Insurance Climate Vulnerability Assessment

1. Insurance CVA

1.1 Introduction

In July 2023, the Australian Prudential Regulation Authority (APRA) commenced the Insurance Climate Vulnerability Assessment (Insurance CVA) on behalf of the Council of Financial Regulators (CFR). The Insurance CVA explores how the affordability of general insurance1 may change between now and 2050 in response to the physical and transition risks modelled against two possible future climate scenarios. This initiative builds on the 2022 Banking Climate Vulnerability Assessment2 that assessed the potential impacts of climate change on bank credit risk, and which identified that climate change and the response to climate change may drive pockets of risk across Australia.

Homes are an integral part of the economic and financial well-being of Australians, as well as being collateral for assets held by banks and investors. Insurance can help shield households, lenders and investors from the financial impacts of weather perils such as floods and wildfires. Climate change will alter the frequency and magnitude of weather peril risks across Australia3, which will in turn impact the future cost of general insurance. At the same time, different climate scenarios will have different economic outcomes that influence future household incomes. Together, these changes in insurance costs and household income may impact the future affordability of general insurance in Australia.

The scenarios to be used for the Insurance CVA are not forecasts or predictions of future climate outcomes, but instead explore possible futures under different climate-related assumptions: the scenarios should not be interpreted as an official forecast. In addition, the assumptions included in these scenarios are not intended to provide an indication as to likely future policy developments or responses from APRA or other government agencies.

The Insurance CVA was designed and developed in collaboration with the five largest general insurers in Australia - IAG, Suncorp, Allianz, QBE and Hollard (the Participants4) – that collectively cover approximately 80% of the Australian general insurance market by gross written premium. The Participants will project insurance affordability to 2050 for two climate scenarios and an additional baseline scenario and provide the results to APRA. The Insurance Council of Australia (ICA) and a range of government and private sector organisations have also supported this initiative.

An improved understanding of how general insurance affordability may change into the future will support a range of stakeholders, including governments, policyholders, the community, and insurers, to better manage future climate challenges. The Insurance CVA will also contribute to the government’s Sustainable Finance Roadmap5, which aims to ensure that the financial system remains stable and resilient throughout different operating and economic environments.

1.2 Objectives

The three key objectives of the Insurance CVA are to:

- Understand future changes in the affordability of general insurance over the medium term under two potential climate change scenarios, and how those changes vary by location and risk type;

- Contribute to the system-level understanding of how changes in affordability could impact the general insurance industry; and

- Inform governments, policyholders, the community, and insurers on the potential evolution of challenges to the affordability of general insurance in Australia.

1.3 Climate Change and Insurance Affordability

Climate change-related weather perils affect both the absolute price of insurance and the income of households, and as a result, decrease households’ ability to pay for appropriate insurance coverage.

To understand the potential financial impacts of climate change, understanding both physical and transition climate risks is necessary. For the Insurance CVA, these risks are understood as follows:

- Physical climate risks are expected to arise from both acute and chronic weather hazards caused by climate change. Acute weather hazards relate to extreme weather events such as floods, fire, cyclone and storms. Chronic weather hazards relate to weather events unfolding over longer periods of time, such as heat stress, rising sea levels and changes to rainfall. The severity, duration and frequency of both acute and chronic weather hazards are heightened by the effects of climate change, thereby increasing the physical climate risks.

- Transition climate risks are expected to arise if there are changes to domestic and international climate and energy policies, technological innovation, social adaptation and markets.

The affordability of general insurance for households can change, through changes to either premiums or household income. Climate change could alter both the cost and the income aspects of affordability for the following reasons:

- General insurance premiums would be impacted by systemic changes to physical climate risks. Systemic changes to weather peril risk are likely to drive increased costs for repairs and construction6, adding to inflationary pressures, as well as increased global reinsurance costs. Collectively, these factors would drive changes to premiums.

- Household income may be influenced by climate transition risks that in turn impact different parts of the Australian economy. Household incomes may be affected differently across industrial sectors and geographies due to the differing impact of transition risks on different regions and economic sectors.

1.4 Key stages of the Insurance CVA initiative

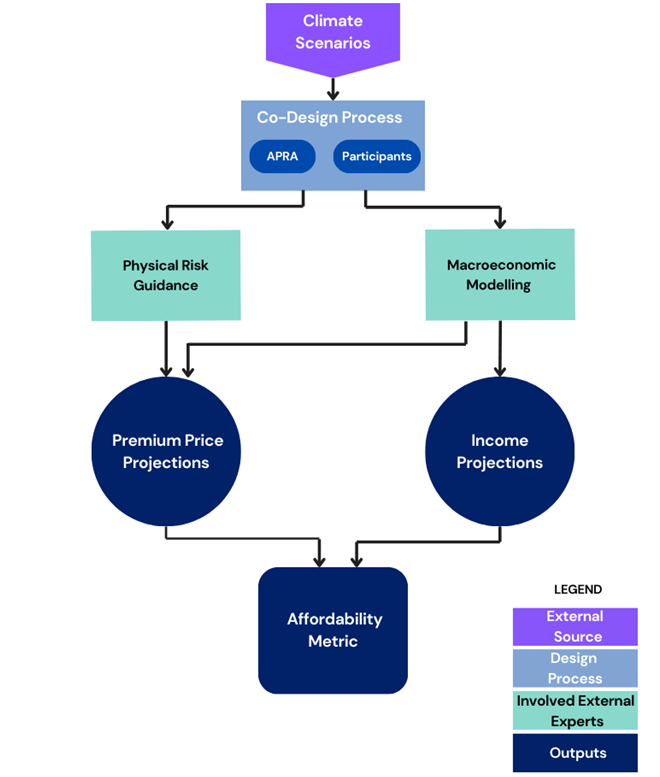

- The Insurance CVA includes a number of key stages (Figure 1) that were followed to set the overall scope and objectives of the initiative, provide key inputs, conduct modelling of insurance premiums and income to 2050, and calculate an affordability metric that will provide insight into how general insurance affordability in Australia may change in future years.

Figure 1: Insurance CVA process map

1.4.1 Climate Scenarios

The initiative explores potential changes to general insurance affordability in Australia under two future climate scenarios developed by the Central Banks and Supervisors Network for Greening the Financial System (NGFS).7 The scenarios published by the NGFS are not forecasts or predictions of future climate outcomes, but instead explore possible futures under different climate-related assumptions: the scenarios should not be interpreted as an official forecast. In addition, the assumptions included in these scenarios are not intended to provide an indication as to likely future policy developments or responses from APRA or other government agencies.

The two scenarios used in the Insurance CVA have been selected from a wider range of NGFS scenarios to explore two different potential climate futures. One is a high emissions scenario, aligned to the NGFS Current Policies Scenario, which includes severe but low-probability, high-impact physical climate risks and limited transition risks. The second is a lower emissions scenario, aligned to the NGFS Delayed Transition Scenario, which results in moderated physical climate outcomes but elevated transition risks. A third scenario was also modelled which assumed no further physical climate change or climate-related policy changes: this baseline scenario provides a basis against which the impact of climate change under the two NGFS scenarios can be assessed.

For both the lower and higher emissions scenarios, APRA sought guidance from and consulted with experts and relevant organisations to adapt the NGFS scenarios to better align with the Australian context and the Insurance CVA’s objectives.

1.4.2 Co-Design Process

Throughout the Insurance CVA, APRA has engaged with a range of organisations, including the Participants, to ensure that a diversity of insights and expertise were available to inform the design decisions taken in the initiative. For the overall design, APRA engaged with the five participating insurers through the “co-design” process facilitated by the ICA, the peak industry body for general insurers in Australia. This approach facilitated the development of a practical design that met the objectives of the initiative, while leveraging the knowledge and experience of industry.

Through the co-design process, APRA identified the guidance and inputs that the Participants would require to complete the affordability projections. APRA was then able to engage leading insurance8, geospatial9, and other experts10 to provide the information necessary to completing the Insurance CVA.

The co-design process facilitated the comparability of the Participants' modelling by establishing agreements on how to handle modelling decisions such as the scope11, coverage level, competition, and how other product features would be treated to maintain existing relative insurance market conditions to 2050. APRA acknowledges that numerous other factors, beyond those modelled, could also impact insurance pricing. However, the common parameters provided to the Participants ensure clarity of climate-related insights and enable comparability across different modelling approaches, time steps, and climate scenarios.

APRA engaged an independent economic modelling consultancy, Oxford Economics, to provide macroeconomic modelling to support the Insurance CVA. The macroeconomic modelling built on, and extended, the economic modelling conducted by the NGFS for the two future climate scenarios, as well as for the baseline scenario.

1.4.3 Macroeconomic Modelling

The modelling provided a more detailed, Australia-specific set of economic parameters for use by the Participants, including different measures of interest rates, inflation, and financial asset price projections relevant to projecting future premiums and household incomes. For the high emissions scenario, Oxford Economics included an economic damage function that considers effects due to temperatures trending away from long-run means, as well as climate change-attributed changes in the volatility and likelihood of extreme weather events.12

1.4.4 Physical Risk Guidance

1.4.4.1 Risk Drivers

APRA worked with leading scientific agencies and experts, including the Bureau of Meteorology (BoM), the Australian Climate Service (ACS), and the Commonwealth Scientific and Industrial Research Organisation (CSIRO), to provide physical risk guidance and support the Insurance CVA. The Insurance CVA includes all physical risks typically covered by general insurance, including both non-climate driven natural perils, such as earthquake and volcanic eruption; and the climate-sensitive weather perils of cyclone (including cyclone-related storm-surge), flood (including non-cyclone storm surge), storm and hail, and bushfire.

For climate-sensitive weather perils, guidance13 was provided to the participants by APRA which included high-level measures of the change in frequency and intensity across the different geographies of Australia. All other natural perils (such as earthquakes), together with other risks (e.g. house fire) are included in future premium price modelling as an “Other Peril” category.

Some weather extremes affected by climate change are not typically priced into insurance products and premiums, such as sea-level rise, water scarcity, and heat stress. While such risks can impact the financial interests of households, the insurance market does not typically provide an explicit price signal, and therefore these risks fall outside the scope of the ICVA.

1.4.4.2 Reinsurance

Reinsurance for weather related perils is currently provided by the Australian Reinsurance Pool Corporation (ARPC) for cyclone reinsurance, and by commercial providers for non-cyclone reinsurance. Reinsurance costs are included in the insurance premium modelling carried out by the insurers.

For cyclone reinsurance, the ARPC provided reinsurance guidance for cyclone risk to the participants; including for damage from associated flooding that is incurred up to 48 hours after a cyclone has ended. For non-cyclone reinsurance, the attachment point for insurers’ reinsurance remains at the same return period as their 2024 arrangement throughout the projection period. In projecting reinsurance premium, insurers will calculate the ceded annual average loss (AAL) over the projection period to 2050, and apply the uplift factor (that is, the margin above the ceded AAL) that is used at the 2024 starting point and maintain this throughout the projection period.

1.4.5 Premium Price Projections

The Participants generated premium price projections using a combination of the external inputs provided by APRA and their internal modelling assumptions.

Premium is defined as the cost to be paid by a customer for a combined home and contents insurance product. The premium is comprised of multiple inputs, including expected claims costs from climate-related perils, reinsurance costs, expected non-climate related claims costs (e.g. earthquake, house fire, theft), taxes, and all other costs (e.g., claims handing costs, financing costs, profit margins, commission costs).

1.4.6 Income Projections

APRA engaged Oxford Economics to model the potential evolution of household income to 2050 for the two climate scenarios, and the baseline scenario. The modelling approach combined macroeconomic variables with region-specific economic influences to derive estimates of household employment income across Australia to 2050.

1.4.7 Affordability metric

The Participants will calculate an insurance affordability metric that expresses the cost of insurance premiums in relation to the number of weeks of income required to cover annual premium. This metric is intended to provide a straight-forward measure of affordability which captures the impact of changes in both physical and transition climate risks. As the frequency and severity of weather perils change into the future, the change in physical climate risk will affect premium prices; at the same time, transition climate risks will impact the broader economy, which in turn can impact household income.

2. Next steps

APRA expects to receive the affordability metric results from the Participants in the first half of 2025 and intends to publish a report based on the results later in 2025. The report will support an improved understanding of potential future general insurance affordability challenges. It is intended to provide stakeholders including governments, policyholders, the community, and insurers, a more informed view of how general insurance affordability may evolve over the medium term in response to the physical and transition risks arising from a changing climate.

Footnotes

1General insurance refers to home and contents insurance.

2 See APRA Banking Climate Vulnerability Assessment(November 2022)

3See CSIRO State of the Climate Report (2022)

4Largest insurers by gross written premium: IAG Limited, Suncorp Group Limited, Allianz Australia Insurance Limited, QBE Insurance Group and Hollard Holdings Australia Pty Ltd.

5See The Treasury Sustainable Finance Roadmap 2024 (June 2024)

6See Investor Group on Climate Change Property and Construction Sector (2020)

7For more information on the NGFS and the scenarios that it has published, see NGFS.

8Aon Australia, Gallagher Re, Finity, Munich Re and Swiss Re

9Geoscape Australia

10the Australian Bureau of Statistics (ABS), the Australian Reinsurance Pool Corporation (ARPC), the Department of Climate Change, Energy, Environment and Water (DCCEEW), Baringa, and independent experts including Prof Paula Jarzabkowski, and Dr David Karoly.

11 The initiative focuses on freestanding residential properties, excluding strata properties and properties without a land title (such as caravans or sheds).

12See: Oxford Economics | Temperature Volatility comes at a price to worldwide growth

13 Developed by APRA the guidance was based on the Australian Climate Service’s (see: BOM : Acute hazards in a future climate: guidance provided to the Australian Prudential Regulation Authority) guidance on the Climate Measurement Standards Institute’s ‘Scenario analysis of climate-related physical risk for buildings and infrastructure: Climate science guidance.’ and other inputs.

Disclaimer and Copyright

While APRA endeavours to ensure the quality of this publication, it does not accept any responsibility for the accuracy, completeness or currency of the material included in this publication and will not be liable for any loss or damage arising out of any use of, or reliance on, this publication.

© Australian Prudential Regulation Authority (APRA) 2024

This work is licensed under the Creative Commons Attribution 4.0 Licence (CCBY 4.0). This licence allows you to copy, redistribute and adapt this work, provided you attribute the work and do not suggest that APRA endorses you or your work. To view a full copy of the terms of this licence, visit: https://creativecommons.org/licenses/by/4.0/