is taking more ownership of the issue in these sorts of areas.

Anyone who’s passed a bus-stop in recent weeks may well have spotted photos of a beaming young woman promoting the ABA’s upgraded Banking Code of Practice. The Code contains a range of new measures designed to strengthen protections for consumers, such as banning unsolicited offers to increase credit card limits, and a requirement to offer low or no-fee bank accounts.

Both the Financial Services Council and the Insurance Council of Australia (ICA) are also reviewing their industry Codes of Practice with a view to increasing consumer protections. The new ICA Code, for example, is likely to have a greater focus on protecting vulnerable customers, including those suffering from financial hardship, family violence or mental illness. The Customer Owned Banking Association and the National Insurance Brokers Association have similar reviews of their codes underway.

It is obviously not purely coincidental that so many codes are being upgraded. It may have taken too long for the penny to drop, but industry can no longer be in any doubt that it’s not enough to provide after-the-event remediation once a problem is called out; customers expect firms to strive harder to avoid bad outcomes in the first place. The financial damage inflicted by so called non-financial risks has added a strong bottom-line incentive to restore reputations and regain trust. In that sense, a cynic might argue the drive to upgrade industry codes is nothing more than self-interest, but if it leads to better community outcomes and enhanced prudential soundness, that’s a win-win we should welcome.

The real evidence of change will be when industry participants are willing to stand against the tide, or even better stand up and call each other out for behaviour that damages the industry’s reputation and long-term standing. We often hear executives complain they would like to curb a certain practice or stop selling a particular product, but would suffer first mover disadvantage. This was a classic excuse in APRA’s intervention in mortgage lending: many industry participants were uncomfortable that competition was eroding sound lending standards, but no one felt they could stand against the tide. The Royal Commission also highlighted multiple examples where companies, having identified a dubious, but lucrative, practice chose to wait for others to act first. The CCI case I referred to earlier is a prime example. Wearing short term commercial cost is inevitably difficult, even when it is the right thing to do. A stronger foundation of professionalism, more akin to that for lawyers, accountants and actuaries, would no doubt help.

At the level of the company, recent events have caused many businesses to examine whether their internal systems of governance and control have kept pace with expectations. For example, the recent exercise in which we asked 36 regulated firms to undertake self-assessments against the CBA Prudential Inquiry’s findings and observations has focused a great deal of attention on the importance of good governance, from the board down, in delivering good outcomes. It also highlighted there is a great deal of work to do. All firms claim good intent, but that has not always been matched in outcomes. Perhaps the most important thing about the self-assessments was the ready acceptance of the need to do better – no one thought the status quo was OK.

I want to re-emphasise that our regulatory goal here is not to tell boards how to do their jobs. Rather, underpinned by the BEAR, APRA’s new remuneration standard and an increase in supervisory focus, we are seeking to promote higher standards of governance by, amongst other things, empowering boards to more effectively govern the firms that they oversee.

That brings me to the individual. Just as regulators can’t be expected to monitor in real time every move a company makes, nor can we expect boards and executives to be across every action or decision their employees take. The buck may stop with boards in a legal sense, and it’s essential they set the right tone, policies and incentives, but as individuals we are faced with a myriad of decisions every day in which we are able to exercise our discretion. The fact that misconduct or unethical behaviour may be possible, or even inadvertently incentivised, is not a licence to take advantage of it. Nor even to turn a blind eye to it.

Initiatives such as the Oath, and Finsia’s drive for a strong foundation of professionalism, are important building blocks for a stronger, more efficient, and more sustainable financial system. They should be welcomed and embraced by industry leaders. There is nothing to fear, and much to gain, from having a workforce that serves all interests in good faith, competes hard but with honour, exercises ethical restraint in their choices, speaks out against wrongdoing, and takes accountability for their own actions. Designing frameworks, practices and systems, and developing norms, cultures and communities of interest that embed and reinforce these behaviours is undoubtedly a challenge but, I would proffer, more than worth the investment. It will also make the task of the other layers of regulation – company, industry and Government – a great deal easier.

Finally, I’d like to make one last point. It cannot be that all responsibility for delivering better community outcomes falls on the Government and industry. My remarks this morning have focused on improving the ability of the financial sector to serve the community through stronger self-regulation but there is also a role for the community to better serve itself. If, as a community, we feel uncomfortable that the financial sector has products and services that profit from apathy and inertia – which it certainly does – then the best response by customers is to be engaged and active. Shop around, exercise choice – or dare I say it, don’t just get mad, get even. There’s no better way to align community and commercial interests than to make the community’s voice evident through action.

Time to step up

To return to my starting point, if self-regulation is not in good shape, we need to restore it. More formal regulation and enforcement cannot be the only answer to the issues of community concern. It must be accompanied by a healthy degree of self-regulation: industry codes of practice with genuine force, stronger frameworks of governance and accountability within companies, and a commitment by individuals to seek to operate with ethical restraint. Everyone needs to step up to the challenge. Governments and regulators can help to restore the foundations for self regulation, but only the industry and its participants can return it to full health.

Footnotes

[1] https://www.sopa.nsw.gov.au/About-Us/History-and-Heritage/Site-Remediation