Information paper - APRA’s Policy Priorities

Executive summary

This information paper sets out APRA’s policy priorities for the next 12-18 months, which support the goal of ensuring the financial system is “protected today and prepared for tomorrow”. It outlines next steps in APRA’s strategic initiative to modernise the prudential architecture, and the key areas of policy development for the banking, insurance and superannuation industries in the period ahead.

APRA’s prudential framework establishes minimum expectations for regulated entities and the standards that supervisors use to assess and enforce prudent practice. This paper should be read in conjunction with APRA’s Supervision Priorities paper, which outlines APRA’s supervisory areas of focus.1

Policy agenda for 2023-2024

Over the past year, APRA has completed major policy reforms for banks and insurers, with the finalisation of new capital frameworks. Finalising these reforms is the culmination of many years of policy development and industry consultation, and allows APRA to draw a line under a substantial set of policy priorities. In superannuation, APRA is progressing a series of core reforms, including to Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515).

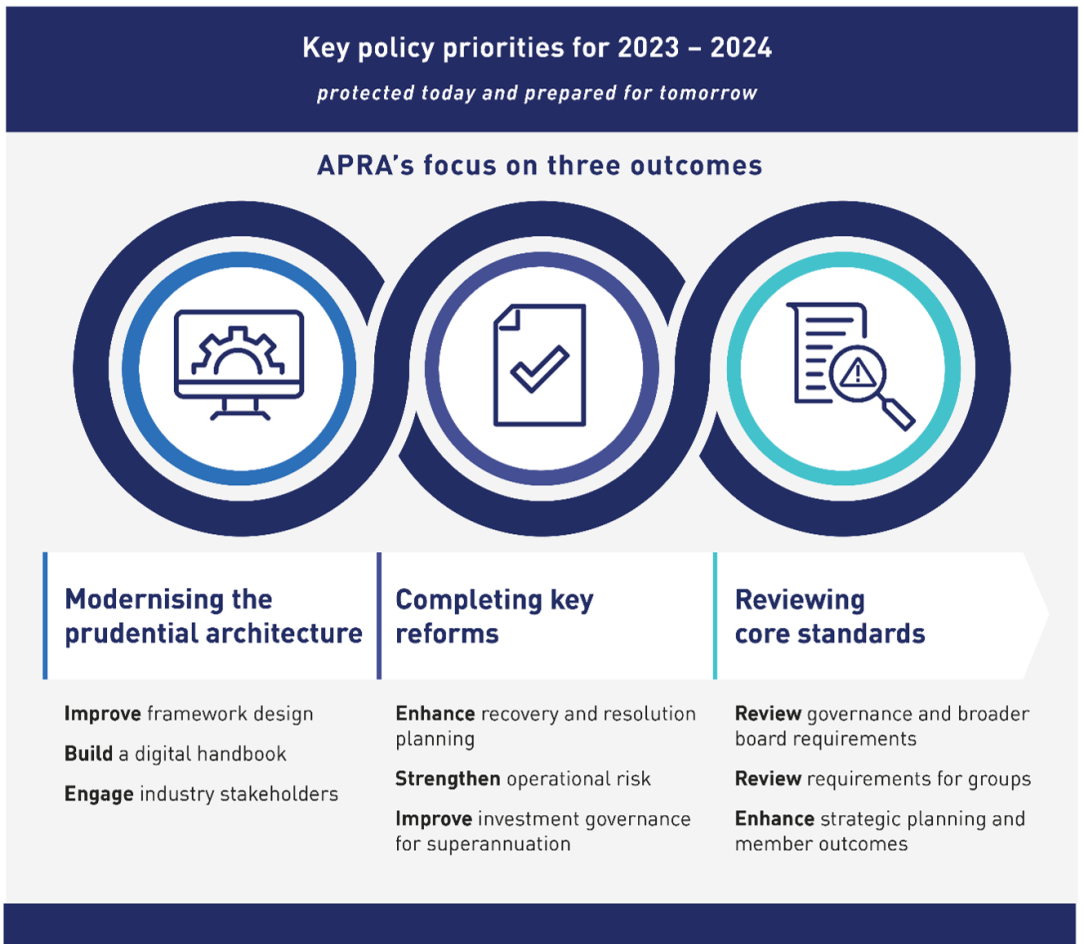

Looking ahead to 2023-2024, APRA’s policy priorities centre on three main objectives:

- Modernising the prudential architecture, a core strategic initiative designed to make the framework clearer, simpler and more adaptable;

- Completing key reforms to strengthen the financial and operational resilience of the system, and improve outcomes for superannuation members;2 and

- Reviewing and rationalising core standards within the framework, including for governance and the regulation of conglomerate groups.

APRA’s policy priorities are fewer than in prior years, which will help APRA-regulated entities to focus on implementing prior policy reforms and managing risks and challenges in the operating environment in the period ahead. APRA is also placing a greater focus on reducing the size and complexity of the prudential framework over time.

The specific policy priorities for 2023-2024 are summarised in the graphic below and detailed in chapters for each regulated industry. For a quick snapshot of key timelines for policy development, see Annex A. A list of recently finalised standards is presented in Annex B, and a summary of the prudential framework on a page for each industry is in Annex C, highlighting the particular standards and prudential practice guides (PPGs) that are under review.

Footnotes

1 APRA’s Supervision Priorities (Information Paper, February 2023). APRA’s Direction for data collections (Response Paper, December 2022) outlines plans to transform its approach to data collection.

2 These reforms include new standards for recovery and resolution planning and operational risk management, as well as revisions to standards for superannuation to improve member outcomes, transfer planning and financial resilience.

Chapter 1 - Modernising the prudential architecture

Objectives

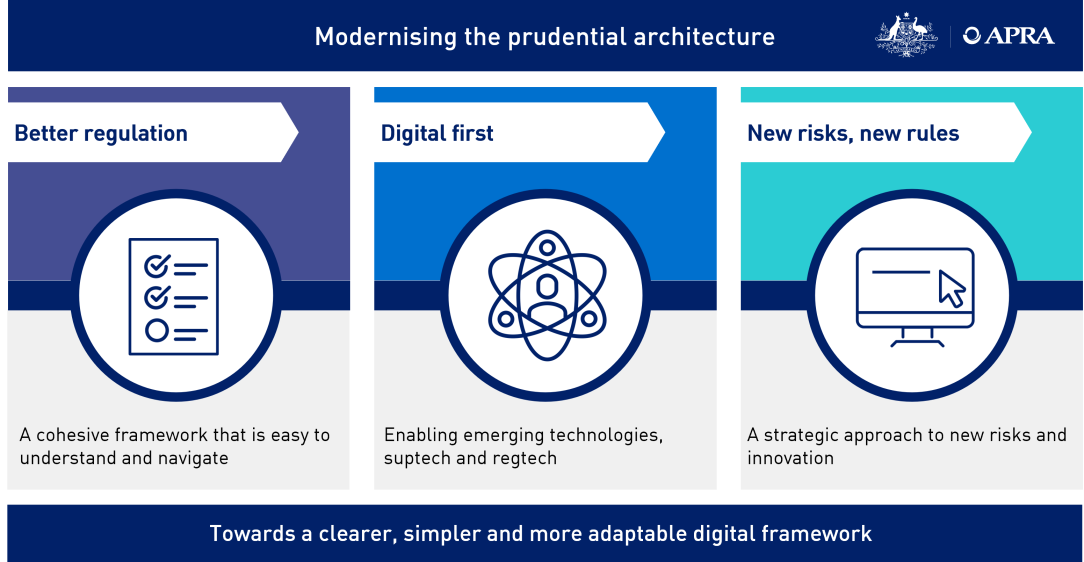

With the financial landscape changing at a rapid pace and the digitisation of finance accelerating, APRA initiated a new strategic program to modernise the prudential architecture. As set out in an Information Paper in 2022 and summarised in the graphic below, the program to modernise the architecture will be a multi-year, evolutionary set of initiatives.3

The graphic below summarises the program, with a focus on building a clearer, simpler and more adaptable digital framework. This will involve incremental changes in framework design, in how APRA writes policy, and in how industry navigates it.

Key initiatives

Over the past year, APRA has been building the foundations for the program. This has included an internal review of the framework to identify and assess potential complexities within it, establishing an advisory panel, and consulting with other regulators domestically and internationally who are facing similar challenges. APRA also released a comprehensive guide for bank board directors, and has started to rationalise key standards and guidance.

As this program develops, the industry can expect:

- reviews of standards that include a focus on rationalising existing requirements and better embedding guidance and FAQs, providing a single source;4

- opportunities to engage further with APRA to address key pain points and improve the overall design of the framework;5 and

- opportunities to work with APRA on the development of a prototype digital prudential handbook, which will bring together standards and guidance into a new digital format that will be easier to navigate, search and filter.

Initial workshops and surveys with regulated entities have demonstrated strong support for APRA’s direction, and the benefits that can be gained. The end goal is a digital framework that is easier for the industry to understand and comply with, and for APRA to supervise and maintain - ultimately helping to better protect Australians’ financial interests.

Footnotes

3 Modernising the prudential architecture (Information Paper, September 2022).

4 Early examples of rationalisation to date include draft Prudential Standard CPS 230 Operational Risk (CPS 230) which combines five standards into one, and guidance integrated with specific requirements in standards. A specific example of this approach in the period ahead will be APRA’s review of the regulation of groups, which will aim to rationalise requirements to provide a clearer and simpler framework.

5 Initial examples include the consolidation of board requirements and guidance into a comprehensive guide for bank board directors, and the alignment of the definition of significant financial institutions.

Chapter 2 - Cross-industry policy

This chapter outlines policy priorities applicable to all APRA-regulated entities. The key priorities include finalising new standards to strengthen financial and operational resilience, and reviews of core standards for governance and the regulation of groups.

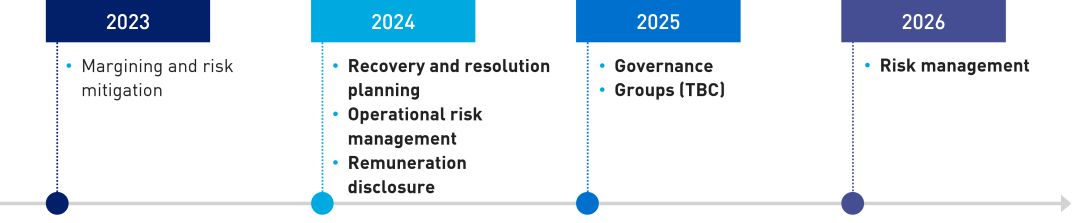

Upcoming effective dates

Policy priorities

Policy priority | Objectives and focus | Next steps |

|---|---|---|

Recovery and resolution planning | The aim of new standards for recovery and resolution planning are to enhance preparedness for crisis management, and ensure the system is well placed to navigate conditions of financial stress. In 2022, APRA finalised Prudential Standard CPS 190 Recovery and Exit Planning (CPS 190). | APRA plans to finalise Prudential Standard CPS 900 Resolution Planning (CPS 900) in the first half of 2023, together with guidance on recovery and resolution planning (CPG 190 and CPG 900). The new standards will come into effect from 2024. |

Operational risk management | All regulated entities must ensure they effectively identify and manage operational risks, are able to continue to deliver critical operations during disruptions, and prudently manage the risks of service providers. APRA is developing Prudential Standard CPS 230 Operational Risk Management (CPS 230), which will replace five existing standards for business continuity and outsourcing. | APRA expects to finalise CPS 230 and consult on associated guidance in the first half of 2023. The new standard is expected to come into effect from 2024. |

Remuneration disclosure | APRA consulted on revised disclosure and reporting requirements in 2022, to support the new Prudential Standard CPS 511 Remuneration (CPS 511). The aim of the requirements is to improve transparency on remuneration practices, and ensure there are stronger incentives to manage risks and apply consequences for poor risk outcomes. | APRA plans to finalise remuneration disclosure requirements in the first half of 2023. APRA expects that the disclosure requirements will come into effect from 2024. |

Governance | Prudential Standard CPS 510 Governance (CPS 510) is a core pillar of APRA’s prudential framework, setting minimum requirements for prudent governance. APRA will review CPS 510, and the broader requirements and guidance relating to boards across the prudential framework in 2023. APRA’s review will take into account findings from key external and APRA supervisory reviews, and will seek to streamline APRA’s expectations of boards. | APRA intends to initiate consultation on CPS 510 and broader governance requirements in the latter half of 2023, with the expectation that changes will be finalised in 2024. APRA also intends to update Prudential Standard CPS 520 Fit and Proper (CPS 520) as part of the review program, following the finalisation of the Financial Accountability Regime (FAR). APRA will sequence the review of Prudential Standard CPS 220 Risk Management (CPS 220) to follow the completion of the review of CPS 510. |

Groups | In recent years, there has been the emergence of more complex corporate structures in the industry, resulting in the need for APRA to supervise more ’groups’ of entities. APRA is reviewing the prudential framework for groups, to ensure it caters to an increasing array of new groups, and is consistently applied to provide a level playing field across different structures.6 There are no immediate changes to existing APRA authorised non-operating holding companies (NOHCs), although individual NOHC conditions may be updated as the review progresses. | APRA intends to release a discussion paper in 2023, to seek industry feedback on five key topics on groups: financial resilience, governance, risk management, resolution and competition issues. APRA will also update its guidelines for licensing new NOHCs. APRA expects to consult on any specific changes to standards in 2024, which would come into effect from 2025 onwards. |

Footnotes

6 The scope of the review was set out in an APRA letter to all regulated entities, Group regulation: roadmap for review (October 2022). The review will encompass the 3PS set of standards (draft 3PS 110, draft 3PS 111, 3PS 310, 3PS 221, 3PS 222 and 3PS 001), and be conducted in parallel with the review of CPS 510 and in due course CPS 220.

Chapter 3 - Banking policy

Upcoming effective dates

Policy priorities

Policy priority | Objectives and focus | Next steps |

|---|---|---|

Interest rate risk in the banking book (IRRBB) and Market risk | APRA is consulting on revisions to update Prudential Standard APS 117 Capital Adequacy: Interest Rate Risk in the Banking Book (APS 117). In November 2022, APRA released its response to previous feedback on APS 117, and proposed new revisions to address concerns from changes in the interest rate environment.7 | APRA intends to finalise the revised APS 117 in the second quarter of 2023, and release a prudential practice guide for consultation. The revised APS 117 is expected to come into effect from 1 January 2025. APRA will sequence the review of the market risk standards to follow the finalisation of APS 117. APRA therefore expects to consult in 2024 on revisions to Prudential Standard APS 116 Market Risk (APS 116) and Prudential Standard APS 180 Counterparty Credit Risk (APS 180), and will delay effective dates to 2026. |

Stored-value facilities (SVF) and stablecoins | Broader government reforms to the regulation of SVFs are being implemented by the Council of Financial Regulators (CFR).8 The CFR is also considering approaches to regulating payment-related stablecoins, including as a type of SVF. Following the finalisation of the broader regulatory framework for SVFs in Australia, APRA plans to review its current standard, Prudential Standard APS 610 Prudential Requirements for Providers of Purchased Payment Facilities (APS 610). | As an interim step, APRA is updating minimum capital requirements in APS 610. APRA plans to finalise this update in the first half of 2023. Following the finalisation of the broader SVF framework, APRA will also progress a comprehensive review of APS 610.

|

Crypto-assets | In late 2022, the Basel Committee finalised the international standard for the prudential treatment of banks’ exposures to crypto-assets.9 This will provide the basis for APRA’s prudential requirements for crypto-assets. | APRA will consult on the prudential treatment for crypto-assets in 2024, which is expected to come into effect in 2025. APRA released interim expectations on the management of risks associated with crypto-assets in April 2022.10 |

Liquidity | APRA will review Prudential Standard APS 210 Liquidity (APS 210) to ensure the standard is updated and fit for purpose. The review will incorporate industry feedback and lessons learned from APRA’s post-implementation review of the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) in 2022.11 | APRA plans to commence the review of APS 210 in 2023, with the release of a discussion paper in the latter half of the year. APRA expects to finalise any changes to the standard in 2024, which will come into effect in 2025. |

Financial Claims Scheme | Prudential Standard APS 910 Financial Claims Scheme (APS 910) was introduced in 2013, to ensure that ADIs are adequately prepared in the event there was a need to use the Financial Claims Scheme. | APRA plans to review APS 910, taking into account developments domestically and internationally over the past 10 years. APRA expects to consult on any potential changes to APS 910 in 2024. |

Footnotes

7 Interest rate risk in the banking book for Authorised Deposit-taking Institutions (Response Paper, November 2022).

8 Reforms to the SVF framework follow a review by the CFR, Regulation of Stored-value Facilities in Australia (October 2019). A key recommendation in the review was that SVFs should be introduced as a new class of regulated product, replacing “purchased payment facilities” (PPFs) in the regulatory framework. PPFs are a specific type of SVF that enable funds to be stored for the purpose of making future payments.

9 Prudential treatment of cryptoassets exposures (Basel Committee on Banking Supervision (BCBS), December 2022).

10Crypto-assets: risk management expectations and policy roadmap (Letter, April 2022).

11 Post-implementation review of the Basel III liquidity reforms (Information Paper, June 2022).

Chapter 4 - Insurance policy

The policy priorities for the general, life and private health insurance industries, in addition to those set out in Chapter 2, are outlined in this chapter. APRA’s focus in 2023 is supporting the insurance industries in implementing the revised capital standards and the new capital framework for private health insurers.

Upcoming effective dates

Policy priorities

Policy priority | Objectives and focus | Next steps |

|---|---|---|

Insurance framework | APRA is consulting on remaking four life insurance prudential standards, which are due to sunset in April 2023.12 APRA also intends to review the existing structure of the insurance prudential frameworks as part of the initiative to modernise the prudential architecture. | APRA expects to remake the four specific life insurance standards, subject to industry feedback, prior to 1 April 2023. APRA will also continue to engage industry and other stakeholders on the broader insurance prudential framework. |

Insurance risk management | APRA is planning to review and refresh guidance for life and general insurers on product design, underwriting and risk management in Prudential Practice Guide GPG 240 Insurance Risk (GPG 240) and Prudential Practice Guide LPG 240 Life Insurance Risk and Reinsurance Risk (LPG 240). The intention of this review is to ensure a consistent standard in insurance risk management is maintained across these industries, with updates to reflect supervisory observations. | APRA has deferred the review of this guidance until 2024-2025, to be sequenced to follow the broader review of the insurance prudential framework. |

Footnotes

12 The four LI standards are Prudential Standard LPS 100 Solvency Standard (LPS 100), Prudential Standard LPS 115 Capital Adequacy: Insurance Risk Charge (LPS 115), Prudential Standard LPS 360 Termination Values Minimum Surrender Values and Paid-up Values (LPS 360), and Prudential Standard LPS 370 Cost of Investment Performance Guarantees (LPS 370). See Letter to life insurers: consultation on remaking four life insurance prudential standards (November 2022).

Chapter 5 - Superannuation policy

The policy priorities for the superannuation industry, in addition to those set out in Chapter 2, are outlined in this chapter. The policy priorities focus on improving outcomes for superannuation members through updates and revisions to SPS 515, and progressing connected reforms on prudent transfer planning, financial resilience, investment governance and retirement incomes.

Upcoming effective dates

Policy priorities

Policy priorities | Objectives and focus | Next steps |

|---|---|---|

Investment governance | In 2022, APRA released revised investment governance requirements to strengthen stress testing, valuation practices and liquidity management. APRA is currently consulting on guidance to support the revised requirements.13 | APRA will finalise the guidance in mid-2023, following the conclusion of the current consultation in March 2023. |

Strategic planning and member outcomes | In 2022, APRA released a discussion paper with proposals to update and enhance the requirements of SPS 515 and associated guidance.14 The aim of the enhancements is to ensure trustees deliver quality outcomes to members. | APRA intends to release proposed revisions to SPS 515 and associated guidance for further consultation in 2023. |

Transfer planning | APRA is consulting on a series of measures to enhance planning by trustees in the event they need to transfer members out of – or into – their fund. This includes new requirements relating to the transfer of MySuper product assets, in the event of cancellation of an authority to offer a MySuper product. | APRA expects that new requirements for the transfer of MySuper product assets will come into effect in 2023, following (and subject to) industry consultation. APRA intends to consult further on broader enhancements to requirements for transfer planning as part of the consultation on SPS 515 (noted above). This includes updating the existing guidance in Prudential Practice Guide SPG 227 Successor Fund Transfers and Wind-ups (SPG 227). |

Financial resilience in superannuation | APRA is consulting on revised requirements to replace Prudential Standard SPS 114 Operational Risk Financial Requirement (SPS 114).15 The revisions aim to ensure that trustees are well-placed to manage the impact of operational risks, and provide confidence that sufficient financial resources would be available to implement contingency plans if needed. | APRA will consult further on draft requirements and associated guidance in 2023, following the conclusion of the current consultation in March 2023. |

Retirement incomes | The retirement income covenant has been incorporated into the Superannuation Industry Supervision Act 1993 (SIS Act) and commenced on 1 July 2022. APRA is considering how the prudential framework might be adjusted to ensure trustees focus on improving retirement outcomes for their members and are managing new risks that arise. | APRA and ASIC are conducting a joint thematic review of trustees’ retirement income strategies and summaries, which will conclude in 2023. APRA will consider potential enhancements to prudential standards and guidance following the thematic review, to reflect any findings and lessons learned. |

Conflicts of interest and Defined benefits | APRA will review Prudential Standard SPS 521 Conflicts of Interest (SPS 521) and Prudential Standard SPS 160 Defined Benefit Matters (SPS 160) in 2023. The review will consider whether the requirements in these standards need to be enhanced or updated, given they were determined 10 years ago. | If APRA determines that changes to SPS 521 and SPS 160 are necessary, APRA will consult on potential changes in 2023.

|

Footnotes

13 Revised Prudential Standard SPS 530 Investment Governance (January 2023); Letter – Investment governance: Revised prudential practice guide (November 2022).

14 Strategic planning and member outcomes: proposed enhancements (Discussion Paper, August 2022).

Annex A - Policy timelines

Cross-industry

| Code | 1H 2023 | 2H 2023 | 2024 | Expected effective |

Recovery and resolution planning | CPG 190, | Finalise |

|

| 2024 |

Operational risk management | CPS 230, | Finalise |

|

| 2024 |

Remuneration disclosures | CPS 511 | Finalise |

|

| 2024 |

Governance | CPS 510 |

| Consult | Finalise | 2025 |

Groups | Various |

|

| Consult | 2025 (TBC) |

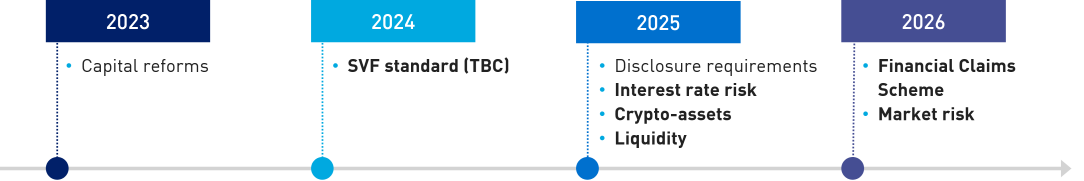

Banking

| Code | 1H 2023 | 2H 2023 | 2024 | Expected effective |

Interest rate risk in the banking book | APS 117, | Finalise |

|

| 2025 |

Stored-value facilities | APS 610 |

| Consult (TBC) | Finalise (TBC) | 2024 (TBC) |

Crypto-assets | TBC |

|

| Consult | 2025 |

Liquidity | APS 210 |

| Consult | Finalise | 2025 |

Financial Claims Scheme | APS 910 |

|

| Consult | 2026 |

Market risk | APS 116, |

|

| Consult | 2026 |

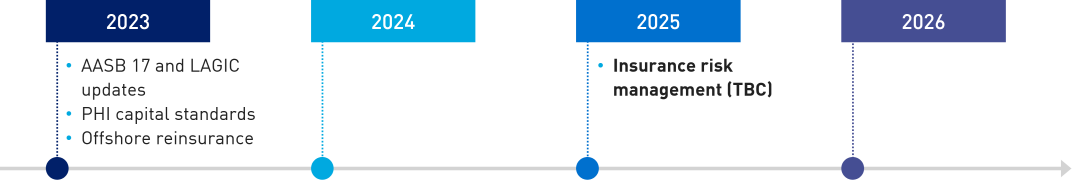

Insurance

| Code | 1H 2023 | 2H 2023 | 2024 | Expected effective |

Remaking four life insurance standards | LPS 100, | Finalise |

|

| 2023 |

Insurance risk management | GPG 240, |

|

| Consult | 2025 (TBC) |

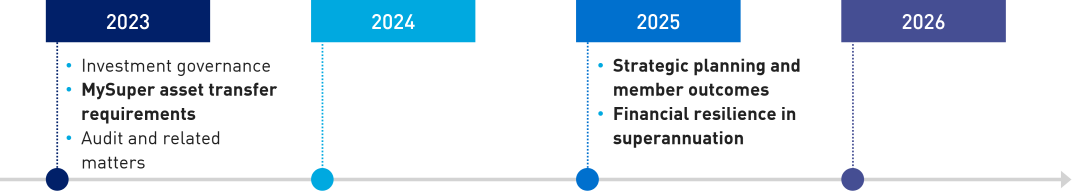

Superannuation

| Code | 1H 2023 | 2H 2023 | 2024 | Expected effective |

Investment governance | SPG 530 | Consult | Finalise |

| - |

Strategic planning and member outcomes, | SPS 515 | Consult | Consult | Finalise | 2025 |

Transfer planning | TBC

| Consult |

|

| 2023 |

| SPG 227 | Consult | Consult | Finalise | - | |

| Financial resilience in superannuation | SPS 114 | Consult | Consult | Finalise | 2025 |

Annex B - Finalised standards

APRA finalised a number of prudential standards and PPGs in 2022. These are outlined in the table below, along with their commencement dates.

Industry | Prudential standard or PPG | Effective date |

Cross-industry | Prudential Standard CPS 226 Margining and risk mitigation for non-centrally cleared derivatives Prudential Standard CPS 511 Remuneration | 1 January 2023 |

Prudential Standard CPS 190 Recovery and Exit Planning | 1 January 2024 | |

Banking | Prudential Standards16 Prudential Standard APS 110 Capital Adequacy Prudential Standard APS 111 Capital Adequacy: Measurement of Capital Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk Prudential Standard APS 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk Prudential Standard APS 115 Capital Adequacy: Standardised Measurement Approach to Operational Risk Prudential Standard APS 116 Capital Adequacy: Market Risk Prudential Standard APS 120 Securitisation Prudential Standard APS 121 Covered Bonds Prudential Standard APS 180 Capital Adequacy: Counterparty Credit Risk Prudential Standard APS 210 Liquidity Prudential Standard APS 220 Credit Risk Management Prudential Standard APS 221 Large Exposures Prudential Standard APS 310 Audit and Related Matters Prudential Standard APS 330 Public Disclosure17 | 1 January 2023

|

Prudential Standard APS 001 Definitions | 30 September 2022 | |

PPGs Prudential Practice Guide APG 110 Capital Adequacy Prudential Practice Guide APG 112 Capital Adequacy: Standardised Approach to Credit Risk Prudential Practice Guide APG 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk Prudential Practice Guide APG 210 Liquidity Prudential Practice Guide APG 223 Residential Mortgage Lending | - | |

Insurance | General Insurance Prudential Standard GPS 001 Definitions Prudential Standard GPS 110 Capital Adequacy[3] Prudential Standard GPS 112 Capital Adequacy: Measurement of Capital[4] Prudential Standard GPS 113 Capital Adequacy: Internal Model-based Method[5] Prudential Standard GPS 114 Capital Adequacy: Asset Risk Charge Prudential Standard GPS 115 Capital Adequacy: Insurance Risk Charge Prudential Standard GPS 116 Capital Adequacy: Insurance Concentration Risk Charge Prudential Standard GPS 117 Capital Adequacy: Asset Concentration Risk Charge Prudential Standard GPS 118 Capital Adequacy: Operational Risk Charge Prudential Standard GPS 230 Reinsurance Management Prudential Standard GPS 340 Insurance Liability Valuation | 1 July 2023 |

Life Insurance Prudential Standard LPS 001 Definitions Prudential Standard LPS 110 Capital Adequacy Prudential Standard LPS 112 Capital Adequacy: Measurement of Capital[6] Prudential Standard LPS 114 Capital Adequacy: Asset Risk Charge Prudential Standard LPS 117 Capital Adequacy: Asset Concentration Risk Charge Prudential Standard LPS 118 Capital Adequacy: Operation Risk Charge Prudential Standard LPS 310 Audit and Related Matters Prudential Standard LPS 340 Valuation of Policy Liabilities Prudential Standard LPS 600 Statutory Funds | 1 July 2023 | |

Private Health Insurance Prudential Standard HPS 001 Definitions Prudential Standard HPS 110 Capital Adequacy Prudential Standard HPS 112 Capital Adequacy: Measurement of Capital[7] Prudential Standard HPS 114 Capital Adequacy: Asset Risk Charge Prudential Standard HPS 115 Capital Adequacy: Insurance Risk Charge Prudential Standard HPS 117 Capital Adequacy: Asset Concentration Risk Charge Prudential Standard HPS 118 Capital Adequacy: Operational Risk Charge Prudential Standard HPS 310 Audit and Related Matters Prudential Standard HPS 340 Insurance Liability Valuation | 1 July 2023 | |

Superannuation | Prudential Standard SPS 530 Investment Governance | 1 January 2023 |

Prudential Standard SPS 310 Audit and Related Matters | 30 June 2023 |

Footnotes

16 This includes a number of prudential standards finalised with minor consequential amendments from the updated capital adequacy and credit risk capital requirements. See APRA releases minor amendments to capital framework for ADIs | APRA.

17 APRA has updated the transitional APS 330 so that ADIs may continue to make public disclosures from 1 January 2023 that are consistent with the new capital framework. The new disclosure standard becomes effective on 1 January 2025.

18 A minor update may be made to this prudential standard, pending the outcome of APRA’s AASB 17 related consultation on the level of accounting equity and the capital base.

19 A minor update may be made to this prudential standard, pending the outcome of APRA’s AASB 17 related consultation on the level of accounting equity and the capital base.

20 This prudential standard will be revoked from 1 July 2023.

21 A minor update may be made to this prudential standard, pending the outcome of APRA’s AASB 17 related consultation on the level of accounting equity and the capital base.

22 A minor update may be made to this prudential standard, pending the outcome of APRA’s AASB 17 related consultation on the level of accounting equity and the capital base.

Annex C - The prudential framework

APRA’s prudential framework is comprised of legislative requirements, prudential standards and guidance. The prudential standards for each regulated industry are summarised below, with the key areas that are under active policy development in 2023–2024 highlighted in bold.

Prudential standards and guidance for banking

Governance | |

|

|

Risk management | Financial resilience |

General risk management

Operational resilience

| Capital

Liquidity

|

Recovery and resolution | |

|

|

Prudential standards and guidance for insurance

Governance | |

|

|

Risk management | Financial resilience |

General risk management

Operational resilience

| Capital

Other requirements (life insurance)

|

Recovery and resolution | |

|

|

Prudential standards and guidance for superannuation

Governance | |

|

|

Risk management | Business operations |

|

|

Recovery and resolution | |

|

|