Group regulation: roadmap for review

In recent years, there has been the emergence of more complex corporate structures in the industry, resulting in the need for APRA to supervise more “groups” of entities. As noted in the recent information paper on Modernising the prudential architecture, new business models and more complex group structures create new challenges and accentuate existing risks.1

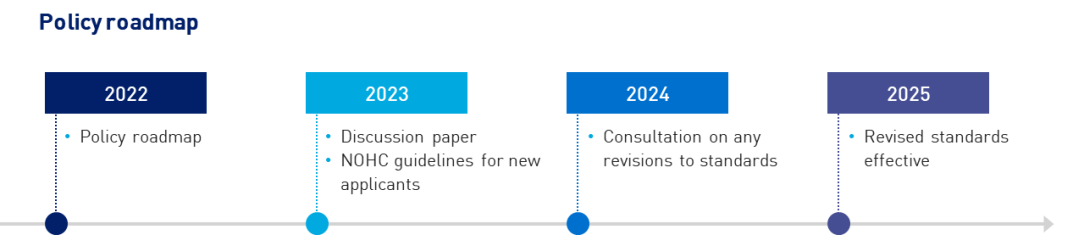

Following the finalisation of the capital reforms for banks and insurers, APRA is setting out a roadmap for a review of the prudential framework for groups. The aim of the review is to ensure that the prudential framework is fit for purpose to cater to an increasing array of new groups, and consistently applied to existing structures to ensure a level playing field.

Background to the review

Group structures can enable innovation and diversity in business models. They can provide benefits for consumers, increase competition and competitiveness of entities. For these benefits to be realised, however, the risks of group structures must be prudently managed.

The prudential framework that applies to groups has evolved over time. APRA released its Level 3 groups framework in 2014, with implementation from 2017. APRA delayed the group capital components of the framework to allow for the finalisation of other domestic and international policy initiatives, including the Unquestionably Strong bank capital reforms. 2

In recent years, there has been a marked increase in the number of applications for new non-operating holding company (NOHC) authority licences, and an increase in the level of complexity in group structures. This reflects shifts in the financial system, expansion into adjacent risk and revenue sources, the growing use of digital technologies, and the emergence of groups that cover multiple industries.

Objectives of the review

In this context, the APRA framework for groups warrants review: there are components of the framework to be clarified, such as on capital requirements, and components to be updated, to ensure they cater effectively to new structures and new business models that are emerging.

APRA’s objective in reviewing the framework is to ensure that the financial safety of APRA-regulated entities within groups is maintained, and not undermined by risks inherent in group structures, new and old. The review will focus on:

- Rationalising requirements for the management of risks presented by group structures, such as contagion risk generated by intra-group exposures and arrangements;

- Promoting consistency in prudential requirements that apply to groups, to ensure the same risks are addressed in a consistent manner across regulated industries; and

- Providing clarity on group capital requirements, as well as APRA’s approach to regulating and supervising different group structures.

As part of the review, APRA will be seeking to ensure that the framework for groups is clearer and simpler, in line with the strategic initiative to modernise the prudential architecture.

Scope of the review

APRA supervises and regulates groups through the application of certain prudential standards that apply at a group level, and bespoke conditions for specific groups that have NOHCs in their structure.3 The key prudential standards within the scope of the review are set out below. 4

The prudential standards that apply to groups cover a range of key topics, including group governance, intra-group transactions and group risk management. The framework is designed to ensure that risks at the group level are well managed and mitigated, and the financial safety of APRA-regulated entities within groups is not undermined by group structures. The management of contagion risk and potential conflicts of interest are particularly important examples of these risks.

Themes | Key prudential standards within scope of the groups review |

|---|---|

Financial resilience | 3PS 110 Capital Adequacy (draft) 3PS 111 Measurement of Capital (draft) |

Governance | 3PS 310 Audit and Related Matters CPS 510 Governance – group requirements |

Risk management | 3PS 221 Aggregate Risk Exposures 3PS 222 Intra-group Transactions and Exposures CPS 220 Risk Management – group requirements |

Resolution | CPS 900 Resolution Planning (draft) |

Competition issues | 3PS 001 Definitions and other industry definition standards as relevant |

Alongside the review of the prudential framework for groups, APRA plans to conduct a parallel broader review of Prudential Standard CPS 510 Governance (CPS 510) and, in due course, Prudential Standard CPS 220 Risk Management (CPS 220). Any revisions to requirements relating to groups within those standards will be considered as part of the review of the groups framework.

As part of the review of the groups framework, APRA will update its guidelines for licencing new NOHC authorities. Following the finalisation of the framework, APRA also expects to update individual NOHC conditions to align with the new requirements, and ensure there is no duplication or inconsistencies.

Next steps

The review will be multi-year, as outlined in the policy roadmap below. It will commence with a Discussion Paper in the first half of 2023 to seek industry feedback on five key topics related to groups: financial resilience, governance, risk management, resolution and competition issues. APRA expects to consult on any revisions to the relevant standards over 2023-2024, with any changes effective from 2025.

For all existing APRA authorised NOHCs, there will be no immediate changes. However, APRA will seek to ensure that any new or adjusted NOHC licence conditions are applied in a consistent manner as the review of the framework progresses. A register of NOHCs licensed by APRA is available on the APRA website.5

If you have questions on the review of the groups framework, please contact your APRA responsible supervisor.

Yours sincerely,

John Lonsdale

APRA Deputy Chair

Footnotes

1 APRA Information Paper, Modernising the prudential architecture (September 2022).

2 See Supervision of conglomerate groups (Level 3) | APRA

3 APRA’s prudential standards apply to regulated entities at different levels of regulatory consolidation. Level 1 is the regulated entity itself (such as an ADI), including any legal entities that are included as Extended Licensed Entities (ELEs) and branches. Level 2 is the regulated entity plus any of its subsidiaries where consolidated. Level 3 is the conglomerate group at the widest level, including non-consolidated subsidiaries.

4 Other prudential standards that apply at Level 3 are unlikely to require significant revisions as part of the review, if any. APRA will consider other relevant standards as needed and provide further details in the Discussion Paper on the review of the groups framework planned for 2023.

5https://www.apra.gov.au/register-of-non-operating-holding-companies