Information paper - The new Private Health Insurance Capital Framework

The New PHI capital framework

Overview

APRA has reviewed and strengthened the capital framework for private health insurers to ensure that the prudential standards provide for an appropriate level of financial resilience and adequate protection for policy holders. The new framework will commence on 1 July 2023.

This Information Paper outlines the objectives of the framework and its key features, and is intended to help boards, senior management, investors and other market participants understand how the new regulatory standards will apply. Further information on the final capital standards and APRA’s response to stakeholder feedback can be found in the accompanying Response to Submissions Paper: Finalising the review of the Private Health Insurance Capital Framework.

Objectives

The aim of the new capital framework is to ensure that private health insurers maintain an appropriate level of financial resilience, for the protection of policy holders. The new capital standards address APRA’s concerns that the previous framework did not appropriately reflect the risks faced by insurers or adequately allow for consideration of adverse events.

In summary, the new standards strengthen risk sensitivity, improve comparability across insurers, and align with APRA’s capital framework for life and general insurers (LAGIC) which is consistent with international best practice:

While the revised framework will enhance minimum requirements, the industry is already well capitalised and there is not expected to be any need for insurers to increase premiums to meet the new standards.

Seeking alignment, reducing burden

The final standards incorporate changes to APRA’s insurance capital framework due to the new accounting standard, AASB 17 Insurance Contracts (AASB 17). This ensures alignment between the prudential and accounting requirements and reduces cost and complexity for industry from otherwise needing to manage and report on divergent frameworks.

The background to APRA’s implementation of AASB 17 is outlined in the Response to Submissions Paper: Finalisation of Integrating AASB 17 into the capital and reporting framework for insurers, and updates to the LAGIC framework.

Summary of the new framework

As set out in the new Prudential Standard HPS 110 Capital Adequacy (HPS 110), capital is the cornerstone of a private health insurer’s financial strength: it supports a private health insurer’s operations by providing a buffer to absorb unanticipated losses from its activities and, in the event of such losses, enables the private health insurer to continue to meet its insurance obligations.

As shown in the graphic below, the new capital framework aligns with the LAGIC standards used by other insurers regulated by APRA, introduces an Internal Capital Adequacy Assessment Process (ICAAP), and also incorporates private health insurance specific risks where appropriate.

Consistency with LAGIC when appropriate | Reflecting PHI specific risks |

|---|---|

| Insurance Risk Charge designed to reflect the bespoke risks of the insurer and the PHI industry including:

|

The table below provides an overview of the key components of the framework. Insurers must hold capital in excess of minimum requirements. The minimum requirements include: the insurance risk charge, asset risk charge, asset concentration risk charge, operational risk charge and aggregation benefit. In addition, APRA may make supervisory adjustments to required capital levels.

Components of the new framework

Component | Overview |

|---|---|

Insurance Risk Charge | The insurance risk charge (IRC) reflects the unique risks specific to private health insurers, including sudden increases in claims, changes in membership and the ability for insurers to take corrective action. |

Asset risk charge and asset concentration risk charge | The asset risk and asset concentration risk charge reflect the risk associated with changes in the value of investments. Assets held by the insurer will be subject to an asset risk charge and asset concentration risk charge. |

Operational risk charge | The operational risk charge reflects the risks that may arise from inadequate or failed internal processes or systems, the actions or inactions of people or external drivers and events. |

Aggregation benefit | To recognise the relationship between asset risk and insurance liability risk events occurring at the same time, an aggregation benefit between the two has been incorporated into the standards. |

Supervisory adjustments | If needed, the standards also provide for APRA to be able to determine adjustments to the prescribed capital amount (PCA) through supervisory adjustments. |

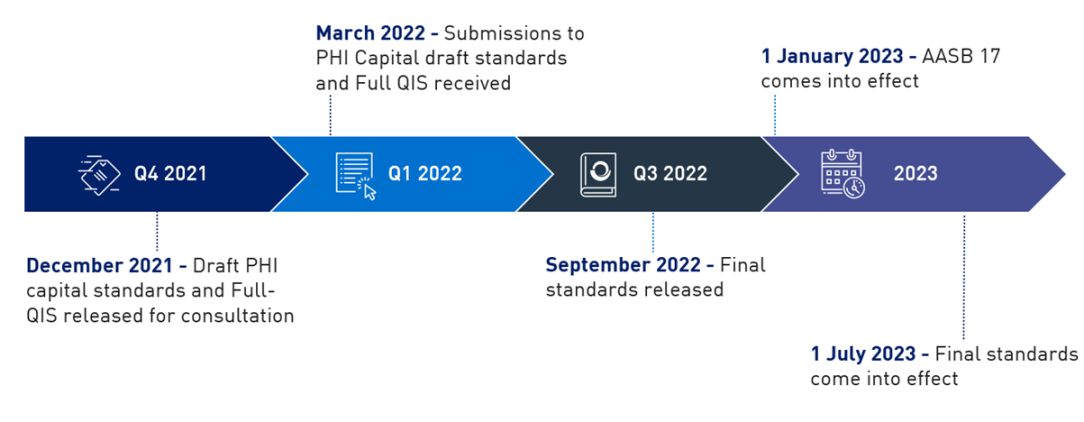

The new standards are the product of extensive consulation with the industry and other key stakeholders. APRA released a roadmap for the new framework in November 2018 and an initial discussion paper on the review of the standards in December 2019. Detailed proposals and draft standards were released in December 2021, and a comprehensive quantitative impact analysis was conducted in 2022.

In finalising the standards, APRA has made a number of additional changes to the proposals in the draft standards. The key changes include technical refinements in several areas, which have reduced the PCA. APRA will also provided transitional arrangements to assist insurers with implementing the new requirements. Full details of the changes made from the December 2021 draft standards to the final standards can be found in the accompanying Response Paper.

Implementation

The new capital standards come into effect from 1 July 2023. Implementing the new framework will require insurers to review the way in which they manage capital, including through enhanced board oversight, setting new capital targets, and strengthening monitoring and reporting where necessary.

As set out in HPS 110, the board of a private health insurer must ensure that the private health insurer has determined its capital to be adequate for the scale, nature and complexity of its business and its risk profile, such that it is able to meet its obligations under a wide range of circumstances.

Box 1: Key points for Boards | |

For directors, accountable for overseeing capital management on the new framework, the key points to note are:

|

Capital targets

APRA expects boards to take the implementation of a new capital framework as an opportunity to undertake a comprehensive assessment of the way in which they oversee capital management, and gain assurance that capital is sufficient for their risks. The ICAAP is intended to provide a framework for this process.

The ICAAP must include a strategy for ensuring adequate capital is maintained over time, including specific capital targets set in the context of the private health insurer’s risk profile, the board’s risk appetite and regulatory capital requirements. The ICAAP must be board approved and should not be a ‘tick-box’ exercise. The board should robustly review, and where appropriate challenge, the assumptions and methodologies behind the ICAAP.

APRA expects that insurers will recalibrate and reset capital targets to reflect the new framework, recognising the additional strength that has been built into minimum capital requirements. For some insurers it may be appropriate to target lower capital coverage ratios than in the past, given the changes in minimum capital requirements, enabling actual capital levels to remain largely the same (in dollar terms).

Further guidance on ICAAPs for all APRA-regulated industries are detailed in Prudential Practice Guide CPG 110 - Internal Capital Adequacy Assessment Process and Supervisory Review (CPG 110).

Premiums

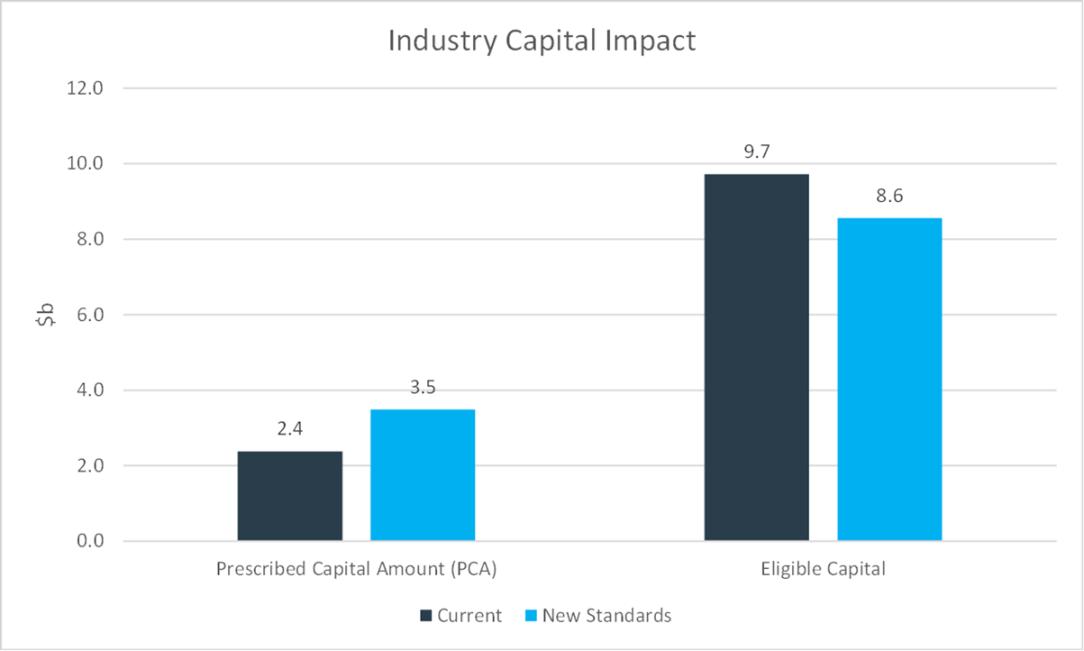

The new standards are not expected to provide a basis for increasing premiums. It is expected that the total industry PCA under the revised capital framework will be around $3.5bn, which compares to an industry capital base of around $8.6bn. The industry is therefore well-positioned to absorb the increase in minimum capital requirements.

Excluding the deferred claims liability, the following chart represents the aggregate industry impact on both the PCA and eligible capital. The specific impact for individual insurers will differ. As the chart indicates, capital coverage for the industry following implementation of the proposed changes is expected to remain very strong.

A small number of insurers may have thin capital buffers (or actual capital held above minimum requirements) under the new framework. To assist the transition, APRA is providing an optional two-year PCA transition. This will assist insurers with progressively increasing capital to appropriate target levels without the need for capital raising exercises or adjustments to premiums.

Pricing risk

As part of the ICAAP, APRA will also expect boards to consider pricing risk. While the new standards will no longer require private health insurers to produce a standalone pricing philosophy, pricing remains a key risk that must be managed by private health insurers and considered as part of an insurer’s risk management strategy and ICAAP.

Transitional arrangements

To assist insurers with the new requirements, several transitional arrangements are available:

- PCA and capital base: A transition period of up to two-years is available for an insurer that may require further time to meet the PCA and capital base requirements under the new standards. An insurer that wishes to utilise this transitional arrangement must notify APRA by 30 June 2023.

- Transitional arrangements for smaller insurers: Non-Significant Financial Institutions (SFIs)1, unless notified by APRA, will not be required to meet certain reporting requirements for the first two years following implementation. Non SFIs, unless notified by APRA, will also have a two-year transition to meet the new ICAAP requirements.

Full details of the transitional arrangements can be found in the accompanying Response Paper. Any insurer who requires additional support beyond these transitional arrangements should contact their APRA supervisor.

Next steps

The timeline below summarises the recent consultation phases and next steps in implementation. The changes to the AASB 17 accounting standards come into effect from 1 January 2023, and the new capital standards apply from 1 July 2023. As noted above, transitional arrangements will apply to some insurers for the period from 2023-2025.

Footnotes

1 A Significant Financial Institution means a private health insurer that either: (a) has total assets in excess of AUD $3 billion; or (b) is determined as such by APRA, having regard to matters such as complexity in its operations or its membership of a group.

Note on submissions

It is APRA's policy to publish all submissions on the APRA website unless the respondent specifically tells APRA in writing that all or part of the submission is to remain confidential. An automatically generated confidentiality statement in an email does not satisfy this purpose. If you would like only part of your submission to be confidential, you should provide this information marked as 'confidential' in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA). APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.