Enhancements for Superannuation Data Collections consultation response

To: All Registrable Superannuation Entity licensees

This letter sets out the Australian Prudential Regulation Authority’s (APRA) response to feedback received on the proposed enhancements to its superannuation data collection relating to Registrable Superannuation Entity (RSE) licensee profile, RSE profile and Investments. APRA consulted on proposals for enhancements to the data collections for these topics in November 2023 (‘Discussion Paper’).

This letter also sets out APRA’s final position and follows APRA’s response to the consultation proposals for indirect investment costs and RSE licensee financial statements on 20 September 2024. The marked up and final versions of the reporting standards accompany this letter.

Aim of enhanced collections

APRA proposed enhancements to APRA’s data collections in respect of:

- RSE licensee profile: to enhance current reporting on the business model and structure of the RSE licensee board and board committees to gain a comprehensive understanding of the governance practices and effectiveness of superannuation trustees.

- RSE profile: to complete the data model for RSE’s business operations, including reporting on specific product distribution arrangements between RSEs and intermediaries such as employer sponsors and promoters, and to enable the establishment of concepts to support future reporting (for example, on defined benefit sub-funds).

- Investments: to address a key gap in APRA’s current collections to inform assessments of the governance of, and exposures to, liquidity and valuation risk; and to rationalise Australian Bureau of Statistics (ABS) reporting standards on investments to meet the needs of both APRA and ABS.

Consultation feedback

Consultation closed on 31 March 2024, with nine written submissions received in response to the proposals. APRA held two roundtables and met with industry working groups and, upon request, with individual superannuation industry stakeholders and RSE licensees.

Submissions were generally supportive of the proposals to enhance the superannuation data collection, however RSE licensees provided feedback on the proposed implementation of the new reporting proposals and specific areas of the proposed RSE licensee profile, RSE profile and Investments reporting. In particular, feedback covered timing and implementation expectations, data availability and materiality thresholds, and requested further clarification on specific reporting requirements.

APRA has included a summary of the key feedback and APRA’s response for the superannuation data collection consultation in Appendix 1.

Following review of the feedback, APRA has made substantial revisions to parts of the data collection, including reducing and simplifying reporting requirements for certain components of the Investments data collection and provided clarity on implementation requirements.

A summary table of final positions with any changes to the reporting standards proposed in response to feedback raised is in Appendix 2.

APRA has also included the final and marked up versions of the reporting standards as attachments to this letter (Attachments A to J), as well as a summary of all reporting tables, together with a mapping of any equivalent data concepts currently reported to APRA (Attachment K).

Next steps

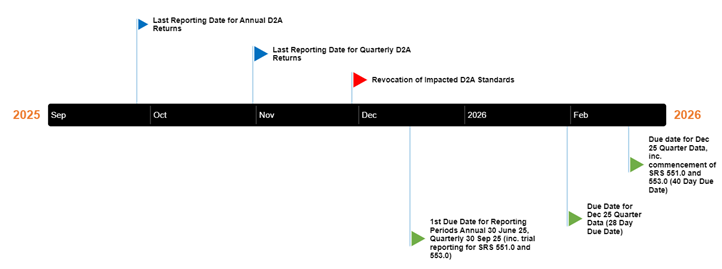

APRA intends to determine the reporting standards in early 2025 and release the accompanying APRA Connect taxonomy artefacts by early 2025. The first reporting period will be 30 June 2025 for annual reporting and September 2025 for quarterly reporting, with the first submissions in respect of all new reporting due December 2025. Refer to Appendix 3 for the timeline for initial reporting under new reporting standards and the final reporting period for the seven predecessor reporting standards which will be revoked.

APRA intends to consult in 2025 on the confidentiality and publication proposals for all new and revised reporting requirements finalised in both this response, and APRA’s September 2024 response to the consultation proposals for indirect investment costs and RSE licensee financial statements. APRA acknowledges concerns raised in submissions on the need to consider competitive neutrality when developing the publications for this data to avoid Australian superannuation funds being at a competitive disadvantage. APRA will consider competitive neutrality in developing publication proposals, noting that many of the collections noted as areas of concern are primarily for prudential purposes rather than addressing transparency, as noted in the discussion paper.

If you have any questions, please contact DataAnalytics@apra.gov.au.

Yours sincerely,

Megan Fenner

General Manager, Superannuation

Appendix 1 – Summary of key feedback and APRA’s response

Implementation timing

Feedback

Submissions sought to confirm that APRA would provide at least 12 months from the finalisation of the reporting standard to the first reporting due date, with a preference for APRA to release the APRA Connect taxonomy artefacts at the same time, to ensure that RSE licensees can build strategic reporting solutions and submit accurate reporting.

Stakeholders also requested that APRA provide a clear timeframe for when APRA will revoke predecessor APRA reporting standards that will be replaced with the new reporting standards, to enable planning and reduce reporting burden.

APRA’s response

APRA has set the first due date for new collections in December 2025, and will release the APRA Connect taxonomy in early 2025.

In response to industry feedback on the complexity of the liquidity and valuations requirements, APRA has delayed the implementation date. To test progress towards implementation, APRA requests that RSE licensees submit a trial set of reporting for SRS 551.0 Liquidity and SRS 553.0 Investment Exposure Concentrations and Valuations for the 30 September 2025 quarter, due on 15 December 2025. The first reporting period under the reporting standards is the 31 December 2025 quarter, due on 9 February 2026. APRA expects all RSE licensees to submit complete and high-quality data for the reporting period ending 31 December 2025 and for all subsequent reporting periods. Refer to Appendix 3 for APRA’s expectations on the trial reporting.

APRA intends to revoke seven existing reporting standards currently reported via Direct to APRA (D2A) by late 2025 prior to the first submission date for the new standards. Refer to Appendix 3 for the timeline for initial reporting under new reporting standards and final reporting under the reporting standards to be revoked.

Ad-hoc reporting timing

Feedback

Some stakeholders noted timing challenges in relation to ad hoc reporting required for changes to other directorships held by RSE licensee directors within 28 days of a change.

Response

In relation to ad hoc reporting, APRA will amend the timing to align the required timing to be comparable with other reporting standards, so that for any quarter which does not coincide with the RSE licensee’s financial year end, reporting will be required within 28 calendar days after the end of the calendar quarter in which the change occurred. For changes that occur in calendar quarters that coincide with the financial year end of the RSE licensee, reporting is required within 3 months of the end of the relevant reporting period.

RSE licensee profile directorship reporting requirements

Feedback

Some submissions requested clarification on reporting requirements for RSE licensee ownership and directors’ other board and employment commitments, as well as instructions where available data fields do not match existing structures within the RSE licensees’ business.

Stakeholders also noted that reporting data for the year ending June 2025 would be challenging for new reporting on RSE licensee directors as the requirements are being finalised partway through the financial year.

Submissions questioned whether reporting requirements about RSE licensee directors could be reduced through data sharing across other APRA collections such as Financial Accountability Regime (FAR) reporting or through inter-agency data sharing. Stakeholders also noted that the proposed threshold test for reporting RSE licensee directors’ other employment based on income would be challenging to report.

Submissions emphasised the sensitive nature of some of the data related to directors and the need for appropriate data governance.

Response

APRA will amend the first year’s reporting requirement of RSE licensee directors’ ‘other employment’ and ‘other directorships’ to capture only the other directorships and employment in place as at the end of the reporting period, rather than for the full financial year for the reporting period.

APRA notes that there is minimal overlap between data fields with the FAR reporting. APRA investigated the possibility of inter-agency data sharing in respect of RSE licensee director data, however infrastructure capability to enable this does not currently exist. APRA has revised the reporting standard to remove the reference to income as one of the threshold elements that require reporting of RSE licensee directors’ other employment.

APRA is bound by the Privacy Act 1988 (Privacy Act) and the Australian Government Agencies Privacy Code 2018 (Privacy Code). This includes a Privacy Impact Assessment (PIA) process to assess the potential impacts that initiatives such as this reporting on director’s other board and employment commitments may have on the privacy of individuals involved. As part of this PIA process, a compliance assessment is conducted against the 13 Australian Privacy Principles (APPs). APRA will consult on confidentiality and publications in 2025. APRA will consider the classification of data as personal information in developing any publication proposals.

RSE structure and business model

Feedback

Submissions sought clarification on APRA’s definitions of sub-funds and promoter arrangements, and which reporting tables should be completed for different distribution arrangements. Stakeholders also noted potential reporting burden resulting from the requirement for quarterly reporting of some data tables, design of the RSE sub-fund tables and availability of certain data items such as standard employer-sponsor industry details.

Response

In response, APRA has substantially redesigned the reporting standard in relation to data on sub-funds to simplify the collection of information on promoter and standard employer-sponsor arrangements. APRA has also refined the data collection on defined benefit sub-funds to enable reporting currently provided in D2A collections under Reporting Standard SRS 001.0 Profile and Structure (Baseline) and Reporting Standard SRS 601.0 Profile and Structure (RSE) to be captured within APRA Connect. APRA acknowledges industry issues raised around reporting timing and data availability and has amended the reporting frequency on three reporting tables from quarterly to annual reporting, as well as removed the reporting requirement on standard employer-sponsor industry type.

APRA has revised the reporting tables and corresponding definitions for Lifecycle investment options based on industry feedback. As an alternative to requiring ad hoc reporting, APRA has revised the reporting frequency on Lifecycle investment options from annual to quarterly reporting.

Materiality for liquidity and valuations reporting

Feedback

Feedback indicated the proposed scope of collection would result in the reporting of a large number of investment options with immaterial balances. Submissions provided suggestions on the proposed materiality threshold for listed exposures and requested that a materiality threshold be applied to the reporting for unlisted exposures.

Response

APRA has aligned the collection of granular data to the level of detailed information that APRA expects RSE licensees should be monitoring. A materiality threshold of $50 million has been introduced for investment option liquidity reporting. Reporting for most tables has been limited to internally managed investment options only.

In relation to reporting investment exposures and valuations, APRA has applied a materiality threshold based on the largest 20 exposures of the RSE and any other exposures greater than half a percent of the RSE’s total investments. In response to industry feedback, this threshold applies to both listed (as originally proposed by APRA) and unlisted exposures to reduce administrative burden on industry while still reporting the material exposures to APRA.

Data availability for liquidity and valuations reporting

Feedback

Submissions noted that RSE licensees do not assess and monitor liquidity at the same level as the proposed collection, particularly in relation to externally managed investment options.

Submissions noted challenges with obtaining some data from third parties (e.g. custodians and external investment managers) at the proposed level of granularity, particularly for platform products and externally managed investments. Some stakeholders noted that areas of the proposed data collection included reporting that could require RSE licensees to seek potentially commercially sensitive information from investment managers that could place RSE licensees at a competitive disadvantage against those global and domestic investment funds which are not subject to the same reporting requirements.

Submissions outlined that:

- the proposed reporting on liquidity event trigger metrics and indicators did not align to the range of approaches taken by RSE licensees in monitoring liquidity, and the reporting would be overly complex;

- the concepts of internally managed and externally managed investments are a better fit with the approach RSE licensees take to managing investments and available associated data, than the concepts of directly held and indirectly held as proposed by APRA;

- RSE licensees do not separately monitor the liquidity of investment options by Accumulation and Transition to Retirement phases, but rather group them into taxed and untaxed pools;

- RSE licensees do not assess liquidity using the same level of detail as the proposed SRF 550.0 Asset Allocation contained in Reporting Standard SRS 550.0 Asset Allocation; and

- submissions indicated that the fair value hierarchy of investments within a superannuation fund’s annual financial report is not available on a look-through asset class basis, and is only available annually.

Submissions also requested that APRA clarify the reportable exposure for reporting on valuations and when ‘look-through’ should be applied, noting that limited data is available to trustees on detailed valuations approaches for externally managed investments.

Response

APRA has reduced the reporting requirements such that most tables are to be completed for internally managed investment options only. APRA notes that this position may be revisited at a later stage for some parts of the collection, for example, based on learnings from APRA’s ongoing supervisory focus on investment governance concerns.

The tables have been adjusted to align with the concepts of internally and externally managed and APRA has provided additional guidance on the reportable exposure. The mapping to product phase has been replaced with taxation status, and the mapping of liquidity values to detailed asset class characteristics has been replaced by a smaller list of characteristics to be reported.

APRA has significantly simplified the reporting of liquidity event metrics and indicators into one table by removing the numerical measures and only requiring entities to report what type of metrics are monitored, and indicate if a trigger is triggered, without providing specific numerical data. APRA also aligned the collection to include metric types suggested in submissions and observed as part of the pilot data collection. The reporting frequency for the proposed SRF 551.2 Table 1 contained in Reporting Standard SRS 551.0 Liquidity has been changed from quarterly to annual and ad-hoc, if a breach has taken place.

APRA has removed the fair value hierarchy reporting requirement. APRA notes that this position may be revisited at a later stage.

APRA acknowledges that the data collection will require the industry to build new reporting processes to submit reporting to APRA. However, APRA’s expectation is that with the amendments following consultation, the data required is aligned with the requirements of Prudential Standard SPS 530 Investment Governance (SPS 530) and reflects data already required for prudent investment governance.

Liquidity stress test scenario

Feedback

APRA proposed that RSE licensees report the measures of liquidity supply and demand in respect of each calendar quarter as well as under the RSE licensee’s worst case liquidity stress scenario.

Stakeholders raised concerns that the lack of specificity with respect to stress testing could lead to potential inconsistencies in reporting due to differences in interpretation and application. Submissions recommended APRA provide guidance on defining the ‘worst-case stress test scenario’, including requests to specify a historic market event that all RSE licensees should include and guidance for calculation methodology.

Submissions also noted that RSE licensees can apply different methodologies to calculate and report the ‘Redeemable for Cash’ timeframe for liquidity. The time to liquidate a large holding or whole asset may be longer than a small proportion of the holding. The period with which these can be liquidated would also depend on the size of haircut that a RSE licensee would be willing to accept.

Response

APRA has clarified the definition of ‘worst case liquidity stress test scenario’ as the ‘extreme but plausible scenario from stress testing’. It is not a reference to the type of reverse stress testing that an RSE licensee may undertake to identify the extreme scenarios that could trigger a liquidity event.

APRA has also clarified that the RSE licensees’ own methodology should be used for reporting the timeframe for ‘Redeemable for cash’, taking into account how much can be reasonably redeemed for cash at or near carrying value given daily trading volume.

While APRA acknowledges that this approach may limit comparability of data across entities, APRA intends to use these parts of the collection to monitor changes in individual entities’ reporting and analyse the likely impacts for individual entities’ portfolios.

Order of asset liquidation

Feedback

APRA proposed to capture information on RSE licensees’ planned order of liquidation of assets that demonstrates their liquidity action plan in a liquidity event. Submissions indicated that the proposed security level granularity is not aligned with RSE licensees’ internal approach. It was suggested that APRA consider reporting at a less granular portfolio level such as strategic asset class, listing and domicile level and relevant asset class characteristics for cash and fixed income.

Response

APRA has amended the tables to replace security level data with strategic asset class level, along with a reduced list of cash and fixed income characteristics to be reported where applicable.

APRA will not require regular reporting for this collection, however RSEs will need to be prepared to report on this collection when notified by APRA. APRA’s intent is for this reporting to form part of a crisis collection, however APRA may test RSE licensees’ ability to report this data from time to time to ensure the reporting process is robust.

Derivative transactions

Feedback

Stakeholders noted they would have difficulty reporting derivative transactions on the basis required by the ABS for the compilation of the Australian National Accounts and other publications. Submissions also raised concerns that the reporting of gross positive and gross negative under different scenarios is unclear and worked examples are needed.

Response

APRA revised the tables in close consultation with custodians and the ABS, to accommodate data availability limitations faced by custodians while balancing the requirements to satisfy ABS reporting. APRA will provide worked examples to assist entities and custodians in completing the tables.

Appendix 2 – Summary of final positions and proposed changes to reporting standards

| APRA Response / Action | Key reporting standard changes |

|---|---|

RSE Licensee Profile - ownership Updated instructions in the reporting standard to clarify requirements that no look through to ownership of RSE licensee shareholders is required. | SRF 604.0 Table 2

|

RSE Licensee Profile – Board Composition Revised reporting requirements for ad hoc reporting and clarified expectations for the first reporting period. Revised reporting requirements for RSE licensee directors’ other employment commitments. | SRF 604.0 Table 3a and 3c

|

RSE Licensee Profile – Board Committees Updated instructions in the reporting standard to further clarify requirements in respect of Group structures and Committee types. | SRF 604.0 Table 4 and 5

|

RSE profile – Business Model Refined the reporting standards by simplifying and reducing the data collection on sub-funds and updating reporting instructions to clarify requirements. Revised reporting frequency from quarterly to annual for reporting tables SRF 605.0 Table 5 (annual, ad hoc) and SRF 607.0. Table 1A and 1B. | SRF 605.0 Table 4: data fields added to capture ‘Intermediary type’. SRF 605.0 Table 5: redesigned for defined benefit sub-funds only. SRF 606.0 Table 5: removed as not required. SRF 606.1 Table 2: data field added to capture defined benefit sub-fund identifiers. SRF 607.0 Table 1A and 1B: redesigned. SRF 607.0 Table 1C: removed as not required. SRF 251.4: Renamed reporting form and table. Added ‘Date of change” for reporting changes to insurance table arrangements. |

RSE profile – Lifecycle Investment Options Refined the reporting standard to reflect industry feedback on the labels and definitions that accurately describe different lifecycle product designs offered by RSEs. Revised reporting frequency from annual to quarterly for reporting tables SRF 607.0 Table 4 and 5. | SRF 607.0 Table 4: revisions to enumeration lists. SRF 607.0 Table 5: redesigned data fields to be reported. |

Liquidity – Materiality and Scope Updated instructions and definitions to provide additional guidance. Adjusted reporting requirements to reduce burden for reporting externally managed investments. | Introduced a $50 million materiality threshold for investment option reporting and excluded certain types of investments from reporting. Added Appendix A to identify tables where only internally managed investments options are required to be reported. |

Liquidity - Supply Enhanced instructions to clarify requirements. Removed asset class characteristic fields and Level 3 Fair Value Hierarchy reporting criteria to simplify reporting. | SRF 551.0 Table 1, 2, 3 and 4

|

Liquidity - Demand Replaced Product Phase with taxation status. Separated the member cash flows and investment cash flows into different tables and amended the relevant cash flow types. Renamed the investment flows tables to Investment Calls On Liquidity, to reflect the reported flows are a subset of all investment cash flows. | SRF 551.1 Table 1 and 3:

SRF 551.1 Table 2 and 4:

SRF 551.1 Table 5

SRF 551.1 Table 6:

|

Liquidity – Liquidity Event Trigger Metrics or Indicators Adjusted the list of enumerations based on feedback and observations of reported items in pilot data collection. Reduced reporting frequency of SRF 551.2 Table 1 from quarterly to annual and ad-hoc. | SRF 551.2 Table 1:

|

Liquidity – Estimated Order of Asset Liquidation Under Liquidity Stress Conditions Elevated reporting to strategic asset level. Replaced detailed asset class characteristics with limited cash and fixed income characteristics list. Mapping to the asset class characteristics reported in SRS 550.0 provided in Appendix B. | SRF 551.3 Table 1:

|

Investment Exposure Concentrations and Valuations - reportable exposures Provided guidance on the reportable exposures in Appendix. Identified tables where only internally managed investment options are required to be reported. Increased reporting due date to 40 calendar days after end of reporting period. | Added definition of internally managed investment, externally managed investment, internally managed investment option and externally managed investment option in SRS 101.0. Restructured tables according to internally managed investments and externally managed investments. |

Investment Exposure Concentrations and Valuations - listed investments Raised the materiality threshold to reduce volume of reporting. Updated instructions to clarify reporting requirements. Removed detailed asset class characteristics fields. | SRF 553.0 Table 1

SRF 553.0 Table 2

|

Investment Exposure Concentrations and Valuations - unlisted investments Updated instructions to clarify reporting requirements. Introduced a materiality threshold to reduce volume of reporting. Introduced a materiality threshold of the top 3 investments for SRF 553.1 Table 3. Removed Level 3 Fair Value Hierarchy reporting criteria. | SRF 553.1 Table 1

SRF 553.1 Table 2

SRF 553.1 Table 3

|

Investment Exposure Concentrations and Valuations - investment option and country exposures Reduced reporting to investment option only in Table 1. Removed investment vehicle exposure table. Consolidated collection of country information (previously proposed in other tables) into Table 2. | SRF 553.2 Table 1

SRF 553.2 Table 2

|

Investment Exposure Concentrations and Valuations - valuations Removed proposed Fair Value Hierarchy data fields from table. Removed previous SRS 553.3 Table 3 Investment Option Valuation Approach. Moved the collection of investment option level details to SRS 605.1 Table 1.

| SRF 553.3 Table 1:

SRF 553.3 Table 2:

SRF 553.3 Table 3:

SRF 553.3 Table 4:

|

Securities Subject to Repurchase and Resale and Securities Lending and Borrowing Separated the reporting of counterparty and collateral, from the reporting of counterparty and securities. Updated reporting instructions to clarify requirements. | SRF 552.0 Table 1

SRF 552.0 Table 2

SRF 552.0 Table 3

SRF 552.0 Table 4

|

Derivative Transactions Updated instructions to clarify requirements for gross reporting basis. | SRF 550.3 Table 1

SRF 550.4 Table 1

SRF 550.3 Table 2

|

Appendix 3 – Timeline for new reporting standards and revocations

Following is the timeline for APRA to revoke seven existing reporting standards currently reported via D2A prior to the first submission date for the new standards. This timeline outlines only one period of parallel reporting in both D2A and APRA Connect for collections replacing existing D2A reporting standards.

| D2A Reporting Standards to be revoked | APRA Connect Reporting Standard replacing predecessor reporting |

|---|---|

| SRS 531.0 Investment Flows | N/A |

| SRS 532.0 Investment Exposure Concentrations | SRS 553.0 |

| SRS 535.0 Securities Lending | SRS 552.0 |

| SRS 600.0 Profile and Structure (RSE) Licensee | SRS 604.0 |

| SRS 601.0 Profile and Structure (RSE) | SRS 607.0 |

| SRS 721 ABS Securities Subject to Repurchase and Resale and Stock Lending and Borrowing | SRS 552.0 |

| SRS 722 ABS Derivatives Schedule | SRS 550.0 |

Liquidity and valuations implementation

For SRS 551.0 and SRS 553.0, APRA expects RSE licensees to:

- Submit trial reporting for the reporting period ending 30 September 2025 on a best endeavours basis. The trial will primarily serve to test progress towards implementation prior to the need for formal controls and sign offs, and as a basis for APRA to conduct exploratory data quality to inform the December quarter reporting.

- Submit complete and high-quality data for the reporting period ending 31 December 2025 and for all subsequent reporting periods.

Trial reporting

| First formal reporting period | |

|---|---|---|

| Reporting Period | Quarter ending 30 Sep 2025 | Quarter ending 31 Dec 2025 |

| Due Date | 15 Dec 2025 | 9 Feb 2026 |

| Expected level of compliance with the reporting standards | Best endeavours | Complete |

| May use test systems | Yes | No |

| Completeness of data sets | Complete data required but may not be reconciled | Complete, reconciled data |

| Signed off by accountable executive | No | Yes |