Governance and senior executive accountabilities

Last updated: June 2024

Foreword

A stable and efficient financial system with strong and resilient financial institutions is critical to supporting and promoting economic growth and development in Australia and to the effective functioning of the economy. Financial crises can be deeply damaging and have a long-lasting, adverse impact on people’s lives. The Australian Prudential Regulation Authority (APRA) plays an important role in Australia’s financial system by supervising approximately 2,000 institutions holding around $8.6 trillion in assets for Australian bank depositors, superannuation fund members and insurance policy holders.

Maintaining the safety and stability of Australia’s financial system in a rapidly changing environment requires continued vigilance and effective prudential supervision including coordinated efforts with other regulatory agencies.

APRA’s organisation structure, internal governance and accountability arrangements have been reviewed to improve our ability to continue to deliver on our important statutory objectives. Amongst other things, this involved reviewing internal governance structures and specifying senior executive accountabilities consistent with the Banking Executive Accountability Regime (BEAR)1. In addition, APRA has formed new divisions to strengthen our ability to deliver on our program of work and set us up for the challenges that lie ahead. APRA continues to update this over time, and this publication formally describes APRA’s current governance arrangements and senior executive accountabilities and is supported by individual accountability statements for senior executive roles.

Embracing the principles of BEAR is an important means by which APRA can demonstrate that we seek to uphold standards of governance and accountability that are consistent with those we expect of the financial institutions we regulate.

John Lonsdale

APRA Chair

Chapter 1 - Background

The Australian Prudential Regulation Authority (APRA) was established by the Australian Government on 1 July 1998. APRA is an independent statutory authority accountable to the Australian Parliament. APRA supervises institutions in the financial sector in accordance with various laws of the Commonwealth. In performing and exercising its functions, APRA is required to balance the objectives of financial safety, efficiency, competition, contestability and competitive neutrality; and, in balancing these objectives, is to promote financial system stability in Australia.

Enabling legislation

APRA’s enabling legislation is the Australian Prudential Regulation Authority Act 1998 (APRA Act). Under the APRA Act, APRA’s main purpose is to regulate institutions in the financial sector in accordance with other laws of the Commonwealth2 that provide for prudential regulation; or for retirement income; and to administer the Financial Claims Scheme provided for in the Banking Act 1959 and the Insurance Act 1973. APRA also has responsibilities under other Acts, including data collection under the Financial Sector (Collection of Data) Act 2001 (FSCOD Act). A full list of APRA’s enabling legislation is available on APRA’s website here.

Statement of expectations and intent

From time to time the Government issues APRA with a Statement of Expectations setting out its expectations of APRA in undertaking its role, balancing its objectives, responding to changing circumstances in the context of the Government’s policy priorities, and meeting appropriate standards of transparency and accountability. Government expectations may change over time, but must always be framed with regard to, and cannot override, APRA’s statutory objectives set out in its enabling legislation.

APRA formally responds to the Government’s Statement of Expectations with a Statement of Intent. The most recent editions can be viewed on APRA’s website.

Accountability

APRA operates as part of the Australian Government and is accountable to the Parliament, and ultimately to the public, through the Treasury Ministers3, the Parliamentary Committee process (including appearances at the Senate Estimates and the House of Representatives Standing Committee on Economics) and the tabling of its Corporate Plan and Annual Report. Other accountability expectations of APRA include complying with the requirements of the Public Governance, Performance and Accountability Act 2013 (PGPA Act), the Regulator Performance Guide issued by the Department of Finance, and the Finance Minister’s Orders.

APRA’s performance is also subject to various independent assessments including by the Australian National Audit Office (ANAO), International Monetary Fund as part of the Financial Sector Assessment Program and the Financial Regulator Assessment Authority (FRAA).

Coordination with other regulatory agencies

APRA works closely with other agencies responsible for financial regulation in Australia including the Treasury; the Australian Securities and Investments Commission; the Reserve Bank of Australia; the Australian Competition and Consumer Commission; and the Australian Transaction Reports and Analysis Centre.

Australia’s Council of Financial Regulators (CFR) is the primary coordinating body for Australia’s main financial sector authorities to promote the stability of the Australian financial system and contribute to the efficiency and effectiveness of financial regulation. You can find more information on the CFR website.

The CFR is not a statutory body and hence does not have a legal persona, nor does it have powers separate from its member agencies. Its members share information and views on developments in the financial system; discuss regulatory reform, and other issues related to areas where responsibilities overlap; and coordinate responses to potential threats to financial system stability. These arrangements are underpinned by a Memorandum of Understanding (MOU). The MOU sets out the objectives of financial distress management and principles to guide decisions and actions during times of financial distress including responsibilities of CFR member agencies.

Chapter 2 - APRA’s organisation structure

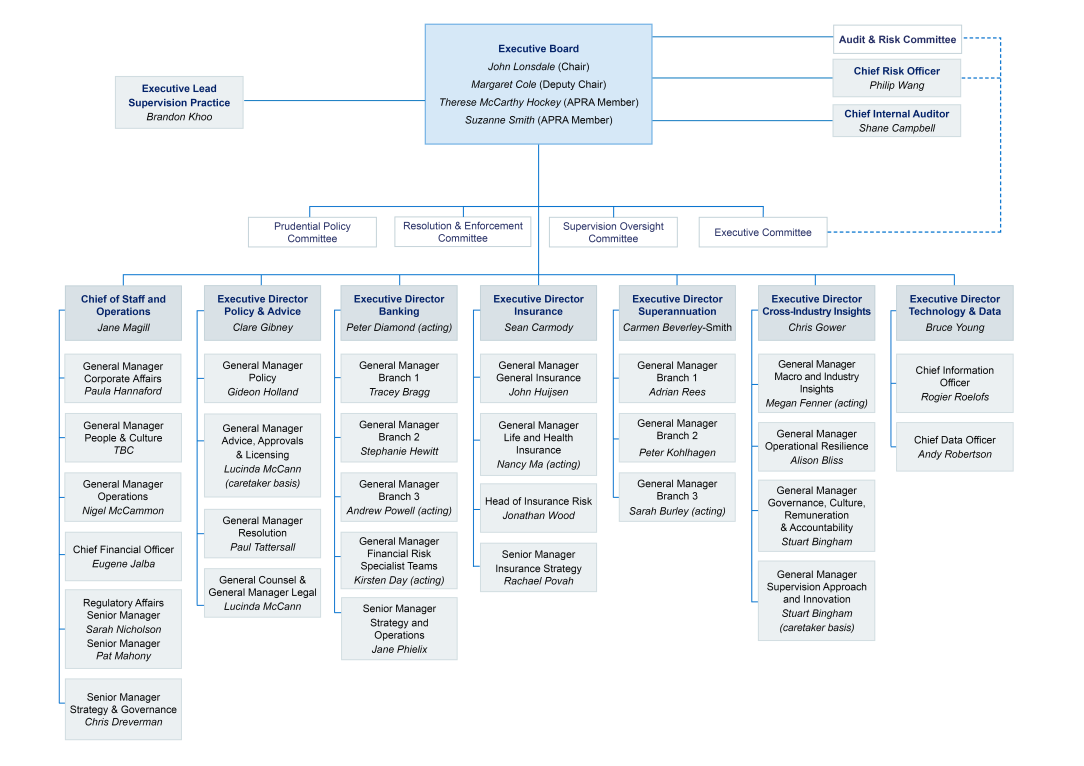

APRA’s structure and executives are outlined below.

An accessible version of APRA's organisation chart can be found on the organisation structure page.

Chapter 3 – APRA’s governance arrangements

APRA’s governance and accountability arrangements are designed to support the achievement of APRA’s statutory objectives, Statement of Intent and Corporate Plan by ensuring that decisions are directed to the appropriate level for determination.

APRA’s governance and accountability arrangements are supported by:

- clearly established roles and responsibilities articulated in approved Charters/Terms of Reference for APRA’s governance committees;

- an accountability map and statements for APRA’s senior executives; and

- a delegation and decision-making framework that defines decision-making responsibilities and authority levels for committees and individuals.

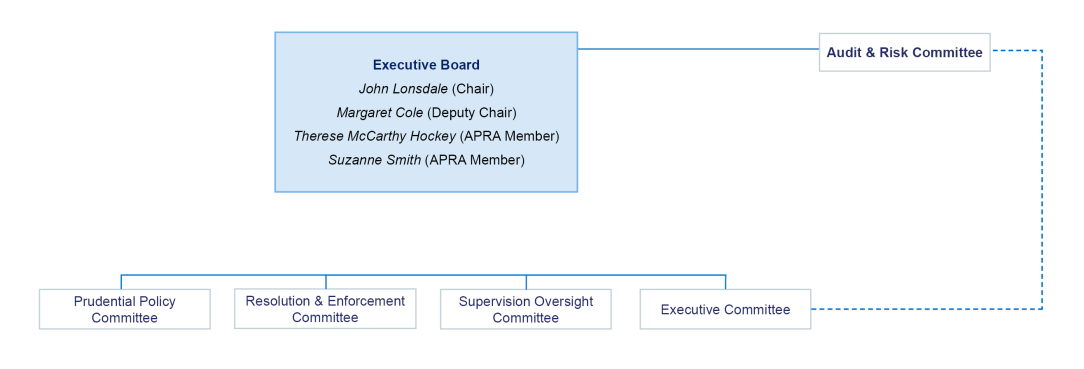

Governance structure

APRA is governed by an executive group of APRA Members (referred to as APRA’s Executive Board). The APRA Members are appointed by the Governor-General on the advice of the Australian Government for terms of up to five years. Terms of appointment may be renewed.

APRA’s governance structure, and a description of each governance committee, is outlined in this Chapter.

| Governance Group | Description |

|---|---|

| Executive Board | APRA’s Executive Board (EB) normally meets on a monthly basis but may meet more frequently if needed. The Executive Board is accountable for overseeing whole-of-APRA performance against its mandate, for approvals and decisions that have not otherwise been delegated and for other matters escalated by management or other governance committees for determination. Each EB incorporates a dedicated focus on risk to oversee APRA’s management and mitigation of risks by ensuring an effective Risk Management Framework, including a Risk Appetite Statement, is in place; overseeing the Executive Committee’s management of risk; monitoring emerging strategic risks; and undertaking deep-dives of key risks where considered necessary, including consistently out-of-tolerance risk. |

| Audit and Risk Committee | APRA’s Audit and Risk Committee (ARC) typically meets four times annually. The ARC comprises three independent non-executive members. The ARC provides independent advice and assurance to the APRA Chair on APRA’s financial and performance reporting responsibilities; risk oversight and management; and systems of internal control. APRA’s ARC is advisory and not a decision-making authority. |

| Executive Committee | APRA’s Executive Committee (ExCo) focuses on driving APRA’s operational effectiveness and risk management over the short- to medium-term. The ExCo is accountable for approvals and decisions made as defined in its Terms of Reference and for other matters escalated by management or other governance committees/groups for determination. |

| Supervision Oversight Committee | APRA’s Supervision Oversight Committee (SOC) meets monthly. The SOC is the primary forum for strategic oversight of APRA's core supervision function, model and practices. The SOC is accountable for approvals and decisions made as defined in its Terms of Reference and other matters escalated by management or other governance committees/groups for determination. |

| Prudential Policy Committee | APRA’s Prudential Policy Committee (PPC) meets twice monthly. The PPC is the primary forum for strategic oversight and development of prudential policy. The PPC is accountable for approvals and decisions made as defined in its Terms of Reference and other matters escalated by management or other governance committees/groups for determination. |

| Resolution and Enforcement Committee | APRA’s Resolution and Enforcement Committee (REC) meets twice monthly, or more frequently as needed. The REC is the primary forum for strategic oversight and review of APRA's crisis and enforcement powers. The REC acts in an advisory capacity in relation to higher risk regulated institutions and the use of APRA’s powers. The REC is accountable for approvals and decisions made as defined in its Terms of Reference and other matters escalated by management or other governance committees/groups for determination. |

Other committees/groups

The following committees/groups have been established and report to the governance committees listed above.

Industry groups

Reporting to the SOC, these groups oversee APRA’s activities in relation to each of APRA’s regulated industries including authorised deposit-taking institutions, superannuation, general insurance, life insurance including friendly societies, and private health insurance, including monitoring industry risks and issues and developing industry strategies designed to achieve APRA’s prudential objectives.

Inclusion and Diversity Council (IDC)

Reporting to the ExCo, the IDC promotes awareness of workplace inclusion and diversity and is responsible for implementing and monitoring APRA’s Inclusion & Diversity strategy.

International committees

Rreporting to the PPC, two committees coordinate APRA’s involvement with international bodies – one for banking and one for insurance. Their purpose is to prioritise the allocation of resources for APRA’s involvement in international activities; coordinate consistent and timely responses to issues raised in the relevant international forums; and ensure information from international sources is communicated effectively within APRA.

Strategic Consultative Forum

Reporting to the ExCo, this Forum facilitates communication and consultation with all APRA employees below the senior management level on internal strategic issues impacting APRA’s work practices, in addition to the terms and conditions of their employment and the impact of these on APRA’s organisational culture and values.

Work Health and Safety Committee

Reporting to the ExCo, this Committee focuses on issues concerning the health, safety and wellbeing of employees, and ensures these are integrated into broader management systems and practices.

Composition and modality

The composition of APRA’s governance committees is determined with the aim of promoting effective and efficient decision-making and diversity of thinking, underpinned by requisite skills and experience.

The chair of each committee has seniority equivalent to its structural level; with executive committees reporting to the Executive Board chaired by an APRA Member and committees/groups below this typically by a General Manager. (Given its role, APRA’s Audit and Risk Committee is an exception to this and is chaired by a non-executive member).

The table below provides a summary of governance committee membership/representation by accountable persons.

| Accountable person | EB | ExCo | ARC | SOC | PPC | REC |

|---|---|---|---|---|---|---|

| J Lonsdale | ✔C | ✔C | SI | ✔C | SI | |

| M Cole | ✔ | ✔ | SI | ✔ | ✔ | ✔C |

| T McCarthy Hockey | ✔ | ✔ | ✔C | ✔ | SI | |

| S Smith | ✔ | ✔ | SI | ✔ | ✔ | |

| J Magill | SI | ✔ | SI | SI | SI | SI |

| P Diamond (acting) | ✔ | ✔ | ✔ | SI | ||

| C Gower | ✔ | ✔ | ✔ | |||

| S Carmody | ✔ | ✔ | SI | |||

| C Beverley- Smith | ✔ | ✔ | ✔ | |||

| C Gibney | ✔ | ✔ | ✔ | |||

| B Young | ✔ | ✔ | ||||

| S Campbell | SI (Risk) | SI | SI | |||

| P Wang | SI (Risk) | SI | SI |

Performance assessment

The performance of APRA’s Executive Board and governance committees/groups are reviewed at least every two years. A formal report is provided to APRA’s Executive Board on the outcomes of the review process and recommended actions to address areas for improvement for approval and implementation.

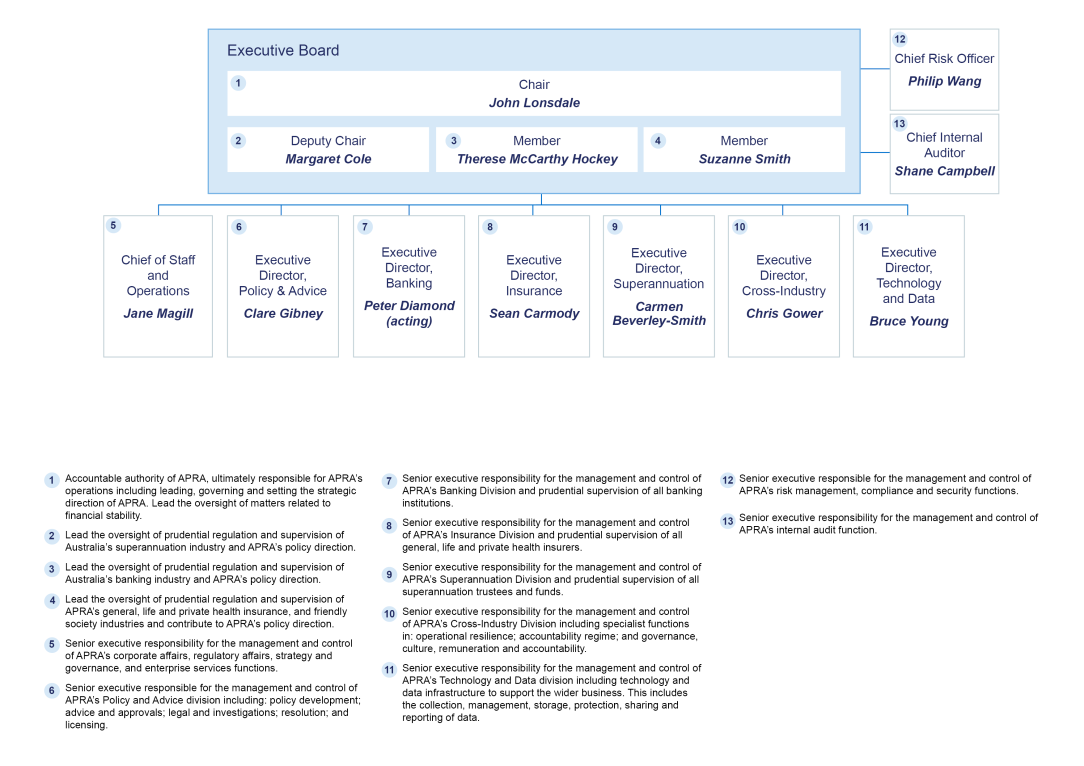

Chapter 4 – APRA’s senior executive accountable persons

APRA’s senior executive accountable persons include the APRA Members (four) and Executive Directors (seven). APRA also identifies its Chief Internal Auditor and Chief Risk Officer as accountable persons given the integral role each plays in APRA’s governance arrangements by providing independent perspectives to assist with decision making.

Accountability map and statements

APRA’s accountability map in Chapter 5 depicts how accountabilities are divided between APRA’s accountable persons and diagrammatically represents the collective suite of accountabilities that cover all aspects of APRA’s operations. Together, APRA’s accountability map and accompanying statements (included in Attachment A to this publication):

- establish clarity on the allocation of responsibility and accountability across APRA by outlining the part(s) or aspect(s) of APRA’s operations over which an accountable person has actual or effective management or control;

- describe the actions, decisions and outcomes for which the individual is accountable for in practice;

- align with (but do not duplicate) the responsibilities of APRA’s governance committees; and

- explicitly identify and define areas where there is joint accountability.

APRA’s accountability map and statements have been approved by APRA’s Executive Board and apply on an ongoing basis. Accountable persons have signed their individual statements as acknowledgment that they understand and accept their accountabilities. This document and APRA’s accountability map and statements is maintained by APRA’s Chief of Staff division on behalf of the Executive Board and will be updated to reflect changes in accountable persons and/or responsibilities as needed.

APRA values

All APRA employees are expected to demonstrate APRA’s corporate values including Integrity; Collaboration; Accountability; Respect; and Excellence.

Leadership behaviours

APRA is committed to having highly skilled and engaged people supported by strong leaders within a values-aligned culture. As such, APRA has developed a set of leadership behaviours that all senior leaders (including APRA’s accountable persons) are expected to demonstrate.

Performance assessment

Remuneration for APRA Members is determined by the Remuneration Tribunal. APRA Members are paid a total remuneration package comprising salary plus superannuation.

APRA’s executives are remunerated under a common law contract and APRA’s remuneration policies. All employees have a fixed salary component as their primary income.

In accordance with Government policy, APRA does not provide bonuses to either the APRA Members, executives or staff.

All decisions relating to executive remuneration are governed by APRA’s Executive Board. Consequences for not meeting expectations (including those articulated in accountability statements) are considered as part of determining remuneration adjustments.

Chapter 5 – Accountability map

Footnotes

[1] The Government enacted legislation to introduce an accountability regime for bank directors and executives (BEAR) for Authorised deposit-taking Institutions (ADIs). The legislative framework imposes heightened obligations and, as recommended by the Royal Commission, will be extended to other industries regulated by APRA via the Financial Accountability Regime (FAR).

[2] The Banking Act 1959, the Insurance Act 1973, the Life Insurance Act 1995, the Private Health Insurance (Prudential Supervision) Act 2015 and the Superannuation Industry (Supervision) Act 1993.

[3] At the time of publication, the Hon. Dr. Jim Chalmers MP has portfolio responsibility for APRA as Treasurer of the Commonwealth of Australia. The Hon. Stephen Jones MP is the Assistant Treasurer and Minister for Financial Services.