Final revised Prudential Standard: APS 111 Capital Adequacy - Measurement of Capital

APRA has today released the final revised Prudential Standard APS 111 Capital Adequacy: Measurement of Capital (APS 111). APS 111 sets out detailed criteria for measuring an ADI’s regulatory capital. The revised APS 111 will come into effect on 1 January 2022.

The key revisions in this update of the Prudential Standard are designed to:

- reinforce financial system resilience, through changes to the capital treatment of an ADI’s equity investments in their banking and insurance subsidiaries;

- promote simple and transparent capital issuance, through the removal of the allowance for the use of special purpose vehicles (SPVs) in regulatory capital issuance; and

- clarify aspects of APS 111, including provision of additional technical information to assist ADIs in issuing capital instruments.

Consultation

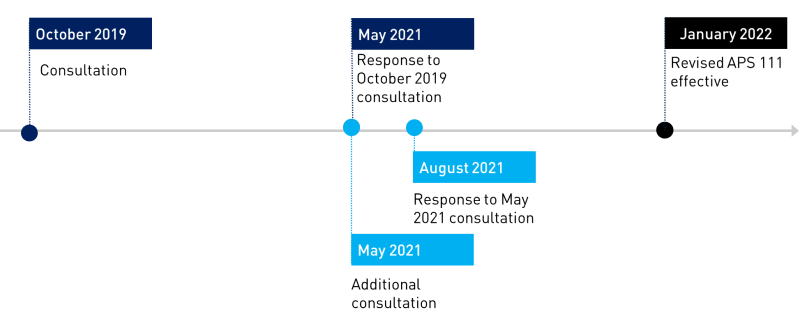

APRA first consulted on proposed revisions to APS 111 in October 2019.1 APRA had planned to finalise APS 111 reforms in 2020, but delayed this to allow ADIs to focus on managing risks associated with COVID-19. APRA received seven submissions to the 2019 consultation.

In May 2021, APRA released a detailed response to issues raised by industry in the 2019 consultation.2 This included final policy positions.

Included in the May 2021 response, APRA also proposed some new minor revisions to APS 111 that were not included in the 2019 consultation. APRA received three submissions to this consultation. This letter sets out APRA’s final policy positions in regard to the issues raised in these final submissions.

APS 111 implementation timeline

Response to May 2021 consultation

In May 2021, APRA proposed some new minor revisions to APS 111. These revisions clarified that Common Equity Tier 1 (CET1) capital would not be permitted to have unusual features that could undermine its role as the highest quality loss absorbing capital, in line with the approach for other capital instruments.

Submissions from industry did not raise concerns regarding this proposal. Some ADIs did, however, request that APRA provide further clarity regarding 'repackaging’ arrangements and the applicability of the revised Prudential Standard to foreign bank branches. On these issues, APRA’s response is provided below:

- Repackaging arrangements: under APS 111, a capital instrument is not eligible for inclusion in Regulatory Capital if it includes ‘repackaging’ arrangements that have the effect of compromising the quality of the capital raised. In response to industry requests for examples of repackaging arrangements, APRA notes these arrangements may occur where an instrument is not marketed in line with its prudential treatment, or if the transaction documentation suggests to investors that the instrument has attributes of a lower level of capital than claimed for in prudential treatment. Repackaging arrangements also occur where a capital instrument is issued to a vehicle which funds itself in another way.

- Foreign ADIs: (foreign bank branches): one submission requested further clarity around the application of APS 111 to foreign ADIs. Consistent with Prudential Standard APS 110 Capital Adequacy, APRA has clarified that APS 111 does not apply to a foreign ADI. As part of APRA’s approach to licensing, APRA will typically review whether foreign ADIs are subject to comparable capital requirements in their home country.

Employee share schemes

During the consultation process, APRA received some queries from ADIs regarding the capital treatment of equity-settled share-based payments granted to employees as part of remuneration schemes. After consideration of these queries, APRA has reverted to the original, clearer requirements in APS 111 in this area. APRA will engage with relevant ADIs to better understand the range of practices and ensure consistent interpretation of these requirements.

Final revised Prudential Standard

The final revised APS 111 will come into effect on 1 January 2022. This letter and the final revised APS 111 are available on APRA’s website at www.apra.gov.au. Attachment A to this letter outlines the steps taken in finalising the revised APS 111, including an assessment of the regulatory impact.

Yours sincerely

John Lonsdale

Deputy Chair

Attachment A: Regulation Impact Analysis

Consistent with the Australian Government Guide to Regulation, APRA has followed a similar process to that required for a Regulation Impact Statement (RIS). APRA’s evaluation of the policy changes to APS 111 is provided below.

APRA has undertaken two rounds of public consultation in revising APS 111 and has also engaged with a variety of stakeholders over a period of 18 months, including individual ADIs, industry associations and other regulatory agencies. As detailed in APRA’s May 2021 and August 2021 responses to submissions, APRA has clarified or amended its proposals in certain areas, following consideration of issues raised by stakeholders.3

In its October 2019 Discussion Paper, APRA set out the problem and why regulatory action was needed.4 APRA initiated the review of APS 111 to ensure that the appropriate capital treatment is applied to an ADI’s equity investments in their banking and insurance subsidiaries and that Australian deposit holders continue to be protected. Over time, APRA has also provided a number of rulings relating to APS 111 and some of these rulings have addressed a lack of clarity in the content of the Prudential Standard. In addition, the Basel Committee on Banking Supervision (Basel Committee) has released updated standards, statements and guidance on capital adequacy measures. APRA’s review of APS 111 is in line with these developments and with the intention of clarifying and simplifying the standard.

The 2019 Discussion Paper also outlined APRA’s preliminary analysis of policy options for APS 111, including the potential impact for industry.5 This Attachment expands on APRA’s initial analysis, taking into account feedback from ADIs during the consultation period.

Assessment of regulatory costs

As part of the consultation process, APRA invited submissions on increases or decreases to regulatory costs incurred as a result of the policy options under consideration. Respondents were invited to use the Australian Government’s Burden Measurement Tool to assess regulatory costs.6

APRA has considered all relevant compliance costs, including administration and substantive compliance costs and delay costs, in estimating the regulatory costs of each option. The consideration of regulatory costs, as reflected in the average annual regulatory costs outlined below, relates to additional compliance costs and does not include costs associated with regulatory capital. The two central options considered, and other alternatives, are presented below.

Option 1: No change to APS 111

Under the first option, there would be no changes to APS 111 and ADIs and other stakeholders would not incur additional compliance costs. There would also be no benefits realised, and so no net benefit.

Annual regulatory costs, averaged over 10 years ($)

Change in costs ($) | Business | Community organisations | Individuals | Total change in costs |

|---|---|---|---|---|

Total by sector | Nil | Nil | Nil | Nil |

Option 2: Revised APS 111

Under the second option, ADIs would incur additional compliance costs. These costs include external legal costs and costs associated with the review of the revised Prudential Standard, capital calculation and reporting, revision of capital instrument terms, consultation responses and compliance plans and controls.

APRA has estimated total industry costs by extrapolating estimates from a sample of ADIs on the cost per hour and the number of hours, and personnel likely to be required to implement the revised Prudential Standard. APRA has summarised the costs in the table below, outlined as annual regulatory costs averaged over 10 years, consistent with standard practice.

APRA considers it likely that the costs to ADIs would be absorbed by business, and would not have an impact on community organisations or individuals.

Annual regulatory costs, averaged over 10 years ($)

Change in costs ($) | Business | Community organisations | Individuals | Total change in costs |

|---|---|---|---|---|

Total by sector | $743,150 | Nil | Nil | $743,150 |

Under option 2, a key policy change is the revised capital treatment of a parent ADI’s equity investments in banking and insurance subsidiaries. APRA’s objective is to reduce the potential risks to Australian deposit holders from large and leveraged equity investments. APRA does not expect this change to materially increase existing capital requirements for the system in aggregate, though the impact will differ across individual ADIs. The costs of higher capital requirements have not been included in the annual regulatory costs, as they are not considered compliance costs.

Option 2 also removes the allowance for the use of SPVs and stapled security structures in regulatory capital issuance. These structures have not been a feature of ADI capital issuance since 2013. While some submissions suggested that the inclusion of SPVs could reduce the additional costs from the Reserve Bank of New Zealand’s (RBNZ’s) proposed changes to its definitions of Additional Tier 1 and Tier 2 capital, these costs have not been included in APRA’s estimates as they relate to RBNZ proposals.

Additional alternative options

In revising APS 111, APRA also considered additional options on key elements of the proposed revisions put forward by industry through consultation. This included a complex option suggested by the major banks, which would retain the use of SPVs in capital issuance programs. APRA’s assessment of this option was detailed in its Response Paper, APRA Response to submissions - APS 111 Capital Adequacy: Measurement of Capital, May 2021.

Assessment of net benefits

There are several net benefits of the proposed amendments to APS 111 (Option 2):

- The Prudential Standard would be clearer and less open to interpretation. The proposed changes are expected to improve the transparency of capital instruments, and assist in their issuance.

- This option also promotes certainty and comparability, which are key elements in the measurement and assessment of capital adequacy across all ADIs. Peer group comparisons with banks in other jurisdictions is also enhanced since regulators in these jurisdictions are also likely to take account of the Basel Committee’s standards, statements and guidance.

- A benefit of the proposed changes to the capital treatment of equity investments in banking and insurance subsidiaries under Option 2 is that it mitigates domestic risks, reinforces ‘unquestionably strong’ capital targets at Level 1, and enhances financial stability.

Conclusion: comparison of policy options

When developing policy, APRA is required to balance the objectives of financial safety and efficiency, competition, contestability and competitive neutrality, while promoting financial system stability in Australia. APRA considers that, on balance, Option 2 will enhance prudential outcomes, improve financial safety and promote financial system stability in Australia.7 As demonstrated in the table below, Option 2 generates a net benefit.

| Option 1 | Option 2 | Additional alternative options |

|---|---|---|---|

Regulatory costs | No change | Low to moderate compliance costs | Low to moderate compliance costs |

Promotion of simple and transparent capital issuance | Does not meet this criterion | Meets this criterion | Does not meet this criterion |

Clarification and simplification of standard | Does not meet this criterion | Meets this criterion | Does not meet this criterion |

Inclusion of international standards, statements and guidance on capital adequacy measures | Does not meet this criterion | Meets this criterion | Does not meet this criterion |

Protection of Australian deposit holders when ADIs hold significant investments in subsidiaries | Partly meets this criterion | Meets this criterion | Meets this criterion |

Overall | Moderate net costs | Moderate net benefit | Low benefit |

Review

As delegated legislation, prudential standards impose enforceable obligations on APRA-regulated institutions. APRA monitors ongoing compliance with its prudential framework as part of its supervisory activities. APRA has a range of remedial powers available for non-compliance with a prudential standard, including issuing a direction requiring compliance, the breach of which is a criminal offence. Other actions include imposing a condition on an APRA-regulated institution’s authority to carry on its business or increasing regulatory capital requirements.

Under APRA’s policy development process, reviews of new measures are typically scheduled following implementation. Such a review would consider whether the requirements continue to reflect good practice, remain consistent with international standards, and remain relevant and effective in facilitating sound risk management practices. APRA will also take action within a shorter timeframe where there is a demonstrable need to amend a prudential requirement.

Footnotes

1APRA Discussion paper - Revisions to APS 111 Capital Adequacy: Measurement of Capital, October 2019

2APRA Response to submissions - APS 111 Capital Adequacy: Measurement of Capital, May 2021

3 Executive Summary, Chapter 1 – Introduction and Chapter 2 – Response to consultation, APRA Response to submissions - APS 111 Capital Adequacy: Measurement of Capital, May 2021

4 Executive Summary and Chapter 1 – Introduction, APRA Discussion paper - Revisions to APS 111 Capital Adequacy: Measurement of Capital, October 2019

5 Attachment A – Policy options and estimated comparative net benefits, APRA Discussion paper - Revisions to APS 111 Capital Adequacy: Measurement of Capital, October 2019

6 This tool calculates the compliance costs of regulatory proposals on business, individuals and community organisations using an activity-based costing methodology. The tool is designed to capture the relevant costs in a structured way, including a separate assessment of upfront costs and ongoing costs. It is available at: https://rbm.obpr.gov.au/home.aspx

7 Chapter 1 – Introduction, 1.2 Balancing APRA’s objectives, APRA Discussion paper - Revisions to APS 111 Capital Adequacy: Measurement of Capital, October 2019