Discussion paper: Private Health Insurance Capital Standards Review

Executive summary

Capital standards are an important tool to support the objectives of APRA’s prudential framework. They are intended to ensure that an insurer has sufficient financial resources available to meet its financial promises to policy holders despite adverse conditions. APRA’s capital standards determine the minimum regulatory capital requirement for an insurer, taking into account the nature of the risks an insurer is exposed to in its business.

Since assuming prudential regulatory responsibility for the private health insurance (PHI) industry in 2015, APRA has progressively reviewed and updated the prudential policy framework. APRA’s review of the capital framework represents the third and final phase of that systematic process.

APRA’s capital standards play an essential role in ensuring that private health insurers have the financial resources available to meet their commitments to policy holders, even in the event of unexpected stress or losses. In a number of respects, the current PHI capital framework is less robust than the capital requirements that apply in other insurance sectors in Australia. APRA is concerned that the current PHI capital framework does not appropriately reflect the risks faced by insurers, and allows for inadequate consideration of extreme adverse events.

The objective of APRA’s review is to address these issues to ensure that insurers have an appropriate level of financial resilience for the protection of policyholders. This discussion paper describes APRA’s proposed structure for the capital framework for private health insurers (insurers). Many of these proposals were foreshadowed in a letter to industry released in 20181. The proposals reflect APRA’s intention to increase the risk sensitivity of capital requirements to the activities of insurers and to improve the alignment of capital standards across the insurance industries it regulates. APRA’s proposals have therefore been developed from the basis of the existing capital standards applying to the life and general insurance industries (known as the LAGIC framework).

The structure proposed in this discussion paper is not defined to the degree needed to enable the quantitative impact on individual insurers to be determined. APRA will consider feedback on the proposed structure to inform subsequent consultation on the draft capital standards which will outline APRA’s proposed parameters for determining minimum capital requirements.

While APRA’s proposals are expected to increase minimum capital requirements for insurers once implemented, current strong capital levels mean APRA does not expect a material need to raise additional capital across industry. The impact of these reforms on premiums is expected to be immaterial given that capital requirements are not a material driver of PHI premiums. Premium increases are mostly affected by growth in benefit payments which reflects changing policy holder demographics, increased utilisation and changes in medical technology and costs.

The LAGIC framework reflects APRA’s overall approach to capital. By starting with the LAGIC framework, APRA aims to strengthen prudential outcomes for policy holders and improve the resilience of the PHI industry to financial stresses. Consistency of capital frameworks across the insurance sectors would allow for a common language for capital and support discussions about capital between APRA and insurers, and within groups that contain multiple APRA-regulated insurers. This will also improve alignment with international prudential regulation of insurance as established through the Insurance Core Principles (ICPs) developed by the International Association of Insurance Supervisors (IAIS).

In developing these proposals, APRA has considered industry specific characteristics of the PHI industry to assess where deviations from the LAGIC framework are warranted. Key elements of the proposals are summarised below:

Key area | Current PHI capital standard | Key proposed change |

Scope of capital standard | Health benefits fund (HBF) only | Whole licensed insurer |

Probability of sufficiency | 98 per cent on going‑concern basis | 99.5 per cent on gone‑concern basis |

Solvency criteria to be met | Quantitative solvency standard | Remove quantitative standard, but maintain qualitative liquidity management requirement (required by Prudential Standard CPS 220 Risk Management) |

Capital adequacy criteria to be met | Quantum of assets test and Concentration of assets test | Prudential Capital Requirement (PCR), comprising capital charges for asset risk, asset concentration risk, insurance risk and operational risk, as well as any supervisory adjustment |

Capital treatment for insurance risk | Stressed net margin amount estimated by insurer | Capital charge based on: (a) Prescribed factor approach, and/or (b) an adverse event stress scenario |

Capital base | Includes all accounting balance sheet items | Adjustments to accounting balance sheet to remove certain assets Establish rules and thresholds for quality of capital instruments |

Capital planning | Capital management plan, including pricing philosophy and investment rules | Introduction of Internal Capital Adequacy Assessment Process, (ICAAP) while retaining requirement for pricing philosophy and investment rules |

Minimum PCR | Not specified | Introduce a $5 million minimum |

APRA is proposing the PHI capital standards be based on the Australian Accounting Standards Board’s new standard AASB 17, which adjusts the accounting treatment of insurance contracts. AASB 17 will impact the measurement and reporting of insurance liabilities, which are fundamental building blocks for the LAGIC framework.

AASB 17 is expected to come into effect after 1 January 2022. In September 20192 APRA proposed to industry that AASB 17 would be adopted for prudential purposes from 1 July 2023. To avoid duplicative effort and cost for entities, APRA’s intent is to align the commencement of the PHI capital framework with the implementation of AASB 17 for prudential purposes from 1 July 2023. In light of the interaction with the implementation of AASB 17, APRA encourages all insurers to also monitor and engage with APRA’s consultation on proposals for the integration of AASB 17 into the capital and reporting frameworks.

The proposals outlined in this discussion paper are open for consultation until 30 June 2020. APRA intends to publish a Response to Submissions and release draft prudential capital standards in the second half of 2020. Information on quantitative impacts based on the draft standards will be sought to inform the calibration of the final prudential standards which are scheduled to be released in 2022. APRA is open to working with impacted insurers on appropriate transition.

1Letter: Roadmap for APRA's review of the private health insurance capital framework, available at: Review of the private health insurance capital framework.

2Letter: Information request and consultation on directions for integration of AASB 17 insurance contracts into the capital and reporting framework for insurers, available at: New accounting standard – AASB 17 Insurance contracts.

Glossary

| AASB | Australian Accounting Standards Board |

|---|---|

| AASB 17 | AASB 17 Insurance Contracts |

| APRA | Australian Prudential Regulation Authority |

| APRA Act | Australian Prudential Regulation Authority Act 1998 |

| CMP | Capital Management Plan |

| Community rating | Community rating precludes insurers from charging members different premiums for the same level of cover due to factors including age (other than age at entry), claims history, gender or health status |

| Corporations Act | Corporations Act 2001 |

| FOIA | Freedom of Information Act 1982 |

| FSCODA | Financial Sector (Collection of Data) Act 2001 |

| GPS 112 | Prudential Standard GPS 112 Capital Adequacy: Measurement of Capital |

| HBF | The health benefits fund (HBF) is established in the private health insurer for the purposes of operating health insurance business and, where relevant, health related business in accordance with the Private Health Insurance Act 2007 |

| HPS 100 | Prudential Standard HPS 100 Solvency Standard |

| HPS 110 | Prudential Standard HPS 110 Capital Adequacy |

| IAIS | International Association of Insurance Supervisors |

| ICAAP | Internal Capital Adequacy Assessment Process |

| ICPs | Insurance Core Principles as adopted by the IAIS |

| LAGIC | Life and General Insurance Capital framework introduced by APRA on 1 January 2013 |

| MEI | Mutual Equity Interest |

| PAIRS | Probability and Impact Rating System |

| PCA | Prescribed capital amount |

| PCR | Prudential capital requirement |

| PHI | Private health insurance |

| PHIAC | Private Health Insurance Administration Council (1989-2015) |

| Risk Equalisation | A system for sharing the hospital treatment costs of high-risk groups and high costs claims between insurers. Risk Equalisation commenced on 1 April 2007. It is comprised of three elements: (i) an age based pool – that shares the costs of treatment for people aged 55 and above; (ii) a high cost claimants pool – that shares the costs of claims above specified thresholds; (iii) the transfer of money between insurers and the Risk Equalisation Special Account, based on the experience and relative risk of their health benefits fund membership base |

| SOARS | Supervisory Oversight and Response System |

Chapter 1 - Introduction

1.1 Background

APRA’s mandate is to protect the Australian community by establishing and enforcing prudential standards and practices designed to ensure that, under all reasonable circumstances, financial promises made by the institutions it supervises are met within a stable, efficient and competitive financial system.

In August 2016, APRA published its PHI Policy Roadmap3 setting out its intention and the timeframes for a systematic review of the PHI prudential policy framework. Phase 1 (risk management) and phase 2 (governance) of the PHI Roadmap have been completed. APRA’s commencement of the capital framework review, signalled in November 20184, represents the third and final phase of that comprehensive process.

APRA’s decision to sequence the capital review as the third phase of the PHI Roadmap took into account the revision of the PHI capital standards in 2014 by the former regulator, the Private Health Insurance Administration Council (PHIAC). Importantly, APRA and other insurance industries were still developing their experience with the capital framework for life and general insurers (LAGIC), which was introduced on 1 January 2013.

1.2 The current PHI capital framework

The current PHI capital framework comprises Prudential Standard HPS 100 Solvency Standard (HPS 100) and Prudential Standard HPS 110 Capital Adequacy (HPS 110). These standards are intended to ensure that, at any time, the health benefits fund (HBF5) of an insurer can meet all liabilities referable to the HBF and there are sufficient assets to provide adequate capital for the operation of the HBF.

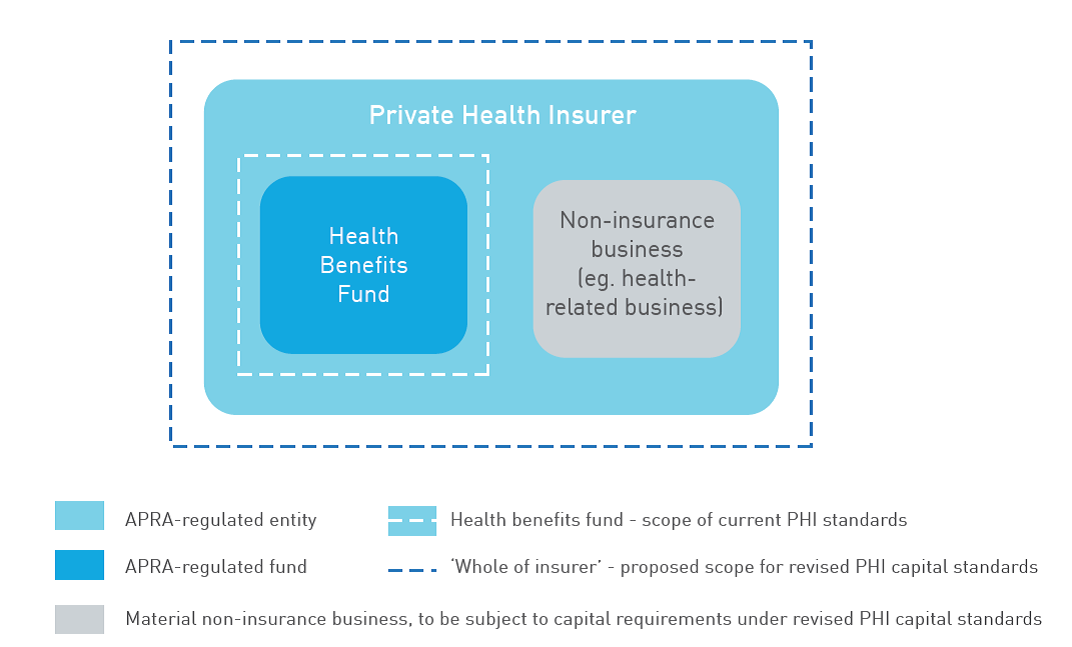

The current PHI capital framework imposes requirements on the HBF only. Therefore, risks or capital needs of any other business activities conducted by the licensed health insurer are not captured in the current capital framework.

HPS 100 and HPS 110 represent a continuation of the capital standards introduced by PHIAC in 2014. PHIAC’s stated intent in introducing these standards was to increase industry awareness of the risks in the business environment, as insurers expanded beyond the traditional areas of hospital and general treatment6.

1.2.1 The capital adequacy standard (HPS 110)

HPS 110 comprises two requirements: a quantum of assets test and the concentration of assets test. An insurer is required to ensure that, at all times, its HBF complies with these tests. While not typical, an insurer may have more than one HBF and the insurer must keep the assets of each HBF separate from assets of other HBFs or assets of the insurer. Each HBF must meet the requirements of HPS 110.

As well as the requirements on assets, each HBF must have a capital management plan featuring capital targets and triggers based on probability.

Quantum of assets test

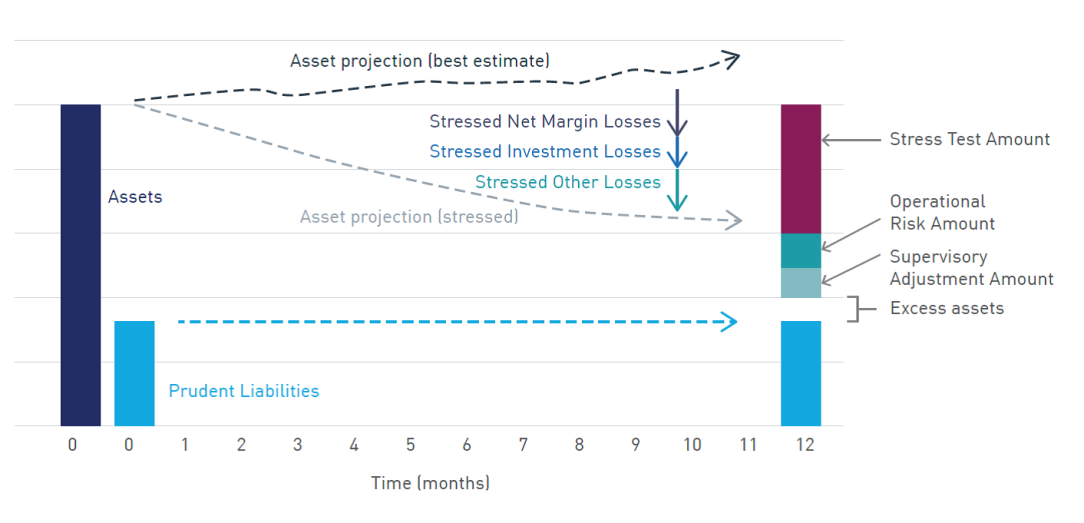

The quantum of assets test requires the HBF to hold sufficient assets so that, after 12 months of any adverse conditions, it would continue to hold more assets than its prudent liabilities. Figure 1 below shows how the quantum of assets test operates.

HPS 110 requires the HBF’s prudent liabilities to be calculated with a 98 per cent probability of sufficiency on a going concern basis, including all liabilities. The stress test amount represents the depletion in assets from 12 months of adverse insurance, investment and other business experience, as well as an adverse operational event.

HPS 110 allows the stress test amount to be based on estimates calculated by the insurer. It is not prescriptive regarding the assumptions used, and differences in the subjective judgements by insurers have led to inconsistencies between entities in determining the stress test amount.

Under HPS 110 the operational risk amount is set at 0.5 per cent of health business revenue. This relates to the risk of losses by the insurer from people, processes, systems and external events affecting the HBF. In certain circumstances, APRA may apply a capital adequacy supervisory adjustment to increase the amount of assets a HBF must hold to satisfy the quantum of assets test.

Concentration of assets test

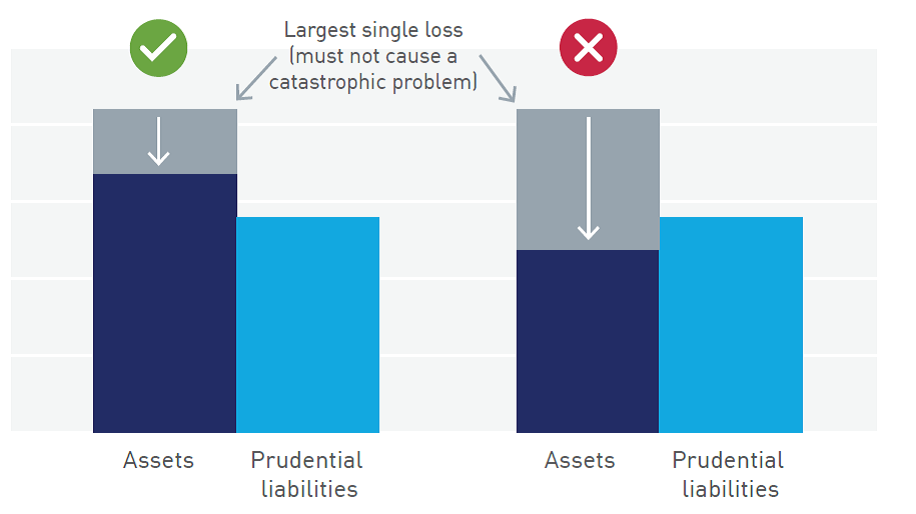

The concentration of assets test is applied separately to address the risks associated with asset concentration, namely, credit and liquidity risks. This test is intended to ensure that no single plausible asset loss could have a catastrophic impact on the financial health of a HBF.

HPS 110 requires calculation of the maximum default loss for each HBF to ensure that it would continue to hold assets greater than its prudent liabilities after such a loss. Again, APRA can apply a supervisory adjustment, in certain circumstances, to increase the amount of assets a fund must hold to satisfy the concentration of assets test.

Figure 2 below shows where a HBF would satisfy and fail the test as indicted by the tick and cross respectively.

1.2.2 The capital management plan

Insurers must have a board endorsed capital management policy for each HBF, which includes a capital management plan (CMP). The CMP, which must outline target capital levels and trigger points, is intended to provide the board with a framework for managing capital in accordance with its risk appetite and the prevailing risks facing their business. The board must review the capital management policy at least every two years.

The CMP must contain a pricing philosophy articulating the board’s appetite for the performance of products referable to the HBF. HPS 110 outlines matters to be considered in the pricing philosophy including profitability targets, capital implications of particular profitability levels and guidelines on the speed of correction of deviations from profitability targets. The CMP must also contain investment rules which provide clear objectives and asset allocation limits, asset concentration limits and consider capital strength for the HBF.

Aside from these high level inclusion requirements, the detail of the CMP are at the insurer’s discretion and insurers use a wide variety of methods to articulate the capital target levels, risk appetite and tolerances. As such, the philosophies and approaches underpinning the CMP, as well as the general structure and level of detail in the document, can vary between insurers.

1.2.3 The solvency standard (HPS 100)

HPS 100 has two main components. The first is a solvency requirement which requires that insurers hold a minimum amount of cash in the HBF. The minimum is determined as the greater of either the stressed net cash outflows over a 30 day period plus a buffer related to health business revenue, or 1 per cent of annual health business revenues. The stressed net cash outflow is an amount of the net cash outflows (outflows minus inflows) for a 30 day period. Stressed net cash outflows are determined at the 98th per centile estimate, taking into account payments required to meet liabilities referable to the HBF and cash receipts from premiums payable and income from investments.

The second component is a board endorsed liquidity management plan for each HBF designed to ensure compliance with the solvency requirement. The liquidity management plan must include management action triggers and be reviewed at least every two years. APRA can also determine a solvency supervisory adjustment to increase the minimum amount of cash a HBF must hold to satisfy the solvency requirement.

1.3 Why is APRA reviewing the standards?

Capital standards are an important tool to ensure that insurers remain financially sound and able to make good on their promises to policy holders. They set minimum requirements to ensure an insurer holds sufficient capital to meet its financial promises to policy holders even under a period of adverse conditions.

In undertaking this review, APRA is seeking to improve the risk sensitivity of the PHI capital standards and, where appropriate, improve the alignment of the capital standards across industries. APRA is concerned that the current PHI capital framework does not appropriately reflect the risks faced by insurers, and does not adequately allow for consideration of adverse events that could affect their performance, such as extreme adverse events with low probability.

APRA is also seeking to reduce availability for discretion in the practices of insurers in determining capital requirements to improve the comparability of performance between insurers, and limit practices which may detract from insurer financial resilience and policy holder protection. In November 2018, APRA advised the industry that it intends to consult on capital proposals for insurers based on the LAGIC framework7. The LAGIC framework reflects APRA’s overall approach to capital and is consistent with the relevant ICPs issued by the IAIS.

In a number of respects the current PHI capital standards are less robust than the LAGIC framework. However, APRA does not intend to apply standards designed for the life or general insurance industries to insurers without change. The characteristics of the insurance coverage in each industry give rise to variation in how insurance risk is experienced and managed.

Reflecting this, the treatment of insurance risk in the LAGIC framework is tailored to the specific insurance risks in each of the life and general insurance industries. For example, the risks arising from changes in the mortality or longevity of policy holders are captured in the life industry capital standards, while the exposure of general insurers to natural catastrophe events is captured in the general insurance capital standards. Insurance risk in the PHI industry differs again and the proposals in this paper have taken account of those characteristics and been informed by expert input from the Actuaries Institute.

1.4 APRA’s proposed approach

The review will consider the approach to calculation of minimum capital requirements and the determination of the capital base for insurers, as well as requirements around capital management (in LAGIC terminology, the Internal Capital Adequacy Assessment Process, or ICAAP). It will also cover the requirements for reporting to APRA on capital adequacy, financial performance and public disclosure requirements.

Further, the PHI capital standards will need to integrate changes to the accounting standards for insurance contracts with the introduction of AASB 17 Insurance Contracts (AASB 17). Implementation of AASB 17 will change the basis for measuring and reporting insurance assets and liabilities, and therefore will impact the way an insurer prepares its financial reports and monitors its financial performance. In November 2018, APRA indicated its intent is to develop the future PHI capital framework from an AASB 17 base. This remains APRA’s approach and consideration of integrating AASB 17 will be taken into account throughout the review of the PHI capital requirements. The development of the PHI capital standards has important interactions with APRA’s work to considering how to integrate AASB 17 into the LAGIC framework, which is based on the existing accounting treatment.

APRA’s proposals will revise the capital framework for the PHI industry to a structure which:

- aligns to LAGIC, including refinements to the LAGIC framework currently being considered by APRA, unless characteristics of the PHI industry warrant a different prudential approach;

- captures the whole licensed health insurer;

- determines the prudential capital base after making adjustments, modelled on those of LAGIC, to accounting balance sheet items determined in accordance with Australian accounting standards;

- lifts the probability of sufficiency to 99.5 per cent over a 12 month period on a gone concern basis;

- specifies rules and thresholds for capital instruments that can be included in the prudential capital base; and

- reduces the available discretion for insurers in calculating capital charges for several components of the prescribed capital amount (PCA) to improve comparability between insurers.

1.5 Balancing APRA’s objectives

The Australian Prudential Regulation Authority Act 1998 (APRA Act) requires APRA to balance the objectives of financial safety and efficiency, competition, contestability and competitive neutrality, and in balancing these objectives, promote financial system stability in Australia. APRA considers that, on balance, the proposals in this discussion paper will enhance prudential outcomes, improve financial safety and promote financial system stability while not unduly impacting the other objectives.

Efficiency considerations

APRA’s proposals for the capital framework are expected to improve efficiency by determining capital requirements on a basis that better reflects the risks faced by each insurer. This approach also allows capital requirements to vary based on the risk management capability of the insurer.

The proposed changes to requirements for capital instruments are expected to improve the transparency of these instruments to assist in their issuance and increase the options for mutual insurers to raise capital. Increased transparency and comparability of capital ratios may also improve access to sources of capital.

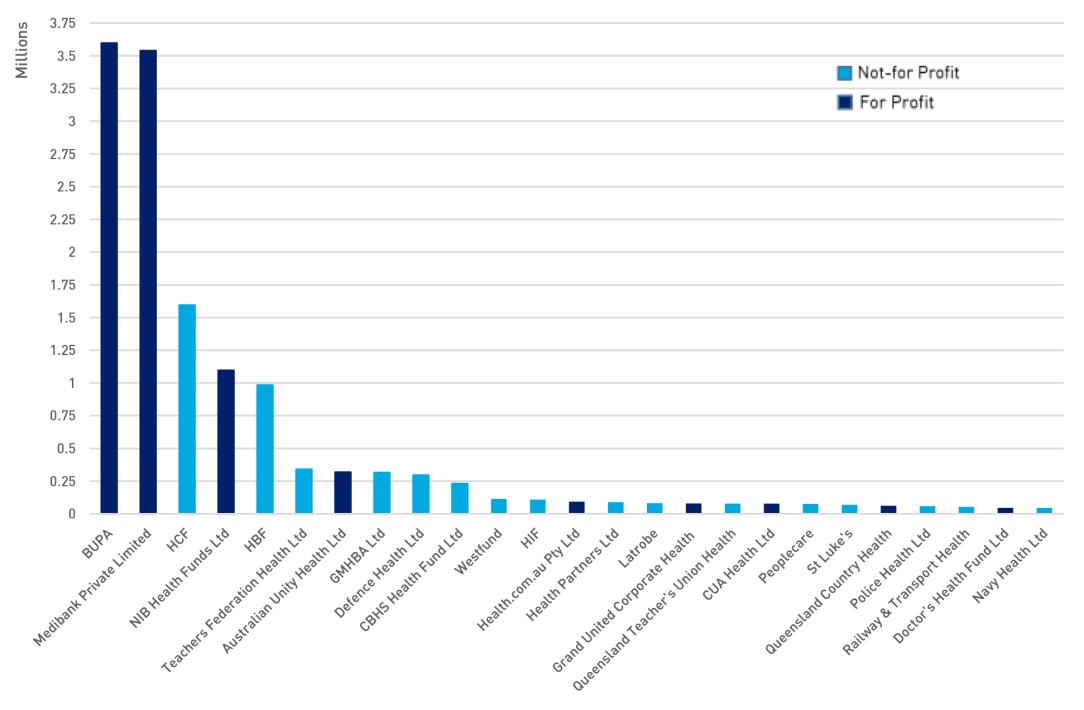

Competition and contestability considerations

There are currently 37 insurers in the PHI market. The five largest insurers hold 80 per cent of policies (5.3 million policies) and account for 80 per cent of the total PHI membership base (10.8 million members) as depicted in Figure 38. While generally stable, there has been a small decline in concentration amongst the insurers with the largest market share in recent years. The decline in concentration coincides with a period of deteriorating affordability and rising churn of members between coverage levels and insurers, suggesting that policy holders have been increasingly looking for policies that better meet their needs.

The PHI industry is strongly influenced by Government policy and regulations. Although legislation and regulation constrain the scope of policy offerings in the PHI market, insurers are offering policies with features designed to meet different needs and provide choice for consumers. Differentiation in offerings between insurers, and clear communication of those offerings, enables consumers to select a product most suitable to their needs.

APRA’s capital proposals are not expected to materially alter opportunities for competition or impact on the ability of insurers to differentiate across product offerings. While it is not yet possible to determine the quantitative impact of the proposals on individual insurers, the proposals are expected to create a higher hurdle for new entrants in the market as a result of higher minimum capital requirements and are likely to have a relatively larger implementation cost for smaller insurers. APRA’s proposal seeks to manage some of these impacts by establishing sufficient transition arrangements that allow insurers to adapt systems and processes over time.

Competitive neutrality considerations

This concept refers to ensuring state-owned and private businesses compete on a level playing field. There are no state-owned insurers currently operating in the PHI industry. APRA’s proposed capital framework will not impact competitive neutrality in the PHI industry.

Primary objectives and other considerations

Financial safety

| Financial system stability

|

|---|---|

| Improved.The proposals strengthen the prudential requirements for capital. This is expected to improve the quality and minimum capital requirements and strengthen capital management practices to support the long‑term financial soundness of regulated entities. | Improved.Proposals to ensure the capital standards provide an appropriate level of protection for policy holders will build the financial resilience of insurers. |

Efficiency

| Increased. The proposals will ensure that the capital requirements for insurers better reflect the risks of their business to enable more efficient allocation of capital within the financial sector. |

|---|---|

Competition

|

|

Contestability

| Reduced. The proposal for a new minimum capital requirement may restrict the entry of small insurers into the market and may require a number of existing insurers to raise additional capital. |

Competitive neutrality

| No change. The proposed framework does not create an advantage for public sector entities relative to other market participants9. |

1.6 Timetable and next steps

In November 2018, APRA provided a timetable for the capital review10, but noted it had some dependency on the implementation of the new accounting standard AASB 17. APRA’s intent is to continue to align the capital review with the timing of its approach to integrate AASB 17 into the capital framework for all insurers. APRA has revised the indicative timetable accordingly, as set out below.

The timetable includes two rounds of consultation and one quantitative impact study. If significant issues arise during consultation that would benefit from further exploration, APRA will consider whether an additional round of consultation or a further quantitative impact study is appropriate.

The key milestones in the timetable for the review are:

Timing | Action |

30 September 2020 | Submissions due on this paper |

Q3 2020 | Response Paper, consultation on draft prudential standards and quantitative impact study request |

Q2 2022 | Second response paper, final prudential standards |

1 July 2023 | Indicative implementation date |

1.7 Transition

APRA’s intention is to put in place appropriate transitional arrangements to allow for an orderly implementation of the new capital framework. These arrangements will consist of a combination of an industry wide transition component and consideration of additional insurer specific arrangements on a case by case basis.

Insurers are expected to comply with the current standards until the new standards take effect. Until the commencement of the new standards, APRA is willing to consider transitional treatment for a capital instrument that aligns with the framework set out in this discussion paper (or in subsequent publications by APRA during its consultation), on a case by case basis.

APRA’s decisions on requests for additional transitional arrangements will take into account an insurer’s approach to capital management while the review is under way. APRA will be less likely to agree to additional transitional arrangements where an insurer takes action to reduce or weaken the composition of capital, or issues a capital instrument which is not aligned with LAGIC requirements or APRA’s proposed PHI capital standards as they become clearer.

APRA’s general approach to the transition of capital instruments that do not meet the requirements of the new standards is to allow for transition through to the next available call date. APRA does not generally ‘grandfather’ instruments. APRA would take a similar approach to any transitional treatment for capital instruments in the period leading up to the commencement date of the new standards.

3Letter: Private Health Insurance (PHI) Prudential Policy Outlook August 2016, available at: Private health insurance: Prudential policy outlook.

4Letter: Roadmap for APRA’s review of the private health insurance capital framework, available at: Review of the private health insurance capital framework.

5The health benefits fund is established in the private health insurer for the purposes of operating health insurance business and, where relevant, health-related business in accordance with the Private Health Insurance Act 2007. An insurer may have more than one health benefits fund, but must keep the assets of each fund separate from assets of other health benefits funds or assets of the insurer.

6Outlined in the Explanatory Statement to the Private Health Insurance (Health Benefit Fund Administration) Amendment Rule 2013 (No 1), available at: https://www.legislation.gov.au/Details/F2013L01684/Download

7Letter: Roadmap for APRA's review of the private health insurance capital framework, available at: Review of the private health insurance capital framework.

8Includes only the top 25 insurers by the number of members. The remaining 12 insurers have a total of 155,503 members.

9To ensure alignment with Parliament’s original intention, APRA adopts the common usage of this term (for example, as found in the Commonwealth Competitive Neutrality Policy Statement).

10Letter: Roadmap for APRA’s review of the private health insurance capital framework, available at: Review of the private health insurance capital framework.

Chapter 2 - APRA’s proposals

2.1 Applying the LAGIC framework for PHI

APRA requires that risks be appropriately recognised and that capital requirements are commensurate with the risks to which the insurer is exposed.

The LAGIC framework seeks to achieve this objective by ensuring prudential capital requirements are sensitive to the risks of the insurer’s business and, where appropriate, align the treatment of similar risks between the capital standards applying to life and general insurers. The adoption of the LAGIC framework as a basis for the PHI capital standards reflects APRA’s view that it has worked effectively to ensure capital requirements are tailored to specific risks faced by insurers.

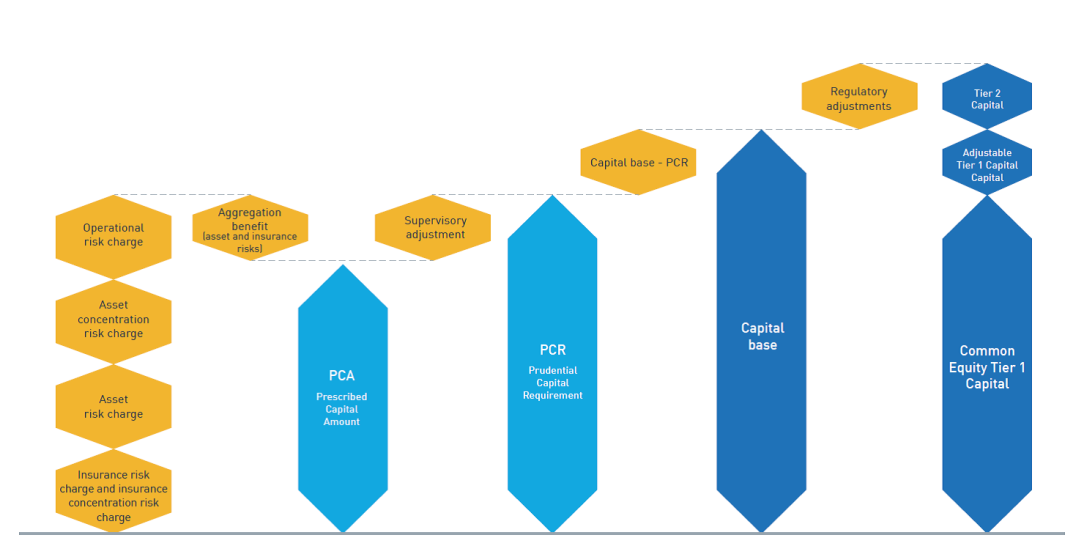

The LAGIC framework, depicted in Figure 4, applies capital charges to each component of risk for life and general insurers, resulting in a PCA that supports insurers to engage with sources of risk and improve risk management.

Adopting a LAGIC based approach for the PHI capital framework will: enable easier comparison and understanding of activities of regulated entities across different industries; simplify risk management for insurers whose activities extend across two or more APRA regulated industries; and enable more effective supervision of entities by APRA.

The LAGIC framework provides a forward looking approach to prudential requirements, based on risk minimisation and management. It is in line with international practice, and delivers an outcomes focused and principles-based framework.

APRA proposes the PHI capital standards include separate charges for insurance risk, asset risk, asset concentration risk and operational risk. APRA also proposes that the capital standards provide for an aggregation benefit to recognise the diversification between insurance and asset risks. Inclusion of an aggregation benefit will allow required capital to better reflect the relative independence of asset and insurance risks.

Reflecting this structure, APRA proposes the PCA for an insurer be the sum of all risk charges minus the aggregation benefit. This is discussed further in section 2.6 (Prescribed Capital and its Components).

APRA proposes that the capital standards provide that APRA may make a supervisory adjustment to the insurer’s capital requirement where it believes the PCA is not sufficient. This approach is consistent with the existing PHI capital standards and will be discussed in section 2.7 (Supervisory Adjustments). Further, APRA proposes the capital standards allow for regulatory adjustments to the capital base. APRA’s approach is discussed in section 2.4 (Defining the capital base).

2.2 Scope of the capital standards

The current PHI capital framework applies to the HBF only, not to the whole of the licensed health insurer. While legislation mandates the dominant purpose of the HBF must be health insurance, insurers are also permitted to operate health related business within their HBF.

PHI business models have evolved such that insurers now offer policies for overseas visitors and students, deliver well being and preventative activities and operate integrated health service businesses such as hospitals, optical and dental centres. This changing nature of activities conducted by insurers, together with the narrow scope of the current capital standards has resulted in differing prudential treatment of non health insurance activities according to how the insurers’ activities are structured.

To address this inconsistency, and better reflect the risks in insurers’ business activities, APRA is proposing to broaden the scope of the capital standards to apply to the insurer, rather than the existing narrow focus on the HBF.

Similar to the requirements that apply in the life insurance industry, APRA proposes to apply capital requirements to the whole licensed insurer (company level). APRA proposes to implement this requirement by applying the capital standards separately to each HBF of the insurer, and also to any activities conducted by the PHI outside the HBF (for example health-related business). Reflecting this, APRA proposes the prudential capital requirement (PCR) at the company level be equal to the total sum of each PCR for the constituent parts. APRA seeks feedback on the implications of this proposal and practical aspects of how insurers would implement this approach.

Figure 5 depicts the scope of current PHI capital standards and the scope proposed for the new capital standards.

2.3 Level of sufficiency

Consistent with the LAGIC framework, APRA proposes that the PHI capital standards target a 99.5 per cent probability of sufficiency over a one year period. The probability of sufficiency in the current PHI capital standards is set at 98 per cent.

APRA considers that an insurer needs to have sufficient capital to absorb unexpected shocks that may arise over the one year period and continue to be able to meet its obligations to policy holders at the end of that period. A 99.5 per cent probability of sufficiency delivers a very high level of certainty to policy holders that an insurer will be able to meet the financial promises that it has made.

APRA also proposes that the probability of sufficiency requirement apply on a gone concern basis. This proposal seeks to ensure that insurers have prudent capital to meet the needs of policy holders, without relying on potential future business revenue or profit which may that may not eventuate if the insurer experiences extreme stress, and that they have also taken into account needs in winding-up the insurer. APRA seeks feedback on the implications of the proposed uplift in the probability of sufficiency requirement.

2.4 Defining the capital base

2.4.1 Admissible assets

The fundamental requirement of LAGIC is that each insurer must have available capital (or capital base) greater than the minimum required capital (or PCR) at all times. The current capital standards generally start with values determined under Australian accounting standards. Regulatory adjustments to those values are necessary to make sure they are sufficiently prudent.

The capital base under the LAGIC framework applies regulatory adjustments such that no value is ascribed to assets that may not be available to pay claims in times of stress. This includes deferred tax assets, goodwill and other intangibles, deferred acquisition costs and a range of other similar assets. For the value of liabilities, APRA proposes to calculate the base value using the forthcoming new insurance accounting standard AASB 17 Insurance Contracts, with appropriate adjustments.

APRA proposes that the PHI capital standards adopt regulatory adjustments based on those specified in Prudential Standard GPS 112 Capital Adequacy:

Measurement of capital (GPS 112) to determine the forms of capital deemed eligible for inclusion in the capital base. Further, APRA proposes that an insurer obtain APRA’s written approval prior to making any planned reduction in the capital base. The insurer would need to provide APRA with a forecast of its projected capital position after the proposed capital reductions. Seeking approval will provide APRA with information to assess capital levels to ensure continued protection of policy holders.

2.4.2 Capital quality

A key aspect of APRA’s LAGIC framework is the quality of eligible capital in recognition that not all capital instruments provide a permanent and unrestricted commitment of funds available to absorb losses. Factors considered in determining the quality of a capital instrument under the LAGIC framework include whether the instrument satisfies all of the following essential characteristics:

- provide a permanent and unrestricted commitment of funds;

- be freely available to absorb losses;

- not impose any unavoidable servicing charge against earnings; and

- rank behind the claims of policy holders and creditors in the event of winding-up of the insurer.

The current PHI capital standards do not include comparable capital quality requirements meaning that an insurer’s regulatory capital requirement may include amounts which may not be reliable in extreme stress and/or otherwise be unavailable to meet policy holder claims.

To strengthen the capital base in the PHI industry, APRA is proposing to introduce restrictions on the composition of an insurer’s capital that is eligible to be included in the capital base. APRA welcomes any feedback on the application of this proposal and challenges of transition to the proposals.

Under the LAGIC framework the components of eligible capital are subdivided into Tier 1 capital, which comprises the highest quality components of capital (Common Equity Tier 1 (CET1) and other Tier 1), and Tier 2 (T2) capital. The latter includes other components of capital such as subordinated debt that, to varying degrees, fall short of the quality of Tier 1 capital but nonetheless contribute to the overall capital available to an entity. APRA proposes to introduce the same Tier 1 and Tier 2 requirements as those in the LAGIC framework.

Following the approach applied in the life insurance industry, APRA proposes that the quality of capital requirements be applied to the whole licenced health insurer, as well as at the HBF level where capital instruments are associated with the specific HBF.

2.4.3 Minimum proportions on the quality of capital components

APRA proposes that insurers be required to hold minimum levels of CET1 and Total Tier 1 capital (both net of regulatory adjustments) sufficient to meet a high proportion of the PCR. CET1 represents the strongest forms of capital, and are available on a going concern basis to address financial pressures on an insurer. APRA proposes that insurers will also be eligible to meet some of the PCR with T2 capital. T2 capital is not available to an insurer until it is a gone concern, and therefore not available to assist whilst an insurer seeks to improve its financial position as a going concern.

Taking the LAGIC framework as a starting base, APRA proposes that:

- CET1 exceed 60 per cent of the PCR;

- Total Tier 1 capital exceed 80 per cent of the PCR; and

- the remaining capital to meet the PCR can be held as T2 capital.

APRA invites feedback on its proposed minimum proportions for capital and transition considerations for the new framework.

2.4.4 Mutual equity interests (MEI)

Under APRA’s current capital frameworks for the insurance sectors (LAGIC and the PHI capital standards), insurers that are owned by members (mutually owned insurers) have limited access to CET1 capital beyond retained earnings. This is partly because instruments which meet APRA’s criteria for classification as ordinary shares may be inconsistent with mutuality principles under the Corporations Act 2001 (Corporations Act).

Until recently, a similar constraint applied to entities in the banking sector which are mutually owned. However, from 1 January 2018 amendments to APRA’s prudential standards for Authorised Deposit Taking Institutions (ADIs) have permitted mutually owned ADIs to issue CET1 eligible capital instruments (Mutual Equity Interests or MEIs).

These ADI reforms stemmed from the 2016 Senate Economics References Committee report in to the role of cooperatives and mutuals, and the subsequent 2017 independent Report on Reforms for Cooperatives, Mutuals and Member owned Firms (Hammond Report). The Hammond Report also received submissions in support of APRA’s prudential framework being amended to enable mutual friendly societies and mutual private health insurers to issue instruments that qualify as CET1 and are consistent with the mutual model (the Hammond Report did not specifically consider issues related to other insurers).

Given the limitations for mutual insurers to raise additional capital which meets the criteria for CET1 capital, other than through retained earnings, these insurers would have a more limited range of options to improve their resilience if their capital position becomes weakened due to adverse experience.

APRA proposes that the PHI capital standards incorporate provisions comparable with those in the ADI capital standards to allow mutually owned insurers to issue MEIs. MEIs can be a useful addition to a mutually owned insurer’s capital structure, however APRA’s view is that MEIs should not constitute a material proportion of an insurers’ CET1 capital. Not only are MEIs new and untested, but uncertainties regarding the cost of capital through MEIs may impose strain on future earnings capacity. Consistent with its approach in the ADI sector, APRA proposes to limit the proportion of MEIs to 25 per cent of an insurers’ CET1 capital, with any MEIs in excess of this limit eligible to be included in other T1 capital.

APRA invites feedback on it proposal to make MEIs allowable capital and its proposed limit on the proportion of CET1 which can be provided by MEIs. APRA is also considering recognising MEIs as allowable capital for life and general insurers through the LAGIC framework.

2.5 Valuing liabilities for capital purposes

The LAGIC framework makes regulatory adjustments to liabilities to ensure they are appropriately valued for prudential purposes.

APRA proposes the PHI capital standards be based on the Australian Accounting Standards Board’s new standard AASB 17 which alters the accounting treatment of insurance contracts. AASB 17 will impact the measurement and reporting of insurance liabilities, which are fundamental building blocks for the LAGIC framework. APRA is considering how to integrate these changes to LAGIC.

As a consequence, APRA proposes that the PHI capital standards adopt the amended regulatory adjustments as determined for LAGIC to accommodate the introduction of AASB 17.

2.6 Prescribed capital and its components

A key difference between the LAGIC framework and the current PHI capital framework is the targeted level of resilience. APRA proposes to adopt the more conservative 99.5 per cent probability of sufficiency for the PHI capital standards. All else being equal, the proposal to align with the LAGIC basis would result in higher capital requirements for insurers.

The current PHI capital framework also generally allows for much more discretion by insurers in the calculation of the prudential capital requirement than the LAGIC framework. While some discretion can be appropriate for parts of the calculation that are highly insurer specific, APRA favours a more standardised approach in the PHI capital standards to narrow the differences between insurers that have similar risk profiles. This is particularly the case for risks that would affect all insurers similarly, such as asset risks.

Outlined below are APRA’s proposals for determining the capital components of the PCA for insurers, encompassing the insurance risk charge, asset risk charge, operational risk charge and an aggregation benefit.

2.6.1 Insurance risk and insurance concentration risk

Insurance risk, the risk that insurance premiums are fixed while benefit claims are uncertain, is a core risk for any insurer. Insurance risk reflects the uncertainty of final costs for existing claims events (liability for incurred claims in AASB 17 terminology), as well as the uncertainty regarding the prevalence and costs of claims for events yet to occur (liability for remaining coverage in AASB 17 terminology). The characteristics of the insurance offering in each industry underpins variation in how insurance risk is experienced and managed.

Reflecting differences in the characteristics of insurance in the life and general insurance industries, APRA’s treatment of insurance risk in the LAGIC framework is tailored to be appropriate to the nature of each industry. The PHI industry also has its own insurance risk characteristics.

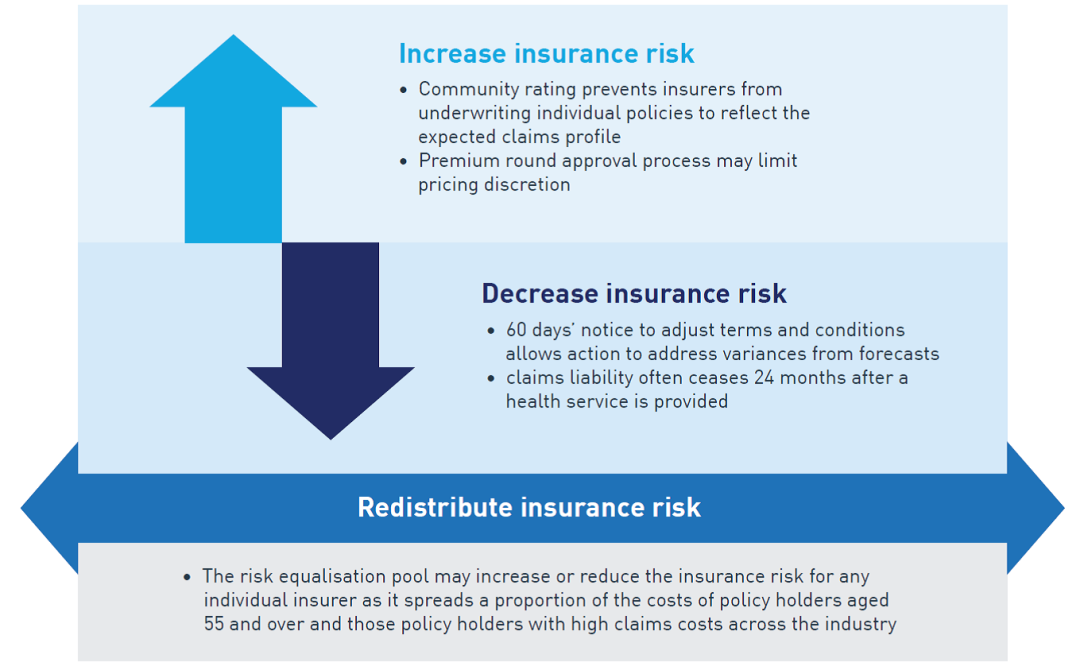

Key insurance risks for the PHI industry include:

- the risk profile of PHI policy holders differs from that assumed by the insurer in estimating claims;

- future claims arising from new products or new markets differ from that assumed;

- movements in overall claims costs are not accurately estimated; and

- the claims experience across the industry differs from that assumed (which impacts the risk equalisation pool across industry).

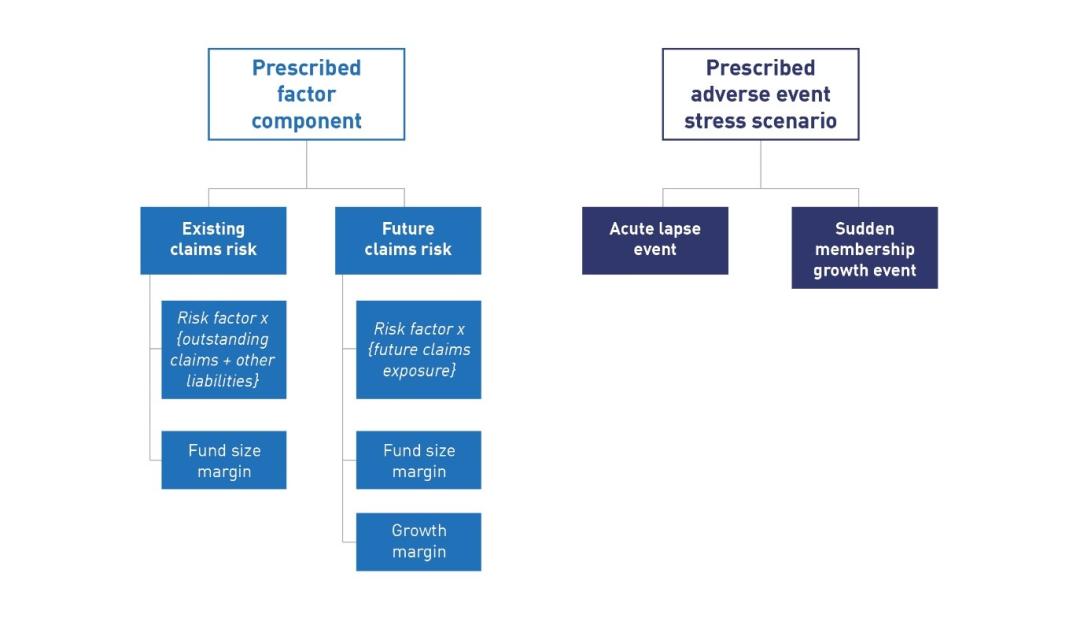

APRA proposes to use the broad structure of the insurance risk charge for general insurers to inform the approach for the PHI industry, given the predominantly short tail nature of claims faced by both industries. Specific characteristics that affect insurance risk in the PHI industry will also be taken into account.

Insurance risk is a central risk in the PHI industry. Reflecting this, APRA considers that the insurance risk charge should be a large proportion of the overall PCA for insurers.

Features of insurance risk in the PHI industry

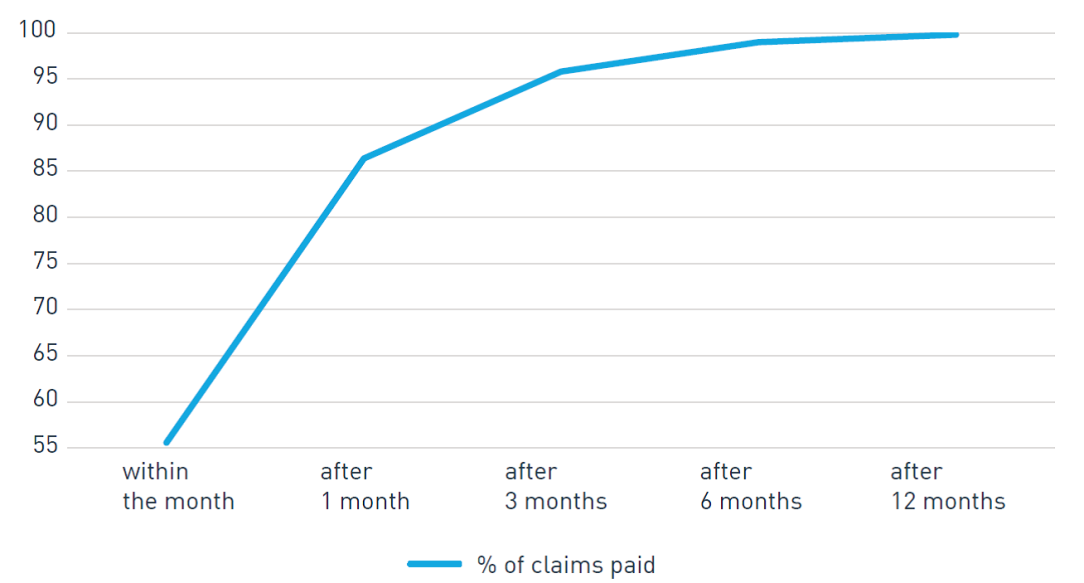

A number of legislative and regulatory settings for the PHI industry affect insurance risk. These can act to increase or reduce insurance risk. Figure 6 identifies a number of the features which impact on insurance risk and have been considered by APRA in developing its proposed approach to the insurance risk charge.

Other specific characteristics of the PHI industry also affect insurance risk. In particular, the very short timeframes for settling claims in the PHI industry reduces the period an insurer is exposed to outstanding claims risk. As shown in Figure 7, typically over 90 per cent of PHI claims are paid within three months. Outstanding claims exposure is also reduced because insurers’ fund rules often preclude claims being paid if they are received more than 24 months after the health care service was provided.

Both community rating and the risk equalisation pool produce a level of collective exposure to the insurance risk experience across industry. Accordingly, APRA is considering a prescribed factor approach applied to premiums to determine a component of the insurance risk charge. This approach would provide simplicity and ensure comparability in between insurers.

Yet, a range of events could also give rise to a severe adverse outcome for the PHI industry or individual insurers – having an effect similar in terms of speed and impact of a catastrophic event in the general insurance industry. To ensure a 99.5 per cent probability of sufficiency, it is necessary for the PHI capital standards to consider events that may cause changes in utilisation or membership more severe than experience in the historical data. Therefore, APRA is also considering an adverse event stress component as part of the insurance risk charge to reflect the risk of such events.

A number of potential calculations could be used to determine the insurance risk charge. To achieve the objective of ensuring that it adequately reflects both typical risks and those arising from a severe adverse event, APRA is considering options for the insurance risk component of the PCA being determined as either:

- the sum of components calculated under the prescribed factor approach and the adverse event scenario, which may be appropriate if the events were strongly correlated and likely to be experienced together;

- the higher of: the amount calculated under either the prescribed factor approach or the prescribed event stress scenario, which may be appropriate if the events were unlikely to occur concurrently; or

- making allowance for an aggregation benefit in the sum of components calculated under the prescribed factor approach and the adverse event scenario, to reflect a view on the diversification between the prescribed factor approach and the adverse event scenario.

APRA notes the likely challenges in differentiating between typical insurance risks and those of a severe adverse event. As such it may be difficult to identify whether historical experiences can be attributed risks arising from adverse events as distinct from typical insurance risk. Adjusting for potential diversification between the components within an aggregate PCA calculation may also introduce complexity to the PHI capital standards, without providing a comparable improvement in risk sensitivity.

APRA seeks feedback on the proposed components of the insurance risk charge, the potential correlation between risks captured in each component and how the components could be aggregated to calculate the overall insurance risk charge.

The structure of APRA’s proposed components for calculation of the insurance risk charge are illustrated in Figure 8. Further detail on the proposed components is provided in the sections below.

Prescribed factor component

APRA proposes the insurance risk charge apply prescribed factors to liability for incurred claims and liability for remaining coverage. Separate factors would be set for risk exposure relating to liability for incurred claims and liability for remaining coverage to reflect the greater relative uncertainty for exposure to claims arising during remaining coverage. Risk margins, which allow for inherent uncertainty in the claims estimation process, would be incorporated to recognise that variability in insurance risk is correlated to fund size and its growth profile.

APRA will also consider whether it is appropriate for the PHI capital standards to set different factors for insurance risk in insurers’ overseas students or visitors’ health insurance business. This may be appropriate to take account of the differing nature of insurance risk for these polices which may cover a longer contract term and insurers’ are unable to adjust premiums over the term.

A number of metrics could be used to determine claims risk for remaining coverage, including expected premium revenue or an estimate of claims liabilities over a fixed period. APRA’s choice of metric will take account of the revised approach to accounting for insurance assets and liabilities with the introduction of AASB 17.

APRA also proposes to take account of the impacts of risk equalisation on the claims risk exposure similar to the way the LAGIC framework treats reinsurance in determining the claims exposure for the life and general insurance industries.

APRA seeks feedback on the proposed prescribed factor approach for the insurance risk charge, including whether there are other matters that should be addressed by risk margins, the advantages and disadvantages of setting different factors for calculating the risk charge and metrics to determine claims risk for remaining coverage.

Prescribed adverse event stress

APRA’s proposal for a prescribed event stress would consider a sudden and significant lapse or growth in membership of between 30 per cent and 50 per cent within one year, with the profile of membership changing in a way that increases the intensity of the stress for the insurer (for example, where a lapse in membership was concentrated among better-risk members). The intent of stressing for both a sudden lapse and growth in membership is to recognise that the risk profile of an insurer may mean a stress in either direction is more severe. The event stress scenario would only take account of the larger of these two stresses.

APRA invites feedback on the proposed prescribed event stress, including the intensity of the stress necessary to reflect a 99.5 per cent probability of sufficiency and whether there are alternative approaches which could be considered in the capital standard to address the risk of a severe adverse outcome.

Insurer specific adjustment

While recognising the high degree of shared exposure to insurance risks, APRA intends for the insurance risk charge to be responsive and incentivise insurers to manage insurance risk effectively. The proposed prescribed factor approach has a strong reliance on high quality forecasting by insurers of their claims risk exposure. APRA has observed differing quality of forecasting and practices by insurers. Consequently, APRA also proposes the insurance risk charge provide for an insurer specific adjustment. This proposal would allow APRA to make adjustment to the insurance risk charge to take account of idiosyncratic risks, consistent with APRA’s ability to make supervisory adjustments (refer to section 2.7 (Supervisory Adjustments)).

APRA’s consideration of an insurer-specific adjustment would take into account an insurers’ governance or decisions on strategy, pricing philosophy, insurance risk management, including the responsiveness to adverse experience, as well as forecasting accuracy. This proposal would enhance the risk sensitivity of the capital charge, where APRA considers there are practices of an individual insurer which are not adequately considered in the capital framework.

APRA invites feedback from stakeholders on its proposal to enable an insurer specific adjustment to take account of experiences of an individual insurer.

2.6.2 Asset risk and asset concentration risk

Capital is required to protect insurers against asset risk that is the risk associated with changes in the value of investments, reinsurance assets and other recoverables. The capital charge for asset risks should reflect the potential for losses arising from such risks and encourage insurers to adopt an investment policy that takes account of the term and nature of their liabilities and the creditworthiness of investments and reinsurance or other counterparties.

Broadly, the PHI industry holds assets similar in character to those held by entities in the life and general insurance industries. APRA therefore proposes to adopt the LAGIC framework’s capital treatment of asset risk and asset concentration risk as APRA did not identify industry specific characteristics in the PHI industry which would warrant deviation.

For the asset risk charge, APRA’s proposal involves subjecting the balance sheet to a series of stress tests, relevant to the asset type, using factors prescribed by APRA. This would ensure capital requirements are sensitive to the nature of risks associated with specific types of assets.

The stresses evaluate potential losses for an insurer from:

- real interest rates (reflecting the portion of the nominal risk-free interest rates after deducting expected inflation);

- expected inflation (reflecting the impact of changes to the expected consumer price index, but not to assets that are affected by the equity or property stresses);

- currency (for assets or liabilities not denominated in Australian dollars to consider the impact of changes in foreign exchange rates);

- equity assets (for listed and unlisted equity assets, and any other assets not considered in other asset risk stresses to consider the impact of a fall in asset values);

- property assets (for property and infrastructure assets to consider the impact of changes in asset values). This stress would be applied to earnings and rental yields rather than directly to asset values;

- credit spreads (for interest-bearing assets, including cash-deposits, to consider the impact of an increase in credit spreads); and

- default risk (for non-interest-bearing assets to consider the risk of counterparty default, including reinsurance and other credits or counterparty exposures that have not been affected by the credit spreads stress).

The asset risk charge reflects APRA’s view that insurers should maintain a well diversified investment portfolio. It does not consider additional risks where investments are concentrated in individual assets or where the insurer has large exposures to individual counterparties (or groups of related counterparties).

To address these risks, APRA proposes a separate asset concentration risk charge intended to act as a significant deterrent to insurers’ holding concentrated exposures. Consistent with LAGIC, APRA would impose a capital charge equal to the amount of each exposure of the insurer to a particular asset class or counterparty in excess of an APRA prescribed limit.

APRA invites feedback on the appropriateness of the proposed asset risk stresses, and whether insurers should hold assets which could be affected by adverse events not captured by these stresses. APRA also invites feedback on impacts of the proposed asset concentration risk charge.

2.6.3 Operational risk

Operational risk is a key risk for insurers which is appropriate to address in APRA’s capital standards. APRA defines operational risk as ‘the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events’.

The nature and complexity of operational risk is continuing to expand as businesses increase their reliance on advanced technology and more complex organisational arrangements or distribution structures. The significance of operational risk has been demonstrated by the findings of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (Royal Commission) which highlighted the impacts on regulated entities of failures in governance and management, as well as the increase in domestic and international experiences with privacy and information breaches. These issues are just as relevant to the PHI industry as they are to other APRA-regulated insurance industries. Indeed, operational risk in the PHI industry may be elevated reflecting the rapid and high volume nature of claim payments, broad reliance service providers and technology platforms and range of non-prudential policy reforms affecting the industry.

The current PHI capital framework considers operational risk arising in the HBF related to health insurance business, as well as in relation to an insurer’s health related business (only to the extent that business is conducted in the HBF). Under current requirements, a uniform approach is applied to determine the operational risk charge for the HBF regardless of whether the activity is health insurance or health related business.

In the PHI industry, the increasing prevalence of insurers operating integrated businesses reinforces the need to consider the potential operational risks in those activities that may give rise to contagion affecting the prudential soundness of insurers.

APRA proposes that the operational risk charge for the PHI capital standards capture the business activity of the whole licenced health insurer. An operational risk charge would be applied to both the HBF and business conducted outside the HBF; with the aggregate operational risk charge determined as the sum of the two. This approach will encourage insurers’ boards and management to focus on risks across the business and how those risks may impact financial resilience, and the ability of the insurer to meet commitments to policy holders.

APRA’s proposal would also have the benefit of applying consistent capital treatment to insurers regardless of structural differences in how insurers’ conduct any non insurance business. The current PHI capital standards allows an insurer conducting business outside its HBF to have a lower capital requirement than if this business was conducted in the HBF (refer to Figure 5). APRA’s view is that such inconsistent capital treatment may impair oversight of potential contagion risks that affect the prudential soundness of insurers.

The LAGIC framework adopts a relatively simple approach to determining the operational risk charge. This involves a straight-line calculation of the operational risk charge based on the size of the insurer’s operations and an additional component related to rapid growth of the insurer. At the time of consultation on the LAGIC framework, APRA acknowledged concerns that the approach was not sufficiently sensitive to an insurer’s operational risks but was not presented with any viable alternative approaches.

To reflect that operational risks may not be directly proportional to the size of business, APRA is open to a non-linear approach and seeks feedback on options, including the relevance of a minimum or maximum threshold and potential metrics to determine the operational risk charge for non-insurance business. If a robust non-linear option was identified, APRA proposes that it would be calibrated to retain a similar relative contribution to the overall PCA as that of the current PHI capital standards.

2.6.4 Aggregation benefit

The concept of diversification is a fundamental principle of insurance and is a key feature of the LAGIC framework. To recognise the independence between asset risks and insurance liability risks, APRA proposes the PHI capital standards include an explicit recognition of diversified risks through an aggregation benefit.

Consistent with the LAGIC framework, APRA’s proposal for the PHI capital standards involves each of the asset risk and insurance risk capital charges being calibrated separately to a target of 99.5 per cent probability of sufficiency. To maintain this level of sufficiency in aggregate, while recognising that asset and insurance risks are not perfectly correlated, the capital charges would be combined using a prescribed formula that yields a total capital charge that is less than the sum of the asset and insurance risk charge.

APRA proposes an aggregation benefit using the formula:

=(A + I) - √(A^2 + I^2 + 2 × corr × A × I)

where:

A = the insurer’s asset risk charge

I = the insurer’s insurance risk capital charge

corr = the specified correlation factor

The correlation factor needs to be set to reflect the likelihood of insurance and asset risk events occurring simultaneously. The value of the correlation factor, which will be a number between 0 and 1 is a matter for further consideration. However, consistent with LAGIC, is likely to be in the range 0.2 to 0.5.

APRA seeks feedback from interested stakeholders on an appropriate approach for the prescribed formula, including whether the formula and correlation factor of 0.211 can be adopted without amendment.

APRA proposes that the capital charge components for operational risk and asset concentration risk would not be included in the aggregation benefit, and would be added without adjustment to determine the aggregate PCA. APRA’s proposal for operational risk reflects that correlation with other risks becomes stronger in times of extreme stress, while the charge for asset concentration risk is designed to strongly discourage asset concentration and, as such, is different in nature from the other risks.

2.6.5 Minimum prescribed capital

APRA proposes the PHI capital standards set an explicit minimum prescribed capital requirement of $5 million for the whole licenced insurer. APRA’s proposal reflects the expectation that all APRA-regulated entities need to hold a certain minimum level of capital against operational and insurance risks to which all insurers are exposed. APRA’s proposal would bring the PHI industry into alignment with other insurance industries where minimum prescribed capital amount currently applies under the LAGIC framework.

While an implicit minimum capital amount of $1 million applies through the operational risk amount in the existing PHI capital adequacy standard (HPS 110), this is low relative to the requirements of LAGIC, of $10 million for the whole life company in the life insurance industry and $5 million in the general insurance industry. APRA is also considering indexation of the minimum capital amount to ensure the minimum remains at an appropriate level over time, without needing explicit amendment of the capital standards.

APRA invites feedback from stakeholders on the impact of an explicit minimum prescribed capital amount, the impact of the proposed quantum on existing insurers and potential new entrants and options for indexing the minimum amount.

2.7 Supervisory adjustments

Capital adequacy is dependent on an insurer’s capital position, but also on the way the insurer monitors and manages its capital position and risks. APRA’s prudential capital framework for other industries is based on a three pillar supervisory approach. This is consistent with the approach adopted internationally under the IAIS ICPs and Solvency II in the European Union. The three pillars are mutually reinforcing and comprise:

- Pillar 1 - quantitative requirements in relation to required capital, liability valuations and the capital base reflecting the PCA determined as the sum of capital components described in section 2.6 (Prescribed Capital and its Components);

- Pillar 2 - the supervisory review process of risk management, capital management and governance practices of an insurer, which may include a supervisory adjustment to capital; and

- Pillar 3 - disclosure requirements designed to encourage market discipline.

APRA proposes that its supervisory review process include provision for it to determine supervisory adjustments to the PCA under either Pillar 1 or Pillar 2, consistent with the approach employed under LAGIC for the other insurance industries.

2.7.1 Determining a supervisory adjustment

APRA proposes that the PHI capital standards allow APRA to make a supervisory adjustment to the insurer’s capital requirement where it considers the PCA insufficient. This occurs when there are concerns about an insurer’s governance, risk management or management capabilities. For example, newly licensed insurers, exposure of an insurer to material new risks or business strategies, insurers with a rapidly changing business mix, and insurers with material governance or risk management weaknesses, including a weak ICAAP or stress testing processes or failing to comply with prudential standards. A non exhaustive list is available in Prudential Practice Guide CPG 110 Internal Capital Adequacy Assessment Process and Supervisory Review (CPG 110).12

A supervisory adjustment will be determined taking into account APRA’s regular assessment of the insurer. As with LAGIC, supervisory adjustments will draw on relevant information sources and analytical tools including risk assessment and supervisory response models (Probability and Impact Rating System (PAIRS) and Supervisory Oversight and Response System (SOARS))13.

The process to determine supervisory adjustments will be subject to APRA’s internal governance processes, including review at appropriate levels within APRA. This will also include comparisons of a regulated institution within relevant peer groups.

APRA’s supervisory decisions are informed by discussions with the regulated institution on matters such as the appropriateness, size and implementation of the supervisory adjustment. However, APRA also proposes to have the ability to impose a supervisory adjustment outside of the ordinary supervisory process. For example, where APRA determines it necessary to act rapidly to protect the interests of policy holders.

The application of supervisory adjustments to the prescribed capital amount is just one of the tools available to APRA in supervising an insurer’s capital adequacy. Other tools include the ability to require improvements in governance, risk management and control practices and to reduce the level of exposure to risk.

Pillar 1 supervisory adjustment

APRA proposes that the capital standards include a provision for it to adjust any aspect of calculation a capital component in the PCA where, in its view, the requirements in the standard do not produce an appropriate outcome.

Under this proposal, APRA would have discretion to make a Pillar 1 supervisory adjustment, to either increase or decrease the capital component in the PCA depending upon the nature and circumstances giving rise to the adjustment. For example, this may be used where interpretation of requirements in a standard by an insurer is deemed by APRA to be incorrect or inappropriate.

Pillar 2 supervisory adjustment

APRA proposes that the capital standards allow it to apply a Pillar 2 supervisory adjustment if it considers an insurer’s PCA does not adequately account for all its risks (reflecting the quality of the insurers risk management, capital management and governance). For example, APRA may use a Pillar 2 supervisory adjustment to address strategic or reputational risks faced by a particular insurer.

A Pillar 2 adjustment may require an increase in the total capital amount and may also require the insurer to strengthen its capital base by holding an increased proportion of higher quality capital.

2.7.2 Disclosure of Prescribed Capital Requirement

APRA proposes that each insurer be required to disclose annually the individual components and total amount of its capital base and PCA. If APRA determines that that a Pillar 1 supervisory adjustment will apply to a component of the PCA, the insurer must disclose only the adjusted PCA component. If APRA determines that a Pillar 2 supervisory adjustment will apply to the insurer, the insurer would not disclose the PCR, but would be permitted to disclose only the PCA and its components.

This proposed requirement on non-disclosure is consistent with APRA’s approach in other industries. Disclosure of any supervisory adjustment may result in adverse market reaction and may inhibit APRA’s ability to take effective and timely action as a prudential supervisor, in that it would have to consider market reactions in its decision-making.

2.8 Capital management planning

2.8.1 Internal Capital Adequacy Assessment Process

All ADIs, life insurers and general insurers are required to have an Internal Capital Adequacy Assessment Process (ICAAP).14 An ICAAP assists entities to identify, measure, aggregate and monitor risks; hold capital commensurate with these risks; and have systems in place to continuously monitor their capital adequacy.

As outlined in section 1.2 (The current PHI capital framework), insurers are currently required to develop and maintain a CMP to assess their capital needs and manage their capital levels. APRA proposes to enhance capital planning for the PHI industry by adopting the ICAAP to underpin capital management and more explicitly articulate those requirements. The ICAAP would be proportionate to the insurer’s size, business mix and the complexity of its operations.

APRA also proposes to enhance the ICAAP by retaining requirements under the current PHI capital standards for the insurer to establish a pricing philosophy, investment rules and build on the circumstances in which the ICAAP will be reviewed. APRA proposes the insurer be required to conduct a more comprehensive and transparent assessment of its risk profile, including stress testing and scenario analysis, as well as the capital and corrective actions needed to support the risks undertaken. APRA’s ICAAP proposal for the PHI industry would require the insurer to consider each HBF, as well as the insurer as a whole.

APRA proposes insurers be required to annually prepare an ICAAP summary statement and an ICAAP report (referred to as ICAAP documents). The ICAAP report provides detail on the outcomes of the ICAAP over the previous 12 months, as well as covering detailed information on current and three year capital forecasts. This is supported by the ICAAP summary statement which provides a high level summary of prescribed components of the ICAAP.

The ICAAP documents must refer to supporting documentation and analysis. Many insurers following prudent business practices may already include supporting documentation and analysis in their CMPs. APRA will make this an explicit requirement in the PHI capital standards.

The ICAAP is required to be reviewed at least every three years, or more regularly in certain circumstances, by qualified people independent of capital management.

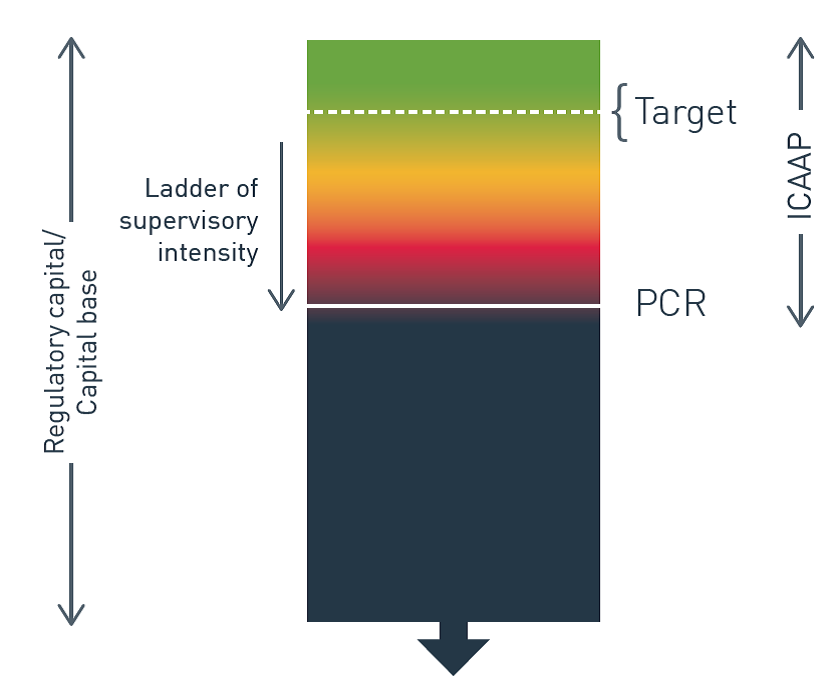

As outlined above, APRA expects an insurer to establish a target capital policy as part of its ICAAP. The intensity of APRA’s supervisory attention will increase as the insurer’s capital level approaches the PCR. Additional guidance on the ICAAP is available in the CPG 11015.

Figure 9 below shows how the ICAAP requirements operate in principle.

2.9 HPS 100 Solvency Standard

As outlined in Chapter 1 (Introduction), the focus of the current PHI solvency standard (HPS 100) is on ensuring that the HBF has sufficient liquid assets to meet liabilities as they become due.

APRA understands that during consultation for the current capital standards, PHIAC had considered removing the solvency standard. However, HPS 100 was retained given a legislative requirement existed at that time for a specific solvency standard. On transfer of the prudential responsibility to APRA, the legislative framework was amended to remove the specific requirement for a solvency standard for the PHI industry.

The PHI industry is characterised by short tail claims. This cash flow pattern is typically paralleled by regular periodic premium payments (often monthly or fortnightly in frequency). These characteristics underscore the importance of cash flow management by insurers. However, it does not necessarily imply that the need for quantitative prudential requirements to provide policy holder protection against liquidity risks is any more acute than for other insurance industries (where APRA has qualitative requirements under Prudential Standard CPS 220 Risk Management but not a quantitative rule).

Adopting the LAGIC framework’s requirements for quality of the capital base would also be expected to act as a baseline on the quality and liquidity of assets in the PHI industry, and further weaken the need for a separate solvency standard.

APRA proposes to remove the solvency standard and its quantitative requirements. However, in light of claims characteristics of the industry, APRA proposes to retain a qualitative liquidity management planning requirement. APRA invites feedback on whether the PHI capital framework should include additional qualitative requirements to supplement those under Prudential Standard CPS 220 Risk Management.

11Detail on the aggregation benefit formula that applies to general insurers is provided in Prudential Standard GPS 110 Capital Adequacy available at: https://www.legislation.gov.au/Details/F2019L00869, while the aggregation benefit formula that applies to life insurers is provided in Prudential Standard LPS 110 Capital Adequacy available at: https://www.legislation.gov.au/Details/F2012L02460.

12Available at:

13APRA is currently reviewing its supervisory model, as flagged under APRA’s 2018-2022 Corporate Plan, and expects to publish a revised PAIRS and SOARS model by mid-2020. APRA proposes that the revised supervisory model will apply to the PHI industry.

14Refer to Prudential Standard APS 110 Capital Adequacy, Prudential Standard LPS 110 Capital Adequacy and Prudential Standard GPS 110 Capital Adequacy for further information.

15Available at:

Chapter 3 - Future regulatory proposals

3.1 Regulatory reporting

As noted in Chapter 1 (Introduction), the implementation of AASB 17 will change the basis for the valuation of insurance contract assets and liabilities. Reflecting this, AASB 17 will also impact APRA’s reporting requirements on the valuation of insurance contract assets and liabilities, as well as their financial performance.

APRA proposes that reporting requirements for the PHI industry be compatible with AASB 17 measurement approaches and reflect the changes to LAGIC to accommodate the introduction of AASB 17. APRA also proposes that reporting requirements for the PHI industry include information on activities conducted outside the HBF, in line with APRA’s proposal that the PHI capital standards capture the whole licensed health insurer. This is likely to include an expansion in the scope of regular statistical reporting under the Financial Sector (Collection of Data) Act 2001 (FSCODA). This would extend APRA’s ability to monitor possible changes to prudential soundness from operations outside the HBF.

Reporting requirements introduced to support the PHI capital standards and the integration of AASB 17 will be be progressed under APRA’s new data transformation program, the Data Collection Solution (DCS)16. APRA expects changes to the way that data is collected including a shift to structured data sets rather than tabular forms, as well as greater options for data uploads to APRA.