Discussion Paper: Superannuation Data Transformation Phase 1

7 November 2019

Executive summary

Australia’s superannuation system is a large, growing and important sector within the financial system and plays an important role supporting members in retirement. In fulfilling its function, the superannuation industry manages the most significant financial asset for many individual Australians.

The industry’s increasing size, complexity and importance to the economy and to everyday Australians brings with it an increase in the scrutiny and expectation placed upon industry participants delivering in their role. Accurate and comparable data on the superannuation industry is essential to enable appropriate regulatory oversight, and transparency and accountability for Registrable Superannuation Entity (RSE) Licensees.

Over 2013 and 2014, APRA introduced new superannuation reporting standards which substantially increased the data on the superannuation industry available to APRA and for publication. This access to better data has enhanced APRA’s ability to supervise, and evaluate the performance of and outcomes being delivered by RSE licensees. It also enabled enhanced transparency and disclosure on the operation of the industry for other stakeholders.

APRA is now undertaking a significant program of work to transform the superannuation data collection and publications (the ‘Superannuation Data Transformation’). This work will support achievement of APRA’s corporate plan objectives, with specific focus on improving outcomes for superannuation members where significant work is already well underway.

Through enhancements to its prudential framework1, supported by greater intensity of supervision in those areas of the industry that are underperforming, APRA aims to improve outcomes for members in both MySuper and choice products. This will be further supported by greater transparency on outcomes for members, including through the publication of heatmaps providing insights on RSE performance assessments in key areas.

It is clear, however, that the existing superannuation data collection does not provide the depth and breadth of data needed to adequately assess all aspects of the industry’s operations or to track progress of RSE licensees in improving outcomes for their members. Improving visibility of product-level and investment option-level data beyond MySuper products is required, in addition to more granular and comparable reporting on fees, costs, expenses and returns. Addressing these gaps will be a key focus for early stages of work on the Superannuation Data Transformation.

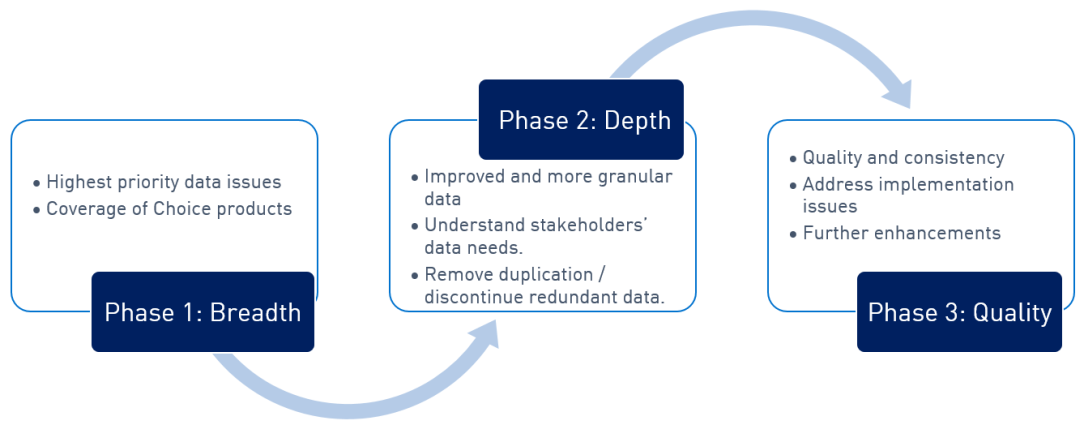

As the Superannuation Data Transformation is broad in scope, APRA has divided this work into three phases:

- Phase 1 - Breadth - will address the most urgent data gaps required to support APRA, the industry and other stakeholders in assessing member outcomes and industry operations and performance. A key area of improvement for Phase 1 will be to boost coverage of the data collected for the superannuation industry, particularly to include all choice products and investment options. Other areas of improvement include expense reporting, member demographics and asset allocation classifications.

- Phase 2 - Depth - will have a wide scope to explore new and better approaches to data reporting, across all areas of RSE licensee operations, including governance and risk management. Taking advantage of APRA’s new data capabilities2, a key outcome from Phase 2 will be to improve the granularity of the superannuation data collection and explore different types and methods of collecting data in addressing the data needs of APRA, the industry and other stakeholders.

- Phase 3 - Quality - the final stage of the Superannuation Data Transformation will be to assess the quality and consistency of data reported in Phases 1 and 2 and review and address any implementation issues.

The Superannuation Data Transformation will greatly enhance the information that is reported to APRA by RSE licensees and support the industry and other key stakeholders in understanding the drivers of and outcomes provided for members, as well as provide additional insights into the operations of the industry, including governance and risk management practices.

APRA intends to use this improved data to inform its own prudential activities, gain deeper insight into fund operations and strengthen its oversight of the industry. This will in turn support the work APRA is doing to improve outcomes for superannuation members and increase its supervisory intensity on areas of the industry that are underperforming or where improvements in practices are needed.

1 SPS 515 Strategic Planning and Member Outcomes (SPS 515)

2 APRA is carrying out a data modernisation program designed to ensure APRA keeps pace with advances in data, analytics and technology. More information on this program of work is available here.

Chapter 1 – Background, scope and objectives

1.1 Background

Over the last decade, the superannuation industry has grown in size and importance in the Australian economy, with total assets of superannuation entities increasing from $1.1 trillion to $2.9 trillion in assets. The evolution of the superannuation system has been accompanied by continued consolidation of RSE licensees and RSEs, with large and more complex entities managing the retirement benefits of most Australians. In this context it is critical that regulators and other stakeholders have access to data that appropriately reflects the size, nature and complexity of the industry.

The superannuation data collection last underwent significant change in 2013 and 2014, following the review into the governance, efficiency, structure and operation of Australia’s superannuation system, referred to as Stronger Super3. The evolution of the industry, and changes to its regulatory framework, since then have highlighted areas where APRA’s data collection requires enhancement. APRA has also been increasing its focus on outcomes to members, and increasing its supervisory intensity on areas of the industry that are underperforming or where improvements in practices are needed. This has also identified areas where more comprehensive, consistent and granular data is needed.

Some of the more recent regulatory changes include amendments to the SIS Act through Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation Measures No. 1) Act 2019 (IAMOIS Act), which were made in April 2019 and require an RSE licensee to undertake an annual outcomes assessment for each of its choice and MySuper products, and to publish the assessment on the trustee’s website. The IAMOIS Act also amends APRA’s powers to collect fund expenses data on a look-through basis, which will enable APRA to gain a more complete picture of expenses relating to the management and operations of RSE licensees and their RSEs.

APRA’s heightened focus on outcomes to members has been strengthened by the introduction of Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515). This includes requirements for RSE licensees to undertake an annual Business Performance Review (BPR), which is a broad assessment of an RSE licensee’s performance against its strategic objectives, and is informed by the outcomes assessment required under the SIS Act. The Superannuation Data Transformation will support implementation of these requirements.

APRA is also working closely with other regulators, such as the Australian Taxation Office (ATO) and the Australian Securities and Investments Commission (ASIC) to ensure changes to the superannuation data collection will also support their data needs in relation to superannuation, and to put in place data sharing arrangements to reduce burden on industry under the principle of ‘collect once and share’. APRA is also liaising with ASIC to ensure that the new reporting framework complements fee and cost disclosure guidance provided in ASIC Regulatory Guide 97: Disclosing fees and costs in PDSs and periodic statements.

Any further legislative amendments will be considered throughout the course of this consultation and amendments made to APRA’s proposed data collection will be made where necessary to support their implementation.

1.2 Objectives of the Superannuation Data Transformation

The Superannuation Data Transformation will support APRA in its overarching objective for the superannuation industry to be a mature, competitive and transparent industry, comprised of well-governed, resilient and efficiently operated funds which deliver quality outcomes for members to and through retirement.

In carrying out the Superannuation Data Transformation, APRA is seeking to:

- Improve the suite of data that supports APRA’s prudential supervision;

- Improve the ability of industry to assess and compare their operations, performance and outcomes for superannuation members; and

- Improve the ability of other stakeholders in the superannuation industry (such as other regulators and policy makers) to make informed, data-enabled decisions.

As part of the project, APRA will also improve the efficiency and effectiveness of how APRA collects data for the superannuation industry.

A key element underpinning these objectives is transparency. A transparent industry enables stakeholders to hold RSE licensees accountable for their performance and meaningful comparisons and analysis to be undertaken, and requires consistent, reliable and granular data.

1.3 Scope of the Superannuation Data Transformation

The Superannuation Data Transformation has a broad scope to consider the complete suite of data needed to support APRA’s prudential supervision and the needs of other industry stakeholders, including other regulators. This includes but is not limited to data supporting the assessment of outcomes for superannuation members, the performance and efficiency of the industry, governance, risk management practices, fund operations and industry risks. The review will include consideration of all current reporting standards as well as the introduction of new reporting standards to support achievement of these goals and address gaps in the current data collection. A detailed list of the current suite of Reporting Standards is set out in Appendix I.

The Superannuation Data Transformation will cover all APRA-regulated RSE licensees as well as Exempt Public Sector Schemes, who are not regulated by APRA, but agree to report data in accordance with APRA’s reporting standards.

The Superannuation Data Transformation is a significant undertaking. APRA will undertake the review in three phases:

Phase 1 (late 2019 – mid 2020) | Phase 2 (2020 – 2021) | Phase 3 (2021- mid 2022) |

|---|---|---|

|

|

|

Overview of Consultation Approach

To facilitate stakeholder engagement on each of the topics included in Phase 1, proposals for each topic will be released for consultation separately in targeted ‘Topic Papers’ with a series of questions on specific areas where feedback is sought.

The first Topic Paper covers the structure and profile of RSEs and accompanies the release of this Discussion Paper. The remaining papers for Phase 1 of the Superannuation Data Transformation will be released over the coming months.

APRA recognises that implementing new data collections takes time and has varied impacts on RSE licensees in the industry. To assist in understanding and balancing these impacts, and enabling timely feedback, consultations with industry will occur in a staged way throughout the three phases of the Superannuation Data Transformation. APRA will also consult with industry stakeholders through a range of different methods, including formal consultation and industry roundtables, to enable ongoing engagement throughout the project.

3The Stronger Super reforms were introduced to implement recommendations of the Review into the governance, efficiency, structure and operation of Australia's superannuation system (2010) chaired by Jeremy Cooper (the Cooper Review).

Chapter 2 - Superannuation data

This chapter discusses the suite of data that is currently available on the superannuation industry, sets out some international comparisons, and outlines some key data gaps and challenges to be addressed to achieve the objectives of the Superannuation Data Transformation.

2.1 Current APRA data collection

APRA has broad data collection powers under the Financial Sector (Collection of Data) Act 2001 (FSCODA) and has determined a number of reporting standards under that Act to require submission of specific data from RSE licensees. This data is used to support APRA’s prudential supervision of these entities, to support policy making by Government and for publication to improve transparency on the industry for a wide range of stakeholders.

APRA’s current suite of superannuation reporting standards encompasses 44 reporting forms;

- 9 are collected on an ad-hoc or annual basis;

- 22 are collected on an annual basis only;

- 7 are collected on a quarterly and annual basis, and;

- 6 are collected on a quarterly basis only.

As well as APRA’s primary role as prudential regulator of the financial system, APRA has an additional role to act as a national data collection agency for the financial sector. In this capacity, 3 of the 44 reporting forms outlined above are collected by APRA on behalf of the Australian Bureau of Statistics (ABS). APRA also collaborates closely with other agencies such as the Australian Taxation Office (ATO) and ASIC to collect data on behalf of these agencies or share reported data.

The data collection relating to MySuper products has seen improvements in quality and reliability over time. APRA is largely satisfied with the breadth and depth of most of the MySuper data collection, but there are some areas of that require enhancement. However there is a need to significantly upgrade the scope and granularity of reporting for choice products and investment options, to improve the visibility of performance and outcomes across the whole of the superannuation industry.

2.2 Key gaps and challenges

A significant volume of data on the superannuation industry is already available, but there are important gaps in coverage and quality that need to be addressed in order to enable deeper insights on RSE licensee operations and provide a better understanding of their effectiveness and the outcomes being delivered to their members.

A key focus for Phase 1 of the Superannuation Data Transformation is to address coverage issues with the current data collection, to support industry to implement the requirements of SPS 515 and support APRA’s work to improve transparency on RSE licensee and RSE performance. In particular, Phase 1 of the Superannuation Data Transformation will facilitate performance assessments for choice products and more granular performance assessment for MySuper products in key areas, such as expenses.

The reporting standards and requirements resulting from Stronger Super in 2013 were a significant upgrade to both the breadth and depth of data collected on the superannuation industry, resulting in a ten-fold increase in the amount of data collected at the time. To reduce burden and promote efficiency, APRA aligned these reporting obligations to accounting standard requirements. This has resulted at times in reporting which is not meaningfully categorised and inconsistent across different funds, in part due to limitations on look-through reporting on all expenses. This review will address these issues.

In the Review of APRA’s 2013 superannuation prudential framework, published in April 2019, APRA received stakeholder feedback noting a lack of clarity in reporting definitions of some data items, and opportunities exist to remove duplication, and enhance comparability and efficiency of the data collection. This review will also propose changes that will address this feedback.

The need for APRA to collect more data on investment performance, fees and costs and expenses has also been clearly articulated through a number of recent reviews. The Productivity Commission’s review into the efficiency and competitiveness of the superannuation system highlighted the limited broad reaching data on products and member outcomes and recommended APRA collect and publish member and performance data at the investment option and asset class level. The Capability Review of APRA conducted in 2019 also noted that APRA doesn’t collect product-level data other than for MySuper products and suggested that APRA ‘collect product level data that facilitates accurate assessments of outcomes and comparability across funds’.

APRA’s data capabilities are also undergoing a transformation. APRA’s improved data collection solution will enable APRA to collect different types and volumes of data. This is expected to enable efficiencies in reporting, particularly where reporting data in a more granular format may remove the need for RSE licensees to produce reporting in formats and classifications specifically for APRA, thereby easing the reporting burden for RSE licensees.

Each Topic Paper released as part of the Superannuation Data Transformation will set out the gaps and issues with the current reporting requirements for that topic, as well as the proposed approach to rectify gaps and meet other objectives for the enhanced data collection.

2.3 Other sources of data

As part of the Superannuation Data Transformation, APRA will also review other sources of data available in industry. For example, as part of its member-level data collection, the ATO collects transactional information for payments into a member’s account. The possibility and appropriateness of data sharing between APRA and the ATO will be considered as part Phase 2.

2.4 Determining data to be non-confidential

To enable improved industry transparency, APRA’s objective is that most of the data proposed under the Superannuation Data Transformation be non-confidential and able to be made public.

Within each Topic Paper accompanying draft reporting standards, APRA will therefore propose that the data be determined non-confidential when submitted under FSCODA.

Determining data in the Superannuation Data Transformation to be non-confidential will increase industry transparency, enabling meaningful insights and comparisons. There are a range of further benefits that flow from making all data available publically. These include benefits for:

- APRA and other regulators, by allowing them to monitor the industry with enhanced granularity to better identify trends, make informed decisions and target regulatory and supervisory efforts;

- RSE licensees, by providing management with important insights and comparisons to enable them to better understand their relative and absolute performance in key areas and the outcomes they are providing to members;

- Other industry stakeholders, through informing their decisions and providing insights;

- Members, through greater transparency and visibility of data via consumer focused data platforms (such as the MoneySmart website offered by ASIC), allowing them to make better informed decisions based on the performance of the funds, products and investment options they are invested in; and

- The community, as enhanced transparency can drive greater accountability and improved performance. Data can also help provide useful context to facilitate an informed public debate on issues in the superannuation industry.

To support APRA’s objective of increased transparency across each of the industries it regulates, APRA will also consider the confidentiality status of the existing data collection as part of the Superannuation Data Transformation.

Specific proposals on the confidentiality of superannuation data in Phase 1 of the Superannuation Data Transformation will be included in each Topic Paper, giving the industry the opportunity to comment on confidentially in respect of each area of the data collection.

2.5 Publication proposals

As a general principle, given the objectives of the data improvements in scope for Phase 1, and its objective to improve the transparency of the industry, APRA intends to make as much data as possible publically available.

Specific publication proposals for the proposed data collection will accompany the final Topic Paper release of Phase 1.

Chapter 3 – Consultation process

3.1 Structure of the Phase 1 consultations

To facilitate consideration of the various elements of change proposed in Phase 1, the review will be conducted under specific topic areas with a series of questions for each topic on which feedback is sought.

The first Topic Paper accompanies the release of this Discussion Paper, with the remaining papers for Phase 1 of the Superannuation Data Transformation to be released over the coming months.

The first Topic Paper, RSE Structure and Profile will establish the population of products, investment menus and investment options on which information is to be reported, and the assets and members in each of these. This will provide a clear and consistent picture of the different components within a fund and the relationships between these components. The data will also provide the foundation upon which more granular and meaningful data can be collected to enable deeper analysis and insights.

In addition to the Topic Paper accompanying this Discussion Paper, Phase 1 will have further releases of Topic Papers up to mid-2020. Other areas that APRA intends to address in Phase 1 are:

Charges and creditsPropose collection of investment performance data and fees and costs and taxes charged at all levels expanded to choice products, investment menus and investment options. This data will support the assessments of member outcomes. | Member demographicsPropose additional granularity to include lower balance tiers and improved reporting on lost and inactive accounts. This data will support assessment of fund sustainability and strategy including the impact of legislative changes relating to default insurance, fee caps and sweeps of inactive accounts to the ATO. |

Fees and costs disclosedPropose expanding fee disclosure data to choice products, investment menus and investment options. This data will provide key forward-looking drivers of member outcomes for choice products and options. | Asset allocationPropose improving asset class classifications and expanding collection of strategic and actual asset allocation to all choice investment options. This data will support outcomes assessments for industry and provide key forward-looking drivers of member outcomes. |

Expense reportingPropose improved expense reporting, utilising look-through of expense data aligned with indirect costs and informative and consistent categories across the superannuation industry. This data will support transparency on where members’ money is being spent and benchmarking of fund expenditure. | Standard insurance arrangementsPropose clarifying the characteristics of standard insurance products and expanding coverage to default insurance offered for choice superannuation products. This will support assessment of key forward-looking drivers of insurance outcomes. |

Refer to Appendix II for information on the areas covered in the Phase 1 proposals and a high level overview of impacts on reporting for entities.

3.2 Pilot data collection

Through the Phase 1 process, APRA will collect pilot data to test and inform areas for refinement and clarification prior to finalising Phase 1 reporting standards.

Past experience has shown that the initial collection of data is where many implementation issues are exposed. APRA has utilised pilot collections of data prior to the finalisation of reporting standards for other industries and these have proven to be useful in road-testing data items and definitions, refining discussion on proposed changes and assisting reporting entities in their implementation efforts.

Each Topic Paper will be accompanied by draft reporting standards, a reporting template to collect pilot data, specified reporting periods for RSE licensees to provide data for in the template and due dates for submission.

After the initial Phase 1 pilot data has been received, APRA will conduct analysis, and where appropriate, share outcomes from the process in the response to submissions. Entity specific learnings will be shared directly with submitting entities. Following the collection of the Phase 1 pilot data, an updated data template will be provided to entities for completion to further test and clarify the draft reporting standards.

APRA will issue its first response to submissions made as part of the consultation (including feedback from industry and the test data collection), together with finalised reporting standards ahead of the June 2020 quarter.

The proposed implementation of the Superannuation Data Transformation is expected to be broadly aligned with APRA’s new data collection solution (APRA Connect), which is intended replace Direct to APRA (D2A), APRA’s current data collection tool. As such, APRA intends that entities will submit data in APRA Connect or an alternative file-based method. Should APRA Connect not yet be available for submission at the time of the first collection under the new and revised reporting standards, APRA expects that RSE licensees will be able to submit data via manual entry or upload of XBRL4 or Microsoft Excel files. More information on APRA Connect is available on the APRA website at:https://www.apra.gov.au/apra-replacing-d2a.

Following the first data collection after the Phase 1 Reporting Standards have been finalised, APRA intends to publish this data. It is intended that the released data will assist RSE licensees in meeting their obligations under SPS 515 Strategic Planning and Member Outcomes. It will also inform Phases 2 and 3 of the Superannuation Data Transformation.

3.3 Timeframes for Phase 1

To assist entities in consideration of the various elements of change proposed in Phase 1, a series of Topic Papers will be released over the coming months. The first paper, RSE Structure and Profile, accompanies this Discussion Paper. Further releases and timeframes for Phase 1 are included below:

| Action | Date |

|---|---|

| Release of Phase 1 Discussion Paper and first Topic Paper | 7 November 2019 |

| Consultation responses for the first Topic Paper due | 17 January 2020 |

| Final package of Topic Papers released for Phase 1 | February 2020 |

| Consultation responses for the final package of Topic Papers due | March 2020 |

| Release of response paper | April - May 2020 |

| Release of final reporting standards | April - May 2020 |

| Phase 1 data collection for June quarter | August - September 2020 |

| Phase 1 publication of data | Late 2020 |

Additional detail on the timing for the Phase 1 pilot data collections will be included in each Topic Paper release.

Timelines and topic papers for Phase 2 and Phase 3 of the Super Data Transformation will be determined and published in a future information paper at the conclusion of the Phase 1 activities.

3.4 Request for submissions

APRA invites written submission on the proposals set out in this Discussion Paper and the Topic Papers to be released in Phase 1.

Written submissions should be sent to superdatatransformation@apra.gov.au by 17 January 2020 and addressed to:

General Manager

Data Analytics & Insights

Risk and Data Analytics Division

Australian Prudential Regulation Authority

GPO Box 9836

SYDNEY NSW 2001

3.5 Information to include in submissions

APRA encourages stakeholders to provide information that will assist APRA in better understanding any impediments to providing the proposed data and requests comments made in submissions are as specific as possible, identifying specific data item(s) or instruction(s) where possible.

In order to perform a cost-benefit analysis, APRA invites feedback from interested parties on the financial impact of the proposed collection. This includes implementation and ongoing costs of reporting under the data collection proposals, and whether these costs are expected to increase or decrease over time. APRA also seek specific feedback on any barriers or associated costs to implementing the changes within the proposed timeframes.

Submissions can also indicate whether there are any particular aspects of the proposals that could be improved or removed to reduce compliance costs, or if there are particular data items which are more or less difficult to provide.

Feedback on expected costs incurred under the proposed collection can be provided to APRA using the template for costings available on the APRA website at:

Comment is invited on all areas covered in this Discussion Paper and the specific questions APRA is seeking comment on included within each Topic Paper.

3.6 Important disclosure requirements – publication of submissions

All information in submissions will be made available to the public on the APRA website unless a respondent expressly requests that all or part of the submission is to remain in confidence.

Automatically generated confidentiality statements in emails do not suffice for this purpose.

Respondents who would like part of their submission to remain in confidence should provide this information marked as confidential in a separate attachment.

Submissions may be the subject of a request for access made under the Freedom of Information Act 1982 (FOIA).

APRA will determine such requests, if any, in accordance with the provisions of the FOIA. Information in the submission about any APRA-regulated entity that is not in the public domain and that is identified as confidential will be protected by section 56 of the Australian Prudential Regulation Authority Act 1998 and will therefore be exempt from production under the FOIA.

4 eXtensible Business Reporting Language

Appendix I - Current reporting standards

Reporting Standard Number | Reporting Standard Name | Reporting Level | Frequency |

|---|---|---|---|

SRS 001.0 | Profile and Structure (Baseline) | RSE licensee | Annual, Adhoc |

SRS 114.0 | Operational Risk Financial Requirement | RSE licensee | Annual |

SRS 114.1 | Operational Risk Financial Requirement | RSE | Annual |

SRS 160.0 | Defined Benefit Matters | RSE | Annual |

SRS 160.1 | Defined Benefit Member Flows | RSE / Sub-fund | Quarterly |

SRS 161.0 | Self-Insurance | RSE | Annual |

SRS 250.0 | Acquired Insurance | RSE | Annual |

SRS 320.0 | Statement of Financial Position | RSE | Quarterly, Annual |

SRS 320.1 | Statement of Financial Position | Sub-Fund | Annual |

SRS 330.0 | Statement of Financial Performance | RSE | Quarterly, Annual |

SRS 330.1 | Statement of Financial Performance | Sub-fund | Annual |

SRS 330.2 | Statement of Financial Performance | MySuper product | Annual |

SRS 331.0 | Services | RSE | Annual |

SRS 410.0 | Accrued Default Amounts | RSE | Quarterly |

SRS 520.0 | Responsible Persons Information | RSE licensee | Annual, Adhoc |

SRS 530.0 | Investments | RSE | Quarterly, Annual |

SRS 531.0 | Investment Flows | RSE | Quarterly, Annual |

SRS 532.0 | Investment Exposure Concentrations | RSE | Quarterly |

SRS 533.0 | Asset allocation | MySuper | Quarterly, Annual |

SRS 533.1 | Asset Allocation and Members Benefits Flows | Select Investment Option | Quarterly, Annual |

SRS 534.0 | Derivative Financial Instruments | RSE | Annual |

SRS 535.0 | Securities Lending | RSE | Annual |

SRS 540.0 | Fees | RSE / MySuper product | Annual |

SRS 600.0 | Profile and Structure (RSE licensee) | RSE licensee | Annual |

SRS 601.0 | Profile and Structure (RSE) | RSE | Annual |

SRS 605.0 | Wind up | RSE | Adhoc |

SRS 610.0 | Membership Profile | RSE | Annual |

SRS 610.1 | Changes in Membership Profile | RSE | Annual |

SRS 610.2 | Membership Profile | MySuper product | Annual |

SRS 700.0 | Product Dashboard | MySuper Investment option | Annual, Adhoc |

SRS 702.0 | Investment performance | Lifecycle stage | Quarterly, Annual |

SRS 703.0 | Fees Disclosed | MySuper product | Annual, Adhoc |

SRS 710.0 | Conditions of Release | RSE | Annual |

SRS 720.0 | ABS Statement of Financial Position | RSE | Quarterly |

SRS 721.0 | ABS Securities Subject to Repurchase and Resale and Stock Lending and Borrowing | RSE | Quarterly |

SRS 722.0 | ABS Derivatives Schedule | RSE | Quarterly |

SRS 800.0 | Financial Statements (Small APRA Funds) | RSE | Annual |

SRS 801.0 | Investments and Investment Flows (Small APRA Funds) | RSE | Annual |

SRS 802.0 | Fund Profile (Small APRA Funds) | RSE licensee | Annual |

Appendix II - Phase 1 proposal summary

Reporting category | Purpose | Impacts to RSE level reporting | Impacts to MySuper reporting | Impacts to choice reporting | Collection changes |

|---|---|---|---|---|---|

RSE structure and profile | To collect and maintain population of all investment levels of superannuation, including the attributes, members and assets pertaining to said levels. This will faciliate a complete view of RSE structure, namely the location of all RSE assets. | - | Minor changes | New | Expanded collection to all investment options and superannuation products. Investment menu introduced as a new level, capturing access fees and descriptive data for suites of investment options. Member accounts data collected at every level, with assets data collected at the investment option level. |

Charges and credits | This data will support the assessments of member outcomes, allowing for a more complete picture of the investment universe and enabling the construction of different representative members. | - | Minor changes | New | Collection of investment performance data and fees and costs and taxes charged at all levels expanded to choice products, investment menus and investment options. |

Asset allocation | This data will support outcomes assessments for industry and provide key forward-looking drivers of member outcomes. | - | Expanded | Expanded | Improving asset class classifications and expanding collection of strategic and actual asset allocation to all choice investment options. |

Fees and costs disclosed | This data will provide key forward-looking drivers of member outcomes for choice products and options. | - | Minor changes | New | Expanding fee disclosure data to choice products, investment menus and investment options. |

Standard insurance arrangements | Expanded collection paired with a restructure of descriptive measures of standard insurance products and coverage, including a rationalisation of worker categories and numbers of members who have opted into cover. This will enable us to understand members' experience with standard insurance. | - | Minor changes | New | Clarifying the characteristics of standard insurance products and expanding coverage to standard insurance offered for choice superannuation products. |

Member demographics | This data will support assessment of fund sustainability and strategy including the impact of legislative changes relating to default insurance, fee caps and sweeps of inactive accounts to the ATO. | Expanded | Expanded | - | Additional granularity to include lower balance tiers and improved reporting on lost and inactive accounts. |

Expense reporting | This data will support transparency on where members’ money is being spent and benchmarking of fund expenditure. | Expanded | Minor changes | New | Improved expense reporting, utilising look-through of expense data aligned with indirect costs and informative and consistent categories across the superannuation industry. |