Insights from APRA’s 2020 InsurTech Survey

In February 2020, APRA surveyed a sample of 36 APRA-authorised general insurers to better understand their current and planned use of InsurTech in Australia. APRA analysed the survey results and the findings are outlined below. The analysis of InsurTech trends also enhances APRA’s understanding of emerging risks, and how insurers are managing them within their risk governance and risk management frameworks.

What is InsurTech?

InsurTech, short for “insurance technology”, refers to the use of new technology by insurers to improve various aspects of their business, such as operational efficiency and customer experience.

There are five main categories of InsurTech currently used by insurers:

1. Big Data

Big Data involves analysing large and varied data sets to provide insights into trends in the data. For example, Big Data helps motor insurers analyse information collected about customer behaviour and claims, allowing them to enhance their pricing, underwriting and claims settlement processes.

2. Artificial Intelligence (AI)

AI refers to systems that can perform functions that are generally associated with human intelligence, such as reasoning, learning and problem solving.

- Machine Learning (ML) is a subset of AI where statistical techniques rather than specific programming are used to give computers the ability to “learn” using data. Examples of ML in insurance include conversational chat bots (natural language processing), and auto-detection of fraud and anomalies (pattern recognition).

3. Software as a Service (SaaS)

Software as a Service (SaaS) is a form of cloud computing where providers host applications and make them available to customers over the internet. For example, an insurer could use a software-based platform for its claims process, and parties – including claimants and the insurer’s claims assessors – could log on to the centralised system to transfer or review documents.

4. Blockchain

Blockchain is a digital ledger of transactions, maintained across several computers linked in a peer-to-peer network. For example, marine insurers could use blockchain to digitally connect with policyholders and allow data transfers about the status of marine cargo to speed up the claims process.

5. Internet of Things (IoT)

Internet of Things devices (IoT) refers to devices connected to the internet being used to collect, receive, store and transmit data over a network. An example of the use of IoT is a home and contents insurer encouraging policyholders to install a smart device – such as a camera or sensor – in their home to instantly alert the home owner if smoke or a water leak is detected, which reduces the risk of property damage.

- Telematics is a subset of IoT technology. For example, a car insurer might install a black box (aka data box) in an insured car. The black box allows the insurer to calculate premiums based on usage by recording when the car is used, its location, distance travelled, speed and braking behaviour.

Risks related to InsurTech

APRA’s interest in InsurTech is primarily in the risk management policies, processes and frameworks insurers have in place to address the strategic and operational risks associated with InsurTech.

Strategic risk can arise when an insurer adopts new technology without sufficient regard to its broader strategic direction, or where their strategic direction does not align with that of its chosen InsurTech partner. Factors that heighten the risk that such outcomes could occur include:

- inadequate governance and risk management for planning and implementing new technologies, or in the assessing of alignment with InsurTech partners,

- uptake of new technologies without a clear strategic direction, and/or

- new entrants or new technologies challenging the market position of existing insurers.

Strategic risk can also arise if an insurer lags behind its competitors in investing in technology and is competitively disadvantaged as a result.

Operational risk is the risk of loss resulting from inadequate/failed internal processes, people and systems, or from external events when using InsurTech. Operational risks could heighten if insurers have:

- inadequate governance and risk management processes to identify opportunities and threats to operations,

- limited access to staff with the appropriate skills to use the technology,

- legacy systems or operations that are incompatible with InsurTech, and

- inadequate contingency planning (particularly around business continuity and disaster recovery).

As detailed below, insurers’ survey responses demonstrate a strong awareness of the various strategic and operational risks associated with InsurTech. Identifying and managing the relevant risks are key to the successful implementation of InsurTech. Insurers will need to carefully consider InsurTech investments in the same way they do with other strategic initiatives, and continually assess and address operational risks, adapting as appropriate.

Results of APRA’s InsurTech Survey

General engagement with InsurTech

The responses indicate a high level of engagement with InsurTech. About 80 per cent of the insurers surveyed stated that they were either using InsurTech, or were in the process of developing or investing in it. Only two of the 36 insurers surveyed indicated that they had no plans or intentions to invest in InsurTech over the next one to three years. The responses confirm that at least half of the insurers surveyed intend to collaborate with InsurTech providers, and that a wide variety of local and international InsurTech firms are being partnered with.

Benefits/opportunities of InsurTech

Survey respondents anticipated several benefits from using InsurTech, including improved customer experiences, more tailored services, improved pricing and operational efficiency. They also expected that using InsurTech would improve their understanding and management of risk, helping them to make better decisions across the insurance business.

Popular technologies

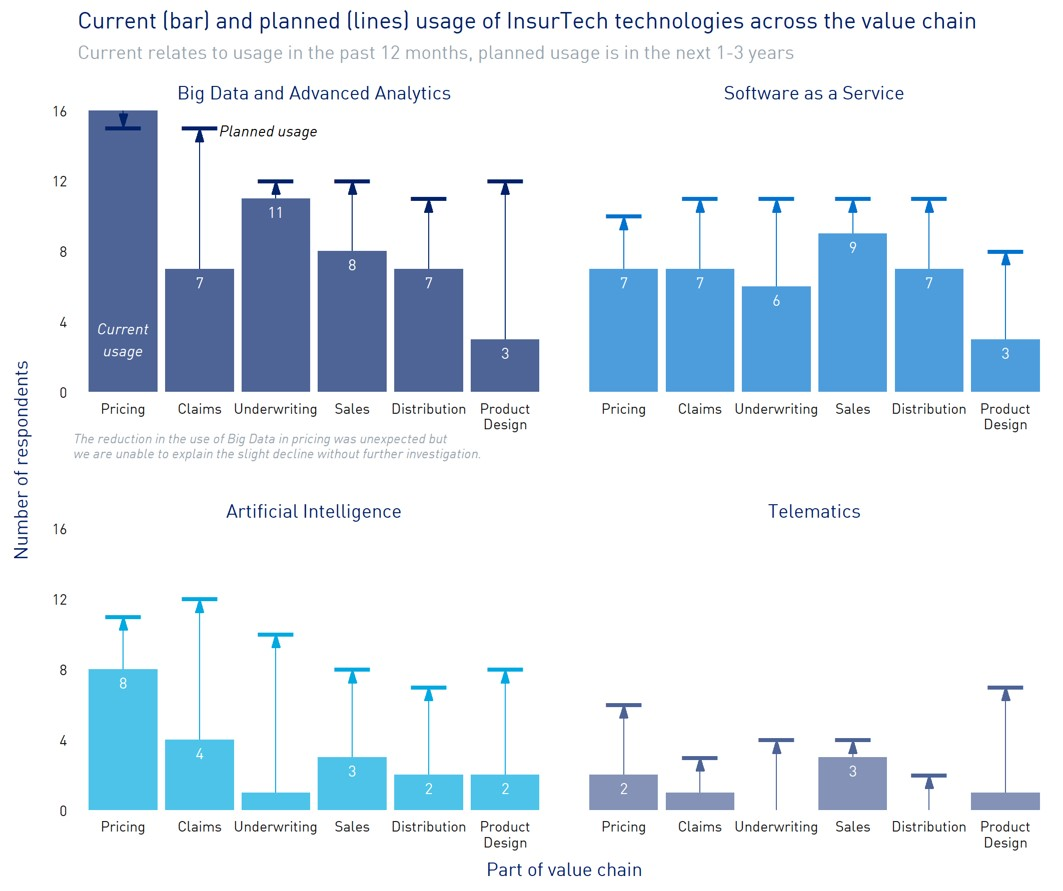

Big Data is the most popular category of InsurTech, used mainly in pricing and underwriting. SaaS is also widely used. The survey results indicate that future use of InsurTech will be concentrated in Big Data, SaaS and AI, and that there is also likely to be a small increase in the use of telematics.

The insurers reported that they currently get the most benefit from InsurTech in their pricing processes, and the least benefit in product design. Most survey respondents anticipate that InsurTech will be beneficial across all parts of their business in the future. The diagram below indicates how the use of each technology is likely to expand across various parts of the insurance business, reflecting insurer perceptions about future benefits of InsurTech.

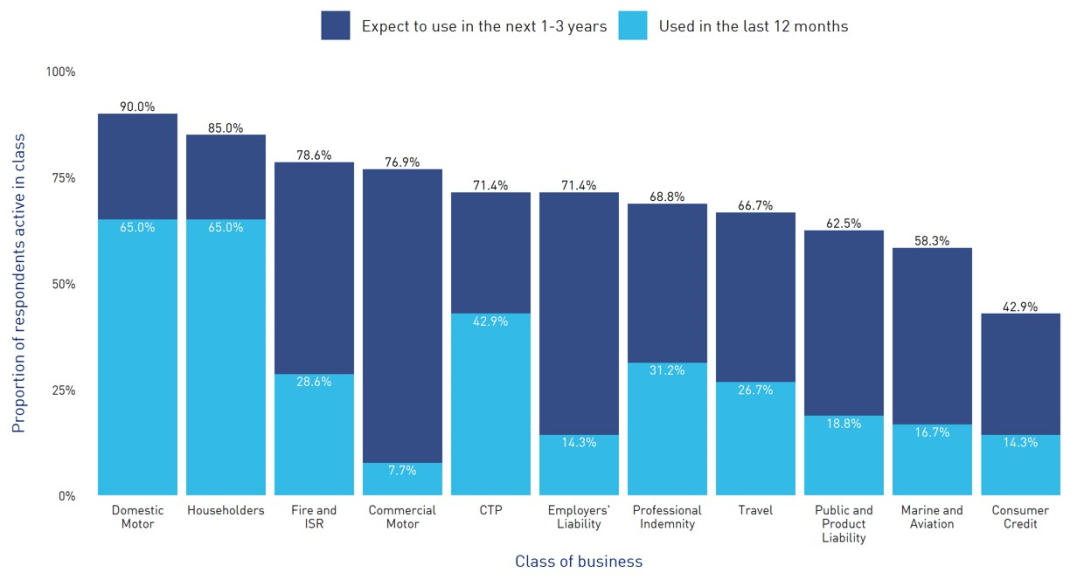

Use of InsurTech across business lines

The current use of InsurTech is concentrated in the Domestic Motor and Householders lines of business, while use in other insurance lines is relatively low. As the graph below shows, future use of InsurTech is expected to increase across almost all insurance lines, especially in the Commercial Motor line of business. This likely reflects insurers’ plans to use technology that has been successful in the Domestic Motor line of business.

Risks of InsurTech

The survey helped APRA gauge insurers’ understanding of risks associated with InsurTech. Some examples of the strategic risks identified by survey respondents were:

- greater competition and a higher cost to compete to keep up with InsurTech developments,

- high upfront cost to establish and embed InsurTech initiatives, which could lead to lower profits, and

- difficulty in identifying the right price point and target market.

Some examples of the operational risks identified by survey respondents were:

Security and privacy risks

- a higher risk of data breaches and cyber threats, which require heightened information security controls,

- increased costs from ensuring adherence to privacy and compliance requirements,

- ensuring the ethical use of customer data, and

- inability to control the access to, or privacy of, data provided from InsurTech partners.

Implementation/other operational risks

- limited management experience in implementing untested new technology,

- new technologies may not be compatible with existing infrastructure and systems,

- a need to transform existing operations/systems to leverage and derive benefits from InsurTech,

- inaccurate or unreliable data,

- legislation that could stifle innovation or render technology unusable after investment,

- making sure that InsurTech products are transparent and fair for customers, and

- a lack of industry standards on transparency and security.

What’s next?

APRA’s survey confirms that InsurTech initiatives are an important and growing trend among general insurers in Australia. With this in mind, APRA will proactively monitor technology developments to understand InsurTech’s potential impact on authorised insurers.

This will contribute to the reviews and further development of prudential standards, guidance and information papers – such as CPS 220 (Risk Management), CPS 231 and CPG 231 (Outsourcing), CPS 232 and CPG 232 (Business Continuity Management), CPS 234 and CPG 234 (Information Security), CPG 235 (Managing Data Risk), and the information paper “Outsourcing involving cloud computing services” – to ensure that they continue to address relevant heightened strategic and operational risks.

APRA will also discuss InsurTech developments with entities as part of regular supervisory engagement, to ensure that associated risk management governance and controls address the implementation of any InsurTech initiatives.