Licensing for authorised deposit-taking institutions

This page contains information regarding APRA’s consultations on the licensing framework for authorised deposit-taking institutions (ADIs).

July 2025

Consultation on improving the licensing framework for ADIs

On 30 July 2025, APRA released a discussion paper with proposals aimed at improving the clarity and efficiency of the ADI licensing process. The paper also seeks stakeholder views on the future of the Restricted ADI (RADI) pathway.

Written submissions should be sent to licensing@apra.gov.au by 31 October 2025.

The discussion paper is available below.

Discussion paper

Improving the licensing framework for authorised deposit-taking institutions

August 2021

Response to consultation on revisions to APRA's approach to licensing and supervising new ADIs

On 11 August 2021, APRA released its revised approach to licensing and supervising new ADIs.

This package responds to feedback received during the consultation period. APRA’s final position remains largely consistent with its original proposals, with the most significant clarifications relating to milestones in the progression of a licence application.

The response paper, information paper and guidelines are available below:

Response paper

Information paper

Guidelines

Non-confidential submissions

APRA received nine non-confidential submissions in response to its consultation, which are available below:

March 2021

Consultation on revisions to APRA’s approach to licensing and supervising new ADIs

On 18 March 2021, APRA released the discussion paper APRA’s approach to new entrant authorised deposit-taking institutions and an information paper ADIs: New entrants – a pathway to sustainability. These papers outline revisions to APRA’s approach to licensing and supervising new entrant ADIs.

Written submissions on the information paper closed on 30 April 2021.

Information paper

Discussion paper

April 2018

Response paper

Information paper

Non-confidential submissions

August 2017

Information on the consultation

APRA is reviewing its licensing approach for authorised deposit-taking institutions (ADIs). The discussion paper seeks views on the proposed amendments to introduce a phased approach to authorisation, designed to make it easier for applicants to navigate the ADI licensing process.

The phased approach is intended to support increased competition in the banking sector by reducing barriers to new entrants being authorised to conduct banking business, including those with innovative or otherwise non-traditional business models or those leveraging greater use of technology. In particular, the purpose of the Restricted ADI licence is to allow applicants to obtain a licence to begin limited operations while still developing the full range of resources and capabilities necessary to meet the prudential framework.

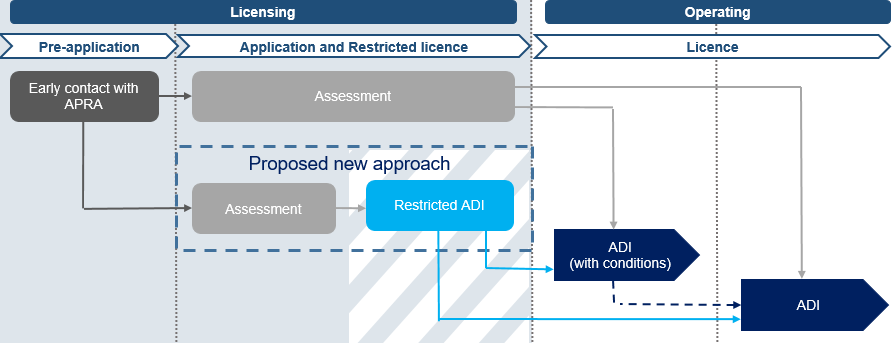

An overview of the phased approach is depicted below.

In facilitating a phased approach, APRA still needs to ensure community confidence that deposits with all ADIs are adequately safeguarded, and that any new approach does not create competitive advantages for new entrants over incumbents, or compromise financial stability. Therefore, reflecting their relative infancy, Restricted ADIs will be strictly limited in their activity and would not be expected to be actively conducting banking business during the restricted period.

The Restricted ADI licence will be subject to certain eligibility requirements and a maximum period after which they are expected to transition to an ADI and fully comply with the prudential framework or exit the industry.

APRA invites written submissions from all interested parties on its proposals for the phased approach to licensing new entrants to the banking sector.

Submissions close on 30 November 2017. To provide a submission please contact Licensing@apra.gov.au.

Submissions are welcome on all aspects of the proposals. In addition, specific areas where feedback on the proposed direction would be of assistance to APRA in finalising its proposals are outlined below.

| Introduction of phased approach for ADIs | Should APRA establish a phased approach to licensing applicants in the banking industry? |

|---|---|

| Balance of APRA‘s mandate | Do the proposals strike an appropriate balance between financial safety and considerations such as those relating to efficiency, competition, contestability and competitive neutrality? |

| Eligibility | Are the proposed eligibility criteria appropriate for new entrants to the banking industry under a Restricted ADI licence? |

| Restricted ADI Licence phase | Is two years an appropriate time for an ADI to be allowed to operate in a restricted fashion without fully meeting the prudential framework? Is two years a sufficient period of time for a Restricted ADI to demonstrate it fully meets the prudential framework? |

| Minimum requirements | Are the proposed minimum requirements appropriate for potential new entrants to the banking industry? Are there alternative requirements APRA should consider? |

| Licence restrictions | Are the proposed licence restrictions appropriate for an ADI on a Restricted ADI licence? Are there alternative or other restrictions APRA should consider? |

| Financial Claims Scheme | Are the proposals appropriate in the context of the last resort protection afforded to depositors under the Financial Claims Scheme? |

| Further refinement | Are there other refinements to the licensing process APRA should consider? |

During the consultation process APRA may also look to arrange discussions of these proposals with interested parties. To note your interest in discussing the proposals with APRA please email Licensing@apra.gov.au.

Discussion paper

Note on submissions

It is APRA's policy to publish all submissions on the APRA website unless the respondent specifically tells APRA in writing that all or part of the submission is to remain confidential. An automatically generated confidentiality statement in an email does not satisfy this purpose. If you would like only part of your submission to be confidential, you should provide this information marked as 'confidential' in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.